Overview

The article titled "10 Essential Tips to Maximize Your Group Tax Benefits" offers compassionate guidance on how individuals and businesses can effectively utilize group tax benefits.

We understand that navigating tax regulations can be overwhelming, and it’s crucial to grasp the eligibility criteria. Gathering the necessary documentation can feel daunting, but it is essential for claiming available tax advantages. Seeking professional assistance is another important step that can significantly enhance your ability to comply with regulations and maximize your benefits.

Remember, you are not alone in this journey; we’re here to help you every step of the way.

Introduction

Navigating the intricate world of group tax benefits can often feel overwhelming. We understand that the ever-evolving regulations and eligibility criteria make this task daunting. However, grasping how to maximize these advantages is not just beneficial; it can significantly impact your financial outcomes, whether for individuals or businesses. What if there was a way to simplify this process? Imagine unlocking potential savings and ensuring compliance with ease. In this article, we present ten essential tips designed to empower you. Together, we can transform complexity into clarity and opportunity.

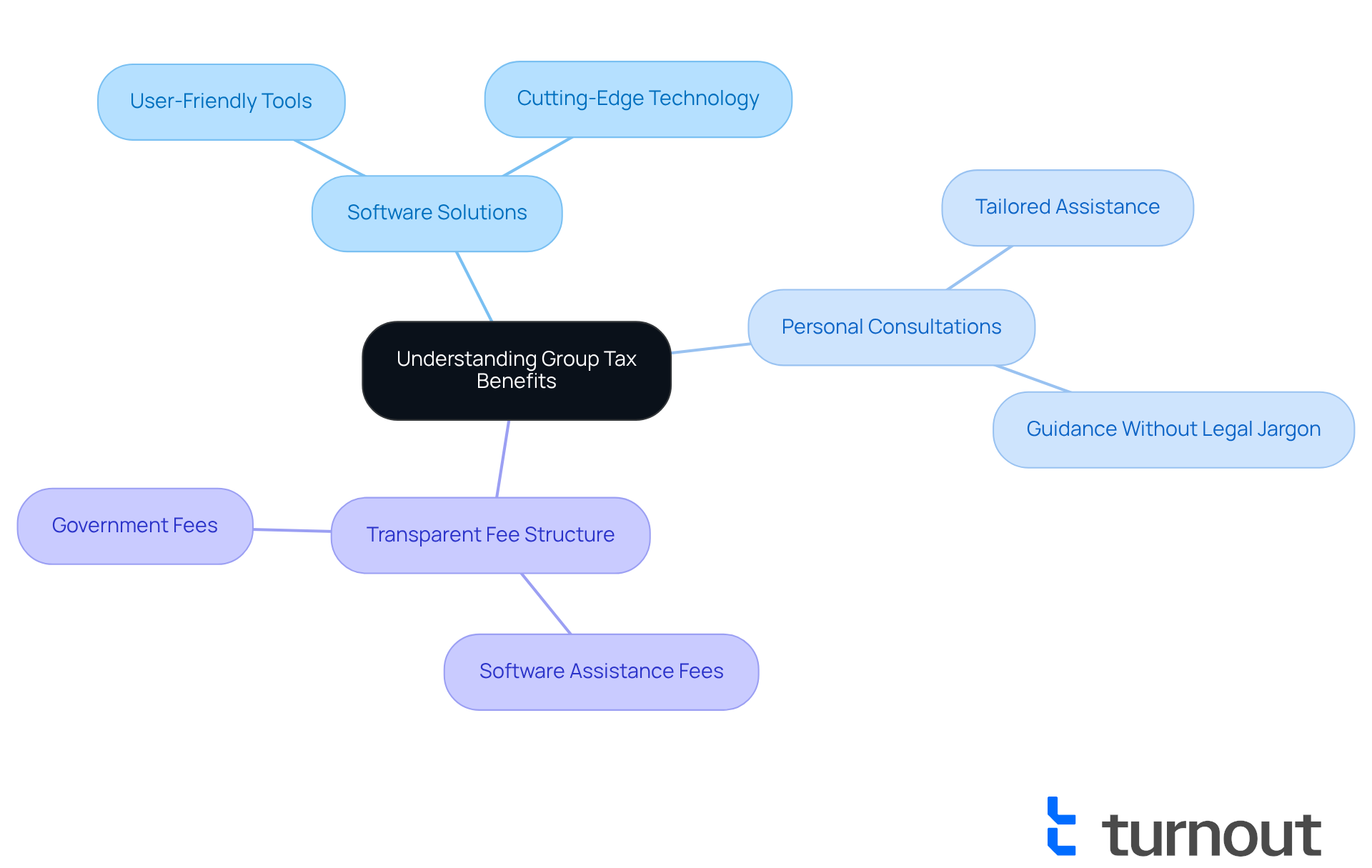

Turnout: Streamline Your Understanding of Group Tax Benefits

At Turnout, we understand that navigating the complexities of tax advantages can be overwhelming. Our commitment is to change how individuals comprehend and access these benefits. By utilizing cutting-edge software solutions and tailored assistance, including personal consultations and user-friendly tools, we aim to simplify the often intricate group tax landscape. This approach empowers you to recognize and obtain the advantages you deserve.

It’s important to note that Turnout Technologies, Inc. operates independently and does not provide legal or financial advice. We strive to offer clear guidance, free from the confusion of legal jargon. This streamlined method not only enhances your understanding but also encourages you to take practical steps toward maximizing your group tax benefits.

Additionally, our transparent fee structure ensures that you are well-informed about the costs associated with our services. We outline service fees for software assistance and separate government fees for paperwork submission, so you can feel confident in your financial decisions. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Know Your Eligibility Requirements for Group Tax Benefits

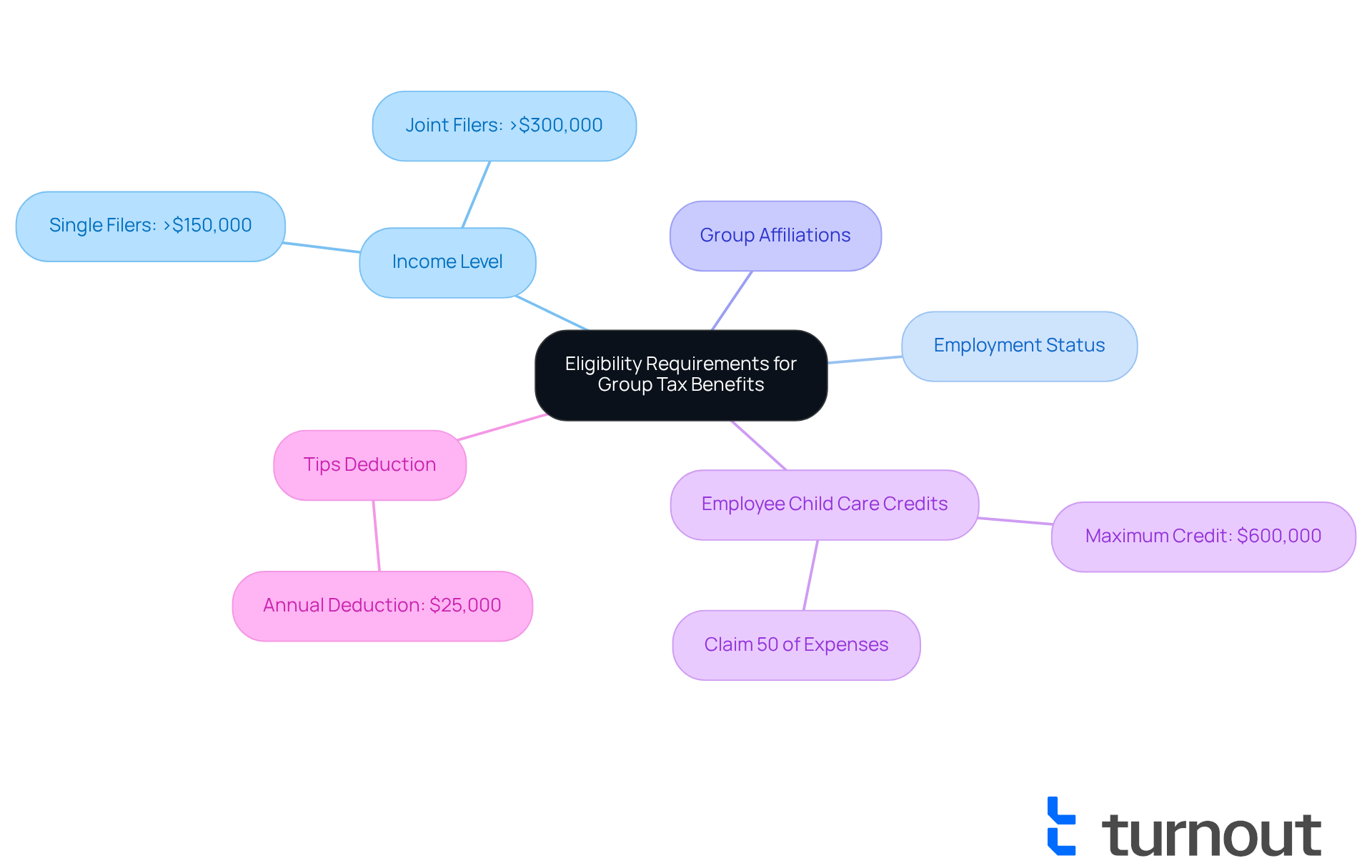

Understanding the eligibility criteria for group tax is essential, especially if you’re feeling overwhelmed by the complexities of tax regulations. Key factors such as income level, employment status, and specific group affiliations play a significant role in determining your eligibility. For instance, small businesses can qualify for various tax credits if they meet certain employee count and wage thresholds.

In 2025, eligible small businesses can claim up to $600,000 in tax credits for employee child care, provided they have gross receipts under $31 million. Additionally, they can claim 50% of expenses related to employee child care. We understand that navigating these requirements can be daunting, especially when considering the tip benefit. Businesses asserting this benefit should maintain detailed records, as the IRS may conduct examinations. It’s important to note that individuals with adjusted gross incomes exceeding $150,000 for single filers and $300,000 for joint filers cannot qualify for this benefit.

Furthermore, small businesses may deduct up to $25,000 in tips annually through 2028. Getting acquainted with these requirements can help you avoid pitfalls and ensure you are on the right path to obtaining your entitlements. To optimize your advantages, consider reviewing your year-to-date equipment purchase records and seeking guidance from a tax expert. Remember, you are not alone in this journey; we’re here to help you fully utilize the available deductions.

Gather Necessary Documentation for Group Tax Benefits

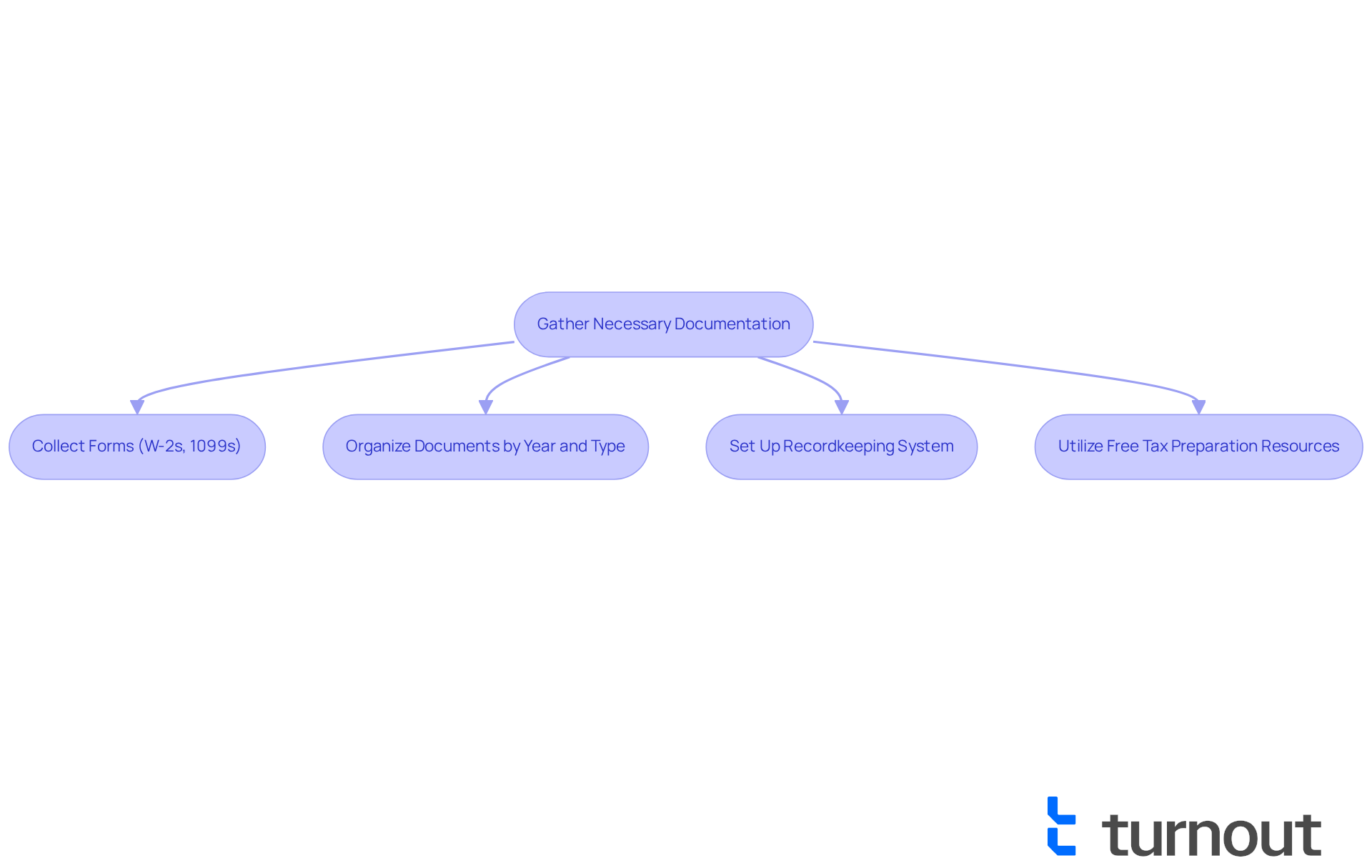

Gathering the correct documentation is essential for successfully claiming advantages related to group tax. We understand that this process can feel overwhelming, but having the right forms—like W-2s, 1099s, and relevant receipts or invoices—can make a significant difference. Organizing these documents systematically can streamline your filing process, reducing the risk of delays or rejections from tax authorities.

To ensure accuracy, it's helpful to have a recordkeeping system that summarizes your business transactions in accounting journals and ledgers. Supporting documents should be organized by year and type of income or expense, including sales slips, paid bills, and canceled checks. This organization not only aids in filing but also helps substantiate entries on tax returns. Remember, errors in documentation can lead to significant issues, and we want to help you avoid that. Did you know that seventy percent of taxpayers can use free brand-name tax software to prepare and file their federal income tax returns electronically using IRS Free File? This highlights the importance of meticulous record-keeping.

Programs like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) offer free tax preparation services, ensuring that individuals receive the necessary support in organizing their documentation. Additionally, the IRS provides resources for checking eligibility for free filing options, which can further simplify the process for those who qualify. By utilizing these resources and following best practices in documentation, you can effectively enhance your group tax advantages. Remember, you're not alone in this journey; we're here to help you every step of the way.

Navigate Bureaucratic Processes for Group Tax Benefits

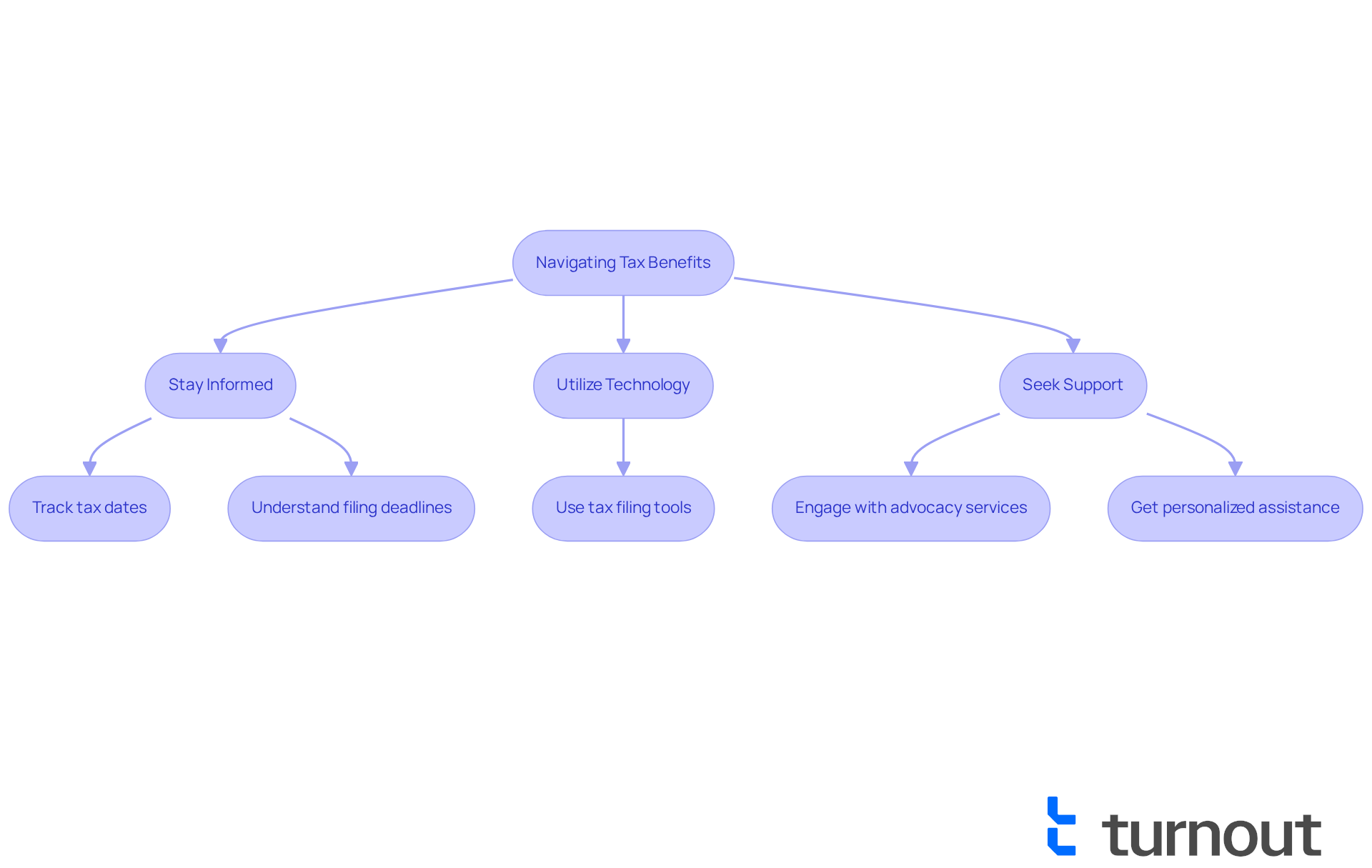

Navigating the bureaucratic landscape of tax advantages can feel overwhelming. We understand that comprehending the specific processes involved is crucial for your peace of mind. Familiarizing yourself with key elements, such as filing deadlines and submission methods, can significantly streamline your experience.

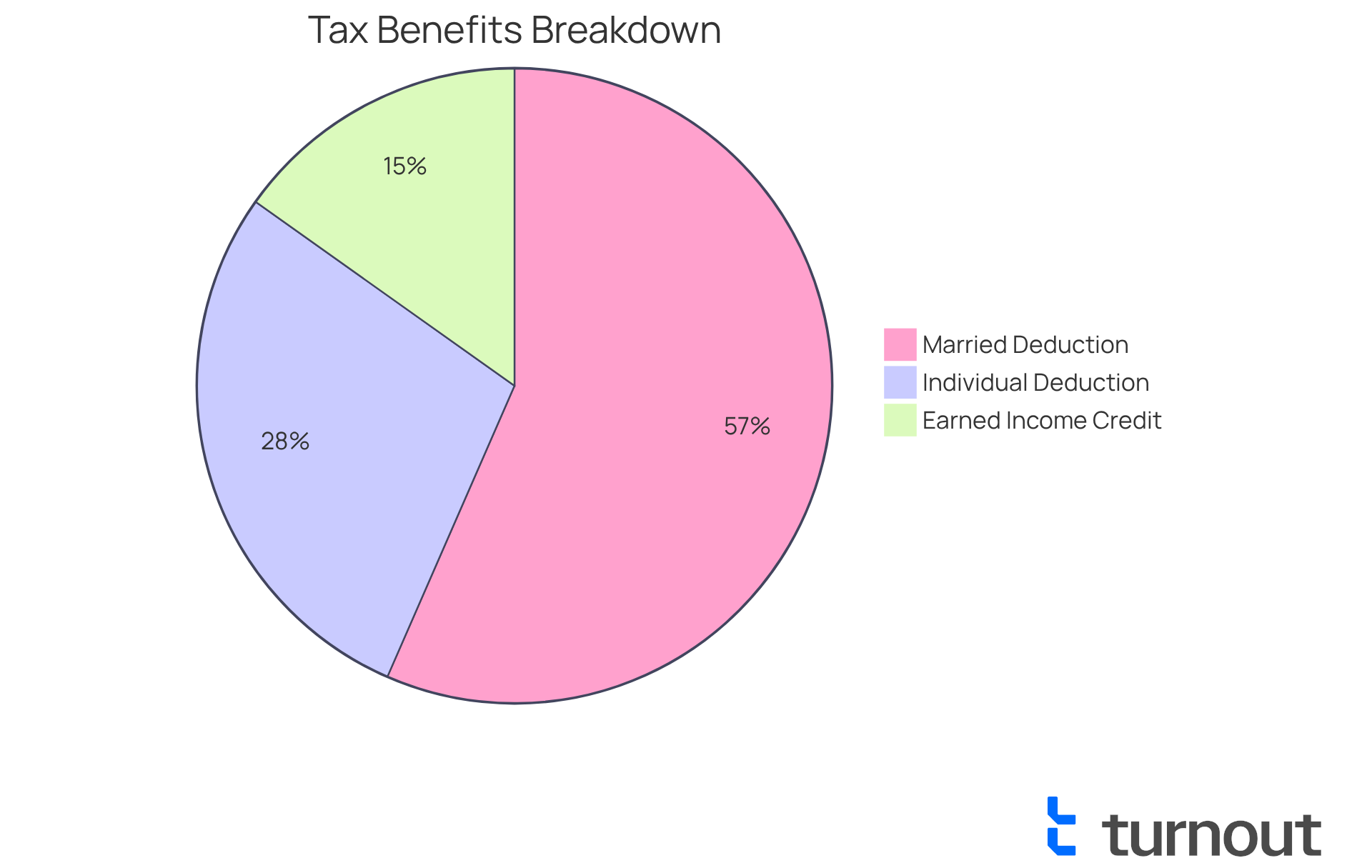

For instance, the highest Earned Income Tax Credit for eligible taxpayers with three or more children has risen to $8,046 for the 2025 tax year, providing substantial economic assistance. Additionally, the basic allowance for married couples filing jointly has increased to $30,000, further enhancing tax advantages for families. Utilizing resources like Turnout can offer essential guidance and support, ensuring you meet all necessary requirements and deadlines. This minimizes the risk of complications, allowing you to focus on what truly matters.

Turnout is dedicated to making it easier for you to obtain government assistance and financial support, especially for SSD claims and tax relief. They employ trained non-legal advocates and IRS-licensed enrolled agents to help clients without providing legal representation. It’s important to note that some services may incur fees, and government fees are separate and must be paid before any paperwork can be submitted on your behalf.

To further ease the process, consider these helpful tips:

- Stay Informed: Keep track of important tax dates and changes in regulations, like the increase in the standard deduction for single taxpayers to $15,000 in 2025.

- Utilize Technology: Leverage tools and platforms designed to simplify tax filing and assistance navigation.

- Seek Support: Engage with advocacy services like Turnout that can help clarify complex tax processes and provide personalized assistance.

As Richard Nixon aptly noted, "Make sure you pay your taxes; otherwise you can get in a lot of trouble." This highlights the importance of compliance and understanding the system. By being proactive and informed, you can navigate tax advantage processes more effectively. This can reduce the average time spent on these tasks and enhance your overall experience.

Furthermore, the maximum credit for the adoption of a child with special needs has increased to $17,280 for the 2025 tax year, which may be beneficial for some readers. Additionally, be aware that the highest out-of-pocket cost limit for family coverage is $10,500 for the tax year 2025. This information is essential for those dealing with healthcare-related tax advantages. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Maximize Your Group Tax Benefits with Tax Deductions

To optimize your tax advantages as a group, we understand that it’s crucial to utilize available tax reductions efficiently. Typical allowances include costs associated with employee perks, business activities, and charitable donations. For instance, did you know that businesses can deduct costs related to employee health insurance, retirement contributions, and even certain travel expenses incurred for business purposes?

By meticulously tracking and documenting these expenses, you can significantly lower your taxable income, which can lead to substantial savings. In fact, many companies report average savings of $3,207 annually by implementing robust expense tracking systems, as noted by TurboTax. This is a great opportunity to enhance your financial situation.

Financial advisors often emphasize the importance of maintaining detailed records. They state that 'if you expect to receive a federal refund of $500 or more, you could be eligible for a Refund Advance loan.' This approach not only ensures compliance but also enhances the potential for significant group tax savings, providing relief for many.

Additionally, businesses that successfully monitor their expenses often find that utilizing software tools designed for expense management can streamline the process and provide insights into spending patterns. By embracing these practices, you can enhance your group tax strategies and ensure you are maximizing all available credits. Remember, there are potential credits for qualified tips and the new allowance for seniors, which can further improve your tax advantages. You're not alone in this journey—we're here to help you navigate these opportunities.

Utilize Tax Credits to Enhance Group Tax Benefits

Tax credits serve as a powerful tool for enhancing your advantages related to group tax. Unlike subtractions, which merely reduce your taxable income, credits provide a direct decrease in the amount of tax you owe. For instance, the maximum Earned Income Tax Credit for qualifying taxpayers with three or more children has risen to $8,046 for the tax year 2025. This change offers significant savings for families who qualify. Additionally, the standard deduction for individual taxpayers increases to $15,000, while for married couples filing jointly, it rises to $30,000, further boosting overall tax benefits.

We understand that navigating the array of available credits can be challenging, especially those tailored for small businesses and specific employee benefits. Many small enterprises have successfully utilized these credits to strengthen their financial position. For example, businesses investing in electric vehicles can benefit from tax incentives that significantly lower operational costs, with studies indicating that electric vehicles can be 41% cheaper to own and operate compared to gas-powered vehicles.

To maximize your tax credits in 2025, it's crucial to familiarize yourself with all applicable credits and ensure you apply for them during tax filing. Tax professionals stress the importance of being proactive in claiming these credits, as they can lead to considerable savings. Remember, while tax deductions reduce your taxable income, group tax credits directly diminish your tax liability, making them a more impactful option for enhancing your overall tax savings. You're not alone in this journey; we’re here to help you navigate through it.

Prepare for Tax Audits Related to Group Tax Benefits

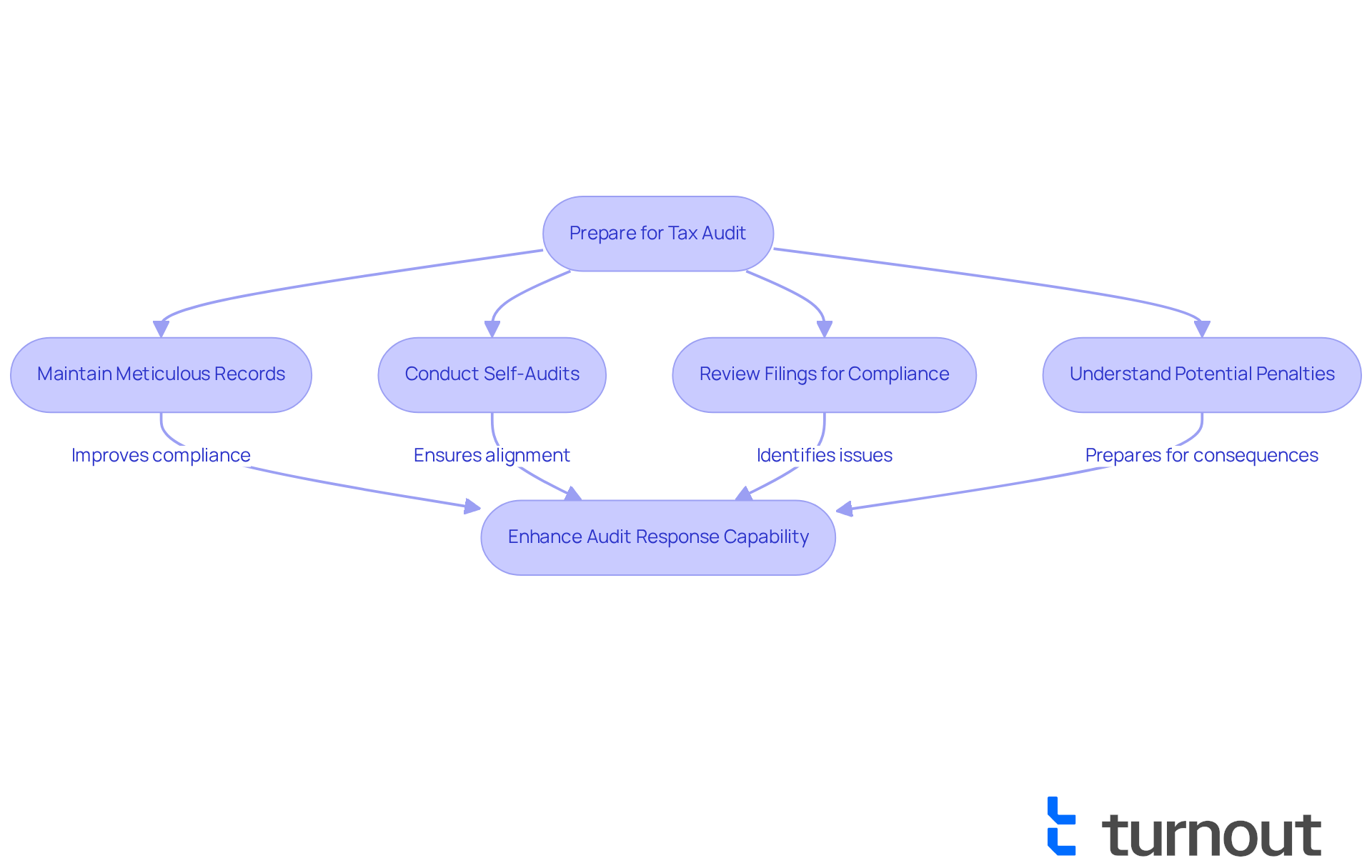

Preparation is essential when confronting tax audits, particularly for organizations like yours that seek to optimize group tax. We understand that maintaining meticulous records of all documentation—such as receipts, forms, and correspondence with tax authorities—can feel overwhelming, but it's crucial. Regularly reviewing your filings and ensuring adherence to tax regulations can significantly enhance your ability to respond effectively in the event of an audit. This proactive approach not only minimizes potential penalties but also helps avoid complications that could arise from non-compliance.

For tax-exempt organizations, particularly those classified under Section 501(c)(3) of the Internal Revenue Code, it’s vital to operate exclusively for exempt purposes to retain your status. With the federal government increasing scrutiny on these organizations, it’s common to feel anxious about compliance. We recommend conducting self-audits and governance reviews to ensure that your activities align with approved tax-exempt purposes. As Christina Culver notes, "Tax-exempt organizations should conduct a self-audit and governance review to ensure activities continue to support the approved tax-exempt purpose." Remember, failure to comply with IRS regulations can lead to severe consequences, including tax adjustments, penalties, or even the revocation of your tax-exempt status.

Experts suggest that organizations prepare for potential audits by maintaining thorough tax records and being aware of the average penalties faced during audits, which can be substantial. For instance, it’s concerning to know that organizations may face penalties reaching thousands of dollars if found non-compliant. By implementing these strategies, you can navigate the complexities of tax compliance with greater confidence and security. Additionally, with the potential for group tax increases looming due to increased scrutiny, it is more important than ever for organizations to be proactive in their audit preparations. We’re here to help you find examples of organizations that assist consumers in preparing for tax audits, including various nonprofit advocacy groups that provide resources and guidance tailored to your specific needs.

Stay Informed on Tax Law Changes Affecting Group Benefits

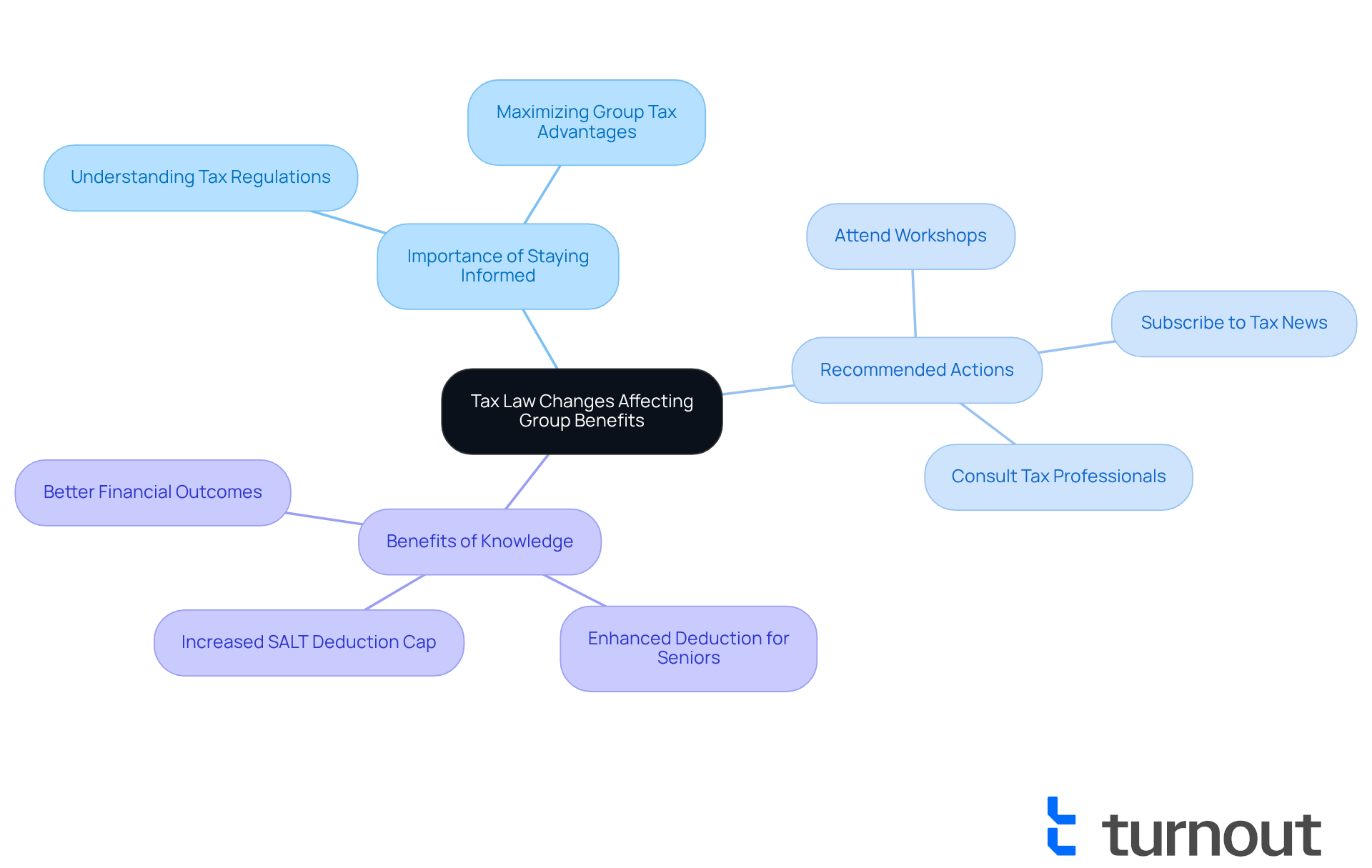

Tax regulations can often feel overwhelming, and it's completely understandable to feel concerned about how these changes may affect your benefits. Staying updated on these modifications is essential for maximizing your group tax advantages. Did you know that about 88% of participants believe the U.S. federal tax code needs changes? This highlights the necessity for all of us to grasp these evolving regulations so we can effectively manage our benefits.

We understand that navigating these updates can be daunting. To help you stay informed about new opportunities and regulations, consider:

- Subscribing to reliable tax news sources

- Attending workshops

- Consulting with tax professionals

Many individuals have successfully adapted to recent tax law changes by taking advantage of new deductions, such as the enhanced deduction for seniors and the increased SALT deduction cap, which now allows deductions up to $40,000 for married couples earning below $500,000.

Experts emphasize that proactive engagement with tax details can lead to better financial outcomes. Knowledgeable consumers are more likely to seize available benefits. As one tax expert wisely noted, 'Staying updated on tax regulations is essential for anyone looking to optimize their financial situation.' By prioritizing tax literacy and remaining informed, you can navigate the complexities of tax regulations and enhance your group's tax advantages through group tax strategies with confidence. Remember, you are not alone in this journey—we're here to help you every step of the way.

Seek Professional Help for Group Tax Benefit Navigation

Navigating the advantages of group tax can feel overwhelming, but you're not alone in this journey. Seeking the help of tax experts can lead to meaningful rewards. These specialists have the expertise to provide insights tailored to your unique situation, helping you uncover valuable opportunities and avoid potential pitfalls. For instance, many veterans have successfully utilized free tax assistance programs, such as IRS Free File, allowing them to file their federal and state tax returns at no cost, ensuring they receive the benefits they deserve.

We understand that the complexities of group tax advantages can be daunting. One expert wisely noted, 'Understanding the nuances of group tax is crucial for maximizing tax benefits.' Their guidance not only helps you comply with tax regulations but also enhances your overall financial strategy.

The impact of professional assistance is significant. Studies show that individuals who consult with tax professionals can save an average of up to 20% on their tax liabilities. This underscores the vital role these specialists play in navigating the often intricate landscape of group tax, empowering you to make informed decisions that align with your financial goals. Remember, we're here to help you every step of the way.

Integrate Group Tax Benefits into Your Financial Planning

Incorporating collective tax advantages into your comprehensive planning is vital for enhancing their effectiveness. We understand that navigating tax options can feel overwhelming; research indicates that only 2% of Americans can identify options with tax advantages, highlighting a significant knowledge gap in tax literacy. By comprehending how these advantages align with your long-term monetary objectives—such as retirement savings or investment strategies—you can develop a more integrated and efficient economic plan.

Monetary advisors emphasize the importance of aligning tax advantages with your financial goals to improve overall economic well-being. For instance, contributing to workplace retirement accounts not only reduces your taxable income but also allows your savings to grow tax-deferred. Recommendations suggest that consumers save at least 10% to 15% of their pay. It’s common to feel uncertain about these decisions, but real-world examples show that individuals who strategically utilize tax benefits often achieve better financial outcomes.

This reinforces the need for a thoughtful approach to financial planning in 2025 and beyond. Remember, you're not alone in this journey; we're here to help you navigate these important decisions.

Conclusion

Maximizing group tax benefits can feel overwhelming, but with the right strategies and insights, it becomes achievable. By understanding eligibility requirements, gathering necessary documentation, and navigating bureaucratic processes, both individuals and businesses can enhance their tax advantages significantly. Remember, utilizing tax deductions and credits is essential, as these tools directly impact the amount of tax owed and can lead to meaningful savings.

We understand that meticulous record-keeping, staying informed about tax law changes, and seeking professional assistance can be daunting. However, these elements are crucial for optimizing group tax benefits. Engaging with tax experts and weaving these advantages into your broader financial planning can create a more effective strategy for achieving your long-term financial goals.

In conclusion, the pathway to maximizing group tax benefits is paved with knowledge, organization, and proactive engagement. By taking the necessary steps to understand and apply these principles, you can unlock your full potential for tax savings. Embracing these strategies not only enhances your financial well-being but also empowers you to navigate the complexities of the tax landscape with confidence. Remember, you're not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is the purpose of Turnout Technologies, Inc. regarding group tax benefits?

Turnout Technologies, Inc. aims to simplify the understanding and access to group tax benefits through advanced software solutions, personalized assistance, and user-friendly tools.

Does Turnout provide legal or financial advice?

No, Turnout operates independently and does not provide legal or financial advice. They focus on offering clear guidance without legal jargon.

How does Turnout help individuals maximize their group tax benefits?

Turnout enhances understanding of group tax benefits and encourages practical steps to maximize these advantages through tailored assistance and transparent fee structures.

What are the eligibility criteria for claiming group tax benefits?

Eligibility for group tax benefits is influenced by factors such as income level, employment status, and specific group affiliations, particularly for small businesses meeting employee count and wage thresholds.

What tax credits can eligible small businesses claim in 2025?

In 2025, eligible small businesses can claim up to $600,000 in tax credits for employee child care if their gross receipts are under $31 million, along with 50% of child care expenses.

What records should businesses maintain when claiming the tip benefit?

Businesses claiming the tip benefit should maintain detailed records, as the IRS may conduct examinations. Individuals with adjusted gross incomes exceeding $150,000 (single) or $300,000 (joint) are ineligible for this benefit.

How much can small businesses deduct in tips annually through 2028?

Small businesses may deduct up to $25,000 in tips annually through 2028.

What documentation is necessary for claiming group tax benefits?

Necessary documentation includes W-2s, 1099s, and relevant receipts or invoices. Organizing these documents systematically is crucial for a smooth filing process.

What resources can assist individuals in organizing their tax documentation?

Programs like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) offer free tax preparation services, and the IRS provides resources for checking eligibility for free filing options.

How can meticulous record-keeping impact tax filing?

Meticulous record-keeping can reduce the risk of delays or rejections from tax authorities and help substantiate entries on tax returns, avoiding significant issues down the line.