Overview

This article is dedicated to helping you identify the key signs of phony IRS letters, so you can recognize and avoid scams. We understand how concerning it can be to receive unexpected communications, especially when they involve your finances. Essential indicators to look out for include:

- The absence of the official IRS seal

- Generic greetings

- Urgent payment demands

- Poor grammar

By being aware of these signs, you can empower yourself to differentiate between genuine and fraudulent communications effectively.

Remember, you are not alone in this journey. Many individuals face similar challenges, and it's common to feel uncertain. We’re here to help you navigate these situations with confidence. By staying informed and vigilant, you can protect yourself from potential scams. Take a moment to review these indicators and share this information with others who may benefit. Together, we can create a safer environment for everyone.

Introduction

Navigating the complexities of IRS communications can feel overwhelming, especially as fraudulent schemes become more sophisticated. With millions of letters sent out each year, it’s essential for taxpayers to recognize the key signs of phony IRS letters. By doing so, you can protect yourself from scams.

This article explores important indicators that will help you discern genuine correspondence from deceitful attempts, empowering you to respond with confidence. What if a seemingly official letter could lead to financial loss or legal troubles? Understanding these warning signs is crucial for safeguarding your personal information and ensuring a smooth tax experience.

Remember, you are not alone in this journey, and we’re here to help.

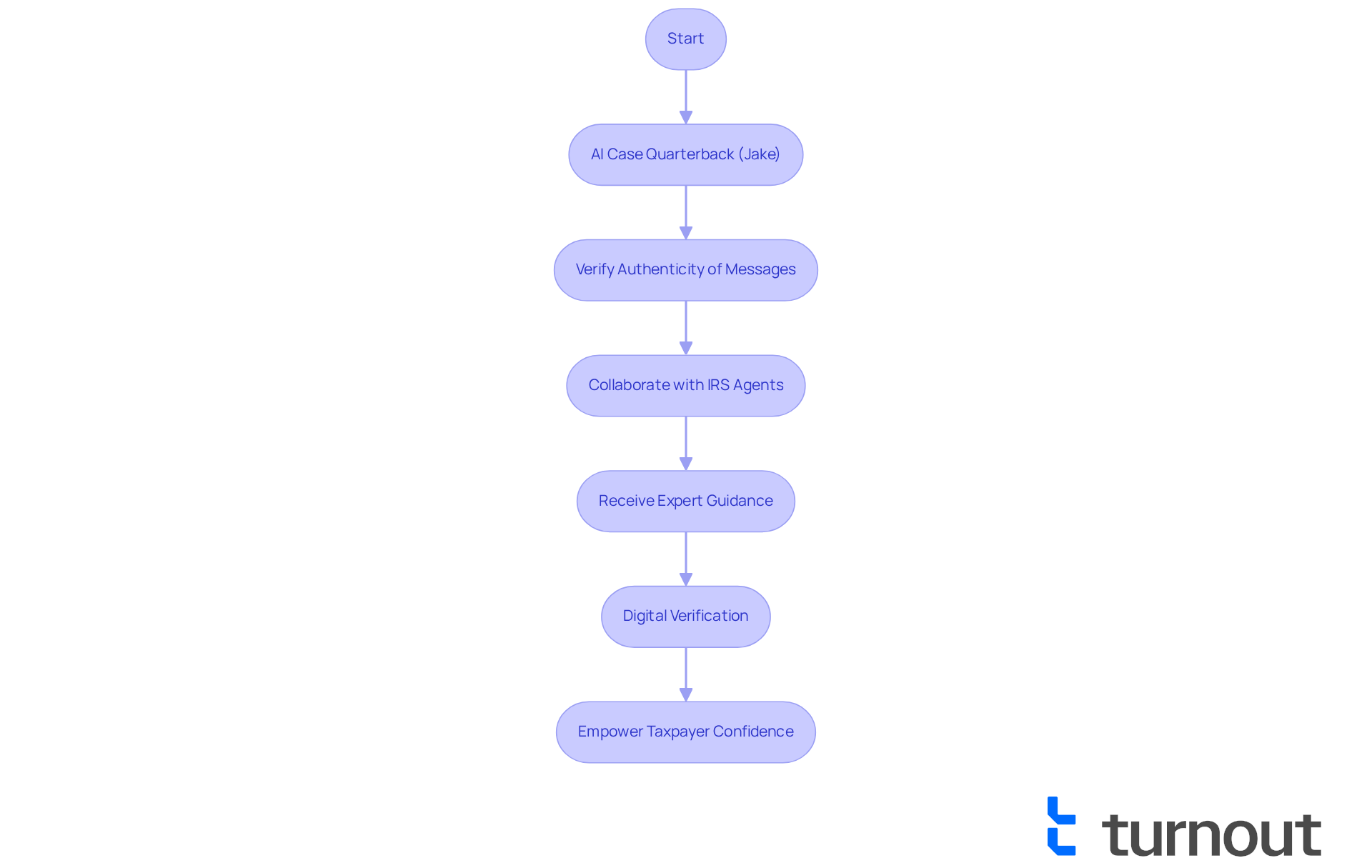

Turnout: Streamline Your IRS Communication Verification Process

Turnout transforms IRS interactions by harnessing AI technology to simplify the verification of letters and notices, including phony IRS letters. We understand that dealing with tax issues can be overwhelming. With Jake, our AI case quarterback, you can swiftly verify the authenticity of messages, significantly reducing the time and stress typically associated with these complex matters.

Our approach involves collaborating with IRS-licensed enrolled agents who are qualified to support you in tax debt relief processes. This ensures you receive expert guidance without the need for legal representation. It's comforting to know that according to recent findings, the IRS has improved its digital identification verification processes, allowing over 70% of tax filers to be verified digitally.

This proactive approach empowers you to address your IRS-related concerns with confidence and clarity, transforming what was once an arduous process into a manageable one. As a consumer advocate noted, 'AI can bring higher efficiencies when used in concert with human interaction.' By streamlining these interactions, Turnout not only enhances consumer advocacy but also fosters a more transparent and efficient relationship between taxpayers and the IRS.

We recognize the importance of carefully deploying AI technologies to mitigate potential challenges. Remember, you are not alone in this journey; we’re here to help you navigate your tax concerns with compassion and expertise.

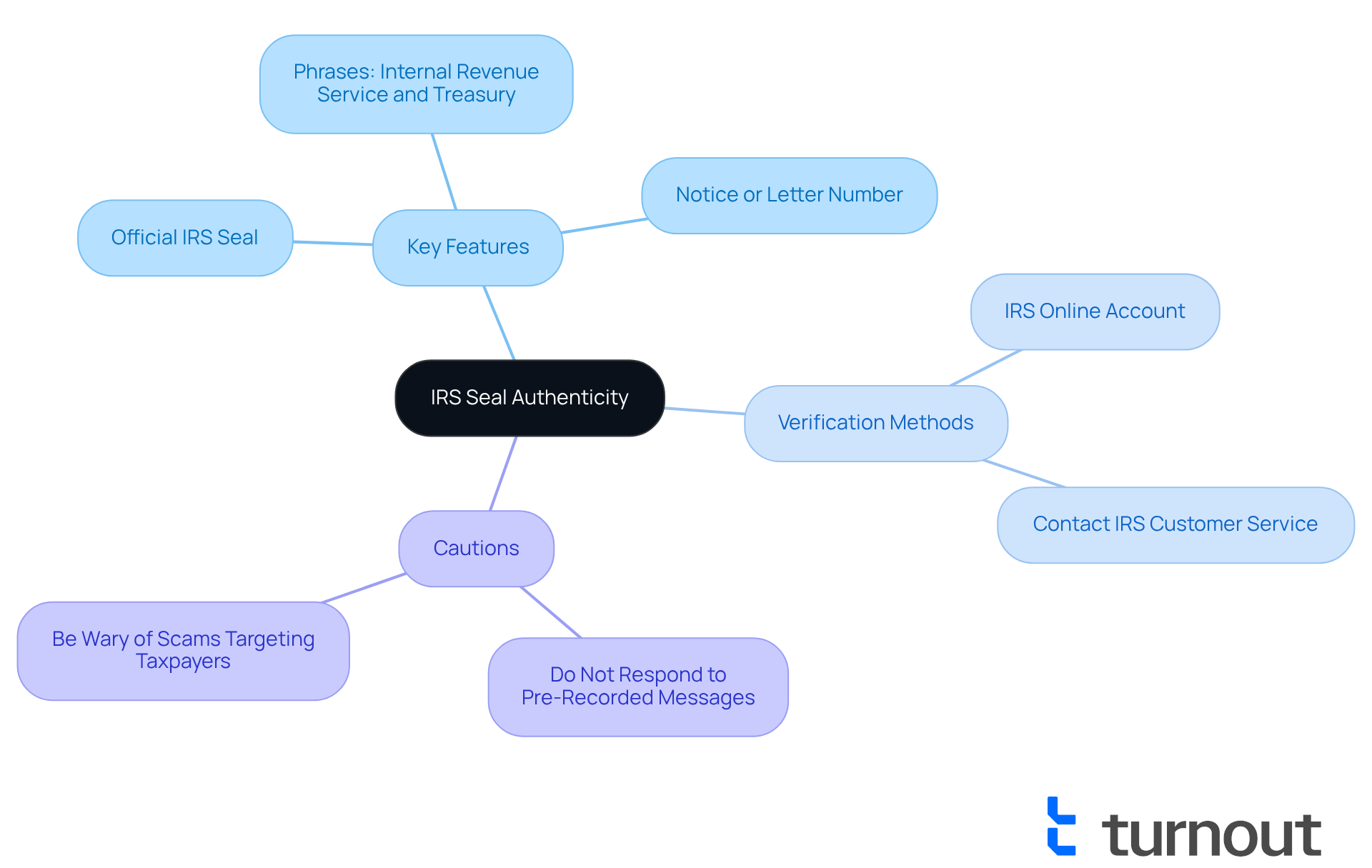

IRS Seal: Key Features to Identify Authenticity

The IRS seal is a crucial factor in helping you differentiate between genuine IRS communications and phony IRS letters. Genuine documents prominently display the official IRS seal on the header, which includes the phrases 'Internal Revenue Service' and 'Treasury' encircling the official shield. Moreover, legitimate IRS letters will contain a notice or letter number that you can verify on the IRS website. It's important to examine these traits to ensure the authenticity of any message you receive, as this can help you identify phony IRS letters.

We understand that navigating IRS communications can be daunting, and verifying the IRS seal is a crucial step in preventing phony IRS letters and scams. With the IRS handling over 266.6 million tax returns and forms each year, it is vital to know these key aspects to ensure you are responding to genuine messages and not being misled by phony IRS letters. Remember, the IRS does not leave pre-recorded, urgent, or threatening messages, so it's wise to be cautious of any correspondence that claims otherwise.

To further verify the authenticity of IRS communications, consider:

- Logging into your secure IRS Online Account

- Contacting IRS customer service directly

You're not alone in this journey; we're here to help you navigate these challenges with confidence.

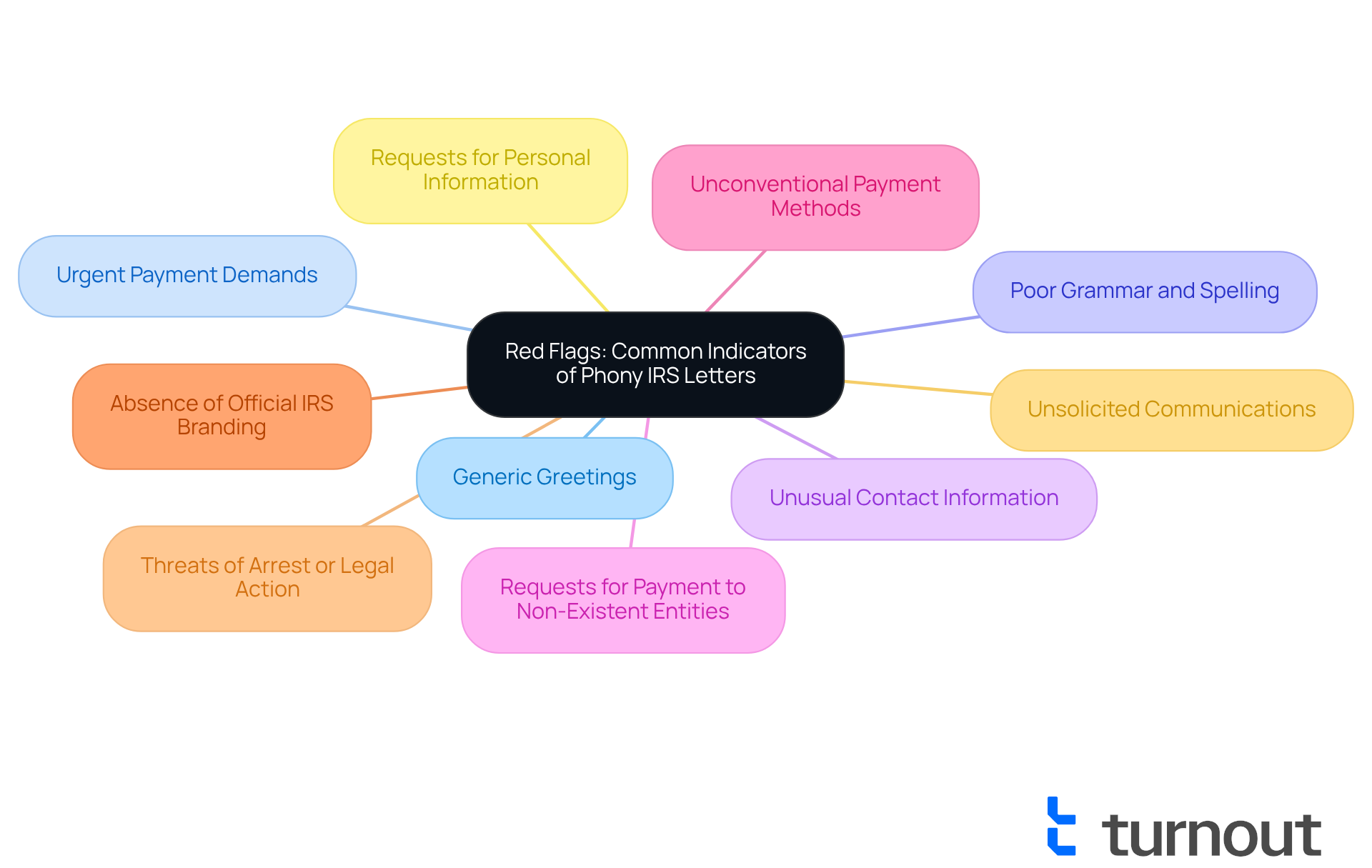

Red Flags: Common Indicators of Phony IRS Letters

When examining IRS correspondence, it's essential to stay alert for warning signs that could suggest a scam. We understand that navigating these communications can be stressful, so here are some common indicators to watch for:

- Generic Greetings: Phony letters often use vague salutations like 'Dear Taxpayer' instead of addressing you by name. In fact, a significant percentage of deceptive interactions employ this tactic to create a sense of impersonality.

- Urgent Payment Demands: Legitimate IRS communications will never demand immediate payment or threaten legal action. If you receive a message demanding quick payment, it's probably a scam.

- Poor Grammar and Spelling: Many counterfeit messages contain grammatical mistakes or awkward phrasing, which can be a telltale sign of illegitimacy.

- Unusual Contact Information: Always verify that the contact details match those listed on the official IRS website. If anything seems off, it's best to proceed with caution.

- Requests for Payment to Non-Existent Entities: Be cautious of communications demanding payment to organizations that do not exist, such as the Bureau of Tax Enforcement.

- Unconventional Payment Methods: Scammers may request payment through unusual methods, like gift cards, which the IRS will never do.

- Absence of Official IRS Branding: Authentic IRS correspondence will feature official logos and formatting. If the envelope or document appears dissimilar to earlier official correspondence, it might be deceitful.

- Threats of Arrest or Legal Action: Scammers often use intimidation tactics, claiming that failure to pay will result in arrest. The IRS will never threaten you in this manner.

- Unsolicited Communications: If you did not initiate contact, be cautious. The IRS does not reach out via email, text, or social media.

- Requests for Personal Information: Be wary of any correspondence asking for sensitive personal details, particularly if it appears unnecessary.

Furthermore, if you come across phony IRS letters, it's crucial to inform the IRS to assist in fighting fraudulent activities. Remember, as John I. Frederick states, "The IRS will never initiate contact via text or email regarding tax payments or refunds." By recognizing these indicators and taking steps when needed, you can enhance your protection from becoming a target of fraudulent schemes that may result in delayed refunds, civil penalties, and IRS audits. You're not alone in this journey; frequently reviewing the IRS's official website for updates on fraudulent activities can also assist you in remaining informed.

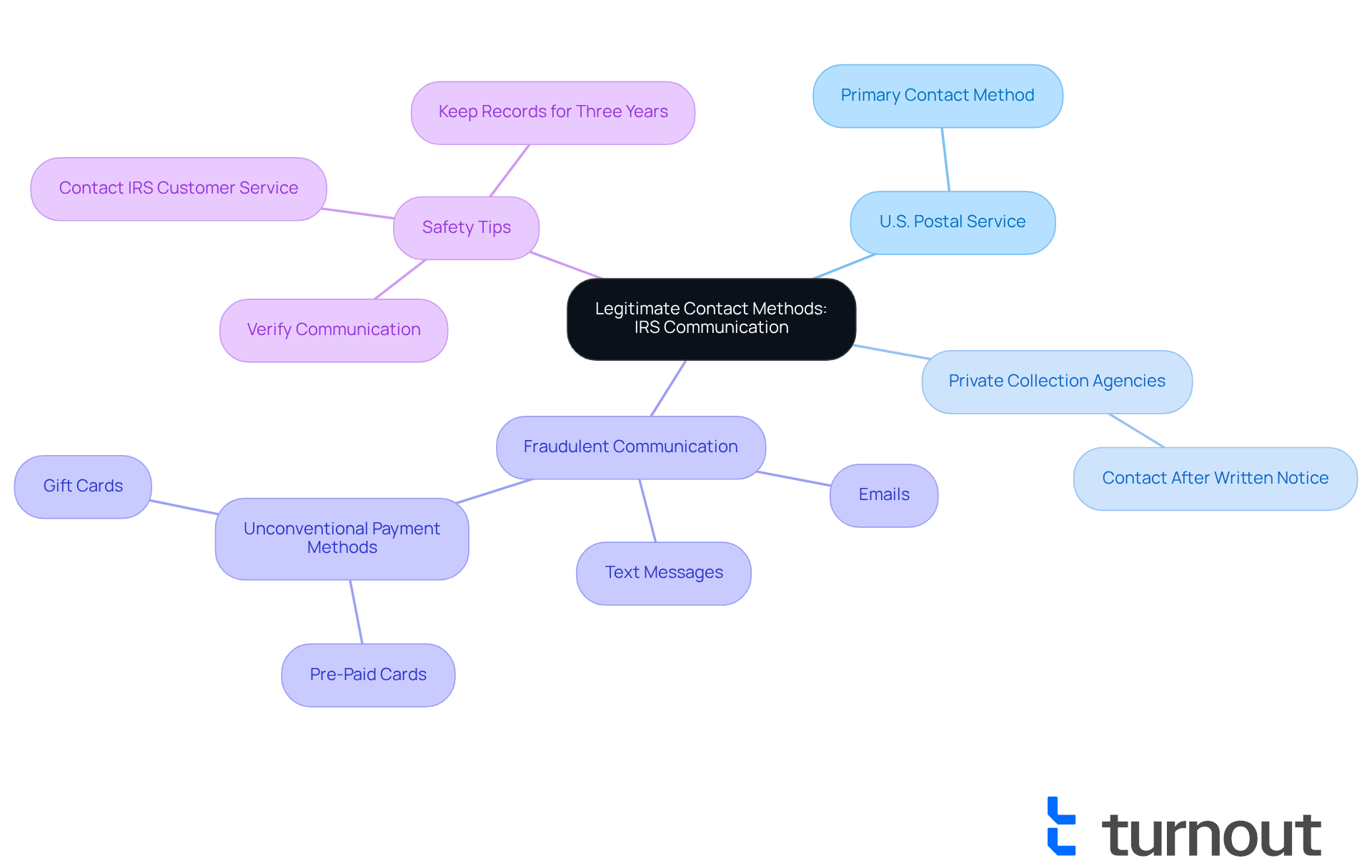

Legitimate Contact Methods: How the IRS Reaches Out

The IRS primarily communicates with taxpayers through the U.S. Postal Service, making a letter likely the first point of contact. We understand that receiving unexpected communication can be concerning. It's crucial to note that the IRS does not initiate contact via email, text messages, or social media; they only text individuals with their permission. If you receive a call claiming to be from the IRS, we encourage you to hang up and verify the legitimacy by calling the official IRS number.

It's common to feel uncertain about who is reaching out to you. Taxpayers should also be aware that private collection agencies contracted by the IRS may reach out, but only after sending a written notice. Always ensure that any correspondence aligns with these established methods to avoid falling victim to scams like phony IRS letters. Remember, the IRS and its authorized private collection agencies will never ask for payment through unconventional methods like pre-paid cards or gift cards. They have also ended most unannounced visits to improve safety.

By staying informed about these messaging protocols, you can better protect yourself from fraudulent attempts. You're not alone in this journey; we're here to help you navigate these communications safely.

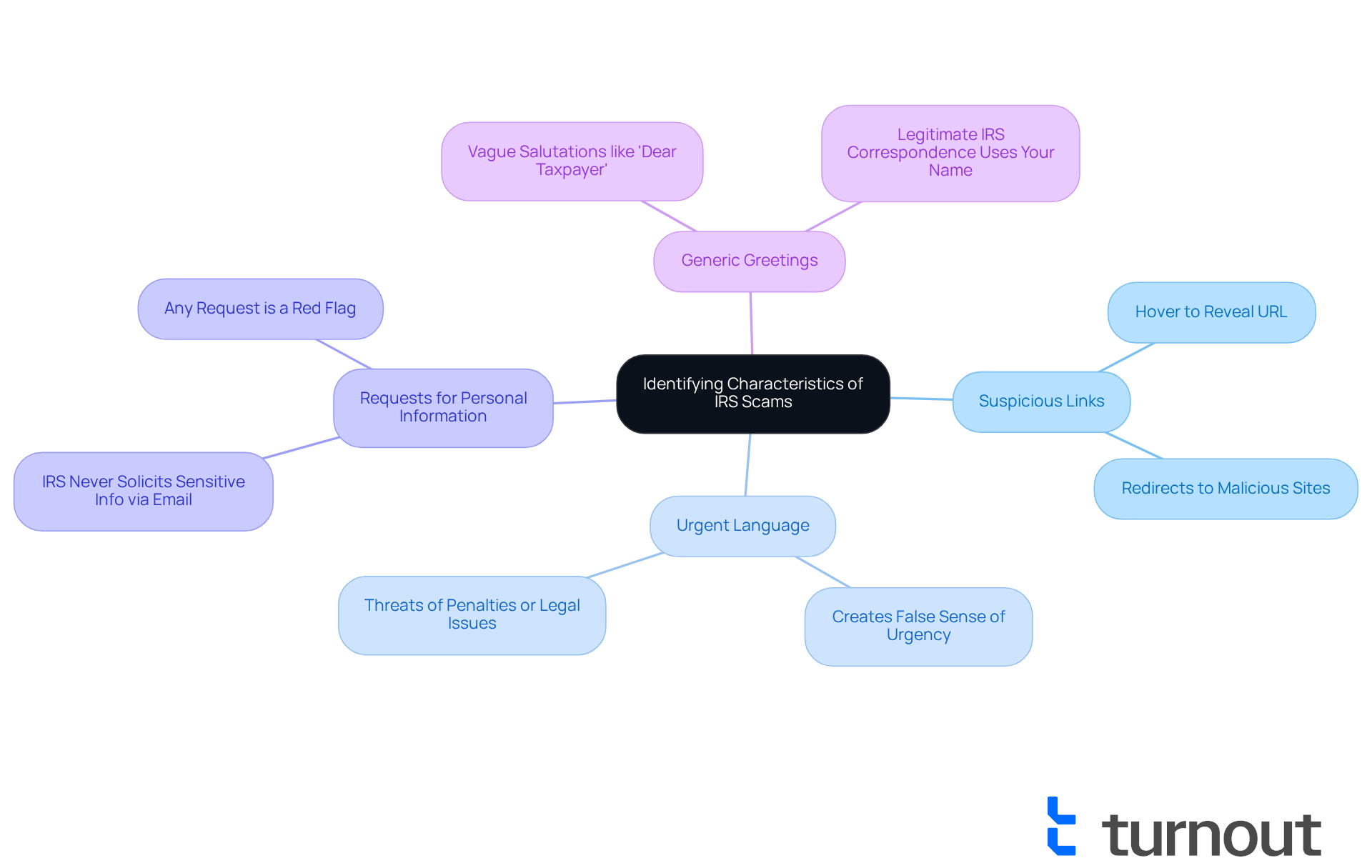

Phishing Emails: Identifying Characteristics of IRS Scams

Phishing emails often mimic genuine IRS messages, but they can be deceptive, especially when they include phony IRS letters. We understand that navigating these communications can be stressful. Here are some key indicators to help you stay safe:

- Suspicious Links: Always hover over links to reveal the actual URL; they often redirect to unofficial or malicious sites.

- Urgent Language: Scammers create a false sense of urgency, insisting that immediate action is necessary to avoid penalties or legal issues.

- Requests for Personal Information: Remember, the IRS will never solicit sensitive information through email. Any such request is a red flag.

- Generic Greetings: Phishing emails typically use vague salutations like 'Dear Taxpayer.' Legitimate IRS correspondence will address you by name.

It's essential to recognize that the primary method the IRS will use to reach a taxpayer is through written communication or notice, which may include phony IRS letters. Therefore, any unsolicited email should be approached with caution. If you encounter an email that raises suspicion, please refrain from clicking any links or providing personal information. Instead, confirm the correspondence through official IRS channels. As the IRS advises, "If you get one of these messages, don't reply or click the link." You're not alone in this journey; we're here to help you navigate these challenges.

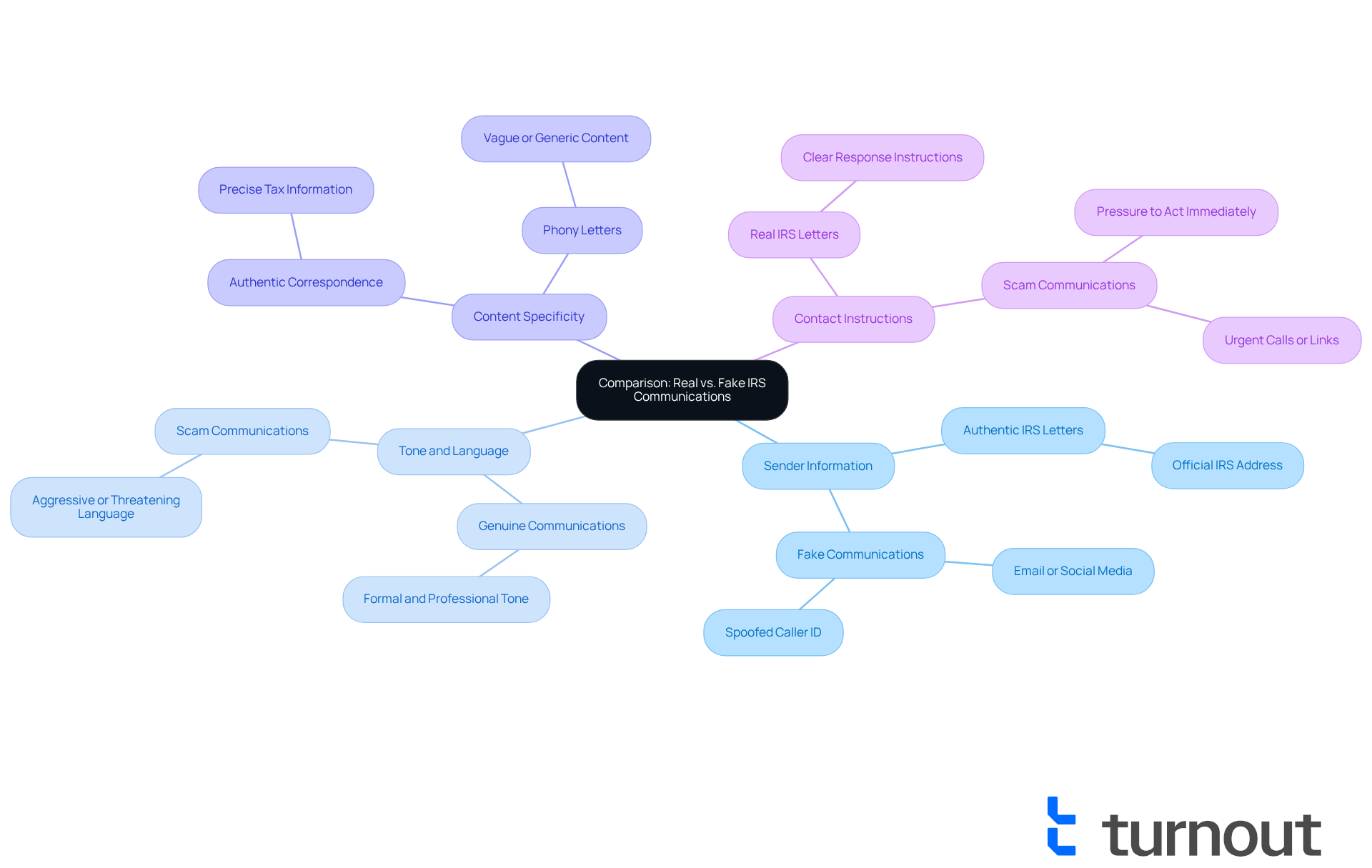

Comparison: Real vs. Fake IRS Communications

To help you distinguish between real and fake IRS communications, let’s consider some important comparisons:

- Sender Information: Authentic IRS letters come from an official IRS address. Remember, the IRS does not reach out via email or social media. If you receive messages through these channels, it’s wise to be cautious.

- Tone and Language: Genuine communications maintain a formal and professional tone. In contrast, scams often use aggressive or threatening language, including phony IRS letters, to instill fear. It’s common to feel anxious when confronted with such tactics.

- Content Specificity: Authentic correspondence includes precise information about your tax situation, such as the tax year in question or the amount due. On the other hand, phony IRS letters may be vague or overly generic, lacking personalized details.

- Contact Instructions: Real IRS letters provide clear, step-by-step instructions on how to respond. Scams often pressure you to act immediately, much like phony IRS letters that urge you to call a number or click a link without delay. Additionally, be aware that scammers may spoof caller ID to make it seem like they are calling from the IRS.

Understanding these differences can empower you to handle communications from the IRS with confidence. You deserve to recognize potential frauds and protect your personal information. The IRS has also released its annual Dirty Dozen list of tax frauds, highlighting the prevalence of IRS impersonation schemes. Staying informed is essential, and remember, we’re here to help you navigate this journey.

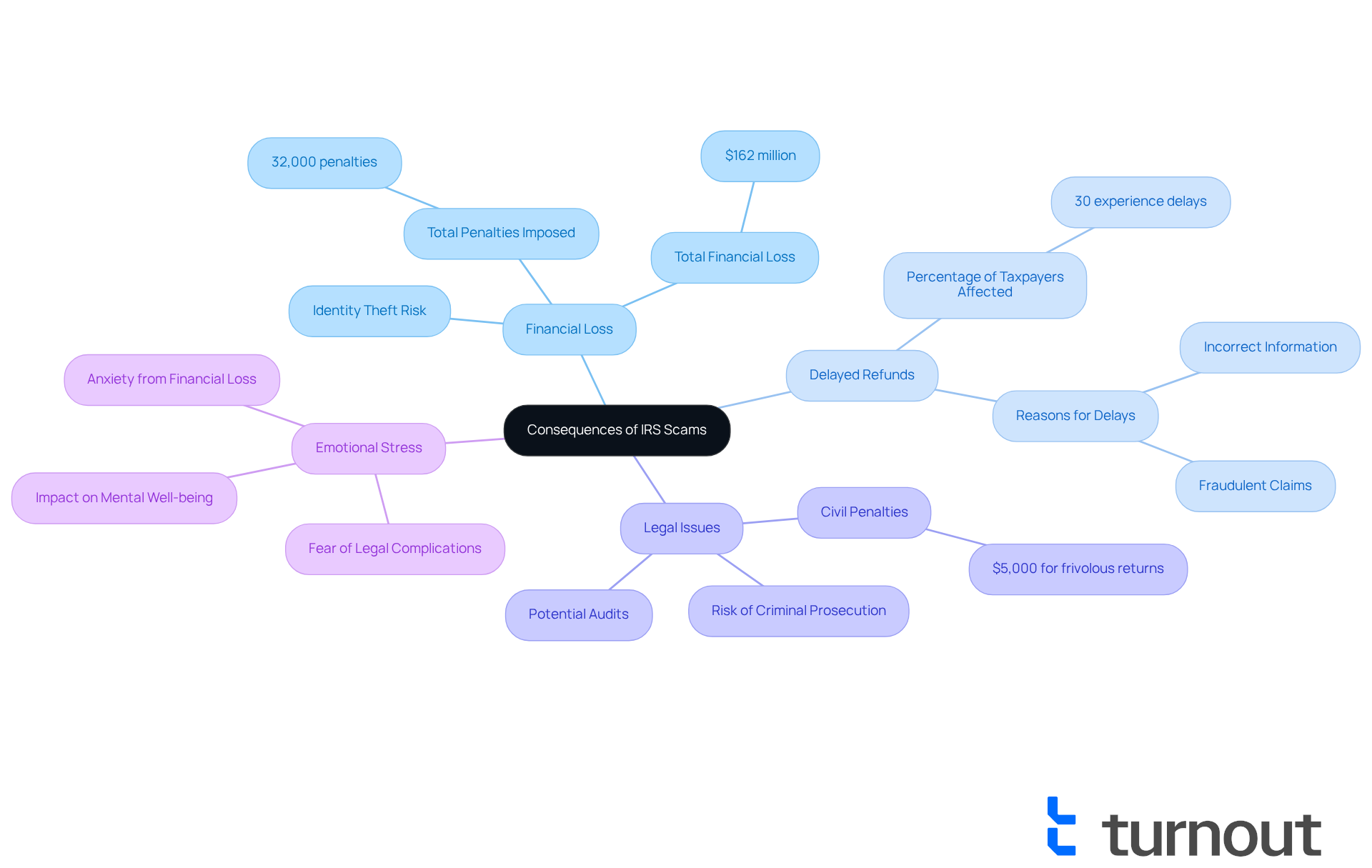

Consequences: What Happens If You Fall for an IRS Scam

Falling for an IRS scam can lead to severe repercussions, and we understand how concerning this can be. Here are some potential consequences to be aware of:

- Financial Loss: Scammers can steal your money or personal information, resulting in identity theft. The IRS has reported over 32,000 penalties connected to these fraudulent activities, costing taxpayers more than $162 million, primarily due to false tax credit claims.

- Delayed Refunds: It's common to feel frustrated when providing incorrect information or falling victim to a fraudulent scheme, as this can significantly delay your tax refund. Many taxpayers experience this issue, with approximately 30% facing extended waits due to fraudulent claims.

- Legal Issues: Engaging with scammers complicates your tax situation, potentially leading to audits or penalties. Taxpayers who file frivolous returns may incur civil penalties of up to $5,000 under Internal Revenue Code Section 6702, alongside the risk of criminal prosecution for filing false tax returns.

- Emotional Stress: We recognize that the anxiety associated with dealing with scams can take a toll on your mental well-being. The fear of financial loss and legal complications can create significant emotional distress. Consumer protection advocates emphasize the importance of vigilance and verification when confronted with suspicious communications. Always be cautious and verify any dubious correspondence to safeguard your financial and emotional health.

Remember, you are not alone in this journey. Consulting a qualified tax professional or utilizing verified IRS resources can provide additional support. We're here to help you navigate these challenges with care and understanding.

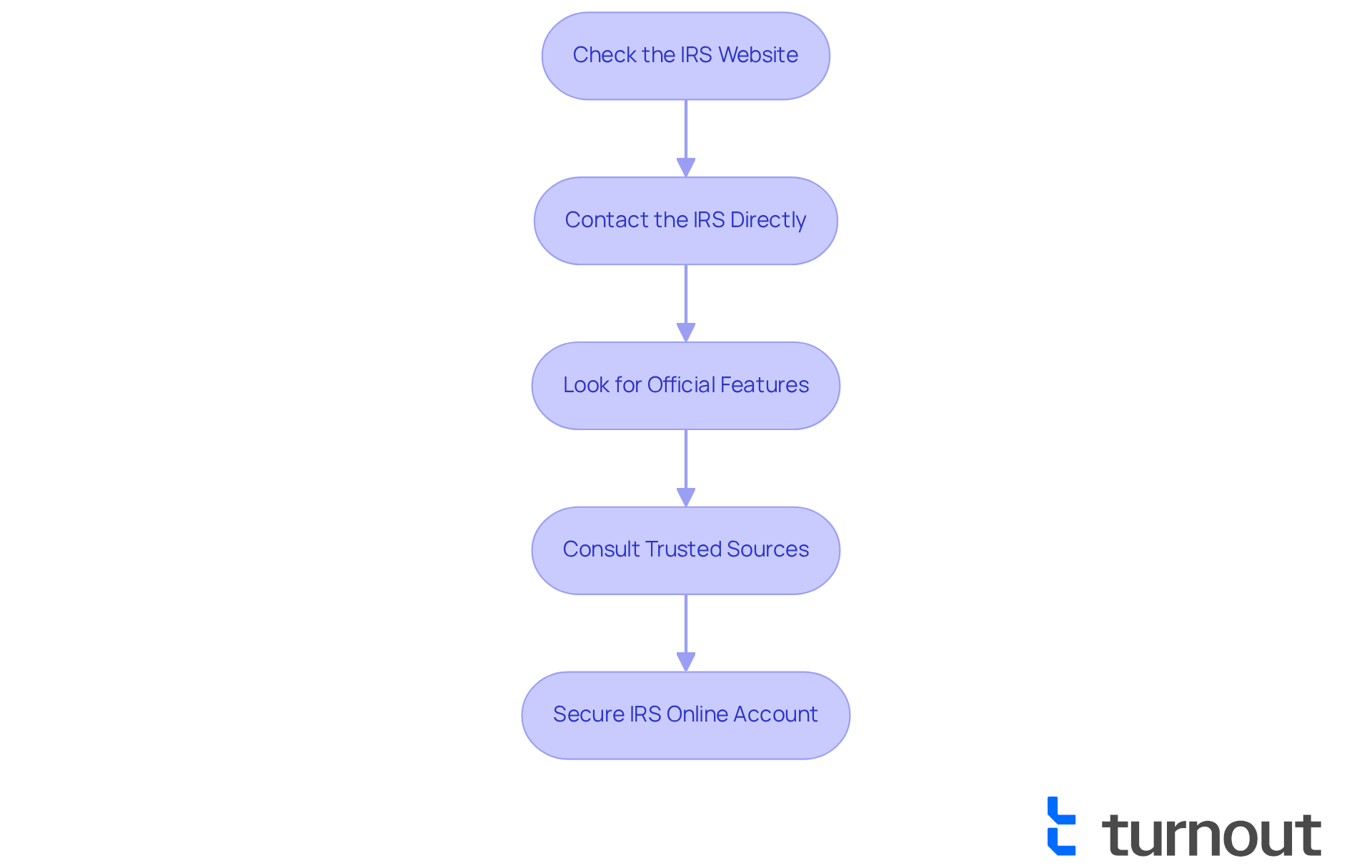

Verification Steps: How to Confirm an IRS Letter's Authenticity

To confirm the authenticity of an IRS letter, we understand that you may feel uncertain. Here are some essential steps to guide you:

- Check the IRS Website: Start by visiting the IRS website to search for the specific notice or document number. This can help you determine if the communication is legitimate and provide some reassurance.

- Contact the IRS Directly: If you still have doubts, please call the official IRS number at 1-800-829-1040. Speaking with an IRS representative can offer clarity and peace of mind during this process.

- Look for Official Features: Ensure the document includes key elements such as the IRS seal, official stationery, and a notice number. These features are critical indicators of authenticity that can help alleviate your concerns.

- Consult Trusted Sources: If uncertainty lingers, reach out to a trusted tax professional or a consumer advocacy organization for guidance. Their expertise can support you in navigating any questions you may have.

It's common to feel overwhelmed, especially since many phony IRS letters are sent out early in the year when people are busy filing. This highlights the need for vigilance. Remember, the IRS follows strict interaction protocols; any threats or unusual payment requests are strong indicators of phony IRS letters. Moreover, we encourage you to retain tax records for at least seven years, emphasizing the importance of preserving documentation associated with IRS interactions. You can also confirm the legitimacy of IRS messages by logging into your secure IRS Online Account.

By adhering to these steps, you can greatly minimize the chance of becoming a target of fraud and ensure that you are handling authentic tax issues. Each year, many taxpayers successfully verify IRS letters, reinforcing the importance of vigilance and awareness in protecting oneself from fraudulent communications. Remember, you are not alone in this journey, and we’re here to help.

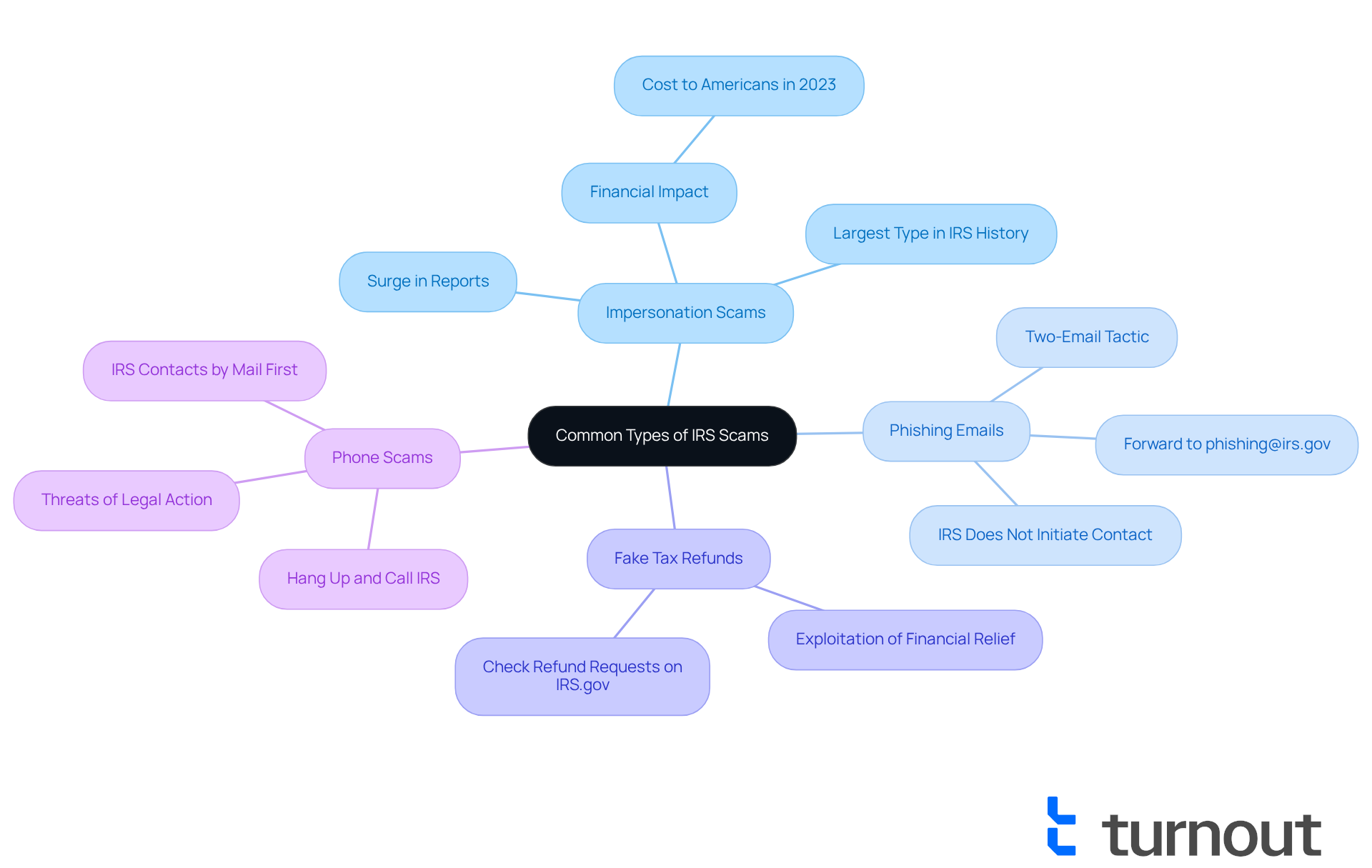

Common Types of IRS Scams: What to Watch Out For

Be aware of these common types of IRS scams:

-

Impersonation Scams: We understand how alarming it can be when scammers pose as IRS agents, demanding immediate payment or personal information. These fraudulent schemes have surged, with reports indicating a 63% rise in government impersonation schemes from 2022, costing Americans over $394 million in 2023 alone. It's important to know that these fraudulent activities are now acknowledged as the largest of their type in IRS history.

-

Phishing Emails: It’s common to feel concerned about receiving fraudulent emails that appear to be from the IRS, often requesting sensitive information. Hackers may send two emails, the first appearing innocuous and the second containing malicious links or attachments. Remember, the IRS does not initiate contact via email to request personal or financial details. If you receive such an email, please do not open attachments or click links; instead, forward it to

phishing@irs.gov. -

Fake Tax Refunds: Scammers may offer fake refunds, asking for personal information to process the claim. This tactic exploits the public's desire for financial relief, especially during tax season. Always check any refund requests directly on the official IRS website, and ensure you access your IRS account only through

IRS.govto prevent fraud. -

Phone Scams: It’s unsettling to receive calls from scammers claiming to be from the IRS and threatening legal action if payment is not made immediately. The IRS typically contacts individuals by mail first regarding unpaid taxes. If you receive a suspicious call, hang up and call the IRS directly at

800-829-1040for assistance. Remember, the IRS will never ask for payment via prepaid debit cards or other unconventional methods.

Remaining aware of these fraudulent activities is essential. We encourage you to report any suspicious activity to local law enforcement and to stay vigilant against offers that seem too good to be true. You're not alone in this journey; we're here to help.

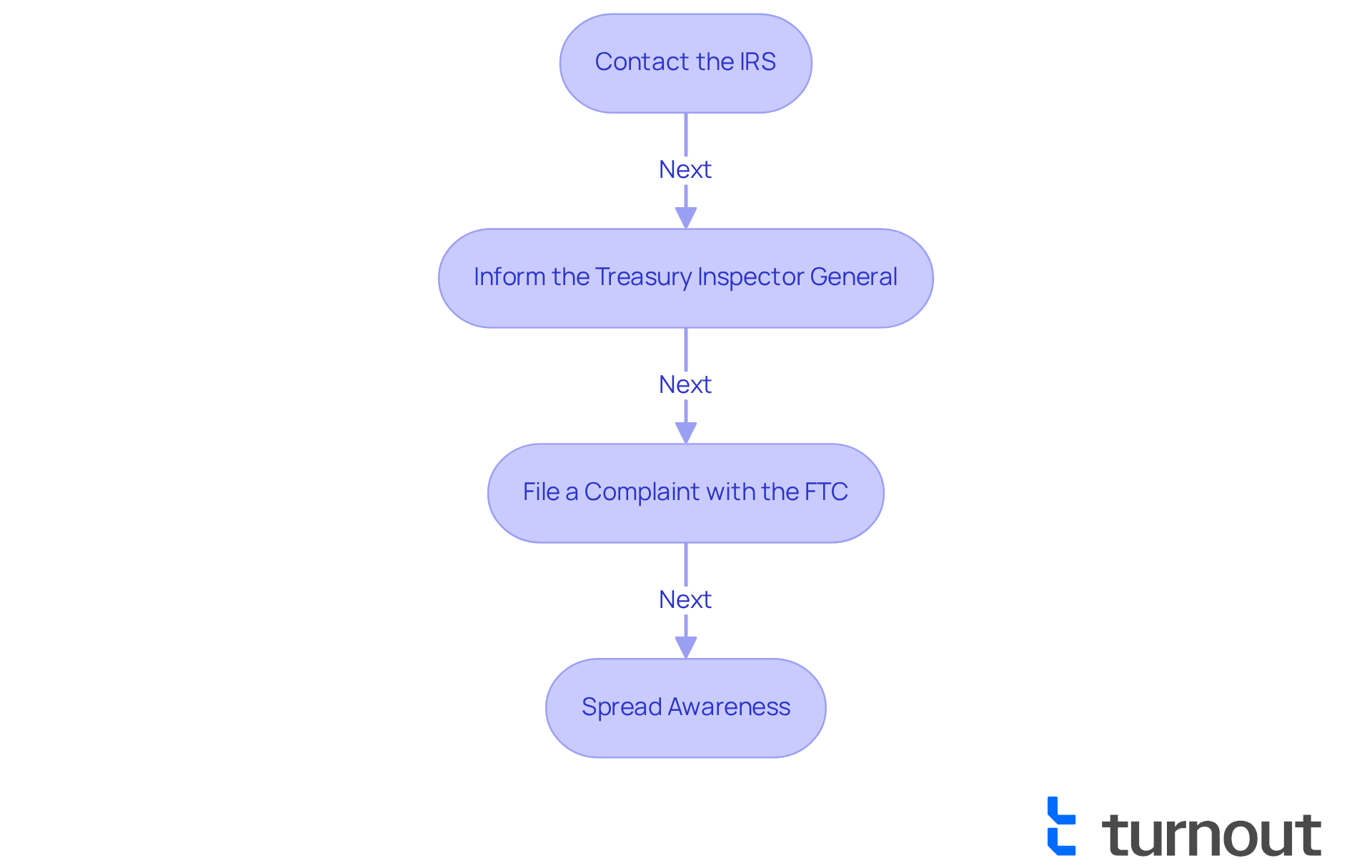

Reporting Fraud: How to Notify Authorities About Fake IRS Letters

If you encounter phony IRS letters, it’s crucial to take immediate action. We understand how concerning this can be, and we’re here to help. Here’s how to effectively report the scam:

- Contact the IRS: Report the scam by calling the IRS at 1-800-829-1040. This direct line allows you to inform them about the fraudulent communication.

- Inform the Treasury Inspector General: You can report IRS-related fraudulent activities to the Treasury Inspector General for Tax Administration (TIGTA) at 1-800-366-4484. This agency examines grievances concerning IRS wrongdoing and fraudulent activities.

- File a Complaint with the FTC: Report the fraudulent activity to the Federal Trade Commission (FTC) at reportfraud.ftc.gov. The FTC collects data on fraud and can take action against deceptive practices.

- Spread Awareness: Share your experience with friends and family to help them identify and evade similar frauds. Awareness is key in preventing others from falling victim to these fraudulent schemes, including phony IRS letters.

Each year, the IRS sees a significant increase in tax fraud cases, with 360 cases reported in fiscal year 2024 alone, marking an 11.0% increase since fiscal year 2020. By notifying the appropriate authorities, you contribute to the fight against tax fraud and help protect others from similar scams. Additionally, if you receive suspicious emails, consider forwarding them to the appropriate authorities to further assist in combating these fraudulent activities. Remember, you are not alone in this journey, and together we can make a difference.

Conclusion

Being aware of the signs of phony IRS letters is essential for protecting your personal and financial information. We understand that navigating these communications can be overwhelming. This article has highlighted key indicators that can help you identify fraudulent letters, such as:

- The absence of the official IRS seal

- Generic greetings

- Unusual payment requests

Recognizing these signs allows you to approach IRS correspondence with greater confidence and security.

Throughout our discussion, we examined various strategies for verifying the authenticity of IRS letters. Important steps include:

- Checking the IRS seal

- Contacting the IRS directly

- Being cautious of unsolicited communications

It's common to feel anxious about falling victim to IRS scams, especially considering the potential consequences like financial loss and legal issues. This underscores the importance of vigilance in dealing with potential fraud.

Ultimately, staying informed and proactive is crucial in combating IRS scams. By utilizing the outlined verification steps and reporting any suspicious activity, you can not only safeguard your own interests but also contribute to a broader effort to combat tax fraud. Awareness and education are powerful tools in navigating the complexities of IRS communications. Remember, you are not alone in this journey; together, we can discern the real from the fake and maintain your financial integrity.

Frequently Asked Questions

What is Turnout and how does it help with IRS communication?

Turnout is a service that utilizes AI technology to simplify the verification of IRS letters and notices, including identifying phony IRS communications. It helps users quickly verify the authenticity of messages, reducing the time and stress associated with tax issues.

Who supports Turnout in the verification process?

Turnout collaborates with IRS-licensed enrolled agents who provide expert guidance in tax debt relief processes, allowing users to receive assistance without needing legal representation.

How has the IRS improved its digital verification processes?

The IRS has enhanced its digital identification verification processes, enabling over 70% of tax filers to be verified digitally, which facilitates a more efficient interaction for taxpayers.

What are the key features to identify the authenticity of IRS communications?

Genuine IRS communications feature the official IRS seal, which includes the phrases 'Internal Revenue Service' and 'Treasury' surrounding the official shield. They also contain a notice or letter number that can be verified on the IRS website.

What should I do if I receive a suspicious IRS letter?

To verify the authenticity of a suspicious IRS letter, you can log into your secure IRS Online Account or contact IRS customer service directly for confirmation.

What are common red flags that indicate a letter might be a scam?

Common indicators of phony IRS letters include: - Generic greetings like 'Dear Taxpayer' - Urgent payment demands - Poor grammar and spelling - Unusual contact information - Requests for payment to non-existent entities - Unconventional payment methods (e.g., gift cards) - Absence of official IRS branding - Threats of arrest or legal action - Unsolicited communications - Requests for personal information.

What should I do if I encounter a phony IRS letter?

If you come across a phony IRS letter, it's important to report it to the IRS to help combat fraudulent activities. Regularly reviewing the IRS's official website for updates on scams can also keep you informed and protected.