Overview

We understand that navigating the complexities of disability payments can be overwhelming. The average payment is shaped by various factors, including your work history, eligibility criteria, and essential cost-of-living adjustments. It's important to recognize how elements such as your previous earnings, family status, and state regulations can significantly impact the amount you receive. By understanding these variables, you can optimize your benefits effectively. Remember, you are not alone in this journey—we're here to help you through the process.

Introduction

Understanding the intricacies of disability payments can feel overwhelming. We recognize that many factors influence the amount you may receive. From eligibility criteria and past earnings to family status and state regulations, each aspect plays a vital role in determining average disability payments. In this article, we explore ten key factors that shape these payments, providing insights to help you navigate this complex system effectively. It's common to wonder: how can you ensure you’re maximizing your benefits and not leaving money on the table?

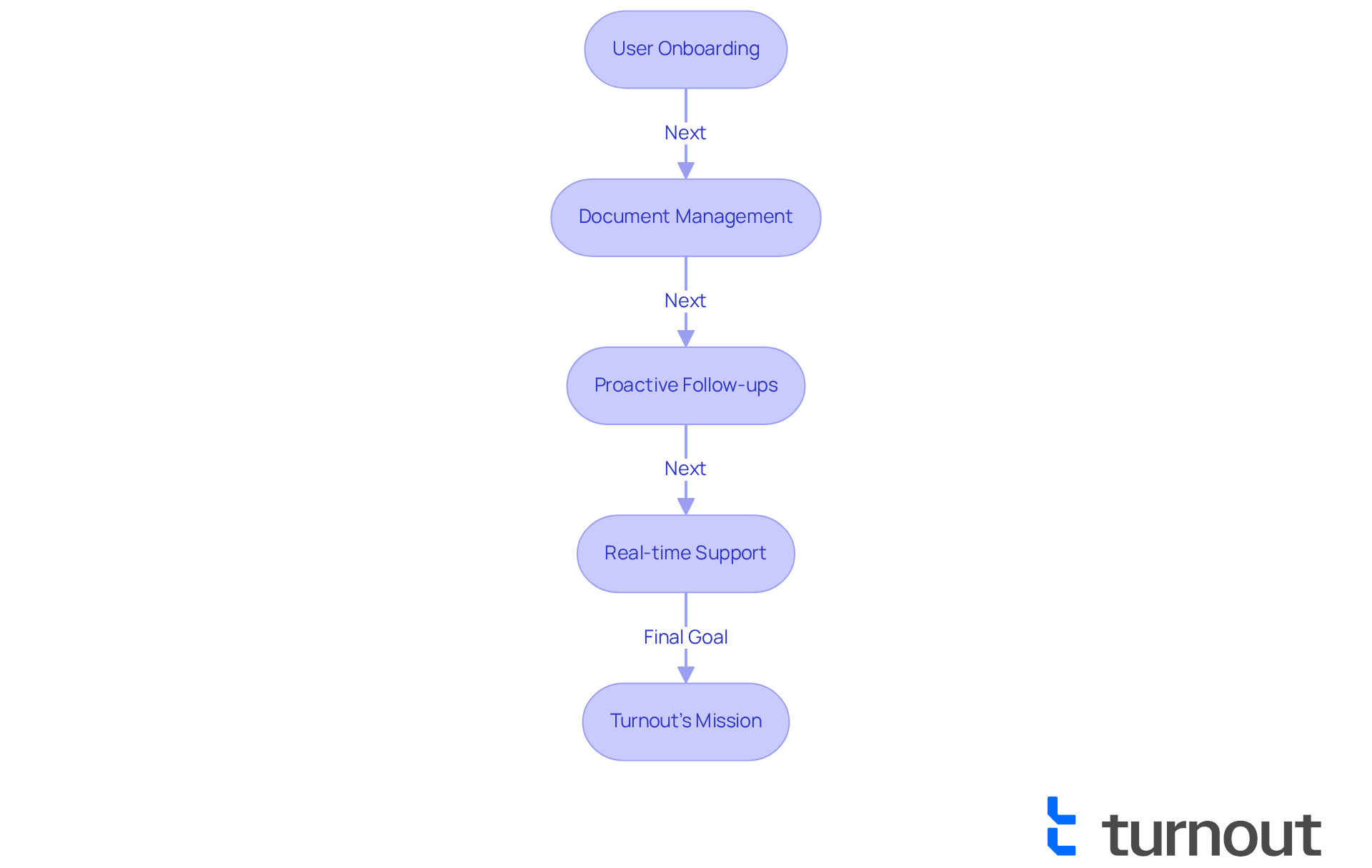

Turnout: Streamlining Your Disability Payment Process

Turnout is reshaping the disability payment landscape by harnessing the power of AI technology to simplify the often overwhelming process of applying for and managing disability support. With Jake, the AI case quarterback, users enjoy a smooth onboarding experience, efficient document management, and proactive follow-ups. These elements work together to keep their cases on track. This modern approach alleviates the administrative burden typically associated with disability claims, allowing consumers to focus on what truly matters: understanding and optimizing their benefits.

We understand that navigating the application process can be daunting. Preliminary data shows that clients using the AI assistant complete intake steps significantly faster than those relying on traditional methods. This highlights the effectiveness of this innovative system. The AI platform offers real-time answers to common questions about eligibility and documentation, empowering users with the knowledge they need to tackle the complexities of the application process.

It's important to note that Turnout is not a law firm and does not provide legal representation. Instead, it employs trained nonlawyer advocates for SSD claims, ensuring clients receive qualified support throughout their journey. This commitment to compassionate assistance is at the heart of Turnout's mission to provide clarity and help at every stage of the application process. Additionally, Turnout offers services related to tax debt relief, further aiding clients in managing their financial challenges.

By simplifying the disability assistance application process, Turnout minimizes confusion and fosters a sense of control for applicants. This ultimately leads to improved outcomes and fewer delays. As the landscape of disability claims evolves, Turnout remains dedicated to empowering individuals to manage their entitlements with confidence. Remember, you are not alone in this journey; we are here to help.

Eligibility Criteria: Key Requirements for Disability Payments

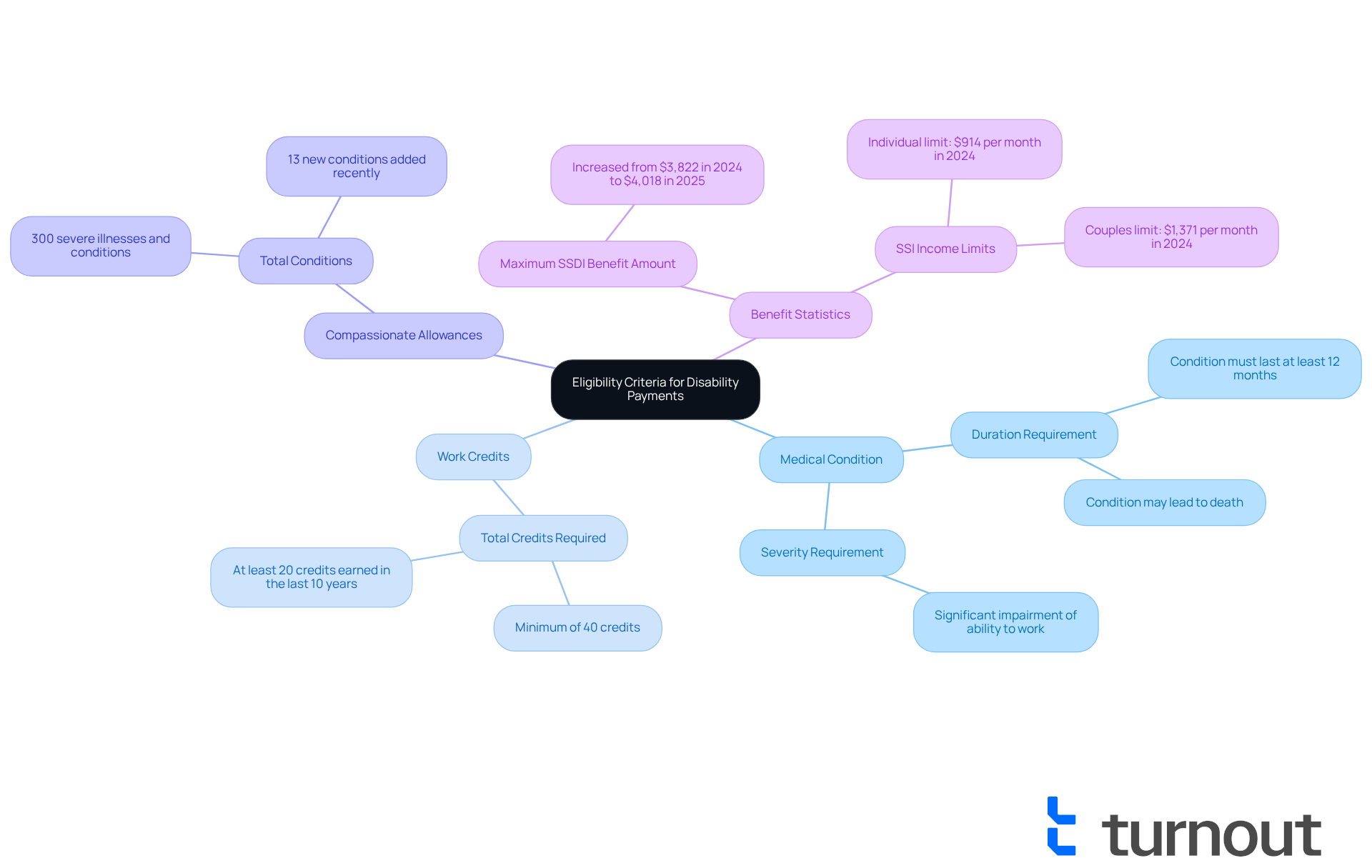

Navigating the world of average disability payment can feel overwhelming. To qualify, applicants must meet specific eligibility criteria set by the Social Security Administration (SSA). It’s essential to demonstrate a medical condition that significantly impairs your ability to work, with the expectation that this condition will last at least 12 months or lead to death. Additionally, you need to have earned sufficient work credits through your employment history—typically, this requires a minimum of 40 credits, with at least 20 earned in the last 10 years.

We understand that this process can be daunting. That’s why it’s significant to note that the Compassionate Allowances list now features 300 severe illnesses and conditions, which can speed up your application process if you are affected. Grasping these requirements is crucial for anyone considering applying for disability assistance. Remember, the SSA regularly revises its medical listings and eligibility standards, so staying informed is vital.

It's also important to highlight that recent statistics show the maximum SSDI benefit amount rose from $3,822 in 2024 to $4,018 in 2025. This emphasizes the financial aspects of average disability payment assistance and how it can significantly impact your life. Engaging with knowledgeable advocates, like those provided by Turnout, can offer valuable insights into effectively meeting SSA eligibility requirements.

Turnout's trained nonlegal advocates focus on assisting applicants through the intricate application process. They are here to ensure that you obtain the support you need without the stress of legal representation. Remember, you are not alone in this journey; there are resources available to help you every step of the way.

Past Earnings: How Your Work History Affects Payment Amounts

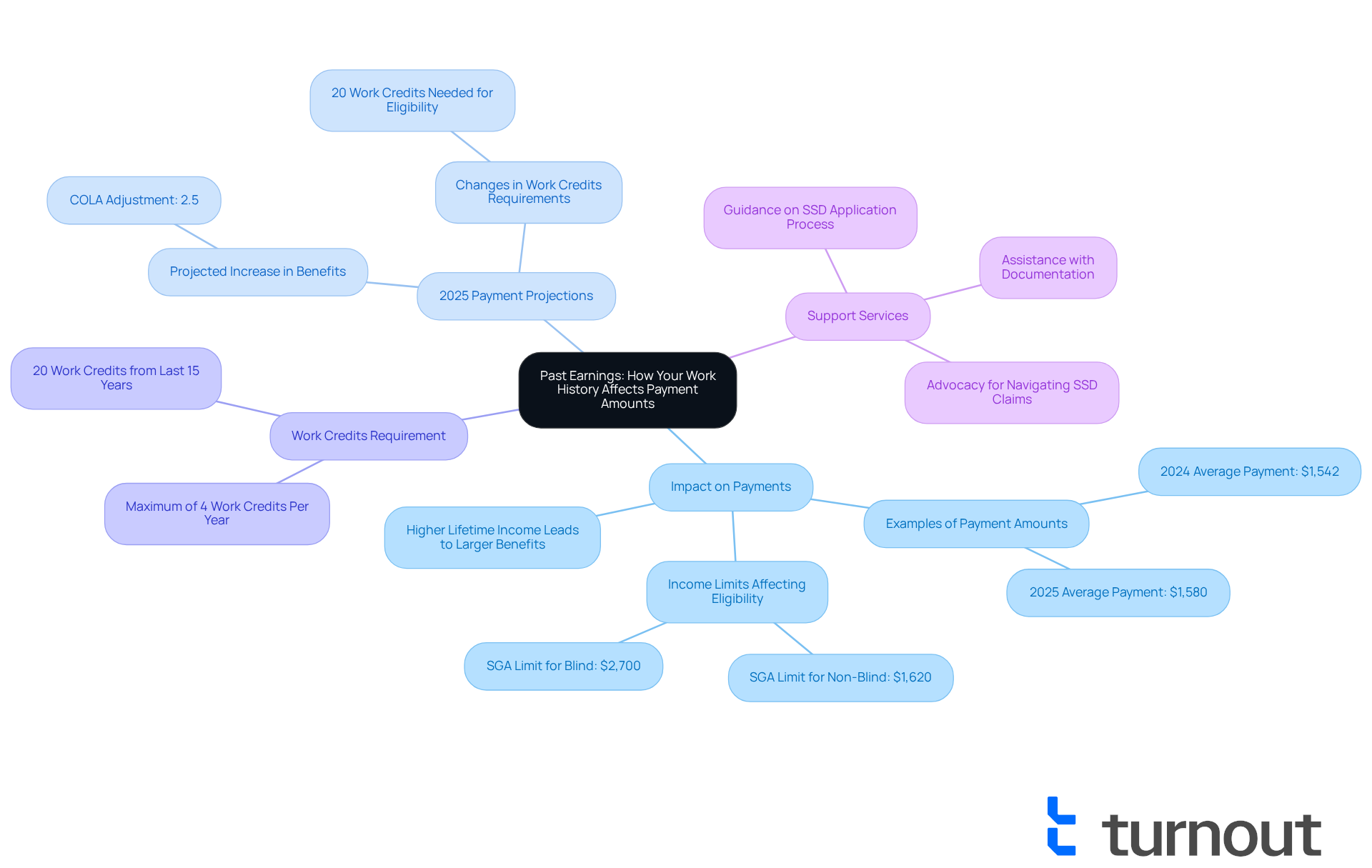

The sum of disability compensation you receive is closely tied to your previous earnings. The Social Security Administration (SSA) determines payments based on the Average Indexed Monthly Earnings (AIME), which reflects your peak earning years. Generally, individuals with higher lifetime income can expect more substantial benefits. For example, if you consistently earned above the national average, you could receive a significantly larger monthly allowance than someone with a lower earnings history. This calculation underscores the importance of maintaining a strong work record throughout your career.

In 2025, the average disability payment for disabled workers is projected to be $1,580, an increase from $1,542 in 2024. This increase reflects the ongoing adjustments made by the SSA to ensure that support keeps pace with inflation and living expenses. Additionally, if you are over 31, you will need a total of 20 work credits from the last 15 years to qualify for disability support, highlighting the necessity of a solid work history.

At Turnout, we are not a law firm and do not have affiliations with any government agency. We provide essential support in navigating the complexities of SSD claims through trained nonlegal advocates. Our team is here to help you understand how your work history influences your entitlements. We offer guidance on the SSD application process and assist in gathering the necessary documentation.

Consider this: a person with a strong earnings history may find their disability payment determined by their highest-earning years, leading to a more favorable outcome. Conversely, individuals with inconsistent or lower earnings may face reduced benefits. Understanding how your work history affects SSDI advantages is crucial as you strategize your financial future. Remember, you're not alone in this journey; we’re here to support you every step of the way.

Cost of Living Adjustments: Impact on Your Disability Payments

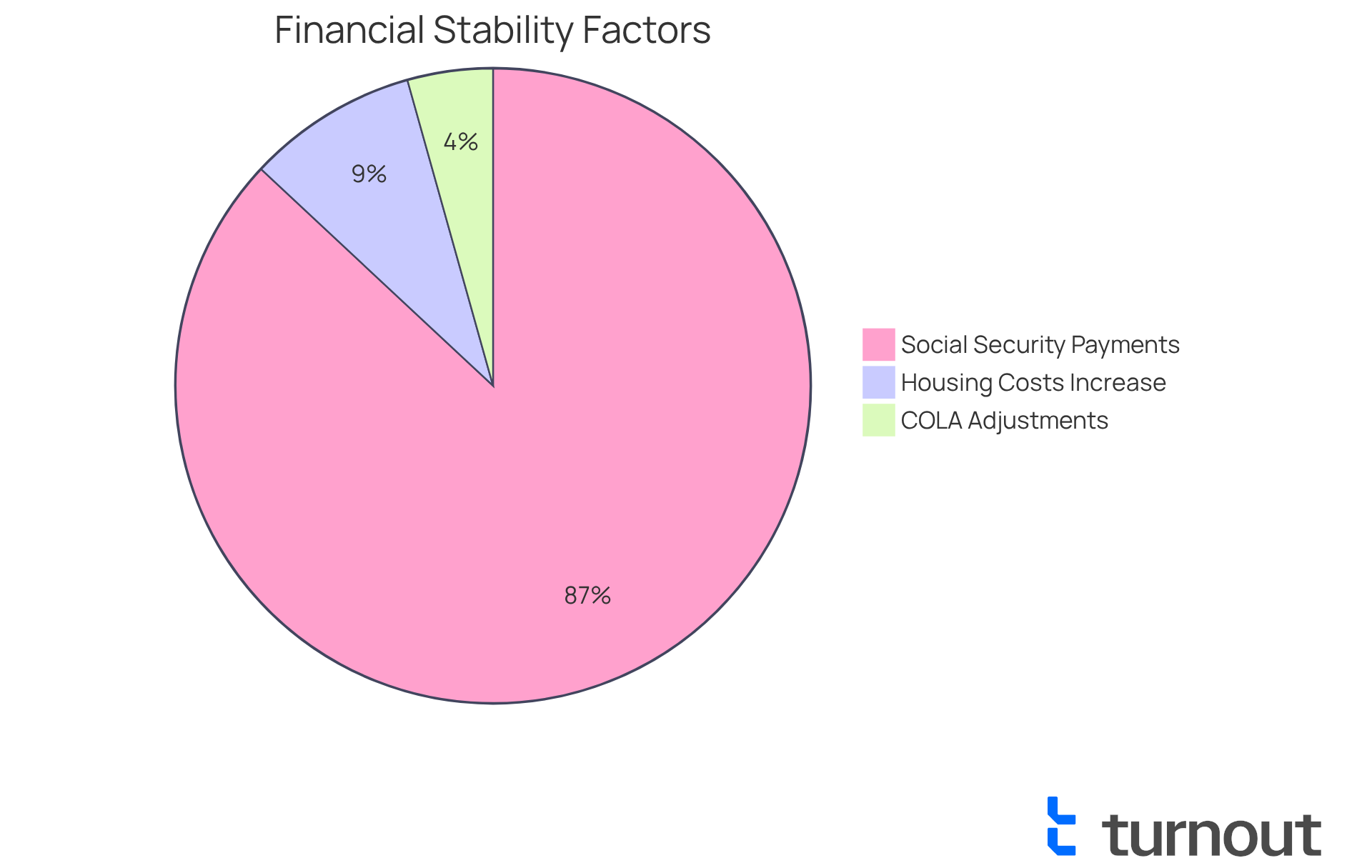

Cost-of-living adjustments (COLA) play a crucial role in preserving the purchasing power of the average disability payment benefits. We understand that navigating financial challenges can be overwhelming. Each year, the Social Security Administration (SSA) assesses inflation rates and modifies assistance accordingly. For instance, in 2025, a 2.5% COLA was introduced, raising monthly disbursements for recipients. This adjustment is essential, as it helps offset rising living costs, ensuring that the average disability payment remains relevant and sufficient to cover essential expenses.

In 2024, housing costs increased by about 5%, further straining the budgets of those relying on these payments. It's common to feel the pressure of rising expenses. Additionally, the average monthly Social Security payment for retired workers was reported as $1,925.46 in November 2024. This highlights the significance of COLA adjustments for maintaining financial stability.

Staying updated on COLA adjustments can assist you in improving your financial planning. Remember, half of seniors receiving Social Security rely on their payments for at least 50% of their household income. You're not alone in this journey, and we're here to help you navigate these important changes.

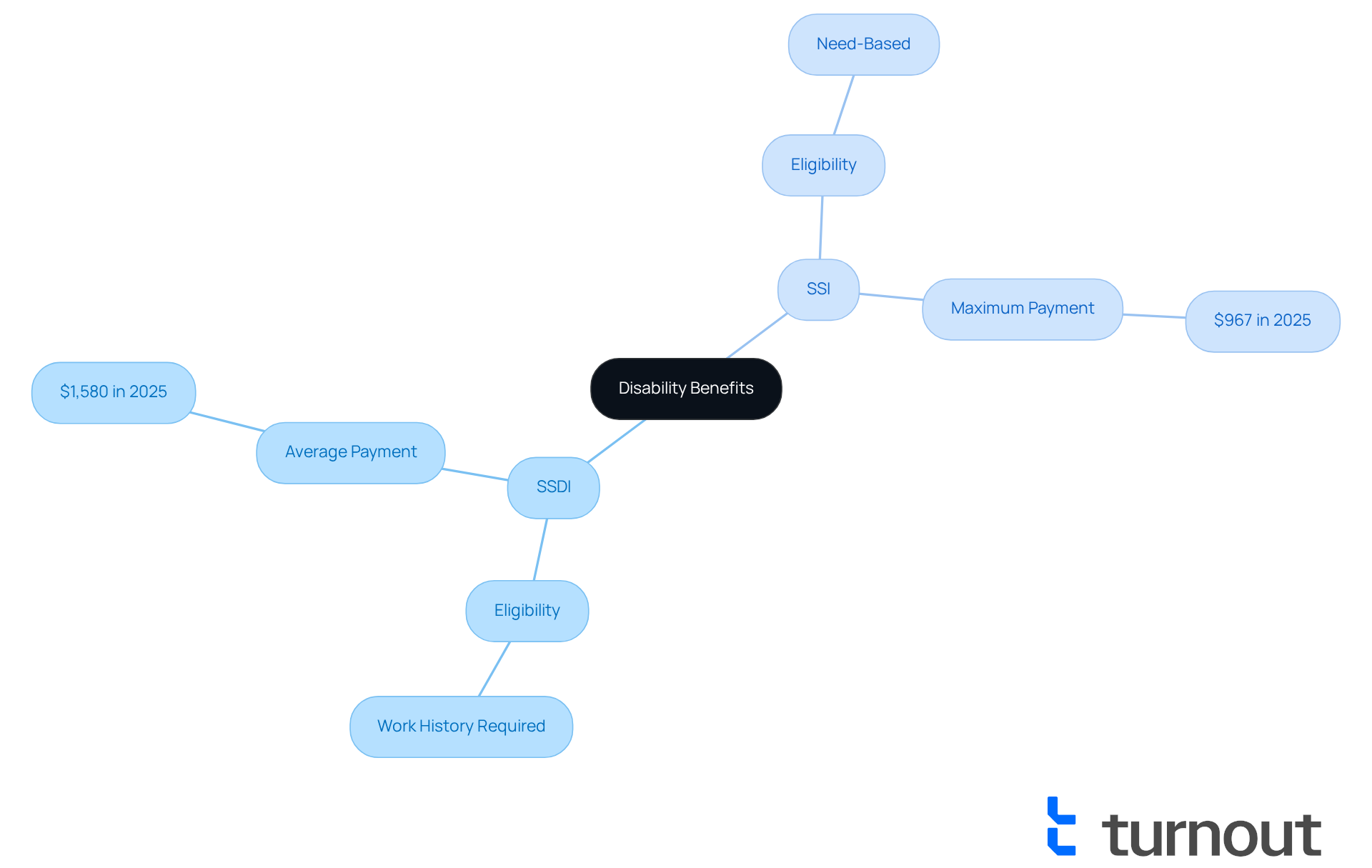

Type of Benefits: SSDI vs. SSI and Their Payment Differences

Navigating disability benefits in the U.S. can feel overwhelming, but understanding your options is crucial. There are two main categories:

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

SSDI is designed for individuals with a solid work history who have contributed to Social Security, while SSI is a need-based program that does not require prior work contributions.

It's important to note that SSDI benefits are generally more substantial than those from SSI. In 2025, the average disability payment from SSDI is anticipated to be approximately $1,580 each month, while the maximum SSI payment will be $967. This significant difference highlights the need to understand the eligibility criteria and the average disability payment structures of each program.

If you qualify for SSDI, it may be beneficial to pursue this option instead of SSI, as SSDI typically offers higher financial support. Millions of Americans rely on these programs, and it's common to feel uncertain about which path to take. Remember, if you receive disability benefits, you automatically become eligible for Medicare after a 24-month waiting period, which can further enhance your financial security.

We understand that making these choices can be complicated. However, grasping the distinctions between SSDI and SSI is essential for optimizing your assistance. You are not alone in this journey; we’re here to help you find the support you need.

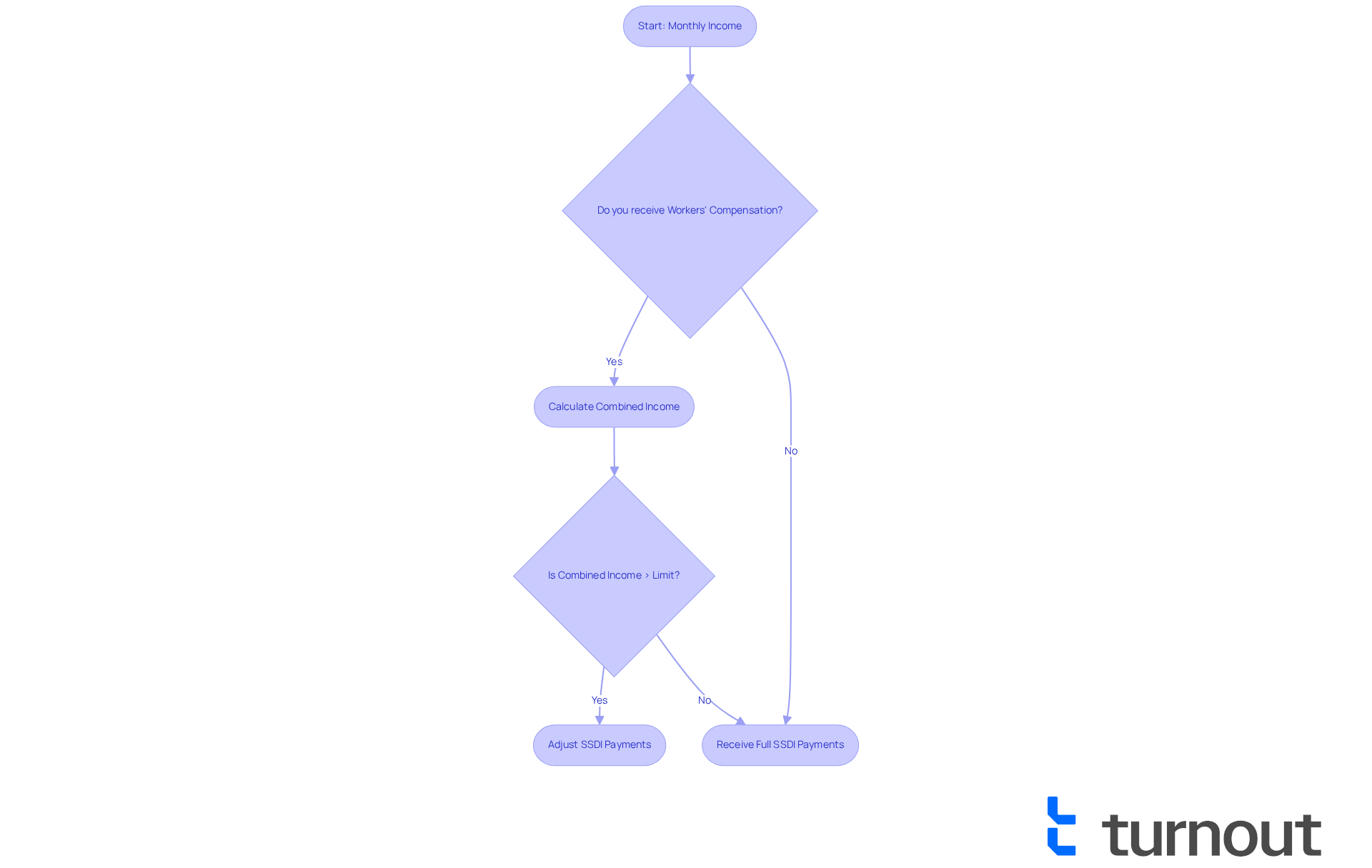

Additional Income: How Other Benefits Influence Your Payments

Obtaining extra income from sources like workers' compensation can significantly impact your Social Security Disability Insurance payments. We understand that navigating these regulations can be overwhelming. The Social Security Administration (SSA) has a rule that limits total assistance to 80% of your average disability payment based on your income before becoming disabled. For example, if you were receiving $4,000 each month prior to your disability, your combined assistance from Social Security Disability Insurance and workers' compensation cannot exceed $3,200 monthly. If your total benefits go beyond this limit, the SSA will reduce your disability payments accordingly.

In practical terms, let’s say you receive $2,000 monthly in workers' compensation and qualify for $2,200 in disability benefits. This totals $4,200, which exceeds the allowable limit. Consequently, the SSA would adjust your disability payment, resulting in a decreased amount of $1,200. Understanding this offset is crucial, as it directly affects your financial planning and overall income.

Moreover, many individuals receiving social security disability also rely on other public assistance, which can complicate their financial situation. For instance, in April 2024, around 86,000 partners received disability assistance, highlighting the interconnectedness of various support systems. In total, approximately 7.3 million individuals received assistance for disabled workers from Social Security during this time, showcasing the program's reach.

Financial advisors stress the importance of managing multiple income sources effectively. They encourage you to evaluate how additional benefits, such as workers' compensation, might impact your SSDI payments to avoid unexpected reductions. Additionally, seeking guidance from trained nonlawyer advocates, like those at Turnout, can provide valuable support in navigating these complexities. By understanding these dynamics and utilizing available resources, you can manage your financial circumstances more effectively and ensure you receive the highest benefits possible. Remember, you are not alone in this journey, and we're here to help you every step of the way.

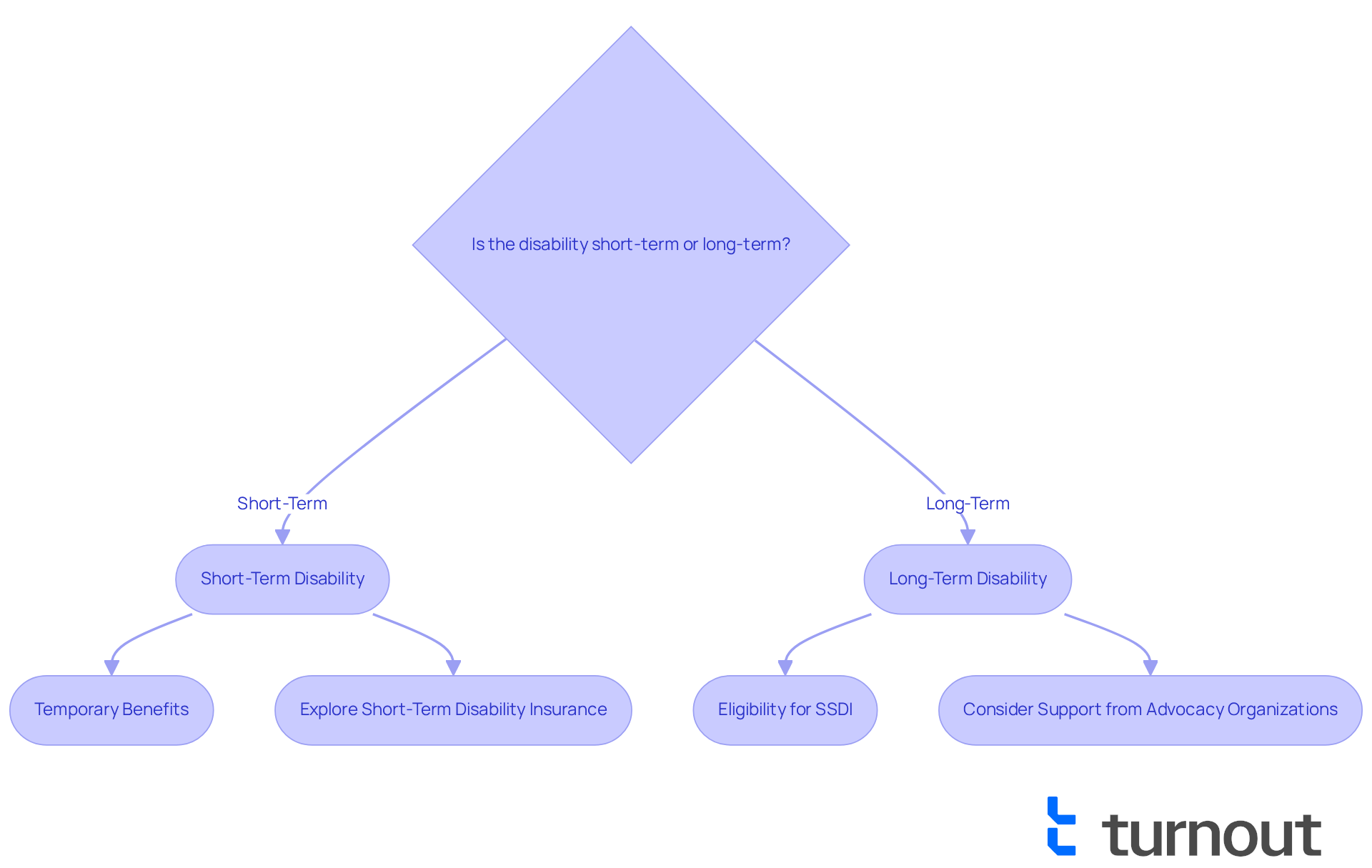

Duration of Disability: Long-Term vs. Short-Term Payment Implications

The length of a disability can greatly affect the kind of assistance you may be eligible for. If you're facing a short-term disability, you might find that temporary benefits are available. On the other hand, long-term disabilities are often linked to eligibility for Social Security Disability Insurance (SSDI). It's important to know that the Social Security Administration (SSA) requires a disability to last a minimum of 12 months for benefits eligibility. This means that if your condition is shorter-term, exploring options like short-term disability insurance could be necessary. Understanding this distinction is crucial for effective financial planning.

We understand that navigating the application process for SSDI can feel overwhelming. Individuals with long-lasting disabilities may encounter a complicated procedure, which often requires an average disability payment approval time of three to five months. That's where organizations like Turnout come in. They offer significant support through trained non-professional advocates who help clients comprehend and maneuver the application process, ensuring you are well-informed about your choices. However, if your condition is expected to last less than a year, you may not meet the criteria for disability benefits, making it essential to consider alternative options. Disability advocates emphasize the importance of understanding these differences, as they can significantly impact your financial stability.

Real-world examples illustrate this point:

- Someone diagnosed with a chronic condition that limits their ability to work for several years may successfully qualify for SSDI.

- Another person recovering from a temporary injury might only be eligible for short-term assistance.

Staying aware of these differences is vital for anyone exploring their assistance options. Additionally, understanding the importance of medical evidence in supporting a disability claim is crucial, as it can significantly affect the outcome of your application. Remember, you are not alone in this journey, and we are here to help you navigate these challenges.

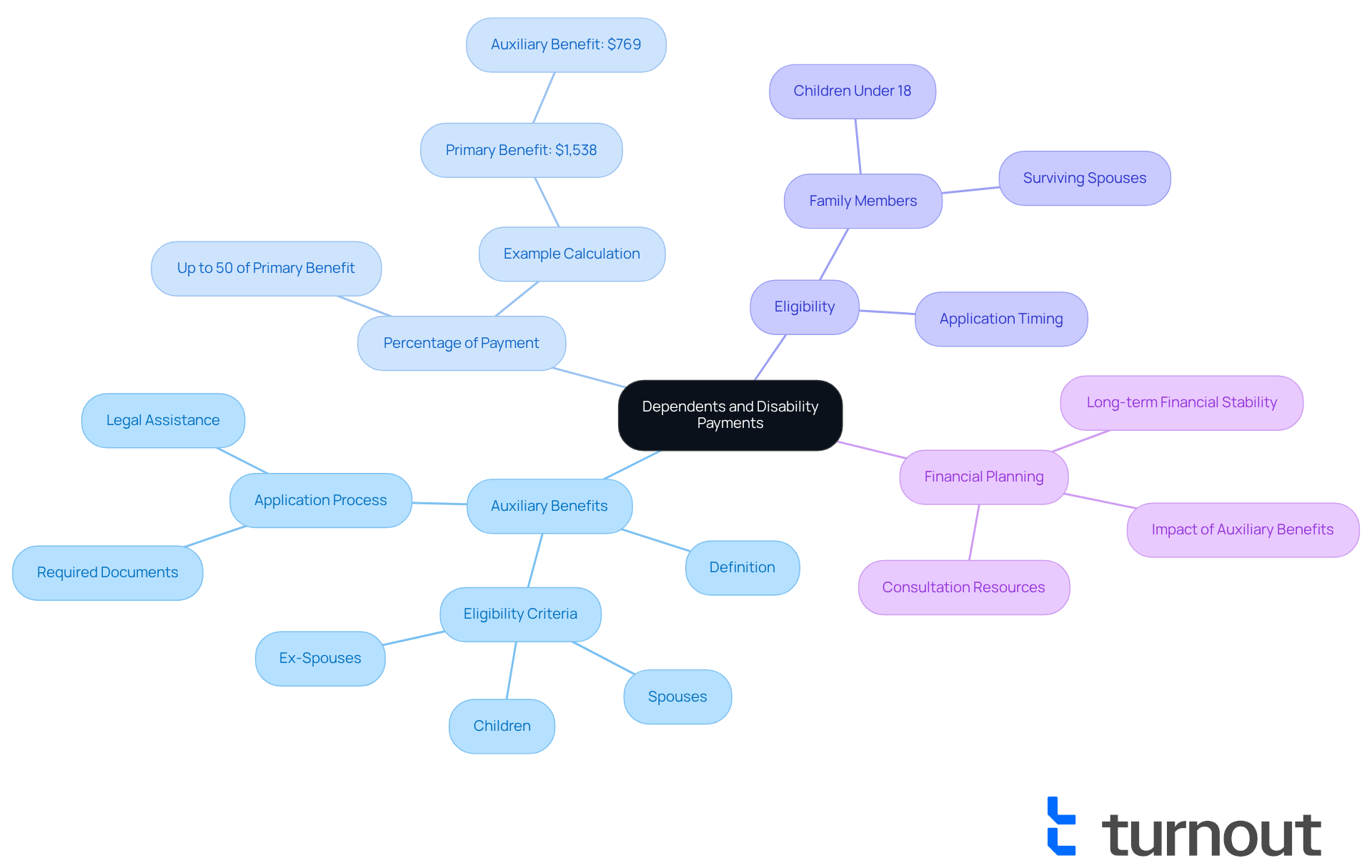

Dependents: How Family Status Affects Disability Payments

Family status plays a crucial role in determining the average disability payment that you or your loved ones may receive. Under Social Security Disability Insurance, auxiliary benefits are accessible for dependents. This enables qualified family members to obtain up to 50% of the primary recipient's compensation. This provision is especially advantageous for families with children or spouses who depend on the primary beneficiary's average disability payment. For instance, if a main beneficiary receives a benefit of $1,538, each qualified family member could receive an additional $769. This can greatly enhance your household's financial security.

In 2025, understanding how dependents influence the average disability payment is essential for ensuring that families like yours are adequately supported. Many SSDI recipients are unaware that they can apply for additional support for their family members, even years after the average disability payment recipient's approval. For example, a family with an adult child who has a disability may be eligible for extra assistance. This can provide essential financial support to help cover living expenses and medical costs.

Furthermore, the influence of family status extends beyond direct financial advantages, impacting the average disability payment as well. Financial planners emphasize the importance of considering supplementary benefits when preparing for the future. These extra payments can significantly improve a family's total income. As the likelihood of disability rises with age, it’s vital for families to understand their eligibility for average disability payment assistance programs. This knowledge can help guarantee long-term financial stability.

We understand that navigating these options can feel overwhelming. That's why Turnout simplifies this process by providing expert guidance and resources. Our trained nonlawyer advocates and IRS-licensed enrolled agents are here to help families like yours explore their options without the need for legal representation. Additionally, it's essential to recognize that these additional benefits can transform into survivors' entitlements if the main recipient passes away. This further emphasizes the necessity for families to be aware of their choices. Remember, you are not alone in this journey; we’re here to help.

State Regulations: Variability in Disability Payments Across Regions

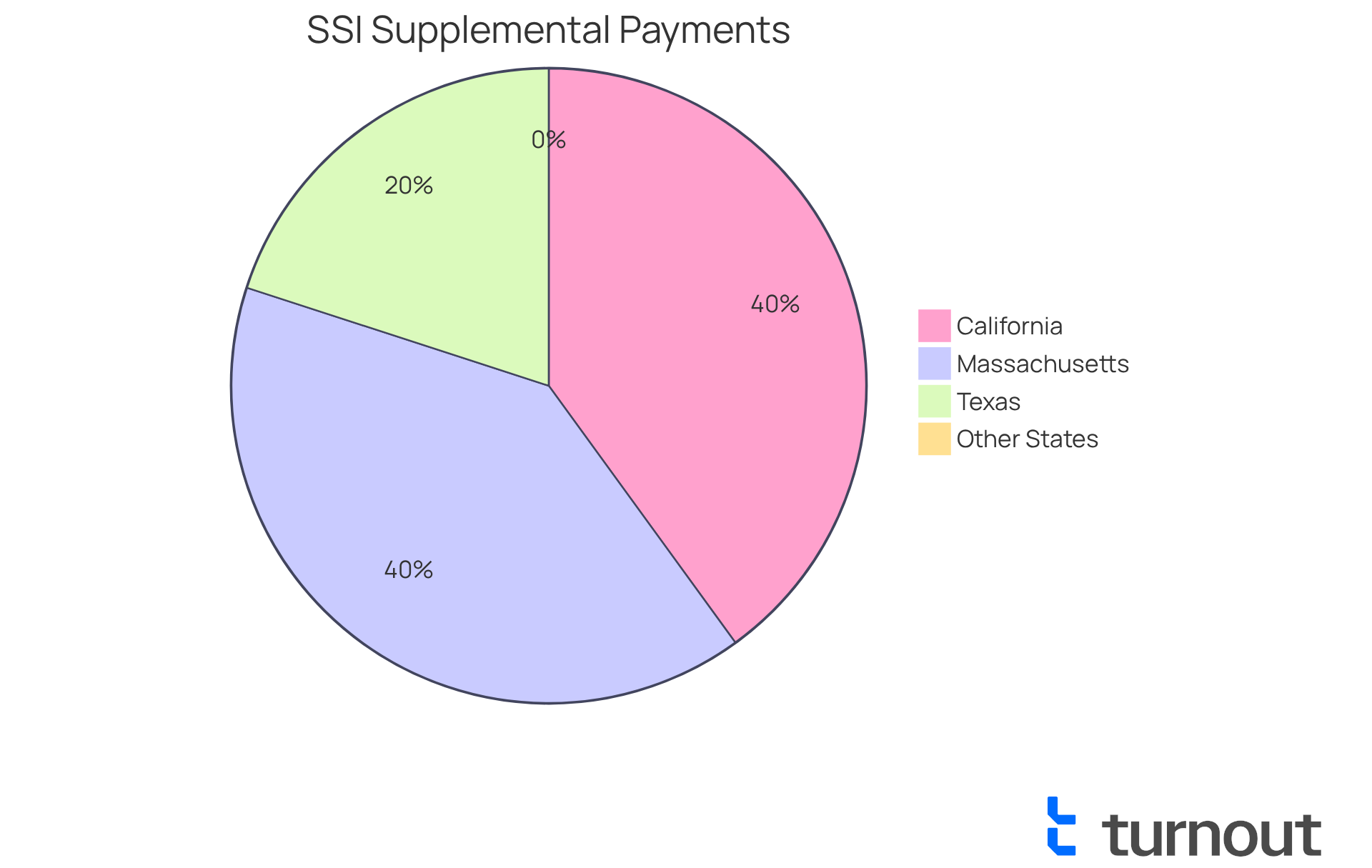

Disability benefits can differ significantly due to state regulations, and we understand that navigating this landscape can be overwhelming. While SSDI disbursements are federally mandated, many states offer additional support or supplemental funds for SSI recipients. For example, California and New York provide extra funds that can greatly enhance the overall benefit amount. In 2025, the maximum monthly federal SSI payout will rise to $967 for individuals, but states like California may offer additional support, increasing the total to over $1,200 per month.

Statistics show that around 30 states provide some form of supplemental payment for SSI recipients, with amounts varying widely. In Massachusetts, total monthly assistance can reach approximately $1,200, while in Texas, it might be closer to $1,000. This regional variability underscores the importance of investigating state-specific regulations and available assistance to maximize your financial support.

Turnout plays a crucial role in simplifying access to these government resources by utilizing trained advocates who guide individuals through the complexities of SSD claims. Disability advocates emphasize that understanding these differences is vital for those seeking assistance. As one advocate noted, "Navigating the complexities of state benefits can make a significant difference in the financial stability of those living with disabilities."

It’s important to remember that Turnout is not a law firm and does not have affiliations with any law firm or government agency. By being informed about local regulations and potential supplemental payments, you can better advocate for your needs and ensure you receive the support you deserve. You're not alone in this journey, and we're here to help you navigate these challenges.

Appeals Process: Navigating Denials to Secure Your Disability Payments

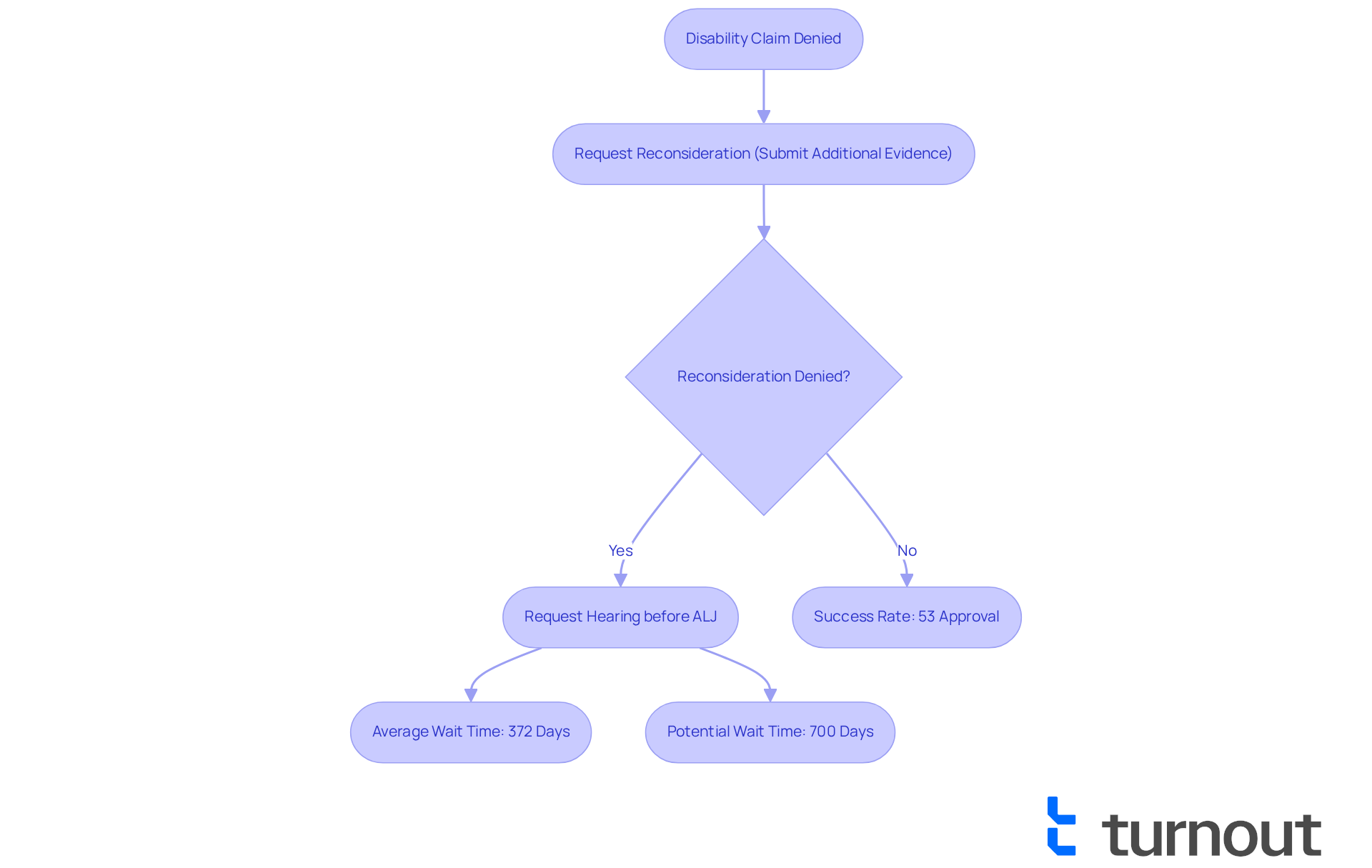

Navigating the appeals process can feel overwhelming, especially for those whose disability claims have been denied. We understand that the first step is to request a reconsideration of the decision. This involves submitting additional evidence or clarifications, which can seem daunting. If the reconsideration is denied, you can escalate your case by requesting a hearing before an administrative law judge (ALJ).

It's important to recognize that the appeals process can be lengthy. As of October 2023, the average wait time for a decision at the ALJ stage was approximately 372 days, with some locations reporting wait times nearing 700 days. It's common to feel frustrated during this time, but persistence is key. Approximately 53% of applicants who appeal their decision are ultimately approved. By staying organized and well-prepared, you can significantly improve your chances of successfully securing your disability payments.

Gathering comprehensive medical records is essential, as these documents are the cornerstone of most successful claims. Remember, Turnout, which is not a law firm and does not provide legal advice, offers support through trained nonlawyer advocates. They can assist you in navigating this complex process, ensuring you have the necessary guidance and resources.

As one expert noted, "Success in the appeals process relies on good record-keeping and detailed notes of all communications." You are not alone in this journey; we're here to help you every step of the way.

Conclusion

Understanding the intricacies of average disability payments is essential for anyone navigating the complexities of disability assistance. We recognize that this journey can feel overwhelming. This article has explored the various factors that influence these payments, from eligibility criteria and work history to the impact of additional income and state regulations. By breaking down these elements, individuals can gain a clearer picture of how to optimize their benefits and navigate the application process effectively.

Key insights discussed include:

- The importance of meeting specific eligibility requirements set by the Social Security Administration.

- It's common to feel uncertain about how past earnings determine payment amounts.

- Cost-of-living adjustments play a crucial role in maintaining financial stability.

- Distinctions between SSDI and SSI.

- Implications of dependents on payment amounts.

- Nuances of the appeals process as critical considerations for applicants.

Ultimately, the journey toward securing disability payments can be daunting, but resources like Turnout provide valuable support. We're here to help you understand your options and streamline your application processes. Empowerment through knowledge is vital; staying informed about these factors can lead to more effective financial planning and improved outcomes. Remember, you're not alone in this journey. We encourage you to seek assistance from trained advocates who can guide you through the complexities of your unique situation, ensuring you receive the support you deserve.

Frequently Asked Questions

What is Turnout and how does it help with disability payments?

Turnout is a service that uses AI technology to simplify the process of applying for and managing disability support. It offers a smooth onboarding experience, efficient document management, and proactive follow-ups through its AI assistant, Jake, alleviating the administrative burden associated with disability claims.

Is Turnout a law firm?

No, Turnout is not a law firm and does not provide legal representation. Instead, it employs trained nonlawyer advocates to assist clients with Social Security Disability (SSD) claims.

What are the eligibility criteria for disability payments?

To qualify for disability payments, applicants must demonstrate a medical condition that significantly impairs their ability to work for at least 12 months or that could lead to death. Additionally, applicants need a minimum of 40 work credits, with at least 20 earned in the last 10 years.

What is the Compassionate Allowances list?

The Compassionate Allowances list features 300 severe illnesses and conditions that can expedite the disability application process for affected individuals.

How do past earnings affect disability payment amounts?

Disability compensation is based on the Average Indexed Monthly Earnings (AIME), which reflects an individual's peak earning years. Generally, those with higher lifetime earnings receive larger benefits.

What is the projected average disability payment for 2025?

The average disability payment for disabled workers in 2025 is projected to be $1,580, an increase from $1,542 in 2024.

How many work credits are needed to qualify for disability support?

Individuals over 31 need a total of 20 work credits from the last 15 years to qualify for disability support.

What role do Turnout's advocates play in the SSD application process?

Turnout's trained nonlegal advocates assist applicants in navigating the complexities of the SSD application process, helping them understand eligibility requirements and gather necessary documentation.

How can Turnout help individuals manage their financial challenges?

In addition to disability support, Turnout offers services related to tax debt relief, providing further assistance to clients facing financial difficulties.

What should applicants keep in mind about the application process?

Applicants should stay informed about the SSA's regularly revised medical listings and eligibility standards, and remember that they are not alone in their journey, as resources and support are available.