Overview

Navigating Maryland's tax payment process can feel overwhelming, but you are not alone in this journey. This article outlines three essential steps for benefits seekers to manage their tax obligations confidently.

- First, it’s important to understand the different tax types, payment methods, and deadlines. We recognize that this can be confusing, so we’ll provide a structured approach to gather the necessary information.

- Next, using the online payment portal can simplify the process. We understand that technology can sometimes be daunting, but we are here to help you through it.

- Finally, we’ll address common issues that may arise, ensuring you have the tools to troubleshoot effectively.

With this guidance, you can avoid penalties and navigate your tax responsibilities with ease.

Remember, you are not alone in this. By following these steps, you can take control of your tax situation and feel empowered in managing your obligations.

Introduction

Navigating the intricacies of Maryland's tax payment system can feel overwhelming, especially for those seeking benefits. We understand that with a diverse array of taxes and ever-evolving regulations, grasping the framework is crucial for both compliance and financial planning. This article serves as your comprehensive guide, aiming to simplify the tax payment process. Here, you will find essential steps and troubleshooting tips designed to empower you in managing your obligations effectively.

But what happens when unexpected challenges arise? How can you ensure a smooth transaction amidst the complexities of tax laws? You're not alone in this journey, and we're here to help.

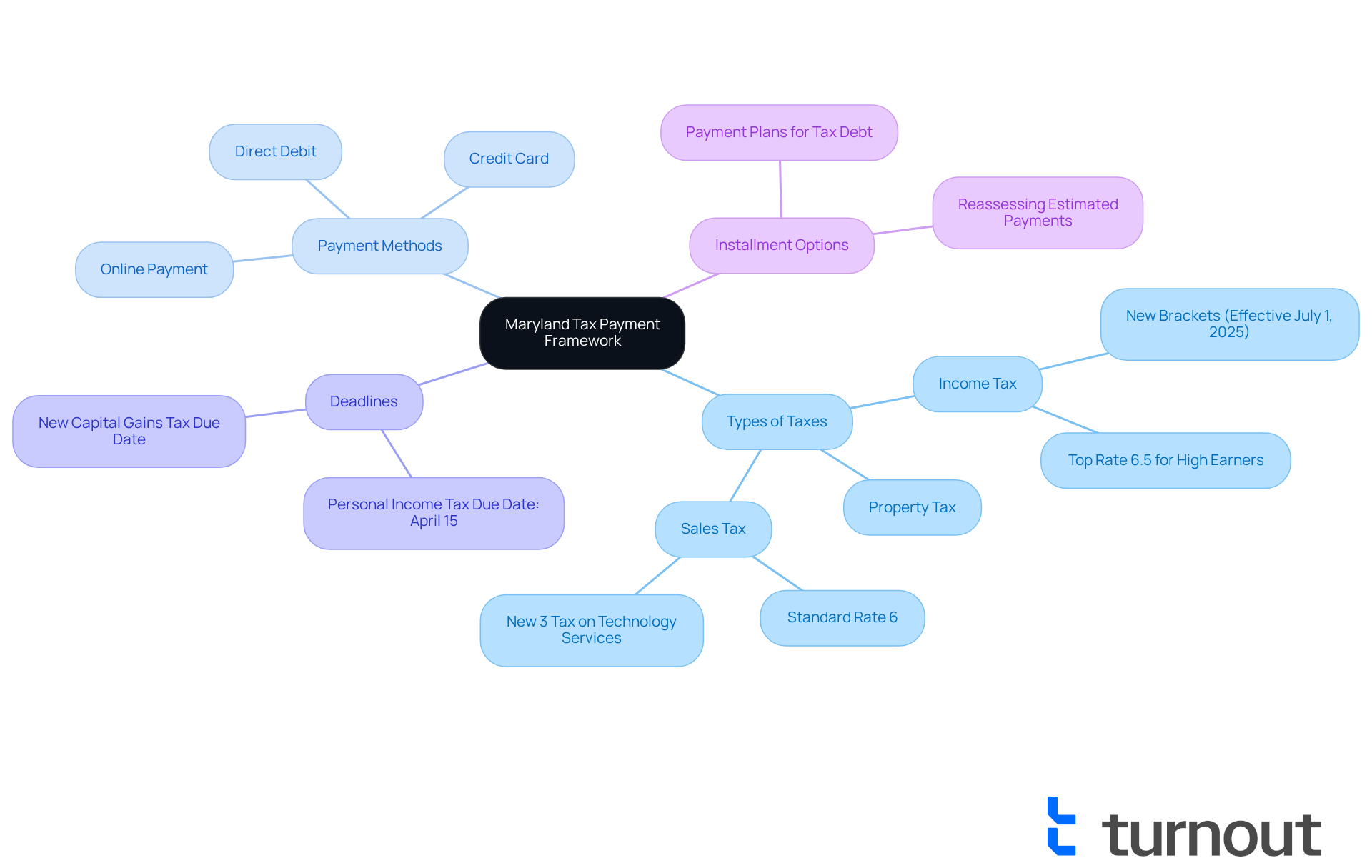

Understand Maryland's Tax Payment Framework

Understanding can feel overwhelming, but we're here to help you navigate it with ease. It's important for benefits seekers to grasp the various components involved:

- Types of Taxes: Maryland imposes several taxes, including income tax, property tax, and sales tax. Each category comes with its own schedules and requirements for remittance. For example, starting July 1, 2025, , significantly affecting high earners, with rates rising to 6.5% for those earning over $1 million.

Payment methods for making a Maryland tax payment can be conveniently done online through the Comptroller of Maryland's website, via direct debit, or by credit card. Familiarizing yourself with these options is essential to choose the best method for your situation. Additionally, businesses will need to consider a new , which could impact their financial strategies.

- Deadlines: Staying informed about crucial deadlines is vital to avoid penalties. The due date for . With new tax rules in place, including a 2% capital gains tax for individuals making over $350,000, timely contributions are more important than ever.

If you find yourself unable to make your Maryland tax payment in full, the state offers that allow you to settle your . Knowing how to set up these plans can be key to managing tax debt effectively. Tax experts recommend that individuals reassess their estimated contributions and withholding strategies in light of recent tax changes to ensure compliance and prevent unexpected liabilities.

By understanding these essential components of Maryland's tax structure, you can navigate the complexities of the tax system more effectively and secure the benefits you rightfully deserve. Remember, you are not alone in this journey, and we're here to support you every step of the way.

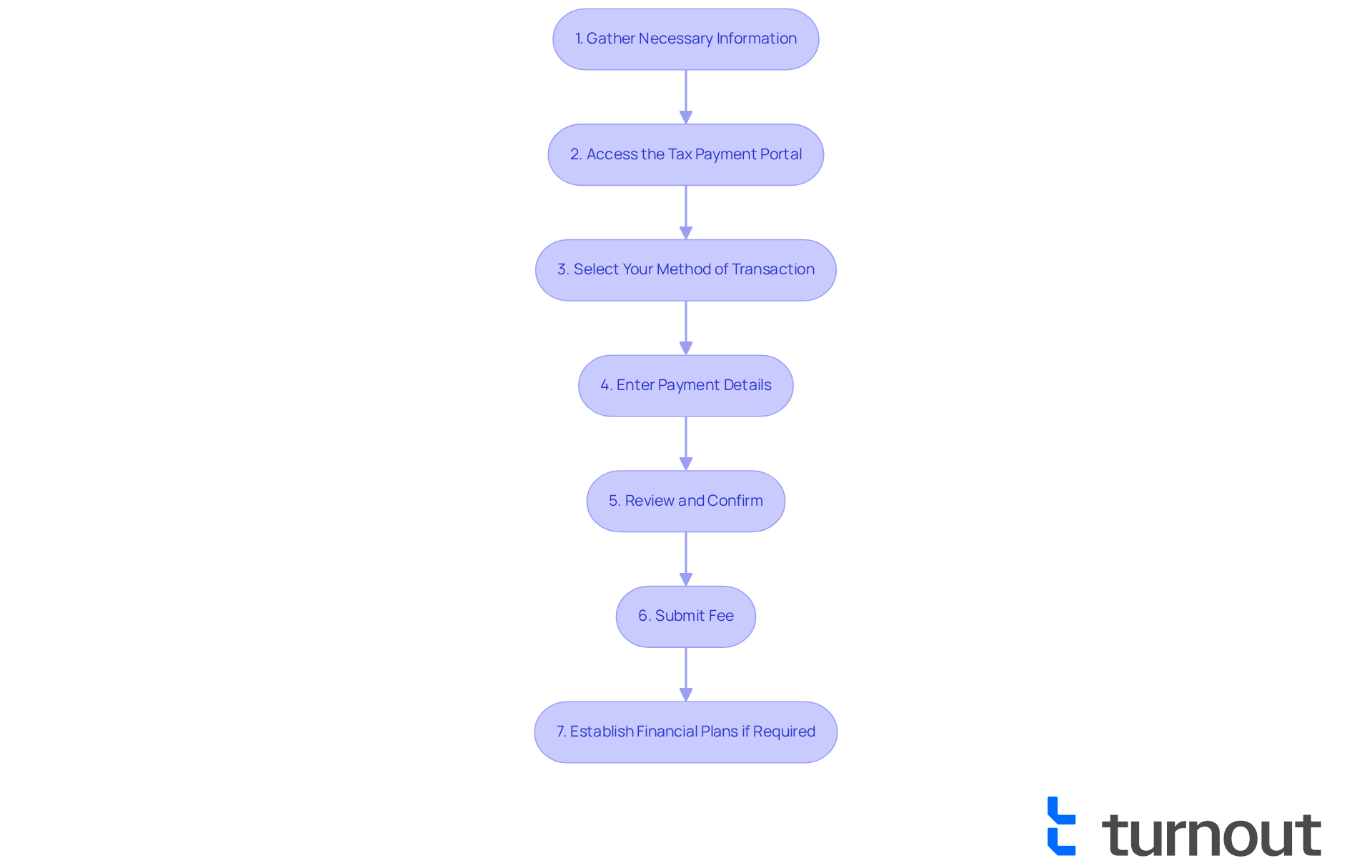

Follow the Step-by-Step Tax Payment Process

Navigating the can feel overwhelming, but we're here to assist you through the Maryland . By following these simple steps, you can manage your obligations with ease and confidence.

- Gather Necessary Information: Start by collecting your (SSN), tax return, and any notices from the Comptroller's office regarding your tax liability. We understand that having all essential documents prepared is vital for a seamless transaction process. Many taxpayers find that being organized can greatly lessen the time devoted to .

- Access the Tax Payment Portal: Visit the Comptroller's Online Payment page. Here, you can choose to pay as a visitor or sign in if you have an account, which simplifies the management of your transactions. The is designed to streamline the Maryland tax payment process, ensuring that you have access to the latest updates and resources.

- Select Your Method of Transaction: Choose between direct debit (ACH) or credit card options. If you opt for direct debit, please ensure you have your bank account details ready to facilitate the transaction. Recent changes in tax regulations highlight the importance of selecting the most effective method to prevent delays.

- Enter Payment Details: Fill in the required fields, including the amount you wish to pay and your tax identification information. Accuracy is key to avoid processing delays, as even minor errors can lead to complications. A tax consultant noted that double-checking your information can save you from unnecessary issues.

- Review and Confirm: Before submitting, take a moment to carefully review all entered information. Verify that the transaction sum and method are accurate to guarantee a successful exchange. This step is particularly important with the beginning in 2025, which may influence how transactions are handled.

- Submit Fee: Click the submit button to process your fee. You should receive a confirmation number; keep this for your records as evidence of the transaction. Holding onto this confirmation is essential, as it serves as your receipt in case of any discrepancies.

- Establish : If you find it challenging to cover the total sum, consider arranging a financial plan through the . This option can help you manage your tax obligations without overwhelming financial strain. Many residents of the state have successfully utilized this service to ease their Maryland tax payment burdens.

Real-world examples show that numerous Maryland residents have effectively navigated this process, using the online portal to simplify their transactions. On average, completing a tax transaction online takes around 15 to 30 minutes, depending on the complexity of your tax circumstances. By following these steps, you can ensure that your tax obligations are managed efficiently and accurately, and remember, you are not alone in this journey.

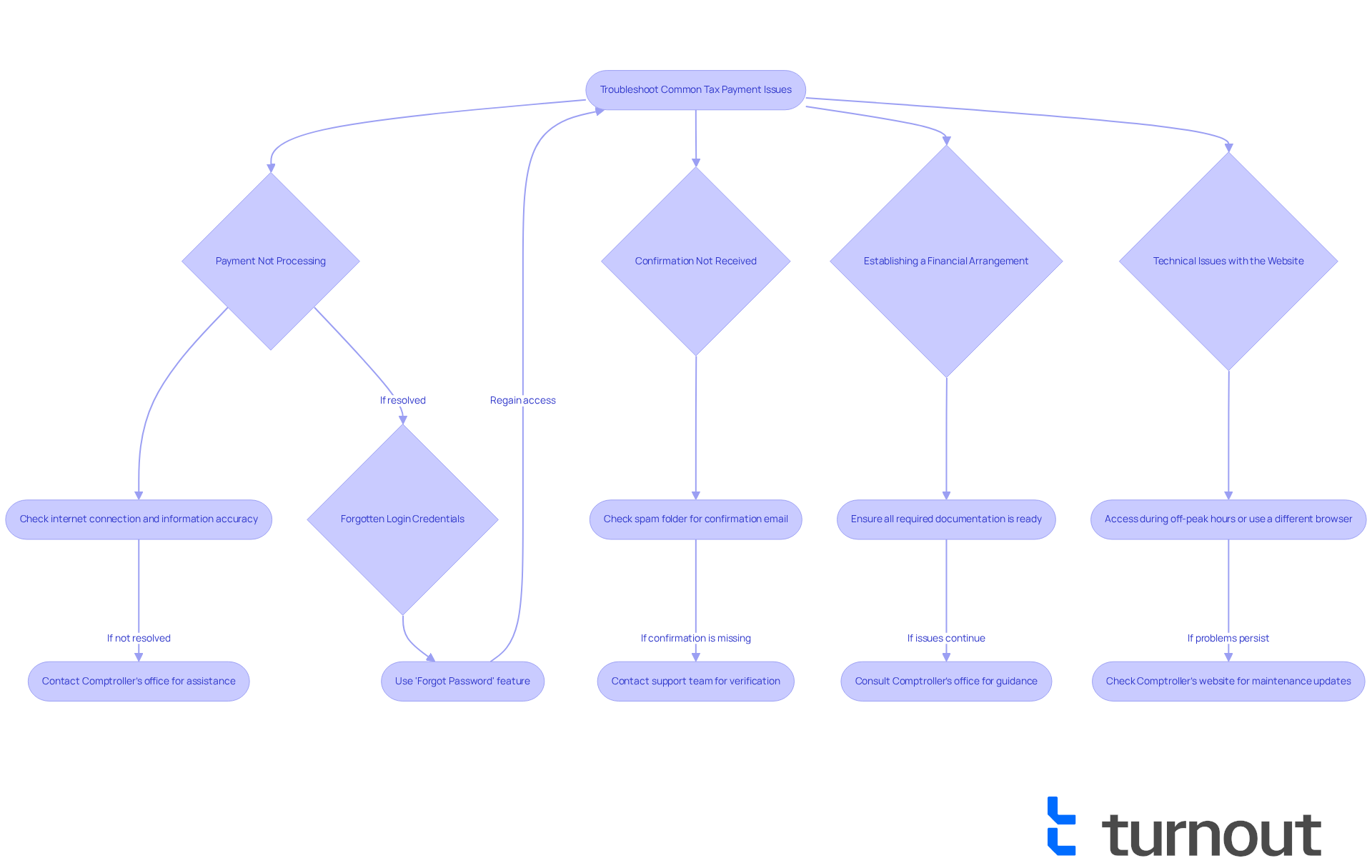

Troubleshoot Common Tax Payment Issues

Navigating the submission process in the state can be challenging, and we understand that it may feel overwhelming at times. Here’s how to troubleshoot some common issues effectively:

- Payment Not Processing: If your payment isn't processing, first check your internet connection and ensure that all entered information is accurate. If the problem persists, please don’t hesitate to reach out to the for assistance with your [[Maryland tax payment](https://blog.turnout.co/master-monthly-payment-irs-plans-your-step-by-step-guide)](https://taxfoundation.org/location/maryland/page/3). You're not alone in this.

- Forgotten Login Credentials: If you’re having trouble accessing your Maryland Tax Connect account, utilize the 'Forgot Password' feature to reset your credentials. Follow the prompts, and you’ll regain access seamlessly.

- Confirmation Not Received: If you do not receive a confirmation email after submitting your transaction, check your spam folder for messages from the Comptroller's office. If it’s still missing, contact their support team for verification. It's important to have that confirmation regarding the Maryland tax payment.

- Establishing a : If you encounter difficulties while creating a [financial arrangement](https://blog.turnout.co/10-handicap-scholarships-for-students-with-disabilities), ensure you have all required documentation, including your notice number. If issues continue, consult the Comptroller's office for guidance on Maryland tax payment. They are there to help you.

- Technical Issues with the Website: If the is experiencing downtime or slow performance, consider accessing it during off-peak hours or using a different browser. If problems persist, check the Comptroller's website for any maintenance updates. We understand how frustrating this can be.

Statistics suggest that many taxpayers face similar challenges, with reports revealing that over 30% of users encounter processing difficulties. By following these steps, you can navigate the in your state with increased assurance. As Maryland State Director Mike O’Halloran wisely noted, 'Understanding the common pitfalls in Maryland tax payment can significantly ease the burden on taxpayers.' Additionally, the Comptroller's Technical Bulletin 56 provides further guidance on tax-related issues, making it a valuable resource for anyone facing challenges. Remember, we're here to help you through this journey.

Conclusion

Understanding the intricacies of Maryland's tax payment system can feel overwhelming, especially for those seeking benefits. We recognize the importance of navigating financial responsibilities effectively. By familiarizing yourself with the various types of taxes, payment methods, and critical deadlines, you can take proactive steps to ensure compliance and avoid unnecessary penalties. Being informed and organized are essential components in managing your tax obligations successfully.

Gathering the necessary information before initiating payments is crucial. Utilizing the online portal can make transactions easier, and recognizing the available financial arrangements can provide relief for those facing difficulties. It's common to encounter issues such as payment processing failures and login problems, but troubleshooting these can significantly enhance your overall experience, making the tax payment journey less daunting.

Ultimately, the Maryland tax payment process does not have to be an overwhelming task. By taking the time to understand the framework, following the outlined steps, and utilizing available resources, you can navigate this system with confidence. Engaging with the Comptroller’s office for support and staying updated on tax regulations will empower you to manage your financial obligations effectively. Remember, you are not alone in this journey. Taking these proactive measures ensures that you can focus on securing the benefits you deserve, free from the added stress of tax-related concerns.

Frequently Asked Questions

What types of taxes are imposed in Maryland?

Maryland imposes several types of taxes, including income tax, property tax, and sales tax. Each tax category has its own schedules and requirements for payment.

What changes are coming to Maryland's income tax brackets?

Starting July 1, 2025, new income tax brackets will be introduced, with rates rising to 6.5% for individuals earning over $1 million.

How can I make a tax payment in Maryland?

Tax payments in Maryland can be made online through the Comptroller of Maryland's website, via direct debit, or by credit card.

What is the new sales tax affecting businesses in Maryland?

Businesses will need to consider a new 3% sales tax on various technology and data-related services, which may impact their financial strategies.

What is the deadline for personal income tax payments in Maryland?

The due date for Maryland personal income tax payments is generally April 15 each year.

Are there any new tax rules for capital gains in Maryland?

Yes, there is a new 2% capital gains tax for individuals making over $350,000.

What should I do if I can't make my Maryland tax payment in full?

If you are unable to make your Maryland tax payment in full, the state offers installment options that allow you to pay your tax obligations gradually.

How can individuals manage their tax contributions effectively?

Tax experts recommend that individuals reassess their estimated contributions and withholding strategies in light of recent tax changes to ensure compliance and prevent unexpected liabilities.