Overview

The article titled "7 Insights into Social Security Cost of Living History" delves into the historical context and significance of cost-of-living adjustments (COLAs) in Social Security benefits.

We understand that navigating financial concerns can be overwhelming, especially when it comes to ensuring your well-being.

COLAs, introduced in 1975 to combat inflation, have varied over the years, but they play a crucial role in maintaining the purchasing power of beneficiaries.

As living costs continue to rise, significant COLAs in recent years serve as a reminder of the importance of these adjustments amid inflationary pressures.

You're not alone in this journey; we're here to help you understand how these changes impact your financial security.

Introduction

The history of Social Security cost-of-living adjustments (COLAs) reveals a complex interplay between inflation, economic policy, and the financial stability of millions of Americans. We understand that as living costs continue to rise, it becomes essential for beneficiaries to grasp how these adjustments have evolved since their inception in 1975. Many rely on Social Security as a primary income source, and recent surges in COLAs due to inflationary pressures have raised important questions:

- Are these adjustments adequate?

- How do they impact seniors' purchasing power?

It's common to feel uncertain in this shifting landscape. Navigating these changes can be daunting, but you're not alone in this journey. Together, we can explore ways to ensure your financial well-being amidst ongoing economic changes.

Turnout: Streamlining Access to Social Security Benefits

is transforming how individuals access by utilizing technology to simplify the application process. We understand that can be daunting. With the help of AI, Turnout ensures that consumers receive timely updates and support, making the journey less intimidating. Importantly, Turnout provides a , distinguishing between free services and those that incur service fees, separate from any government fees that must be paid prior to submitting paperwork. This contemporary method not only improves efficiency but also enables individuals to manage their advantages, ensuring they obtain essential support without undue delays.

It's common to feel overwhelmed when dealing with government benefits. By utilizing for SSD claims and IRS-licensed enrolled agents for , Turnout simplifies access to government benefits and financial support, all without the need for legal representation. You are not alone in this journey; we’re here to help. You consent to receive all communications electronically, including notices, agreements, and disclosures.

Historical Overview of Social Security Cost-of-Living Adjustments

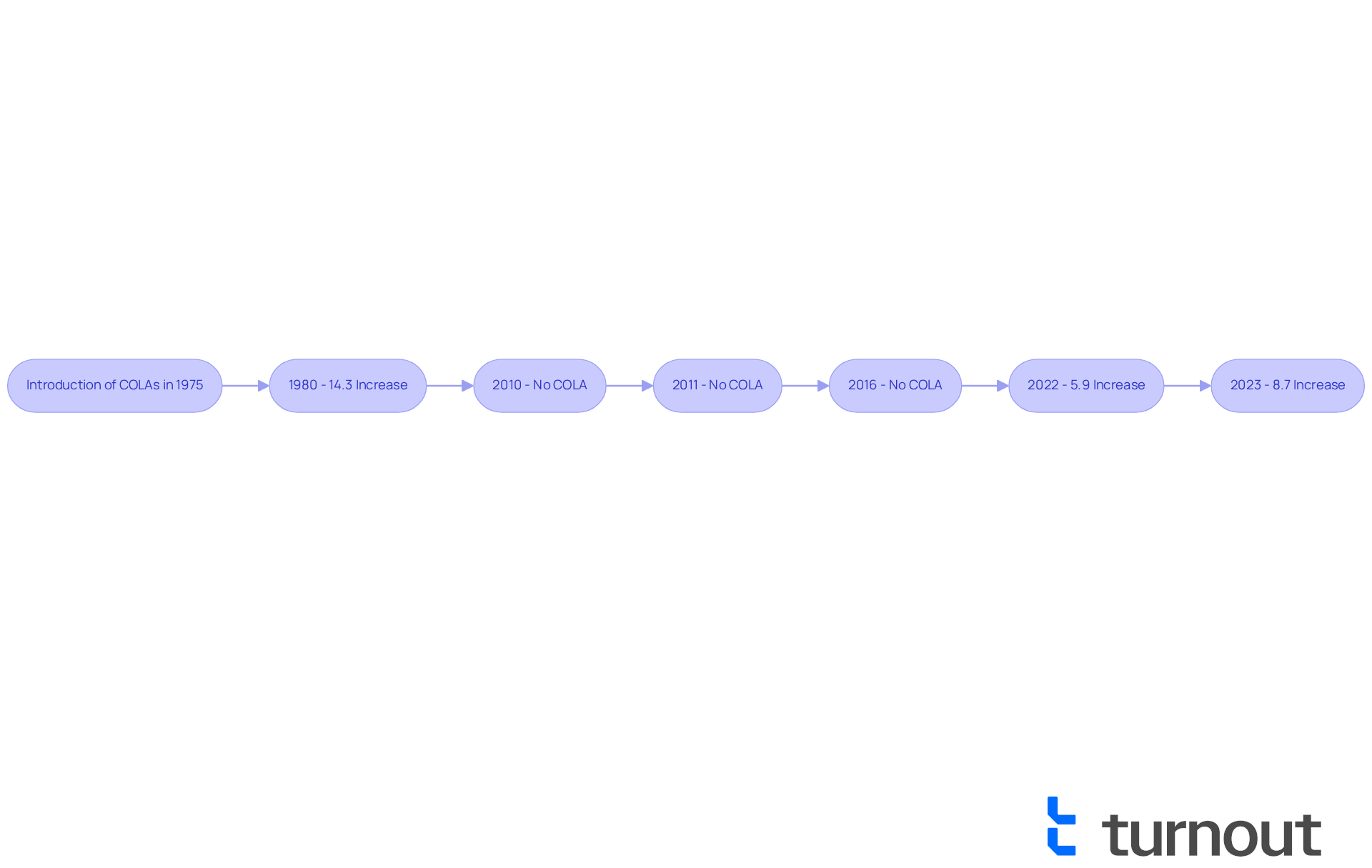

The cost of living history includes the introduction of in 1975 as a response to soaring inflation. These adjustments help beneficiaries preserve their purchasing power amidst rising expenses. Initially linked to the , these adjustments have evolved to better reflect economic realities. The introduction of automatic COLAs marked a significant shift, ensuring that beneficiaries receive annual adjustments without the need for new legislation, a process that was previously cumbersome and inconsistent.

Since 1975, the reveals that cost-of-living adjustments have varied considerably, with . For instance, the most significant COLA occurred in 1980, when payments increased by an extraordinary 14.3%. This adjustment was particularly important as it marked the first automatic COLA introduced after the 1972 amendments. In contrast, the early 21st century saw more modest adjustments, averaging around 2% each year. There were no benefit enhancements in 2010, 2011, and 2016, highlighting the variability of COLAs.

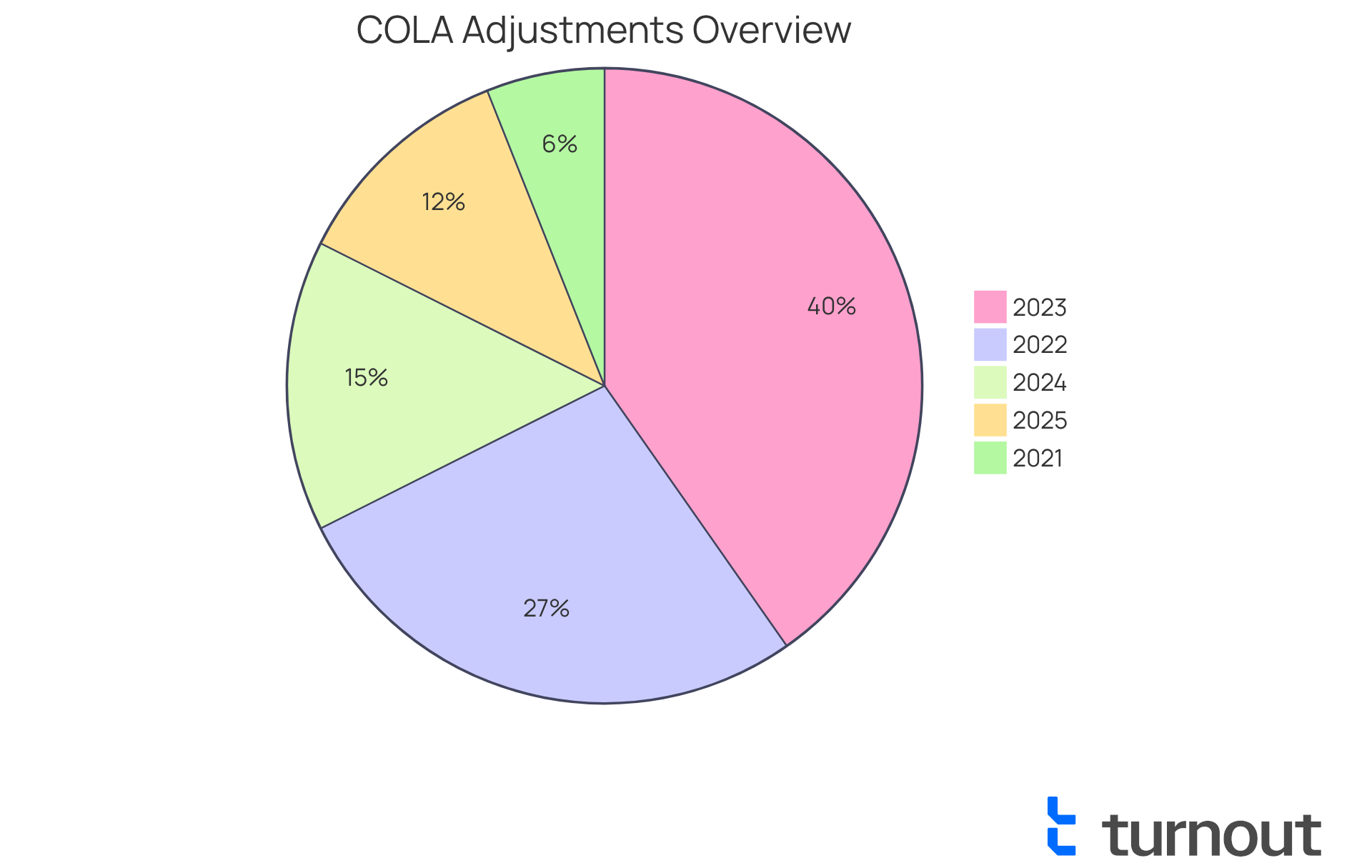

However, recent years have brought substantial increases, with COLAs of 5.9% in 2022 and 8.7% in 2023, driven by rising prices for essential goods and services. We understand that for many, [Social Security](https://myturnout.com/service) represents a significant portion of their income. This is especially true for low-income households, where it constitutes 81% of retirement income. Therefore, tracking cost-of-living adjustments is vital for ensuring . A low COLA can diminish purchasing power, while a higher adjustment can provide .

Experts emphasize the in the context of the social security cost of living history to ensure they accurately reflect the costs faced by seniors. Alternative indices, such as the CPI-E, which considers expenses specific to older adults, are being discussed as potential improvements to the current system. As the economic landscape continues to change, understanding the social security cost of living history and the future of cost-of-living adjustments will be crucial for beneficiaries managing their financial prospects. Remember, you are not alone in this journey, and we are here to help you navigate these changes.

How Social Security COLA is Calculated: Key Methods Explained

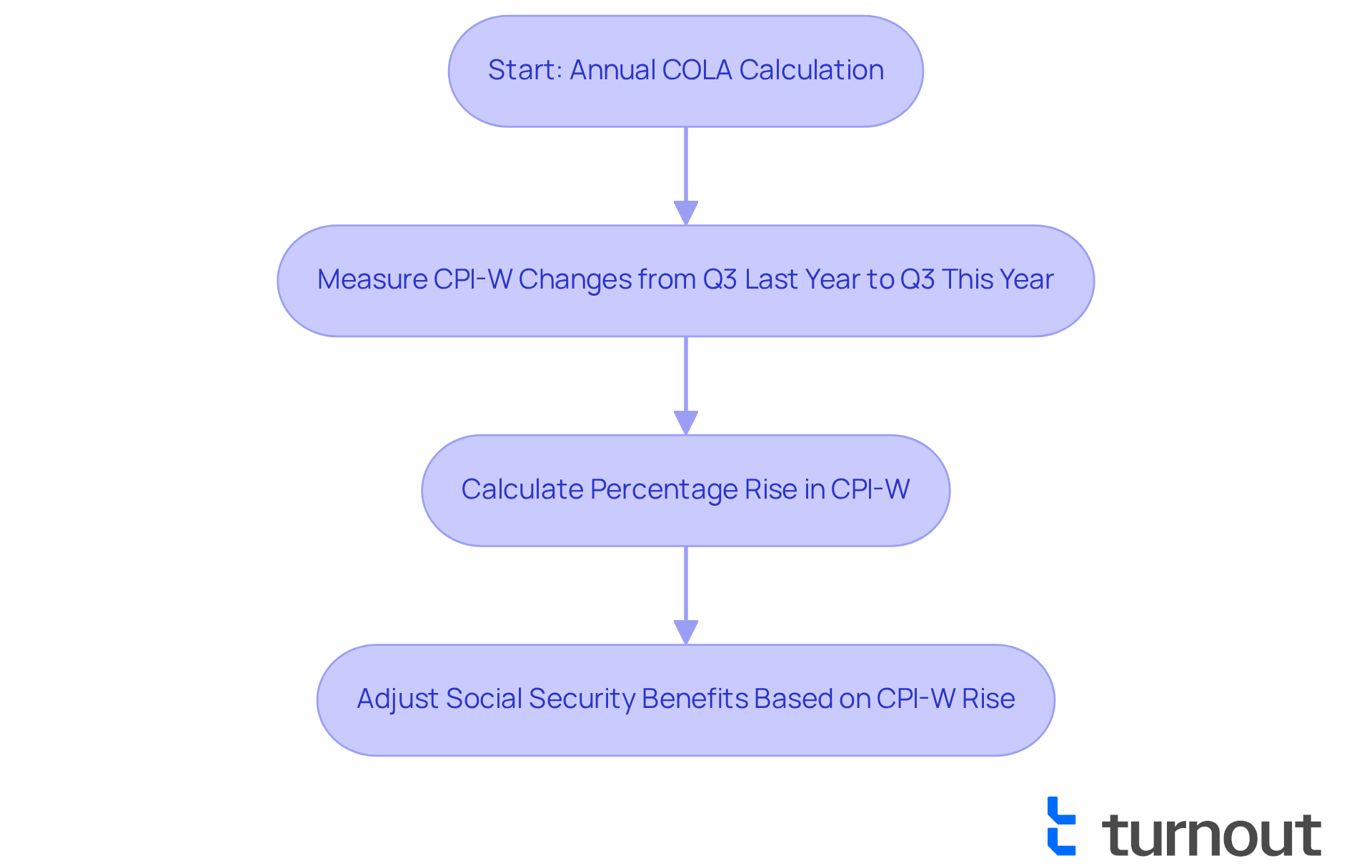

We understand that navigating the complexities of can be challenging, especially in terms of the and the . This adjustment primarily relies on the . This index measures changes in the cost of living by tracking the prices of a basket of goods and services, reflecting the economic realities many of us face.

Each year, based on the percentage rise in the CPI-W from the third quarter of the prior year to the third quarter of the present year. This process ensures that allowances are aligned with current economic circumstances, taking into account the to help alleviate some of the you may experience. We want you to know that these adjustments are designed with your needs in mind, aiming to provide a sense of stability in uncertain times.

You are not alone in this journey; we are here to help you understand how these adjustments work and what they mean for your .

Impact of Inflation on Social Security Benefits and COLA

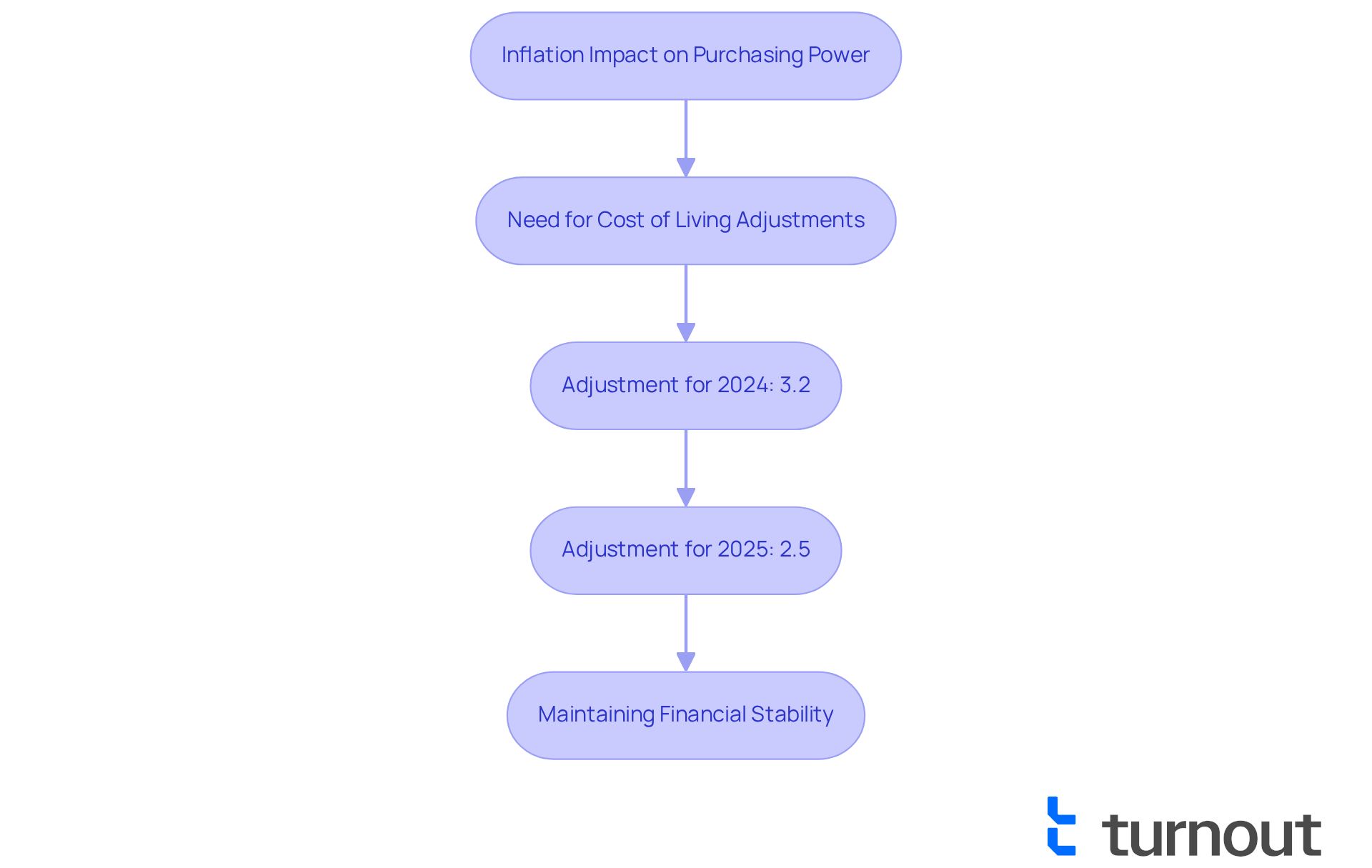

Inflation can significantly impact the purchasing power of your payments. As living expenses rise, the fixed nature of these benefits may lead to a reduction in their actual worth. This makes essential for maintaining your . Without these adjustments, many beneficiaries face increasing challenges in covering essential expenses like housing, food, and healthcare. The aims to counteract this erosion of purchasing power, reflecting changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

In recent years, the has grown. For 2024, the adjustment is set at 3.2%, and for 2025, it is projected to be 2.5%. While these gains may seem modest, they play a vital role in helping you maintain your standard of living amid rising inflation. Financial specialists emphasize that even minor cost-of-living adjustments can have a considerable . For instance, a retiree starting with a $2,000 monthly payment would need about $3,370 by age 84 to maintain the same purchasing power. This highlights the crucial role of cost-of-living adjustments in protecting your financial stability.

Furthermore, the shows their necessity. Initially, adjustments were only made when inflation reached 3% or more. However, this threshold was eliminated in 1986, allowing for more responsive adjustments whenever inflation exceeds 0%. This change has broadened the scope for benefit increases, ensuring that Social Security recipients are better protected against the .

The ongoing discussion about inflation and the social security cost of living history underscores the importance of prompt and precise calculations. As inflation continues to impact the cost of living, the need for effective cost-of-living adjustment mechanisms becomes clearer. We want to ensure that you can afford essential items and maintain your quality of life. Remember, you are not alone in this journey, and we’re here to help navigate these challenges together.

CPI Controversies: CPI-W vs. Chained CPI vs. CPI-E in COLA Calculations

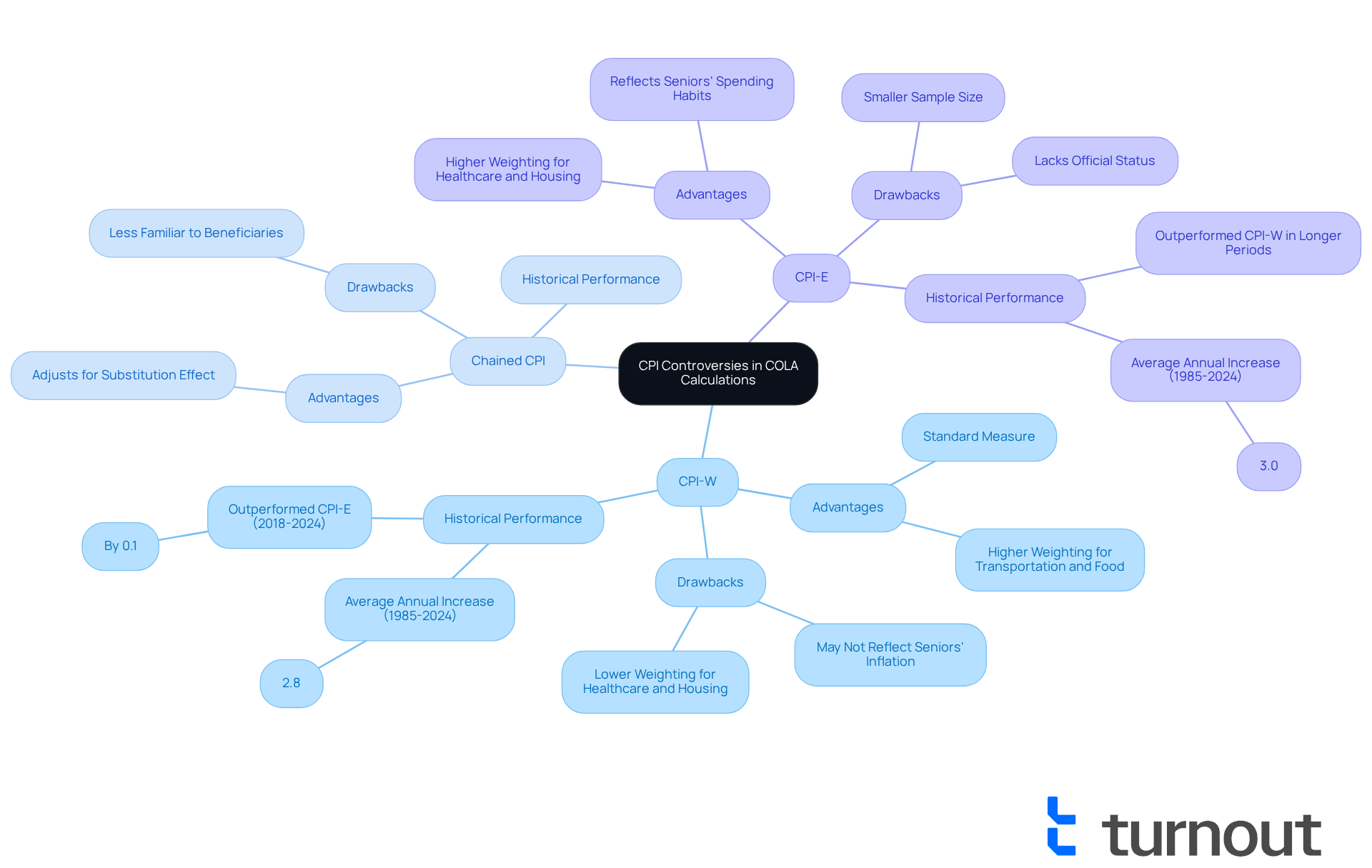

The ongoing discussion about the most suitable (CPI) for determining the is crucial for beneficiaries like you. We understand that navigating these complexities can be challenging. Traditionally, the CPI-W has been the standard measure, but alternatives such as the and CPI-E, which specifically targets the elderly, have emerged as contenders. Each index presents unique advantages and drawbacks, influencing the social security cost of living history and the COLA amounts that beneficiaries receive.

For instance, while CPI-E during certain periods—such as from 2018 to 2024— of 3.0% from 1985 to 2024, compared to CPI-W's 2.8%. This distinction highlights that the social security cost of living history generally reflects a higher inflation rate due to its greater emphasis on healthcare and housing costs, which are significant for older adults. It’s common to feel uncertain about which index best represents your needs.

Additionally, CPI-E presently lacks official recognition or application for modifying Social Security payments, raising concerns about its reliability. If officially adopted, CPI-E could provide a closer match to retirees' actual expenses. However, its smaller sample size leads to a higher likelihood of sampling error, complicating its use as a reliable measure. This distinction is vital for you, as it affects how well your benefits reflect your living expenses.

The choice of index can lead to substantial differences in the , influenced by the social security cost of living history. It's essential to understand these nuances to advocate effectively for your needs. Staying informed about CPI changes and their potential impact on your benefits is crucial. Remember, ; we’re here to help you .

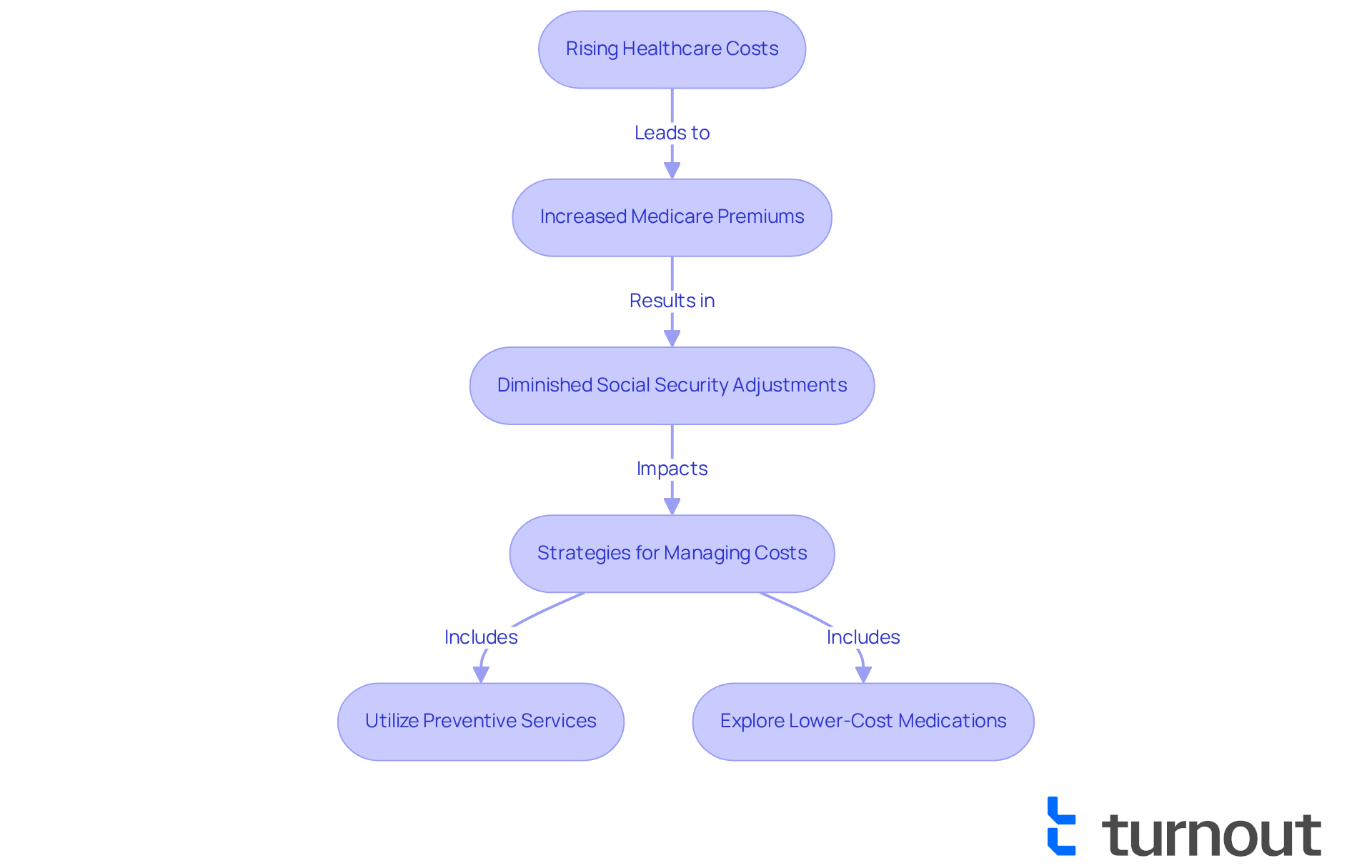

Medicare's Influence on Social Security Cost-of-Living Adjustments

Medicare expenses significantly influence the adjustments related to the . We understand that as healthcare costs continue to rise, many beneficiaries find their adjustments diminished by increased premiums and out-of-pocket expenses. For instance, while the 2026 , based on inflation figures from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), substantially from $185 in 2025 to $206.50 in 2026. This rise could lead to a net gain of just over $30 for retirees after accounting for the premium hike, potentially offsetting any financial benefit from the COLA.

It's common to feel overwhelmed by the interplay of healthcare costs and the [social security cost of living history](https://imercer.com/articleinsights/hot-off-the-presses-social-security-and-medicare-updates). This trend underscores the importance of . Financial planners emphasize that beneficiaries should in light of the social security cost of living history and these adjustments. Some have successfully navigated rising healthcare expenses by utilizing preventive services and exploring lower-cost medication options. These strategies can help maximize available income.

Staying informed about these trends and regularly reviewing Medicare and Social Security updates is essential. By doing so, beneficiaries can effectively manage their finances and ensure they can cover both living costs and healthcare needs. Remember, you are not alone in this journey, and we’re here to help you .

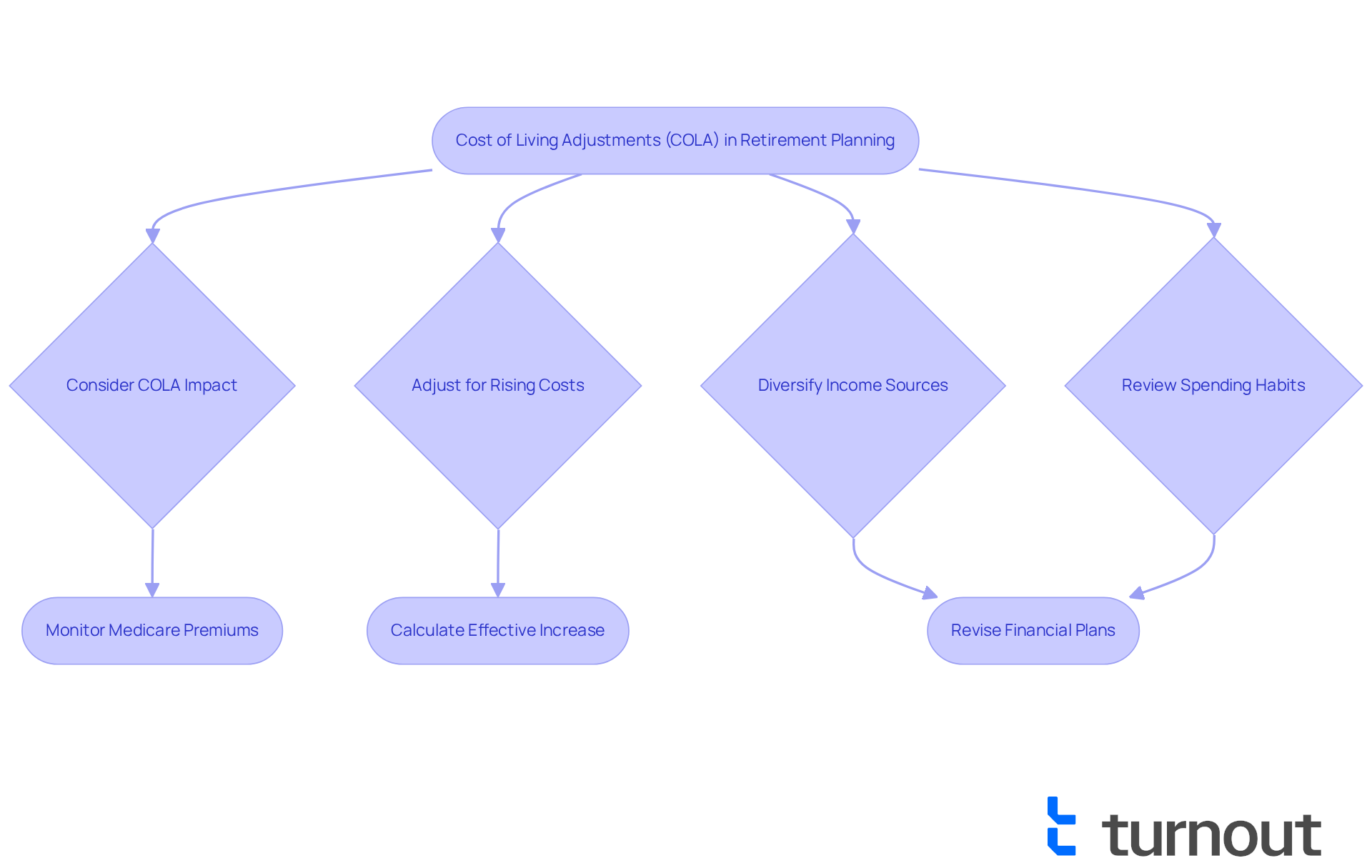

The Role of COLA in Retirement Planning Strategies

Incorporating Cost of Living Adjustments into is crucial for ensuring long-term . We understand that beneficiaries must consider how these adjustments will influence their income over time, especially with . For instance, the anticipated adjustment of 2.7% for 2026 translates to an extra $54.18 monthly, or $650.16 annually, based on the average payment of $2,006.69. However, this rise may be offset by increasing Medicare premiums, expected to rise by $21.50, which could consume nearly 40% of the cost-of-living adjustment, reducing the effective increase to $32.68. This situation highlights the necessity for retirees to thoughtfully consider potential when developing their .

Financial advisors emphasize that understanding cost-of-living adjustments is vital for preserving during retirement. It's common to feel uncertain as inflation continues to erode the value of fixed incomes. Therefore, retirees should develop robust plans that account for these adjustments. Strategies might involve:

- Diversifying income sources

- Adjusting spending habits to align with expected cost-of-living changes

Additionally, the social security cost of living history indicates that have lost approximately 40% of their purchasing power since 2000 due to inadequate cost-of-living adjustments. While COLAs increased benefits by 64% from 2000 to 2022, the costs of goods and services surged by 130% during the same period. This underscores the importance of regularly reviewing and adjusting retirement plans to ensure they remain effective amidst . As Shannon Benton, Executive Director of The Senior Citizens League, observes, many older adults feel that the cost-of-living adjustment does not adequately reflect their inflation experiences. By proactively considering cost-of-living adjustments in their retirement strategies, individuals can better safeguard their financial futures and enhance their overall stability in retirement.

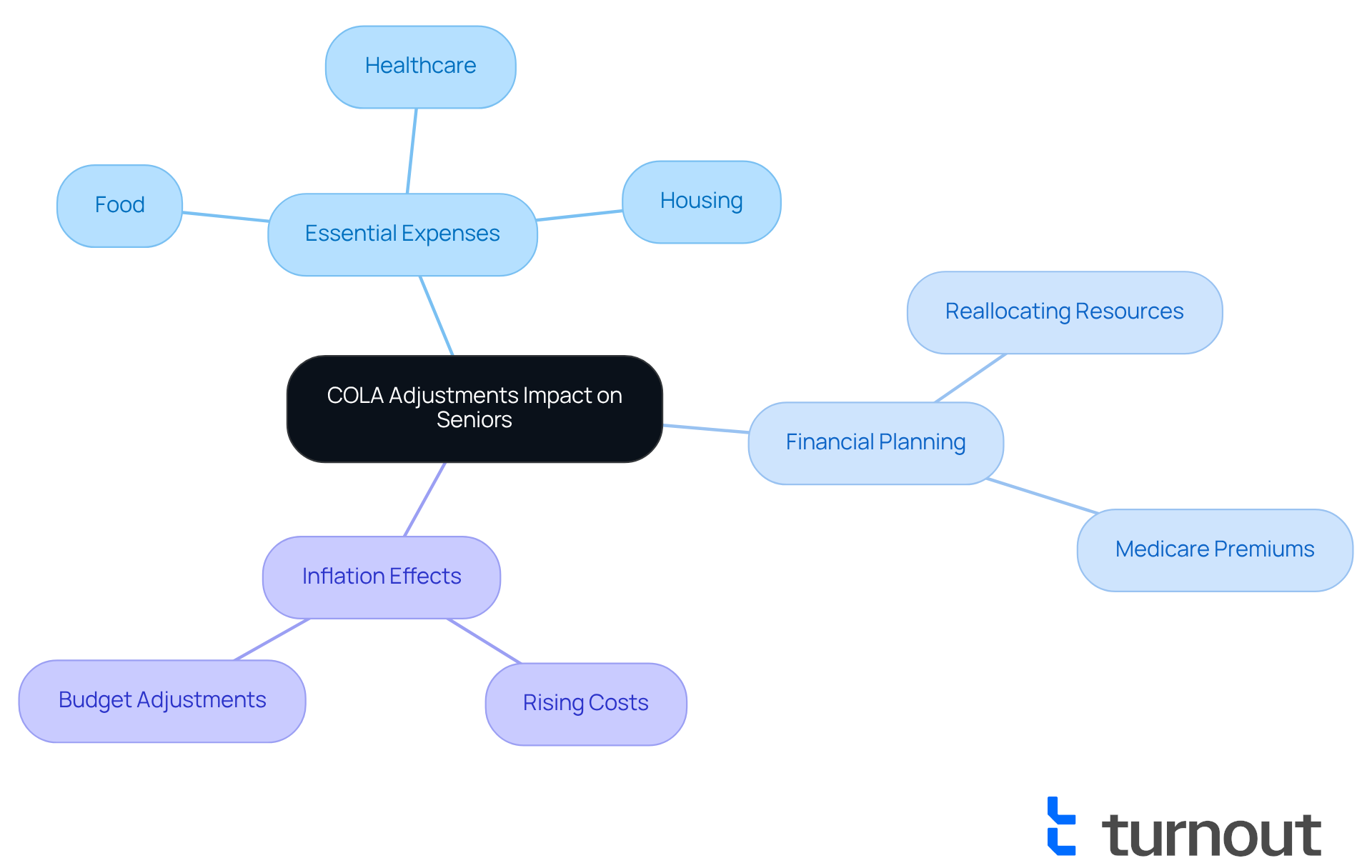

How COLA Adjustments Affect Senior Purchases and Living Costs

are vital for preserving the within the framework of , especially as the costs of essential items and services continue to rise. In 2025, the is set at 2.5%. This adjustment aims to alleviate inflation and ensure that Social Welfare benefits remain relevant amidst escalating expenses, taking into account the social security cost of living history. For seniors managing tight budgets, this adjustment is crucial, as it directly impacts their ability to afford necessities like food, housing, and healthcare.

Consumer advocates emphasize the for seniors. Jimmy Merdian, a Certified Financial Planner, shares, "Without these adjustments, many seniors would struggle to meet their basic needs, especially as healthcare costs continue to rise." This highlights the in easing financial strain for seniors who often rely heavily on the social security cost of living history for their income.

Many older adults have reported reallocating resources to cope with rising costs in areas such as food and healthcare due to changes in cost-of-living allowances. For instance, one senior mentioned needing to adjust their monthly budget to account for increasing food prices, illustrating the direct effect of these adjustments on their everyday lives. As living expenses continue to fluctuate, is crucial for seniors to make informed financial decisions and maintain their quality of life.

While the 2.5% cost-of-living adjustment increase is beneficial, it’s important to recognize that it may be offset by . This can complicate . Understanding this dynamic is essential for effective budget management. Remember, you are not alone in this journey—staying updated and proactive can make a significant difference.

Future Trends in Social Security COLA Adjustments

As economic circumstances change, we understand that many may feel uncertain about the future of the . It's common to wonder how these adjustments will impact your financial well-being. Future adjustments are anticipated to increasingly reflect the specific costs faced by seniors, particularly in crucial areas like , which often weigh heavily on older Americans.

This change could lead to more . The social security cost of living history over the last two decades shows that the has been approximately 2.6%, indicating a return to normal levels in 2025. Staying informed about these trends is essential, as it allows you to anticipate how your benefits might shift in response to .

Looking ahead, the is 2.5%, influenced by several economic factors. This adjustment might result in an increase of about $40 to $50 monthly for the typical retired employee. By understanding these dynamics, you can make informed choices about your .

As a rise in Social Security payments may also affect other supports, like or Medicaid, it’s important to consider how these changes might impact your overall assistance. Remember, you're not alone in this journey; we’re here to help you navigate these changes.

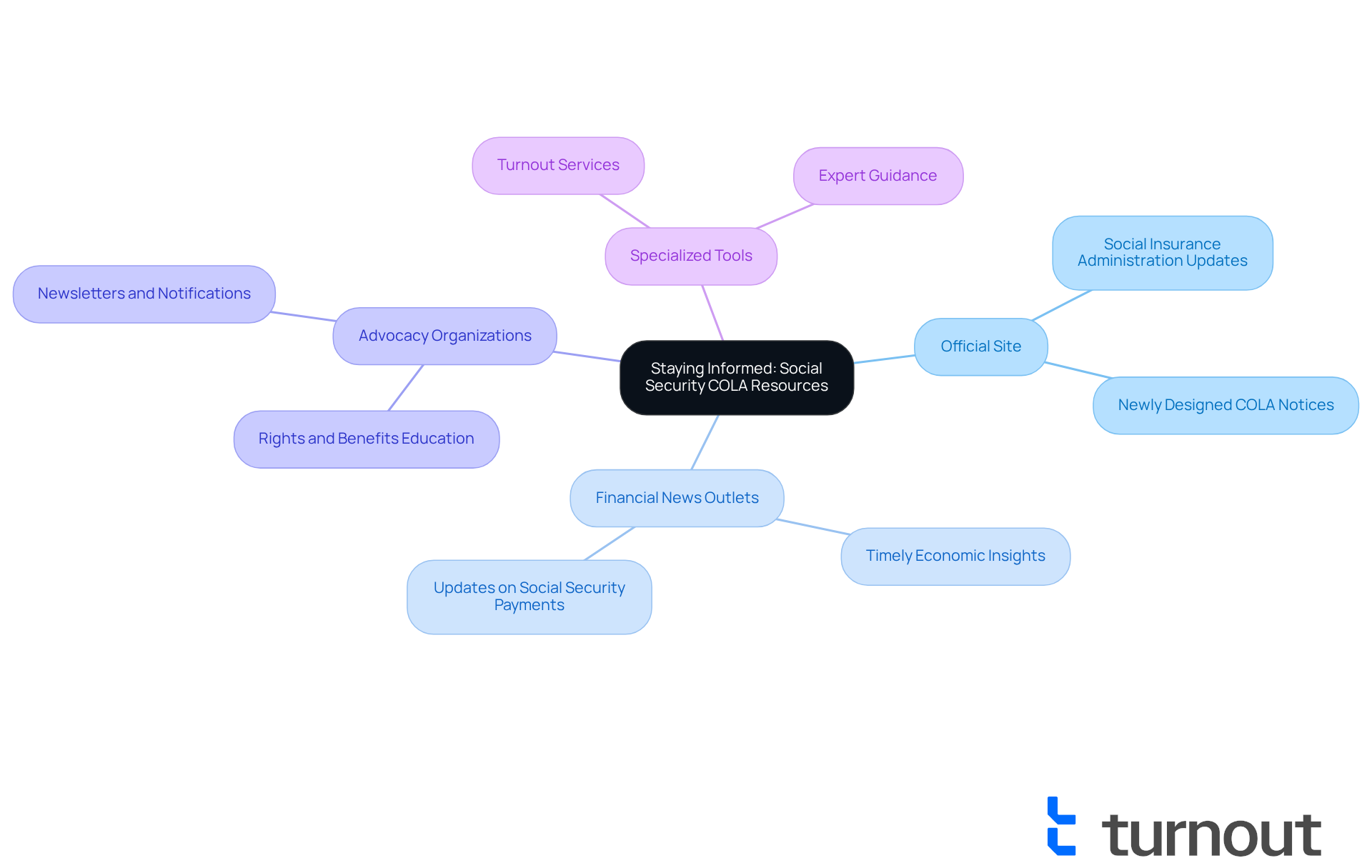

Staying Informed: Resources for Understanding Social Security COLA Changes

We understand that navigating Social Assistance can be challenging. Beneficiaries can . The Social Insurance Administration's official site is a key source for updates, offering and modifications. It's common to feel overwhelmed, but provide timely insights into broader economic factors that may impact payments.

play an essential role in helping you understand your rights and advantages. They often offer newsletters and notifications about . Engaging with these resources empowers you to proactively manage your benefits and advocate for your needs, ensuring you are prepared for any adjustments that may arise.

and services designed to simplify the navigation of these complex systems. With , you can feel more confident in managing your resources. Statistics indicate that a significant portion of beneficiaries actively seek information about their Social Security resources. Remember, staying informed is crucial in this ever-evolving landscape. You are not alone in this journey; we’re here to help.

Conclusion

Understanding the historical context and future trends of Social Security Cost-of-Living Adjustments (COLA) is essential for beneficiaries who rely on these payments to maintain their financial stability. We recognize that navigating these complexities can be overwhelming, but knowledge is power. Since its introduction in 1975, COLA has evolved significantly, playing a crucial role in preserving the purchasing power of seniors amid fluctuating inflation rates and rising living costs. Innovative solutions like Turnout can help individuals access Social Security benefits more easily, ensuring they receive the support they need.

Key insights reveal the significant impact of inflation on Social Security benefits. It's common to feel confused by the controversies surrounding the different Consumer Price Indices used for calculations and the influence of rising Medicare costs on net benefits. Historical data shows that while COLAs have varied, recent increases have been vital for many, particularly those in low-income households where Social Security constitutes a substantial portion of retirement income. Understanding these nuances is crucial for effective retirement planning, empowering beneficiaries to adapt their financial strategies in response to economic changes.

As the landscape of Social Security continues to evolve, staying informed about COLA adjustments and their implications is paramount. We encourage beneficiaries to utilize available resources and advocacy organizations to navigate these changes with confidence. By keeping abreast of updates and actively managing their financial planning, seniors can better secure their financial futures and maintain their quality of life. Remember, you are not alone in this journey; proactive engagement in understanding and advocating for your benefits can significantly impact your financial well-being in retirement.

Frequently Asked Questions

What is Turnout and how does it help individuals access Social Security benefits?

Turnout is a platform that utilizes technology to simplify the application process for Social Security benefits. It provides timely updates and support, making the navigation of these systems less intimidating for individuals.

What kind of support does Turnout offer to users?

Turnout offers assistance through trained nonlawyer advocates for Social Security Disability (SSD) claims and IRS-licensed enrolled agents for tax debt relief, allowing individuals to access government benefits and financial support without the need for legal representation.

How does Turnout structure its fees?

Turnout has a clear fee structure that distinguishes between free services and those that incur service fees, which are separate from any government fees that must be paid before submitting paperwork.

What historical changes have occurred regarding Social Security cost-of-living adjustments (COLAs)?

Cost-of-living adjustments (COLAs) were introduced in 1975 in response to inflation, initially linked to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Automatic COLAs were introduced to ensure beneficiaries receive annual adjustments without new legislation.

How have COLAs varied over the years?

Since 1975, COLAs have varied significantly, with notable increases during high inflation periods, such as a 14.3% increase in 1980. More modest adjustments averaging around 2% occurred in the early 21st century, with no enhancements in 2010, 2011, and 2016. Recent years have seen substantial increases, with COLAs of 5.9% in 2022 and 8.7% in 2023.

Why are COLAs important for Social Security beneficiaries?

COLAs are crucial for maintaining the purchasing power of beneficiaries, especially for low-income households where Social Security constitutes a significant portion of their income. A low COLA can diminish purchasing power, while a higher adjustment can provide essential financial relief.

How is the Social Security COLA calculated?

The Social Security COLA is primarily based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in living costs. Adjustments are made annually based on the percentage rise in the CPI-W from the third quarter of the previous year to the third quarter of the current year.