Overview

Navigating IRS payment plans can feel overwhelming, but you are not alone in this journey. This article outlines a comprehensive approach to help you set up an IRS payment plan with ease. By utilizing AI technology through the Turnout app, we aim to simplify the process for you, making it more manageable and less stressful.

First, let’s assess your eligibility. Understanding the costs associated with your payment plan is crucial. We highlight both short-term and long-term options available to you, ensuring you have the information needed to make informed decisions.

Managing your payment plan effectively is essential to avoid default. We provide guidance on this aspect, empowering you to navigate your financial obligations with confidence. Remember, it’s common to feel uncertain, but with the right support, you can take control of your situation.

We’re here to help you every step of the way. Take action today and explore the solutions available to you. Together, we can make this process simpler and more supportive.

Introduction

Navigating the complexities of IRS payment plans can often feel like an uphill battle. We understand that facing mounting tax obligations can be overwhelming. However, with the introduction of user-friendly technologies like Turnout, you now have an opportunity to streamline the setup process. This makes it easier than ever to manage your financial responsibilities.

As you explore the various options available, you may wonder: what are the most effective steps to ensure a successful payment plan with the IRS? This article outlines ten essential steps that not only simplify the application process but also empower you to take control of your financial future. Remember, you are not alone in this journey; we're here to help you every step of the way.

Turnout: Streamline Your IRS Payment Plan Setup

Turnout is transforming how IRS financial plans are established by harnessing the power of AI technology. This innovative approach simplifies the application process, enabling users to navigate the complexities of tax obligations with ease. With a user-friendly app and dedicated support, Turnout empowers individuals to manage their financial responsibilities confidently, alleviating the stress often linked to bureaucratic hurdles.

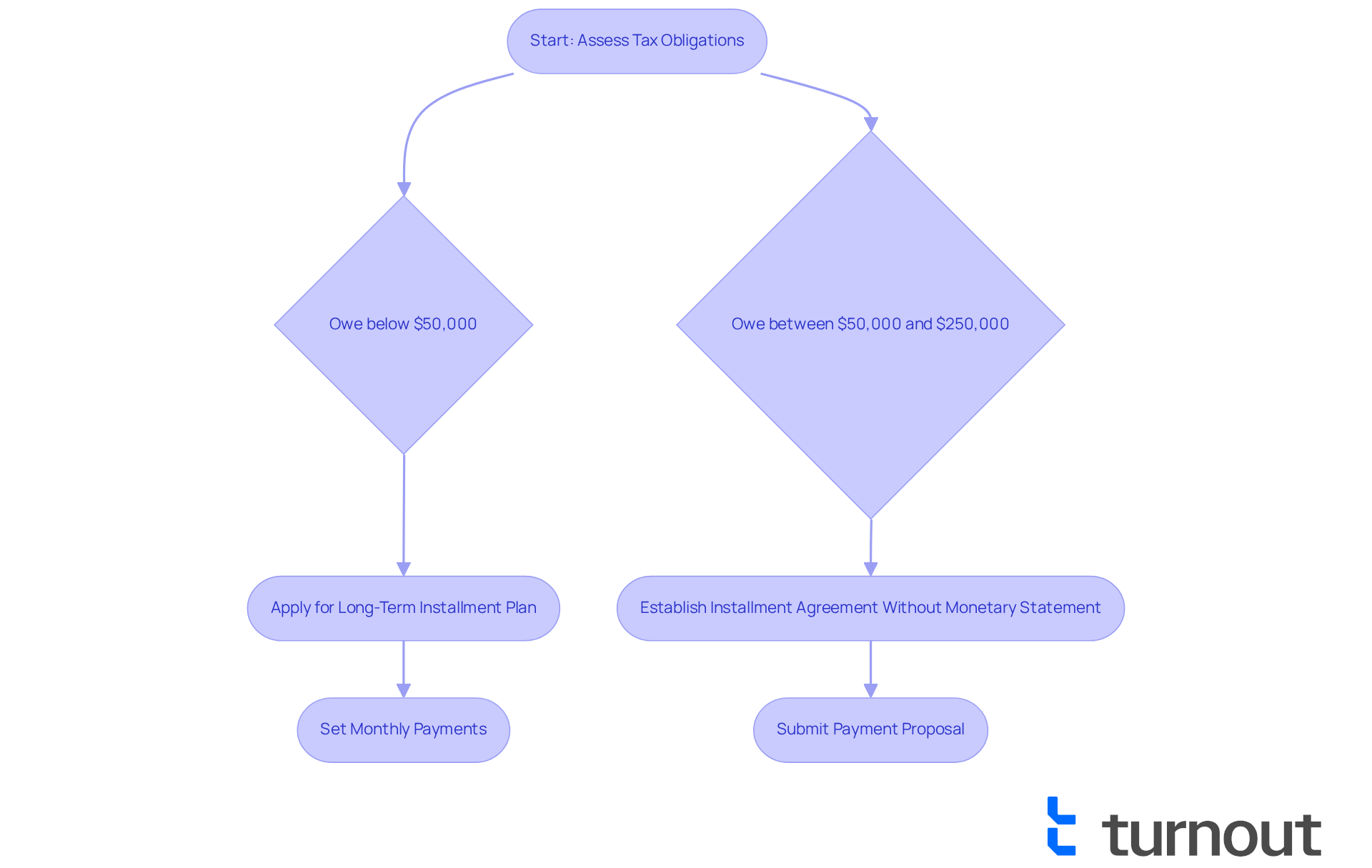

We understand that managing tax obligations can feel overwhelming. For instance, the IRS has introduced a Long-Term Installment Plan, prompting many to ask, 'can a payment plan be set up with the IRS' for taxpayers with balances below $50,000 to make monthly payments over a period of up to 10 years. This initiative simplifies the management of tax debts, making it easier for consumers to stay on top of their obligations. Additionally, taxpayers who owe under $250,000 can establish Installment Agreements without needing to submit a monetary statement, which leads to the question of how can a payment plan be set up with the IRS, provided their monthly payment proposal is adequate.

Financial specialists emphasize the importance of streamlining IRS financing options to enhance accessibility for consumers. The integration of AI technology in financial services is reshaping how individuals engage with their tax responsibilities, making processes more efficient and user-friendly. Turnout exemplifies this change by offering a platform that not only streamlines IRS financial arrangements but also provides ongoing assistance to keep users informed and empowered throughout their financial journey. Remember, you are not alone in this process; we're here to help you every step of the way.

Assess Your Eligibility for an IRS Payment Plan

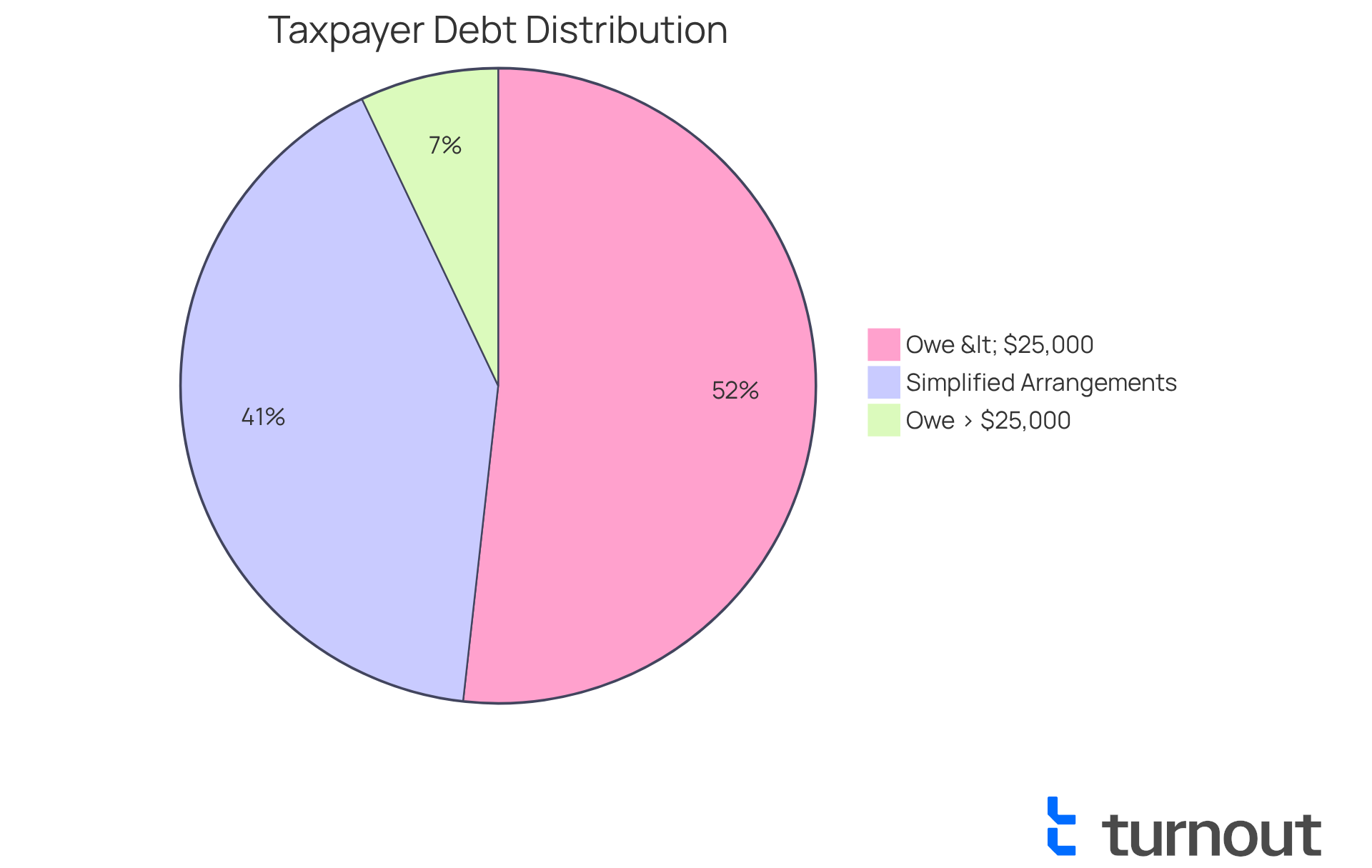

Before you consider an IRS installment option, it's important to assess your eligibility. We understand that navigating tax obligations can be overwhelming, especially if you owe under $50,000 in total tax, penalties, and interest. If this applies to you, you may qualify for a simplified arrangement, which can significantly ease the process. Remember, all required tax returns must be filed to be eligible.

It's common to feel unsure about these requirements. In fact, around 88% of individual taxpayers owe under $25,000, highlighting the appeal of simplified installment arrangements (SLIAs). These arrangements account for nearly 70% of IRS financing options, making them a popular choice.

To verify your eligibility and understand any specific requirements, we encourage you to use the IRS's online resources. Alternatively, consider seeking advice from a consumer advocate who can help you evaluate your tax situation and offer personalized guidance tailored to your circumstances. Tax professionals emphasize that applying directly with the IRS can save you time and money, ensuring you receive the assistance you need efficiently.

You are not alone in this journey, and we're here to help you navigate these options with confidence.

Initiate Your IRS Payment Plan Application Process

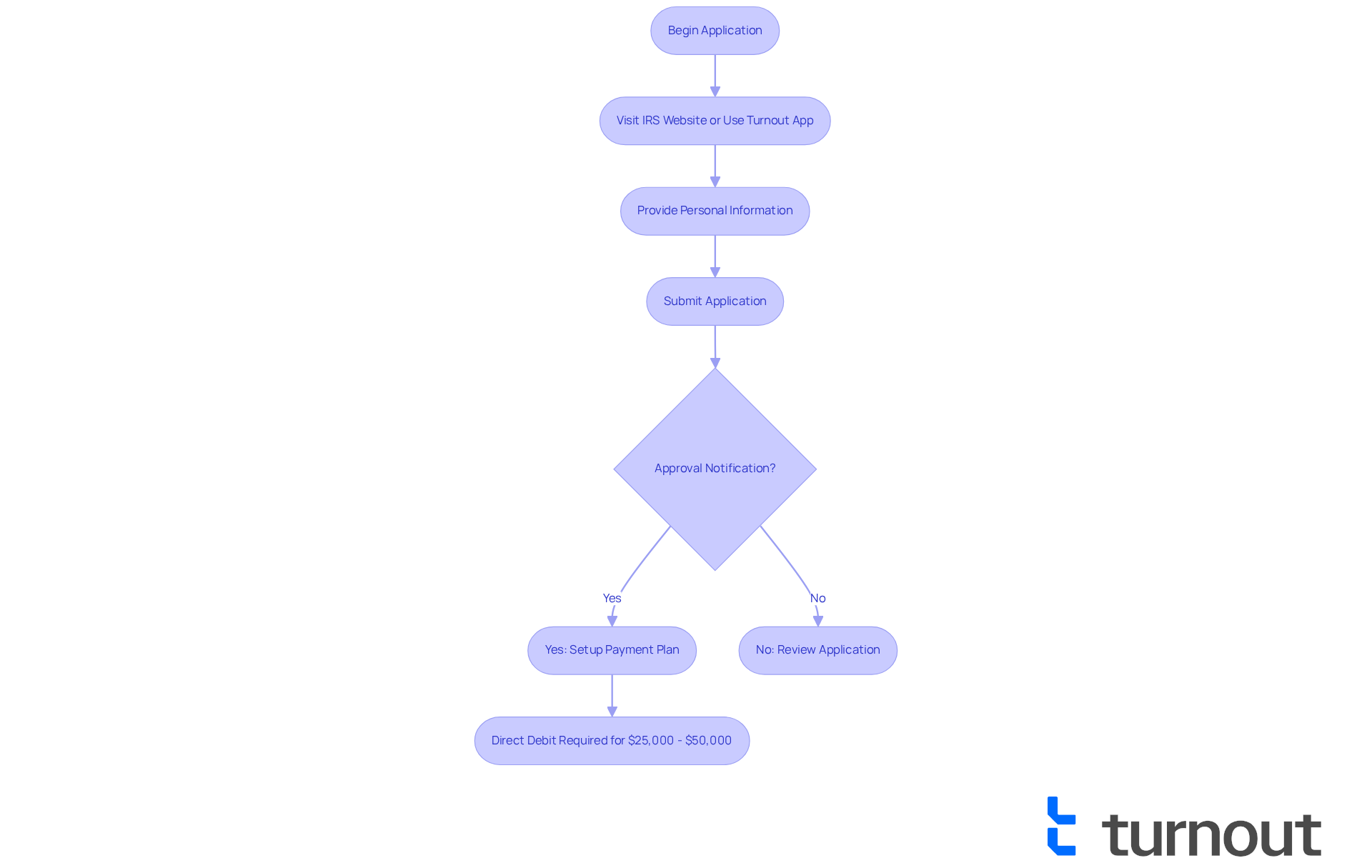

If you're feeling overwhelmed by the IRS installment application, we understand. To begin this process, you can visit the IRS website or use Turnout's consumer app, which makes everything easier for you. You'll need to provide some personal information, including your Social Security number, tax details, and financial situation. The online application is designed for efficiency, allowing most taxpayers to complete it in just a few minutes.

The good news is that most taxpayers can find out how a payment plan can be set up with the IRS, and you will receive prompt notification of your approval after submitting the online application. For amounts between $25,000 and $50,000, direct debit is necessary, which simplifies the transaction process. This streamlined approach not only saves you time but also emphasizes ease of use, as it requires no paperwork or direct contact with the IRS. This can significantly reduce the stress often associated with tax obligations. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Evaluate the Costs and Fees of IRS Payment Plans

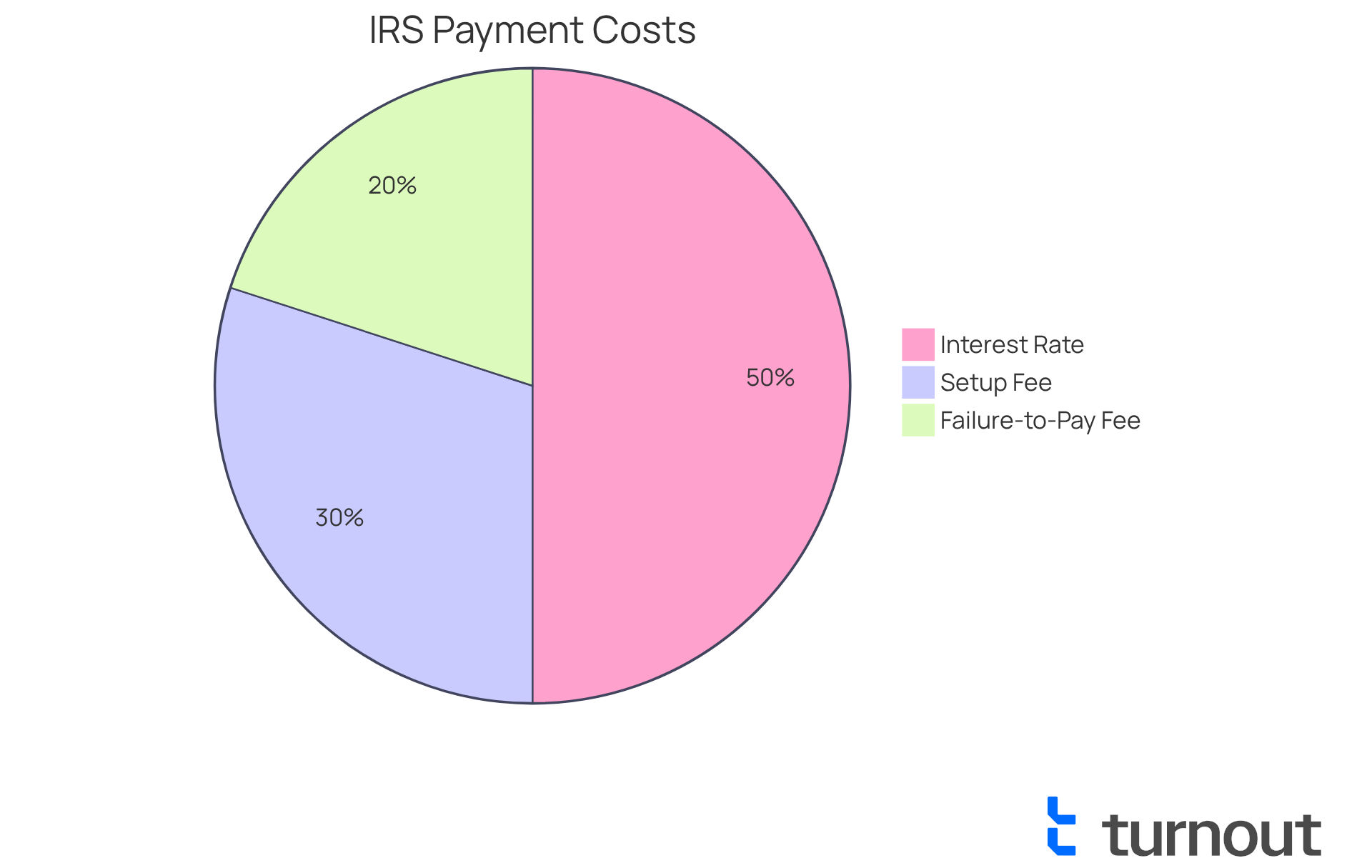

It’s essential to evaluate the related expenses and charges carefully when considering how a payment plan can be set up with the IRS, as it can feel overwhelming. The IRS does impose a setup fee that varies based on your selection, ranging from $22 to $178 depending on how you apply. If you’re seeking a short-term arrangement (under 180 days), you’ll be relieved to know that there is usually no setup fee when you apply online. However, long-term arrangements may incur fees that you should be aware of.

For those who may be struggling financially, low-income taxpayers can have the user fee waived if they opt for automatic withdrawals from their bank account. It’s important to remember that interest will accrue on any unpaid balance, currently set at 8% per year, compounded daily. This means that even while you’re enrolled in a financing arrangement, the total amount due may increase due to interest and fees. Fortunately, while enrolled in a financial arrangement, the failure-to-pay fee is lowered to 0.25%, down from 0.5%, which can help ease some of the financial burden.

We understand that navigating these expenses can be daunting, but it’s crucial to review them thoroughly and factor them into your overall financial strategy. This way, you can avoid unexpected financial burdens. Remember, you must have submitted all tax returns to be eligible for a short-term arrangement.

Proactive handling of your financial arrangement can significantly reduce stress and ensure that you adhere to IRS guidelines. If your situation changes, you even have the option to modify your financial agreement through the Online Payment Agreement tool. You are not alone in this journey; we're here to help you every step of the way.

Explore Short-Term and Long-Term IRS Payment Plan Options

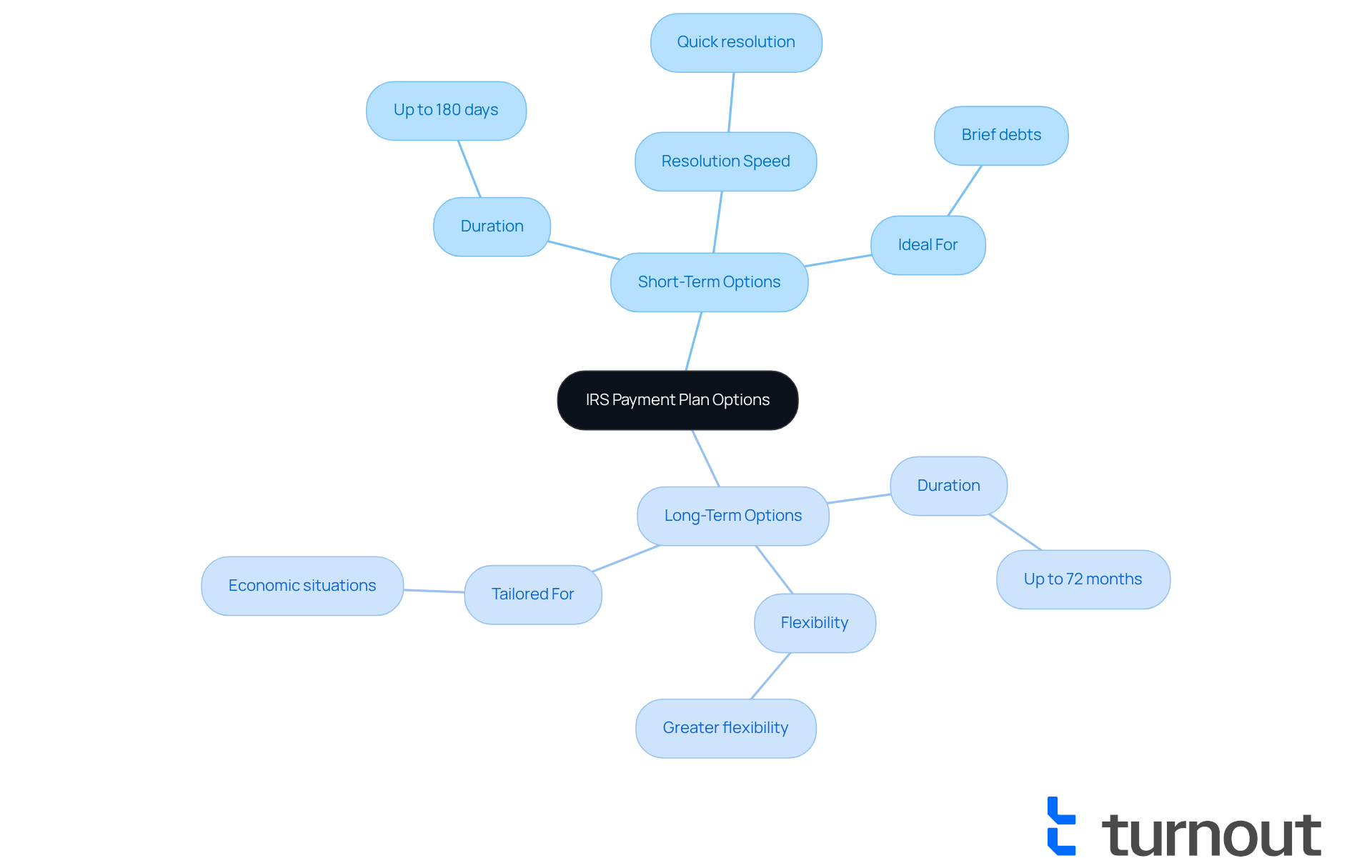

The IRS offers two main payment arrangement options: short-term and long-term. We understand that navigating tax obligations can be overwhelming, so it's important to know your options.

- Short-term strategies typically last for up to 180 days, allowing individuals to resolve their tax obligations quickly. This option is ideal for those who can settle their debts in a relatively brief period.

- On the other hand, long-term strategies can extend up to 72 months or even longer, providing greater flexibility for those facing larger tax responsibilities.

It's essential to evaluate your financial situation carefully to determine which option best suits your repayment capabilities. As expert Brad Thibeau wisely points out, "With different strategies and options, you can discover an approach that fits your economic circumstances, enabling you to meet your tax responsibilities without excessive difficulty."

In 2025, the typical length for short-term arrangements remains around 180 days, while long-term arrangements can be tailored to fit various economic situations, ensuring that taxpayers can find a feasible path forward.

Furthermore, the IRS has expanded Installment Agreement options, which raises the question of how can a payment plan be set up with the IRS to alleviate some of the stress. For amounts owed up to $250,000, there's no need for financial statements if the monthly contribution proposal is reasonable. Remember, you are not alone in this journey; we're here to help you find a solution that works for you.

Calculate Your Monthly Payments for IRS Payment Plans

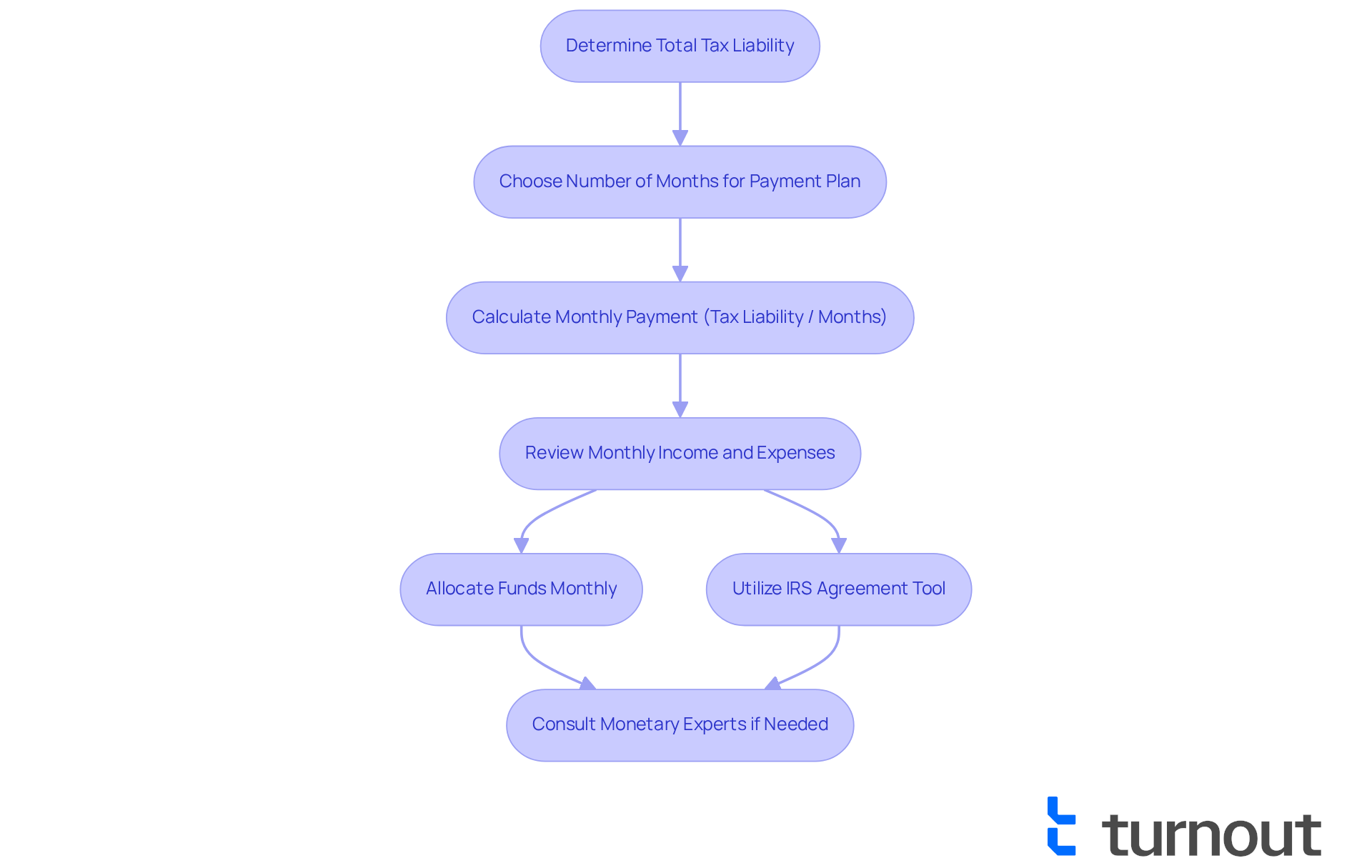

To determine your monthly dues, first, consider if a payment plan can be set up with the IRS by dividing your total tax liability by the number of months you plan to settle it. For instance, if your tax obligation is $5,000 and you opt for a 12-month plan, your monthly installment would be approximately $416. We understand that budgeting can be challenging, so it's essential to consider your overall budget and other financial obligations to ensure this expense is manageable.

Here are some budgeting tips to help you stay on track:

- Review your monthly income and expenses to identify areas where you can cut back.

- Allocate a designated sum each month for your IRS obligation to prevent falling behind.

- Utilize the IRS agreement tool to monitor your expenses and manage your financial strategy effectively.

It's common to feel overwhelmed, especially when data indicates that many taxpayers face challenges with debt amounts. Therefore, selecting an arrangement that fits your economic circumstances is crucial. Consulting with monetary experts can provide insights into effective budgeting strategies tailored to your needs. As the IRS states, 'the IRS will ask you what you can afford, and you may wonder, can a payment plan be set up with the IRS?'

Furthermore, low-income taxpayers may qualify for a $0 setup charge for short-term arrangements, emphasizing accessible assistance options. It's vital to comprehend the possible repercussions of failing to uphold financial responsibilities, such as the risk of tax levies or liens, to ensure you remain compliant with your obligations. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

Understand How to Revise Your IRS Payment Plan

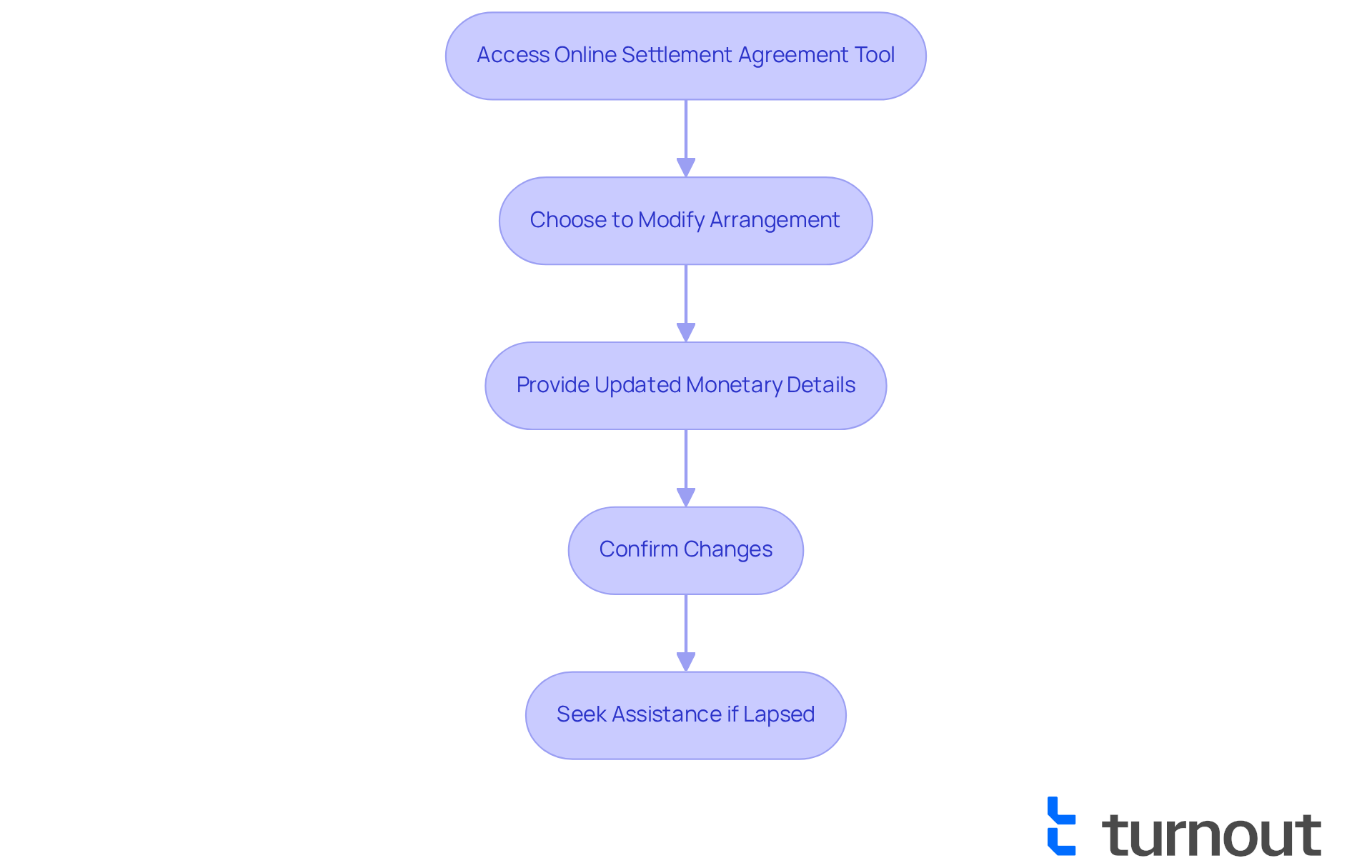

If your financial circumstances have changed and you need to know if a payment plan can be set up with the IRS, it’s important to act quickly. You can reach out to the IRS directly or use Turnout's app to learn how a payment plan can be set up with the IRS through expert guidance from IRS-licensed enrolled agents. Many taxpayers find themselves needing to make adjustments; in fact, a significant number owe less than $100,000 in combined tax, penalties, and interest, leading them to wonder if a payment plan can be set up with the IRS, allowing access to short-term options without incurring setup fees.

To adjust your payment plan, follow these steps:

-

Access the Online Settlement Agreement tool: This platform allows you to view your current financial arrangement details and make necessary adjustments. The tool is available Monday to Friday from 6 a.m. to 12:30 a.m. Eastern time, Saturday from 6 a.m. to 9 p.m. Eastern time, and Sunday from 6 p.m. to 12 a.m. Eastern time.

-

Choose the option to modify your arrangement: You can adjust your monthly contribution amount, due date, or even extend the length of your agreement. Please note that modifying a current financial arrangement incurs a $10 charge, and it is important to ask if a payment plan can be set up with the IRS, especially for low-income applicants who may receive a refund.

-

Provide updated monetary details: If your new amount does not meet the IRS requirements, you will be prompted to revise it further.

-

Confirm your changes: Make sure all adjustments are documented to avoid any potential penalties or defaults. If your financial arrangement has lapsed due to default, a reinstatement fee may apply, and you might ask if a payment plan can be set up with the IRS, with Turnout ready to assist you in managing this process.

Tax advisors emphasize the importance of addressing changes promptly, particularly when asking, can a payment plan be set up with the IRS? As one consultant wisely noted, "Prompt modifications to your billing strategy can avert extra penalties and keep your financial situation manageable." By staying proactive and utilizing Turnout's resources, you can effectively manage your IRS payment responsibilities and understand how a payment plan can be set up with the IRS to maintain control over your economic well-being. Remember, we’re here to help you navigate this journey, and you are not alone.

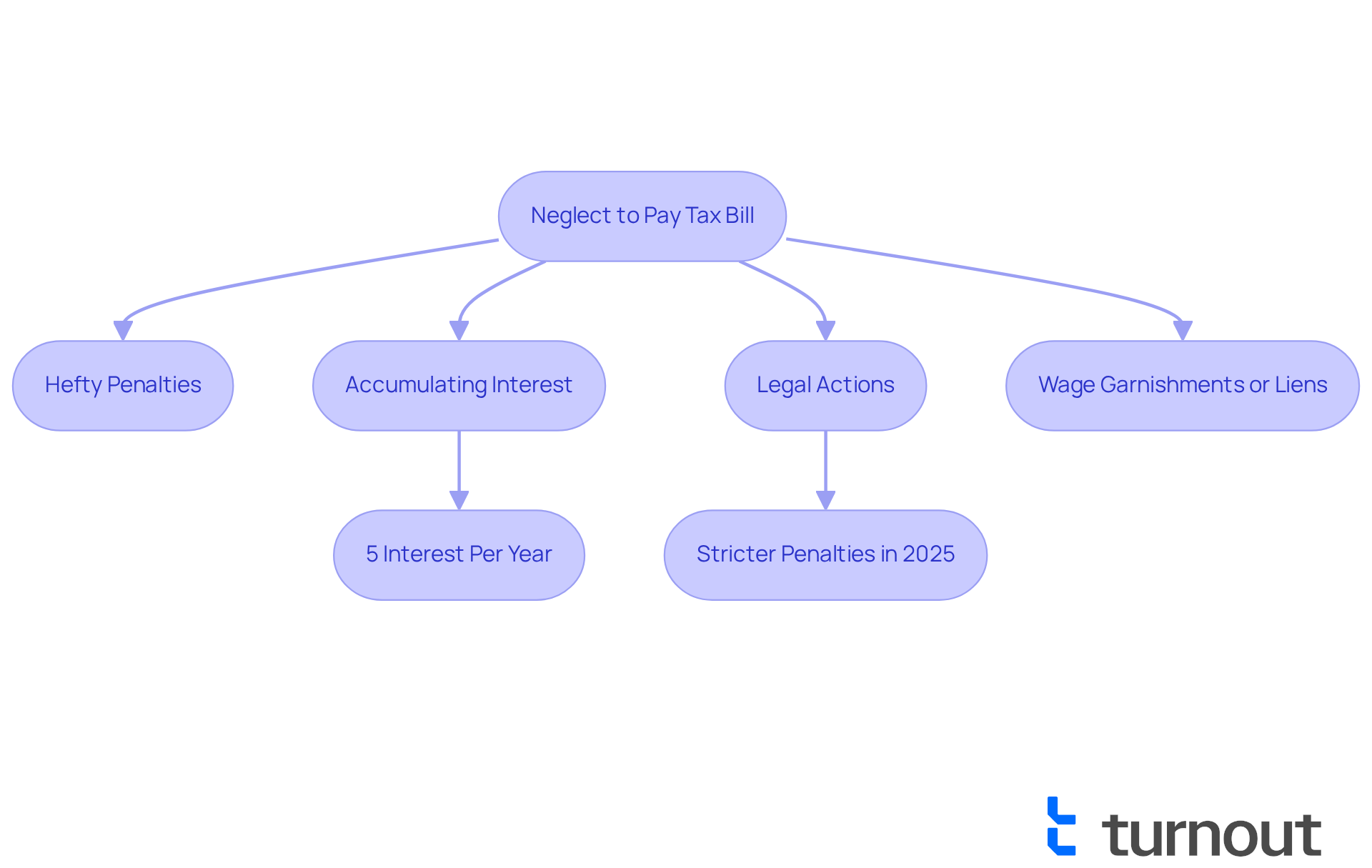

Recognize the Consequences of Not Paying Your Tax Bill

Neglecting to pay your tax bill can lead to serious consequences, including hefty penalties, accumulating interest, and potential legal actions from the IRS. We understand that facing these responsibilities can be overwhelming. Individuals who overlook their tax obligations may encounter wage garnishments or liens on their property, which can significantly impact their financial stability.

For instance, as noted by the National Association of Home Builders, each $819 incurred during construction can increase the final cost of a home by $1,000. This example illustrates how expenses can escalate unexpectedly. Tax specialists emphasize that the typical interest on overdue tax bills can reach as high as 5% each year, adding to the financial burden over time.

Furthermore, the IRS imposes penalties for non-payment, which can escalate quickly. In 2025, these penalties are expected to become even stricter, making it crucial to act promptly. It's common to feel anxious about these potential repercussions, but understanding them can empower you to take control.

Real-life examples show the challenges faced by those who neglected their tax obligations, leading to prolonged financial difficulties. Comprehending these possible outcomes highlights the importance of creating a financial strategy to manage your tax responsibilities effectively. Remember, you are not alone in this journey, and we're here to help you navigate these challenges and prevent a cycle of debt.

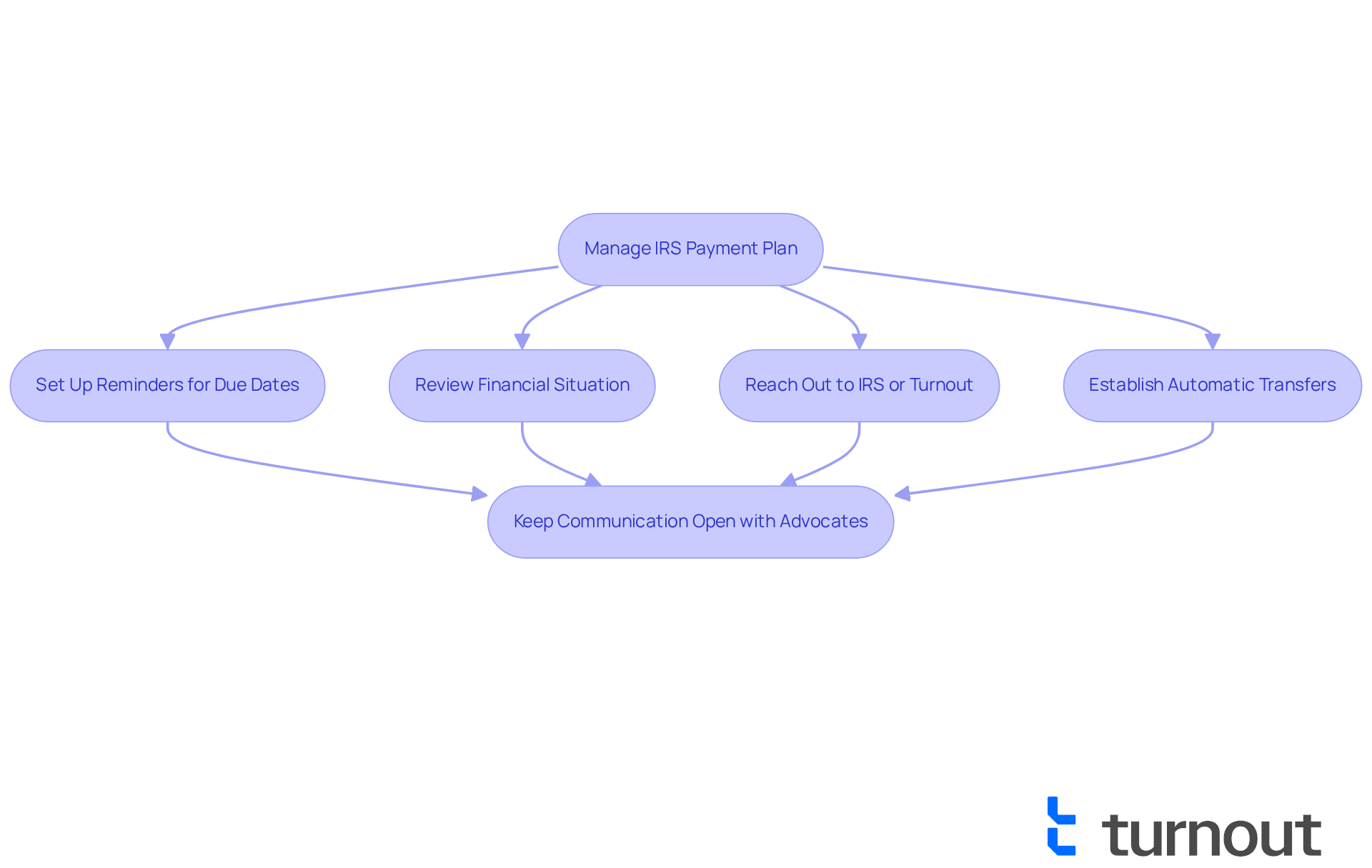

Manage Your IRS Payment Plan to Avoid Default

To avoid defaulting on your IRS installment plan, it's important to set up reminders for due dates and understand how a payment plan can be set up with the IRS by closely observing your financial situation. We understand that financial challenges can be daunting. If you anticipate difficulties with a transaction, please reach out to the IRS or Turnout promptly to find out if a payment plan can be set up with the IRS. Turnout offers access to trained nonlawyer advocates and IRS-licensed enrolled agents who are here to help you navigate these processes, ensuring you have the support you need.

Financial advisors emphasize that staying proactive is crucial. They recommend regularly reviewing your budget and adjusting your spending to meet your obligations. Moreover, consider establishing automatic transfers to streamline the process and reduce the chance of missing deadlines. Did you know that around 70% of taxpayers effectively manage their IRS arrangements, which makes one wonder how can a payment plan be set up with the IRS? By applying these strategies—like examining your budget each month and setting reminders for dues—you can maintain adherence and avoid fines, leading to a smoother experience with your financial arrangement.

Lastly, always keep an open line of communication with your advocates. Discuss any changes in your financial situation with them. Remember, you are not alone in this journey, and support is available every step of the way.

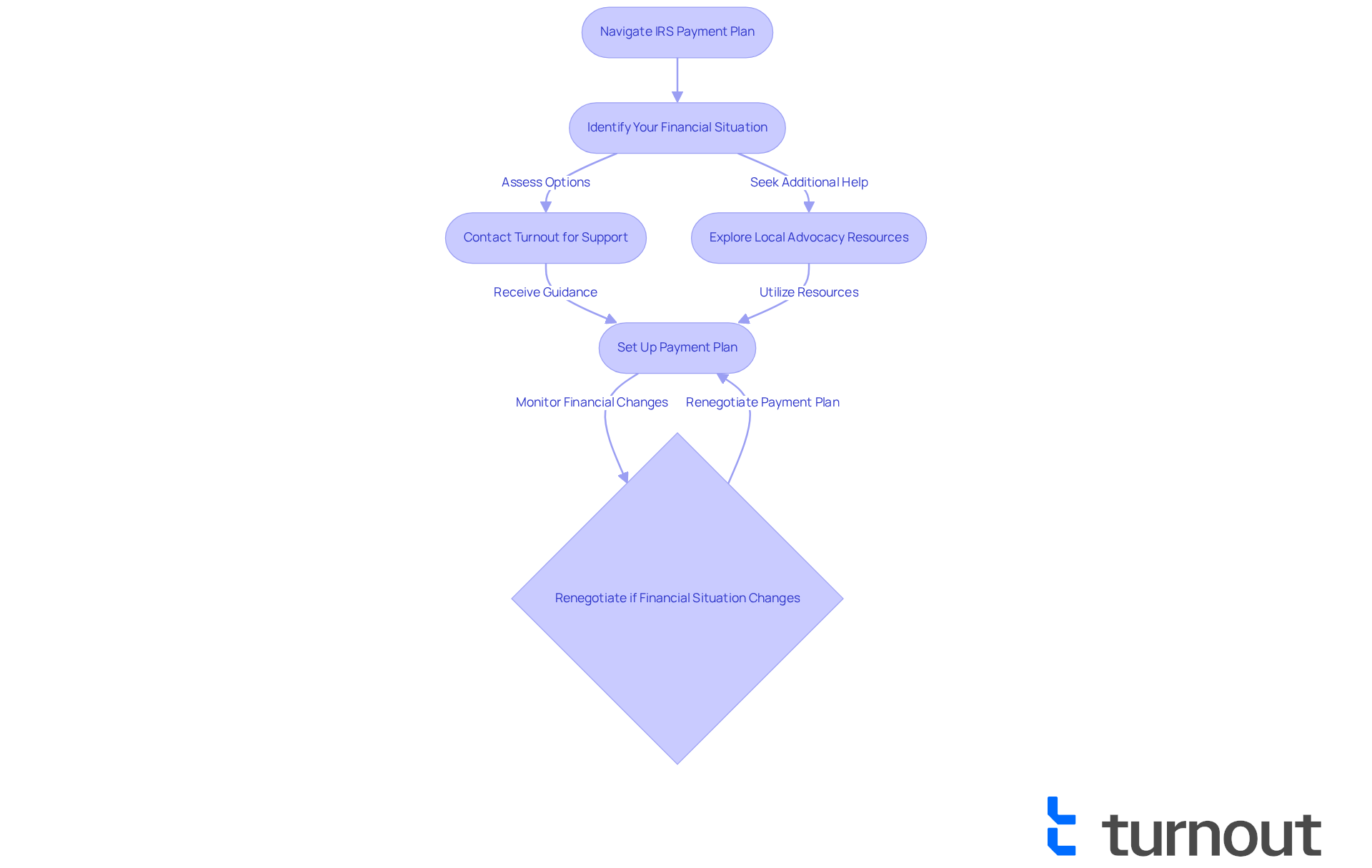

Seek Assistance for Your IRS Payment Plan Setup

Navigating the process of how can a payment plan be set up with the IRS can feel overwhelming. But remember, you don't have to do it alone. Turnout is here to help, offering dedicated support through our app and licensed advocates who will guide you through each step of the process. With over 5 million Americans seeking assistance with Social Security Disability and tax-related issues, the need for effective support is significant.

In addition to Turnout, local consumer advocacy organizations provide valuable resources tailored to your specific needs. These organizations focus on helping individuals understand their options and navigate the complexities of IRS financial arrangements. It's common to feel uncertain, but many advocates stress the importance of acting quickly; delays can worsen tax issues. They also highlight that if your financial situation changes, you can renegotiate your settlement agreements, making it easier to meet your tax obligations.

By leveraging the support of Turnout and other consumer advocacy groups, you can confidently explore how can a payment plan be set up with the IRS. Together, we can transform a potentially overwhelming process into a more straightforward and achievable task. Remember, you are not alone in this journey; we're here to help.

Conclusion

Navigating the complexities of setting up an IRS payment plan can feel overwhelming, but with the right support and tools, it becomes a manageable journey. We understand that the application process can be daunting, which is why this article outlines essential steps to simplify it. By emphasizing the importance of understanding eligibility, evaluating costs, and knowing your payment options, we aim to empower you. Utilizing resources like Turnout can help you approach your financial responsibilities with confidence, alleviating the stress often associated with tax obligations.

Key insights discussed include:

- The various payment options available to you

- The significance of accurately calculating monthly payments

- The necessity of staying proactive in managing your plan to avoid default

It’s common to feel anxious about the potential consequences of neglecting tax bills; this serves as a crucial reminder of the importance of timely action and informed decision-making. With over 70% of taxpayers successfully managing their IRS arrangements, it’s clear that a structured approach can lead to positive outcomes.

Ultimately, seeking assistance and leveraging available resources can transform what may seem like an overwhelming process into a clear path forward. By acting promptly and utilizing the support of platforms like Turnout and local advocacy organizations, you can navigate your IRS payment plans effectively. Embracing these strategies not only helps you fulfill your tax obligations but also fosters financial stability and peace of mind. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it help with IRS payment plans?

Turnout is an innovative platform that utilizes AI technology to simplify the process of setting up IRS payment plans. It provides a user-friendly app and dedicated support to help individuals manage their tax obligations more easily and confidently.

What is the Long-Term Installment Plan offered by the IRS?

The Long-Term Installment Plan allows taxpayers with balances below $50,000 to make monthly payments over a period of up to 10 years, simplifying the management of tax debts.

Who can establish Installment Agreements without submitting a monetary statement?

Taxpayers who owe under $250,000 can establish Installment Agreements without needing to submit a monetary statement, provided their monthly payment proposal is adequate.

What should I consider before applying for an IRS payment plan?

Before applying, it's important to assess your eligibility, especially if you owe under $50,000 in total tax, penalties, and interest. All required tax returns must be filed to qualify for a simplified arrangement.

How common are simplified installment arrangements (SLIAs)?

Simplified installment arrangements are quite common, accounting for nearly 70% of IRS financing options, and around 88% of individual taxpayers owe under $25,000.

How can I verify my eligibility for an IRS payment plan?

You can verify your eligibility by using the IRS's online resources or by seeking advice from a consumer advocate who can provide personalized guidance based on your tax situation.

What information do I need to provide to apply for an IRS payment plan?

To apply, you will need to provide personal information such as your Social Security number, tax details, and your financial situation.

How can I initiate the IRS payment plan application process?

You can initiate the application process by visiting the IRS website or using Turnout's consumer app, which allows most taxpayers to complete the application in just a few minutes.

What happens after I submit my online application for an IRS payment plan?

After submitting your online application, you will receive prompt notification of your approval, making the process efficient and reducing the stress associated with tax obligations.

Is direct debit necessary for all payment plans?

Direct debit is necessary for amounts between $25,000 and $50,000, which simplifies the transaction process and requires no paperwork or direct contact with the IRS.