Overview

Navigating the world of Long Term Social Security Disability (SSDI) benefits can be overwhelming. We understand that many individuals face significant challenges when seeking financial support due to disabilities. This article is here to guide you through the essential steps, outlining eligibility requirements, the application process, and how LTD and SSDI benefits interact.

It's crucial to grasp the criteria for qualification. Gathering the necessary documentation can feel daunting, but knowing what to prepare can ease this burden. Additionally, being aware of potential offsets that could affect your total income from these benefits is vital for planning your financial future.

Remember, you are not alone in this journey. We’re here to help you understand these processes and provide the support you need. By taking the time to familiarize yourself with these important aspects, you can better navigate your path toward securing the benefits you deserve.

Introduction

Navigating the complexities of Long Term Social Security Disability benefits can feel like an uphill battle for many individuals facing disabling conditions. We understand that this journey can be overwhelming, especially with approximately 10 million Americans relying on Social Security Disability Insurance (SSDI) for financial support.

It’s crucial to grasp the ins and outs of eligibility, application processes, and the interplay between different disability benefits. As regulations evolve and new updates emerge, you might wonder how to ensure you’re making informed decisions that maximize your support.

This article delves into the essential aspects of SSDI and Long Term Disability, offering valuable insights and practical tips to help you confidently navigate your options. You are not alone in this journey, and we’re here to help.

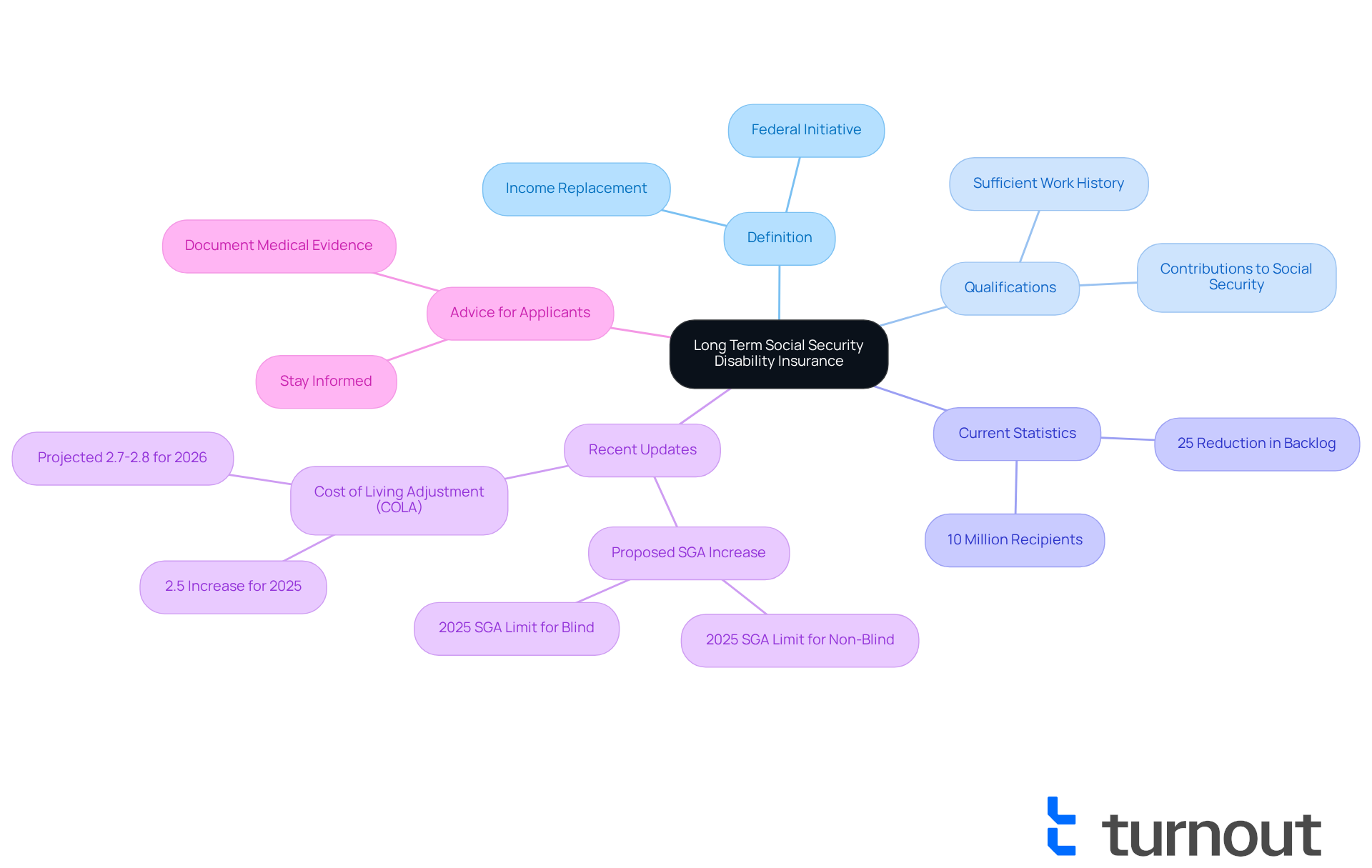

Define Long Term Disability and Social Security Disability Insurance

Long Term refers to insurance coverage that provides income replacement for individuals unable to work due to a disabling condition for an extended period. This insurance is often provided through employers or can be purchased individually. It's important to understand that is a federal initiative designed to assist people with a qualifying disability that prevents them from working. To qualify for , individuals need to have a sufficient work history and have contributed to Social Security through taxes.

As of 2025, around 10 million Americans are receiving SSDI assistance, underscoring the program's vital role in offering during tough times. Recent by about 25%, enabling quicker processing and access to support for those who need it. Additionally, , allowing recipients to earn more income while still receiving support. This change could provide greater flexibility for those considering a return to work.

for individuals navigating the complexities of . We understand that staying informed about these changes can empower you to make better decisions regarding your eligibility and the assistance available to you. Remember, you are not alone in this journey, and we’re here to help you through it.

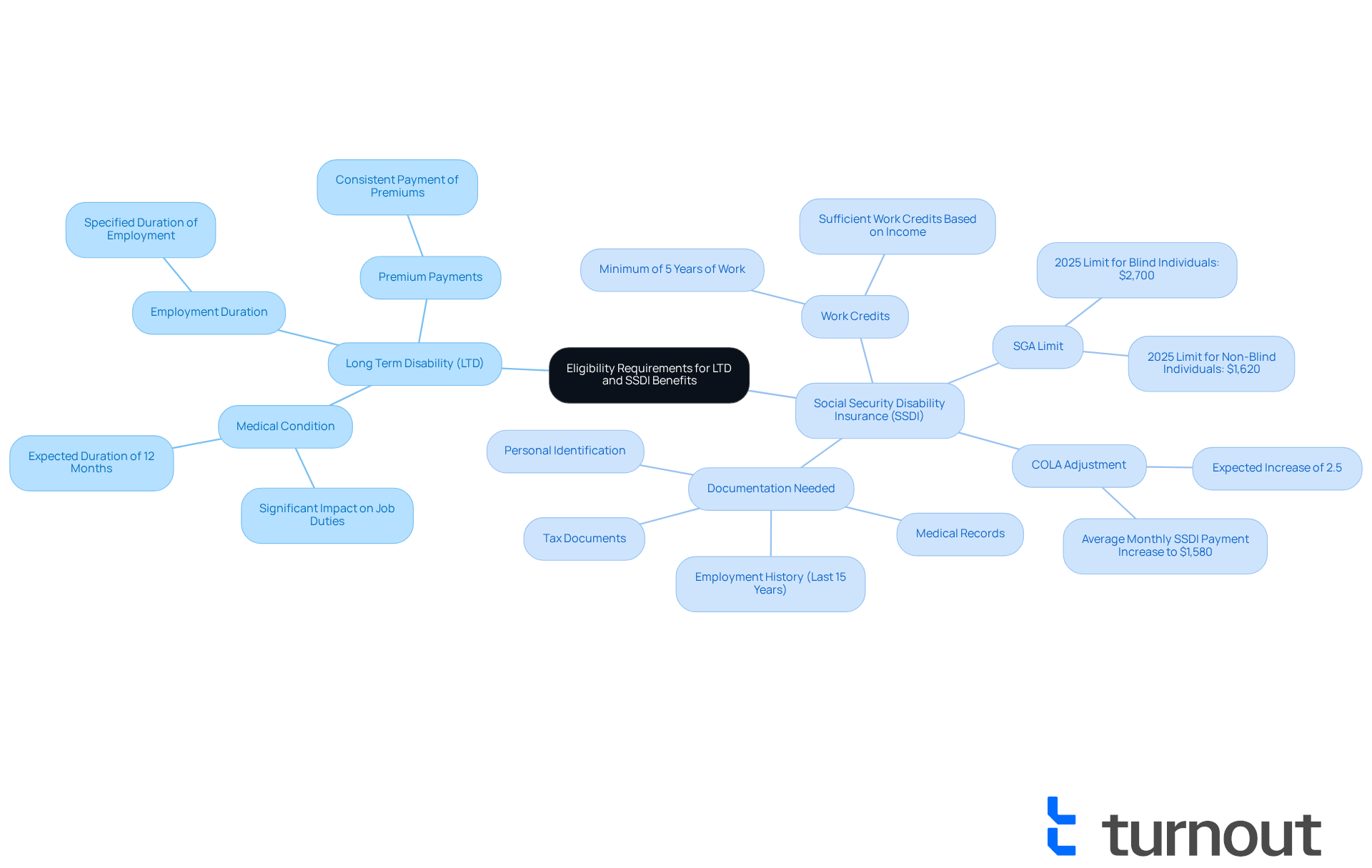

Outline Eligibility Requirements for LTD and SSDI Benefits

To qualify for benefits, individuals often face the challenge of demonstrating a medical condition that significantly impacts their ability to perform job duties. Typically, LTD policies require that applicants have been employed for a specified duration and have consistently paid premiums for coverage. In contrast, eligibility for necessitates that , earning sufficient work credits based on their income. Additionally, to qualify for long term social security disability, the disability must be expected to last a minimum of 12 months or result in death.

As we look ahead to 2025, the for non-blind individuals is set at $1,620 per month. This limit plays a crucial role in determining eligibility for assistance. For those living with disabilities—excluding visual impairments—, as exceeding it may disqualify them from receiving support. Furthermore, the anticipated 2.5% cost-of-living adjustment (COLA) for 2025 is expected to increase the average monthly SSDI payment from $1,542 to approximately $1,580, offering additional financial relief for recipients.

Disability rights advocates emphasize the importance of . We encourage applicants to gather essential materials such as:

- Medical records

- Employment history covering the last 15 years

- Personal identification

This preparation can streamline the application process and enhance the likelihood of success. It's important to remember that and does not provide legal representation. Understanding these requirements is crucial for applicants to ensure they meet the necessary criteria for long term social security disability before applying, ultimately improving their chances of receiving the support they need. You are not alone in this journey; we’re here to help.

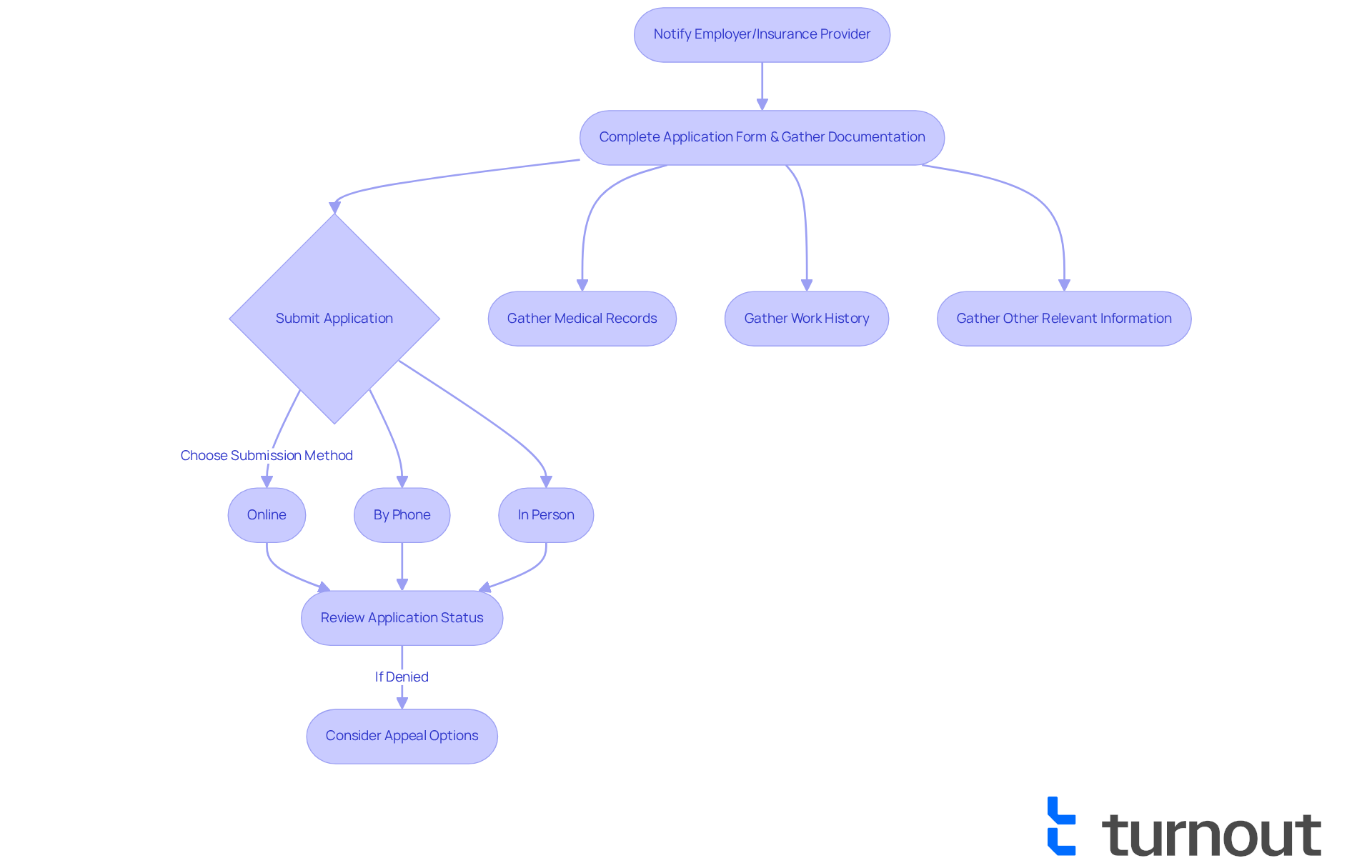

Explain the Application Process for LTD and SSDI

Starting the (LTD) can feel overwhelming, but you are not alone in this journey. It typically begins by notifying your employer or the insurance provider about your condition. Completing an application form and providing medical documentation to support your claim is essential. We understand that following up with your employer is crucial to ensure that all necessary paperwork is submitted promptly.

When it comes to , applicants have options. You can submit your applications:

- Online

- By phone through the SSA’s toll-free number

- In person at a

Gathering extensive documentation, including medical records, work history, and any other relevant information that demonstrates your disability, is vital. The Social Security Administration (SSA) will review your application, which usually takes three to five months. However, it's common for appeals to extend this timeline significantly.

In 2025, the estimated (SGA) limit for non-blind persons is $1,530 monthly, while the limit for blind persons may increase to $2,550 monthly. This allows recipients to work part-time without losing assistance. Additionally, individuals receiving disability support experienced an 8.7% Cost-of-Living Adjustment (COLA) in 2024, the most significant rise in decades. Staying informed about these changes is essential.

can help you prepare adequately and avoid common pitfalls, such as incomplete submissions or insufficient medical evidence. Many individuals face denials due to a lack of documentation or failure to meet the definition of disability. By being thorough and proactive—perhaps by utilizing , which employs to assist with SSD claims—you can improve your chances of a successful outcome.

It's also advisable to review any denial letters carefully. can guide your future applications or appeals. Remember, you're not alone in this process, and with the right support and preparation, you can .

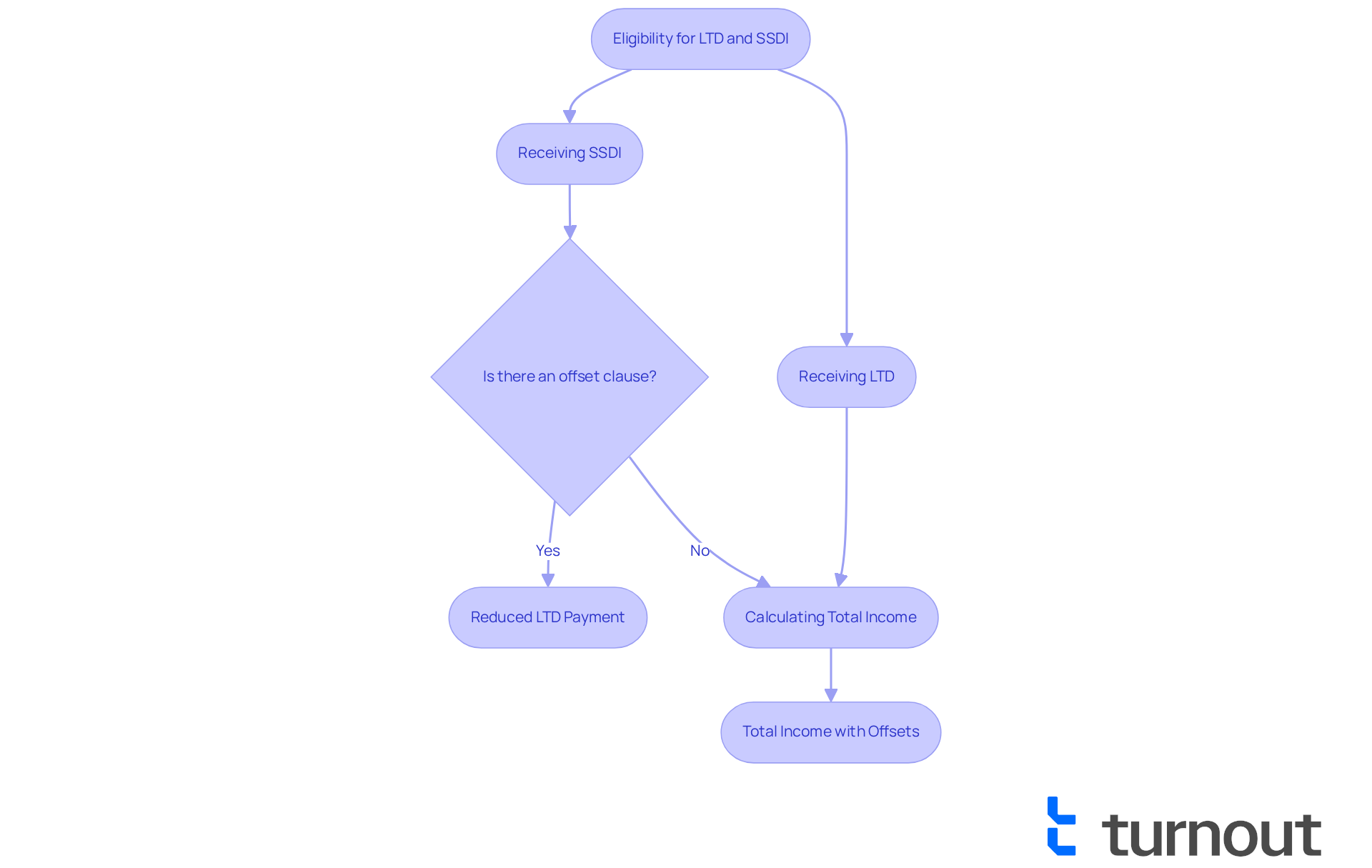

Analyze the Interaction Between LTD and SSDI Benefits

If you find yourself eligible for both (LTD) and , you can indeed receive both forms of assistance simultaneously. However, is crucial for those seeking long term social security disability. Many policies related to long term social security disability come with , which may reduce your LTD payment based on the amount you receive from SSDI. For instance, if you receive $1,000 from SSDI, your long-term disability payments could be decreased by that same amount, depending on your policy's specific terms. This interaction can significantly affect your , so it’s important to carefully review the details of your .

Consider real-life scenarios that illustrate these complexities:

- One individual receiving $1,500 from two LTD policies and $800 from SSDI faced a 'double offset,' resulting in a total of only $2,200 instead of the expected $3,000.

Such situations highlight the importance of seeking guidance from knowledgeable these intricacies effectively.

Financial consultants emphasize that understanding the benefits of long term social security disability is vital for your . They encourage proactive management of claims and a thorough review of policy terms to ensure accurate calculations of offsets. This approach can ultimately help you . Remember, you're not alone in this journey—we're here to help you make sense of it all.

Conclusion

Navigating long-term social security disability benefits can feel overwhelming, but it’s a crucial journey for those unable to work due to disabling conditions. Understanding the complexities of both Long Term Disability (LTD) and Social Security Disability Insurance (SSDI) is vital for securing the financial support you need during these challenging times. By familiarizing yourself with eligibility requirements, application procedures, and how these benefits interact, you can make informed decisions that significantly enhance your chances of receiving assistance.

It’s essential to recognize the importance of thorough documentation when applying for benefits. Understanding eligibility criteria, such as the Substantial Gainful Activity limits, can make a difference in your application’s success. Additionally, being aware of potential offset clauses when receiving both LTD and SSDI is crucial. Staying informed about recent changes—like improvements in claim processing and anticipated cost-of-living adjustments—empowers you to navigate the system more effectively. Remember, seeking guidance from knowledgeable advocates can help streamline your application process and avoid common pitfalls.

You don’t have to face the journey through long-term social security disability benefits alone. By taking proactive steps, gathering the necessary documentation, and seeking expert advice, you can maximize your benefits and achieve greater financial stability. Embracing this support not only enhances the likelihood of successful claims but also fosters a sense of community and reassurance for everyone on this challenging path. You're not alone in this journey; we're here to help you every step of the way.

Frequently Asked Questions

What is Long Term Social Security Disability Insurance?

Long Term Social Security Disability Insurance is a federal initiative that provides income replacement for individuals unable to work due to a qualifying disability for an extended period. It can be offered through employers or purchased individually.

What are the eligibility requirements for Social Security Disability Insurance (SSDI)?

To qualify for SSDI, individuals must have a sufficient work history and have contributed to Social Security through taxes.

How many Americans are currently receiving SSDI assistance?

As of 2025, approximately 10 million Americans are receiving SSDI assistance.

What recent improvements have been made to the SSDI claims process?

The Social Security Administration has improved the backlog for initial claims by about 25%, allowing for quicker processing and access to support for those in need.

What proposed changes for 2025 may affect SSDI recipients?

Proposed changes for 2025 may increase the Substantial Gainful Activity (SGA) thresholds, enabling recipients to earn more income while still receiving support.

Why is it important to stay informed about SSDI changes?

Staying informed about changes in SSDI can empower individuals to make better decisions regarding their eligibility and the assistance available to them, as well as navigate the complexities of disability support.