Overview

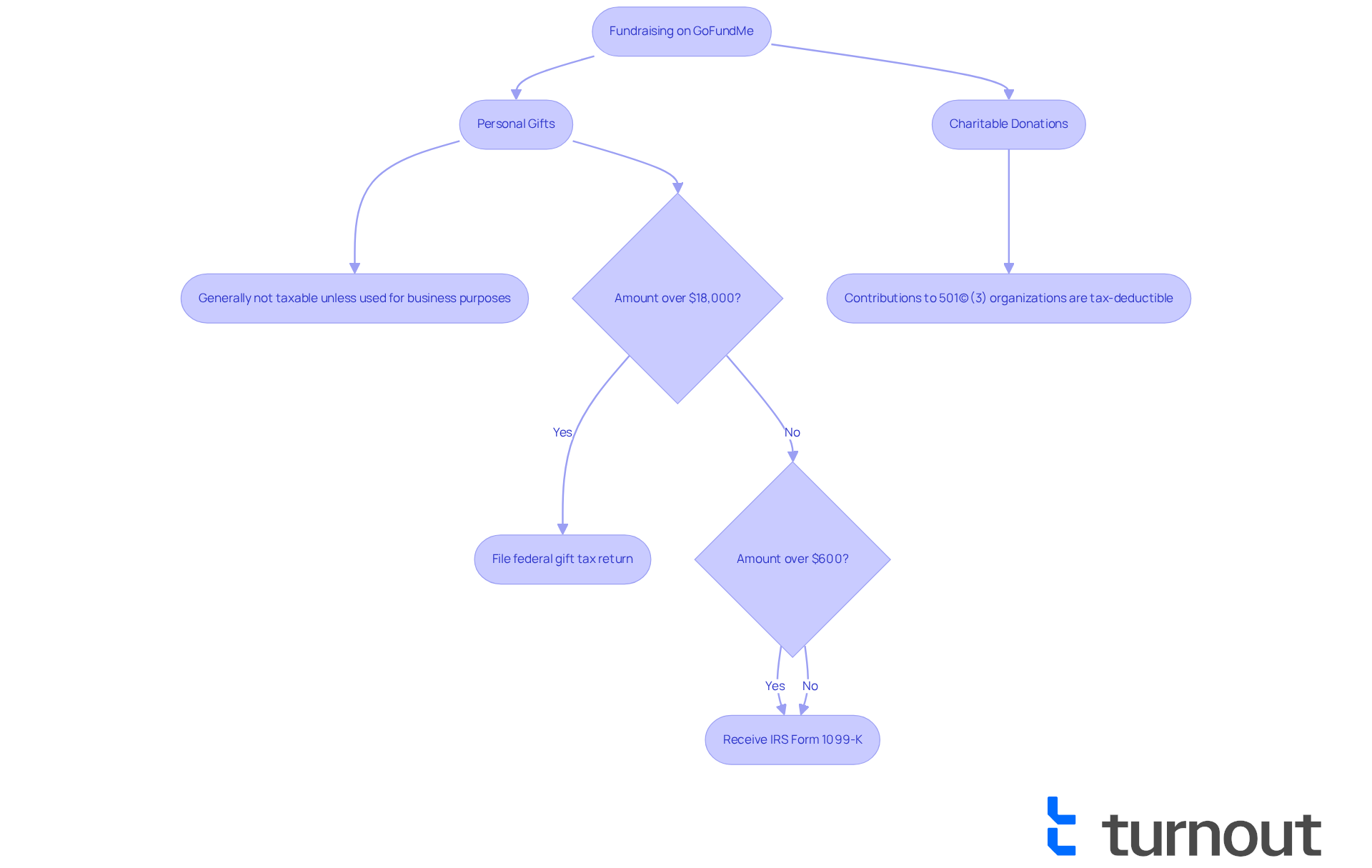

Understanding taxes for GoFundMe can feel overwhelming, but we’re here to help you navigate this important aspect. Funds raised can be classified as personal gifts or charitable donations, each carrying different tax implications.

- Personal donations are generally not taxable unless used for business purposes.

- On the other hand, contributions to registered charities are tax-deductible for donors.

It’s common to feel uncertain about what this means for you. Proper documentation is crucial, and consulting with tax professionals can provide the guidance you need to ensure compliance. Remember, you are not alone in this journey; seeking help is a positive step towards clarity and peace of mind.

Introduction

Understanding the intricacies of taxes related to crowdfunding platforms like GoFundMe is essential for both fundraisers and donors. We understand that as individuals increasingly turn to these platforms for financial support, the implications of how these funds are classified—whether as personal gifts or charitable donations—can significantly impact tax obligations.

It's common to feel overwhelmed by the potential for confusion and misinterpretation surrounding these matters. So, how can you navigate the complexities of this financial landscape to ensure compliance and maximize benefits?

This guide aims to demystify the tax fundamentals of GoFundMe, providing clarity on what to expect and how to manage your responsibilities effectively. Remember, you are not alone in this journey; we’re here to help.

Explore Tax Fundamentals for GoFundMe Fundraising

When fundraising on platforms like GoFundMe, it's important to understand the . We recognize that can be challenging. Generally, funds raised can be classified as or , each treated differently by the IRS based on their intended use.

- Personal Gifts: Most donations to personal GoFundMe campaigns are classified as gifts and are not considered taxable income for the recipient. Contributions made from detached and disinterested generosity are also regarded as donations by the IRS and are excluded from the recipient's gross income. However, it's essential to note that if the resources are utilized for business purposes, they may incur [taxes for GoFundMe](https://myturnout.com/service/tax-relief-resolution).

- Charitable Donations: Contributions made to registered 501(c)(3) organizations via GoFundMe are , provided they adhere to IRS guidelines. Understanding this distinction is essential for both fundraisers and contributors.

Recognizing these categories clarifies potential taxes for GoFundMe that may arise from fundraising activities and aids in effective management of those responsibilities. For instance, if a donor contributes over $18,000 to a personal campaign, they may need to file a federal return on contributions. However, most will not owe taxes unless their total donations exceed the lifetime exclusion amount of $13.99 million in 2025. Additionally, organizers of successful campaigns that raise over $600 will receive , which details the gross payments made to the campaign. This necessitates .

By maintaining clear communication about the campaign's purpose, consulting with tax professionals, and keeping detailed records of fundraising activities for at least three years, fundraisers can navigate these complexities and ensure compliance with taxes for GoFundMe. Remember, as the IRS states, " may be taxable; taxpayers should understand their obligations and the benefits of good recordkeeping." You're not alone in this journey, and we're here to help you every step of the way.

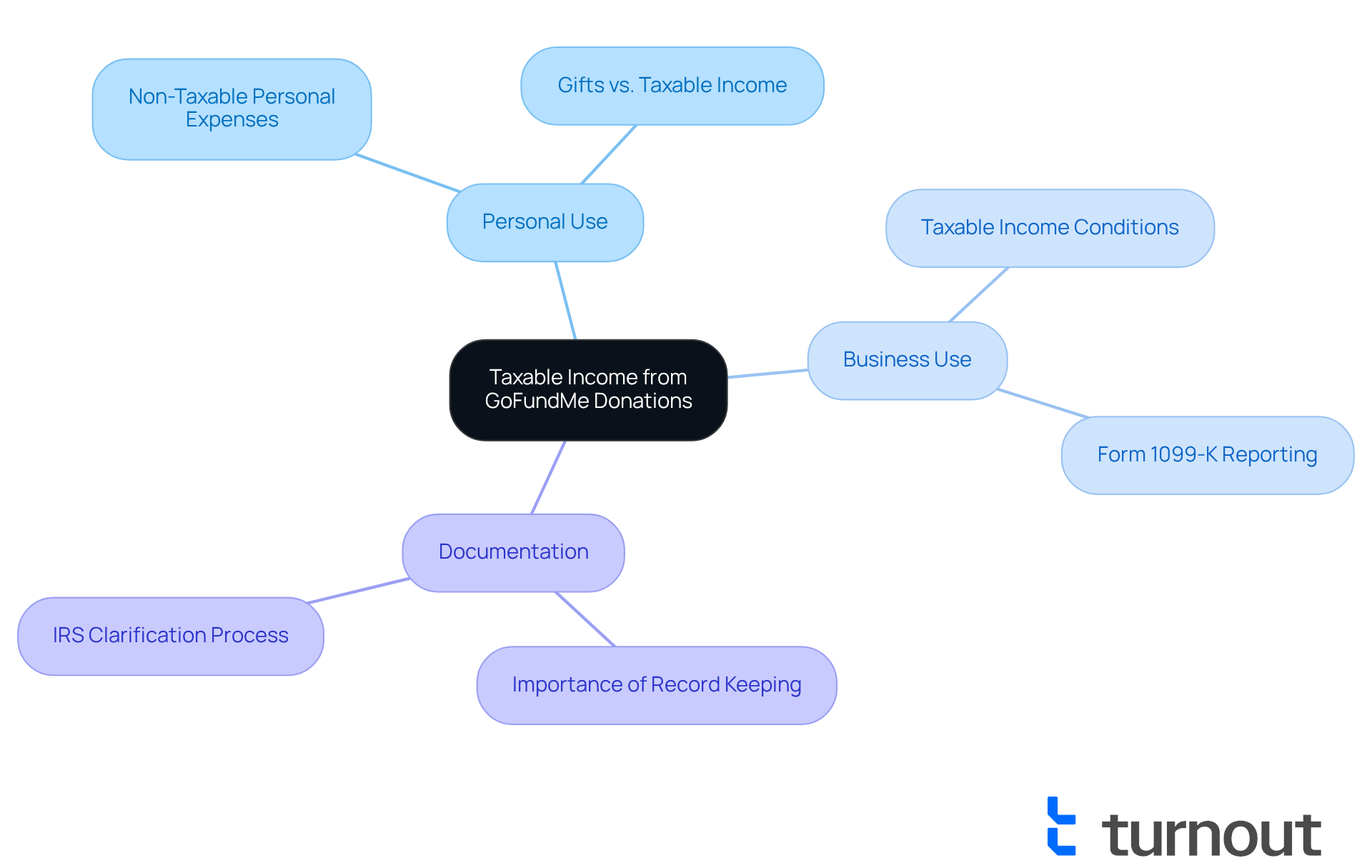

Identify Taxable Income from GoFundMe Donations

Understanding the received can be overwhelming, but we are here to help you .

Personal Use: If you use the funds for personal expenses—like medical bills or education—these are generally not taxable. The IRS often views these contributions as gifts, particularly when they stem from genuine generosity.

Business Use: However, if the funds are intended for business purposes or if your campaign offers goods or services in return for contributions, the earnings may be taxable. In these cases, it's important to . If you receive over $600, the crowdfunding platform may issue Form 1099-K, which signals to the IRS that payments have been made. Remember, receiving a 1099-K does not automatically mean the money is taxable; it requires careful categorization of the funds.

Documentation: of how you utilize the funds is essential. If the IRS questions the nature of the contributions, clear documentation can clarify their tax status. If you receive significant donations, be aware that there may be that arise, and large contributions can trigger reporting requirements.

We understand that tax matters can feel daunting, so is advisable to navigate these complexities and ensure compliance with tax regulations.

By grasping these distinctions, you can better prepare for your tax obligations and avoid potential pitfalls. Remember, you're not alone in this journey; seeking support can make a significant difference.

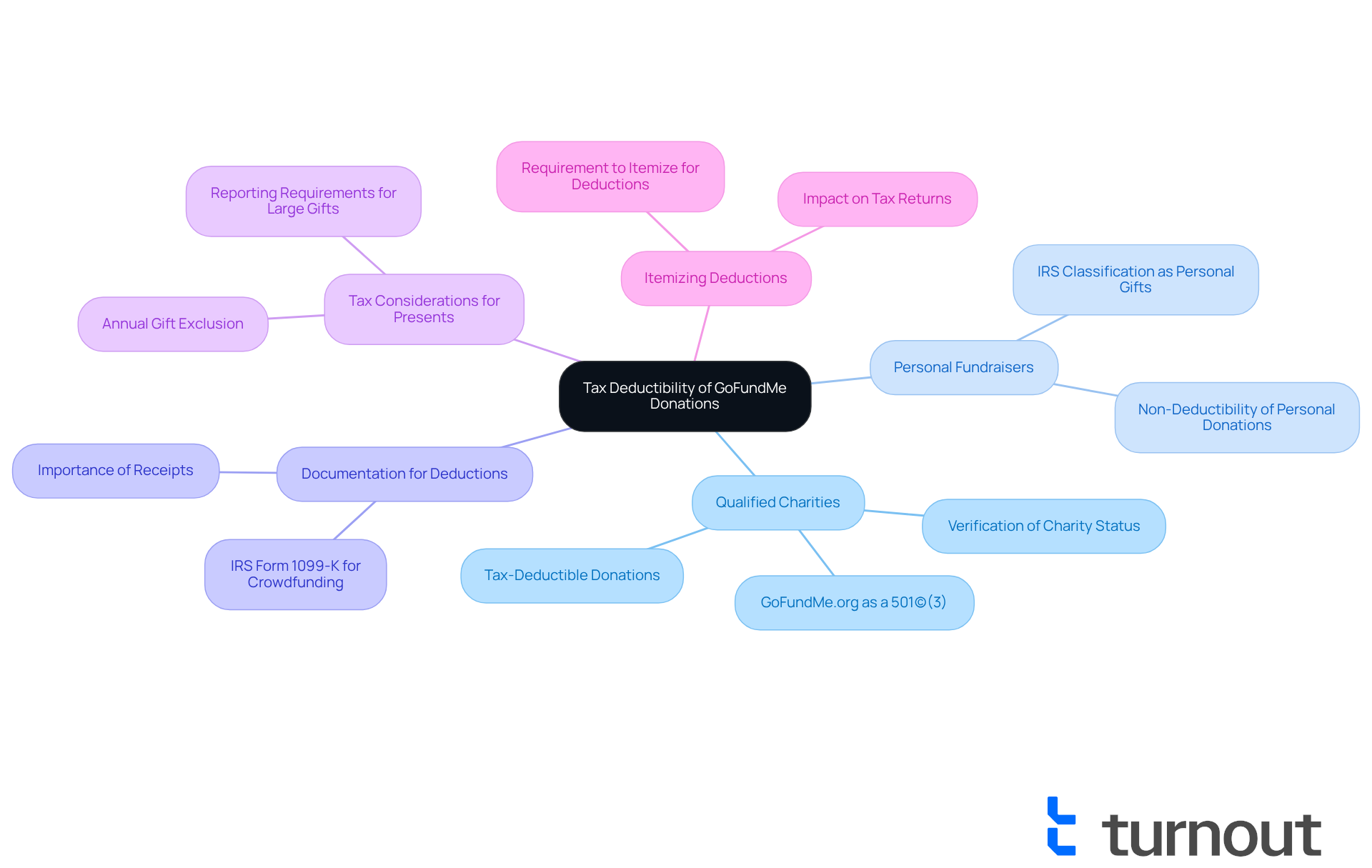

Clarify Deductibility of Donations to GoFundMe Campaigns

Not all donations made through GoFundMe are tax-deductible, and we understand that this can be confusing when it comes to . Here’s what you need to consider:

- Qualified Charities: , such as GoFundMe.org, are generally tax-deductible. It’s essential to verify that the campaign is explicitly linked to a qualified charity. Remember, a significant percentage of donations on GoFundMe are directed towards individuals, which are not eligible for deductions.

- Personal Fundraisers: Contributions to personal fundraisers, like those for medical expenses or individual projects, are typically classified by the IRS as personal donations and are not tax-deductible. Understanding this distinction is crucial to avoid .

- Documentation for Deductions: To support deductions when submitting income reports, we encourage you to ask for a receipt for your donations, especially for sums over $250. This documentation is essential for claiming any potential . Additionally, if a crowdfunding campaign raises more than $600, donors may receive IRS Form 1099-K, which reports income from third-party payment apps, and must consider the implications for their [taxes for GoFundMe](https://myturnout.com/service).

- Tax Considerations for Presents: The yearly exclusion amount for presents is $19,000 in 2025. Contributions below this limit generally do not incur taxation, but those exceeding this amount may require additional reporting.

- Itemizing Deductions: As noted by CPA Sharon Brucker, to claim any possible deduction for , you will need to on your tax return.

Understanding these rules helps you navigate your contributions effectively, ensuring you can claim deductions where applicable. Remember, we're here to help you through this process.

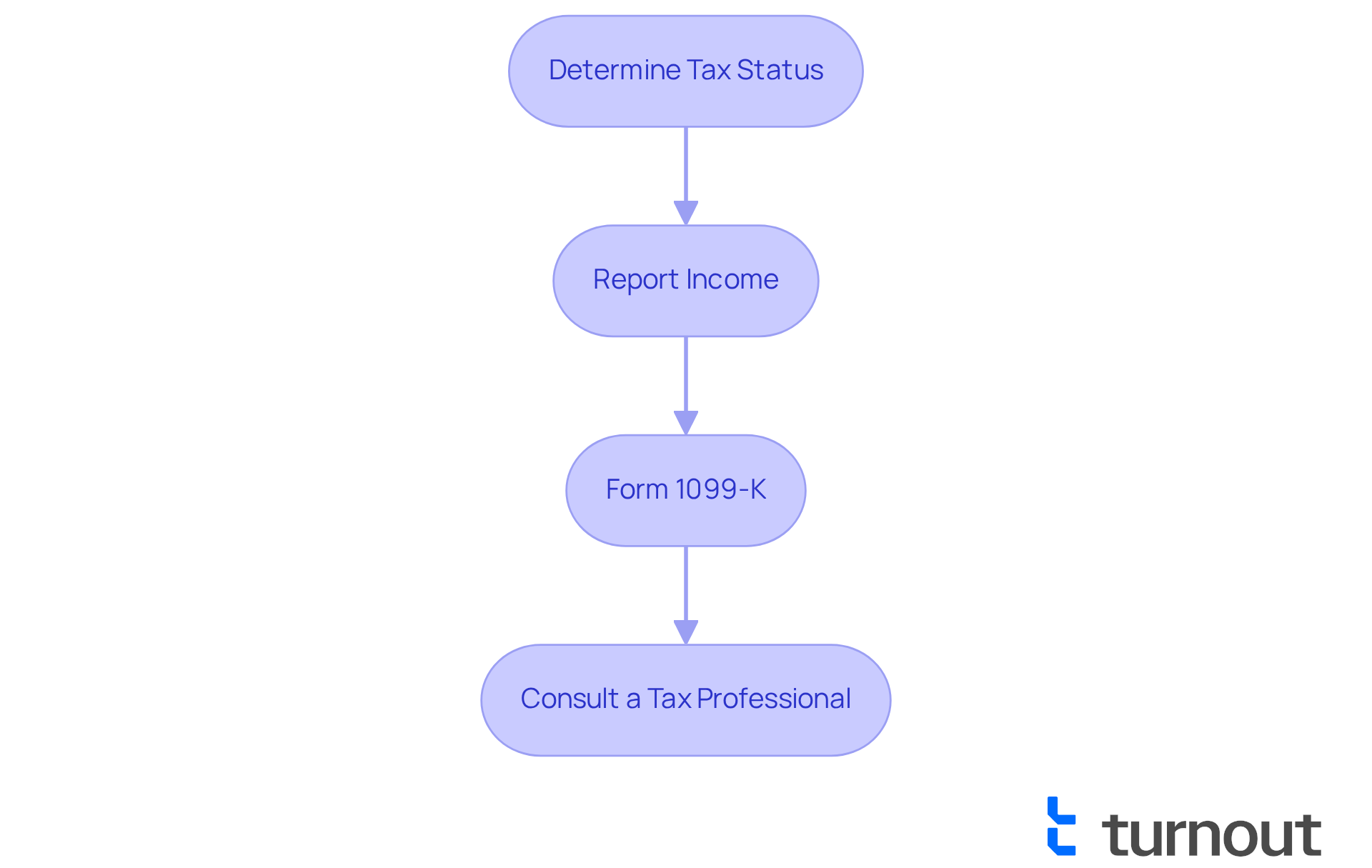

Implement Reporting Procedures for GoFundMe Income

Navigating can feel overwhelming, but we're here to help. By following these reporting procedures, you can manage your responsibilities with confidence:

- Determine Tax Status: It's important to assess whether the funds you raised are considered gifts or . For instance, funds raised for personal causes, such as medical bills, are generally treated as gifts and not subject to tax, provided donors receive nothing in return.

- Report Income: If the resources are deemed taxable, you will need to declare them on your tax return using . Include the income as 'Other Income' if applicable. Remember to keep precise documentation of your fundraising efforts and how the funds were allocated for at least three years, as this will support your taxes for GoFundMe.

- : If your campaign raises over $600 in gross payments, GoFundMe will issue a Form 1099-K, detailing the total amount raised. This form is also sent to the IRS, so make sure to include it in your tax filings. As of 2023, campaigns exceeding this threshold will receive this form to clarify the taxes for GoFundMe, regardless of the number of transactions.

- : We understand that the complexity of can be daunting. Consider reaching out to a tax professional for personalized advice regarding taxes for GoFundMe. They can clarify the taxability of your funds and help ensure compliance with IRS regulations.

By implementing these procedures, you can navigate your and avoid potential issues with the IRS. Remember, you are not alone in this journey; support is available to guide you.

Conclusion

Understanding the tax implications of GoFundMe fundraising is crucial for both organizers and donors. We recognize that navigating these responsibilities can feel overwhelming. By distinguishing between personal gifts and charitable donations, you can better manage your tax obligations and avoid unexpected liabilities. This clarity is essential for ensuring compliance with IRS regulations and for maximizing the benefits of your fundraising efforts.

Throughout this article, we’ve highlighted key points such as the classification of funds, the importance of documentation, and the necessity of consulting tax professionals. It’s common to wonder about the tax treatment of funds. Personal use of funds typically does not incur taxes, while business-related fundraising may require careful reporting. Additionally, recognizing which donations qualify for tax deductions is vital, and maintaining thorough records will help substantiate any claims made on your tax returns.

In conclusion, understanding the tax fundamentals for GoFundMe can significantly impact the success and legality of your fundraising initiatives. By staying informed and seeking expert guidance, you can confidently manage your tax obligations and focus on your campaign goals. Remember, you are not alone in this journey. Embrace this knowledge to ensure that your fundraising efforts are both effective and compliant, paving the way for a smoother financial journey ahead.

Frequently Asked Questions

How are funds raised on GoFundMe classified for tax purposes?

Funds raised on GoFundMe can be classified as personal gifts or charitable donations, each treated differently by the IRS based on their intended use.

Are donations to personal GoFundMe campaigns considered taxable income?

No, most donations to personal GoFundMe campaigns are classified as gifts and are not considered taxable income for the recipient, as they are regarded as donations by the IRS.

When might funds raised on GoFundMe incur taxes?

If the funds raised are utilized for business purposes, they may incur taxes. Additionally, if a donor contributes over $18,000 to a personal campaign, they may need to file a federal return on contributions.

What are the tax implications for charitable donations made through GoFundMe?

Contributions made to registered 501(c)(3) organizations via GoFundMe are tax-deductible for the donor, provided they adhere to IRS guidelines.

What is the lifetime exclusion amount for donations, and how does it affect taxes?

The lifetime exclusion amount is $13.99 million in 2025. Most individuals will not owe taxes unless their total donations exceed this amount.

What is IRS Form 1099-K, and when is it issued?

IRS Form 1099-K is issued to organizers of successful campaigns that raise over $600, detailing the gross payments made to the campaign. This requires accurate record-keeping and income reporting.

How can fundraisers ensure compliance with tax obligations?

Fundraisers can ensure compliance by maintaining clear communication about the campaign's purpose, consulting with tax professionals, and keeping detailed records of fundraising activities for at least three years.