Overview

Navigating the world of benefits can be challenging, especially for those seeking assistance. This article highlights the essential steps that disabled benefit seekers should take regarding the CP565 notice, which verifies their Individual Taxpayer Identification Number (ITIN). Understanding the importance of this document is crucial, as it plays a significant role in both tax purposes and accessing benefits.

Upon receiving the CP565 notice, it’s vital to take specific actions:

- Verify the information contained within the notice.

- Make sure everything is accurate and secure this important document for future reference.

- Remember, your ITIN is not just a number; it’s a key that unlocks opportunities for applications and benefits.

We understand that this process can feel overwhelming. However, by taking these steps, you can navigate the complexities of disability assistance with greater confidence. You are not alone in this journey, and we’re here to help you every step of the way.

Introduction

Navigating the complexities of tax identification can feel overwhelming, especially for individuals seeking disability benefits. We understand that critical documentation, such as the CP565 notice, can add to this stress. This official communication from the IRS not only confirms the allocation of an Individual Taxpayer Identification Number (ITIN) but also acts as an essential tool for accessing vital support services.

You might be wondering: what steps should you take after receiving this notice? How does it impact your pursuit of disability assistance? Understanding these nuances is crucial for ensuring compliance and maximizing the resources available to you.

Remember, you're not alone in this journey, and we're here to help you every step of the way.

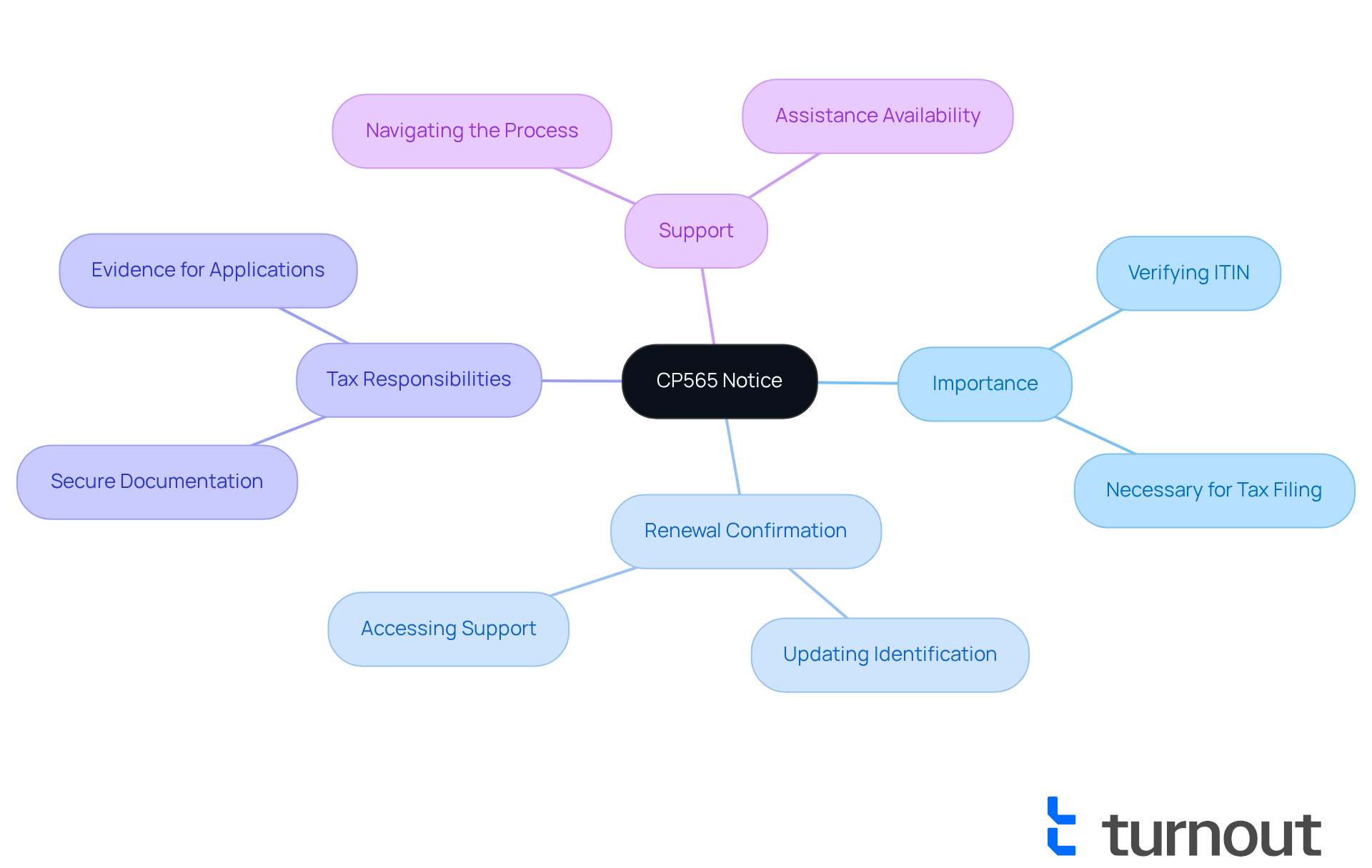

Define the CP565 Notice and Its Importance

This document serves as an official message from the IRS, verifying the allocation of your Individual Taxpayer Identification Number (ITIN). We understand that this announcement holds significant importance, especially for those who may not qualify for a Social Security Number (SSN) yet need to file taxes or seek specific assistance.

For individuals seeking help, obtaining a renewal confirmation is a vital step. It indicates that your identification number has been successfully updated or allocated, which is essential for accessing the support you need and fulfilling your tax responsibilities. Remember, maintaining this document securely is crucial. It acts as evidence of your tax identification number assignment, which may be necessary for various applications and procedures related to disability benefits.

We’re here to help you navigate this process. You are not alone in this journey, and having the right documentation can make a significant difference. If you have any questions or need further assistance, please reach out—we’re committed to supporting you every step of the way.

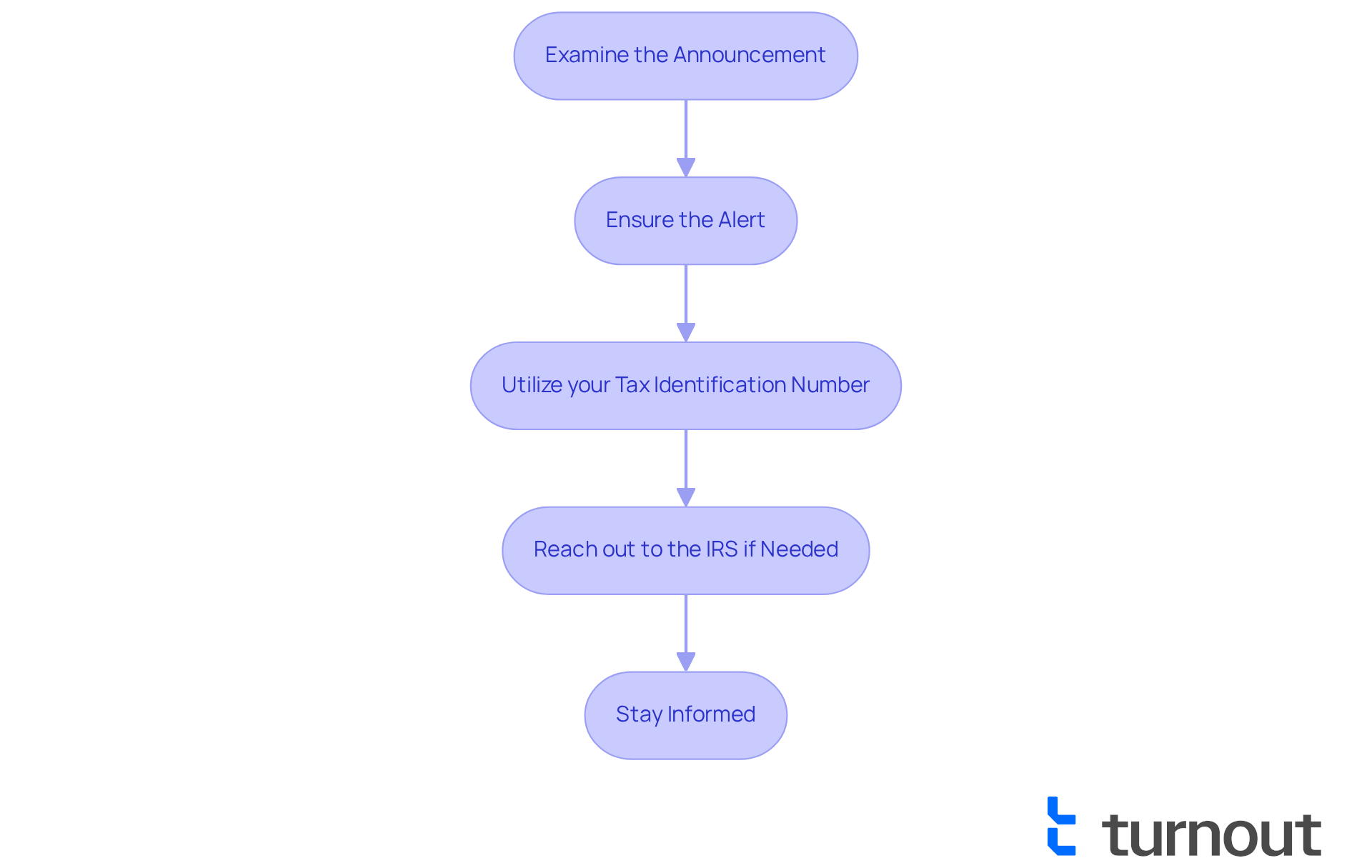

Outline Required Actions After Receiving a CP565 Notice

Receiving a cp565 notice can be overwhelming, but our team is here to help you navigate this process with care. Here are some important steps to follow:

- Examine the Announcement: Take a moment to carefully verify the information on the document. Check your name, ITIN, and any other personal details. Ensuring accuracy now can prevent complications in your future applications.

- Ensure the Alert: It's essential to keep the notice in a secure place along with your other important documents. This announcement may be crucial for your tax submissions or when you're seeking benefits.

- Utilize your tax identification number: When you're ready to submit your federal tax returns or any other necessary paperwork, make sure to use the tax identification number provided in the communication CP565. This step is vital for complying with IRS regulations.

- Reach out to the IRS if Needed: If you notice any inconsistencies in the notice or if you haven’t received your identification number, don’t hesitate to reach out to the IRS at the number listed on the notice. They are there to assist you.

- Stay Informed: Keeping yourself updated on any further communications from the IRS or related agencies regarding your taxpayer identification number or disability benefits is important. This proactive approach will help you respond promptly to any requests for additional information.

Remember, you are not alone in this journey. Turnout is here to support you, ensuring you have the guidance you need without the complexities of legal representation.

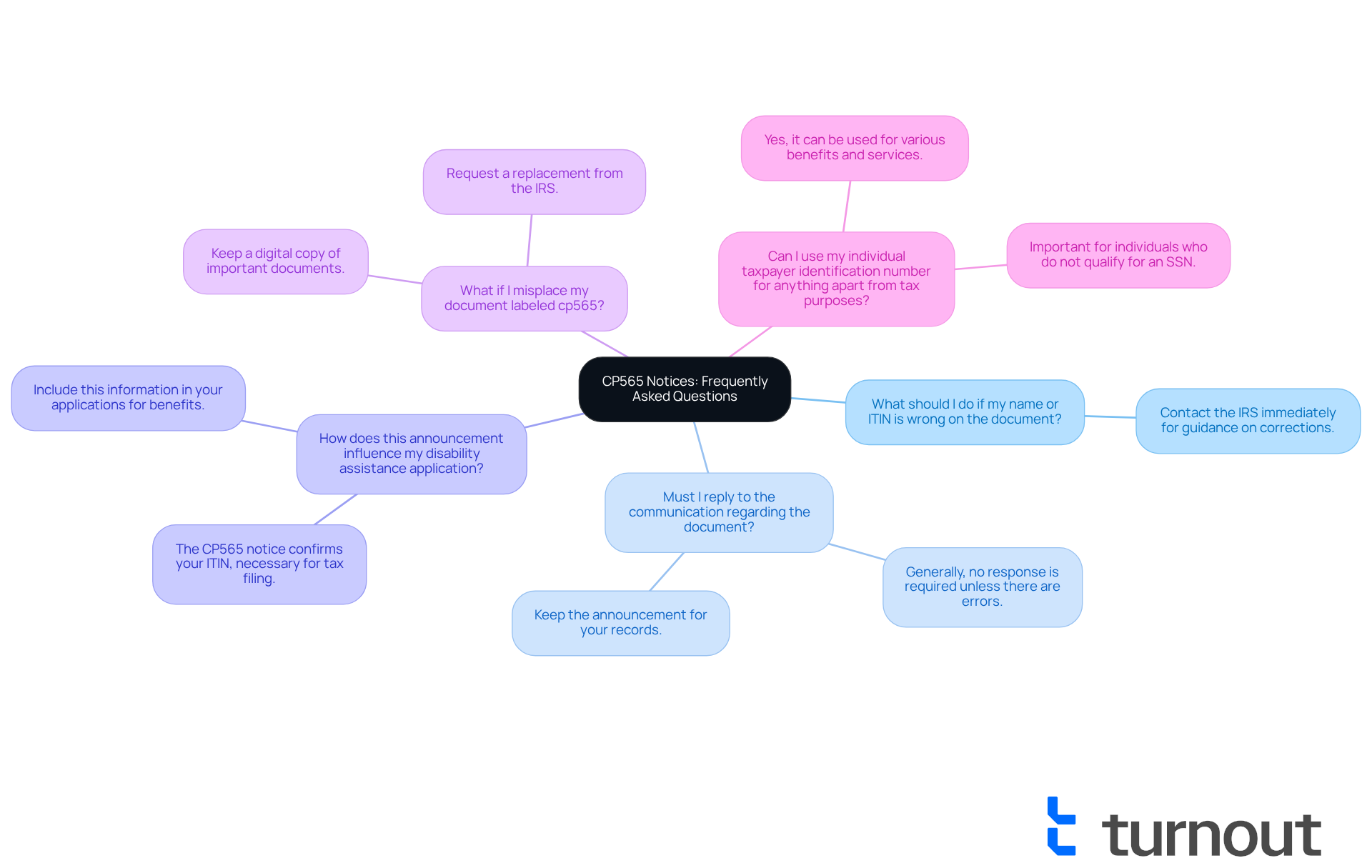

Address Frequently Asked Questions About CP565 Notices

Here are some frequently asked questions regarding the CP565 notice:

- What should I do if my name or ITIN is wrong on the document?

We understand that errors can be concerning. If you notice any mistakes, please contact the IRS immediately using the number provided on the notice. They will guide you on how to correct the information, ensuring everything is in order. - Must I reply to the communication regarding the document?

Generally, no response is required unless there are errors or you need to provide additional information. However, it's important to keep the announcement for your records, as it can be helpful in the future. - How does this announcement influence my disability assistance application?

The CP565 notice confirms your ITIN, which is necessary for filing taxes and may be needed when applying for certain benefits. Make sure to include this information in your applications, as it can make a difference. - What if I misplace my document labeled cp565?

If you lose the notice, don’t worry—you can request a replacement from the IRS. We recommend keeping a digital copy of important documents to avoid such situations in the future, giving you peace of mind. - Can I use my individual taxpayer identification number for anything apart from tax purposes?

Yes, an ITIN can be used for various purposes, including applying for certain benefits and services that require identification. This is especially important for individuals who do not qualify for an SSN. Remember, you are not alone in this journey; we're here to help.

Conclusion

The CP565 notice is more than just a document; it serves as a vital resource for individuals seeking disabled benefits, acting as an official verification of your Individual Taxpayer Identification Number (ITIN). Understanding its significance is essential as you navigate the complexities of tax responsibilities and access critical support services. This document not only confirms your identity but also plays a pivotal role in ensuring you can apply for the benefits you need.

In this article, we've outlined key actions to help you effectively manage your CP565 notice. From verifying the accuracy of the information provided to securely storing the document, each step is designed to empower you as a benefit seeker. We also address frequently asked questions to provide clarity on common concerns, such as what to do in case of errors or how this notice influences your disability assistance applications.

In summary, the importance of the CP565 notice cannot be overstated. It is your gateway to essential services and benefits. By staying informed and proactive, you can navigate this process with confidence. If you ever feel overwhelmed, remember that support is available. Taking these necessary steps can lead to a smoother journey toward securing the assistance you deserve.

Frequently Asked Questions

What is the CP565 Notice?

The CP565 Notice is an official document from the IRS that verifies the allocation of your Individual Taxpayer Identification Number (ITIN).

Why is the CP565 Notice important?

The CP565 Notice is important because it serves as proof of your ITIN, which is essential for individuals who do not qualify for a Social Security Number (SSN) but need to file taxes or seek specific assistance.

What should I do if I need to renew my ITIN?

If you need to renew your ITIN, obtaining a renewal confirmation is a vital step, as it indicates that your identification number has been successfully updated or allocated.

How does the CP565 Notice help with accessing support?

The CP565 Notice is essential for accessing support related to tax responsibilities and may be necessary for various applications and procedures, including those related to disability benefits.

What should I do with my CP565 Notice once I receive it?

It is crucial to maintain the CP565 Notice securely, as it acts as evidence of your tax identification number assignment.