Overview

The article titled "10 Essential Resources for Understanding Federal Allowances" is designed to provide you with vital information and tools that can help you navigate the complexities of federal allowances and benefits. We understand that seeking assistance can often feel overwhelming, and this article aims to simplify that journey for you.

Within its pages, you will find important resources like:

- Turnout

- the Canada Revenue Agency

- the IRS

These organizations collectively offer guidance on eligibility, application processes, and the various types of federal allowances available. By presenting this information, we hope to empower you to access the benefits you deserve with greater ease.

Remember, you're not alone in this journey. We’re here to help you understand and utilize these resources effectively, ensuring that you can take the necessary steps towards securing your federal allowances.

Introduction

Understanding federal allowances can often feel overwhelming, like navigating a labyrinth of information. Each turn reveals new complexities and potential benefits, which can be daunting. This article presents ten essential resources designed to simplify your journey. We offer insights into everything from AI-driven advocacy platforms to comprehensive government guidelines.

We understand that with so many avenues to explore, it can be challenging to ensure you are maximizing your access to these vital benefits. How can you confidently claim your rightful advantages? This exploration seeks to unravel that question, equipping you with the knowledge you need to navigate this process with assurance. Remember, you are not alone in this journey—we're here to help.

Turnout: AI-Powered Advocacy for Federal Allowances

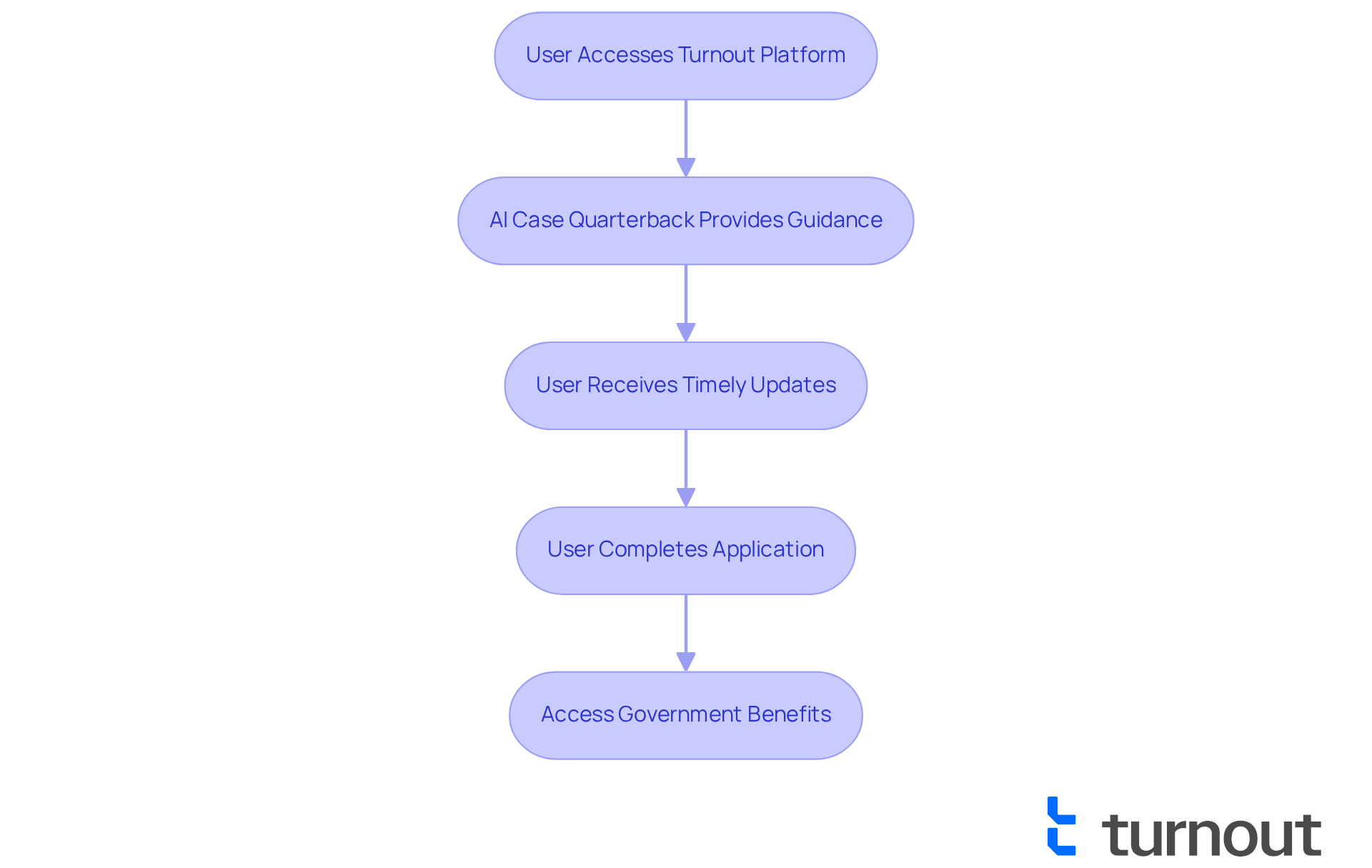

Turnout is changing how individuals access government benefits through its . We understand that . By utilizing advanced technology, Turnout , allowing you to better comprehend and access your advantages. The platform's AI case quarterback, Jake, plays a crucial role by providing timely updates and support. This effectively transforms a traditionally daunting experience into a manageable one.

This innovative method not only improves efficiency but also enables you to confidently maneuver through the intricacies of governmental benefits. You deserve to obtain the assistance you require without added stress. Importantly, Turnout is not a law firm and does not provide legal advice; instead, it utilizes trained and works with IRS-licensed enrolled agents for . This dedication to transparent communication and specialized support further strengthens Turnout's role in . Remember, you are not alone in this journey—we're here to help.

Canada Revenue Agency: Comprehensive Guide to Federal Allowances

The Canada Revenue Agency (CRA) offers a comprehensive guide to national grants, highlighting the various advantages available to Canadian citizens. This valuable resource provides insights on eligibility, application processes, and the types of federal allowances that can be claimed. We understand that navigating these systems can be overwhelming, but by grasping how the CRA operates, U.S. consumers can gain insights into their own federal systems and discover potential benefits they may qualify for.

At Turnout, we're here to simplify and . We specifically assist individuals with and tax debt relief through our dedicated nonlawyer advocates and IRS-licensed enrolled agents. Our guidance is designed to help you effectively navigate these complex systems, ensuring that you feel supported every step of the way. Remember, you are not alone in this journey.

Investopedia: Insights on Withholding Allowances and Tax Implications

At Investopedia, we understand that navigating can be overwhelming, but we're here to provide into how these exemptions impact the amount of tax withheld from your paycheck. Comprehending withholding exemptions is crucial for anyone looking to improve their . By strategically asserting the right number of exemptions, you can significantly influence your , ensuring you receive maximum benefits while minimizing potential tax obligations.

For instance, typically results in increased take-home pay, allowing you to manage your finances more effectively throughout the year. Conversely, asserting too few deductions might lead to , resulting in a larger refund but less immediate cash flow. It's important to note that a single individual under age 65 is exempt from withholding if their annual income does not exceed $12,000—this is a vital consideration for many.

Additionally, if you have dependent children under 17, remember that their number can be multiplied by the credit amount stated on the form for added tax benefits, further influencing your deductions. Economic specialists emphasize the importance of regularly reviewing and adjusting your withholding amounts, especially after significant life events, to align with your current financial situation. This proactive approach can help you avoid and enhance your overall financial well-being.

Moreover, if you're married and have a single income stream, submitting a joint return with two exemptions can provide a clearer framework for managing your [tax situation](https://communitytax.com/tax-blog/tax-allowances). Remember, you are not alone in this journey; we are here to help you make informed decisions that benefit your financial future.

SmartAsset: Tax Allowances and Financial Planning Resources

At SmartAsset, we understand that and can be overwhelming. That's why we offer a complete range of resources designed to empower you. Our calculators and guides help you effectively manage the complexities of .

For the upcoming year, it's important to note that:

- The standard deduction for single taxpayers will rise to $15,000.

- Married couples filing jointly will see an increase to $30,000.

This change can significantly impact how you organize your finances and make the most of the resources available to you.

Tax experts emphasize the essential importance of , as they can greatly influence your overall tax savings. Many individuals who have utilized SmartAsset's resources have seen improvements in their tax situations, demonstrating the real advantages of knowledgeable monetary planning.

With tools like and personalized , you can make informed choices that enhance your financial well-being. Remember, seeking insights from tax professionals can provide you with further clarity on how to utilize these resources effectively. We're here to help you on this journey, and you are not alone in seeking financial peace of mind.

.](https://images.tely.ai/telyai/qljzqjhl-the-chart-shows-how-much-each-standard-deduction-contributes-to-overall-tax-benefits-the-larger-the-segment-the-more-significant-the-deduction-for-financial-planning.webp)

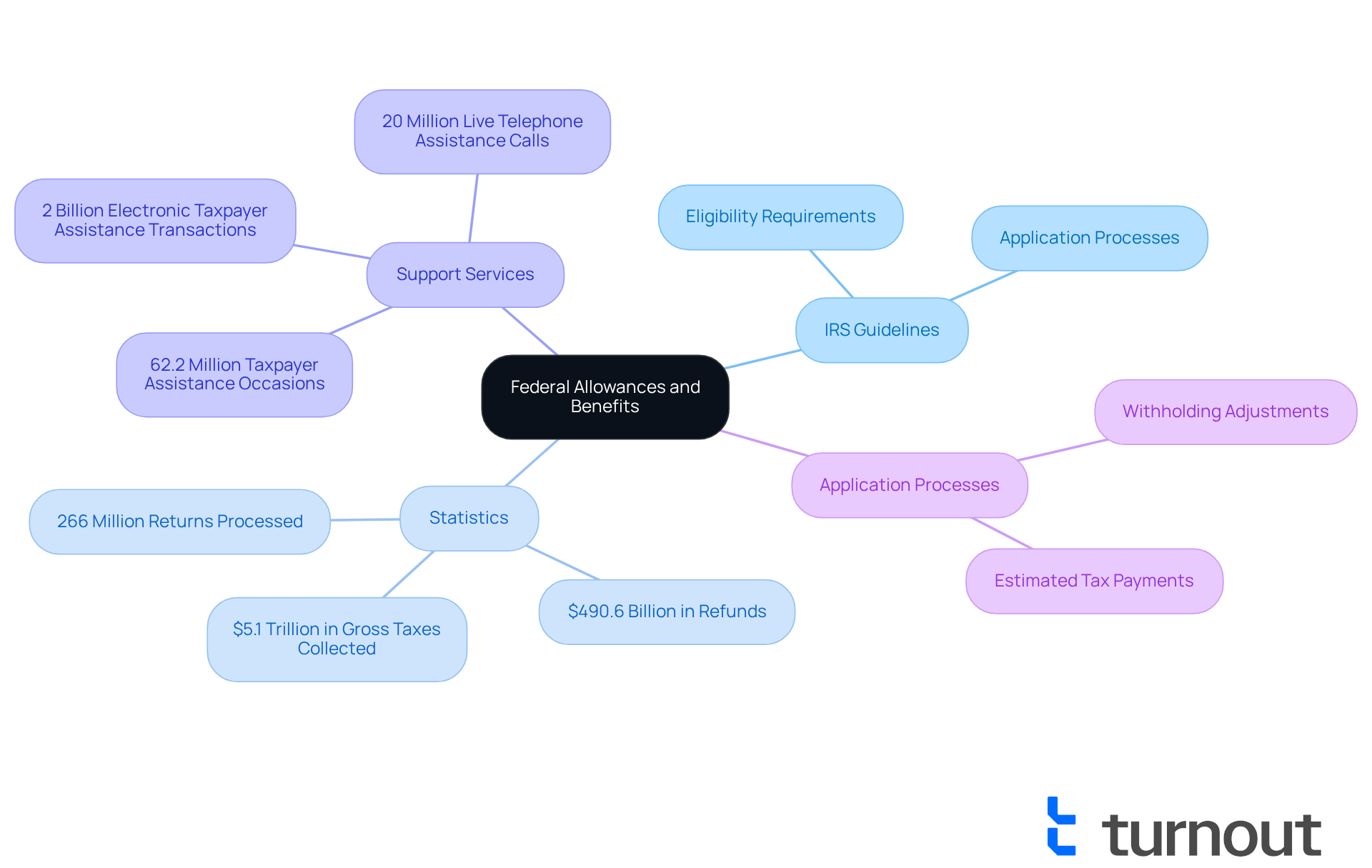

IRS: Official Guidelines on Federal Allowances and Benefits

Navigating the world of national allowances and entitlements can feel overwhelming. The IRS provides , application processes, and the . This resource is invaluable for anyone seeking to understand the complexities of national assistance, as it offers clear and reliable information.

In FY 2024, the IRS processed over 266 million returns and issued nearly $490.6 billion in refunds, while also collecting more than $5.1 trillion in gross taxes. These numbers reflect the vast scale of national assistance available to individuals like you. empowers you to make informed decisions about your entitlements, including federal allowances, and ensures compliance with national regulations.

We understand that seeking assistance can be daunting. As the IRS continues to enhance its services, including a remarkable 47% increase in electronic taxpayer assistance transactions—totaling over 2 billion transactions—you can expect improved support in navigating your applications. As stated by the IRS, 'The agency observed progress in all key areas of taxpayer support,' which underscores its commitment to helping individuals effectively manage their federal allowances.

Furthermore, designed to ease access to these benefits. They provide expert advice to help you navigate the and tax debt relief. It's important to note that Turnout is not a law firm and does not provide legal advice; the professionals involved are trained nonlawyer advocates and IRS-licensed enrolled agents.

Additionally, the time required to handle government support applications can vary. Understanding this timeframe can help you plan accordingly. Remember, you are not alone in this journey; support is available, and we are here to help you every step of the way.

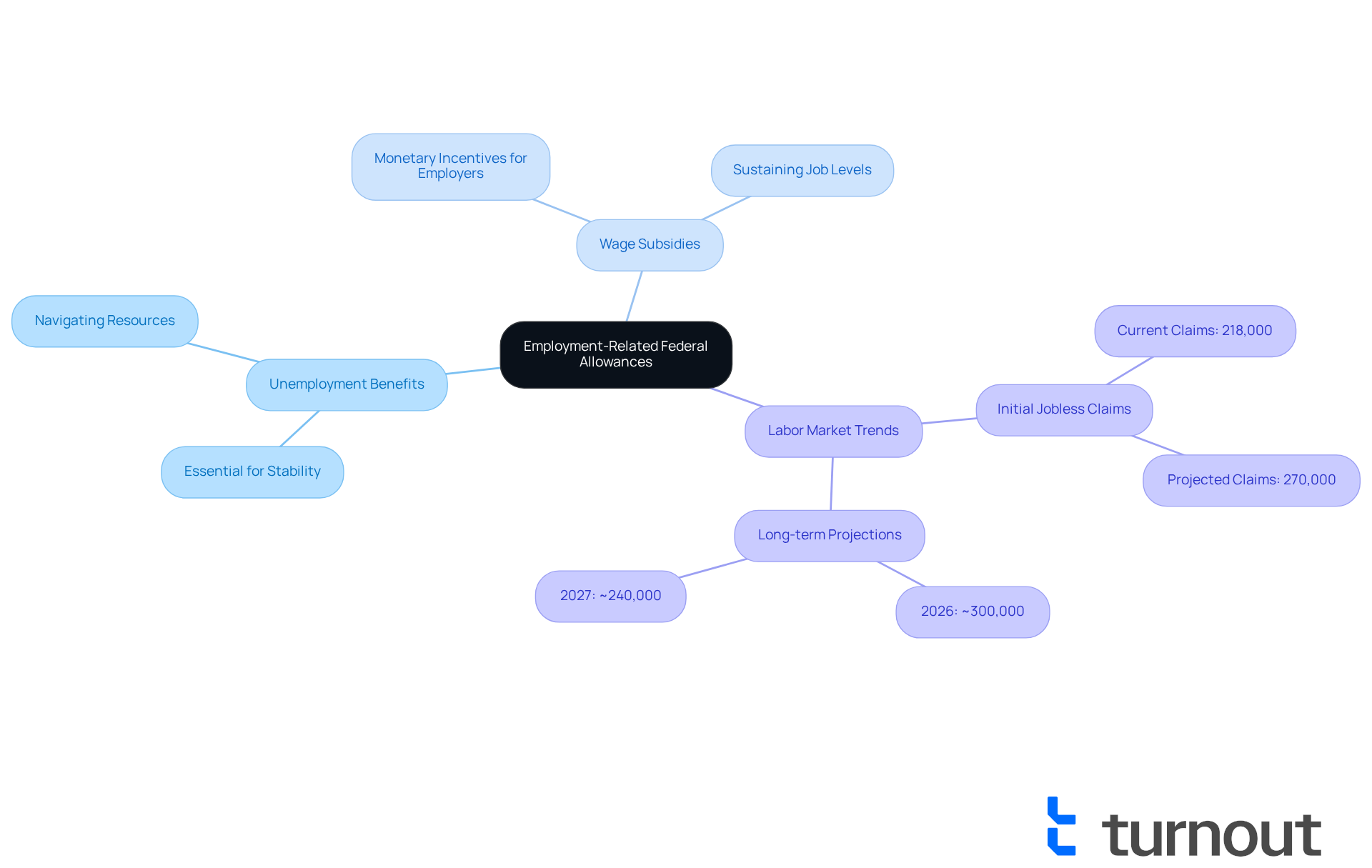

U.S. Department of Labor: Employment-Related Federal Allowances

The U.S. Department of Labor provides , including and . These programs are designed to , ensuring access to resources necessary for stability. We understand that navigating these can be vital for individuals seeking to secure the assistance they need, especially amidst economic uncertainties.

Recent updates reveal that in the United States have in the week ending September 20, 2025, down from 232,000 the previous week. This decline suggests a , easing fears of a downturn. However, projections indicate that initial jobless claims may reach 270,000 by the end of the current quarter. This highlights the ongoing need for federal allowances to ensure accessible unemployment benefits.

Wage subsidies are essential for supporting employment rates and are often linked to federal allowances. By offering monetary incentives to employers, these subsidies help sustain job levels during economic downturns, ultimately benefiting workers who depend on stable employment. Understanding how these provisions operate can empower individuals to utilize available resources and enhance their economic situations. Remember, you are not alone in this journey; we’re here to help.

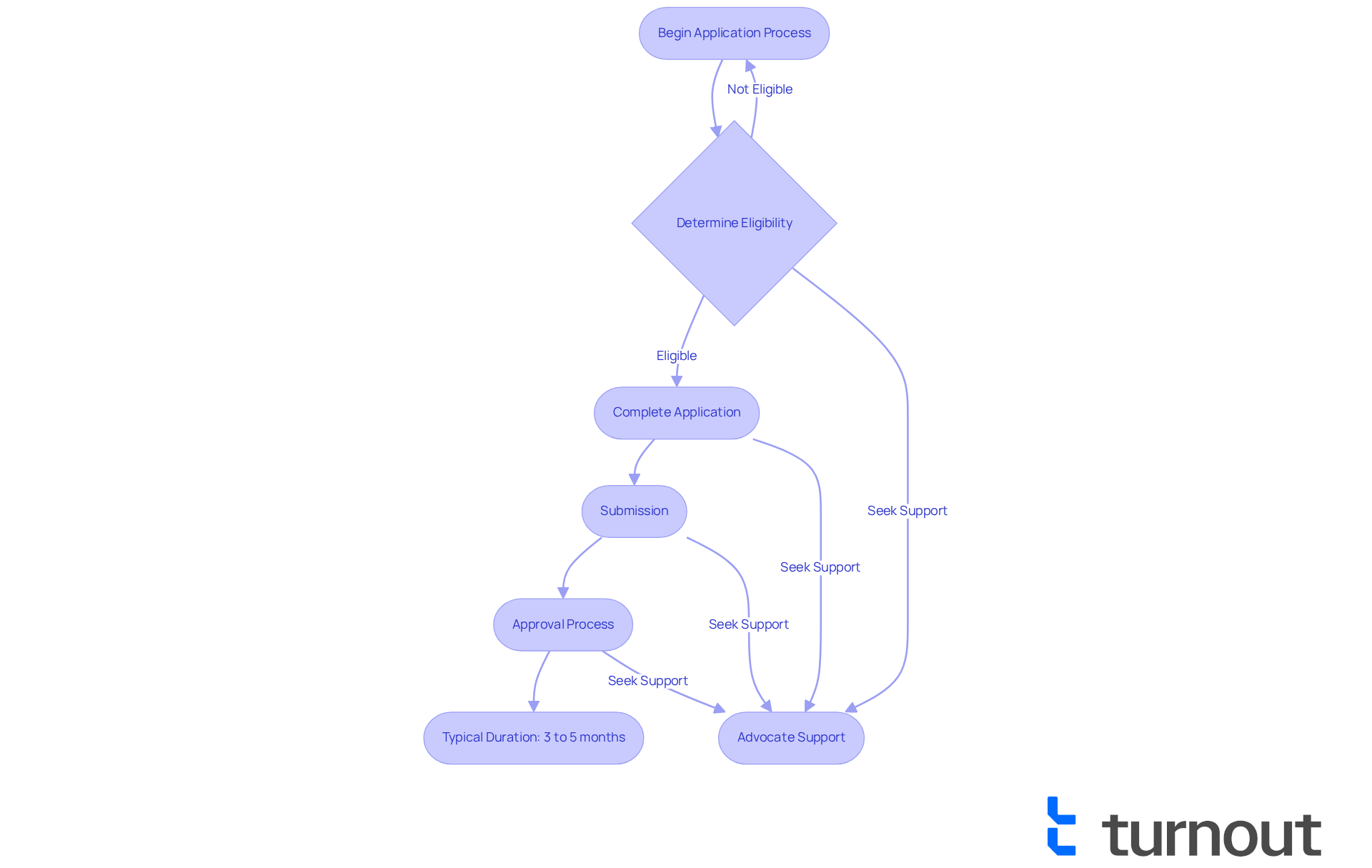

Social Security Administration: Disability Benefits and Allowances

The Social Security Administration (SSA) serves as a vital resource for , offering comprehensive information on disability assistance and federal allowances. We understand that , , and types of assistance available can be overwhelming for those seeking financial support. Typically, the approval process for assistance can take several months, often ranging from three to five months. This timeline can be influenced by various factors, including the complexity of the case and the volume of applications being processed.

Turnout provides access to trained nonlawyer . They ensure that individuals feel informed and supported throughout their journey. Advocates stress the when engaging with these systems. For instance, one advocate shared, "" This powerful sentiment resonates with many who have successfully navigated the SSA's processes, underscoring the need for clarity and guidance.

In 2025, updates to were announced, reflecting ongoing efforts to enhance access for individuals facing significant challenges. Real-world examples illustrate the journeys many consumers undertake. For example, a veteran who encountered obstacles in claiming benefits shared how persistence and the right information ultimately led to a successful outcome. Such stories emphasize the importance of advocacy and support in navigating the complexities of disability benefits, ensuring that individuals receive the assistance they truly deserve.

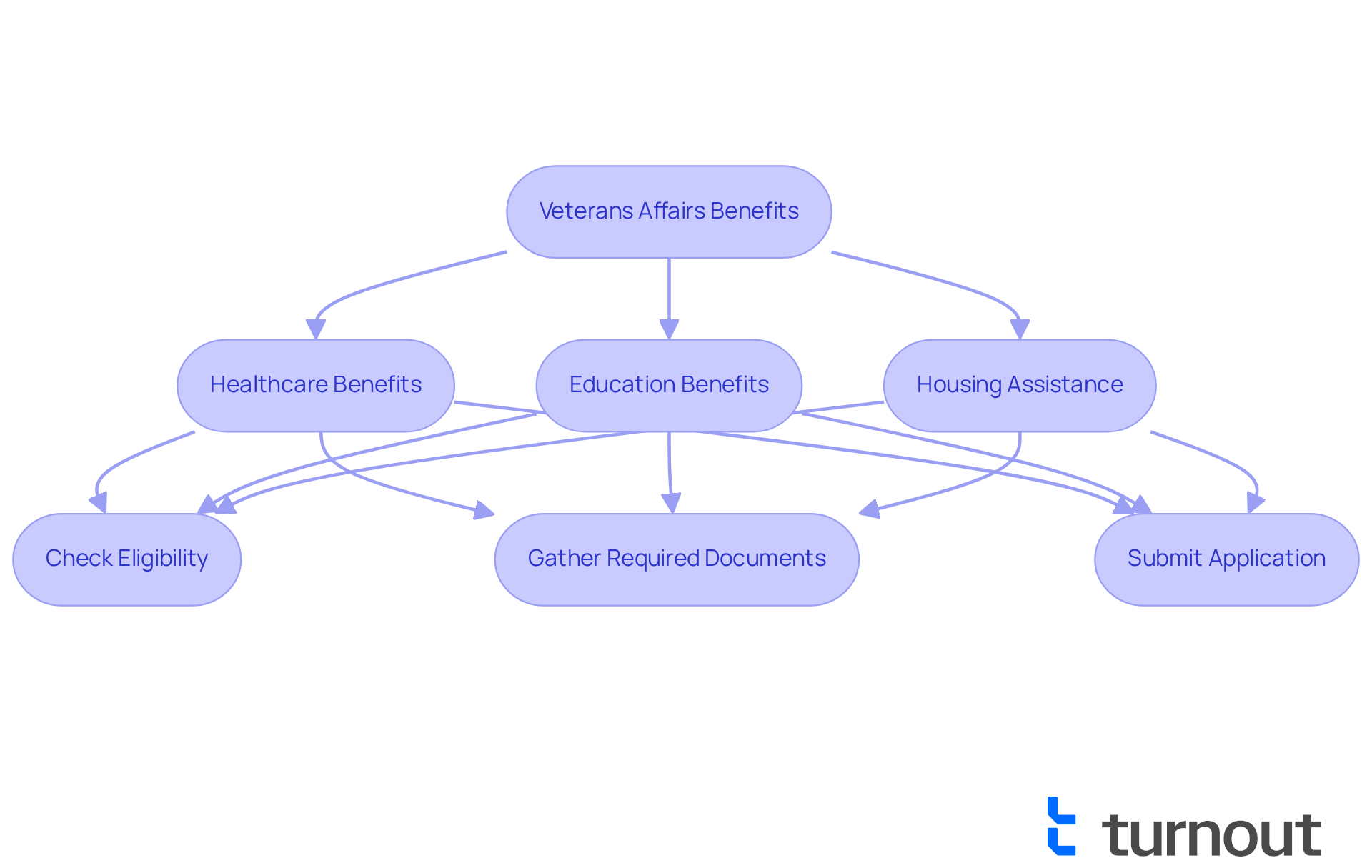

Veterans Affairs Department: Federal Allowances for Veterans

The Veterans Affairs Department provides various , which include support for healthcare, education, and housing assistance. These benefits are crucial for supporting those who have served in the military, ensuring they receive the resources they have rightfully earned. For example, receive an average annual payment of $48,227, showcasing the significant financial support available.

We understand that navigating the for these benefits can be overwhelming. Many veterans face challenges when trying to access their entitlements, often feeling daunted by bureaucratic hurdles. For instance, the , which aids low-income veterans, provided an average yearly payment of $14,211 to 153,568 recipients in FY2023, totaling $2.18 billion. This underscores the importance of and the application process to secure these vital funds.

In 2025, revisions to the application process for benefits aimed to streamline access and enhance efficiency. With the introduction of advanced platforms, claims can now be processed more quickly, with some systems capable of indexing large eFolders in under 20 minutes. This technological advancement is essential for veterans seeking timely assistance.

are also vital components of the national provisions. Veterans can access a variety of services, including medical care and educational support, designed to ease their transition into civilian life. Advocates emphasize the necessity for veterans to be aware of these benefits, as many may not realize the full range of resources available to them.

Overall, and federal allowances is essential for veterans to and ensure they receive the assistance they deserve. Remember, you are not alone in this journey, and we're here to help you every step of the way.

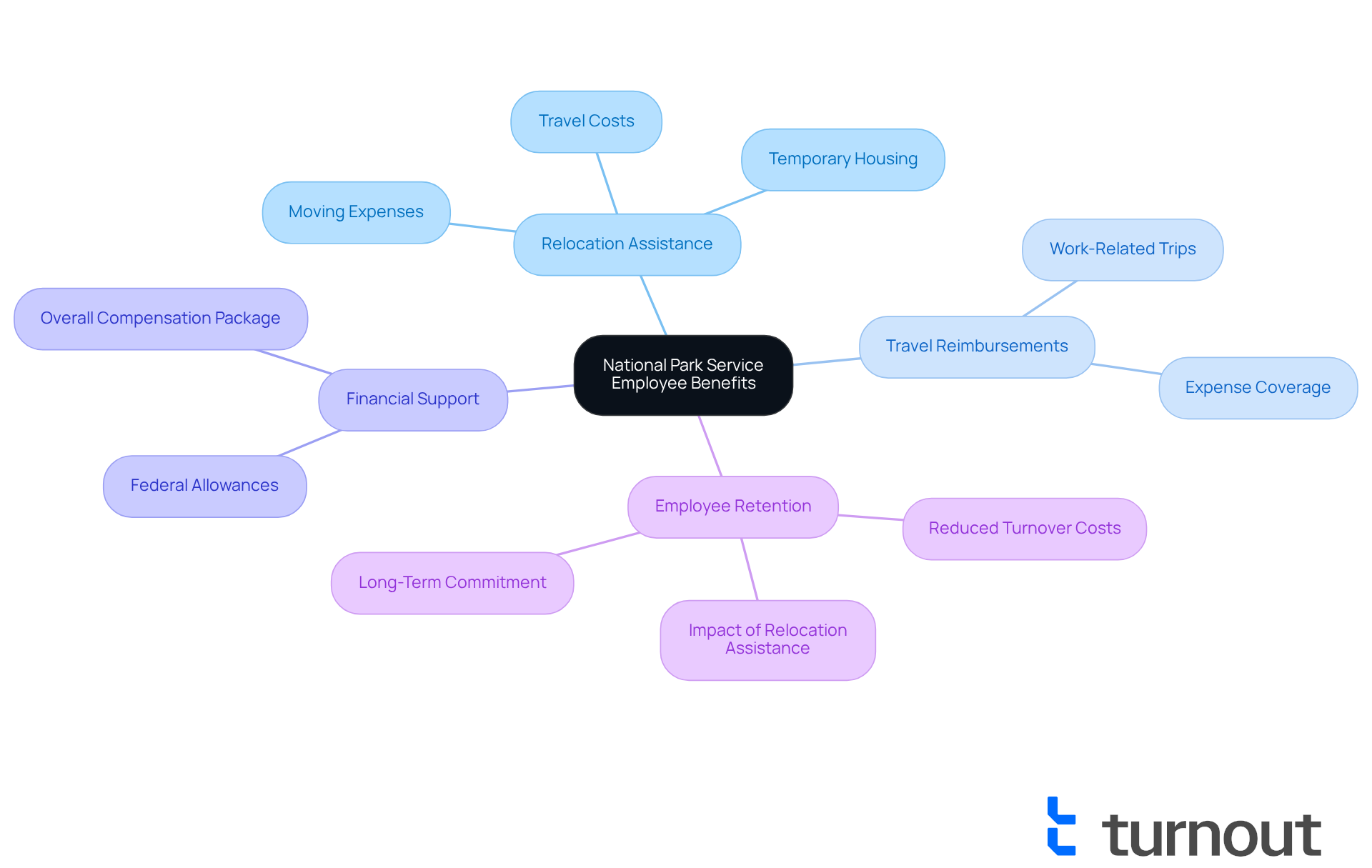

National Park Service: Federal Employee Allowances and Benefits

The National Park Service provides a comprehensive overview of the entitlements and perks available to government workers, including relocation assistance, travel reimbursements, and various forms of financial support. These provisions play a vital role in enhancing the overall compensation package for government employees, ensuring they receive the necessary support in their roles. Understanding these benefits is essential for employees aiming to and .

, as it aids employees in transitioning smoothly when moving for work-related reasons. Many government workers rely on these allowances to cover moving expenses, temporary housing, and travel costs linked to their relocation. This support not only eases financial burdens but also encourages employees to accept positions in different locations, fostering greater workforce mobility.

The impact of relocation assistance on . Research indicates that national organizations offering substantial relocation support tend to retain employees for longer periods, reflecting a commitment to their workforce. When employees feel valued and supported, they are more inclined to stay with their agency, which helps reduce turnover and associated costs.

HR specialists emphasize the importance of optimizing . They encourage employees to familiarize themselves with the full range of federal allowances available, including travel reimbursements for work-related trips. By understanding the complexities of these benefits, employees can ensure they are maximizing the financial support provided by their agencies.

As we approach 2025, continue to evolve, reflecting the changing needs of the workforce. Staying informed about these updates is crucial for employees to navigate their compensation effectively and utilize available resources to enhance their overall employment experience. Remember, you are not alone in this journey—there are resources and support available to help you thrive.

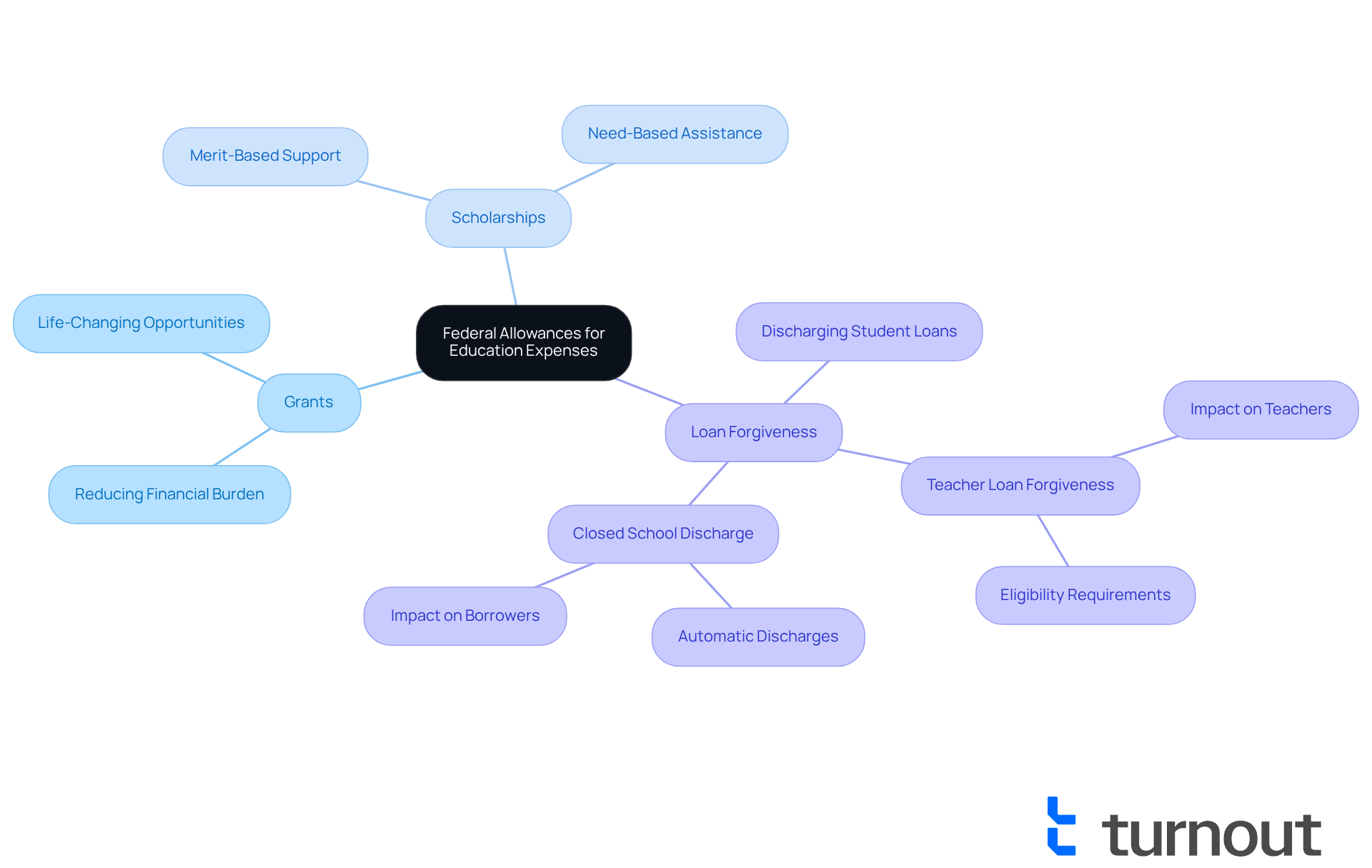

U.S. Department of Education: Federal Allowances for Education Expenses

The U.S. Department of Education offers vital resources aimed at easing the through grants, scholarships, and loan forgiveness programs. We understand that can be challenging for students and families. By familiarizing themselves with the various benefits available, individuals can make informed decisions about their educational paths and to achieve their dreams.

Many families have successfully secured , significantly lightening their financial load. The Department of Education highlights that these , allowing students to focus on their studies without the heavy weight of debt.

In 2025, updates to grants and scholarships reflect a strong commitment to making education more accessible. The Department emphasizes that these programs are crucial in reducing , with playing a key role in this mission. Recent reports indicate a substantial impact, with billions in student loans discharged, enabling borrowers to concentrate on their careers and futures instead of financial worries.

not only empowers individuals to explore their educational options but also highlights the ongoing support available to help them thrive. Remember, you are not alone in this journey; we're here to help you succeed.

Conclusion

Understanding federal allowances is crucial for individuals seeking to access various forms of government support and benefits. We recognize that navigating this complex landscape can feel overwhelming. This article highlights essential resources designed to simplify the process, empowering you to explore your options with confidence. By leveraging these resources, you can gain clarity and access the assistance you need, ensuring you are not alone in this journey.

Key insights discussed include the innovative role of AI-powered platforms like Turnout, which streamline the application process for federal benefits. Additionally, comprehensive guides provided by agencies such as the Canada Revenue Agency and the IRS serve as invaluable tools. It's common to feel uncertain about tax implications, particularly regarding withholding allowances. Understanding these aspects can help you optimize your financial situation. Each resource acts as a stepping stone, guiding you through the intricacies of federal allowances, whether for education, disability, or employment-related benefits.

Ultimately, the significance of these federal allowances cannot be overstated. They provide vital support to individuals and families, ensuring access to essential resources during challenging times. By staying informed and utilizing the available tools, you can navigate the complexities of federal assistance more effectively. Engaging with these resources is not just about securing benefits; it's about empowering yourself to thrive in various aspects of life. Remember, we're here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it assist individuals with government benefits?

Turnout is an AI-powered advocacy platform that helps individuals access government benefits by streamlining the application process and providing support through its AI case quarterback, Jake. This technology transforms the often overwhelming experience of navigating government benefits into a more manageable one.

Is Turnout a law firm and does it provide legal advice?

No, Turnout is not a law firm and does not provide legal advice. Instead, it employs trained nonlawyer advocates for Social Security Disability (SSD) claims and works with IRS-licensed enrolled agents for tax debt relief.

What role does the Canada Revenue Agency (CRA) play in federal allowances?

The Canada Revenue Agency (CRA) offers a comprehensive guide to national grants, providing information on eligibility, application processes, and types of federal allowances available to Canadian citizens. This resource can help individuals understand potential benefits they may qualify for.

How does Turnout help with Social Security Disability (SSD) claims?

Turnout assists individuals with SSD claims through dedicated nonlawyer advocates who guide them through the complexities of the application process, ensuring they feel supported throughout their journey.

What are withholding exemptions and why are they important?

Withholding exemptions determine the amount of tax withheld from your paycheck. Understanding and strategically asserting the right number of exemptions can significantly influence your financial outcomes, allowing for increased take-home pay and better financial management.

What should individuals consider when claiming withholding exemptions?

Individuals should consider their financial situation, such as income level and number of dependents. For example, a single individual under age 65 is exempt from withholding if their annual income does not exceed $12,000. Additionally, those with dependent children can multiply their number by the credit amount for added tax benefits.

Why is it important to regularly review and adjust withholding amounts?

Regularly reviewing and adjusting withholding amounts is important to align them with your current financial situation, especially after significant life events. This proactive approach helps avoid unexpected tax charges and enhances overall financial well-being.

How can married couples effectively manage their tax situation?

Married couples with a single income stream can submit a joint return with two exemptions, which can provide a clearer framework for managing their tax situation and potentially optimize their financial outcomes.