Overview

Filing your Arkansas tax return can feel overwhelming, but we're here to help you through it. This article outlines a five-step process designed to guide you confidently. Understanding tax basics is crucial, and we acknowledge that this can be a source of stress for many.

- Start by gathering the necessary documentation. We understand that organizing paperwork can be daunting, but it’s an essential step in simplifying your filing experience.

- Next, you’ll complete the tax form. Remember, resources like TurboTax are available to assist you, ensuring you don’t miss out on maximizing your refund.

- Once your form is ready, the next step is submitting it. It’s common to feel anxious about this stage, but rest assured that you are taking the right steps.

- Finally, tracking your tax return's status is vital. You can stay informed and feel more in control of the process.

Each step is supported by detailed explanations of Arkansas's tax structure and required forms. You are not alone in this journey—many find comfort in knowing there are resources available to help simplify the process. With these steps, you can approach your tax return with confidence, knowing that meeting deadlines and maximizing your refund is achievable.

Introduction

Navigating the intricacies of filing a tax return can often feel daunting, especially in a state like Arkansas, with its unique tax laws. We understand that grasping the state's graduated tax system, which ranges from 0% to 3.9% based on earnings, is just the beginning of your journey.

This guide will break down the essential steps to help you file your Arkansas tax return with confidence. Our goal is to maximize your potential refunds and help you avoid common pitfalls along the way.

How can you ensure that you are fully prepared and informed, transforming what is often seen as a stressful obligation into a straightforward process? You're not alone in this journey—we're here to help.

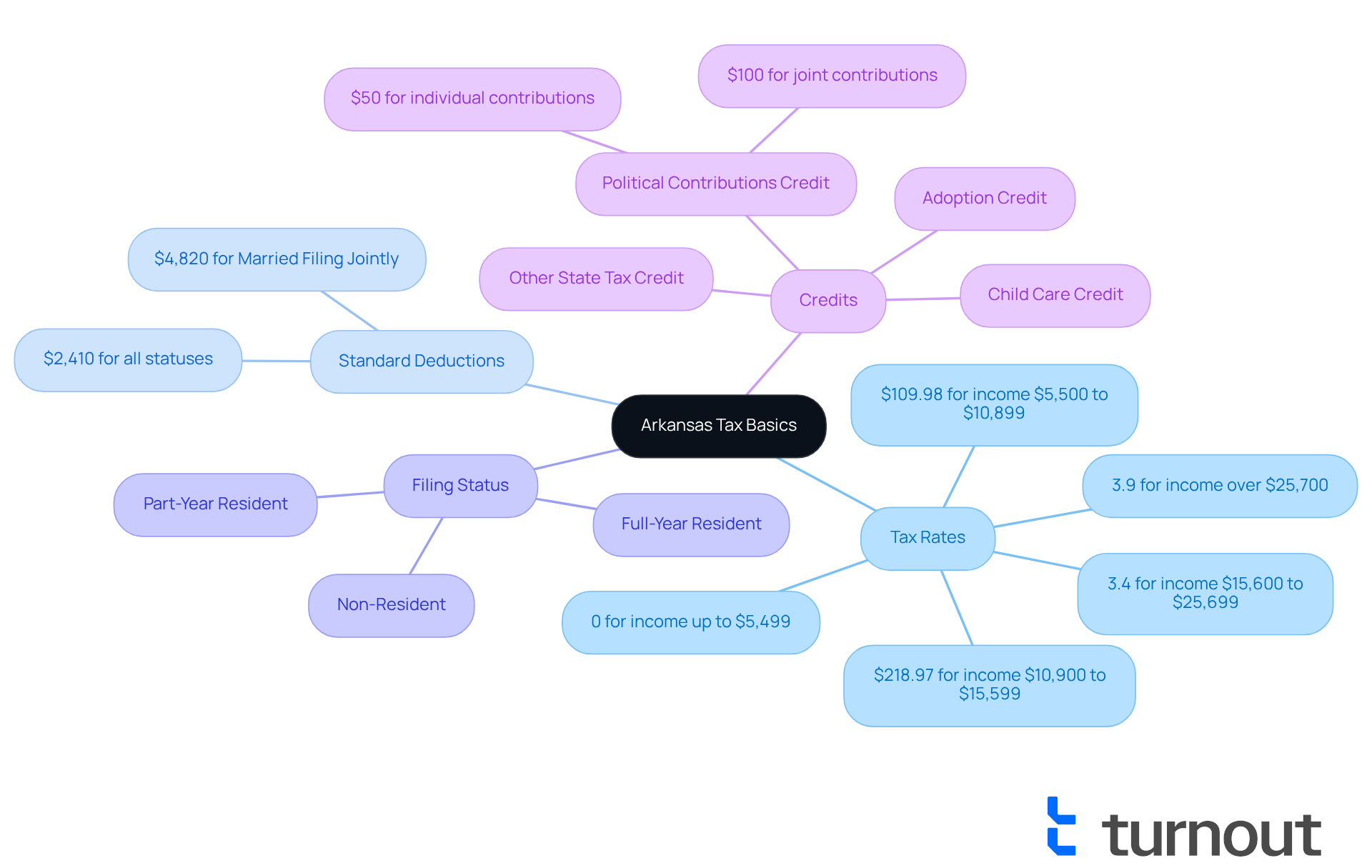

Understand Arkansas Tax Basics

Before you file your Arkansas , it's important to . We know that navigating taxes can be overwhelming, but . , with rates ranging from 0% to 3.9%, depending on your earnings. For the 2025 tax year, the earnings tax rates are as follows:

- Amounts up to $5,499 are exempt from tax.

- If you earn between $5,500 and $10,899, you will incur a tax of $109.98.

- For individuals making between $10,900 and $15,599, the tax is $218.97.

- Earnings from $15,600 to $25,699 are taxed at 3.4%.

- If your earnings exceed $25,700, the tax rate increases to 3.9%.

Moreover, for all statuses, except for Married Filing Jointly, which has a standard deduction of $4,820. This deduction can significantly reduce your taxable income and enhance your potential refund. It's common to feel anxious about deadlines, so remember that the for the 2025 tax year is generally April 15. , such as natural disasters.

Understanding your filing status—whether you are a full-year resident, part-year resident, or non-resident—is crucial for your Arkansas tax return, as it directly affects your tax obligations. Full-year residents are taxed on all income, while non-residents are only taxed on Arkansas-sourced income. If you make political contributions, you may qualify for the , allowing a credit of $50 per taxpayer or $100 for a joint return.

Getting acquainted with these details can greatly simplify the submission process and assist in . If you feel uncertain about the process, consider using tools like TurboTax. They can guide you through tax filing and help ensure you claim all eligible deductions and credits. Remember, you are not alone in this journey; we're here to support you every step of the way.

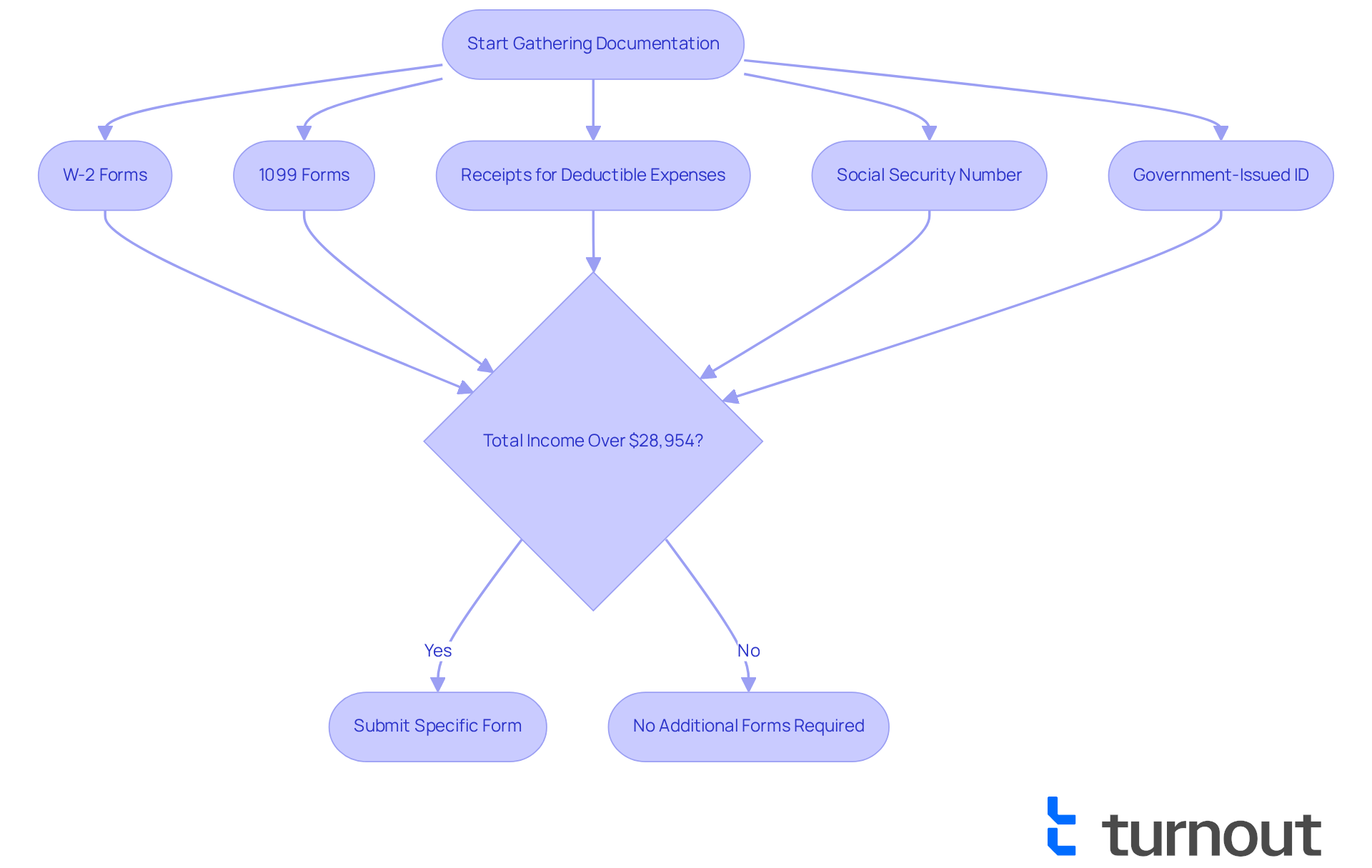

Gather Required Documentation

Filing your may seem overwhelming, but we're here to assist you with the process. Start by gathering your W-2 forms from your employers. These documents outline your yearly earnings and the taxes that have been deducted. If you have additional income sources, like freelance work or investments, don’t forget to collect your 1099 forms as well.

For the 2024 tax submission year, it's important to note that:

- If your total income exceeds $28,954 for married couples filing jointly, you will need to submit a specific form.

- Compile receipts for any , such as medical bills or charitable contributions. These can significantly impact your , and we want to ensure you take advantage of every opportunity.

It’s also wise to have your number and a government-issued photo ID ready. Furthermore, consider the , which allows you to claim:

- $50 for contributions to political candidates or parties in Arkansas

- $100 if you're filing jointly

Organizing these documents ahead of time will make the smoother and help you navigate the complexities of your [Arkansas tax return](https://blog.turbotax.intuit.com/income-tax-by-state/arkansas-106620) with confidence.

Utilizing resources like TurboTax can simplify the process even further, providing guidance on residency rules, . Remember, you're not alone in this journey, and taking these steps can make a significant difference.

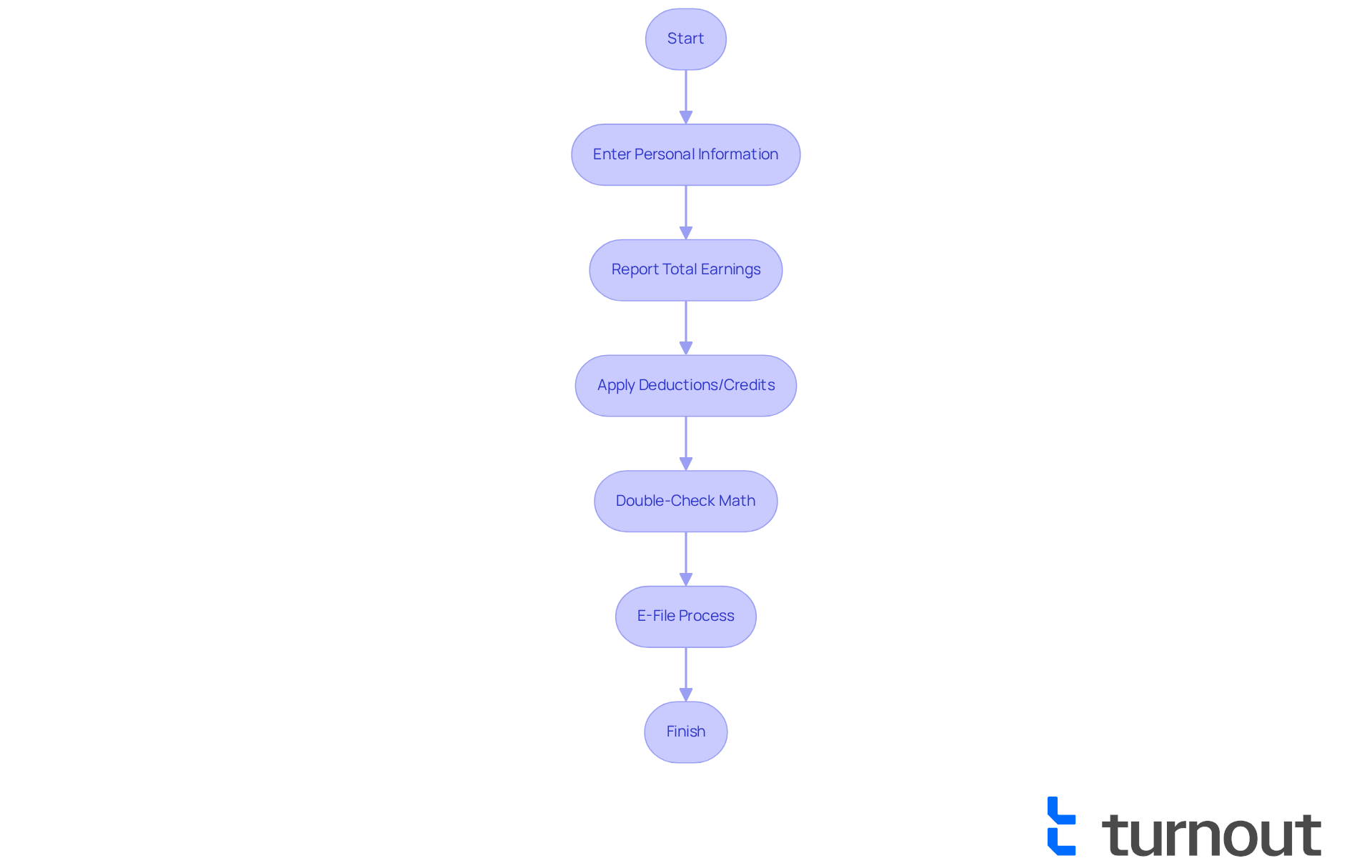

Complete Your Tax Return Form

Completing your may seem overwhelming, but . For full-year residents, you'll primarily use Form AR1000, while non-residents should refer to Form AR1000NR. Start by entering your personal information, including your name, address, and number.

Next, report your total earnings as indicated on your W-2 and 1099 forms. It's common to feel uncertain about this step, but just follow the instructions to calculate your . Remember to apply any deductions or credits you qualify for.

Double-checking your math is essential, and ensuring all required fields are filled out can alleviate some of that stress. If you choose to e-file, simply provided by your tax software to complete the process. You're not alone in this journey, and taking it step by step can make it manageable.

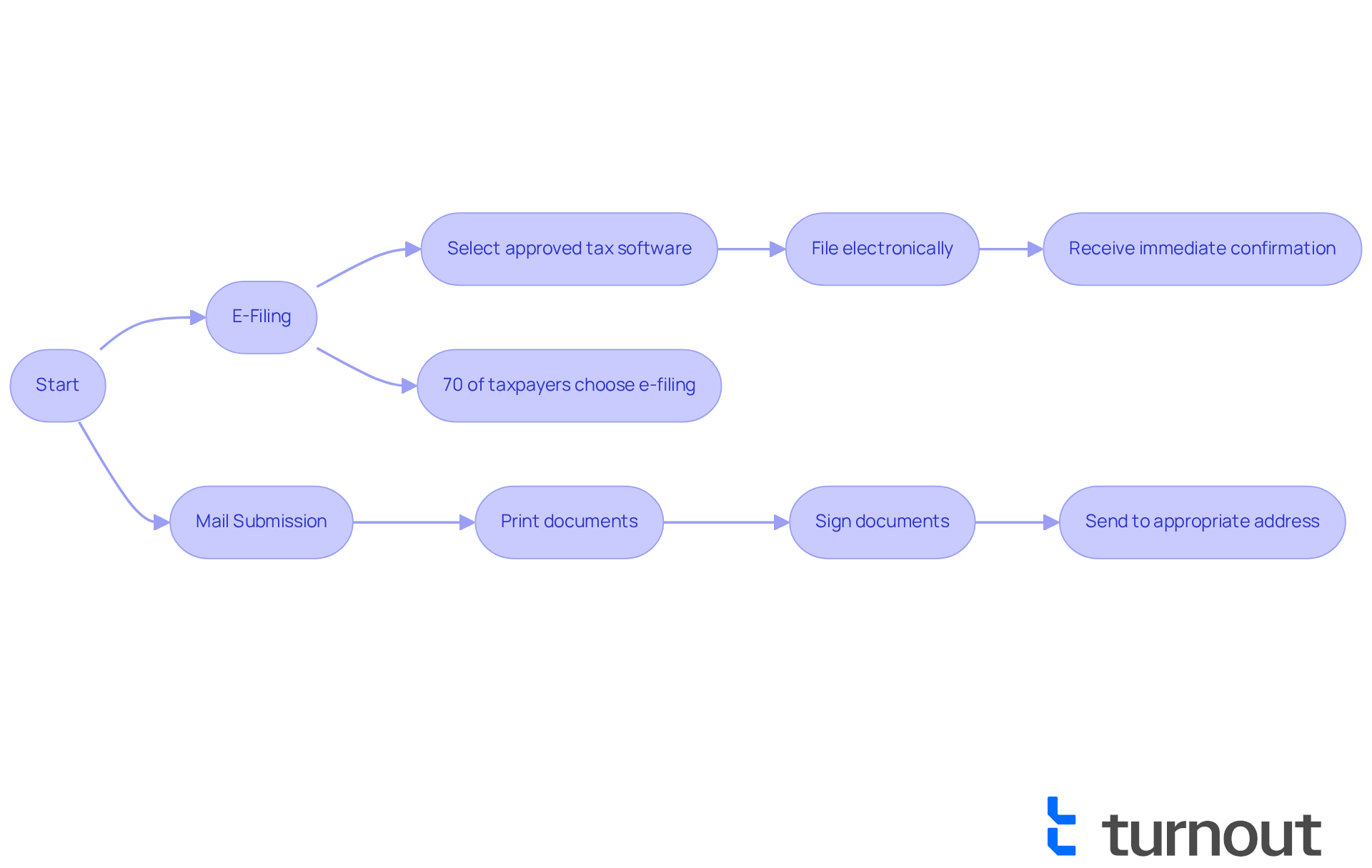

Submit Your Tax Return

After finishing your tax documentation, you have the choice to or by mail. If you opt for e-filing, we understand that selecting an can feel overwhelming. However, this option is increasingly popular, with approximately 70% of Arkansas taxpayers choosing to e-file their . This method offers and immediate confirmation of receipt, reflecting a growing trend among those who appreciate the efficiency of electronic submissions.

For individuals who prefer to mail their documents, we recommend:

- Printing

- Signing

- Sending it to the Arkansas Department of Finance and Administration at the appropriate address based on your submission type.

It's common to feel anxious , so please ensure you mail it well before the April 15 deadline to avoid any penalties. If you expect a refund, utilizing for tracking purposes, ensuring prompt receipt of your submission.

Remember, submitting the Arkansas tax return is mandatory for full-year residents, regardless of their income levels. Even if your income is below the threshold, we encourage you to submit your form to potentially claim refunds and avoid penalties. You're not alone in this journey; we're here to help you .

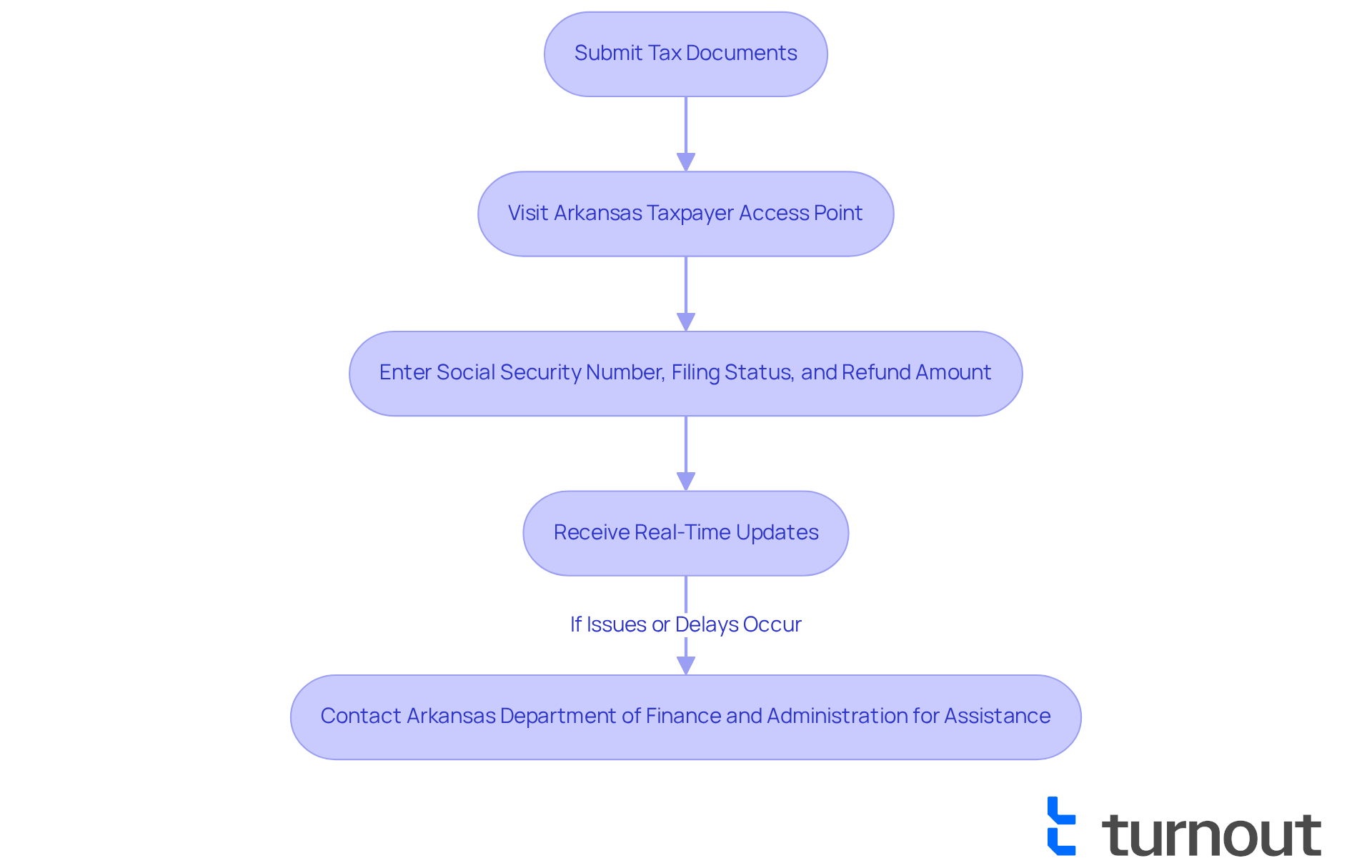

Track Your Tax Return Status

After submitting your tax documents, we understand that you may feel anxious about the status of your return. You can easily of your through the Arkansas Taxpayer Access Point. Simply visit the website and enter your number, filing status, and the exact amount of your expected refund. This will provide you with on the processing of your return, helping to ease your worries.

If you encounter any issues or delays, remember that you are not alone in this journey. You can reach out to the for assistance. They are here to help you you may face.

Conclusion

Understanding the intricacies of filing an Arkansas tax return can truly empower you to navigate the process with confidence. We know that tax season can be overwhelming, but by familiarizing yourself with the state's tax structure, gathering the necessary documentation, completing the appropriate forms, submitting your returns accurately, and tracking their status, you can ensure a smoother experience.

This guide has outlined essential steps for you, highlighting the importance of:

- Knowing Arkansas tax rates

- The significance of deductions

- The benefits of e-filing

We also emphasize the need for proper documentation, such as W-2 and 1099 forms, and the relevance of monitoring your return status through available resources. Each step is designed to alleviate the common anxieties associated with tax filing, making it a more manageable task.

Ultimately, being well-informed and organized can significantly enhance your tax filing experience. Embracing these steps not only aids in compliance with Arkansas tax laws but also maximizes your potential refunds and minimizes stress. Remember, taking action today to prepare for the upcoming tax season will pave the way for a more confident and efficient filing experience in 2025. You're not alone in this journey; we're here to help you every step of the way.

Frequently Asked Questions

What is the tax structure in Arkansas for the 2025 tax year?

Arkansas uses a graduated tax system with rates ranging from 0% to 3.9%. Earnings up to $5,499 are exempt from tax. For earnings between $5,500 and $10,899, the tax is $109.98; for $10,900 to $15,599, the tax is $218.97; earnings from $15,600 to $25,699 are taxed at 3.4%; and earnings exceeding $25,700 are taxed at 3.9%.

What is the standard deduction in Arkansas?

The standard deduction in Arkansas is $2,410 for all filing statuses, except for Married Filing Jointly, which has a standard deduction of $4,820.

What is the deadline for filing Arkansas tax returns for the 2025 tax year?

The submission deadline for the Arkansas tax return for the 2025 tax year is generally April 15. Extensions may be allowed in unique situations, such as natural disasters.

How does my filing status affect my Arkansas tax return?

Your filing status—full-year resident, part-year resident, or non-resident—affects your tax obligations. Full-year residents are taxed on all income, while non-residents are only taxed on Arkansas-sourced income.

What is the Political Contributions Credit in Arkansas?

The Political Contributions Credit allows taxpayers to claim a credit of $50 for contributions to political candidates or parties in Arkansas, or $100 for a joint return.

What documents do I need to gather to file my Arkansas tax return?

You need to gather W-2 forms from employers, 1099 forms for additional income sources, receipts for deductible expenses (like medical bills or charitable contributions), your Social Security number, and a government-issued photo ID.

What should I do if my total income exceeds $28,954 while filing jointly?

If your total income exceeds $28,954 for married couples filing jointly, you will need to submit a specific form.

How can I simplify the Arkansas tax filing process?

Utilizing resources like TurboTax can simplify the process by providing guidance on residency rules, tax deductions, and credits, helping you navigate the complexities of your Arkansas tax return.