Overview

This article addresses the essential tax payment plans that can truly help individuals manage their debt with care and understanding. We recognize that navigating tax obligations can be overwhelming, and we want you to know that you're not alone in this journey. By exploring various strategies—such as automated services, personalized financial counseling, and flexible payment arrangements—we aim to alleviate the stress associated with tax obligations and encourage your financial recovery.

It's common to feel anxious about managing debt, but there are supportive solutions available:

- Automated services can simplify your payments.

- Personalized financial counseling offers tailored guidance to meet your unique needs.

- Flexible payment arrangements can provide the breathing room necessary to regain control over your finances.

Remember, the goal is to promote your peace of mind and empower you on your path to financial health. We’re here to help you find the right plan that fits your situation. Together, we can work towards a brighter financial future.

Introduction

Navigating the labyrinth of tax obligations can feel overwhelming, especially when financial pressures mount. We understand that this can be a daunting experience. Fortunately, there are essential tax payment plans designed to help you manage these debts effectively, providing relief and clarity during turbulent times.

However, with numerous options available, how can you determine the most suitable strategy to avoid penalties and regain your financial stability? This article explores ten vital tax owing payment plans that not only ease the burden of debt but also empower you to take control of your financial future.

You're not alone in this journey; we're here to help.

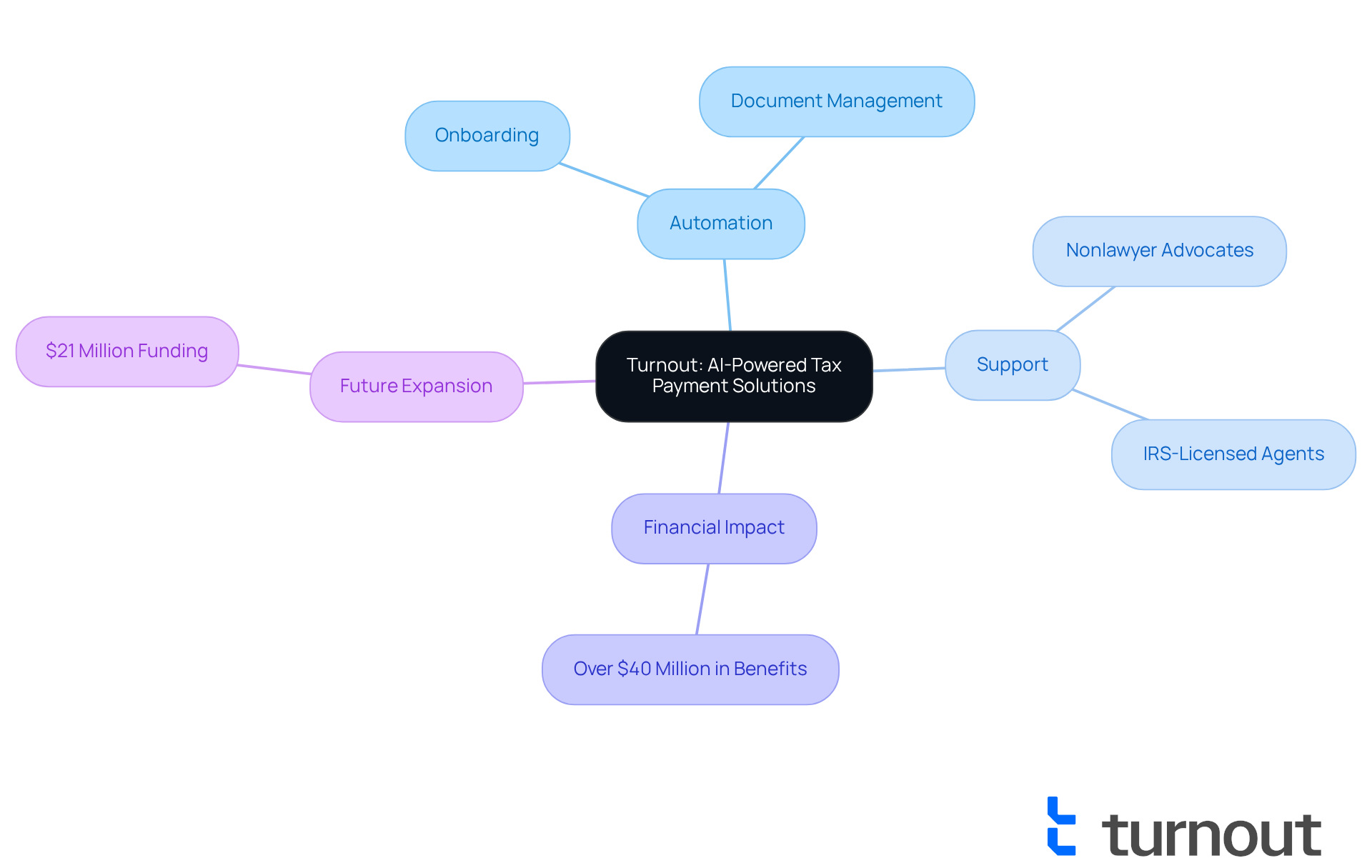

Turnout: AI-Powered Tax Payment Solutions

Navigating the complexities of tax relief can be overwhelming. That's where Turnout comes in, harnessing the power of AI technology to simplify tax owing payment plans for you. By automating essential processes like onboarding and document management, Turnout allows you to manage your tax obligations with ease.

Meet Jake, our AI system that takes care of deadlines and follow-ups. We understand that you want to focus on your recovery, not get caught up in bureaucratic intricacies. It's important to note that Turnout is not a law firm and does not provide legal representation. Instead, we work with trained nonlawyer advocates and IRS-licensed enrolled agents to support you through your process.

This innovative approach not only speeds up the resolution of your tax obligations and tax owing payment plans but also provides you with the vital information needed to make informed choices about your financial future. Since our inception, Turnout has facilitated over $40 million in benefits for Americans, demonstrating our commitment to consumer advocacy.

As Itai Hirsch, CEO of Turnout, shares, "This is an area where you can run fast and break things, but you have to be really careful with the service and the output." With recent funding of $21 million, we are excited to expand our services further, enhancing tax management efficiency for everyday Americans. We particularly aim to assist those facing challenges in navigating complex systems, including those seeking help with SSD claims. Remember, you are not alone in this journey; we're here to help.

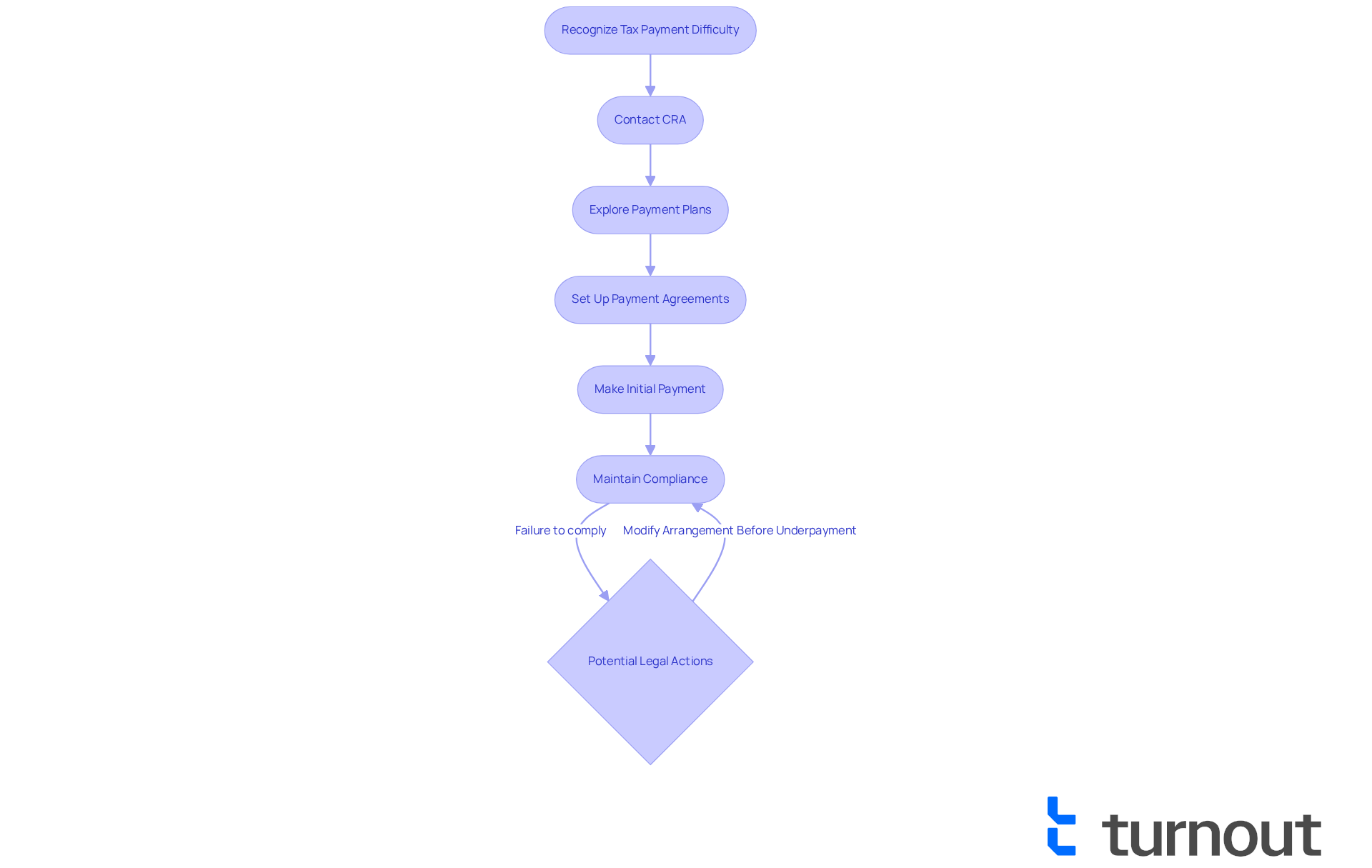

Canada Revenue Agency: Tax Payment Arrangements

The Canada Revenue Agency (CRA) understands that many individuals face challenges in meeting their tax obligations. For those who cannot pay their taxes in full, the CRA offers various tax owing payment plans as settlement options. You can set up a series of contributions through pre-authorized debit agreements or by reaching out to the CRA directly. These tax owing payment plans allow you to settle your obligations gradually, making it easier to manage your finances without incurring additional penalties.

It's important to communicate with the CRA as soon as you realize you may struggle to meet your tax obligations. Proactive engagement can lead to more favorable terms, and you are not alone in this journey. Recent statistics indicate that approximately 30% of Canadians utilize CRA financial arrangements, highlighting the growing need for flexible financial management solutions.

If you find yourself having difficulty settling your dues, you can adjust your agreements related to tax owing payment plans by contacting the CRA. However, it's crucial to do this before making a reduced payment to avoid potential legal actions. For example, one individual successfully established tax owing payment plans after making an initial payment of $200, allowing them to manage their financial obligations without overwhelming financial pressure.

Remember, it's essential to adhere to the established financial schedule and submit future tax returns on time to maintain your arrangement. Recent news has emphasized that the CRA may allocate other federal payments you receive toward your existing tax obligations, even if a payment arrangement is in place. This underscores the importance of understanding the implications of tax liability management and staying aware of your responsibilities.

For more information, consider reaching out to the CRA or visiting their website. We're here to help you explore your options and find the support you need.

Credit Canada: Financial Counseling for Tax Debt

At Turnout, we understand that facing tax obligations can be overwhelming. Our dedicated team is here to provide crucial assistance tailored to your needs. Comprising IRS-licensed enrolled agents, we work closely with you to evaluate your financial situation and develop personalized tax owing payment plans.

We offer:

- Budgeting advice

- Financial management strategies

- Guidance to help you navigate your tax obligations

You are not alone in this journey; we are committed to supporting you every step of the way. By taking a comprehensive approach to your financial well-being, we empower you to take charge of your finances and effectively manage your tax owing payment plans.

Let us help you find peace of mind as you work towards financial stability. Together, we can create a plan that works for you.

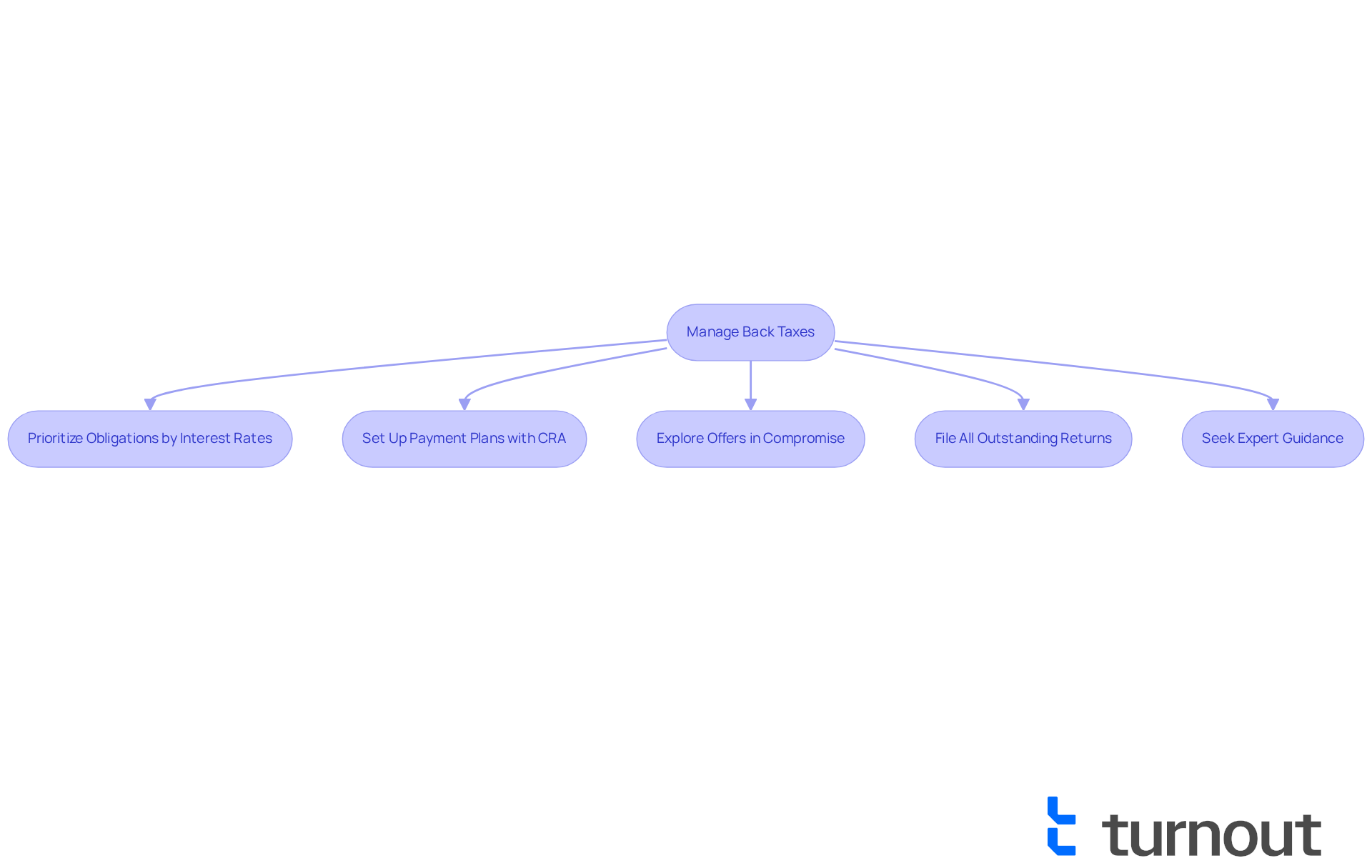

Debt.ca: Strategies for Managing Back Taxes

We understand that managing back taxes can be overwhelming. At Debt.ca, we offer several compassionate strategies to help you navigate this challenging situation. One effective approach is to prioritize your obligations based on interest rates. Additionally, establishing tax owing payment plans with the CRA can help ease your burden. Exploring options like offers in compromise may also provide relief.

Filing all outstanding returns is crucial, as it can prevent further penalties and interest from piling up. Remember, you are not alone in this journey. Seeking expert guidance can empower you to understand your rights and options, ensuring you make informed decisions about your tax obligations. We're here to help you take the next steps toward financial peace.

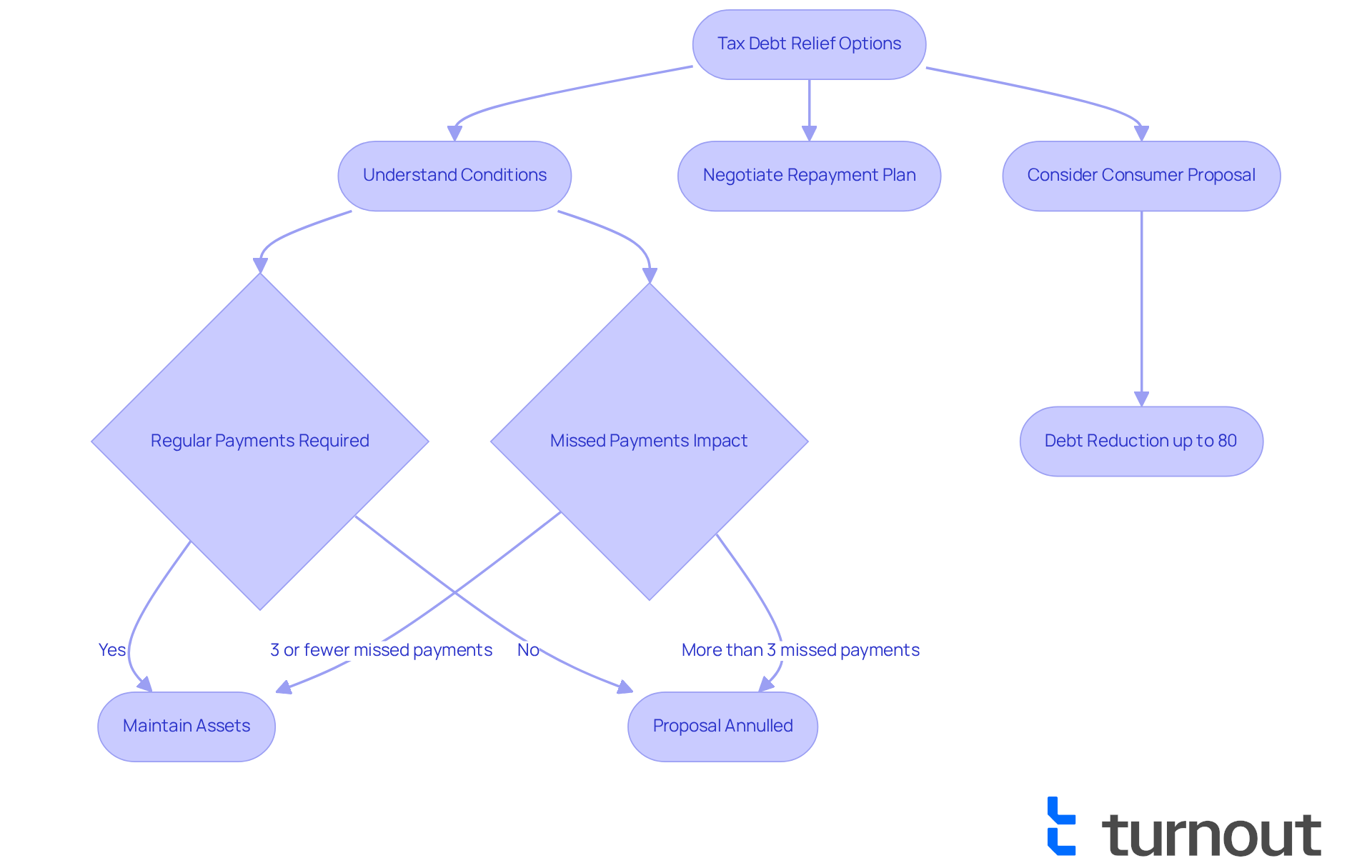

Hoyes Michalos: Tax Debt Relief Options

Hoyes Michalos understands the financial challenges many Canadians face and specializes in providing tax relief options to help alleviate that burden. They offer services like consumer proposals, which empower individuals to negotiate a repayment plan with their creditors, including the Canada Revenue Agency (CRA). It’s crucial to recognize that consumer proposals do not cover secured debts such as mortgages and car loans, an important detail for those considering this option. Additionally, if individuals miss more than three installments, the consumer proposal will be canceled, highlighting the importance of making regular contributions.

By collaborating with a licensed insolvency trustee, individuals can explore various avenues to ease their tax owing payment plans. Consumer proposals not only assist in negotiating reduced costs but also protect assets, allowing individuals to retain home equity and tax refunds acquired after submission. As Joshua Harris, a Licensed Insolvency Trustee, wisely points out, "One of the main benefits of a consumer proposal over bankruptcy is that you keep your home equity, savings plans, tax refunds, and other personal assets."

Recent statistics reveal that consumer proposals can reduce total liabilities by up to 80%, offering a lifeline for those feeling overwhelmed by tax owing payment plans. Furthermore, individuals can miss up to three monthly payments without automatic cancellation of their proposal, providing a buffer during tough times.

For example, a consumer proposal can effectively manage tax obligations and also incorporate tax owing payment plans alongside other unsecured debts, such as credit cards and personal loans. This legally binding agreement requires the approval of the majority of creditors, including the CRA, ensuring that everyone is aligned with the repayment plan.

In summary, Hoyes Michalos empowers Canadians to regain control over their tax debts through consumer proposals and tax owing payment plans. They offer a structured and supportive pathway to financial recovery, reminding you that you are not alone in this journey. We're here to help you navigate these challenges and find a brighter financial future.

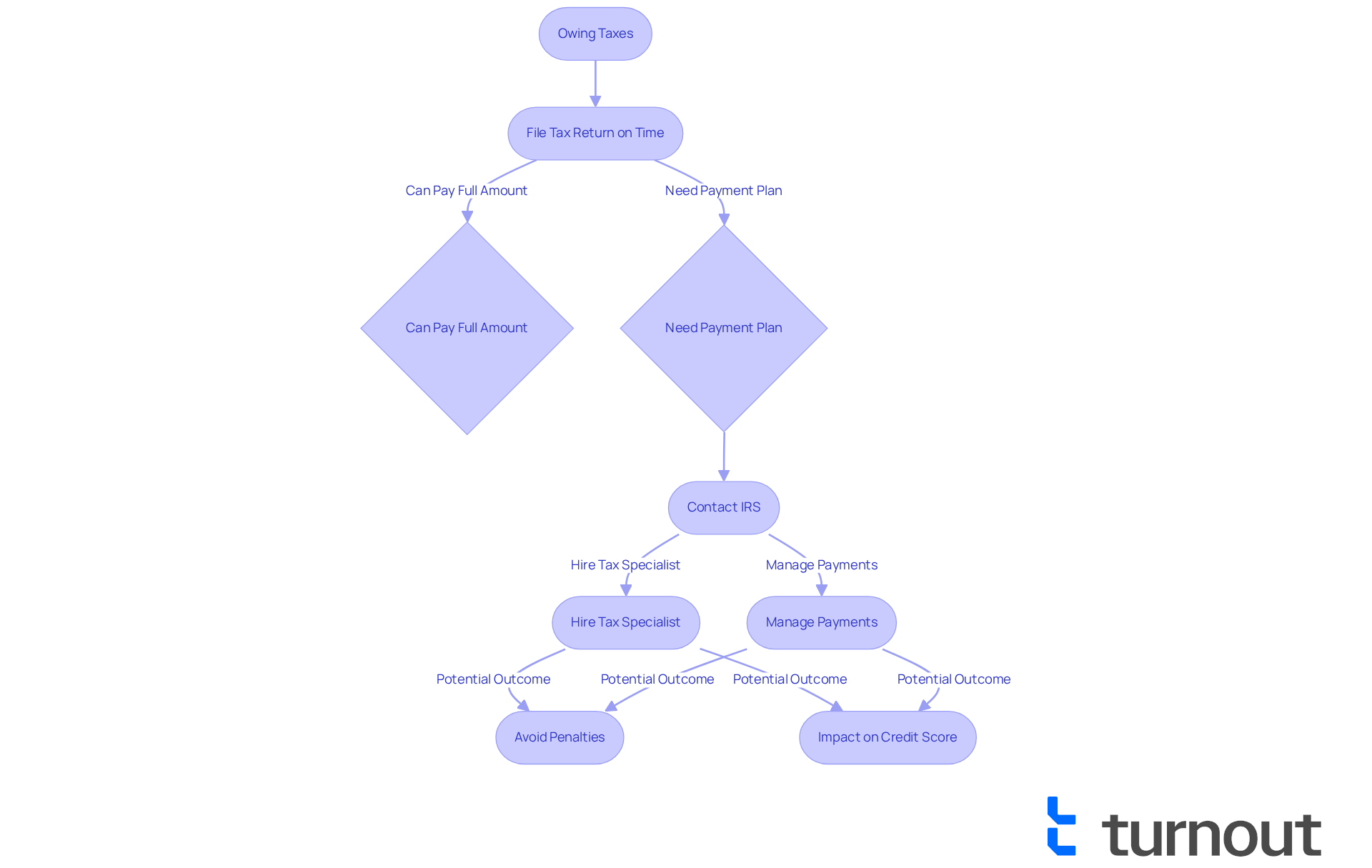

Global News: Tax Time Guidance for Owing Taxes

Global News understands that owing taxes during the filing season can be a stressful experience. It's important to submit your tax return on time, even if you can't pay the full amount and need to explore tax owing payment plans. Doing so can help you avoid additional penalties. We encourage you to reach out to the IRS about your financial situation and explore the available tax owing payment plans. Many individuals have found that by contacting the IRS, they can establish tax owing payment plans that are manageable. This allows you to pay what you can right away while organizing payments for the remaining balance.

As Randall Brody, Founder of Tax Samaritan, wisely states, "Hiring a specialist who comprehends the tax regulations and the IRS collection procedure can significantly impact the resolution of your payroll tax obligations." Understanding how tax obligations affect your future financial decisions is vital for your long-term economic well-being. Remember, failing to file on time can lead to serious penalties, starting at 33% within the first 16 days. It can also affect your credit score and loan eligibility.

Therefore, keeping open lines of communication with tax authorities and adhering to filing deadlines is essential for effectively navigating your tax obligations. You're not alone in this journey, and there are resources available to help you through it.

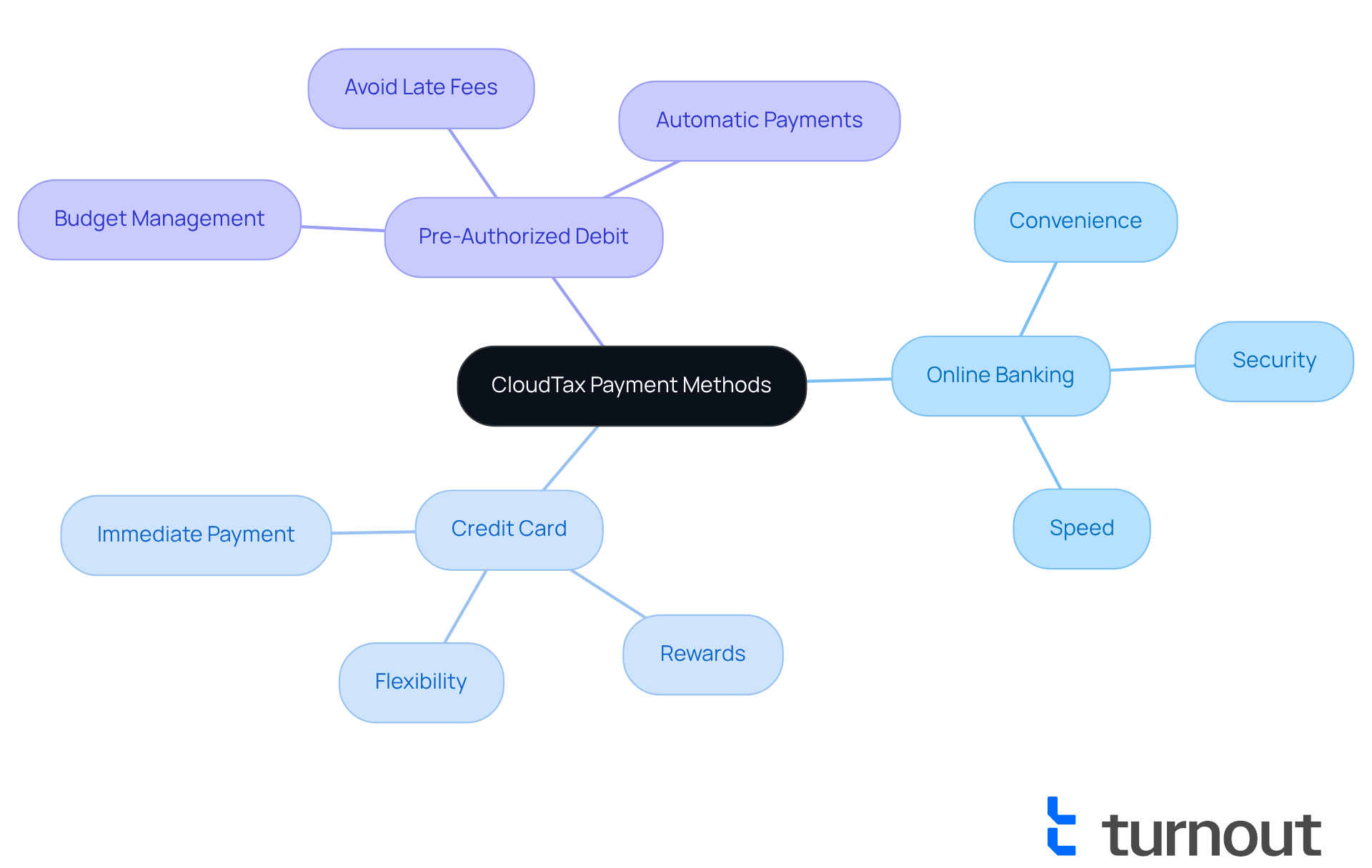

CloudTax: Convenient Payment Methods for Taxes

At CloudTax, we understand that resolving tax debts can feel overwhelming. That's why we offer a variety of convenient options tailored to your needs. Whether you prefer online banking, credit card transactions, or pre-authorized debit agreements, you can choose the method that best fits your financial situation. This flexibility is particularly beneficial for those on tight budgets or looking to avoid late fees.

As the U.S. Department of the Treasury transitions to entirely electronic transactions by September 30, 2025, it’s important to embrace these new approaches. This shift will impact the 5.9 million taxpayers who still receive paper checks, making it crucial to explore secure electronic transaction alternatives.

Financial technology specialists highlight that online transaction systems simplify the process, enhance security, and reduce the chances of errors. Nicholas Edwards, a content writer for TaxDome, shares that "with years of experience in the accounting sector, he enjoys converting complex monetary and tax ideas into understandable, practical insights."

There are many examples of flexible payment options helping taxpayers overcome financial hurdles. Many individuals have successfully used tax owing payment plans to manage their tax debts, allowing them to pay off obligations in manageable increments. This approach not only alleviates immediate financial pressure but also fosters a sense of control over their economic futures by utilizing tax owing payment plans.

With the upcoming requirement for fully digital transactions, CloudTax’s commitment to providing various transaction methods positions it as a vital resource for taxpayers navigating their financial responsibilities. Remember, you are not alone in this journey—CloudTax is here to help you every step of the way.

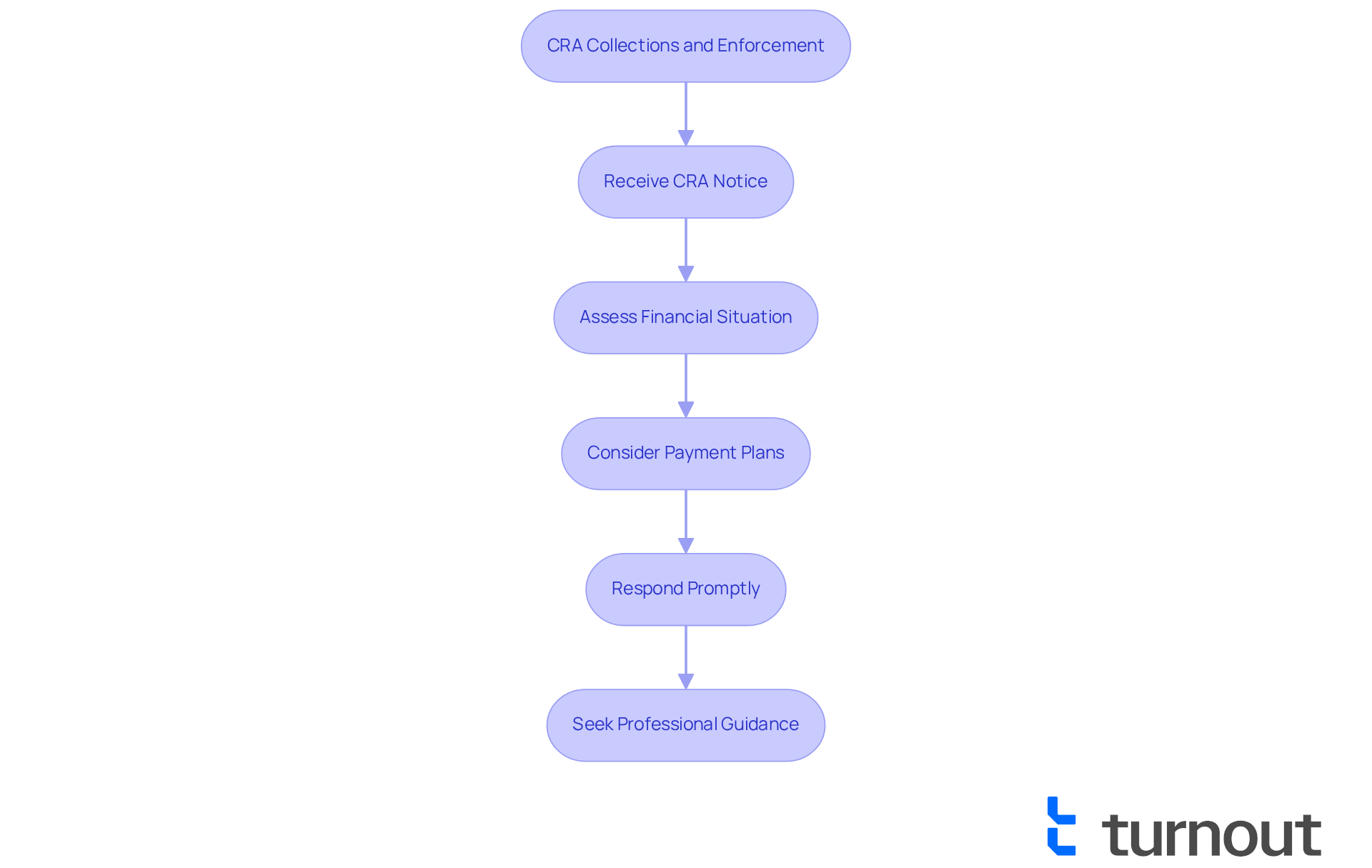

TaxPage: Understanding CRA Collections and Enforcement

TaxPage outlines the essential collection and enforcement processes employed by the Canada Revenue Agency (CRA), which are important for you to understand. We know that dealing with taxes can be overwhelming, especially when they go unpaid. The CRA can initiate various collection measures, such as:

- Garnishing wages

- Placing liens on property

- Withholding tax returns and GST/HST reimbursements

It's common to feel anxious about these situations, and you're not alone—many Canadians experience CRA enforcement actions. This highlights the importance of addressing your tax obligations without delay.

We encourage you to respond promptly to any notices from the CRA. If you're struggling to meet your obligations, seeking assistance through tax owing payment plans is a wise step. For instance, discussing tax owing payment plans that fit your financial situation can lead to more favorable outcomes. Understanding these processes empowers you to manage your financial circumstances and avoid serious consequences, such as accumulating liabilities from interest and penalties. As one tax professional wisely notes, being proactive in managing your tax obligations is vital to preventing future financial strain.

Additionally, under the Fairness Provisions of the Income Tax Act, you may qualify for relief from penalties and interest under extraordinary circumstances. It's also important to recognize that the CRA can secure a court ruling on your assets, which can complicate their sale or refinancing until the obligation is resolved. To effectively handle your tax obligations, ensure that all your tax filings are current. Remember, seeking guidance from a Licensed Insolvency Trustee can provide you with the support you need. You're not alone in this journey, and we're here to help.

Credit Canada: Consequences of Not Paying Taxes

We understand that facing financial obligations can be overwhelming. Credit Canada highlights the serious repercussions of failing to meet these responsibilities, such as accumulating interest, penalties, and potential harm to your credit score. It's common to feel anxious about the possibility of wage garnishments or asset seizures. This makes it crucial to proactively tackle tax owing payment plans.

Tax liens, which are claims against your property by the IRS for unpaid taxes, can apply not just to current assets but also to future ones. This underscores the long-term implications of tax debt. While tax liens do not show up on credit reports, they can still influence lenders' perceptions, possibly leading to higher interest rates or even credit denials. In fact, all tax liens were removed from credit reports by April 2018, yet their existence as public records can still affect your credit approval.

Seeking assistance from money advisors or tax experts can provide the support you need to navigate these challenges effectively. As writer Ben Luthi observes, "While a tax lien can affect your monetary situation and your capacity to secure credit, it won't appear on your credit reports or adversely influence your credit score." Therefore, it is vital to take proactive steps in managing your tax owing payment plans. Regularly checking your credit reports for inaccuracies can safeguard your financial health.

Remember, you are not alone in this journey. We're here to help you find the right path forward.

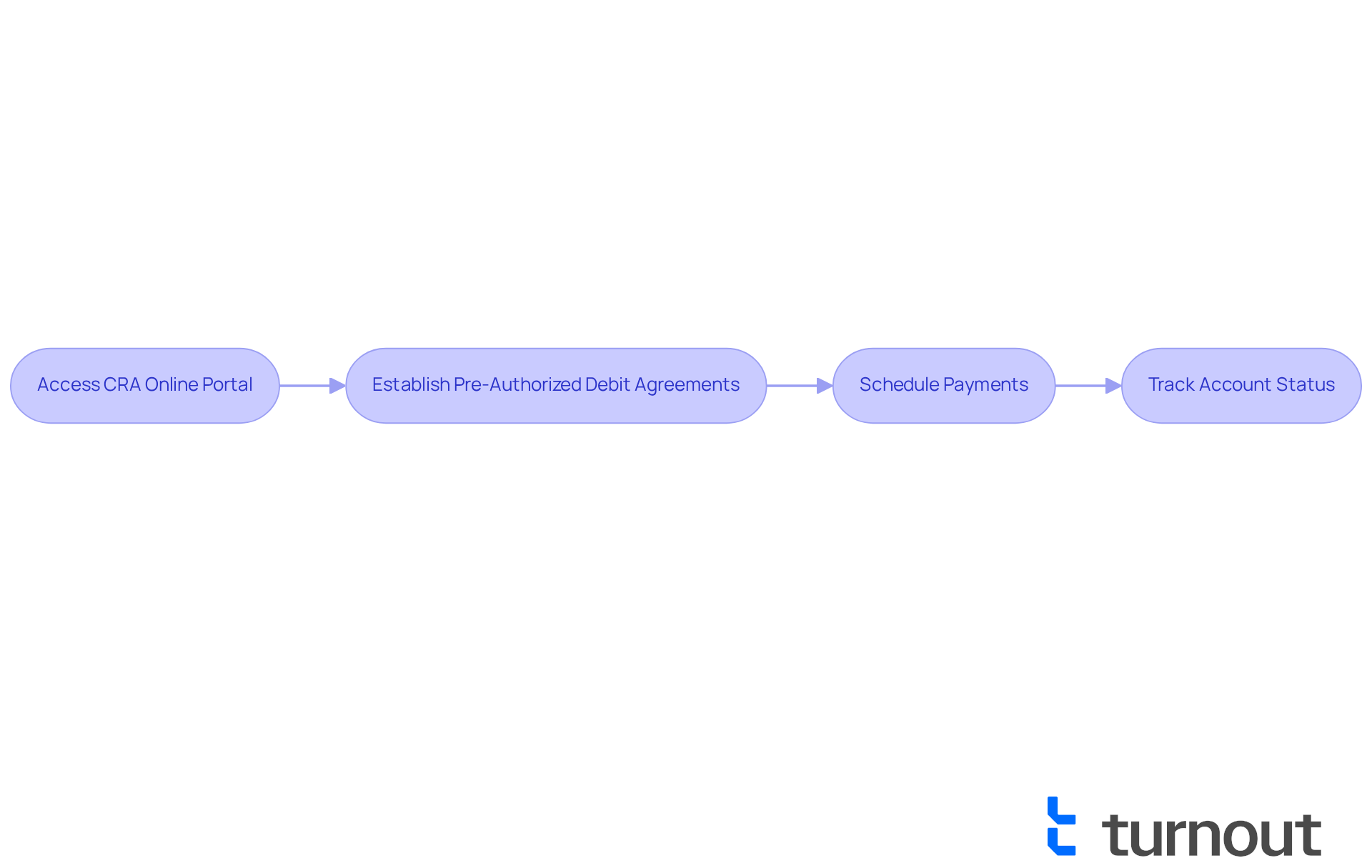

CRA Automated Services: Managing Payment Arrangements

The CRA offers automated services designed to assist taxpayers in managing their financial arrangements with greater ease and efficiency. We understand that navigating tax obligations can be overwhelming. Through the CRA's online portal, individuals can conveniently establish pre-authorized debit agreements, schedule payments, and keep track of their account status. This technological advancement simplifies the process, allowing you to focus on your financial recovery without the stress of manual tracking.

By utilizing these online services, the CRA significantly enhances accessibility and convenience for those managing tax obligations. Additionally, Turnout provides support through trained non-lawyer advocates and IRS-licensed enrolled agents, who are dedicated to helping clients understand their options for tax debt relief. It's important to remember that Turnout is not a law firm and does not provide legal advice or representation.

As noted by industry experts, the integration of technology in tax management not only enhances compliance but also empowers individuals to take control of their financial obligations more effectively. You are not alone in this journey; support is available to guide you every step of the way.

Conclusion

Managing tax obligations can feel overwhelming, but we understand that there are various payment plans and resources available that can help ease this burden. This article highlights essential tax owing payment plans, including innovative solutions like AI-powered services, the flexibility offered by the Canada Revenue Agency (CRA), and the importance of financial counseling. By leveraging these options, you can take control of your tax debts and work towards a more stable financial future.

Key insights discussed include:

- The importance of proactively engaging with tax authorities

- Filing on time

- Exploring various strategies for managing back taxes

Services such as consumer proposals and automated payment arrangements provide structured pathways for those struggling with tax debts, allowing for manageable payments and reduced financial stress. Remember, open communication with agencies like the CRA and seeking expert guidance are vital steps in effective debt management.

Ultimately, addressing your tax obligations promptly is crucial. Delaying action can lead to serious consequences, including penalties and damage to your credit score. Therefore, we encourage you to explore the available resources, seek support from financial experts, and take proactive steps in managing your tax responsibilities. By doing so, you can pave the way for financial recovery and peace of mind. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Turnout and how does it help with tax payment solutions?

Turnout is an AI-powered service that simplifies tax payment plans by automating processes like onboarding and document management. It helps users manage their tax obligations more easily and efficiently.

Who is Jake and what role does he play in Turnout's services?

Jake is Turnout's AI system that manages deadlines and follow-ups, allowing users to focus on their recovery rather than bureaucratic details.

Does Turnout provide legal representation for tax issues?

No, Turnout is not a law firm and does not provide legal representation. Instead, it works with trained nonlawyer advocates and IRS-licensed enrolled agents to assist users.

How much financial benefit has Turnout facilitated for Americans?

Since its inception, Turnout has facilitated over $40 million in benefits for Americans, showcasing its commitment to consumer advocacy.

What recent funding has Turnout received and what are its future plans?

Turnout recently received $21 million in funding, which will be used to expand its services and enhance tax management efficiency for everyday Americans.

What options does the Canada Revenue Agency (CRA) offer for individuals struggling with tax payments?

The CRA offers various tax owing payment plans that allow individuals to settle their tax obligations gradually through pre-authorized debit agreements or direct communication with the CRA.

How can individuals proactively engage with the CRA regarding their tax obligations?

Individuals should communicate with the CRA as soon as they realize they may struggle to meet their tax obligations. Proactive engagement can lead to more favorable terms.

What should you do if you need to adjust your tax owing payment plan with the CRA?

If you need to adjust your payment plan, contact the CRA before making a reduced payment to avoid potential legal actions.

What financial management support does Credit Canada provide for tax debt?

Credit Canada offers budgeting advice, financial management strategies, and guidance to help individuals navigate their tax obligations.

How does Turnout ensure personalized support for individuals facing tax obligations?

Turnout's team, which includes IRS-licensed enrolled agents, evaluates each individual's financial situation to develop personalized tax owing payment plans tailored to their needs.