Overview

The article titled "10 Key Insights on Own Occupation Disability Insurance" highlights crucial aspects and benefits of this specialized coverage, particularly for high-income professionals.

We understand that financial security is a significant concern for many, especially when it comes to protecting your income.

This type of insurance allows individuals to receive benefits if they cannot perform their specific job duties, even if they can work in other roles.

It's common to feel uncertain about the future, and that’s why tailored insurance solutions are essential in safeguarding against income loss due to disability.

Remember, you are not alone in this journey, and we’re here to help you navigate these important decisions.

Introduction

Navigating the complexities of disability insurance can feel overwhelming, especially for high-income professionals who depend on their unique skill sets. We understand that the thought of losing the ability to perform your job can be daunting. Own occupation disability insurance provides a tailored safety net, ensuring that you receive financial support if you can no longer fulfill your specific job duties, regardless of your ability to work in other roles.

However, with numerous misconceptions and varying policies available, how can you determine the right coverage that truly protects your livelihood? It’s common to feel uncertain in this situation. This article explores ten essential insights about own occupation disability insurance, shedding light on its benefits, key features, and the critical distinctions that can safeguard your financial stability in times of need. Remember, you are not alone in this journey; we're here to help.

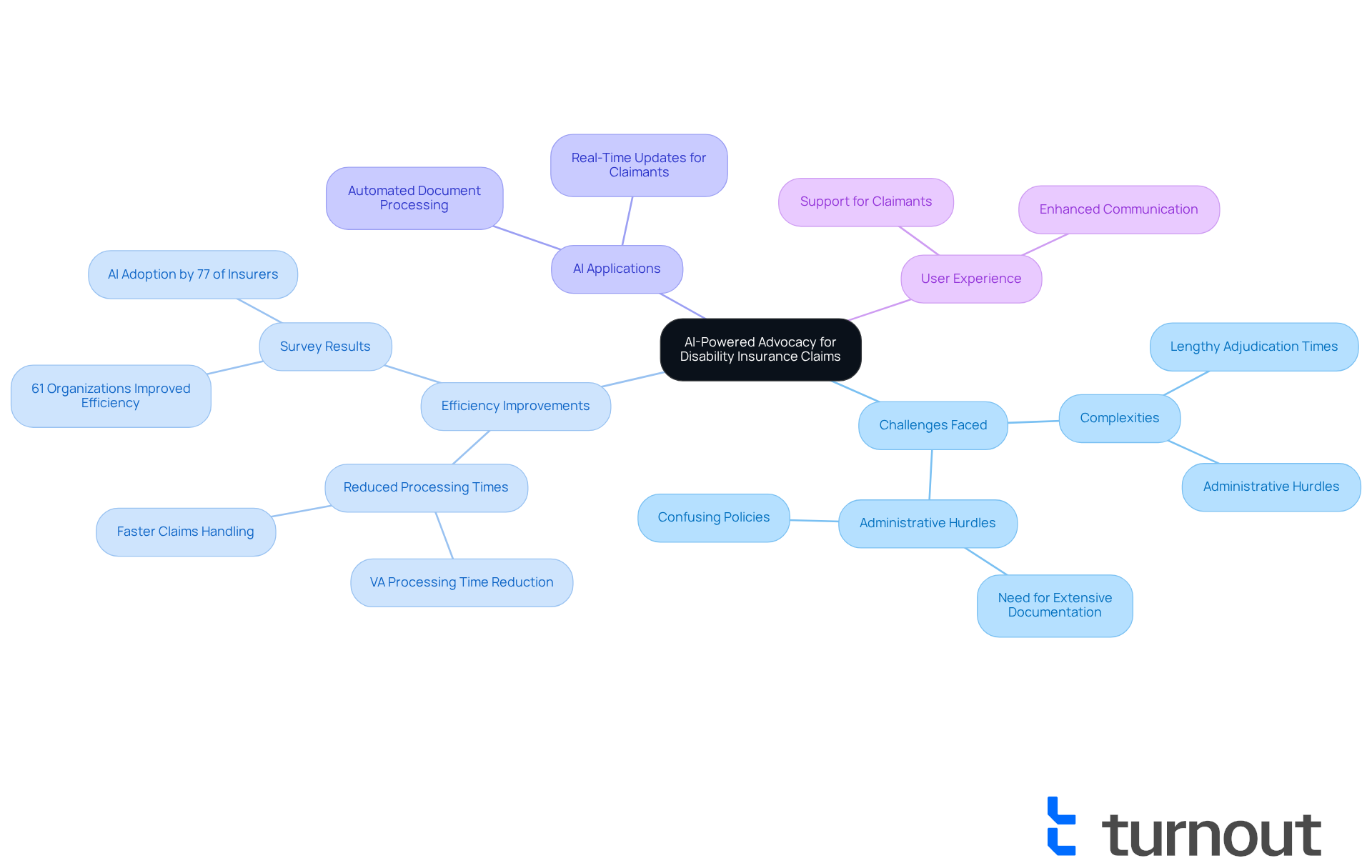

Turnout: AI-Powered Advocacy for Disability Insurance Claims

Turnout is and with its , designed to streamline the often daunting process of filing claims. We understand that navigating these challenges can be overwhelming. By utilizing advanced technology, Turnout simplifies the experience for individuals, ensuring they receive timely support without unnecessary hurdles. Central to this innovation is Jake, the AI system that assists users in managing documentation, deadlines, and communication. This results in a more user-friendly and efficient process, allowing you to focus on what truly matters.

This method not only speeds up claims processing but also enables consumers to confidently manage the intricacies of insurance related to their , impairments, and , including . It’s common to feel lost in the complexities of these systems, but Turnout is here to guide you.

The incorporation of has demonstrated substantial enhancements in efficiency. For instance, the Department of Veterans Affairs successfully reduced processing times from ten days to just half a day by employing AI technologies. Moreover, a recent survey indicated that 61% of organizations experienced . These advancements highlight the critical role of technology in addressing the challenges faced by claimants, such as lengthy adjudication times and administrative hurdles.

Effective applications of AI in consumer advocacy have shown its ability to enhance outcomes for individuals managing claims related to disabilities. AI-powered solutions can automatically extract key information from medical records, allowing insurers to focus on more complex cases while ensuring faster decisions and clearer communication. This not only alleviates the burden on claimants but also enhances the overall . You deserve a process that works for you, not against you.

As the need for efficient claims processing keeps increasing, Turnout's innovative platform shines as a beacon of hope for those seeking benefits for impairments and tax debt relief. By utilizing AI and expert advice, Turnout is not merely streamlining the claims process; it is transforming how consumers engage with the insurance system for disabilities, particularly regarding their own occupation disability insurance, making it more accessible and manageable for all. Remember, you are not alone in this journey; we’re here to help you every step of the way.

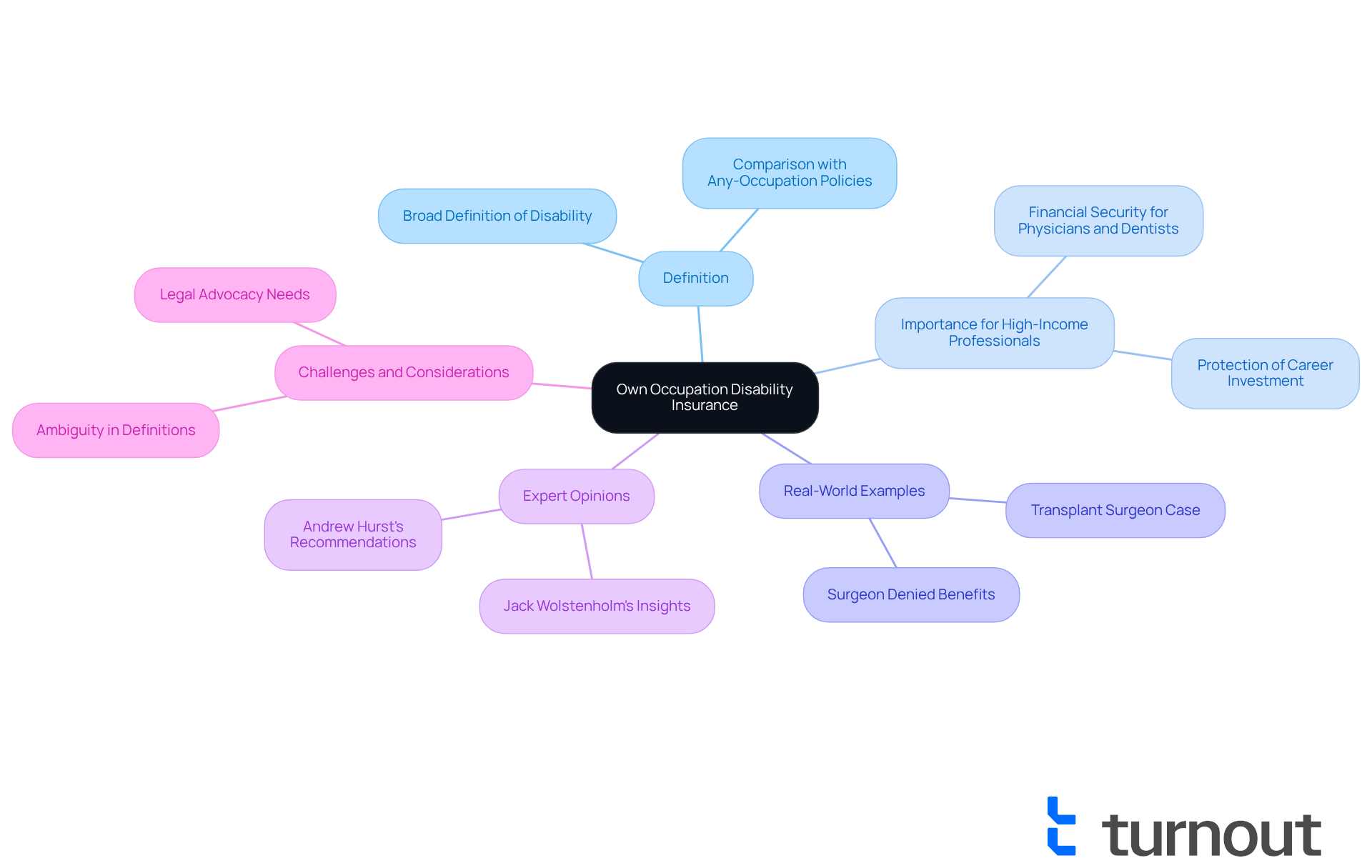

Definition of Own Occupation Disability Insurance

is a specialized form of coverage designed to provide unable to perform the due to illness or injury. Unlike other types of income protection insurance, this policy focuses on your ability to work in your specific role. It ensures you receive assistance if you cannot meet your job duties, even if you can perform in another position.

As we look ahead to 2025, many workers, especially in specialized fields, are beginning to recognize the importance of this insurance. This coverage is particularly crucial for , such as physicians and dentists, who invest years in training and may face significant financial loss if they cannot practice their specialty.

A broad definition of disability is one of the key characteristics of own occupation . This allows policyholders to receive support if they cannot perform their particular job, regardless of their ability to work in different positions. For instance, a surgeon who suffers an injury that prevents them from performing surgery can still receive support while teaching or consulting.

Real-world examples underscore the effectiveness of this coverage. In one notable case, a transplant surgeon was denied benefits after a wrist injury, even though they were unable to perform transplants. The successful appeal demonstrated that the inability to carry out specific duties constituted total incapacity. This highlights the policy's protective nature and the ambiguity in insurer definitions of incapacity.

Insurance experts emphasize that own occupation coverage is vital for individuals in . It offers a safety net against the of impairment. Jack Wolstenholm, an insurance expert, shares, "Disability insurance is something most people should consider owning. For physicians, dentists, and other high-income medical professionals, it’s simply a must-have." This type of insurance not only protects your career investment but also provides peace of mind as you navigate unforeseen health challenges.

When exploring alternatives, it's essential to understand how insurers interpret impairment. This understanding is crucial to ensure you have sufficient coverage. Remember, you are not alone in this journey. secure the protection you need.

Own Occupation vs. Any Occupation Disability Insurance

Understanding the difference between and any occupation impairment insurance is vital for your peace of mind. Own occupation disability insurance offers support if you can’t perform the specific duties of your job, even if you’re able to work in another role. For instance, a surgeon who can’t operate due to an impairment may still receive assistance, as they might teach or take on managerial responsibilities. In contrast, only offer benefits if you’re unable to work in any position suited to your qualifications, based on your education, training, or experience. This stricter definition can lead to fewer approved claims and more disputes, as insurers might argue that you could take on alternative roles, like a hospital administrator, even if your original job is out of reach.

This distinction is particularly important for professionals in specialized fields, as it directly impacts your . Research indicates that own occupation disability insurance plans tend to have a compared to any occupation plans. One expert wisely noted, 'Understanding these terms can directly affect whether you qualify for benefits, how long your benefits last, and ultimately, your financial security if you’re unable to work due to illness or injury.' Therefore, if you’re in a high-skill profession, it’s crucial to to ensure you choose coverage that truly protects your income and career.

Additionally, many long-term coverage plans start with an 'own occupation disability insurance' definition for a limited time before transitioning to 'any occupation.' This is an to grasp. While any occupation policies may be more affordable, they also carry a greater risk of claim denial. Remember, you are not alone in this journey; we’re here to help you navigate these important decisions.

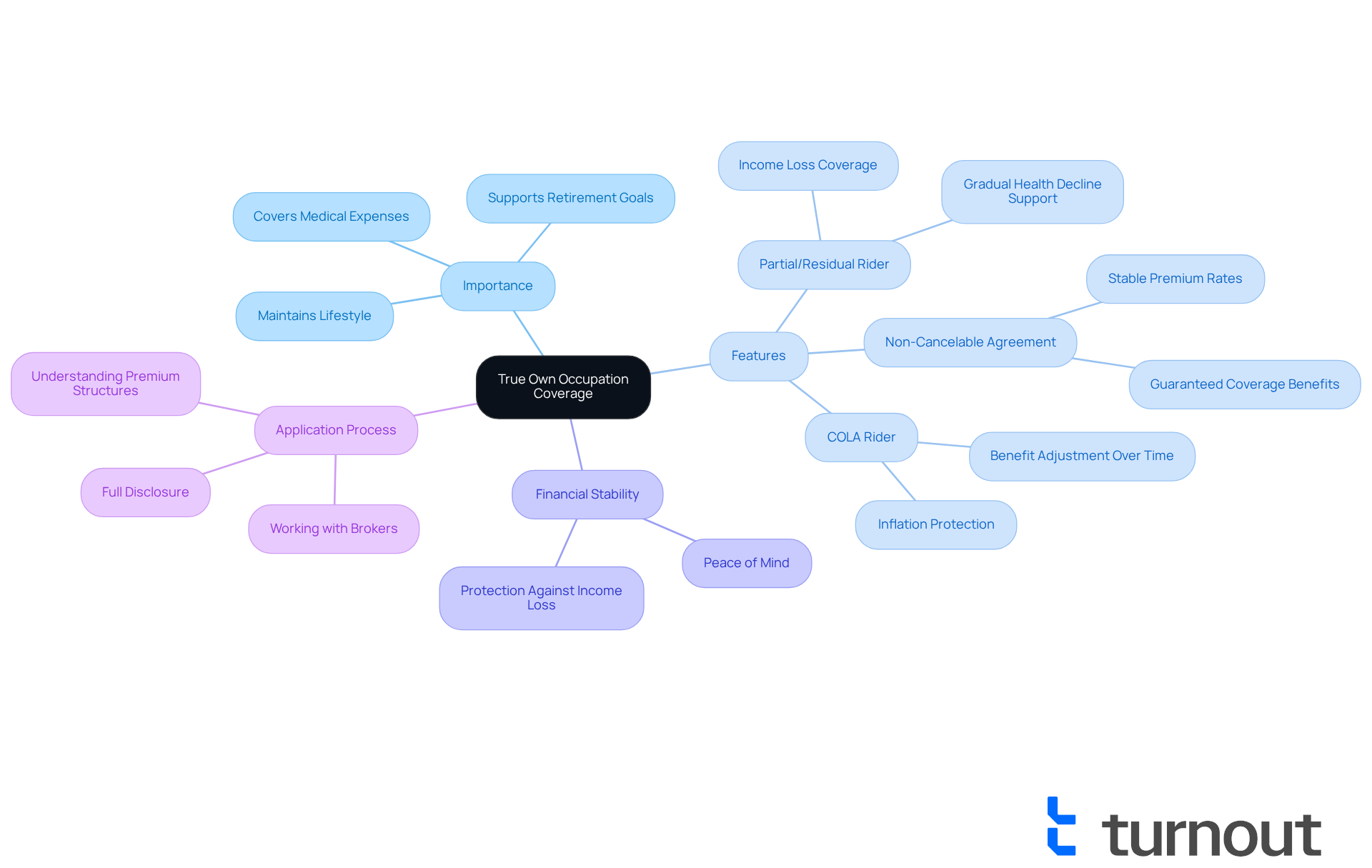

Importance of True Own Occupation Coverage for High-Income Professionals

For high-income professionals, we understand that is crucial for preserving your standard of living in case of an impairment. This specialized insurance recognizes the unique abilities and extensive training that high earners possess, providing the needed to navigate potential challenges without sacrificing your lifestyle. Without , you face the risk of significant income loss if you cannot perform your primary job, even if there are alternative employment opportunities in different fields.

Financial advisors emphasize that genuine own occupation policies offer the most , ensuring that you receive support if you're unable to work in your field, regardless of your ability to generate income elsewhere. It's common to feel overwhelmed by the complexities of insurance, but securing coverage early can lead to lower premiums and protect against health issues that may arise later.

Additionally, integrating features like the partial/residual rider can be vital for high-income individuals who might experience a gradual decline in health. This guarantees that you receive support that aligns with your income reduction. A non-cancelable disability insurance agreement ensures that your premium rates and coverage benefits remain stable as long as payments are made, providing essential .

Moreover, the cost of living adjustment (COLA) rider is key for maintaining economic stability during times of rising prices, ensuring that your benefits keep pace with inflation. Recent data indicates that many high-earning professionals, particularly doctors, are increasingly aware of the necessity for this type of protection, with many opting for plans that specifically cater to their unique occupational needs.

In conclusion, understanding the nuances of true own occupation coverage is vital. Remember, full disclosure during the application process is crucial to avoid policy denials. You are not alone in this journey; we are here to help you safeguard your against unforeseen circumstances.

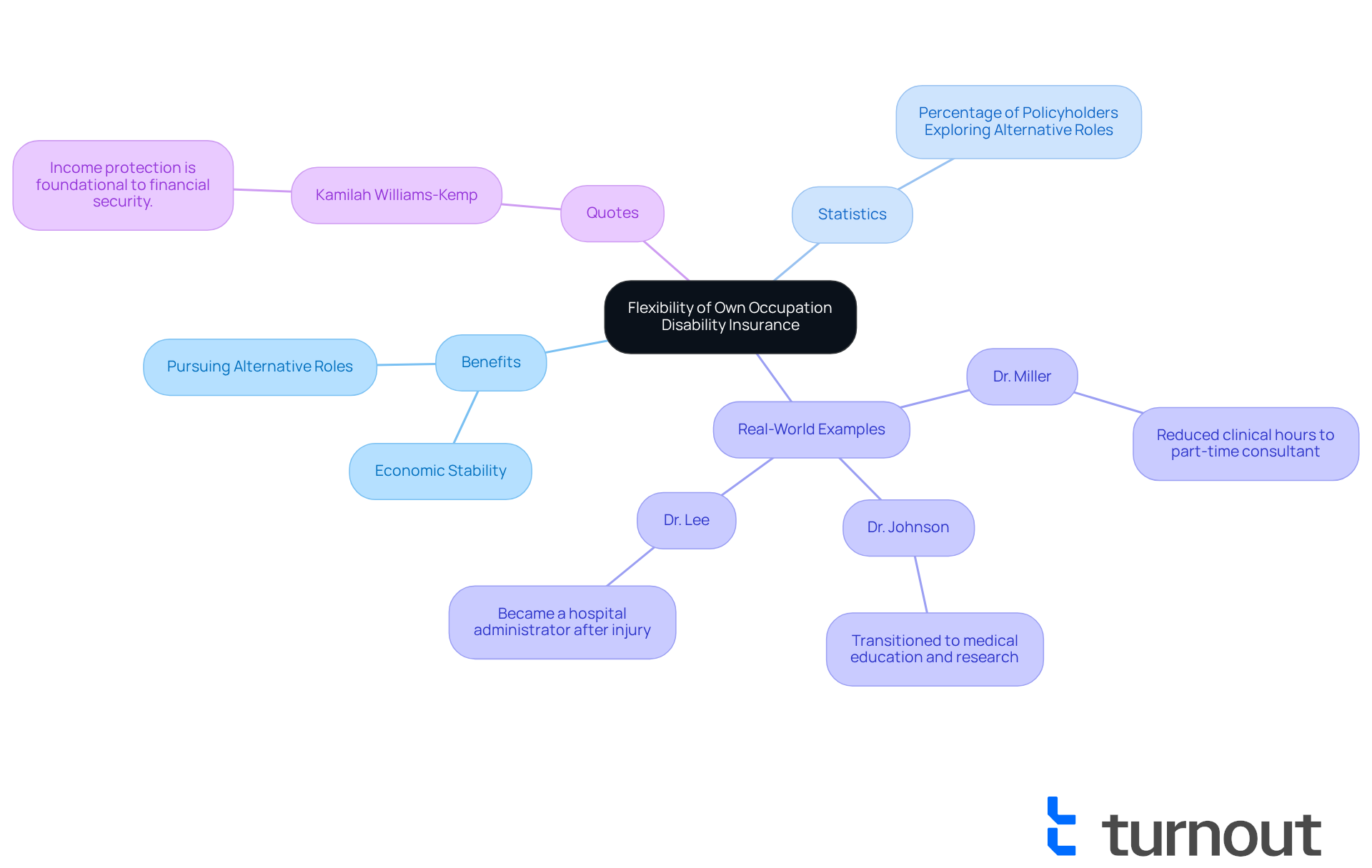

Flexibility to Work in Other Roles with Own Occupation Policies

One of the significant advantages of is the flexibility it provides. We understand that facing a disability can be challenging, and this insurance allows policyholders to without jeopardizing their benefits, as long as they are unable to perform the duties of their original occupation. This flexibility enables individuals to adjust to their situations, potentially undertaking part-time or alternative positions while still receiving . This feature is particularly beneficial for professionals who may wish to transition to different roles during their recovery, especially if they have own occupation disability insurance.

Statistics indicate that a notable percentage of policyholders explore alternative roles while on disability, demonstrating the practicality of these policies. For example, benefits are decreased dollar for dollar depending on earnings after the initial year, which highlights the importance of understanding the monetary implications of returning to work. The ability to work in other roles not only supports but also encourages a sense of purpose and involvement during difficult times. As Kamilah Williams-Kemp, Vice President of Risk Products, noted, " to economic security in any plan, and it is especially important for medical professionals."

Real-world instances further demonstrate this point. Consider Dr. Miller, a surgeon, who reduced his clinical hours to work part-time as a consultant due to chronic back pain. His continued to offer full benefits, ensuring his financial stability. Similarly, Dr. Johnson, a neurosurgeon who experienced hand tremors, shifted to medical education and research, gaining complete benefits from his coverage despite being unable to conduct surgery. Furthermore, Dr. Lee, a cardiologist, transitioned to a hospital administrator following a serious injury, and her True Own Occupation coverage also provided complete benefits. These cases highlight how own occupation disability insurance empowers professionals to maintain their livelihoods while focusing on recovery. You're not alone in this journey; these stories remind us that support is available.

High-Income Replacement Benefits of Own Occupation Insurance

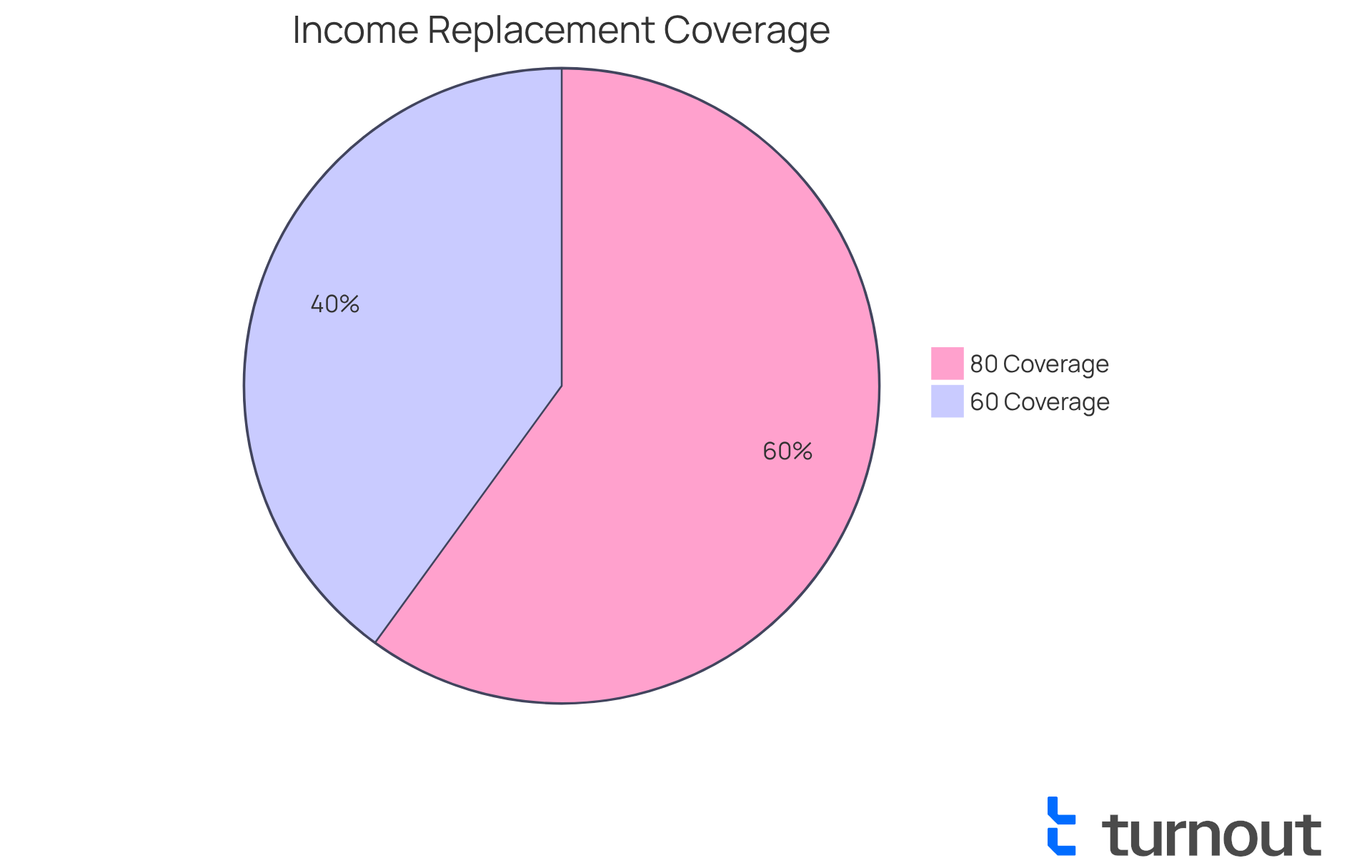

is designed to provide vital income replacement assistance, typically covering 60% to 80% of your earnings before you are unable to work. This level of coverage is especially crucial for high-income earners, as it enables you to maintain your obligations and lifestyle, even if you can work in another field. We understand that the economic impact of an impairment can be significant, particularly for those in specialized careers where earnings exceed the norm.

By obtaining own occupation disability insurance, you can alleviate the stress of . This allows you to focus on what truly matters: restoring your health. Statistics reveal that individuals with adequate income protection are more likely to achieve economic stability. It’s important to recognize that many who faced financial challenges after an impairment found their own employment agreements provided the essential support they needed.

Dr. Stephanie Pearson's experience underscores the risks of relying solely on employer-provided coverage. It’s vital to consider a . Remember, you are not alone in this journey; we’re here to help you navigate these challenges and secure your financial future.

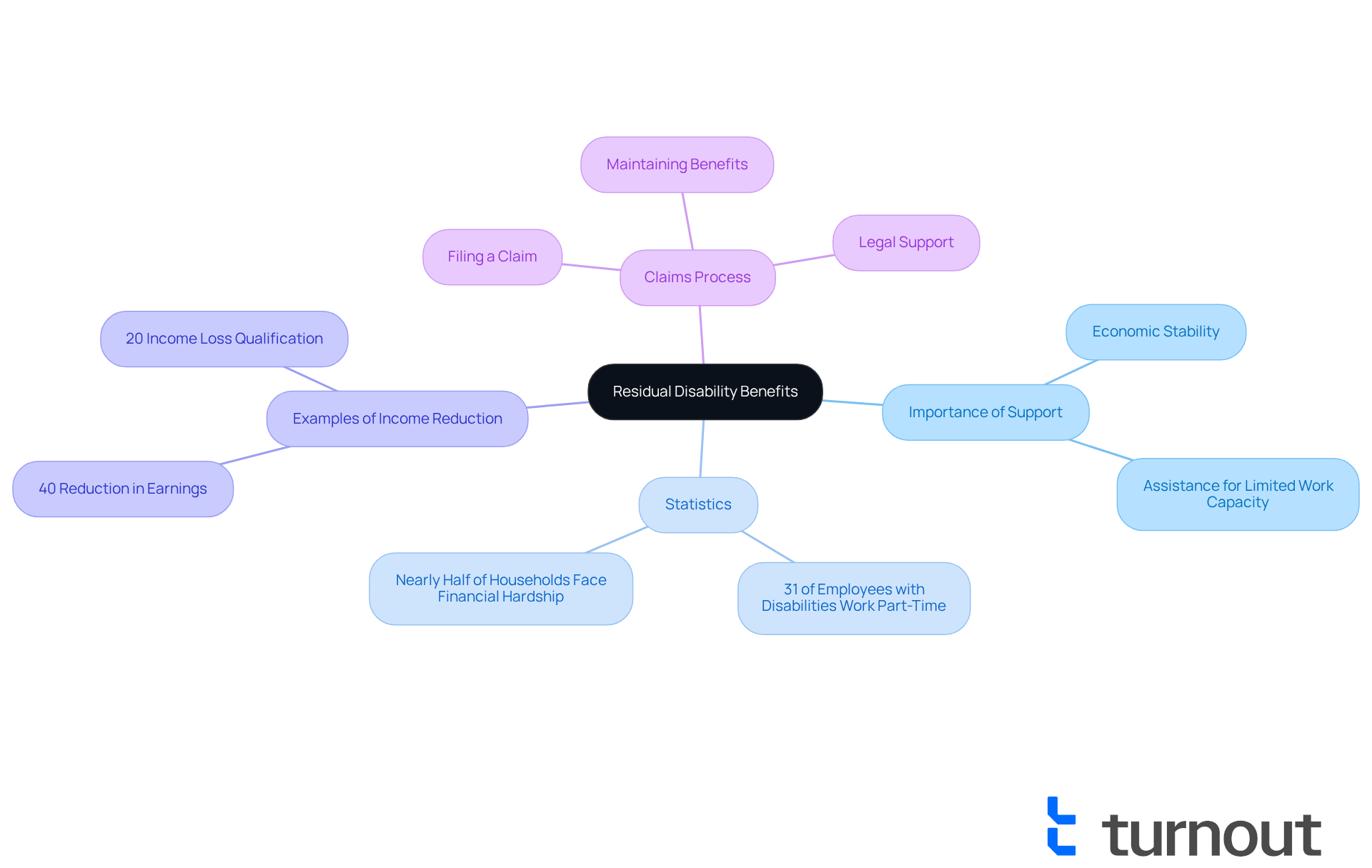

Residual Disability Benefits Explained

plays a vital role in providing monetary support for individuals who can still work but have experienced a decrease in earnings due to their disability. We understand that this financial aid helps bridge the gap between pre-disability income and reduced earnings, ensuring that you do not face economic hardship during your recovery. This support is especially crucial for those who may return to work in a limited capacity but still need assistance to maintain their .

Statistics show that about 31% of employees with physical challenges work part-time, highlighting the reality that many are grappling with reduced income. Furthermore, nearly half of U.S. households would encounter within six months if the primary income provider were unable to work. This underscores the , such as residual support.

For example, individuals facing a 40% reduction in earnings due to partial impairment may receive assistance that corresponds with that income decline. This support enables them to manage essential expenses like medical bills and mortgage payments. Financial advisors emphasize that involves a strategic approach, as many policies might only require a 20% income loss to qualify for these crucial resources.

Understanding how work is key to maintaining your economic stability. These benefits vary based on the insured's level of income loss, providing a tailored support system that recognizes the range of impairments. By keeping detailed records of your medical conditions and work activities, you can navigate the claims process effectively and secure the support you need during these challenging times. Remember, you are not alone in this journey; we’re here to help.

Key Features of Own Occupation Disability Insurance

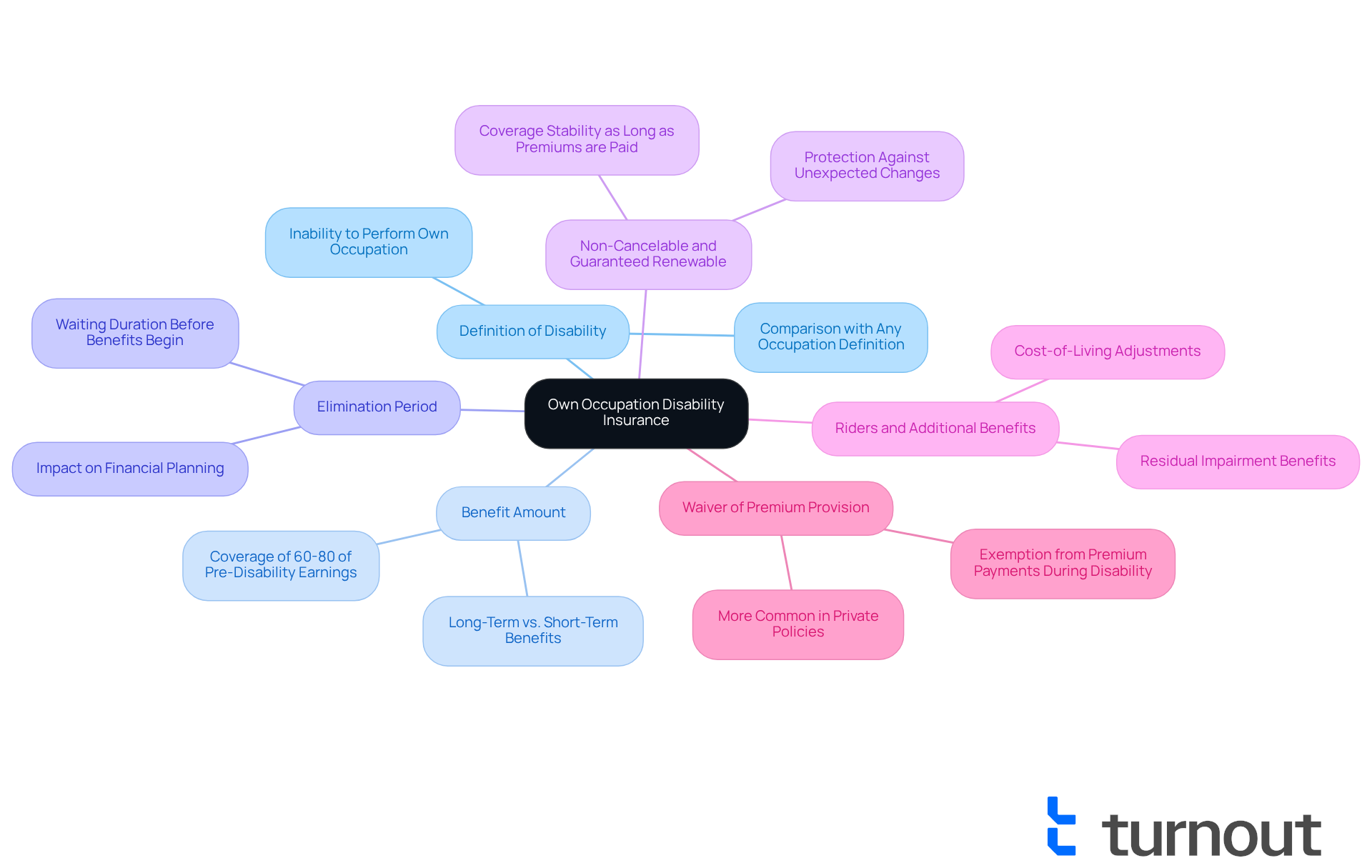

Understanding the key features of is vital, especially when facing life's uncertainties. We know that navigating these options can be overwhelming, so let’s break down some key elements that can provide you with peace of mind.

- : Policies offer clear definitions that specify the inability to perform your own occupation, ensuring that own occupation disability insurance benefits are accessible when you need them most.

- : Typically, these plans cover 60-80% of pre-disability earnings, providing significant support during difficult times.

- : This is the waiting duration before benefits begin, which can vary greatly by policy. Understanding this period is crucial for your financial planning.

- Non-Cancelable and Guaranteed Renewable: These features ensure that your coverage remains intact as long as premiums are paid, giving you peace of mind against unexpected changes.

- Riders and Additional Benefits: Options such as and cost-of-living adjustments allow for customization based on your individual needs, enhancing your overall coverage.

- : This provision allows you to stop paying premiums if you are unable to work due to an impairment, alleviating financial burdens during challenging times.

In the evolving landscape of own occupation disability insurance, understanding these features is essential for securing adequate protection. It’s common to feel uncertain about the future, but recent trends suggest an increasing focus on adaptability and portability in plans. This means you can retain coverage even as your employment situation changes.

Insurance experts emphasize the importance of choosing plans that not only meet your current needs but also adapt to future circumstances, ensuring lasting economic stability. For instance, consider how the waiver of premium provision can significantly influence your financial planning during times of impairment. Furthermore, specialists stress that guidelines with residual benefits can provide essential support for those who may still manage part-time work but face income reduction.

We’re here to help you navigate these options. Integrating these insights can empower you to make informed choices regarding your insurance needs. Remember, you are not alone in this journey.

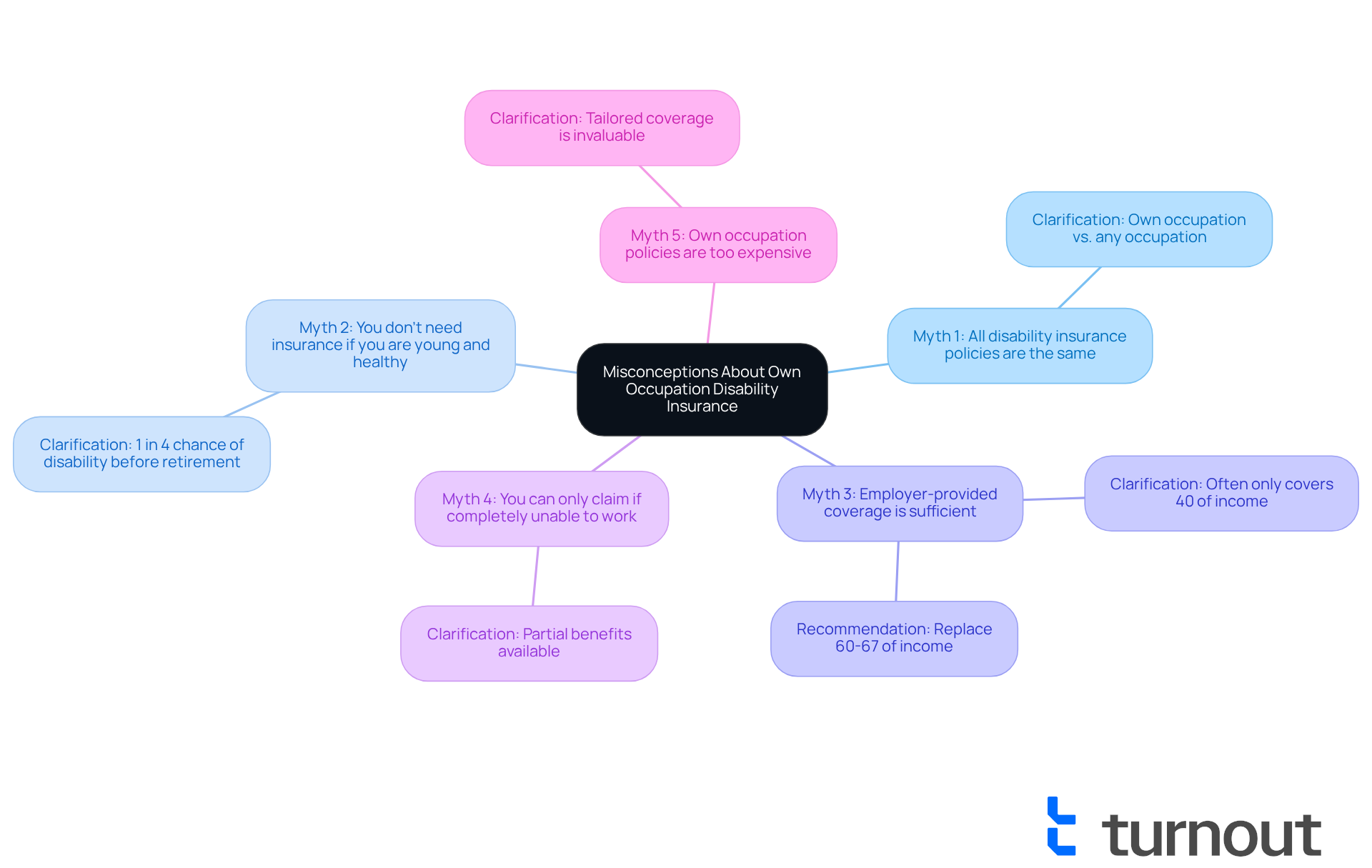

Common Misconceptions About Own Occupation Disability Insurance

can lead to uncertainty for many individuals. Let’s clarify these myths together:

- Myth 1: All disability insurance policies are the same. In reality, regulations can differ greatly, particularly between definitions of 'own occupation disability insurance' and 'any occupation'. An 'own occupation disability insurance' policy provides benefits if you are unable to perform your specific job, whereas an 'any occupation' policy mandates that you are unable to work in any job for which you are qualified.

- Myth 2: . It's important to recognize that the are just over 1 in 4 for today's 20-year-olds. This emphasizes the importance of having coverage, regardless of your age or health status.

- Myth 3: . Many individuals mistakenly believe that their employer's disability insurance will fully protect them. However, these plans often replace only about 40 percent of income, which may not be adequate for most people. Most at least 60-67% of gross pre-disability income to ensure adequate financial protection.

- Myth 4: You can only . This is deceptive; numerous plans permit partial benefits if you are unable to carry out your specific job responsibilities due to illness or injury.

- Myth 5: Own occupation policies are too expensive. While they may seem pricier upfront, the tailored coverage of own occupation disability insurance they provide can be invaluable, especially for professionals whose income relies heavily on their ability to work in their specific field.

Understanding these misunderstandings can assist you in making more informed decisions regarding your insurance requirements. Remember, you are not alone in this journey, and we’re here to help you navigate your options.

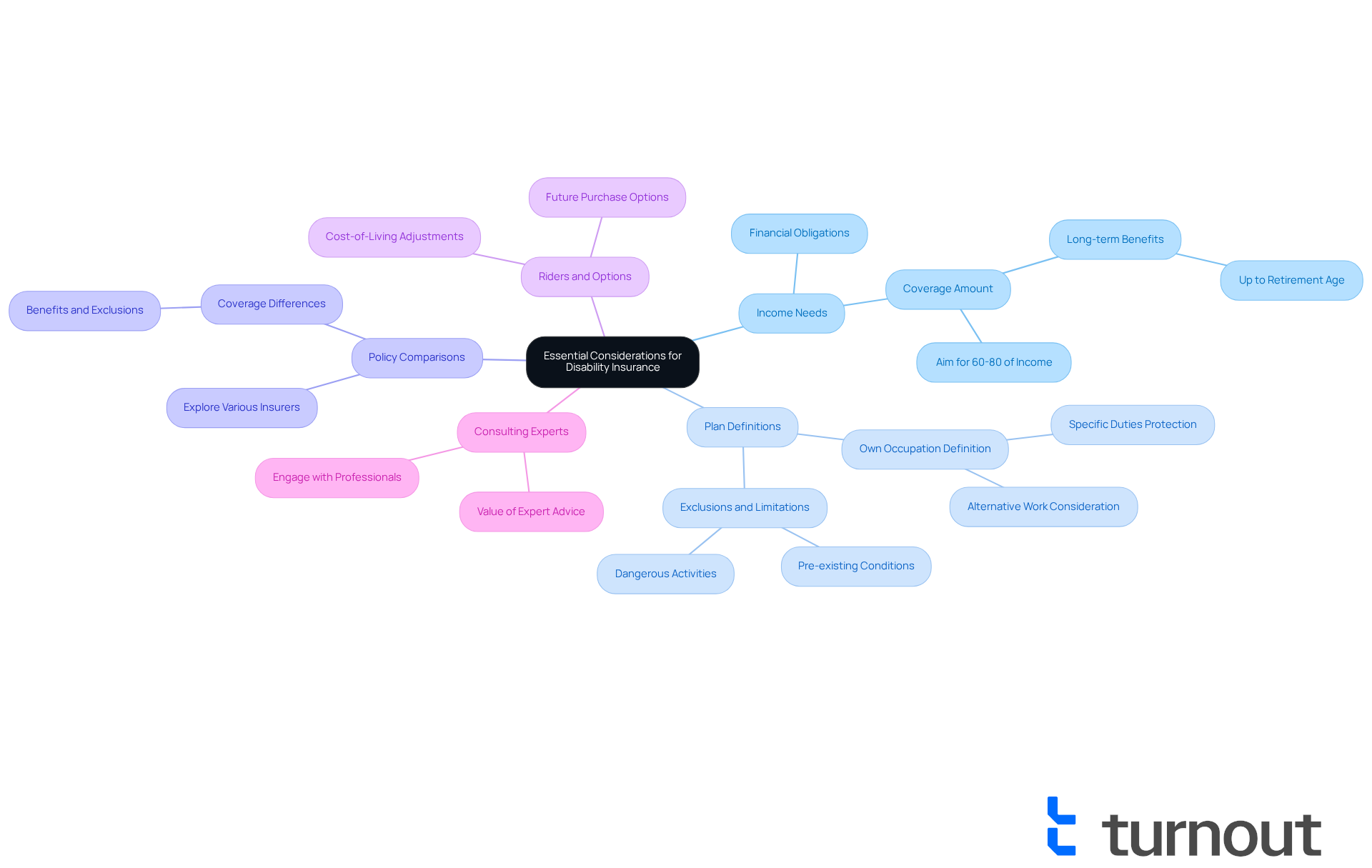

Essential Considerations When Purchasing Own Occupation Disability Insurance

When considering , acknowledging the factors that can significantly impact your is important.

- Assess Your Income Needs: Start by reflecting on how much coverage you truly need to maintain your lifestyle. Aim for a strategy that can replace 60-80% of your income. This ensures you can meet your , even if you're unable to work in your primary role. Securing a plan early can lead to through reduced premiums.

- Evaluate Definitions of the Plan: It's essential to ensure that the policy clearly defines 'own occupation.' This definition should safeguard your income through own occupation disability insurance if you're unable to perform the specific duties of your profession, even if you're capable of working in another role.

- Compare Policies: Take the time to explore various insurers and their offerings. Policies can differ greatly in terms of coverage, exclusions, and benefits, so a thorough comparison is vital to finding the best fit for your needs. Remember, disability insurance premiums are influenced by factors such as age, gender, occupation, state of residence, coverage amount, and health history.

- Understand Riders and Options: Consider additional benefits that can enhance your coverage, like cost-of-living adjustments or future purchase options. These riders can provide crucial financial stability as your circumstances change over time.

- : Engaging with knowledgeable professionals can help you navigate the complexities of disability insurance. Many individuals find value in expert advice; in fact, a significant percentage consult with financial advisors before making a purchase. This guidance can be invaluable in assessing your specific needs and ensuring you choose the right policy. The best time to seek coverage for disabilities is when you're young and healthy, as this can lead to better rates and coverage options.

Additionally, it's important to consider the , as it can create significant strain during times of disability. With approximately 26 million children and adults in the US living with Type 2 diabetes, being prepared for unforeseen circumstances is more crucial than ever. Remember, you are not alone in this journey, and we're here to help you find the right coverage.

Conclusion

Navigating the complexities of own occupation disability insurance is essential for professionals, especially those in specialized fields. This type of coverage provides crucial financial protection, ensuring that you can maintain your standard of living if you are unable to perform your specific job due to illness or injury. By understanding the nuances of this insurance, you can make informed decisions that safeguard your financial future.

We understand that the journey can feel overwhelming. Key insights highlight the transformative impact of AI on the claims process, the importance of true own occupation coverage for high-income earners, and the flexibility that allows you to pursue other roles while still receiving benefits. Additionally, addressing common misconceptions helps clarify the vital role that this insurance plays in your financial security, particularly if you have invested years in your career.

It's common to feel uncertain about the right steps to take. Therefore, it is imperative for you to proactively seek out the right own occupation disability insurance to protect yourself against unforeseen circumstances. Engaging with experts, understanding policy features, and debunking myths are critical steps in this journey. By prioritizing these considerations, you can ensure you have the coverage needed to navigate life's uncertainties with confidence and peace of mind. Remember, securing adequate protection is not just about safeguarding your income; it's about preserving the investment you have made in your career and well-being.

Frequently Asked Questions

What is Turnout and how does it assist with disability insurance claims?

Turnout is an AI-powered platform designed to simplify the process of filing impairment insurance claims and tax debt relief. It helps users manage documentation, deadlines, and communication, making the claims process more user-friendly and efficient.

How does Turnout's AI system improve the claims process?

The AI system, named Jake, streamlines claims processing by reducing administrative hurdles and speeding up processing times. It allows consumers to confidently navigate their own occupation disability insurance and government benefits, enhancing the overall claims experience.

What are the benefits of using AI in claims processing for disabilities?

AI has demonstrated significant improvements in efficiency, such as reducing processing times at the Department of Veterans Affairs from ten days to half a day. Additionally, AI can automatically extract key information from medical records, enabling quicker decisions and clearer communication.

What is own occupation disability insurance?

Own occupation disability insurance provides monetary security for individuals unable to perform their specific job duties due to illness or injury. It ensures that policyholders receive benefits even if they can work in a different role.

Why is own occupation disability insurance important for specialized professionals?

This type of insurance is crucial for high-income professionals, like physicians and dentists, who may face significant financial loss if they cannot practice their specialty. It protects their career investment and provides peace of mind during health challenges.

What distinguishes own occupation disability insurance from any occupation disability insurance?

Own occupation disability insurance offers benefits if you cannot perform your specific job duties, even if you can work in another role. In contrast, any occupation policies only provide benefits if you are unable to work in any position suited to your qualifications, making them stricter and potentially leading to more claim denials.

How do claim acceptance rates compare between own occupation and any occupation policies?

Research indicates that own occupation disability insurance plans generally have a higher acceptance rate for claims compared to any occupation plans, which can lead to more disputes over claims.

What should policyholders know about long-term coverage plans?

Many long-term coverage plans begin with an 'own occupation disability insurance' definition for a limited time before transitioning to 'any occupation.' Understanding this detail is essential for policyholders to avoid claim denials later on.