Overview

We understand that managing tax debt can be overwhelming. This article shines a light on the top tax relief groups dedicated to helping individuals like you navigate these challenges with care and expertise. Organizations such as Turnout, Optima Tax Relief, and Tax Defense Network offer tailored strategies and personalized support, ensuring you are not alone in this journey.

These groups provide expert negotiation and compassionate guidance, helping clients tackle the complexities of tax obligations. By partnering with them, you can work towards achieving favorable resolutions that bring peace of mind. Remember, reaching out for help is a strong first step towards regaining control of your financial situation.

You deserve support that understands your unique circumstances, and these organizations are here to offer just that. Don’t hesitate to explore the options available to you, and take that important step towards relief today.

Introduction

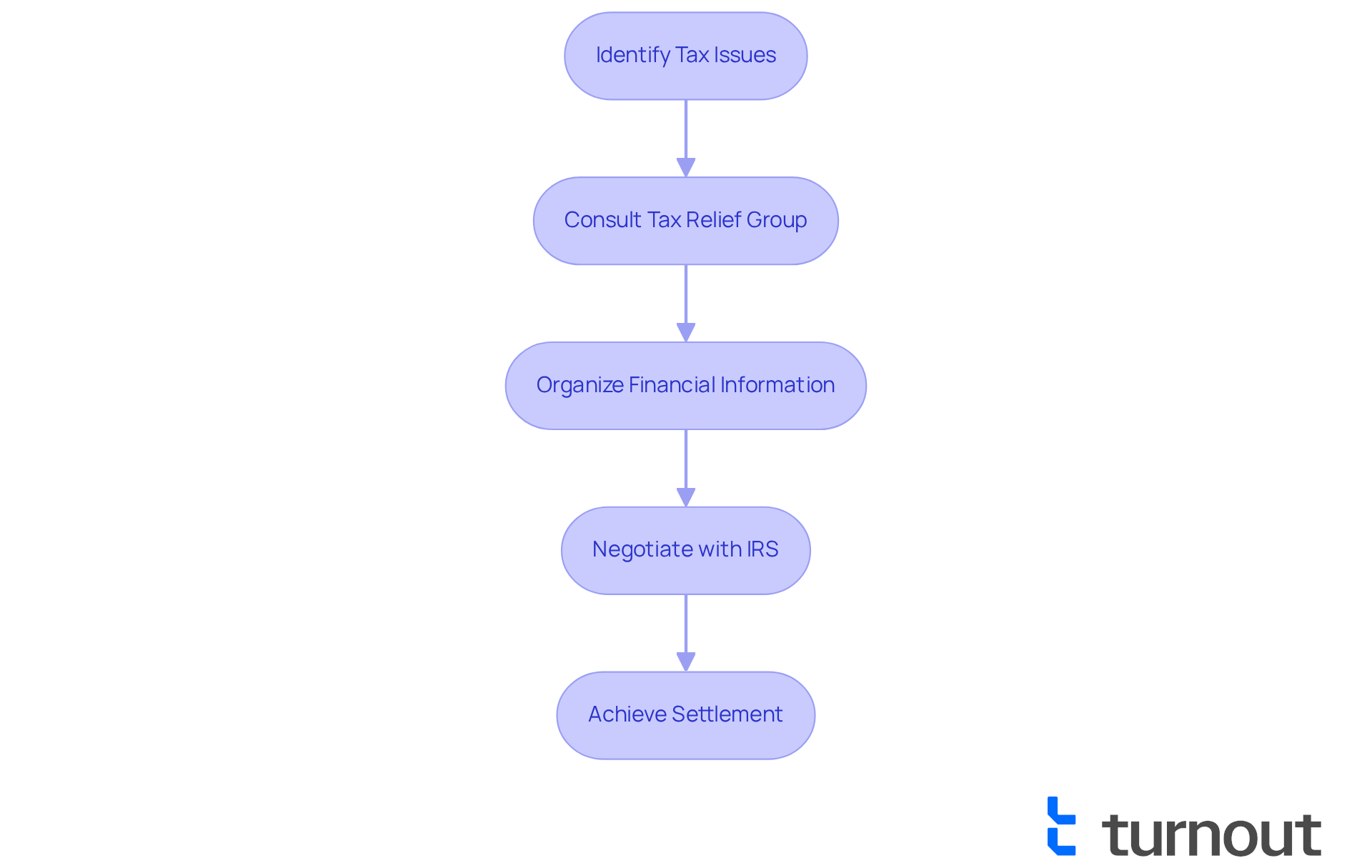

Navigating tax debt can often feel like traversing a labyrinth. The countless pitfalls and complexities may leave you feeling overwhelmed and uncertain. But take heart—there are tax relief groups ready to guide you through this challenging journey. These organizations are dedicated to helping taxpayers reclaim control over their financial obligations, offering the support you need.

In this article, we will explore seven top tax relief organizations that are redefining the landscape of debt management. Each one showcases unique services and inspiring success stories. With so many options available, how can you determine which group truly offers the best chance for relief? We're here to help you find the right path forward.

Turnout: Leverage AI for Efficient Tax Relief Solutions

At Turnout, we understand that navigating the can be overwhelming. That’s why our tax relief group is transforming services through the strategic application of AI, exemplified by our , Jake. This innovative technology ensures that you receive from the tax relief group during the tax relief process.

By , we not only accelerate the handling of tax issues but also empower you to confidently navigate the complexities of tax systems. Our AI integration enhances accuracy and efficiency, allowing for real-time monitoring of compliance and . It’s important to note that Turnout is not a law firm and does not provide legal advice.

The advantages of AI in handling tax cases are significant. You can expect:

- Improved precision in recognizing deductions

- Shortened processing durations

- Better

This establishes Turnout as a crucial resource for within the tax relief group. We also utilize trained nonlawyer advocates and IRS-licensed enrolled agents to provide essential support without the need for legal representation.

This contemporary method is vital for effective tax obligation resolution, ensuring that you receive the support you require while . Remember, you are not alone in this journey—we're here to help.

Optima Tax Relief: Expert Guidance for Tax Debt Management

At Optima Tax Relief, we understand that dealing with can feel overwhelming. Our dedicated team is here to provide personalized support, working closely with you to develop strategies that specifically address your unique tax issues. This tailored approach not only increases the chances of a successful resolution but also alleviates the stress that often accompanies .

Many of our customers have shared their , highlighting how our methods have allowed them to resolve their tax issues in a fraction of the time it would take to . On average, individuals see a significant reduction in the time required to resolve their tax debt when they have expert assistance.

We place a strong emphasis on transparency and customer service, ensuring that you feel informed and supported throughout the process. It's important to know that nearly 5 million tax returns received penalty relief from the IRS between 2020 and 2021, showcasing the relief options available to you. Understanding the total amount owed to the IRS is crucial in determining the right strategy for your situation.

This commitment to exceptional service has made Optima a trusted choice for those looking for a to help alleviate their . Remember, you are not alone in this journey; we're here to help you every step of the way.

Tax Defense Network: Comprehensive Strategies for Tax Resolution

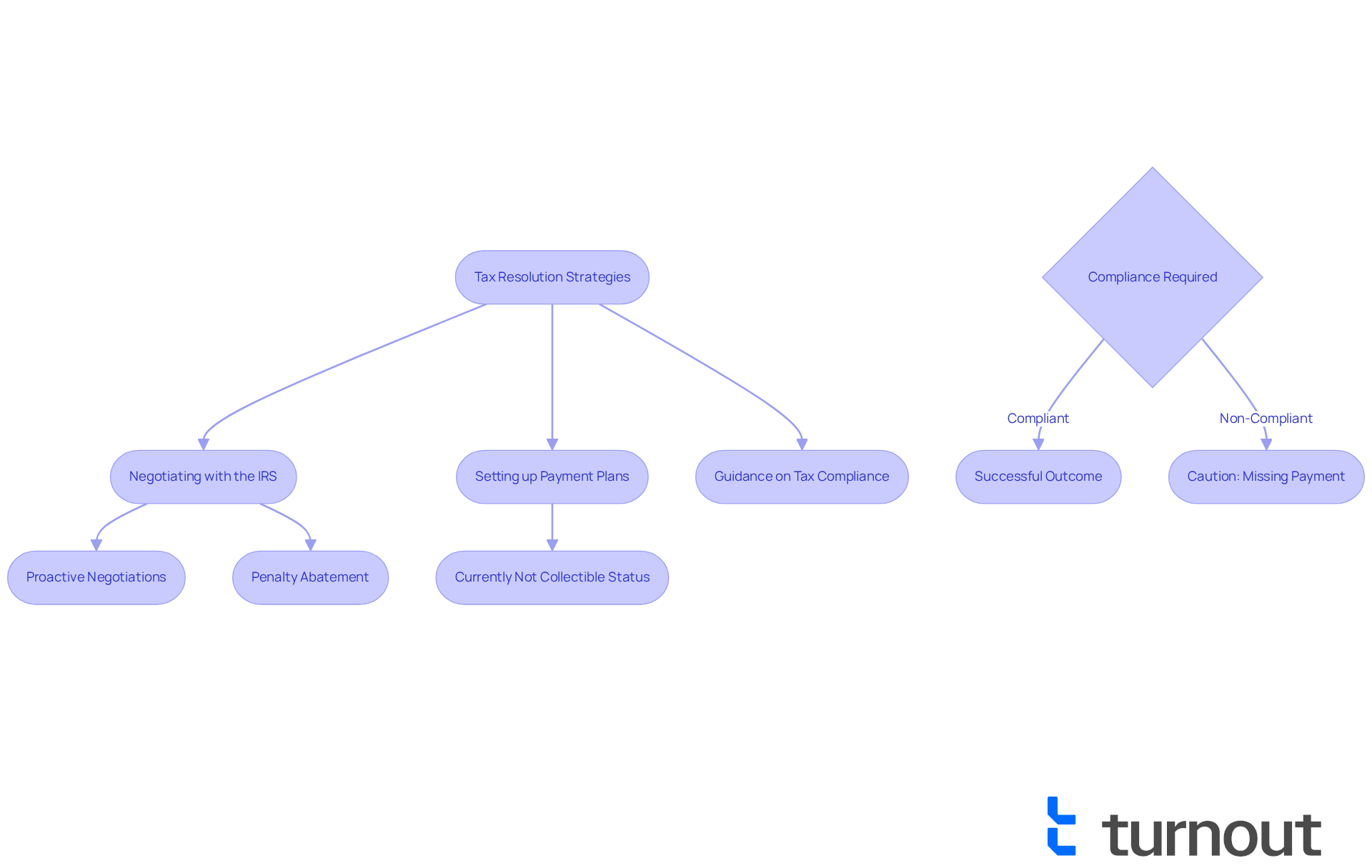

At Tax Defense Network, we understand that dealing with can be overwhelming for both individuals and businesses. That’s why we offer a wide range of services designed to help you resolve these challenges. Our comprehensive strategies include:

- Setting up

- Providing guidance on tax compliance

By focusing on personalized solutions, we aim to help you navigate the complexities of , ensuring that your case is handled with the utmost care and expertise.

Successful negotiations with the IRS can significantly impact the outcome of your tax obligations. Many individuals find that by engaging in proactive conversations, they can resolve their for less than the total amount owed through programs like Offers in Compromise. Statistics show that a well-prepared negotiation can lead to favorable terms, easing the financial burden on taxpayers. However, it’s important to remember that missing even one payment could nullify the entire agreement, highlighting the necessity of compliance in tax resolution agreements.

Understanding the nuances of IRS negotiation techniques is essential. At Tax Defense Network, we emphasize the importance of gathering accurate documentation and maintaining compliance with filing requirements, as these factors can greatly influence your chances of success. Our specialists are trained to identify opportunities for , which can significantly reduce or eliminate penalties for those who meet specific criteria. Remember, programs like penalty abatement can be a valuable resource if you qualify.

In a landscape where procrastination can worsen tax issues, our comprehensive strategies provide a structured approach to tax resolution. Procrastination can lead to increased penalties, as the longer you wait, the more interest and penalties accumulate. By addressing both federal and state obligations, we help you avoid aggressive collection actions and regain your financial stability. Ignoring state-level responsibilities can lead to serious repercussions, emphasizing the importance of resolving both federal and state tax liabilities. Engaging with our knowledgeable team can save you time, reduce errors, and ultimately lead to a more favorable resolution of your tax matters. Additionally, if you are facing severe financial hardship, the potential for Currently Not Collectible (CNC) status is an important option to consider. Remember, you are not alone in this journey; we’re here to help.

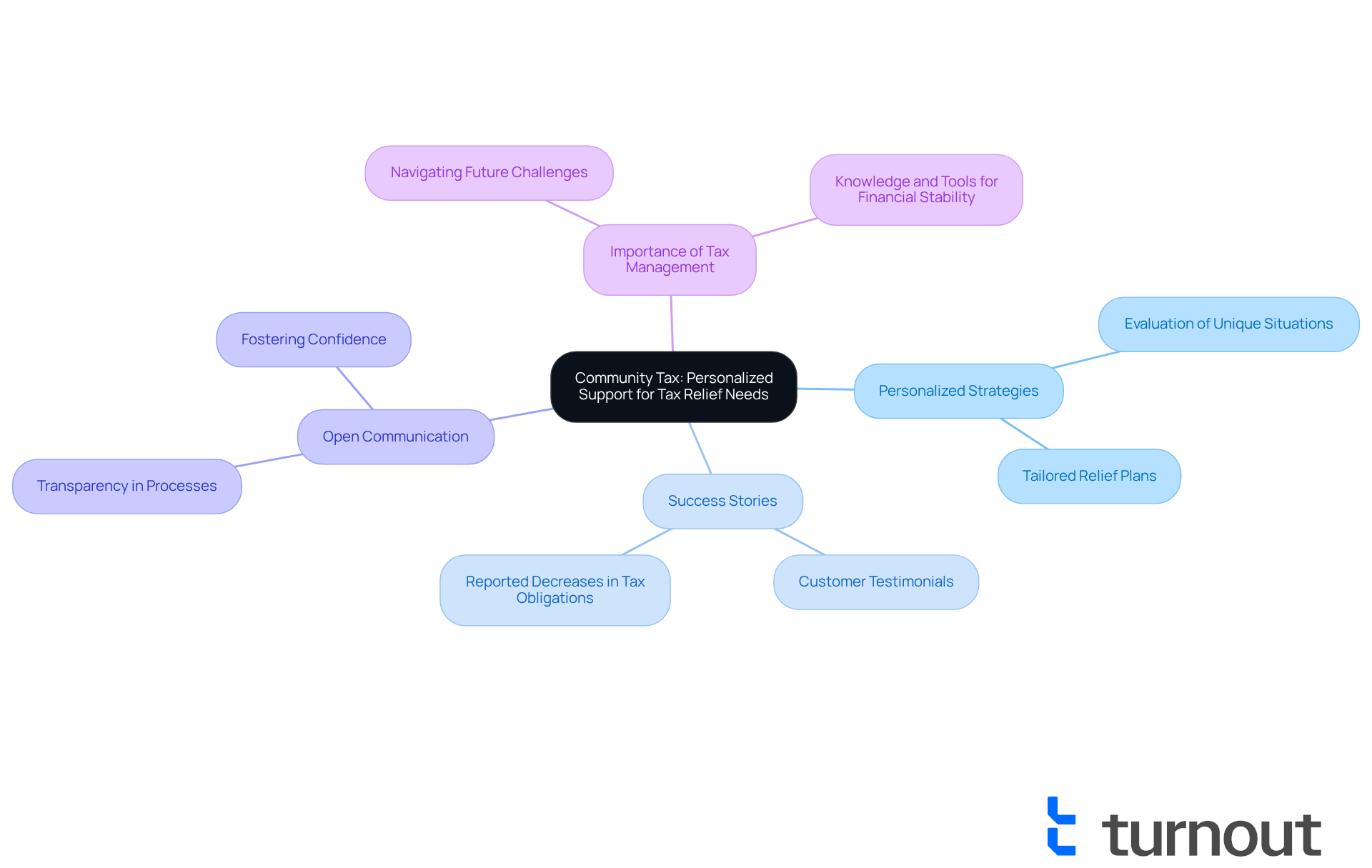

Community Tax: Personalized Support for Tax Relief Needs

At Community Tax, we understand that dealing with can be overwhelming. Our dedicated team of tax experts is here to support you every step of the way. We take the time to evaluate your unique situation and develop through our tax relief group that truly fit your needs. Many individuals have found success through our tailored approach, reporting and a newfound sense of .

We emphasize open communication and transparency, allowing you to regain control over your tax issues. You are not alone in this journey; our goal is to foster confidence and agency as you navigate these challenges. Success stories from our customers highlight the . They show how Community Tax not only addresses immediate tax concerns but also equips you with the knowledge and tools to face future challenges.

As Benjamin Franklin famously noted, 'in this world nothing can be said to be certain, except death and taxes.' This underscores the importance of effective tax management. Moreover, statistics reveal that can lead to substantial decreases in liabilities. Let us help you take the first step towards financial relief. We're here to help you find peace of mind and a brighter financial future.

Tax Relief Advocates: Client-Centric Advocacy for Tax Issues

At our group, we prioritize , focusing on the unique needs of individuals grappling with . Our dedicated teams work tirelessly to understand each person's situation, ensuring that you receive the necessary support and guidance to navigate the complexities of tax relief effectively. As tax regulations evolve in 2025, we are here to simplify the process for you, achieving a success rate that reflects our commitment to your interests.

Many customers have shared their experiences, highlighting significant improvements in their tax circumstances thanks to our . One customer remarked, 'The experience was exceptional. The team walked me through the entire process and ensured I was well-prepared with the proper documentation.' This level of is crucial, especially as the IRS faces challenges like , which can leave taxpayers feeling frustrated and unsupported.

in 2025 requires not only expertise but also a compassionate approach. At Tax Relief Advocates, we excel in this area, with numerous individuals expressing gratitude for the timely and knowledgeable responses they receive. As one satisfied customer shared, 'I couldn’t be happier with the result; they took care of everything—I didn’t even break a sweat.' This underscores the effectiveness of client-centric advocacy in achieving successful resolutions, making us an invaluable resource for those in need of a .

We understand that seeking help can feel overwhelming, but you are not alone in this journey. Let us .

CuraDebt: Tailored Solutions for Tax and Debt Relief

CuraDebt is dedicated to offering customized solutions through a tax relief group for both tax and , recognizing the unique monetary situations of each individual. We understand that navigating financial challenges can be overwhelming. That's why our process begins with a thorough assessment of your financial situation, allowing us to craft a personalized plan that effectively addresses your specific needs. This tailored approach not only enhances communication but also fosters a supportive atmosphere, empowering you to regain and peace of mind.

In 2025, achieving financial stability through a tax relief group is more crucial than ever. Many clients have experienced an average recovery time of just a few months when utilizing our customized financial relief services. However, it's common to feel cautious, as the financial relief sector can be rife with scams. Recently, the Federal Trade Commission (FTC) halted a 'Accelerated Debt,' which for services that falsely promised to reduce their financial obligations by up to 75%. This operation amassed an estimated $100 million, underscoring the importance of choosing trustworthy providers like CuraDebt.

Christopher Mufarrige, Director of the FTC’s Bureau of Consumer Protection, stated, "The defendants falsely posed as consumers’ banks and credit bureaus to mislead them into paying thousands of dollars for their supposed debt relief services." Such tactics often , including military consumers, who are at a higher risk of falling victim to these scams. We believe in the power of success stories from CuraDebt users, which illustrate the transformative impact of our services. These narratives showcase how individuals have and emerged stronger. By prioritizing effective communication and support, we stand out as a caring partner in your journey toward financial recovery.

Taxation Solutions: Expert Negotiation for Tax Settlements

At Taxation Solutions, we understand that navigating the complexities of tax negotiations can be overwhelming, especially for those involved with a . Our team, as a tax relief group, specializes in expert negotiation for tax settlements, dedicated to helping individuals like you secure the most favorable outcomes possible. We are here to assist you through the intricate landscape of IRS negotiations with the help of a tax relief group, ensuring you can achieve .

Recent updates reveal a significant backlog of unpaid revenues at the IRS, amounting to roughly $380 billion. This situation may delay collection efforts for older debts, presenting a unique opportunity for you to negotiate settlements. Remember, the IRS cannot collect back taxes after the Collection Statute Expiration Date, typically 10 years from the due date. Consulting with a tax professional is crucial for determining the exact expiration date of your back tax amounts, which is essential for effective negotiation.

We have successfully aided numerous individuals in overcoming these challenges, demonstrating that our tax relief group’s proactive engagement with tax issues can lead to positive outcomes. By organizing collection notices and creating a budget, you can gain a clearer understanding of your financial situation, which is vital for .

Consider this inspiring example: a self-employed individual successfully resolved $39,378 in overdue payments. This remarkable achievement illustrates the potential for considerable relief through the skilled negotiation efforts of a tax relief group. As the IRS refines its systems for tracking unpaid taxes, collaborating with a knowledgeable tax relief group can help ensure compliance with deadlines and maximize your chances of a favorable settlement.

As Mark Twain wisely noted, "The secret to getting ahead is getting started." At Taxation Solutions, we empower you to tackle your tax challenges directly, transforming what can feel like an insurmountable process into a manageable and achievable endeavor. Additionally, exploring options like the IRS Offer in Compromise (OIC) with a tax relief group can open further avenues for resolving back tax issues.

Remember, you are not alone in this journey. We’re here to help you every step of the way.

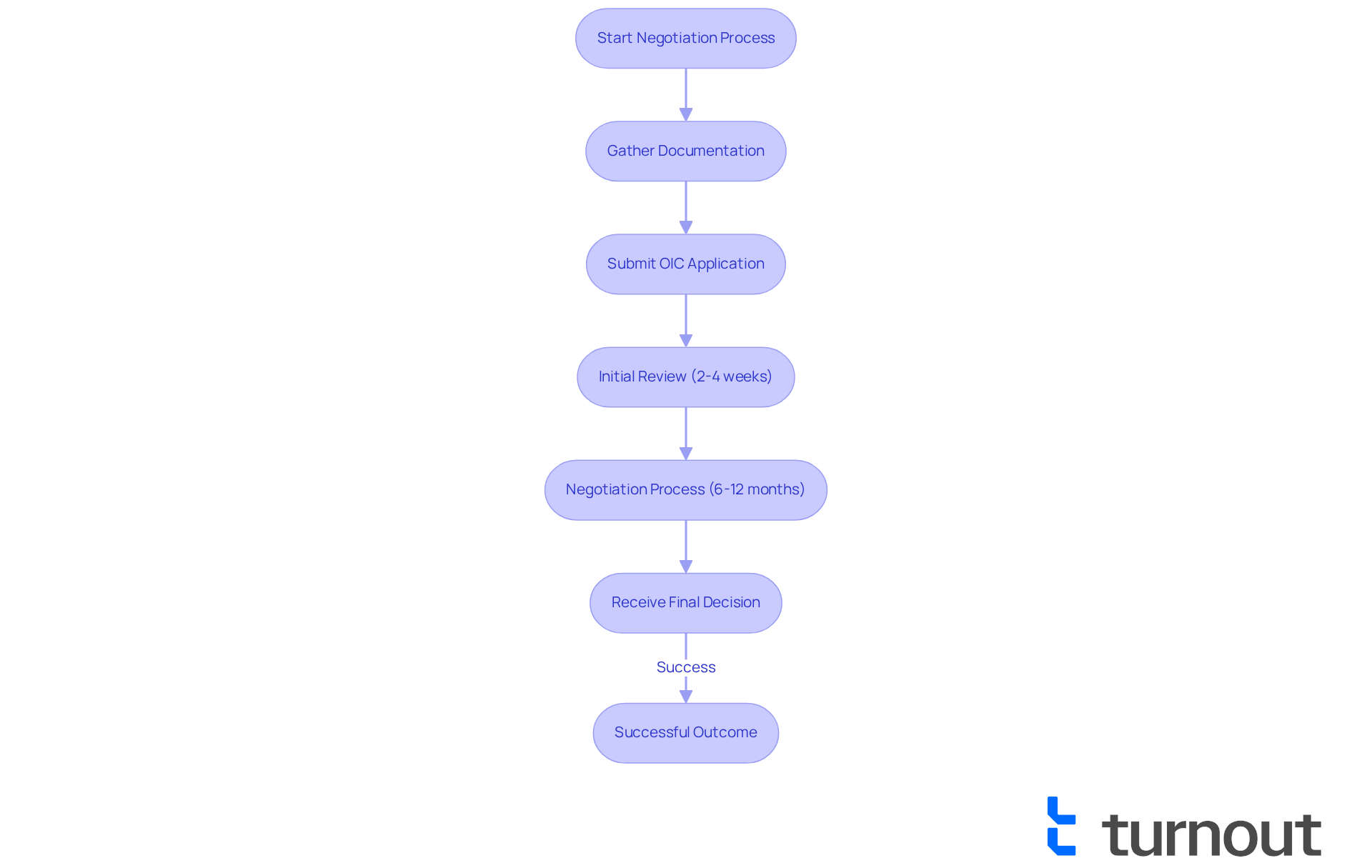

IRS Tax Relief Group: Direct Negotiation with the IRS

The group from the IRS is navigate the complexities of . We understand that facing tax issues can be overwhelming. By directly negotiating with the IRS, our team leverages a deep understanding of to advocate effectively for you. This approach simplifies the often convoluted , ensuring you receive the best possible outcomes.

In 2025, many individuals have experienced quicker resolutions through direct negotiation, often within just a few months. For example, the initial review of an (OIC) application typically takes about 2-4 weeks. The overall process can range from 6 to 12 months. This efficiency is crucial, particularly for those who owe $15,000 or more in back taxes. Timely responses to IRS requests can significantly expedite the negotiation process.

Successful outcomes from negotiations truly highlight the effectiveness of this approach. Customers have shared their stories of , such as one person saving $23,000 through our intervention. These results reinforce the importance of having a dedicated team that understands the nuances of tax negotiations and is committed to your success.

As the landscape of tax resolution evolves, it’s essential to stay informed about the benefits of direct negotiation. Factors such as case complexity and IRS backlog can influence the OIC timeline. We encourage you to be prepared and proactive. The tax relief group from the IRS is here to adapt to these changes, ensuring you are well-equipped to with confidence.

James Madison once stated, "The power of taxing people and their property is essential to the very existence of government." This emphasizes the importance of and seeking assistance when needed. If you’re considering an OIC, we advise gathering all necessary documentation and responding promptly to IRS requests. This will help facilitate a smoother negotiation process. Remember, you are not alone in this journey; we’re here to help.

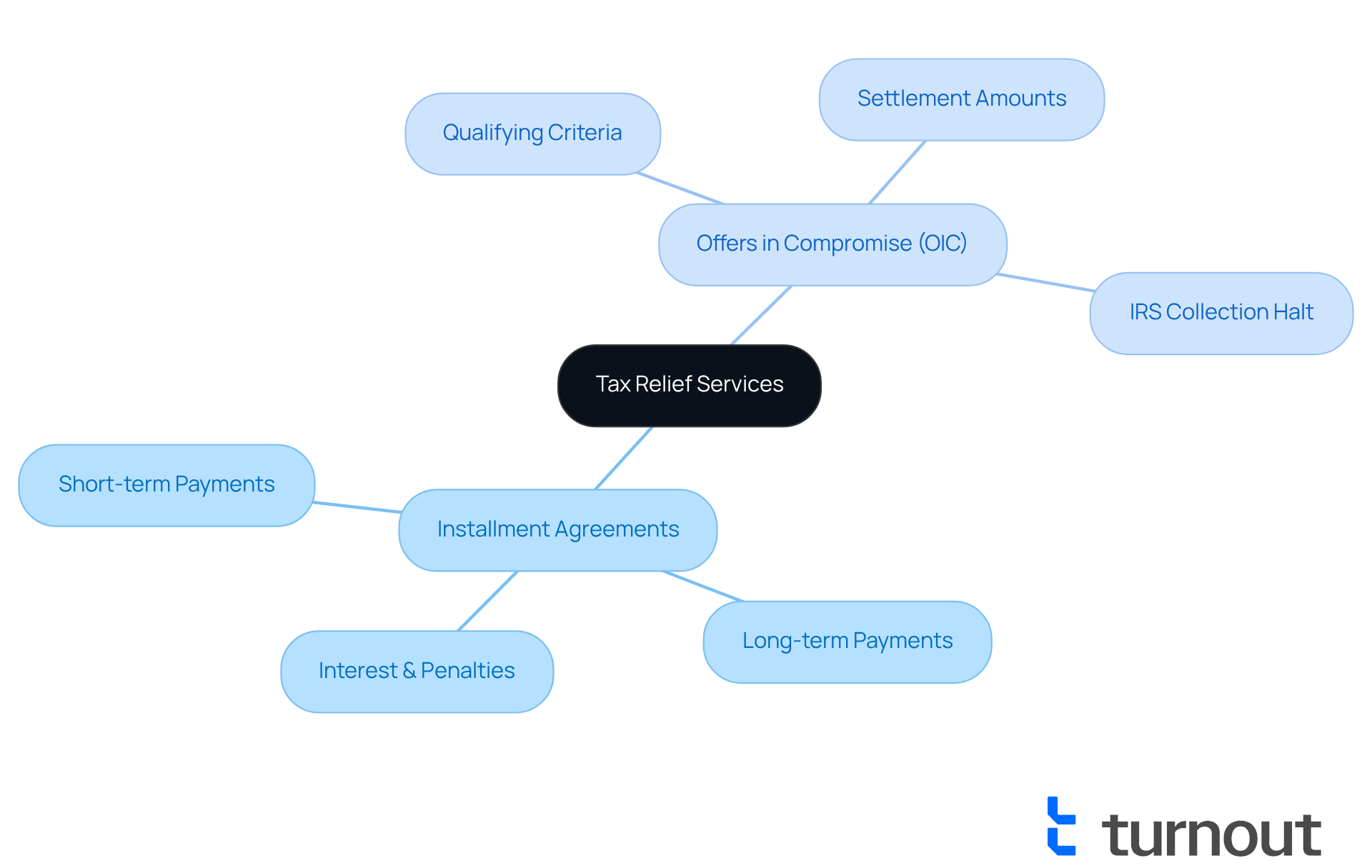

Tax Relief Services: Diverse Options for Tax Debt Resolution

At the , we understand that managing can be overwhelming. That's why we offer a wide range of solutions tailored to meet your unique needs. Among these options, and (OIC) stand out as effective ways to help you manage your tax liabilities.

With installment agreements, you can break down your tax payments into smaller, more manageable monthly amounts. This approach is especially beneficial for those with a steady income who may struggle to pay their tax obligations in full. For instance, short-term can help manage obligations under $100,000 without any setup fee. Long-term options are available for individuals owing less than $50,000, although a setup fee applies. It's important to note that while these can ease the burden, they do not stop interest and penalties from accruing until the full balance is settled, which can affect the total amount owed over time.

On the other hand, the tax relief group offers in compromise provide a lifeline for individuals facing significant . This option allows you to resolve your tax obligations for less than the total amount owed. However, qualifying for an OIC can be complex, as the IRS requires proof of and a detailed review of your situation. If accepted, you can settle for a reduced amount, either as a lump sum or through structured payments over time. It's reassuring to know that the IRS typically cannot enforce collection while a payment plan or OIC request is pending, giving you peace of mind during the resolution process.

Clients who have worked with the tax relief group often share their satisfaction, especially when their unique are taken into account. By exploring both payment arrangements and settlement offers through a tax relief group, you can make informed decisions that align with your financial goals, leading to positive outcomes in managing your tax obligations. Additionally, the Taxpayer Advocate Service (TAS) is available to assist those facing financial difficulties or immediate threats of adverse action, providing further support.

Understanding the pros and cons of each option is essential for effective tax debt management. At Tax Relief Services, we are committed to ensuring you feel informed and supported throughout this journey. Remember, you are not alone in this; we're here to help you navigate your tax challenges with confidence.

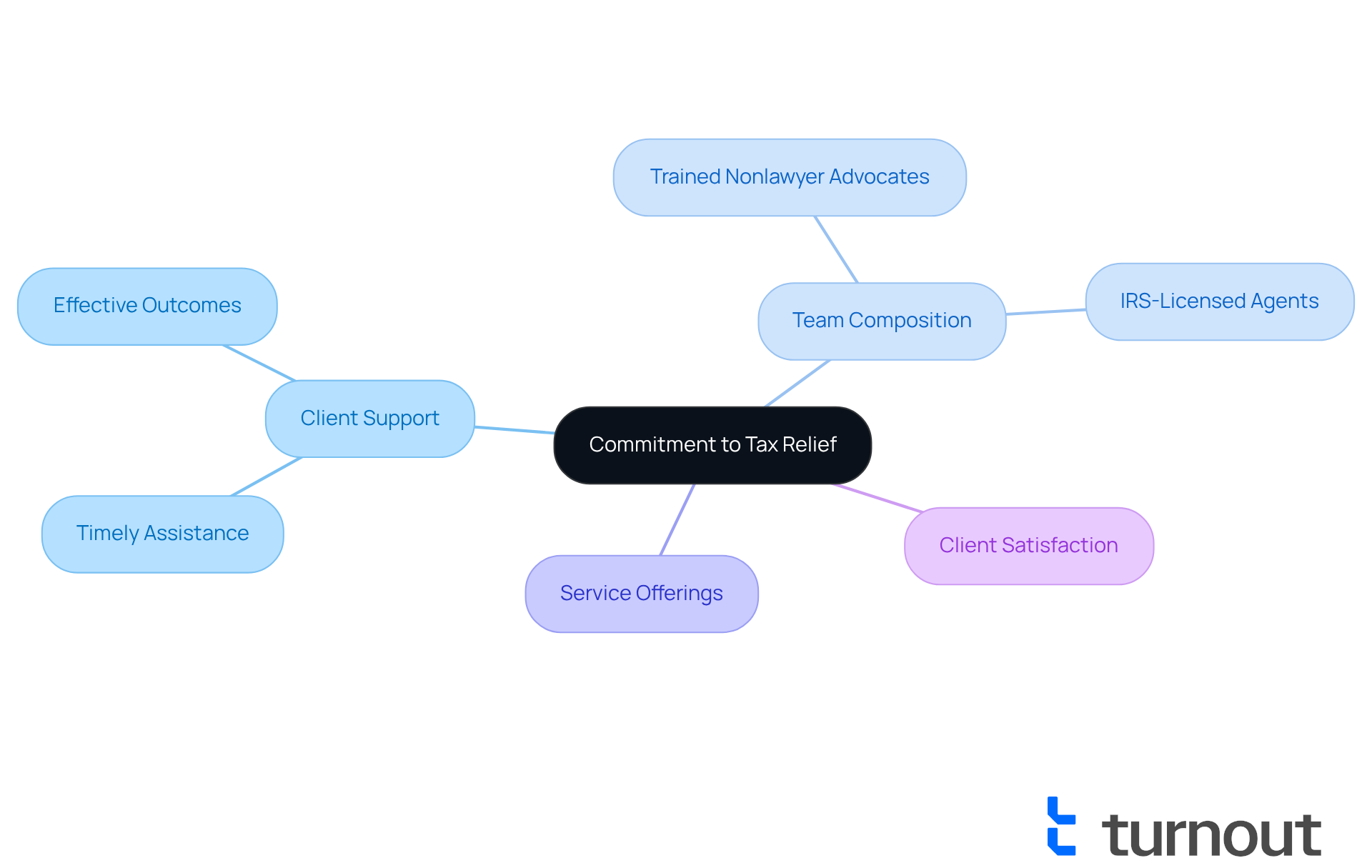

National Tax Relief: Commitment to Achieving Tax Relief for Clients

At Turnout, we understand that can be overwhelming. Our dedication lies in providing effective solutions through our , tailored to your unique circumstances, especially for those and governmental systems. Our committed team works tirelessly to comprehend your individual situation, crafting strategies that prioritize your success and satisfaction.

This commitment fosters enduring connections and offers reassurance to those grappling with tax responsibilities while seeking government assistance, including help from a tax relief group, such as (SSD). With trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents in our tax relief group for , we ensure you receive qualified support without the need for legal representation.

When you turn to us, you can expect timely assistance and . In fact, our average resolution time is significantly shorter than industry standards. Your satisfaction is our priority, as reflected in our high feedback ratings, showcasing the positive impact of our services.

As Benjamin Franklin wisely observed, 'In this world, nothing is certain except death and taxes.' That's why having a reliable partner like Turnout is crucial as you . Remember, —we're here to help.

Conclusion

Navigating the complexities of tax obligations can feel overwhelming, but finding the right tax relief group can truly transform your experience. This article highlights seven top organizations dedicated to providing personalized support, expert guidance, and innovative solutions, helping individuals manage their tax debt effectively. Whether it’s leveraging AI technology at Turnout or the comprehensive strategies offered by Tax Defense Network, these groups are committed to simplifying the tax relief process and empowering you every step of the way.

We understand that tailored approaches in tax resolution are vital. Community Tax and CuraDebt exemplify this by emphasizing the importance of understanding each client's unique financial situation. Moreover, the proactive negotiation techniques employed by organizations like Taxation Solutions and the IRS Tax Relief Group can lead to significant savings and favorable outcomes for you. Each group showcased offers distinct advantages—be it personalized support, expert advocacy, or innovative technology—reinforcing the notion that help is readily available for those who seek it.

In a world where tax challenges are inevitable, reaching out to a reliable tax relief group is crucial for achieving financial stability. The insights provided in this article serve as a guiding light for anyone facing tax obligations, encouraging you to take proactive steps towards resolution. By exploring the diverse options available, you are empowered to make informed decisions that align with your needs, ultimately paving the way for a brighter financial future. Remember, you are not alone in this journey; support is just a call away.

Frequently Asked Questions

What is Turnout and how does it assist with tax relief?

Turnout is a tax relief group that utilizes AI technology, specifically their AI-driven platform named Jake, to provide timely updates and comprehensive support during the tax relief process. They streamline case management, enhance accuracy, and allow for real-time monitoring of compliance.

What are the benefits of using AI in tax relief services?

The benefits of AI in tax relief include improved precision in recognizing deductions, shortened processing durations, and better consumer advocacy, all contributing to effective tax obligation resolution.

Does Turnout provide legal advice?

No, Turnout is not a law firm and does not provide legal advice. They utilize trained nonlawyer advocates and IRS-licensed enrolled agents for support.

How does Optima Tax Relief help individuals with tax debt?

Optima Tax Relief provides personalized support to develop strategies that address unique tax issues, increasing the chances of successful resolution and alleviating stress associated with tax challenges.

What success have customers experienced with Optima Tax Relief?

Many customers have reported resolving their tax issues in a fraction of the time it would take to navigate the complexities alone, often experiencing significant reductions in the time required for resolution.

What is the importance of understanding the total amount owed to the IRS?

Understanding the total amount owed to the IRS is crucial for determining the right strategy for resolving tax issues and maximizing relief options available.

What services does Tax Defense Network offer for tax resolution?

Tax Defense Network offers services such as negotiating with the IRS, setting up payment plans, and providing guidance on tax compliance to help individuals and businesses resolve tax challenges.

How can successful negotiations with the IRS benefit taxpayers?

Successful negotiations can lead to resolving financial responsibilities for less than the total amount owed, particularly through programs like Offers in Compromise, easing the financial burden on taxpayers.

What is penalty abatement and how can it help taxpayers?

Penalty abatement is a program that can significantly reduce or eliminate penalties for those who meet specific criteria. It is a valuable resource for taxpayers facing penalties.

Why is it important to address both federal and state tax obligations?

Addressing both federal and state tax obligations is crucial to avoid aggressive collection actions and serious repercussions, ensuring overall financial stability.

What should individuals do if they face severe financial hardship regarding tax obligations?

Individuals facing severe financial hardship should consider the option of Currently Not Collectible (CNC) status, which may provide relief from tax collection efforts.