Overview

The article titled "Your Step-by-Step Tax Debt Help: Navigate Relief Options Today" aims to provide compassionate guidance for individuals seeking relief from tax debt.

We understand that navigating tax obligations can be overwhelming, and it's essential to assess your financial situation thoughtfully.

Effective communication with tax authorities is key, and exploring various relief options can feel daunting.

This article equips you with the necessary tools and strategies to manage your tax liabilities and find the help you need.

Remember, you're not alone in this journey, and we're here to support you every step of the way.

Introduction

Navigating the complexities of tax debt can feel overwhelming for many individuals and businesses. We understand that the financial landscape is increasingly challenging, and it’s crucial to grasp the implications of unpaid tax obligations. This guide serves as a compassionate roadmap to explore various relief options.

- From negotiating with tax authorities

- To understanding consumer proposals

- And bankruptcy,

we’re here to help you find your way. How can taxpayers effectively manage their obligations and discover the best path forward amidst the looming threat of penalties and financial strain? You are not alone in this journey.

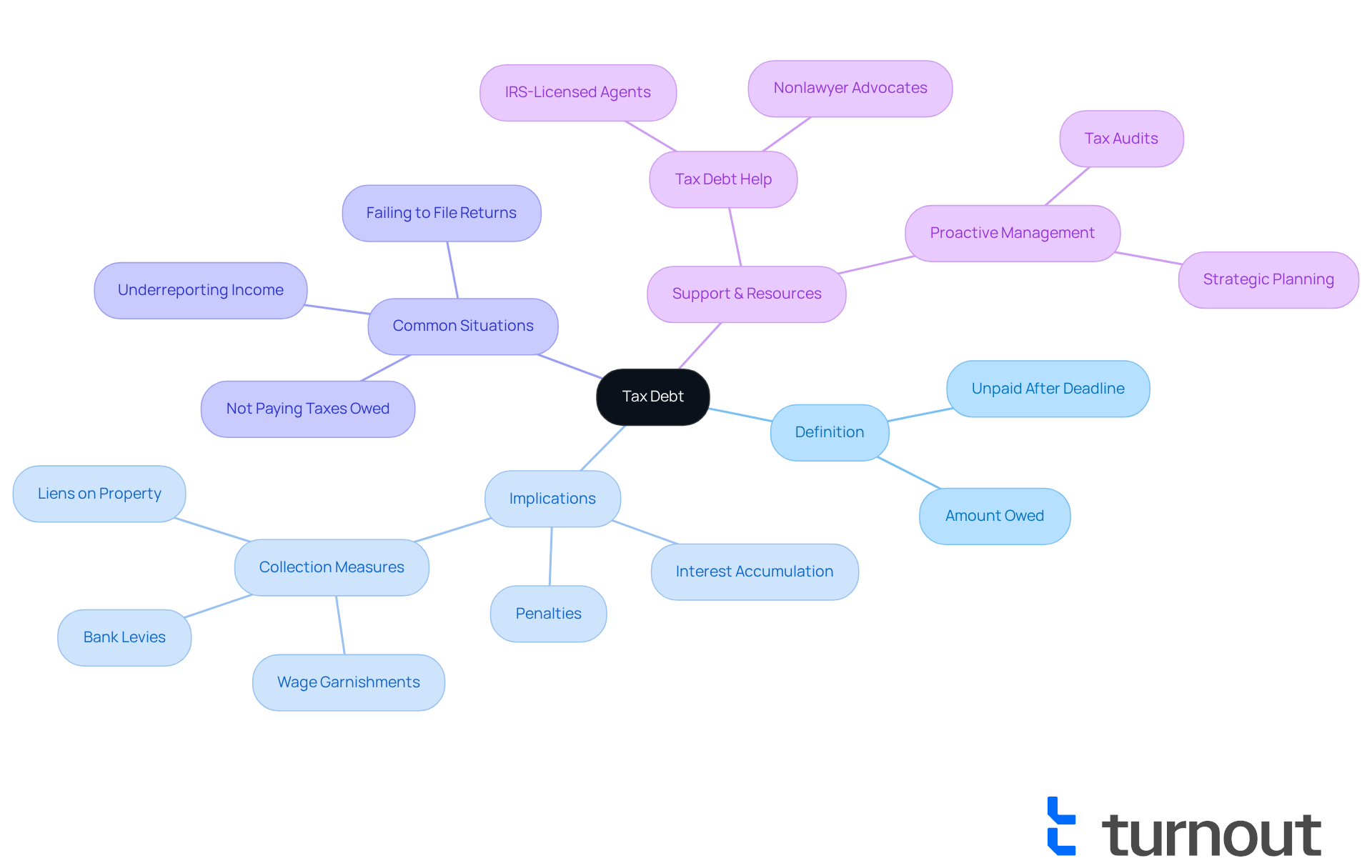

Understand Tax Debt: Definition and Implications

Tax obligation refers to the amount owed to federal, state, or local tax authorities that remains unpaid after the filing deadline. We understand that this can arise from various situations, such as underreporting income, failing to file returns, or not paying taxes owed. Comprehending tax obligations is essential, as it can lead to serious repercussions, including penalties, interest accumulation, and possible collection measures by the IRS. It's common to feel overwhelmed by the thought of wage garnishments, bank levies, or even liens on your property if the obligation remains unresolved.

In 2025, the effect of tax obligations on American households is considerable, with many experiencing financial strain. As Chris Horymski mentioned, consumers in the United States had around $17.57 trillion in total liabilities, which is an increase of 2.4% from 2023. Acknowledging these implications is the first step in successfully managing and resolving tax obligations. For instance, a medium-sized business successfully navigated a tax audit with minimal penalties or liabilities, demonstrating that proactive management can lead to favorable outcomes.

Tax experts highlight the significance of understanding tax responsibilities and exploring available tax debt help measures to mitigate the effects of unpaid tax liabilities. At Turnout, we're here to help. We provide access to tools and services that guide consumers through these complex economic systems, including tax debt help through IRS-licensed enrolled agents. Our trained nonlawyer advocates are here to support you in understanding your options and managing your tax obligations effectively. You are not alone in this journey.

Assess Your Financial Situation and Gather Documentation

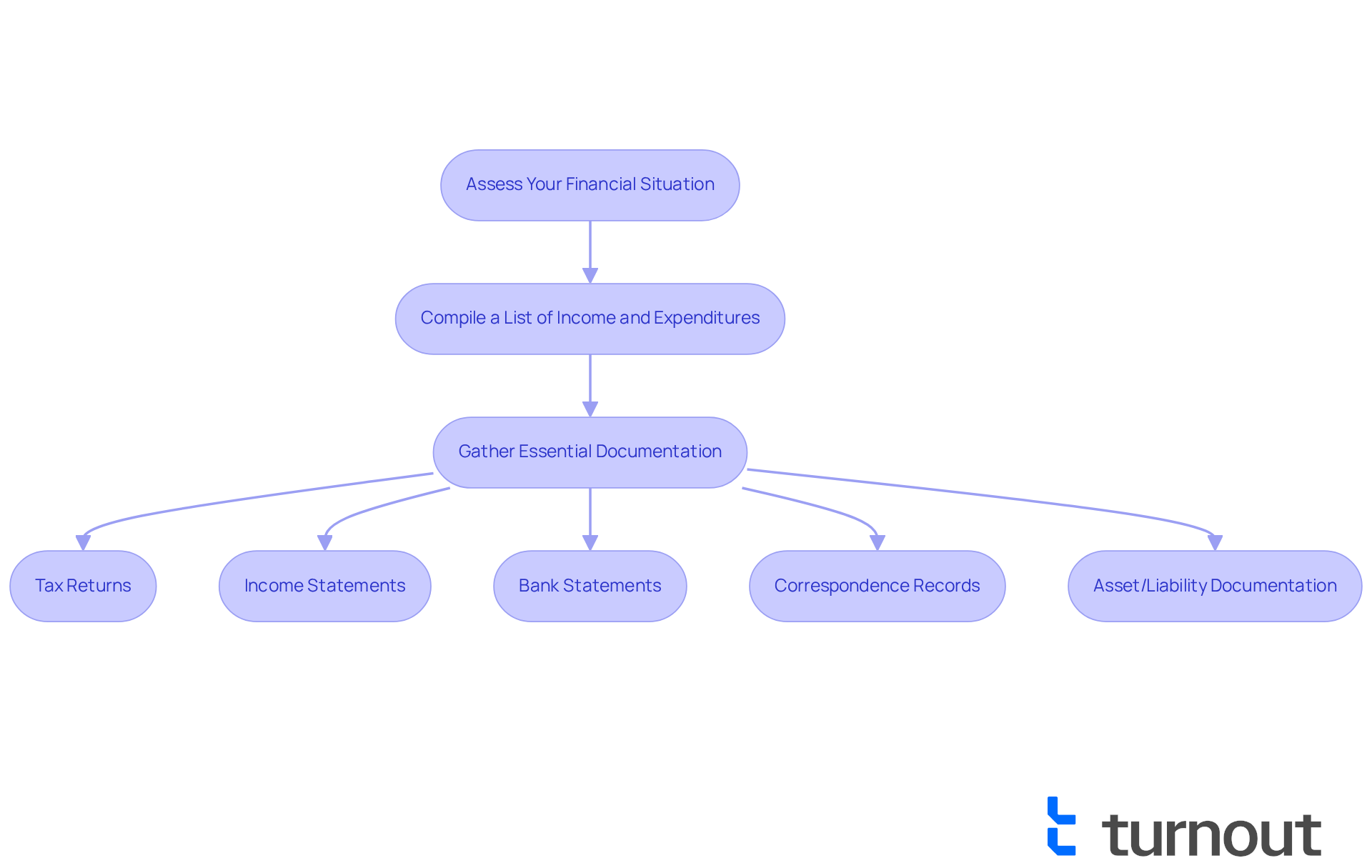

We understand that evaluating your overall financial situation can feel overwhelming. Start by compiling a detailed list of all your income sources, monthly expenditures, and any remaining financial obligations. This evaluation will clarify your ability to manage tax obligations effectively.

Next, gather essential documentation. This includes:

- Recent tax returns

- Pay stubs or income statements

- Bank statements

- Records of any correspondence with tax authorities

- Documentation of any assets or liabilities

Organizing this information not only clarifies your financial standing but also prepares you for discussions with tax authorities or financial advisors. In 2025, the average income for taxpayers with financial obligations is projected to be around $1,165 per week. This may affect your capacity to negotiate tax liabilities effectively.

It's common to feel the pressure of increasing costs due to inflation. In fact, 59% of Americans mention elevated prices for essential items as a major economic stressor. Financial advisors emphasize that having thorough documentation is crucial for obtaining tax debt help and negotiating effectively. As one advisor wisely noted, 'Having a clear understanding of your monetary situation is essential for advocating your case for relief options.'

By being well-prepared, you are taking a significant step toward navigating the complexities of tax negotiations and obtaining tax debt help with greater confidence. Remember, you are not alone in this journey; we're here to help you every step of the way.

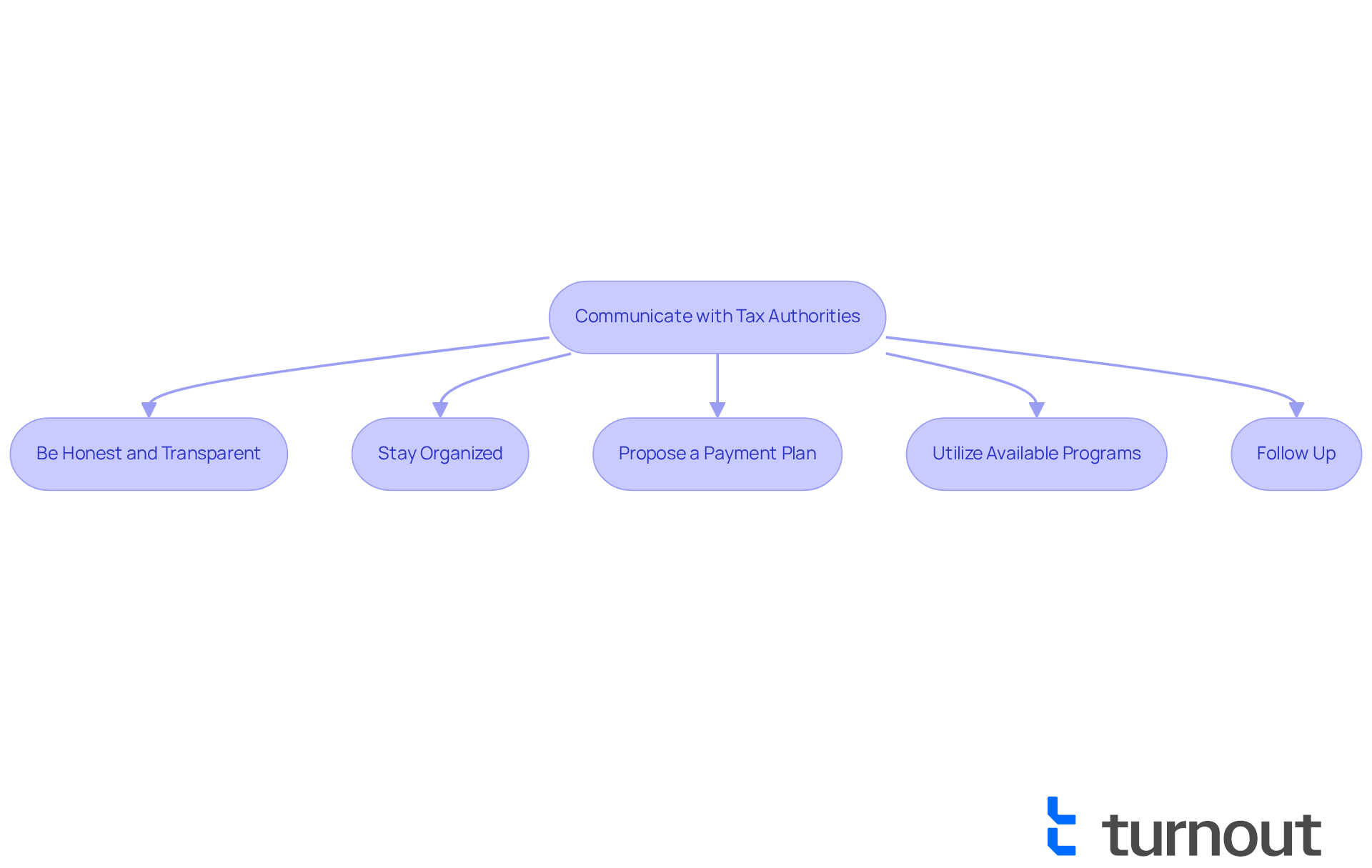

Communicate with Tax Authorities: Strategies for Effective Negotiation

When communicating with tax authorities, it’s essential to approach the situation with clarity and professionalism. We understand that this can be a challenging experience, and we’re here to offer you tax debt help to navigate it. Here are some strategies to enhance your negotiation efforts:

- Be Honest and Transparent: It’s important to clearly explain your monetary situation and why you are unable to pay the total amount due. Sharing your story can foster understanding.

- Stay Organized: Keeping all relevant documentation handy during discussions can support your claims and provide clarity.

- Propose a Payment Plan: If possible, suggest a realistic payment plan that aligns with your financial capabilities. This shows your commitment to resolving the issue.

- Utilize Available Programs: Inquire about programs like the Offer in Compromise or installment agreements that may provide relief. There are options available to provide you with tax debt help.

- Follow Up: After your initial communication, ensure to follow up. This keeps the conversation active and demonstrates your dedication to finding a solution.

By employing these strategies, you can foster a more productive dialogue with tax authorities. Remember, you are not alone in this journey, and taking these steps can lead to a positive outcome.

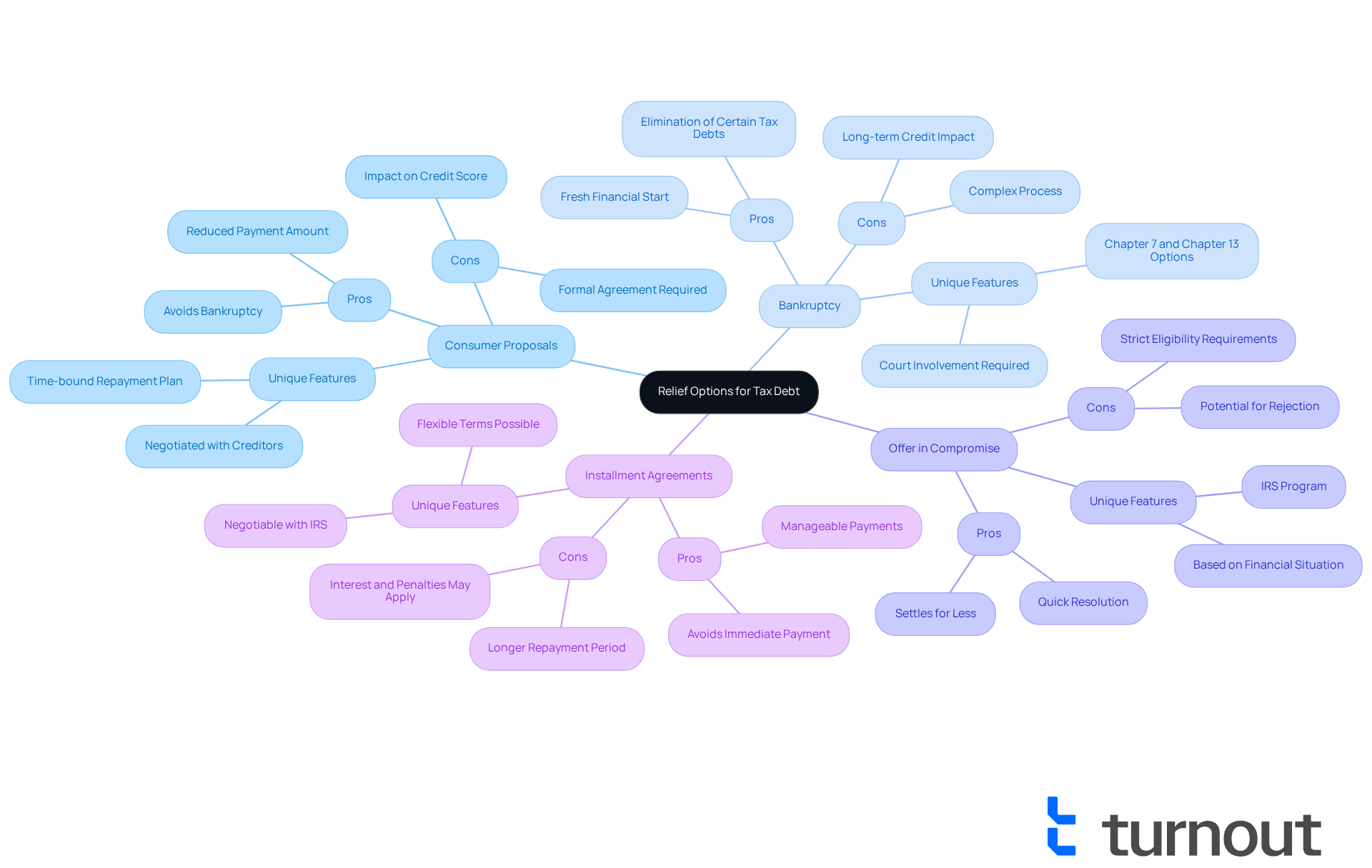

Explore Relief Options: Consumer Proposals and Bankruptcy

Facing overwhelming tax debt can be incredibly stressful, but several relief options may be available to you:

- Consumer Proposals: This formal agreement with creditors allows you to repay a portion of your obligation over time, often at a reduced amount. It can be a feasible choice for managing tax obligations while steering clear of bankruptcy.

- Bankruptcy: While typically seen as a last resort, bankruptcy can eliminate certain tax obligations under specific circumstances. Chapter 7 and Chapter 13 bankruptcy options provide different approaches to managing tax liabilities.

- Offer in Compromise: This program enables you to resolve your tax obligation for less than the total amount due, provided you meet specific eligibility requirements.

- Installment Agreements: You can negotiate a payment plan with the IRS to pay off your debt over time, making it more manageable.

Each option comes with its own pros and cons. It’s crucial to evaluate them carefully. We understand that this can be a daunting process, and seeking tax debt help from a financial advocate can assist you in determining the best path forward. Remember, you are not alone in this journey, and support is available.

Conclusion

Navigating tax debt can feel overwhelming, but understanding your options and strategies is essential for finding relief. This guide has shed light on the various aspects of tax obligations, from their definition and implications to practical steps for assessing your financial situation and communicating effectively with tax authorities. By recognizing the significance of these elements, you can take proactive measures to manage your tax liabilities and seek the assistance you need.

Key insights throughout this article highlight the importance of thorough documentation, strategic negotiation, and exploring relief options like consumer proposals and bankruptcy. These insights empower you to approach your tax debt with clarity and confidence, knowing that there are pathways to resolution available. Remember, the support of trained professionals can further enhance your chances of a favorable outcome, ensuring that you don’t have to face these challenges alone.

Ultimately, the message is clear: taking action is vital in addressing tax debt. By understanding the implications, assessing your financial situation, and utilizing available resources, you can navigate your tax obligations more effectively. The journey toward financial relief begins with informed decisions and proactive steps, reinforcing the idea that tax debt help is not just a possibility but an achievable goal. We’re here to help you every step of the way.

Frequently Asked Questions

What is tax debt?

Tax debt refers to the amount owed to federal, state, or local tax authorities that remains unpaid after the filing deadline.

What are some common reasons for incurring tax debt?

Common reasons for incurring tax debt include underreporting income, failing to file returns, or not paying taxes owed.

What are the potential consequences of unpaid tax obligations?

Unpaid tax obligations can lead to penalties, interest accumulation, and possible collection measures by the IRS, such as wage garnishments, bank levies, or liens on property.

How significant is tax debt for American households in 2025?

In 2025, tax obligations significantly impact American households, contributing to financial strain, with consumers in the United States having around $17.57 trillion in total liabilities.

What steps can individuals take to manage tax obligations effectively?

Understanding tax responsibilities and exploring available tax debt help measures are crucial steps in managing tax obligations effectively.

How can Turnout assist individuals with tax debt?

Turnout provides access to tools and services that guide consumers through complex economic systems, including tax debt help through IRS-licensed enrolled agents and support from trained nonlawyer advocates.