Overview

Navigating the tax filing process can be daunting, especially when it comes to completing Form 1040 in Spanish. We understand that you may feel overwhelmed, but we're here to guide you through it. This article outlines four essential steps to help you along the way:

- Gathering necessary documents

- Filling out personal information

- Reporting your earnings

- Claiming deductions

It's crucial to grasp the form's structure and stay updated on recent changes. This knowledge can help you avoid common mistakes and maximize your potential refunds. Remember, proper preparation and understanding can truly simplify the tax filing journey.

You are not alone in this process. With the right support and information, you can tackle Form 1040 with confidence. Let's work together to ensure your tax experience is as smooth as possible.

Introduction

Navigating the complexities of tax season can feel overwhelming, especially when trying to understand the intricacies of Form 1040. This essential document is the cornerstone for millions of taxpayers, detailing earnings, deductions, and tax liabilities. We understand that clarity is crucial during this time. This guide not only breaks down the steps to complete Form 1040 in Spanish but also highlights critical updates and resources to ensure a smooth filing experience.

It's common to feel uncertain with evolving tax regulations and common pitfalls to avoid. So, how can you confidently tackle Form 1040 and maximize your potential refunds? We’re here to help you navigate this process without falling prey to mistakes.

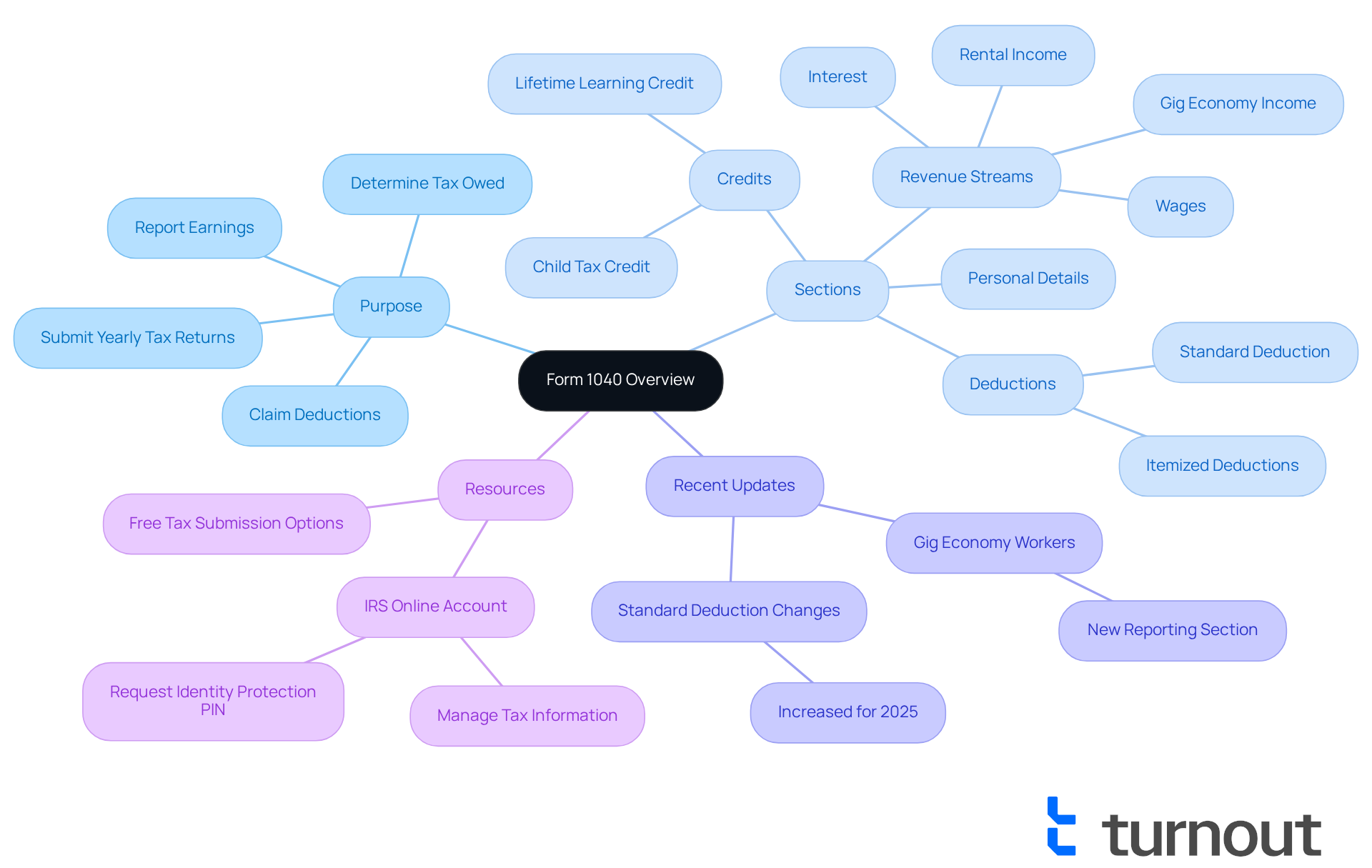

Understand Form 1040: Key Information and Purpose

Form 1040 is the primary IRS document that individuals use to submit their yearly tax returns. It allows you to report your earnings, claim deductions, and determine what you owe. We understand that navigating the layout of the can feel overwhelming. It's essential to know that it includes sections for personal details, various revenue streams, deductions, and credits. Familiarity with the form's structure not only simplifies the submission process but also ensures that all necessary information is accurately reported.

Each year, over 150 million taxpayers file Form 1040, underscoring its importance in the tax landscape. that having a clear understanding of the formulario 1040 en español can help you avoid common pitfalls and . As one expert wisely noted, 'Staying informed on changes gives you a real edge.' This knowledge is particularly vital as the IRS updates the formulario 1040 en español annually to reflect new tax rules and regulations.

Recently, updates have included:

- A to declare earnings from digital platforms.

- The , which can significantly impact your tax liability and possible refunds.

We want to reassure you that the IRS has also enhanced the Individual Online Account, making it easier for you to .

If you find yourself facing financial limitations, know that there are complimentary available. These resources are designed to simplify the process for everyone, ensuring that you can manage your tax submissions with confidence. Remember, you are not alone in this journey—we're here to help you every step of the way.

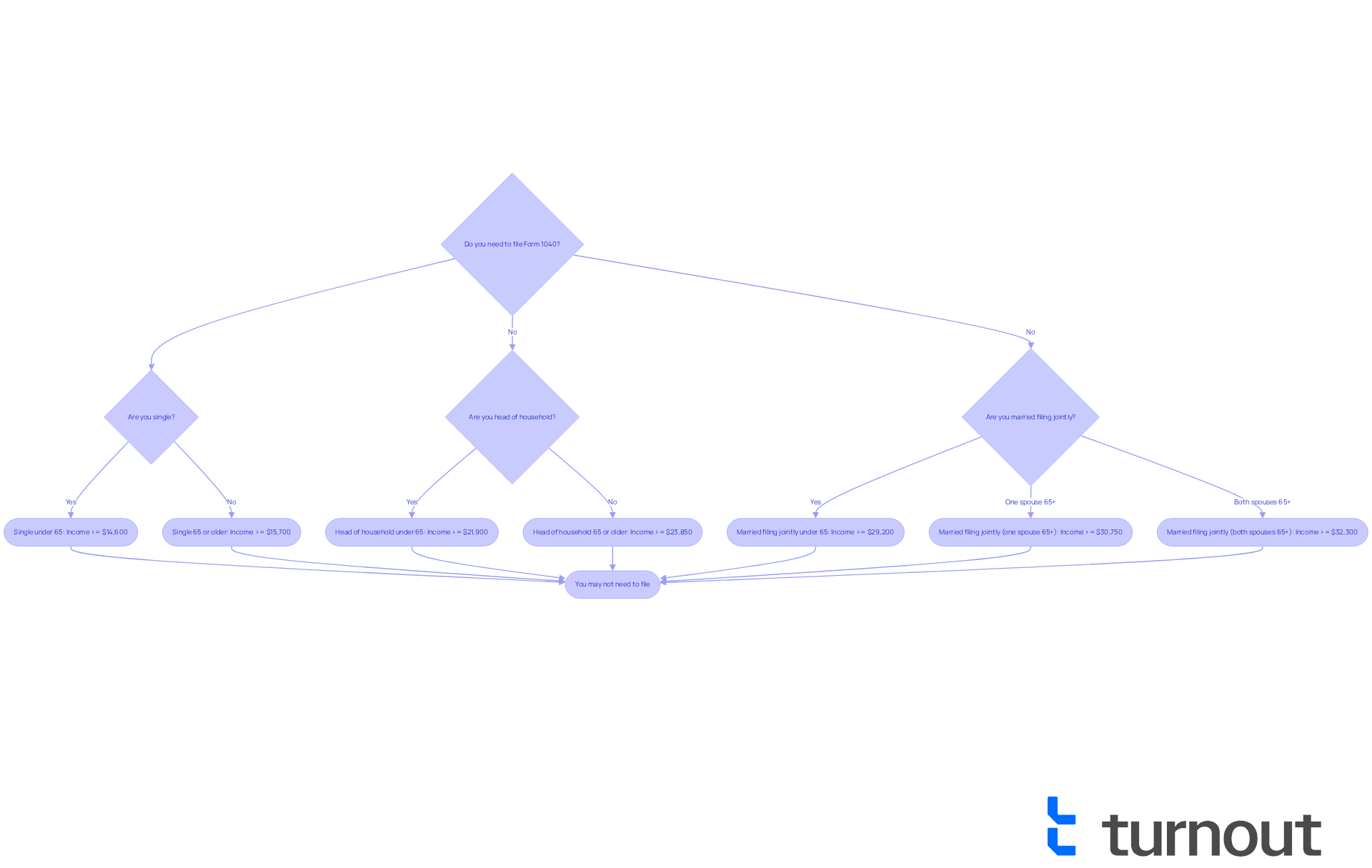

Determine Eligibility: Who Needs to File Form 1040?

We understand that figuring out whether you need to can be overwhelming. To help you navigate this, it's important to evaluate your total earnings, tax status, and age. Generally, if your total earnings exceed the IRS threshold for your filing status, you are required to file. For the tax year 2024:

- Single filers under 65 must submit if their earnings reach a minimum of $14,600.

- Head of household filers under 65 must file if their earnings are at least $21,900.

It's also essential to know that if you owe particular taxes, received advance payments of the premium tax credit, or are claiming specific credits, . For instance, married partners submitting jointly need to report if their total gross income is at least $29,200 when both individuals are under 65. We encourage you to review the to verify your submission requirements, as these can vary based on personal situations.

Did you know that approximately 37% of taxpayers qualify for tax breaks? This makes it beneficial to file even if you think you may not need to. Neglecting to submit your taxes can lead to losing out on possible refunds or credits, so it's crucial to remain aware of your responsibilities. Remember, you are not alone in this journey. You can also use the Interactive Tax Assistant, an online resource that helps identify your submission requirements based on your specific circumstances.

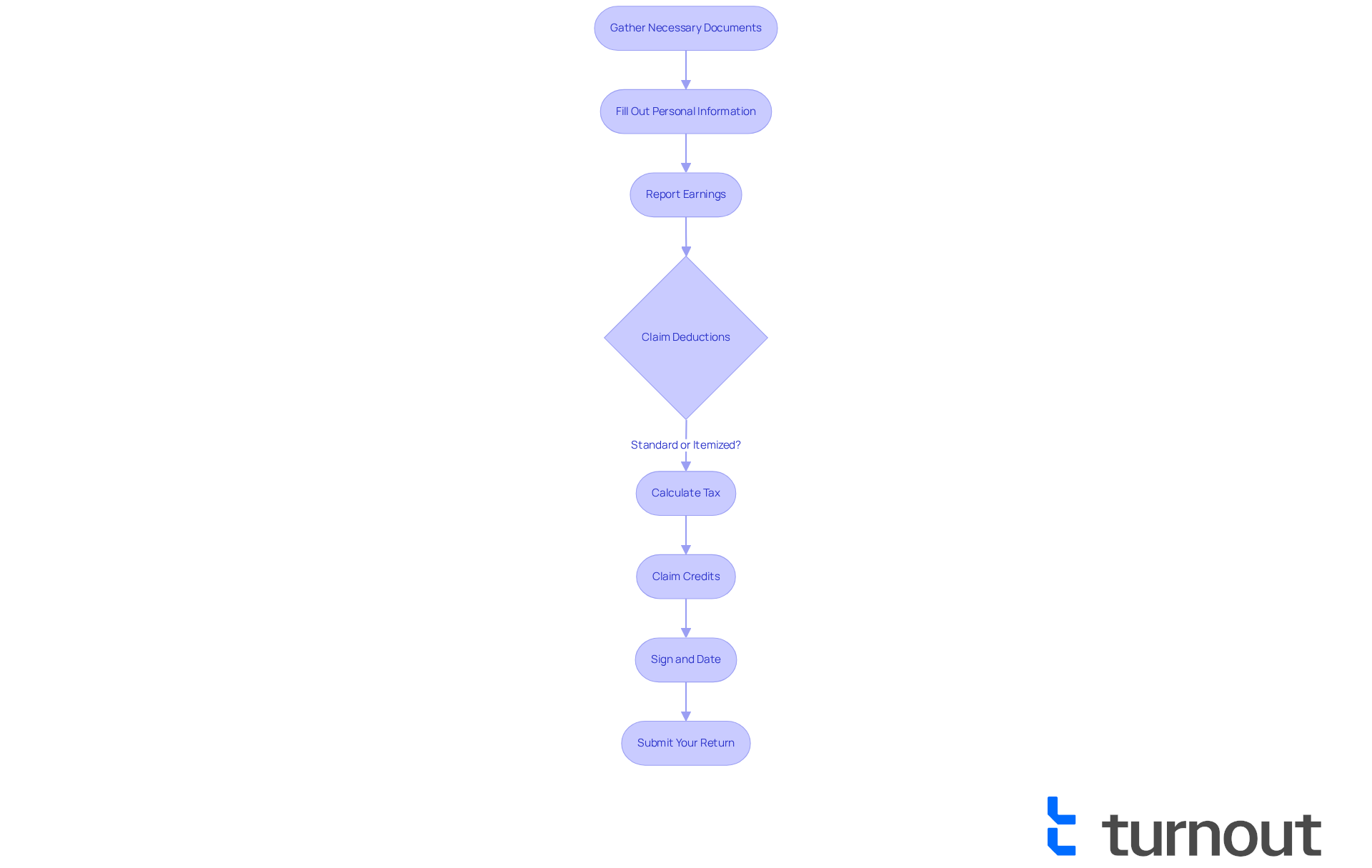

Complete the Form: Step-by-Step Instructions for Filing Form 1040

- Gather Necessary Documents: Before you begin, take a moment to you’ll need. This includes W-2s, 1099s, and any other earnings statements. Don’t forget to have your and those of your dependents handy.

- Fill Out Personal Information: At the top of the , kindly enter your name, address, and [Social Security number](https://myturnout.com/service/social-security-disability). If you’re filing jointly, remember to include your spouse's information as well.

- Report Earnings: In the earnings section, it’s essential to disclose all sources of revenue. This includes wages, dividends, and any other taxable earnings. Use the appropriate lines to carefully enter the amounts from your W-2s and 1099s.

- Claim Deductions: or itemize your deductions. For 2024, the standard deduction is $14,600 for single filers, $29,200 for married couples filing jointly, and $21,900 for heads of household. If you decide to itemize, complete Schedule A and transfer the total to the formulario 1040 en español.

- Calculate Tax: Use the tax tables provided by the IRS to determine your tax liability based on your taxable income. We understand that this can feel overwhelming, but taking it step by step helps.

- : If you’re eligible, be sure to claim any tax credits, such as the Earned Income Tax Credit or Child Tax Credit, which can significantly reduce your tax bill.

- Sign and Date: Don’t forget to . If you’re submitting together, both partners must sign to ensure everything is in order.

- Submit Your Return: You can choose to or mail your completed formulario 1040 en español to the appropriate IRS address based on your state.

It’s common to make mistakes, so be sure to double-check your Social Security number and and supporting documents for at least three years. Consider using tax preparation software for e-filing, as it can help ensure accuracy and speed up your refund process. Remember, if you need assistance, free tax preparation help is available for individuals earning $67,000 or less, those with disabilities, and seniors aged 60 and older. By following these steps carefully, you can ensure a smoother submission process and potentially increase your refund. You're not alone in this journey; we're here to help you every step of the way.

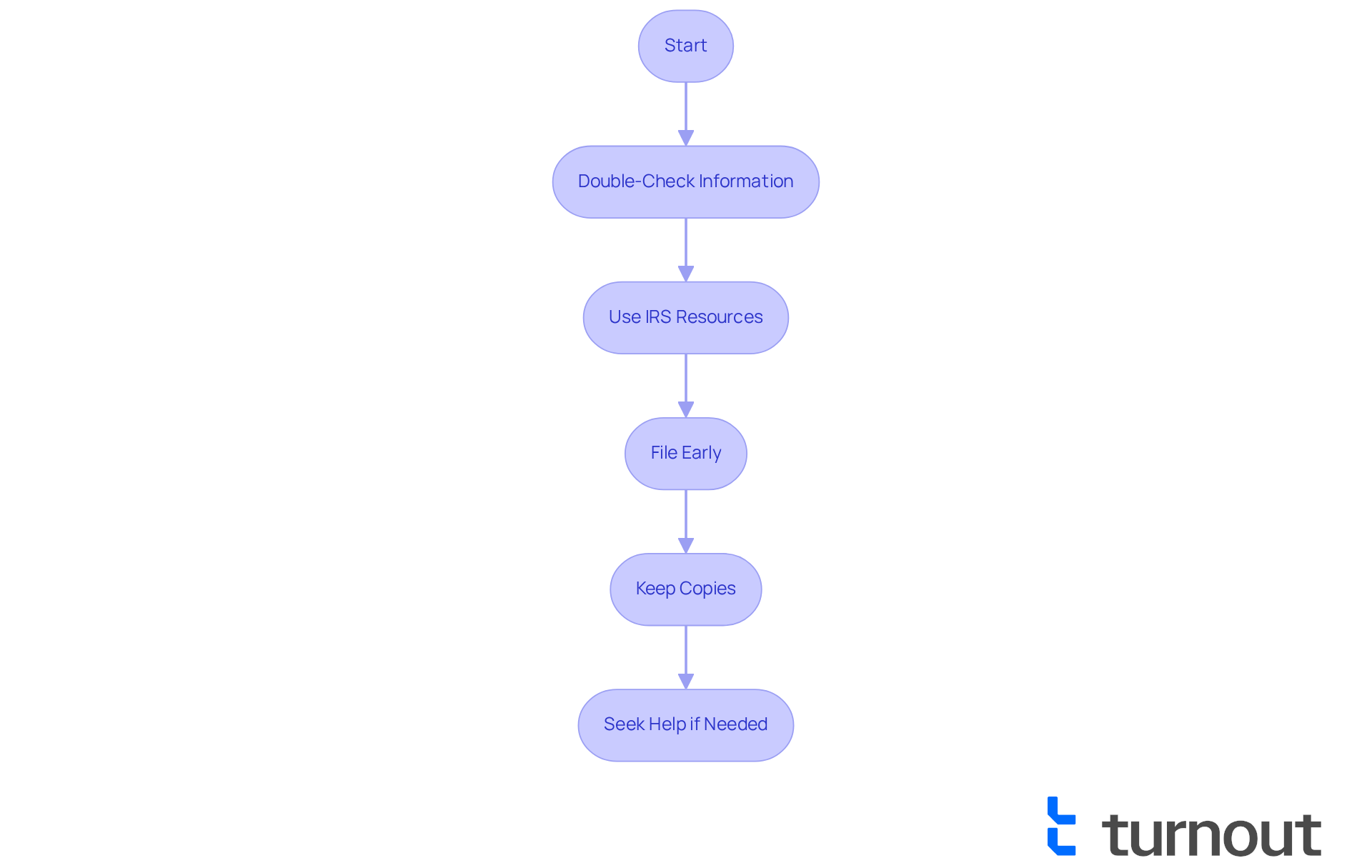

Troubleshoot Common Issues: Tips for a Smooth Filing Experience

- Double-Check Information: We understand that accuracy is crucial when it comes to your tax return. Ensure that all names, Social Security numbers, and financial figures are correct. Mistakes in these areas can lead to significant processing delays. In fact, the IRS has identified nearly 2.5 million math errors on returns filed for the 2017 tax year. By , you can avoid these . Remember, it’s vital that Social Security numbers match exactly as printed on the Social Security card to prevent processing issues.

- Use : If you encounter issues, it’s common to feel lost. Don’t hesitate to refer to the IRS website for guidance or utilize their interactive tools, like the Interactive Tax Assistant, to clarify your questions. These resources are designed to help you assess eligibility for credits and deductions, making the application process easier. Additionally, consider exploring free submission options like IRS Free File or MilTax for military service members and veterans. We’re here to help you navigate these resources.

- File Early: We know that tax season can be stressful. To alleviate some of that pressure, submit your tax return as early as possible. This proactive step can help you avoid last-minute issues and ensure prompt receipt of any refunds. can significantly reduce errors, with the IRS reporting an error rate of less than 1% for e-filed returns compared to 21% for paper submissions. By filing early and electronically, you not only minimize errors but also sidestep the stress of last-minute entries.

- Keep Copies: It’s important to feel prepared. Always and any supporting documents. This practice is crucial in case of audits or discrepancies, as having accurate records can simplify the resolution process. You are not alone in this journey; being organized can help ease your mind.

- Seek Help if Needed: If the process feels overwhelming, know that it’s okay to ask for help. Consider reaching out to a or a trusted resource for assistance. Involving experienced tax preparers can greatly decrease the chances of mistakes, providing a more seamless submission experience. As the IRS recommends, utilizing electronic filing tools can provide the fastest way to get the information and answers you need to file your federal tax returns. Remember, you have support available to you.

Conclusion

Understanding and completing Form 1040 is essential for individuals navigating their tax responsibilities. We recognize that this process can feel overwhelming, and that’s why being informed about the structure and requirements of the formulario 1040 en español is so important. This knowledge allows taxpayers to accurately report their earnings, claim deductions, and avoid common mistakes that could impact their refunds.

This guide outlines crucial steps for successfully filing Form 1040. Start by determining your eligibility based on income and filing status. Next, gather all necessary documents meticulously. Following a structured approach to complete the form can make a significant difference. Key insights, such as recent updates to the form and the availability of free tax assistance, highlight resources that can make the process more manageable and less intimidating.

Ultimately, being proactive and organized in tax filing simplifies the experience and maximizes potential refunds and credits. By taking the time to familiarize yourself with the requirements and utilizing available resources, you can approach your tax submissions with confidence. Remember, you are not alone in this journey—embracing this knowledge empowers you to navigate your financial obligations effectively, ensuring a smoother and more rewarding tax season.

Frequently Asked Questions

What is Form 1040?

Form 1040 is the primary IRS document that individuals use to submit their yearly tax returns, allowing them to report earnings, claim deductions, and determine tax liabilities.

Why is understanding Form 1040 important?

Understanding Form 1040 is important because it helps taxpayers avoid common pitfalls, maximize potential refunds, and ensures that all necessary information is accurately reported.

How many taxpayers file Form 1040 each year?

Over 150 million taxpayers file Form 1040 each year.

What are some recent updates to Form 1040?

Recent updates to Form 1040 include a new section for gig economy workers to declare earnings from digital platforms and an increase in the standard deduction for 2025.

How has the IRS improved the Individual Online Account?

The IRS has enhanced the Individual Online Account to make it easier for taxpayers to manage their tax information.

Are there resources available for individuals facing financial limitations when filing taxes?

Yes, there are complimentary tax submission options available to help simplify the process for everyone.