Overview

The article titled "7 Essential Reasons to Hire a Tax Attorney in San Diego" focuses on the vital benefits of engaging a tax attorney when facing various tax-related challenges. We understand that navigating tax laws can be overwhelming and stressful. That’s why hiring a tax attorney can provide you with expert guidance and representation during audits, ensuring you feel supported every step of the way.

By seeking tailored strategies for tax debt relief, you can effectively mitigate financial risks. It’s common to feel uncertain about your options, but remember, you are not alone in this journey. A tax attorney can help you navigate these complexities with confidence.

We’re here to help you find the right solutions for your needs. The support of a knowledgeable professional can make a significant difference in alleviating your concerns and empowering you to take control of your financial future.

Introduction

Navigating the complexities of tax law can feel overwhelming for both individuals and businesses, especially in a vibrant city like San Diego. We understand that the stakes are high; missteps can lead to significant financial repercussions and legal troubles.

In this article, we explore seven essential reasons why hiring a tax attorney is not just beneficial but crucial for anyone facing tax challenges:

- Expert guidance in understanding intricate tax regulations

- Providing robust defense during audits

- Assistance in tax planning and compliance

- Representation in negotiations with tax authorities

- Resolving tax disputes effectively

- Protection from penalties and legal repercussions

- Peace of mind in managing tax obligations

The insights shared here will illuminate the invaluable role a tax attorney plays in safeguarding your financial well-being. Have you ever wondered what happens when individuals attempt to tackle these issues alone? It's common to feel uncertain, and those attempts can lead to unintended consequences.

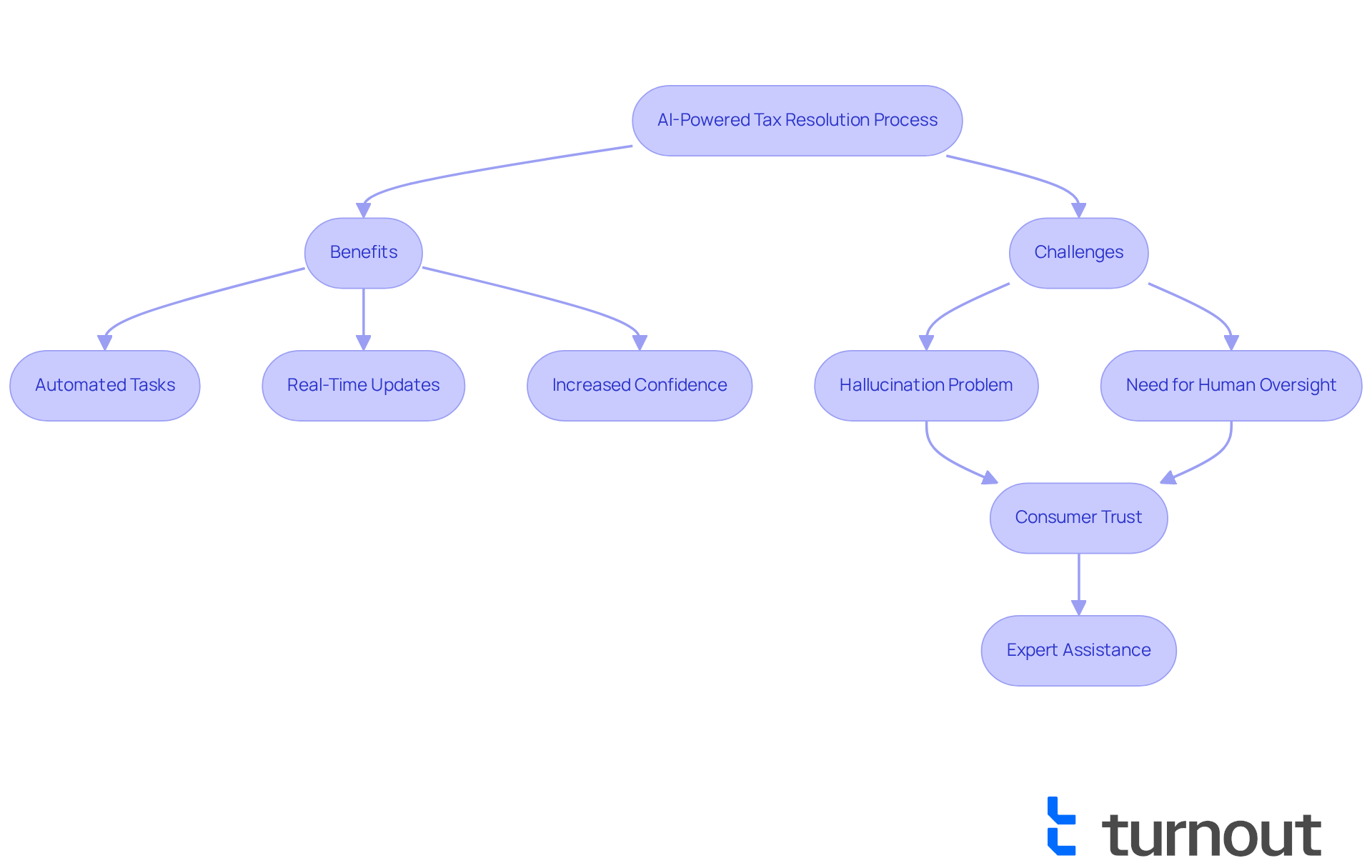

Turnout: Streamline Your Tax Resolution Process with AI-Powered Advocacy

We understand that navigating tax challenges can feel overwhelming. Turnout harnesses AI technology to revolutionize the tax resolution process, making it more accessible and efficient for you. By automating routine tasks and delivering real-time updates, Turnout empowers individuals like you to tackle tax issues with confidence. What once seemed daunting is now understandable, actionable, and winnable.

This AI-driven advocacy not only accelerates the resolution process but also alleviates the stress often associated with tax authorities. With Turnout, you can focus on your financial recovery. In fact, 80% of corporate customers utilizing AI-supported resources report that this technology allows them to handle work internally that they would have otherwise outsourced to external consultants.

While AI streamlines complex processes, it's common to have concerns about challenges such as the 'hallucination problem' and the need for human oversight. We want to assure you that maintaining consumer trust is a priority. As Bloomberg Tax highlights, AI serves as a valuable research tool for answering tax questions, further solidifying Turnout's commitment to transforming how consumers engage with tax issues.

Additionally, Turnout employs trained non-legal advocates and IRS-licensed enrolled agents. They are here to offer expert assistance in navigating SSD claims and tax debt relief, ensuring you receive timely support tailored to your needs. Remember, you are not alone in this journey—we're here to help.

Expert Guidance: Simplify Complex Tax Laws with a San Diego Tax Specialist

Navigating tax regulations can be overwhelming, but a knowledgeable tax expert is here to help. They can clarify intricate tax laws and offer personalized guidance tailored to your unique situation. This support not only helps you understand your rights and obligations but also ensures that potential benefits are not overlooked.

We understand that facing tax challenges can be daunting. Personalized guidance empowers you to make informed decisions. For instance, retirees like Patricia and Daniel were able to lower their tax liability through optimized withdrawal strategies and Roth conversions. Meanwhile, Linda, a widowed retiree, sought clarity and control in her estate plan, highlighting the importance of tailored support.

In fact, many taxpayers seek professional guidance to navigate these complexities. This underscores the value of specialized support in simplifying tax laws and enhancing financial clarity. You're not alone in this journey. To take the next step, consider reaching out to a tax expert who can provide customized guidance suited to your specific circumstances. We're here to help you find peace of mind amidst the tax landscape.

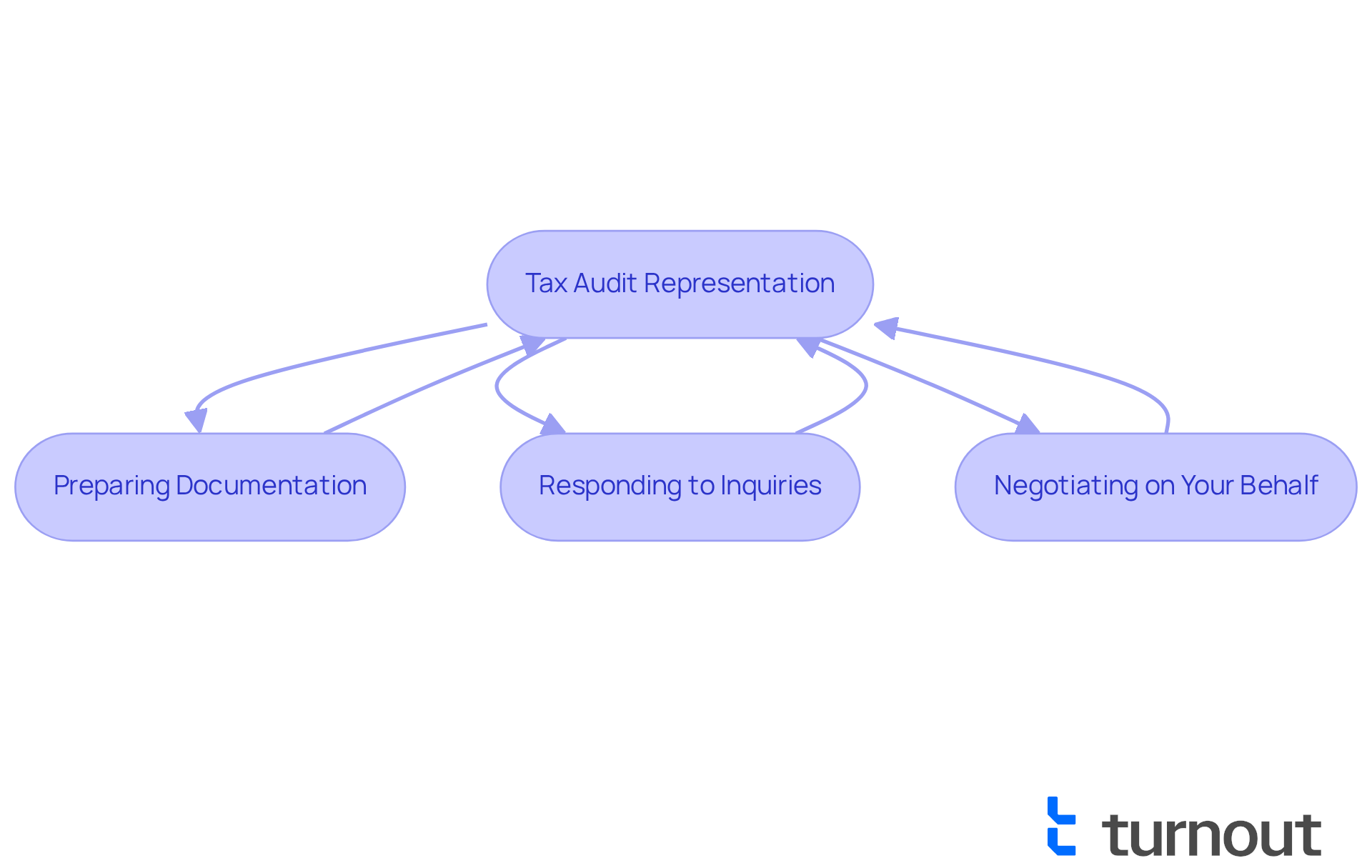

Audit Representation: Protect Your Rights with a San Diego Tax Specialist

Facing an examination can be overwhelming, but having a tax expert by your side can truly make a difference. We understand that this process can feel daunting, and that's where professional representation comes in. A tax expert can advocate for you before tax authorities, ensuring your rights are protected every step of the way.

This support includes:

- Preparing all necessary documentation

- Responding to inquiries

- Negotiating on your behalf

By having someone knowledgeable in your corner, you can alleviate much of the stress and confusion that often accompanies audits. Remember, you are not alone in this journey; we are here to help you navigate these challenges with confidence.

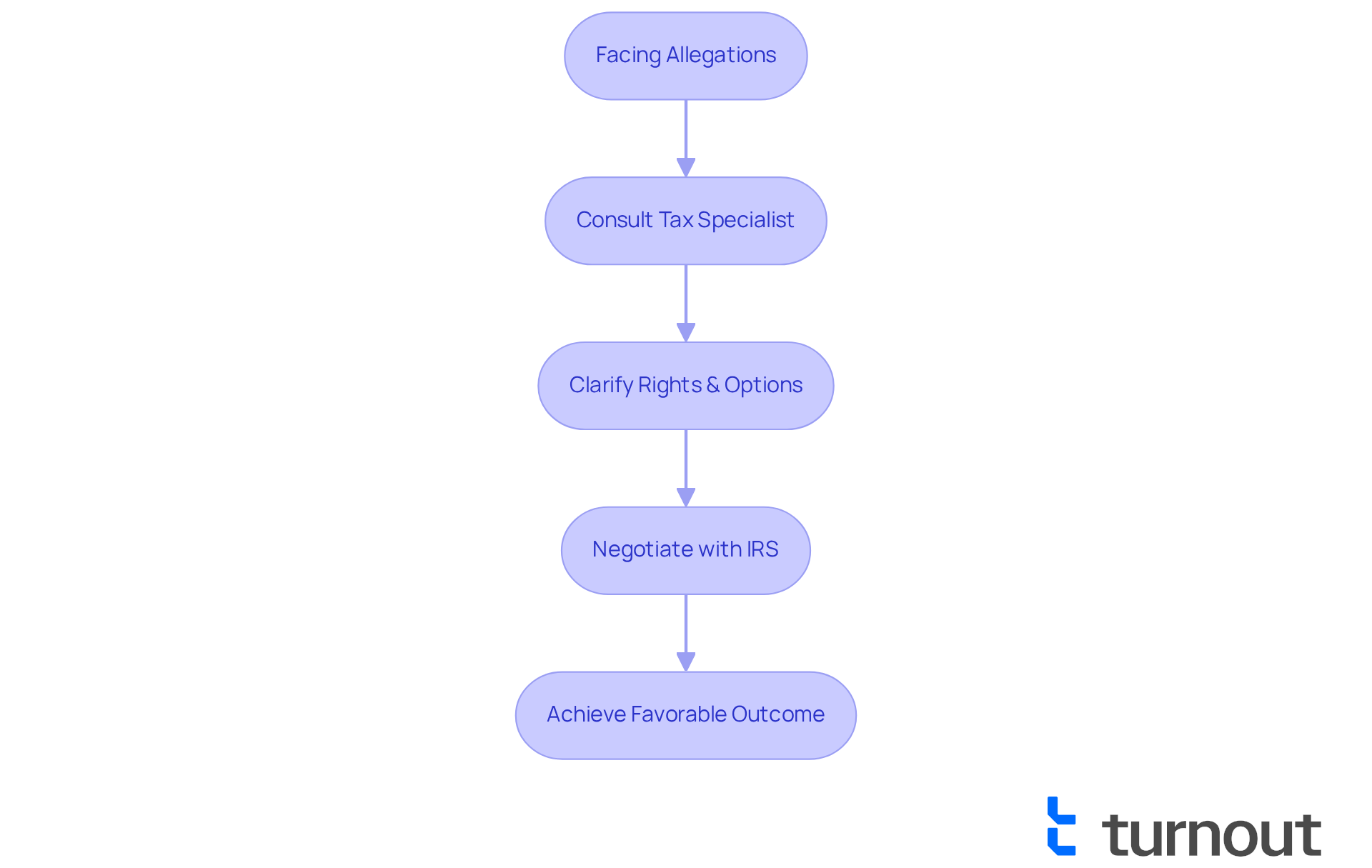

Defense Against Tax Evasion: Secure Your Future with a San Diego Tax Specialist

Facing allegations of tax evasion can be daunting, and we understand that the consequences can be severe. Fines may reach up to $250,000, and imprisonment could last for up to five years. In such challenging times, consulting a tax expert is crucial. Their expertise not only provides a strong defense but also ensures that you comprehend your rights and options. They can help clarify any misunderstandings with tax authorities.

Tax professionals have successfully negotiated favorable outcomes for individuals in IRS disputes. This showcases their ability to mitigate the impact of such claims. By leveraging their knowledge of tax laws and strategic negotiation skills, they can help secure a more favorable resolution, ultimately protecting your financial future.

In high-stakes situations like this, the guidance of a tax specialist is invaluable. They provide clarity and direction in what can often feel like an overwhelming process. Remember, you are not alone in this journey; we’re here to help you navigate these complexities with care and understanding.

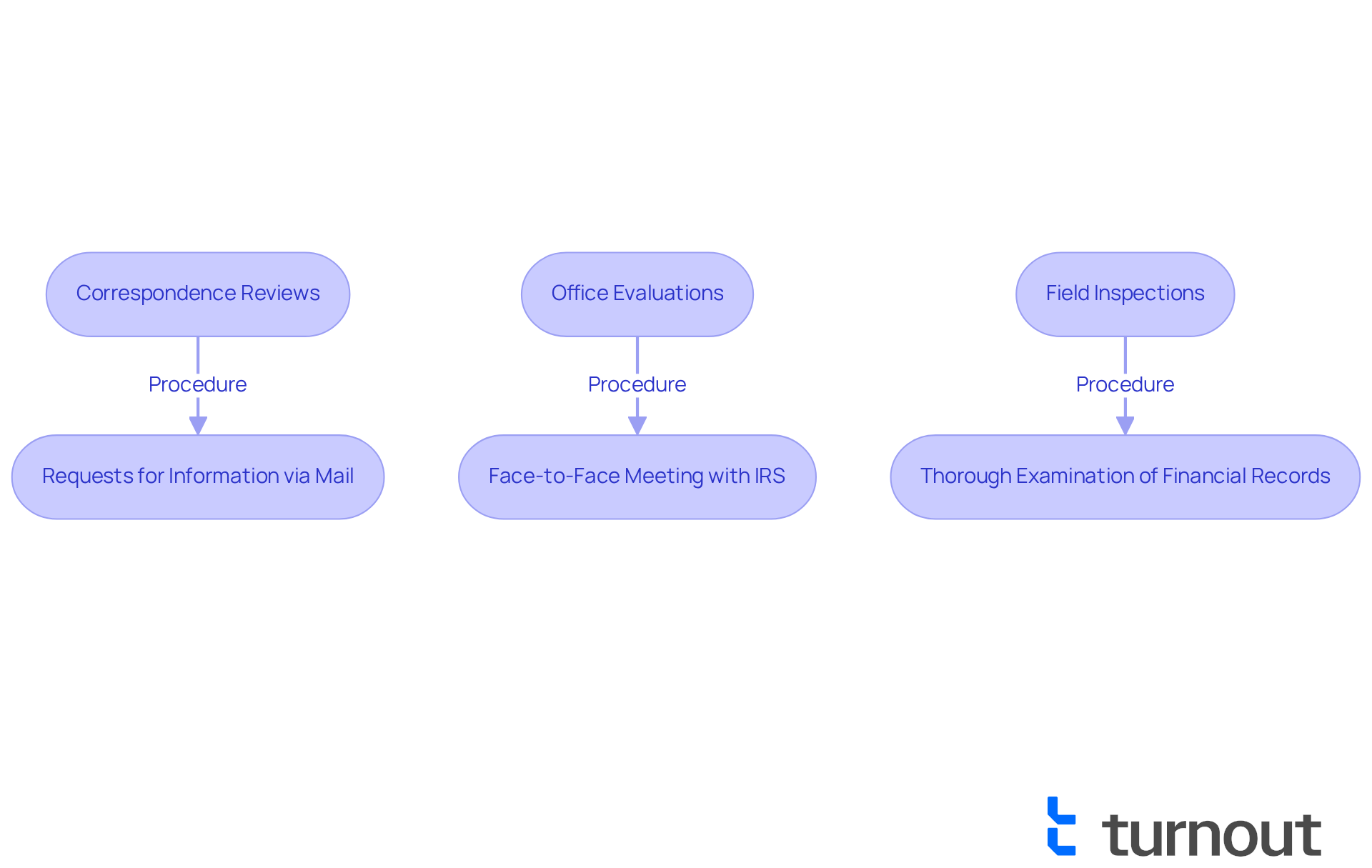

Audit Types Explained: Navigate IRS and State Audits with a Tax Specialist

Comprehending the different categories of evaluations is essential for efficient tax management. We understand that navigating these processes can be overwhelming. The IRS performs several types of examinations, including:

- Correspondence reviews

- Office evaluations

- Field inspections

Each type has distinct procedures and implications. A tax attorney in San Diego plays a vital role in guiding individuals through these processes, ensuring they understand the specific requirements and expectations linked to each review type. For example, correspondence reviews usually entail requests for further information sent through the mail, while office examinations require clients to meet with IRS representatives face-to-face. Field inspections are more comprehensive, often involving a thorough examination of financial records at the taxpayer's location.

Statistics indicate that taxpayers who consult with experts feel considerably more prepared for evaluations. For instance, individuals earning between $100,000 and $199,999 encountered a review rate of 0.12%, whereas those making between $25,000 and $49,999 experienced a review rate of 0.18%. In contrast, individuals earning $1,000,000 to $4,999,999 faced a higher examination rate of 0.60%. This disparity highlights the importance of understanding income-related risk factors. Moreover, the overall review rates have declined over the years, suggesting a change in IRS examination practices.

It's common to feel anxious about these evaluations. Practical instances demonstrate how tax professionals, such as a tax attorney in San Diego, handle these intricacies; individuals frequently express gratitude after receiving expert help in managing their examination circumstances. As one expert noted, "CPAs are not just auditors; they are custodians of fiscal responsibility." This emphasizes the value of professional support in achieving favorable outcomes. By utilizing their knowledge, tax professionals assist individuals in reducing stress and improving their readiness for any audit situation. Remember, you are not alone in this journey. We’re here to help you navigate through it.

Tax Debt Relief Strategies: Find Solutions with a San Diego Tax Specialist

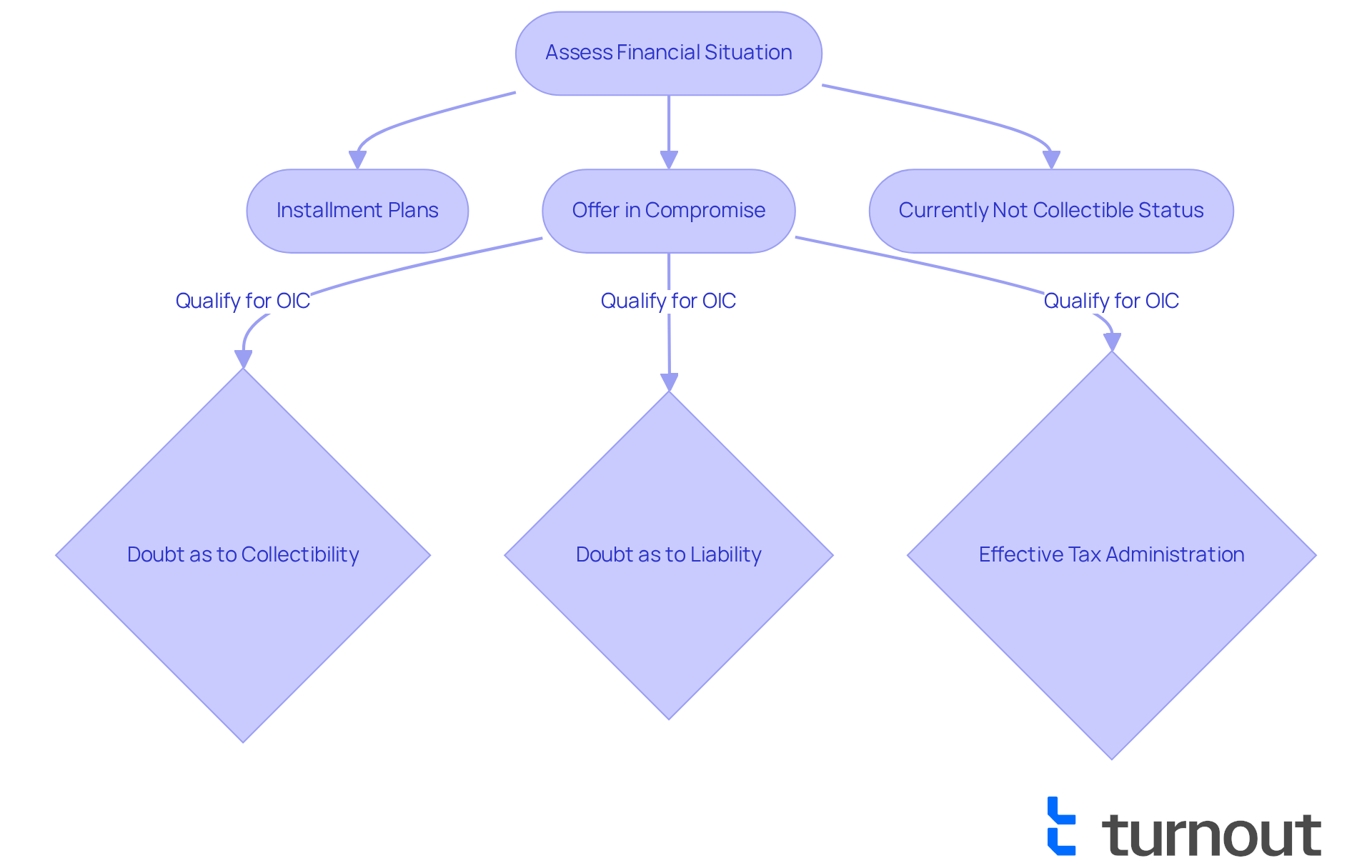

Tax debt can feel overwhelming, and it's completely understandable to be concerned about your finances. Fortunately, there are various relief strategies available to help you regain control. A tax attorney San Diego can assist you with options like installment plans, offers in compromise, and currently not collectible status. By thoroughly assessing your financial situation, they can recommend the most effective course of action tailored to your needs.

For instance, the Offer in Compromise program allows qualifying taxpayers to settle their tax debt for less than the total amount owed. To qualify, taxpayers must demonstrate one of three conditions:

- Doubt as to collectibility

- Doubt as to liability

- Effective tax administration due to exceptional circumstances

In 2025, the IRS adopted more flexible evaluation standards for this program. This change has led to increased success rates when taxpayers work with knowledgeable professionals. Some firms, like Traxion Tax, report approval rates as high as 70% when clients are well-prepared.

Additionally, if you are facing severe financial hardship, you may qualify for currently not collectible status. This option temporarily halts IRS collection efforts, providing crucial relief. It’s important to note that this status does not forgive tax debt, but it prevents wage garnishment, bank levies, and property seizures while you are under this status. This allows you to focus on stabilizing your financial situation without the immediate pressure of tax payments.

Real-life examples illustrate the effectiveness of these strategies. For instance, a taxpayer who successfully navigated the Offer in Compromise process was able to significantly reduce their tax liability, alleviating the burden of overwhelming debt. Such success stories highlight the importance of consulting a tax attorney San Diego in achieving favorable outcomes.

Ultimately, a tax attorney San Diego plays a vital role in evaluating financial situations and identifying the best relief strategies. Their expertise simplifies the complex tax landscape and empowers individuals to take actionable steps toward financial recovery. The IRS typically prefers to work with taxpayers to resolve debt issues through partial payment agreements rather than aggressive collection actions. This further emphasizes the value of professional assistance. Remember, you are not alone in this journey, and help is available.

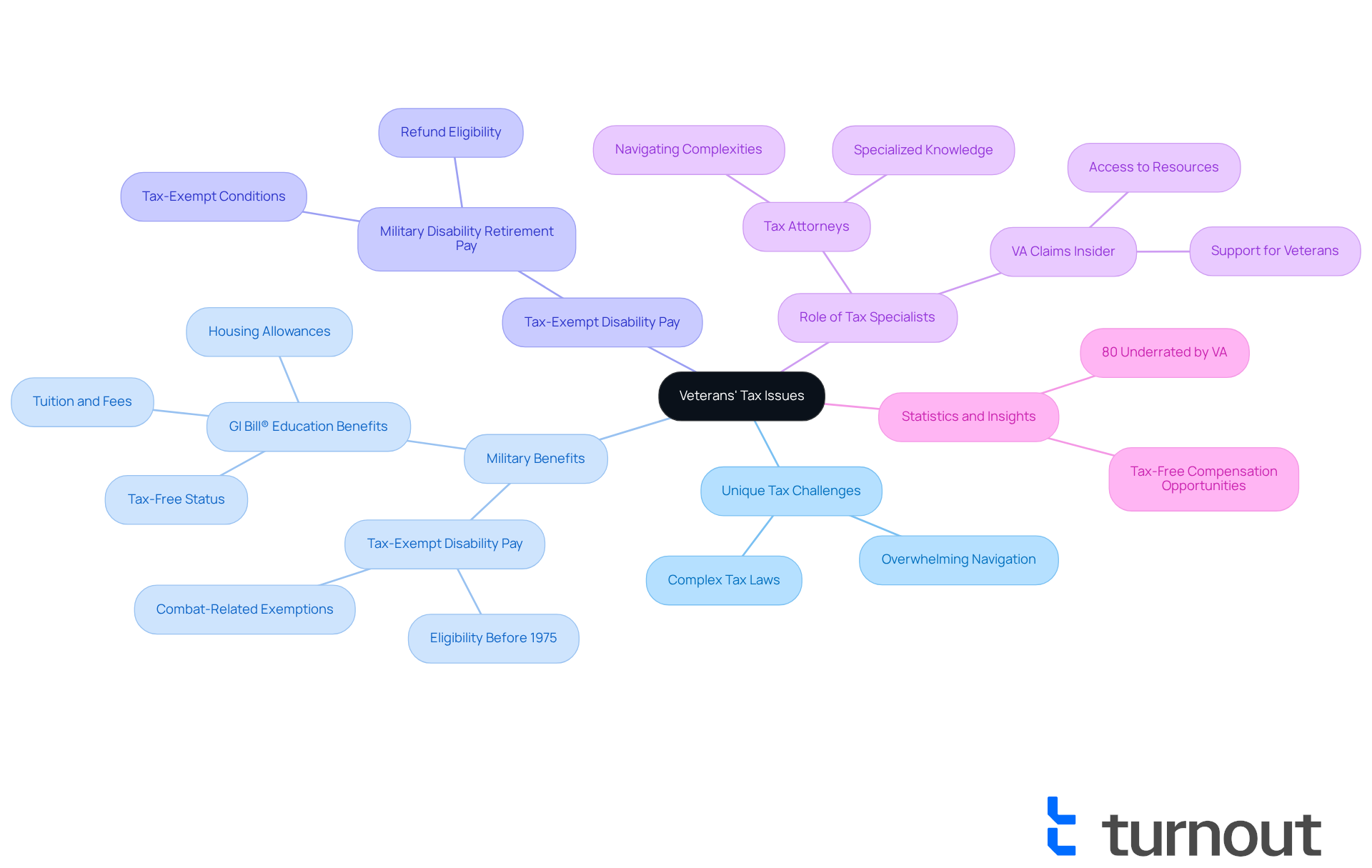

Veterans' Tax Issues: Get Support from a San Diego Tax Specialist

Veterans often face unique tax challenges, including issues related to military benefits and service-related deductions. We understand that navigating these complexities can be overwhelming. That's why involving a tax attorney San Diego who is knowledgeable about veterans' tax matters is crucial for ensuring you obtain the benefits and deductions you deserve.

This specialized knowledge is essential for tackling the intricacies of tax laws that affect veterans. For instance, did you know that military disability retirement pay is tax-exempt if you were entitled to receive disability pay before September 25, 1975? Unfortunately, many veterans are underrated by the VA—statistics indicate that 80% may miss out on significant tax-free compensation and benefits.

By collaborating with a tax attorney San Diego, you can efficiently handle your tax responsibilities and enhance your financial advantages. Turnout offers access to trained nonlawyer advocates and IRS-licensed enrolled agents who are here to assist you in understanding your tax situation and navigating the processes related to tax debt relief. Remember, you are not alone in this journey; we're here to help.

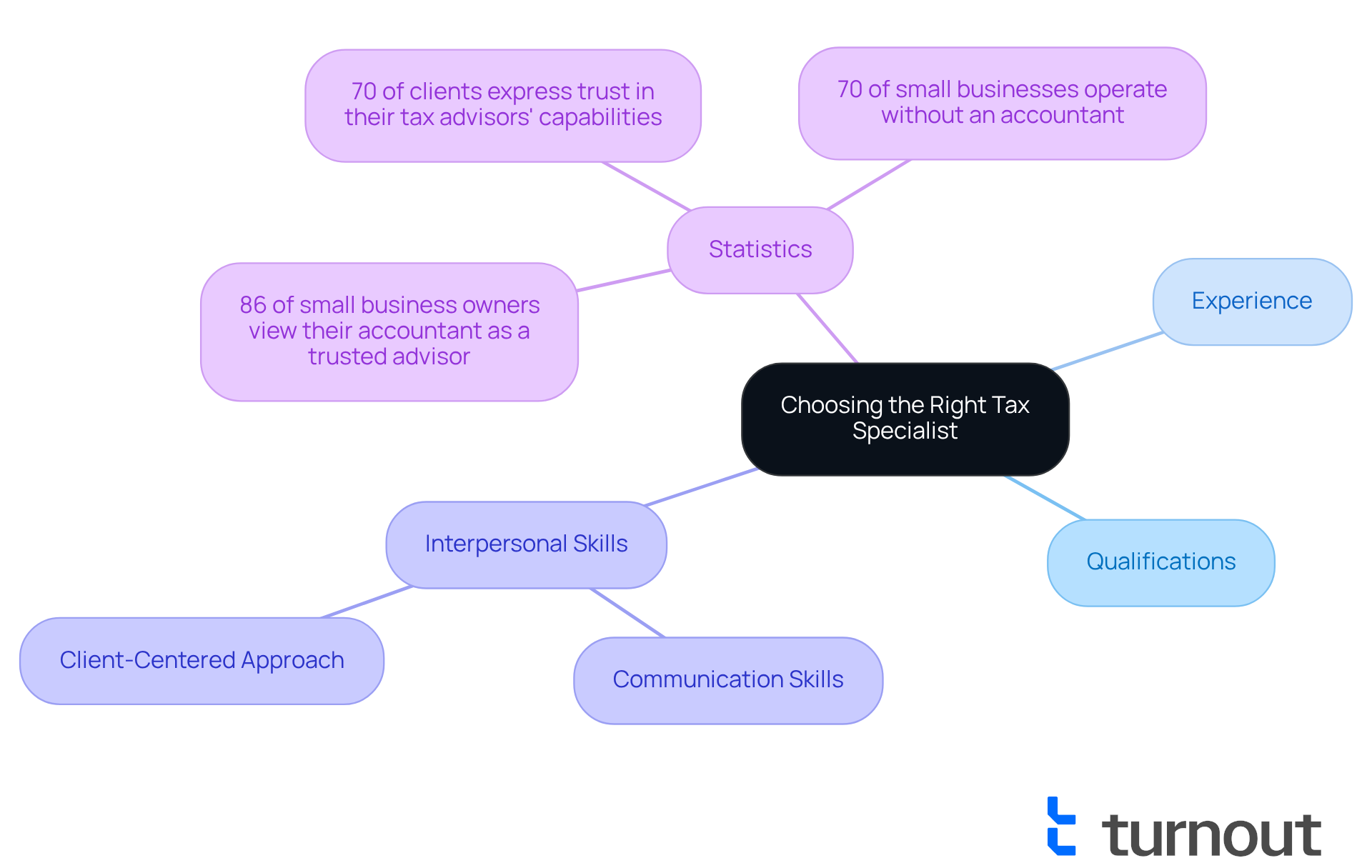

Choosing the Right Tax Specialist: Key Qualifications to Consider

When choosing a tax professional, it’s essential to prioritize their qualifications, experience, and specific areas of expertise. We understand that this decision can feel overwhelming. Look for professionals who have a proven track record in tax resolution and stay informed about current tax laws. Strong communication skills and a client-centered approach are crucial, as these qualities significantly enhance effective advocacy.

Statistics show that:

- 86% of small business owners view their accountant as a trusted advisor.

- 70% of clients express trust in their tax advisors' capabilities.

- 70% of small businesses operate without an accountant.

This highlights the importance of establishing a supportive relationship. Real-life instances demonstrate that experts who focus on client communication often achieve higher satisfaction levels.

This underscores the potential pitfalls of navigating tax issues alone. To help you choose a qualified preparer, consider utilizing the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications.

Ultimately, selecting a tax expert with the right qualifications and interpersonal skills can lead to more favorable outcomes when dealing with intricate tax matters. Remember, you are not alone in this journey; we’re here to help you make the best choice for your financial well-being.

Business Tax Matters: Get Expert Help from a San Diego Tax Specialist

We understand that businesses often encounter complex tax issues, from compliance to deductions and credits. It's common to feel overwhelmed by these challenges. A tax attorney San Diego can provide invaluable support in addressing these concerns, ensuring that you stay compliant while optimizing your tax advantages. A tax attorney in San Diego can provide expertise to help you avoid costly mistakes and develop effective tax strategies.

You are not alone in this journey. With the right guidance, you can navigate the intricacies of tax regulations and make informed decisions that benefit your business. We're here to help you find the best solutions tailored to your unique situation. Take the first step toward a brighter financial future by seeking the assistance you deserve.

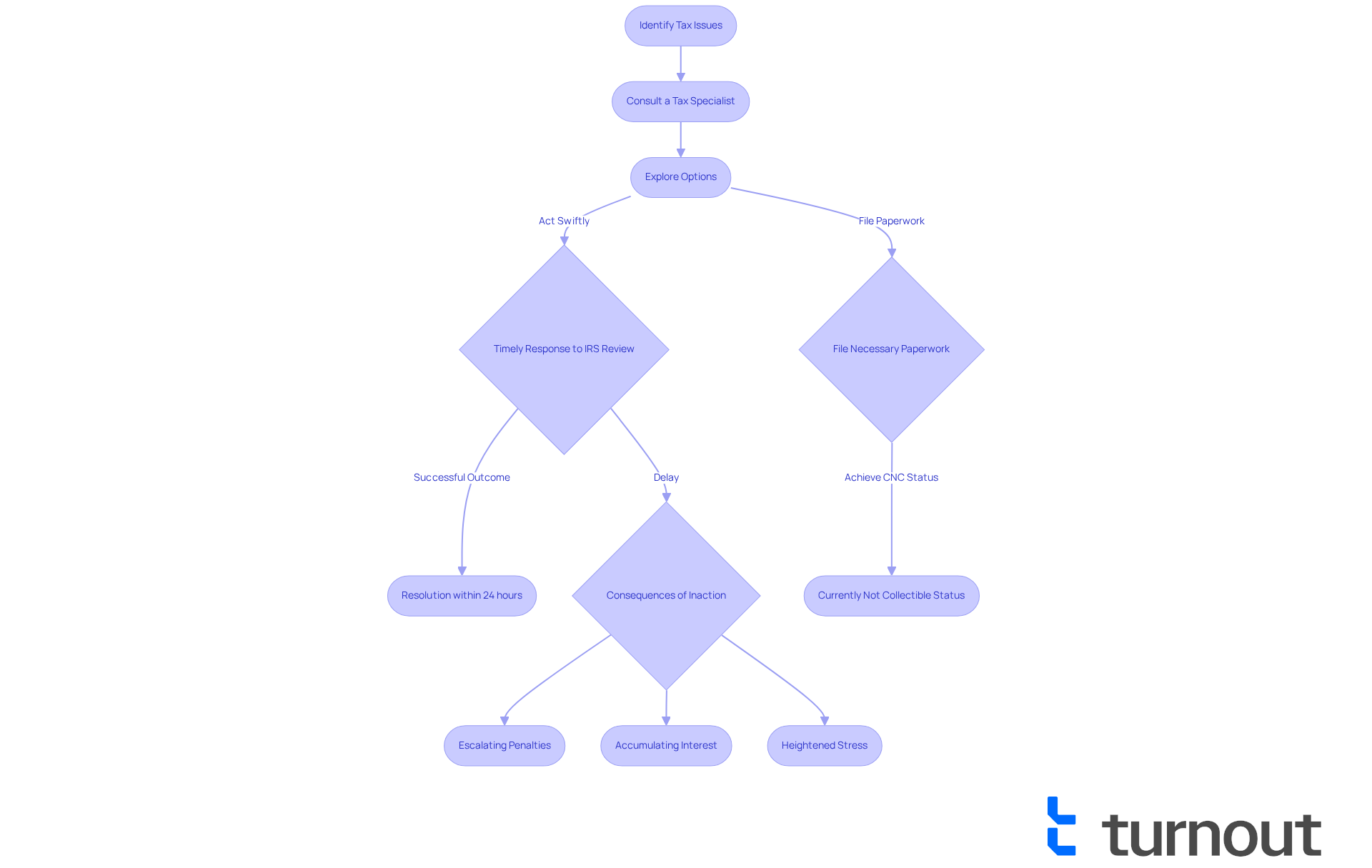

Timely Action: Why You Should Consult a San Diego Tax Specialist Immediately

When dealing with tax issues, we understand that prompt action is crucial. Delaying can lead to escalating penalties, accumulating interest, and heightened stress. Engaging a tax attorney San Diego immediately allows you to explore your options and formulate a strategic plan to tackle your tax challenges effectively.

Statistics indicate that the IRS reviews less than 0.5% of the population each year. However, if you find yourself among those chosen, it’s important to respond swiftly to minimize possible repercussions. For instance, a correspondence audit typically takes three to six months to resolve, while more complex situations can extend for a year or longer.

Real-life examples underscore the benefits of early consultations.

- One client, facing significant tax issues, received timely guidance that led to a resolution within just 24 hours, alleviating their financial burden.

- Another individual successfully obtained currently not collectible status, providing temporary relief from tax obligations after filing the necessary paperwork with the help of a specialist.

By addressing tax issues promptly with a tax attorney San Diego, you not only enhance your chances of a favorable outcome but also regain peace of mind. Remember, you are not alone in this journey. We’re here to help you avoid the pitfalls of prolonged inaction.

Conclusion

We understand that navigating the complexities of tax law can be a daunting experience. However, hiring a tax attorney in San Diego can provide invaluable support and guidance. These professionals simplify the process, empowering you to make informed decisions about your financial future. The importance of having expert assistance cannot be overstated. It ensures that you are equipped with the knowledge and resources needed to effectively address your unique tax challenges.

Throughout this article, we've highlighted key reasons for hiring a tax attorney:

- They offer personalized guidance

- Protect you during audits

- Provide defense strategies against tax evasion

- Develop tailored tax debt relief plans

Moreover, the integration of AI technology in tax resolution enhances these services, streamlining processes and improving accessibility for clients. Real-life examples illustrate the positive outcomes achievable with the right expert support. Remember, timely consultations can mitigate potential issues.

Ultimately, the path to financial recovery and peace of mind begins with seeking professional help. Engaging a tax attorney not only alleviates stress but also equips you with the tools necessary to navigate the intricate world of taxation. If you are facing tax challenges, taking the step to consult with a qualified tax professional can lead to favorable resolutions and a more secure financial future. You are not alone in this journey; we're here to help.

Frequently Asked Questions

What is Turnout and how does it assist with tax resolution?

Turnout is an AI-powered platform that streamlines the tax resolution process by automating routine tasks and providing real-time updates, making it more accessible and efficient for individuals facing tax challenges.

How does Turnout benefit individuals dealing with tax issues?

Turnout empowers individuals by simplifying complex tax issues, reducing stress associated with tax authorities, and enabling them to focus on financial recovery. It helps users feel more confident in handling their tax matters.

What percentage of corporate customers report benefits from using Turnout's AI technology?

80% of corporate customers utilizing AI-supported resources report that this technology allows them to manage tasks internally that they would have otherwise outsourced to external consultants.

What concerns might users have about AI in tax resolution, and how does Turnout address them?

Users may be concerned about issues like the 'hallucination problem' and the need for human oversight. Turnout prioritizes consumer trust and employs AI as a valuable research tool for answering tax questions, ensuring that human oversight is maintained.

Who provides support through Turnout?

Turnout employs trained non-legal advocates and IRS-licensed enrolled agents to offer expert assistance with SSD claims and tax debt relief, ensuring timely and tailored support for users.

How can a tax expert help simplify complex tax laws?

A knowledgeable tax expert can clarify intricate tax laws and provide personalized guidance tailored to individual situations, helping taxpayers understand their rights and obligations and ensuring potential benefits are not overlooked.

What examples illustrate the importance of personalized tax guidance?

Examples include retirees who lowered their tax liability through optimized withdrawal strategies and Roth conversions, and a widowed retiree seeking clarity and control in her estate plan, demonstrating the value of tailored support.

What does audit representation entail?

Audit representation involves having a tax expert advocate for you during an examination, which includes preparing necessary documentation, responding to inquiries, and negotiating on your behalf to protect your rights.

How can professional representation alleviate stress during an audit?

Having a knowledgeable tax expert by your side can reduce the stress and confusion associated with audits, providing reassurance and support throughout the process.