Overview

The article titled "7 Insights on Social Security COLA Historical Trends for Beneficiaries" delves into the historical trends of Cost-of-Living Adjustments (COLA) in Social Security and their significance for beneficiaries. We understand how crucial these adjustments are for preserving the purchasing power of recipients amid rising inflation. However, it’s important to acknowledge the challenges and limitations of current calculation methods, such as the reliance on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This method may not fully capture the unique spending patterns of seniors, particularly concerning healthcare.

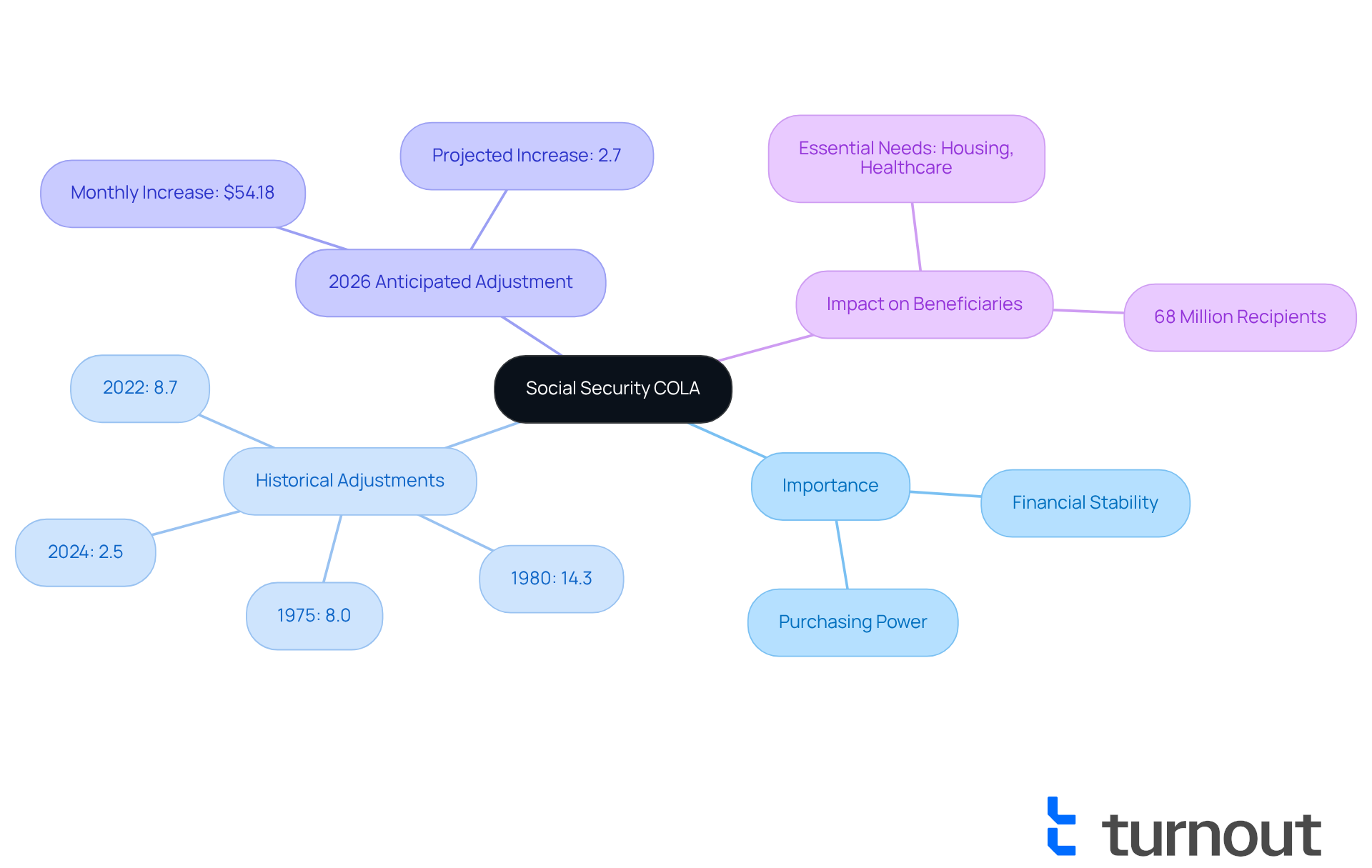

Since their introduction in 1975, COLAs have varied significantly in response to inflation rates. This historical context underscores the necessity for ongoing advocacy for adjustments that truly reflect the financial realities faced by beneficiaries. We recognize that navigating these complexities can be overwhelming, but you are not alone in this journey. Together, we can work towards ensuring that the adjustments meet your needs more effectively.

Introduction

Understanding the historical trends of Social Security cost-of-living adjustments (COLAs) is essential for millions of beneficiaries who rely on these benefits to navigate their financial landscapes. We understand that as inflation continues to fluctuate, the need for accurate and fair adjustments becomes increasingly pressing. This impacts everything from healthcare costs to housing stability.

It's common to feel overwhelmed as many recipients face the daunting reality of rising expenses that outpace these adjustments. A significant question emerges: how can beneficiaries effectively advocate for changes that truly reflect their financial needs? Exploring the nuances of COLA calculations and their implications is crucial for empowering individuals. Together, we can secure financial futures amidst economic uncertainty. You're not alone in this journey.

Turnout: Simplifying Social Security COLA Navigation for Beneficiaries

Turnout is dedicated to transforming how beneficiaries engage with and . We understand that can feel overwhelming. By leveraging AI technology and the expertise of trained , Turnout simplifies this journey, offering .

This innovative approach not only streamlines the application process but also and benefits. It's common to feel daunted by the challenges of handling and tax relief options, but Turnout makes these tasks more approachable.

With a focus on guidance without legal representation, we are here to help you effectively navigate your and . Remember, you are not alone in this journey; we are committed to supporting you every step of the way.

Historical Overview of Social Security COLA Adjustments Since 1975

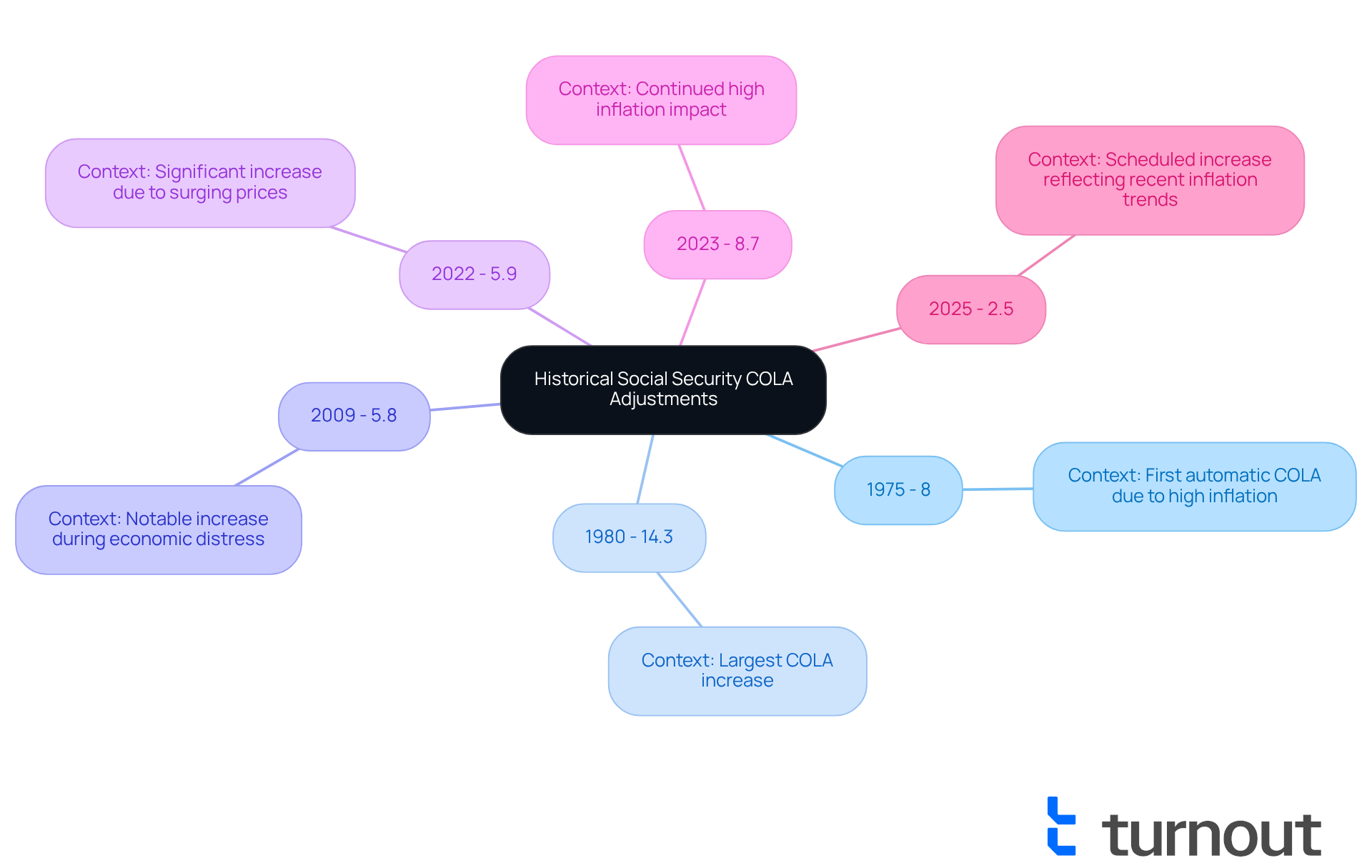

Since the introduction of automatic in 1975, the have been made annually to reflect inflation. The first COLA was set at 8%, responding to the high inflation rates of the 1970s, which exceeded 12% from 1969 to 1974. This economic hardship required automatic modifications to help recipients preserve their purchasing power.

We understand that navigating these changes can be challenging. The Social Security Administration (SSA) calculates COLAs by comparing the for July, August, and September of the previous year with the same three-month period in the current year. Over the years, COLAs have varied significantly, with notable increases during periods of economic distress, such as the 5.8% adjustment in 2009.

Understanding these adjustments related to is essential for beneficiaries to grasp how inflation impacts their benefits over time. For example, the typical advantage for people with disabilities is scheduled to increase from $1,542 to $1,580 in January 2025, reflecting the 2.5% .

It's common to feel uncertain about these changes. The will be revealed in October 2025, as mentioned by the Administration. Remember, you are not alone in this journey; we’re here to help you understand and navigate these adjustments.

How Social Security COLA is Calculated: Methods and Implications

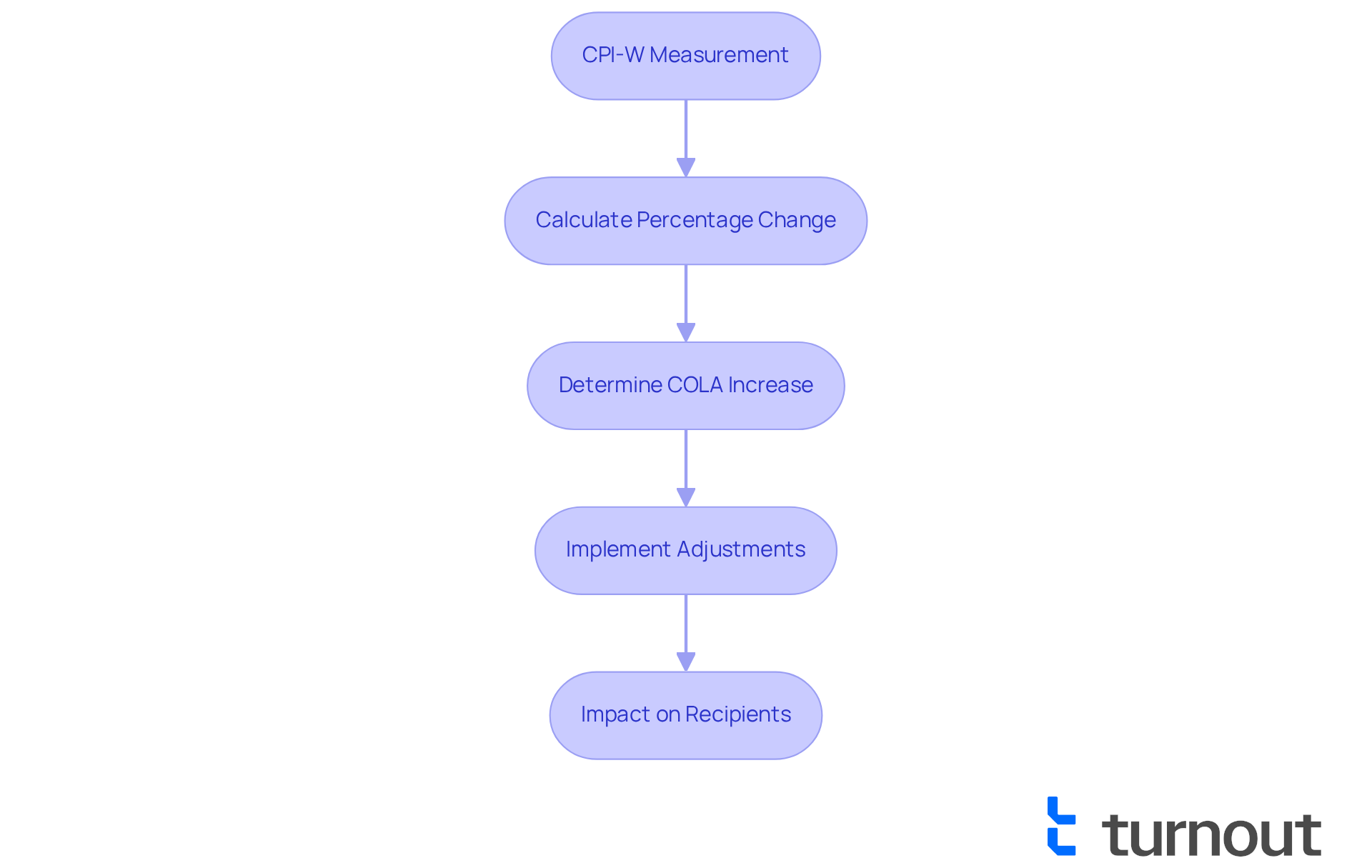

The Administration (SSA) understands the importance of the for many individuals. This adjustment is calculated using the (CPI-W), which tracks inflation by comparing the average prices of a selected basket of goods and services over time. It's common to feel concerned about how these adjustments affect your .

The COLA is determined by the percentage rise in the CPI-W from the third quarter of the previous year to the third quarter of the current year. For instance, the average CPI-W for the third quarter of 2023 was 301.236, while it rose to 308.729 in 2024. This method aims to ensure that , as indicated by the set at 2.5%. This translates to an average increase of over $50 per month for recipients starting in January 2025.

However, we recognize that this approach has faced scrutiny. It may not fully capture the unique spending patterns of seniors. For example, while the CPI-W reflects general inflation trends, it often overlooks rising costs in essential areas like healthcare and housing, which can have a significant impact on older adults.

Social Security Commissioner Martin O'Malley has acknowledged these challenges, noting that the will provide some relief as inflation has moderated. Economists have pointed out that while the CPI-W is a useful tool for adjusting benefits, its limitations highlight the need for ongoing discussions about how best to support beneficiaries in our ever-changing economic landscape. Remember, you are not alone in this journey, and we are here to help together.

CPI Controversies: CPI-W vs. Chained CPI vs. CPI-E in COLA Calculations

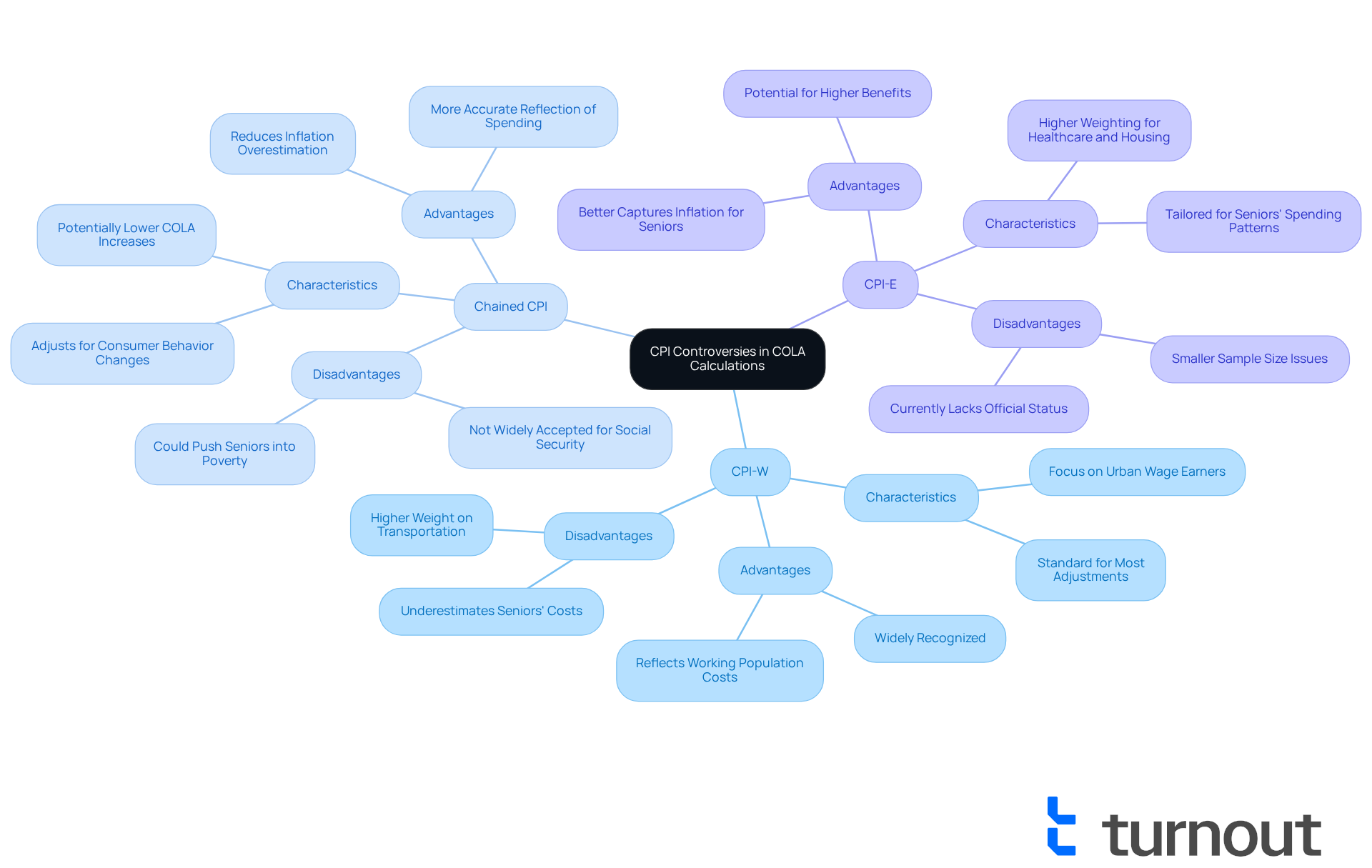

The computation of , especially in relation to cola historical data, can be a source of worry for many, particularly when it comes to understanding which Consumer Price Index (CPI) is most suitable. Currently, the CPI-W, which focuses on urban wage earners, is used for these adjustments. However, there’s the Chained CPI, which considers shifts in due to price changes. This approach could lead to lower COLA increases, which may not be what you need. On the other hand, the to reflect the spending patterns of seniors. This index often reveals higher inflation rates for older adults, especially in crucial areas like .

For instance, while COLAs increased benefits by 64% from 2000 to 2022, the costs of goods and services surged by 130% during the same period. This disparity highlights the inadequacy of the current index, including the social security cola historical, in preserving . According to the Senior Citizens League, benefits from the social safety net have diminished 40% of their purchasing power since 2000. This situation underscores the urgency of this conversation.

Public opinion shows a strong preference for the CPI-E, as it may better capture the faced by retirees. This is particularly important in critical areas like healthcare and housing. Expert evaluations, including insights from Max Richtman, suggest that for seniors. Yet, there are concerns about the long-term viability of the system if such changes are made.

It's important to note that the CPI-E currently lacks official status or application for adjusting Social Security benefits, which limits its relevance in this debate. Understanding these distinctions is essential for recipients, as the choice of CPI directly affects their financial well-being. We encourage recipients to stay informed about upcoming COLAs and explore financial options that may help alleviate the effects of inflation. Remember, you are not alone in this journey, and there are resources available to support you.

Impact of Inflation on Social Security COLA Adjustments

Inflation significantly affects the annual cost-of-living increase for , which is evident in the . As inflation rises, the cost-of-living adjustment is typically increased, as shown in the social security cola historical, to help recipients maintain their purchasing power. For example, the was set at 2.5%, reflecting a period of lower inflation compared to previous years.

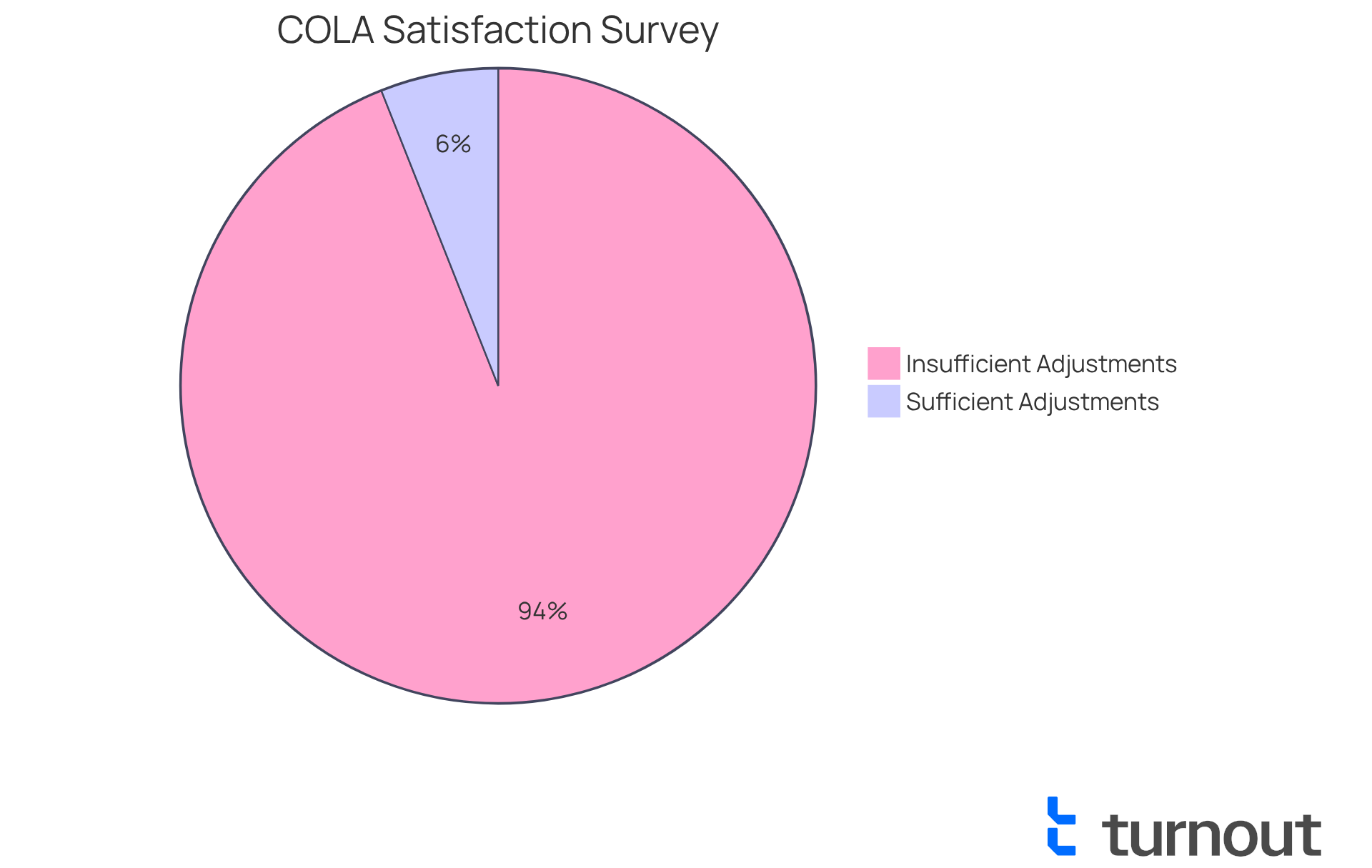

However, we understand that many Social Security beneficiaries feel this increase is insufficient. A survey by the Senior Citizens League revealed that 94% of recipients believe the adjustment does not meet their needs, particularly as many live on less than $2,000 per month and allocate a large portion of their income to healthcare. This situation underscores the in making ends meet, highlighting the urgent need for a deeper understanding of how inflation influences their .

Financial analysts have noted that while , particularly the social security cola historical, aim to provide support, they may not fully account for the unique inflationary pressures older Americans encounter, especially in critical areas like medical expenses and housing. Advocacy groups, such as TSCL, have called for the use of the to calculate cost-of-living adjustments, which would better reflect the real expenses seniors face.

As inflation trends continue to evolve, the remains a pressing concern. It’s common to feel overwhelmed by these financial challenges, but we want to reassure you that is essential. Together, we can work towards ensuring that the adjustments truly represent the actual expenses faced by older adults, helping to secure their financial well-being.

Medicare's Influence on Social Security COLA Adjustments

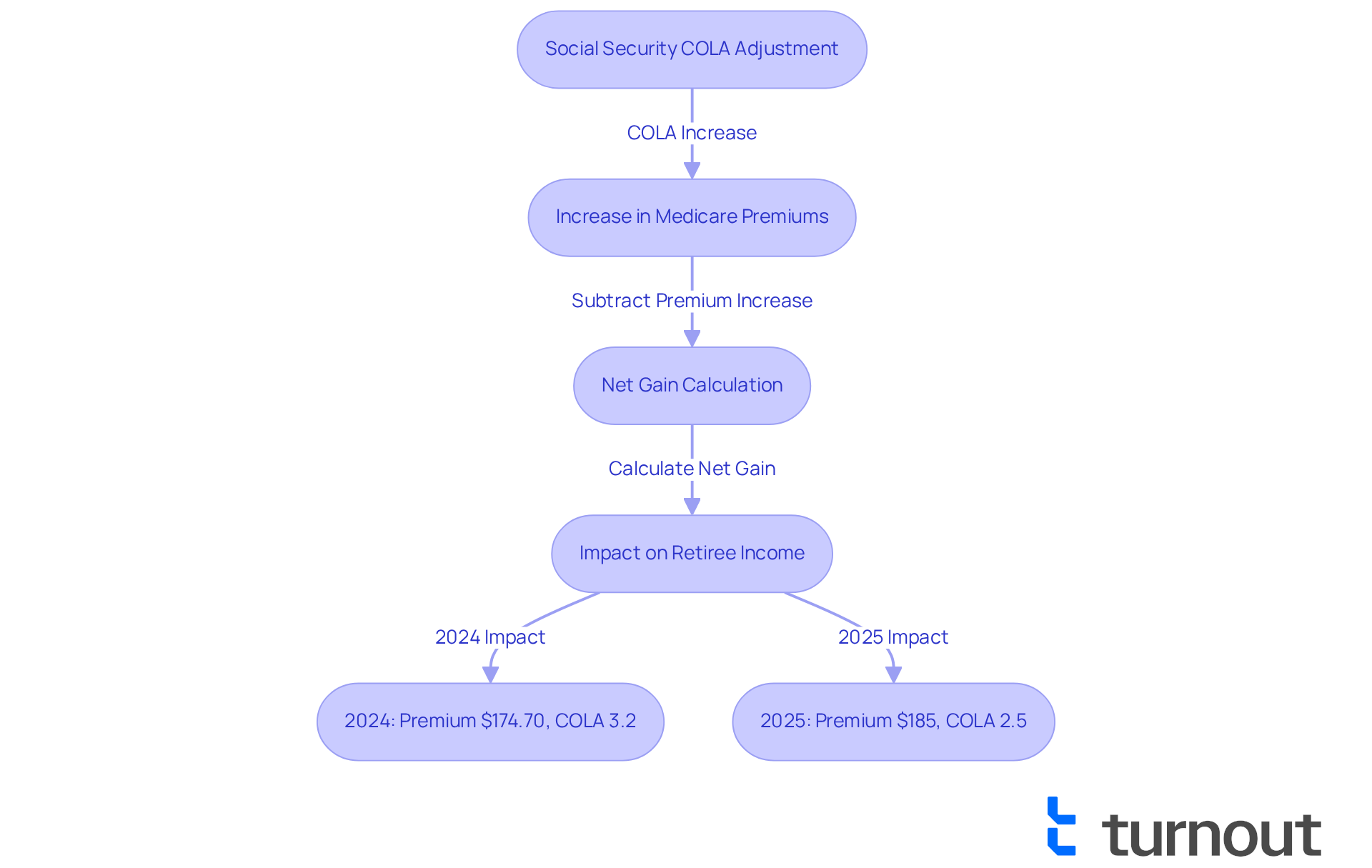

how the impact recipients' incomes. We understand that as these adjustments are applied, Medicare Part B premiums often rise, which can diminish the real benefit growth that recipients see in their monthly payments. For instance, if a beneficiary receives a $50 increase due to COLA but faces a $30 increase in Medicare premiums, their net gain is only $20. This dynamic highlights the importance of understanding both public assistance and the social security COLA historical adjustments for effective .

Financial specialists have observed that of welfare benefits. In 2024, by 6% to $174.70, while the COLA for that year was only 3.2%. This widening gap between Medicare costs and retirement benefit adjustments can lead to increased financial pressure for retirees, as a larger portion of their income is directed toward healthcare expenses.

Looking ahead, Medicare Part B premiums are projected to rise to around $185 in 2025, marking a $10.30 increase from 2024. Additionally, the (IRMAA) complicate matters even further. Approximately 8% of Medicare recipients face surcharges based on their income, resulting in monthly premiums that can range from $259 to $628.90. This extra financial burden can significantly impact the net earnings that recipients derive from their income adjustments. It's crucial for them to consider these factors when planning their finances.

Understanding how Medicare influences the is essential for recipients who want to maintain their quality of life. As continue to rise at a pace that often exceeds cost-of-living adjustments, retirees may find it increasingly challenging to manage essential living expenses. This underscores the importance of . As retirement specialist Mark Miller noted, 'The significant dollar rise will pressure the financial assistance adjustment for seniors.' This serves as a reminder of the ongoing challenges retirees face in managing their finances amid increasing healthcare costs.

How Social Security COLA Affects Retirement Planning

Including in your is essential for securing long-term . We understand that navigating these financial waters can be challenging. Beneficiaries should consider how will impact their overall income, especially as living costs continue to rise.

Financial consultants often recommend estimating future benefits from , including potential adjustments such as , to create a . This proactive approach can help you prepare for your , ensuring you maintain the you desire.

Remember, you are not alone in this journey; we’re here to help you every step of the way.

Historical Trends in Social Security COLA Adjustments: What to Expect

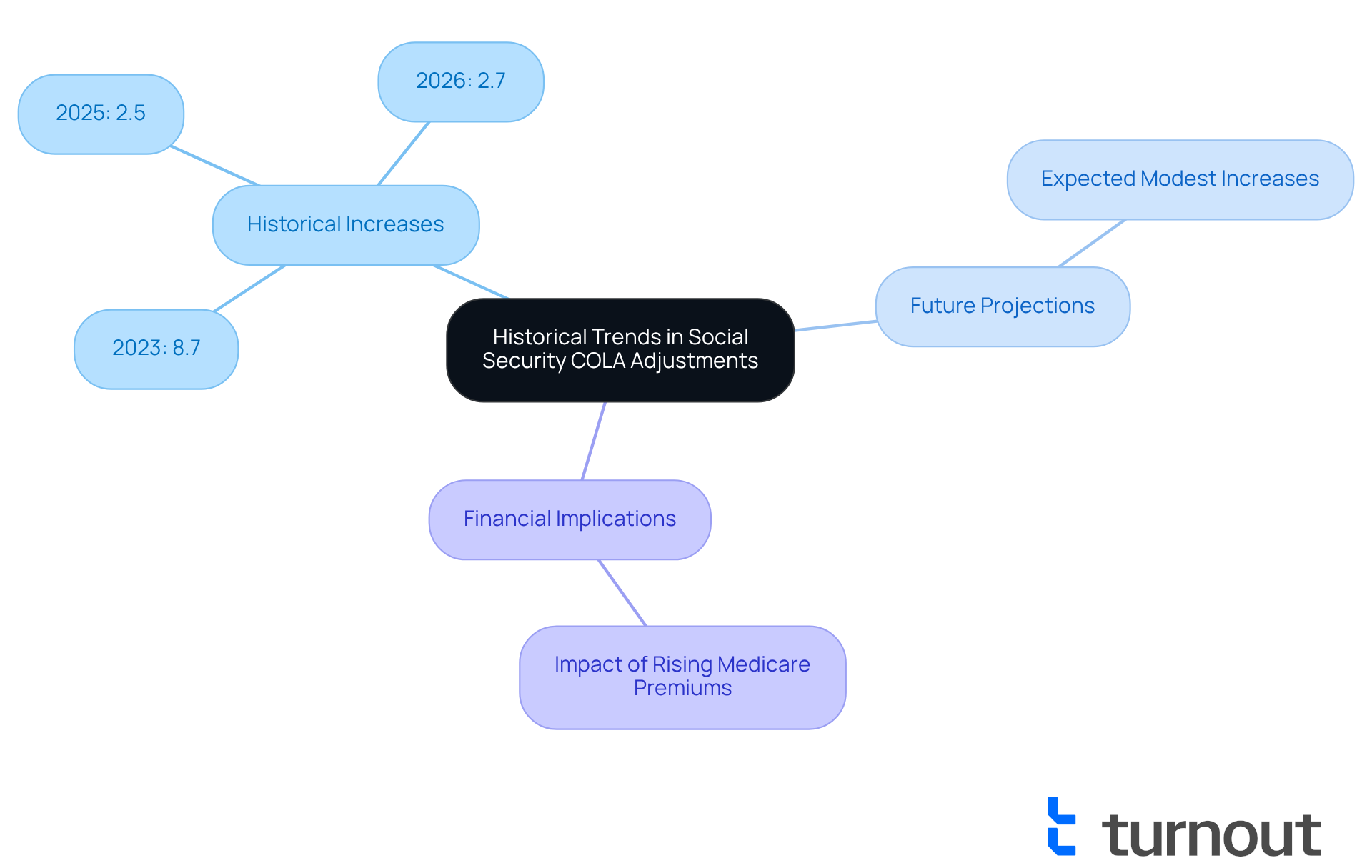

Understanding the trends in is essential for navigating your . Over the past few decades, the have shown , particularly during times of high inflation. For instance, beneficiaries experienced record increases of 8.7% in 2023, followed by a more modest rise of 2.5% in 2025. As we look ahead, it’s common to wonder what future adjustments will look like. Analysts anticipate that COLAs will continue to reflect economic conditions, with forecasts suggesting modest increases as inflation stabilizes. In fact, are expected to rise by 2.7% in 2026, according to Rachel Christian and James Royal from Bankrate. This reflects ongoing economic adjustments that can impact your .

We understand that is essential for your financial well-being. Rising costs, such as Medicare premiums, can significantly affect your net benefits. A case study on Medicare Part B premiums highlights a crucial point: while the social security cola historical provides a projection of anticipated increases, it does not account for potential hikes in premiums, which can diminish your overall benefits. With around 73.9 million individuals in April 2025, it’s vital to stay informed.

You are not alone in this journey. By staying proactive and adjusting your financial plans accordingly, you can better prepare for the future. Remember, we’re here to help you navigate these changes and ensure that you make the most of your benefits.

COLA vs. Actual Cost Increases: Understanding the Differences

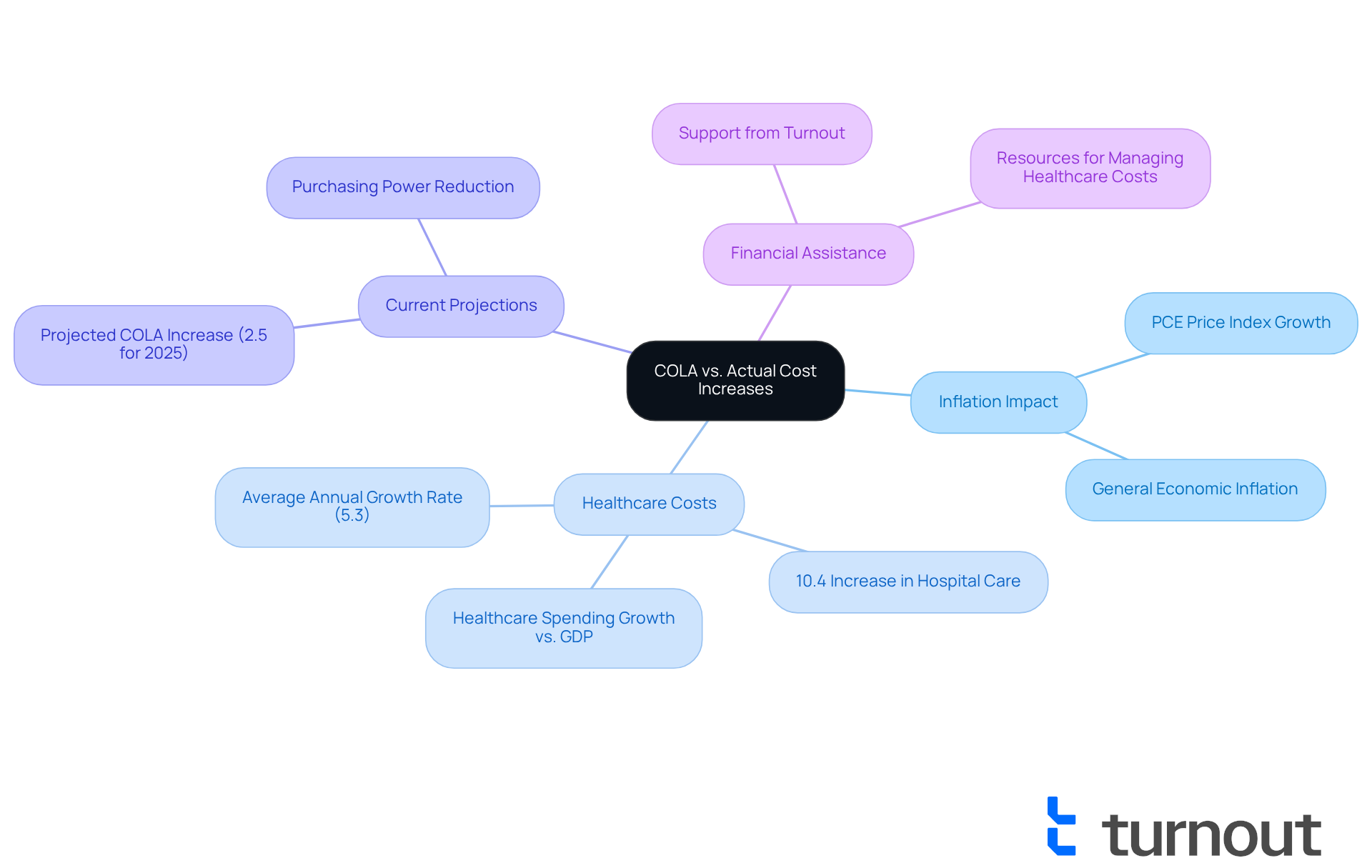

Adjustments in aim to align Social Security benefits with inflation, yet they often fall short in addressing the real cost increases faced by recipients. We understand that , for instance, have been rising at a significantly higher rate than general inflation. In 2023, healthcare spending growth outpaced GDP growth for the first time since the pandemic, with hospital care costs increasing by 10.4%. This trend highlights a concerning reality: even with a projected of 2.5% for 2025, many beneficiaries may experience a reduction in their purchasing power.

Financial analysts have observed that the average annual social security cola historical over the past two decades has been about 2.6%, which does not adequately compensate for the rapid . It's common to feel overwhelmed by these financial pressures, leading many recipients to grapple with . Understanding this discrepancy is essential when planning for your financial future.

At , we’re here to help. We offer tools and expert guidance, including trained nonlawyer advocates and IRS-licensed enrolled agents, to assist individuals in . Our support for SSD claims and comes without the need for legal representation. You are not alone in this journey; we guarantee that recipients can they need to manage their healthcare costs efficiently.

The Importance of Social Security COLA for Beneficiaries' Financial Security

The adjustment for cost of living is essential for the of millions of recipients. We understand that aligning benefits with inflation helps individuals maintain their purchasing power over time. For many retirees and individuals with disabilities, represent a significant portion of their income, often exceeding 50% for many retirees. This reliance underscores the importance of advocating for fair , ensuring that recipients can meet their basic needs amidst rising living expenses.

Recent discussions have highlighted that , slightly higher than last year's adjustment of 2.5%. This increase translates to an additional approximately $54.18 each month for the typical recipient. It's vital to recognize this adjustment, especially given that inflation rates have surged in recent years, affecting the cost of everyday essentials. Without adequate cost-of-living adjustments, recipients face a challenging 'catch-22' situation where increased adjustments reflect rising inflation, while reduced changes fail to provide necessary support.

Moreover, the role of the cost-of-living adjustment extends beyond mere numbers; it significantly impacts recipients' quality of life. The upcoming adjustment will benefit nearly starting in January 2025, ensuring that their . This adjustment is particularly crucial for those who rely solely on Social Security, as it directly affects their ability to afford housing, healthcare, and other essential needs.

The began in 1975, highlighting the ongoing necessity to adjust benefits in response to economic changes. In summary, understanding and advocating for fair COLA adjustments is vital for protecting the financial well-being of beneficiaries. Together, we can help them navigate an increasingly challenging economic landscape, ensuring they are not alone in this journey.

Conclusion

Understanding the historical trends of Social Security Cost-of-Living Adjustments (COLA) is crucial for beneficiaries like you, who aim to maintain financial stability. Since the introduction of automatic adjustments in 1975, these increases have been vital in helping individuals keep pace with inflation. We understand that the ongoing dialogue around COLA highlights the necessity for fair adjustments that truly reflect the living costs faced by retirees and individuals with disabilities.

Key insights from the article reveal the complexity of COLA calculations and their implications. The use of the Consumer Price Index for Urban Wage Earners (CPI-W) has raised concerns. It may not adequately capture the unique inflationary pressures you experience, particularly in healthcare and housing. Additionally, the interplay between rising Medicare premiums and COLA adjustments complicates financial planning for many beneficiaries. This emphasizes the need for proactive strategies to navigate these challenges.

As inflation continues to evolve, advocating for accurate and fair COLA adjustments is more important than ever. We encourage you to stay informed about upcoming changes and consider how these adjustments will impact your overall financial well-being. By engaging with available resources and support systems, you can better prepare for the financial realities of retirement. Remember, you are not alone in this journey, and your voice matters in the ongoing discussions surrounding Social Security COLA.

Frequently Asked Questions

What is Turnout and how does it assist beneficiaries?

Turnout is dedicated to helping beneficiaries navigate government assistance processes and tax debt relief by simplifying the application process and providing support through AI technology and trained nonlawyer advocates.

What are Cost-of-Living Adjustments (COLAs) in Social Security?

COLAs are annual adjustments made to Social Security benefits to reflect inflation, first introduced in 1975 to help recipients maintain their purchasing power against rising costs.

How are COLAs calculated?

COLAs are calculated by comparing the average Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for July, August, and September of the previous year with the same period in the current year.

What was the first COLA percentage and why was it implemented?

The first COLA was set at 8% in 1975 due to high inflation rates exceeding 12% from 1969 to 1974, aimed at preserving the purchasing power of Social Security recipients.

What is the significance of the CPI-W in relation to COLAs?

The CPI-W tracks inflation by comparing the average prices of a selected basket of goods and services, and it is used to determine the percentage rise for COLAs, ensuring benefits keep pace with inflation.

When will the upcoming COLA be revealed?

The upcoming cost-of-living adjustment will be revealed in October 2025.

What are some criticisms of the COLA calculation method?

Critics argue that the CPI-W may not accurately reflect the unique spending patterns of seniors, particularly in essential areas like healthcare and housing, which can significantly affect their financial well-being.

What is the expected increase in benefits for people with disabilities in January 2025?

The typical benefit for people with disabilities is expected to increase from $1,542 to $1,580, reflecting a 2.5% cost-of-living adjustment for that year.