Overview

Navigating a state tax levy can be overwhelming, and we understand that receiving a levy notice can bring a wave of anxiety. It's crucial to take prompt action to address your tax obligations. Exploring options like payment plans or offers in compromise can provide relief during this challenging time.

Maintaining open communication with tax authorities is essential. They are there to help you, and by keeping the lines of dialogue open, you can effectively manage and resolve your tax issues. Remember, you are not alone in this journey—many have faced similar challenges and found their way through.

We encourage you to take the first step today. Acknowledging your situation is the beginning of finding a solution. Together, we can navigate this path toward financial relief.

Introduction

Navigating the complexities of a state tax levy can feel overwhelming, especially when the potential loss of property or assets looms due to unpaid tax obligations. We understand that thousands of taxpayers face these challenges each year, and it’s crucial to grasp the intricacies of the levy process to regain control over your financial situation.

What steps can you take to effectively respond to a levy notice and explore viable options for relief? This guide offers essential insights and strategies designed to help you tackle the challenges posed by state tax levies and find a reassuring path toward resolution.

Understand What a State Tax Levy Is

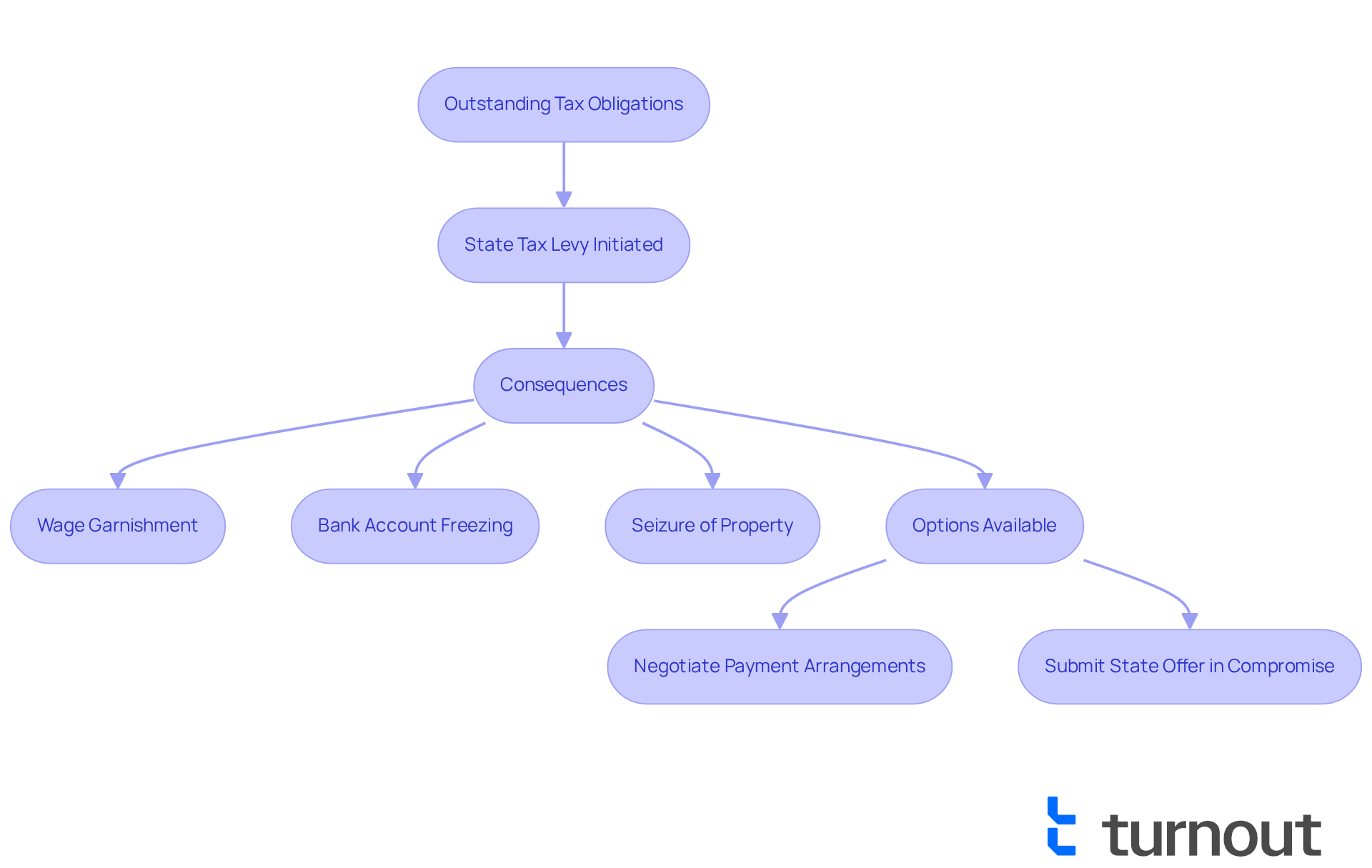

A governmental tax assessment can feel overwhelming. A state tax levy is a legal process initiated by a tax authority to confiscate your property or assets if you have outstanding tax obligations. This might involve garnishing your wages, freezing your bank accounts, or seizing personal property. Understanding how the state tax levy works is essential, as this process typically follows a series of notifications and requests for payment. Each year, thousands of individuals face governmental tax assessments, highlighting the significance of this concern.

For instance, if you owe $50,000 or more, the IRS may even request that your passport be revoked. If you receive a notice indicating that tax collection is imminent, it’s crucial to respond quickly. Taking prompt action can help you avoid additional financial issues. We understand that navigating tax laws can be complex, especially since regulations vary by region.

Tax experts emphasize that acting swiftly can mitigate the effects of a state tax levy assessment. This allows you to explore options such as negotiating payment arrangements or submitting a State Offer in Compromise to resolve your debts. Working with a tax expert at Omni Tax Solutions is one of the quickest and most effective ways to address your local tax issues and develop a strategy for moving forward.

Many individuals only realize the severity of their situation when they experience wage garnishment or when their tax refunds are seized. This underscores the importance of taking proactive measures. Remember, you are not alone in this journey; we’re here to help you navigate these challenges and find a way to regain control.

Take Immediate Action Upon Receiving a Levy Notice

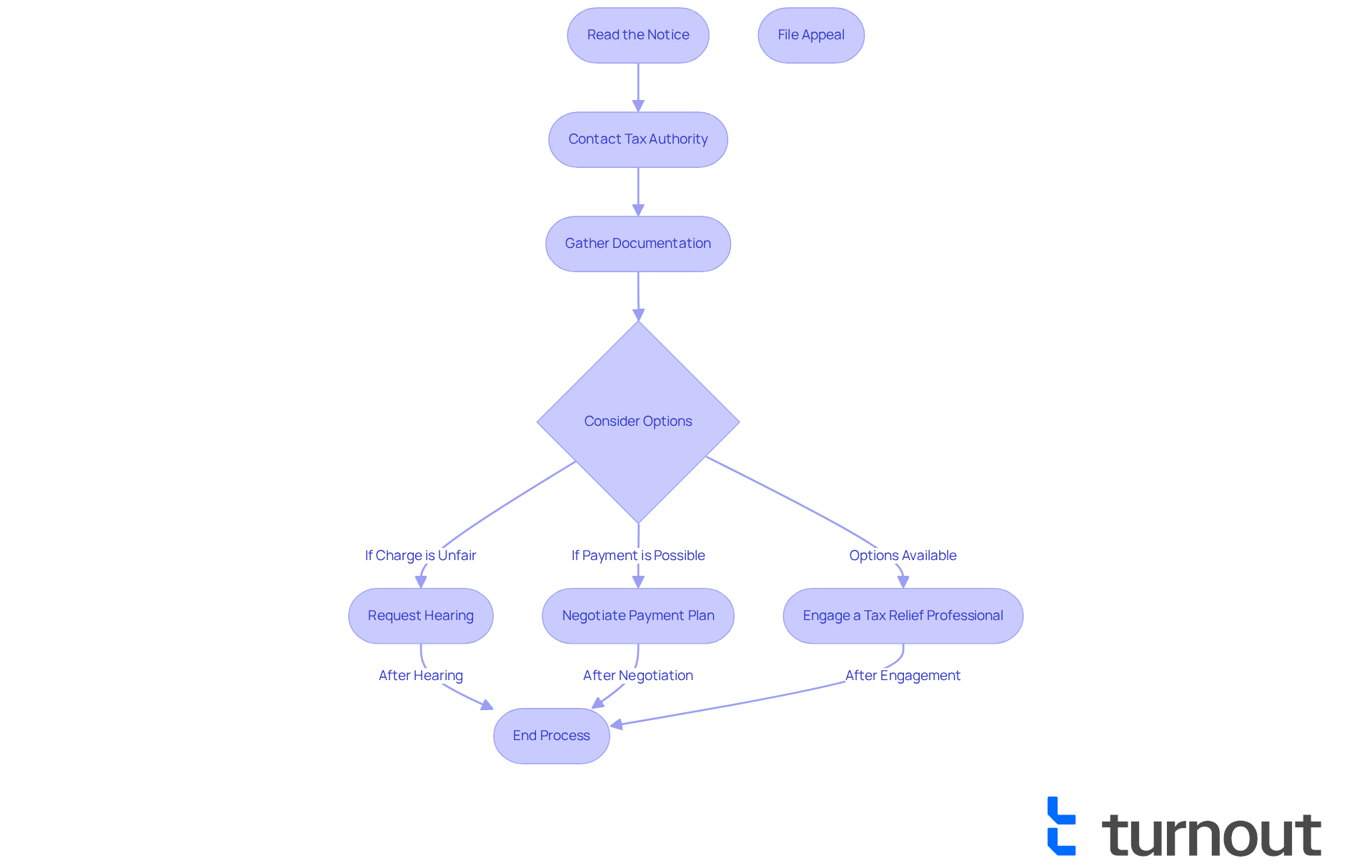

Upon receiving a tax notice, we understand that your first instinct may be to feel overwhelmed. It’s important to take a moment and read the document thoroughly. This notice will detail the amount owed and the deadline for payment. We encourage you to reach out to your local tax authority promptly to discuss your situation. Be prepared to supply any required documentation that supports your case.

If you believe the charge is unfair or if paying the amount due feels impossible, know that you have options. You may request a hearing or contest the charge. Engaging a tax relief professional can also be beneficial. For instance, the experts at Turnout, who work with IRS-licensed enrolled agents, can help you navigate these complexities without the need for legal representation. Remember, Turnout is not a law firm, and their services do not constitute legal advice.

As one expert wisely notes, 'Ignoring the IRS is the worst choice.' This emphasizes the importance of proactive engagement. It’s common to feel anxious about addressing a state tax levy, but typically, this can take several weeks to months, depending on the intricacy of your situation and the responsiveness of the tax agency.

Successful appeals against government state tax levy impositions often require demonstrating financial difficulty or mistakes in the evaluation process. This highlights the importance of keeping comprehensive records and taking prompt action. You are not alone in this journey, and we’re here to help you find the best path forward.

Explore Options for Resolving a State Tax Levy

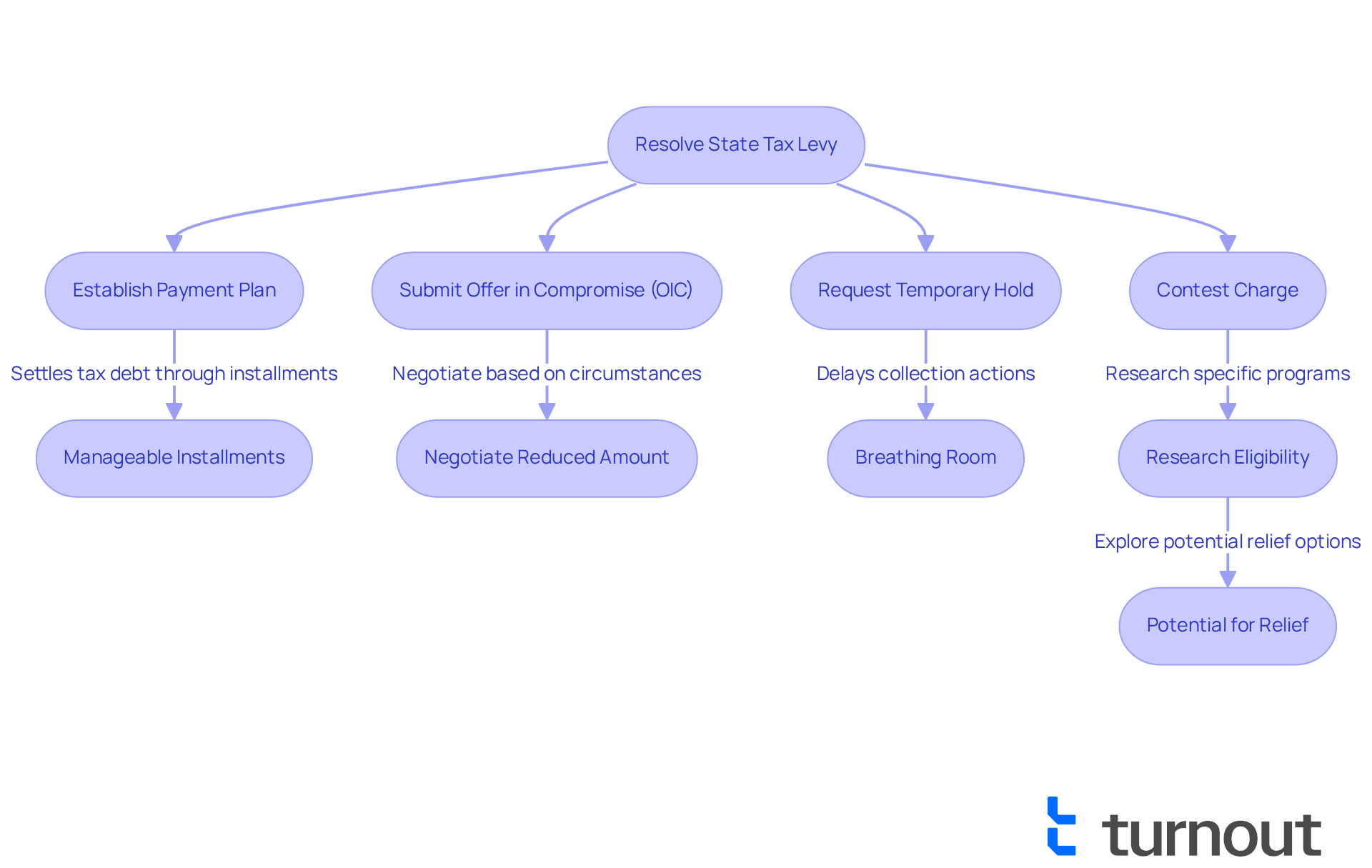

Resolving a state tax levy can feel overwhelming, but there are several strategic options designed to fit your financial situation. One effective method is establishing a payment plan. This allows you to settle your tax debt through manageable installments, offering a sense of relief. Tax relief experts emphasize that these plans can provide significant support, especially for those facing financial difficulties.

In fiscal year 2024, individuals submitted 33,591 offers in compromise (OIC) to settle existing tax liabilities for less than the full amount owed. The IRS accepted 7,199 offers totaling $163.4 million. This shows that a substantial percentage of taxpayers qualify for an OIC, enabling them to negotiate a reduced total amount owed based on their unique circumstances.

If you're experiencing temporary financial hardship, you may also qualify for a temporary hold on collection activities. This can provide crucial breathing room while you assess your options. For instance, applicants facing temporary financial hardship may have collection actions delayed, allowing for a pause in enforcement while you regroup.

Furthermore, if you believe the charge was made by mistake, you have the right to contest the ruling. It's essential to research your region's specific programs and eligibility requirements, as these can vary significantly. Many success stories exist where individuals have navigated the OIC process, resulting in substantial reductions in their tax liabilities.

By understanding these choices and taking proactive measures, including submitting your OIC application online through a MyFTB account, you can effectively handle your state tax levy. Remember, you are not alone in this journey, and we’re here to help you work towards a resolution.

Maintain Communication with Tax Authorities

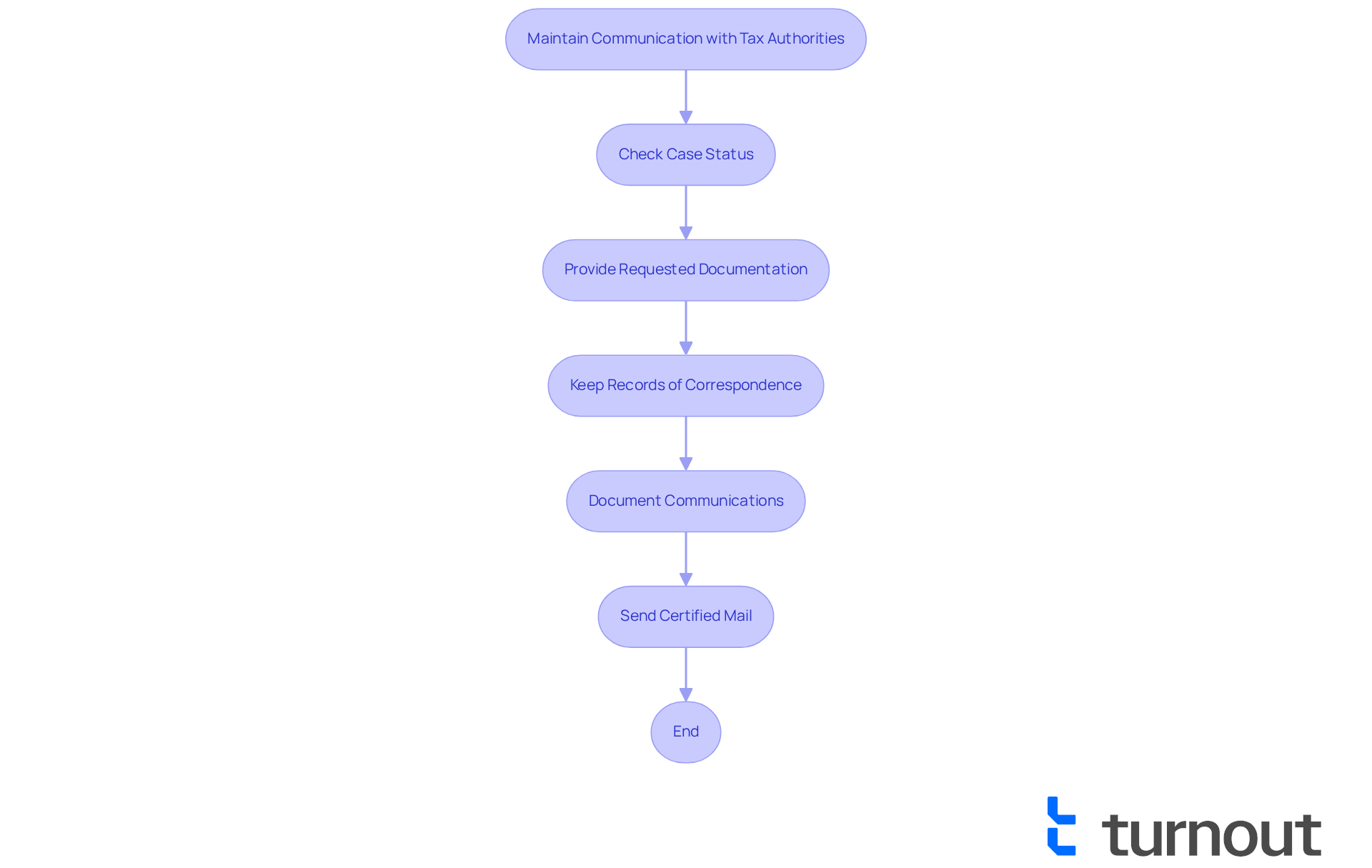

Maintaining open lines of communication with local tax authorities is essential throughout the resolution process. We understand that navigating these waters can be challenging. Regularly check in on the status of your case and promptly provide any requested documentation. If you have established a payment plan or are awaiting a decision on an appeal, keep meticulous records of all correspondence and notes from phone calls. This documentation can prove invaluable in the event of disputes.

Proactive communication not only demonstrates your commitment to resolving the issue but may also lead to more favorable treatment from tax officials. For instance, individuals who document their communications effectively often find themselves better positioned to negotiate outcomes. Statistics suggest that clear communication can significantly improve compliance with the state tax levy authorities, fostering a cooperative relationship that benefits both sides.

As one tax professional notes, "If there are any breakdowns in the oral or written communications with the IRS agents on the frontlines who directly handle taxpayer audits or investigations, people should not hesitate to escalate." Additionally, it is crucial to document all communications in writing and send correspondence by certified mail to maintain a clear record, which can be useful in disputes. Remember, you are not alone in this journey; we’re here to help you navigate through it.

Conclusion

Navigating a state tax levy can feel overwhelming, but understanding the process and knowing the steps to take can empower you to regain control of your financial situation. By recognizing the implications of a state tax levy and the importance of prompt action, you can effectively mitigate potential consequences and explore viable options for relief.

In this article, we've discussed key strategies to support you. It's crucial to take immediate action upon receiving a levy notice. Exploring payment plans and maintaining open communication with tax authorities can make a significant difference. Engaging with tax professionals and understanding available relief options, such as Offers in Compromise, can ease the burden of tax debt and promote a more favorable outcome.

Remember, you do not have to face the journey through a state tax levy alone. By taking proactive steps and utilizing available resources, you can navigate this complex landscape with confidence. Timely engagement and clear communication can lead to better resolutions, allowing you to move forward without the weight of tax burdens holding you back. We're here to help, and you are not alone in this journey.

Frequently Asked Questions

What is a state tax levy?

A state tax levy is a legal process initiated by a tax authority to confiscate your property or assets due to outstanding tax obligations. This can include garnishing wages, freezing bank accounts, or seizing personal property.

What actions can a state tax levy involve?

A state tax levy can involve actions such as garnishing your wages, freezing your bank accounts, or seizing personal property.

What should I do if I receive a notice about imminent tax collection?

It is crucial to respond quickly to any notice indicating that tax collection is imminent, as prompt action can help you avoid additional financial issues.

How can I mitigate the effects of a state tax levy assessment?

Acting swiftly can help mitigate the effects of a state tax levy assessment. You may explore options such as negotiating payment arrangements or submitting a State Offer in Compromise to resolve your debts.

Why is it important to understand state tax levies?

Understanding state tax levies is essential because they typically follow a series of notifications and requests for payment, and many individuals only realize the severity of their situation when facing wage garnishment or seized tax refunds.

How can tax experts assist with state tax levy issues?

Tax experts, such as those at Omni Tax Solutions, can help address local tax issues and develop effective strategies for moving forward, making it one of the quickest ways to resolve tax concerns.