Overview

The article titled "10 Sacramento Tax Attorneys to Help You Navigate Benefits" addresses the concerns of individuals facing tax-related issues. We understand that navigating tax law can be overwhelming, and finding the right support is crucial. This piece highlights various tax professionals in Sacramento, showcasing their expertise in advocating for clients and ensuring they receive the benefits they deserve.

It's common to feel lost when dealing with tax challenges. These attorneys play a vital role in fostering a supportive environment, helping individuals understand their rights and options. By sharing personal anecdotes and testimonials, we aim to connect with you on this journey.

If you're feeling uncertain, remember: you are not alone. The right tax attorney can make a significant difference, guiding you through the complexities of tax law with compassion and care. We're here to help you take the next step toward resolving your tax issues and reclaiming your peace of mind.

Introduction

Navigating the labyrinth of tax laws and relief options can feel overwhelming for many individuals and businesses. We understand that the increasing complexities of tax regulations, coupled with innovative solutions like AI-powered advocacy, make it crucial to effectively manage tax obligations.

This article presents a curated list of ten top Sacramento tax attorneys who are here to provide expert guidance. They can help you comprehend your rights and optimize your benefits in this ever-evolving tax landscape.

How can these professionals help you demystify the tax relief process and empower you to take charge of your financial future?

Turnout: AI-Powered Advocacy for Tax Relief

Navigating the complexities of tax relief can be overwhelming, but our company is here to help. We are transforming the landscape with our AI-powered platform, designed to simplify the intricate tax system for consumers like you. By harnessing advanced technology, our platform empowers individuals to easily access the benefits they deserve, fostering confidence in tackling tax challenges. This approach not only enhances efficiency but also ensures that you remain informed and supported throughout your journey.

In addition to our AI capabilities, we employ trained nonlegal advocates for Social Security Disability (SSD) claims and partner with IRS-licensed enrolled agents for tax debt relief. This model allows us to offer expert guidance without the need for legal representation, making the process more accessible for those seeking assistance.

The integration of AI in consumer advocacy is indeed a game-changer. With over 65% of tax preparation firms planning to adopt AI technologies within the next two years, the industry is witnessing a significant shift toward automation. This trend is driven by the need for faster processing and higher accuracy, essential in navigating tax relief complexities. Moreover, AI tools have been shown to reduce errors by an average of 40%, significantly improving compliance and operational efficiency.

Experts agree on the transformative potential of AI in this domain. Many professionals acknowledge that AI not only boosts accuracy and security but also expands service offerings, making it an essential component of modern tax advocacy. As AI continues to evolve, we expect it to enhance your overall experience, allowing for more personalized and effective support.

Recent developments in AI for tax relief further illustrate its impact. For example, AI algorithms can identify tax fraud with an impressive accuracy rate of 85%. This capability not only aids in preventing fraud but also fosters trust in the integrity of tax services. Additionally, AI-driven solutions assist in identifying potential tax credits that might otherwise be overlooked, boasting a detection rate of 85% as well.

However, we understand that trust in AI solutions is crucial. As highlighted by Werfel, trust is essential because companies with untrustworthy AI will struggle in the market, and users won’t adopt technology they can’t trust. Furthermore, the IRS has faced challenges post-2022 tax season, underscoring the urgency of adopting AI solutions in tax preparation.

In summary, Turnout’s innovative use of AI, combined with expert guidance from trained advocates and enrolled agents, is not just about technology; it’s about creating a more compassionate and efficient system. We want to empower you to navigate your tax issues with clarity and confidence, knowing that you are not alone in this journey.

John M. Goralka: Expert in Business Tax and Estate Planning

John M. Goralka is a caring expert in business tax and estate planning, with over 30 years of experience. At Goralka Law Firm, we are dedicated to providing personalized tax solutions for both individuals and businesses. We understand that navigating tax law can be overwhelming, but Goralka's deep knowledge positions him as a vital resource for addressing your concerns.

As we look ahead to 2025, the landscape of tax law presents both opportunities and challenges. Increased IRS funding has led to heightened audits and compliance enforcement. However, there are also potential benefits, such as enhanced federal tax credits for businesses investing in clean energy initiatives, thanks to the Inflation Reduction Act incentives. It's common to feel uncertain about these changes, but Goralka's insights can help you navigate them effectively, ensuring you stay compliant while optimizing your advantages.

Our firm exemplifies the proactive approach necessary for successful business tax planning. For instance, the Work Opportunity Tax Credit allows employers to claim credits of up to $9,600 per qualified employee. This highlights the importance of proper documentation to avoid complications. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Klasing Associates: Dual-Licensed Tax Professionals

At Klasing Associates, we understand that navigating tax and financial matters can be overwhelming. That's why our team of dual-licensed professionals is here to help. By combining the expertise of tax specialists and financial advisors, we offer comprehensive solutions tailored to your unique needs.

Our approach is designed with your success in mind. We provide personalized strategies for:

- Tax planning

- Compliance

- Dispute resolution

Ensuring that you feel supported every step of the way. You are not alone in this journey; we are committed to addressing your specific concerns and guiding you toward the best outcomes.

Let us work together to create a plan that meets your needs. With our caring and compassionate team, you can trust that your financial future is in good hands.

Evolution Tax and Legal: Specialized Expat Tax Services

Navigating the complexities of government benefits and financial support can be overwhelming, especially for expatriates facing intricate tax obligations. We understand that this journey can feel daunting. That's why organizations like Evolution Tax and Legal focus on expatriate tax services, while others offer essential support with Social Security Disability (SSD) claims and tax debt relief for U.S. citizens living abroad.

At Turnout, we’re here to help. By utilizing trained nonlawyer advocates and IRS-licensed enrolled agents, we ensure that expatriates receive personalized guidance tailored to their unique needs. This compassionate approach not only aids individuals in understanding their tax responsibilities but also empowers them to optimize available advantages.

Our goal is to enhance clarity and efficiency throughout this process. You are not alone in this journey; we are committed to supporting you every step of the way. Let us help you navigate these challenges with confidence.

Sacramento Law Group: Comprehensive IRS Tax Relief and Audit Defense

At Sacramento Law Group, we understand that dealing with IRS tax issues can be overwhelming, which is why our Sacramento tax attorneys are here to help. That's why we offer a comprehensive suite of services dedicated to IRS tax relief and audit defense, facilitated by our Sacramento tax attorneys. Our experienced team of Sacramento tax attorneys is here to protect you from aggressive IRS actions, providing strategic representation and steadfast support throughout the audit process. By concentrating on proactive measures, we help you gather essential documentation, which is vital for supporting your claims and managing potential audits effectively.

In 2025, audit defense strategies have evolved, highlighting the importance of preparation. We encourage you to treat your documentation as if you are preparing for a legal defense. Having mortgage agreements, payment confirmations, and other relevant records readily available can significantly reduce the anxiety linked to audits. This method not only alleviates stress but also prepares you for positive outcomes. As Dominique Molina, co-founder and President of the American Institute of Certified Tax Planners, wisely states, "the best defense is a good offense"; proactive documentation can make audits a more straightforward process.

With the IRS randomly selecting audits, as noted by the General Accounting Office, being prepared is crucial. Real-world examples illustrate the effectiveness of these strategies. Clients who have diligently gathered their supporting documentation, as highlighted in the case study "Establishing Evidence for Tax Deductions," have successfully navigated audits, regaining control over their tax situations. At Sacramento Law Group, our Sacramento tax attorneys empower you to take charge of your financial future, ensuring you are equipped to handle any challenges that arise with confidence. Remember, you are not alone in this journey; we're here to help.

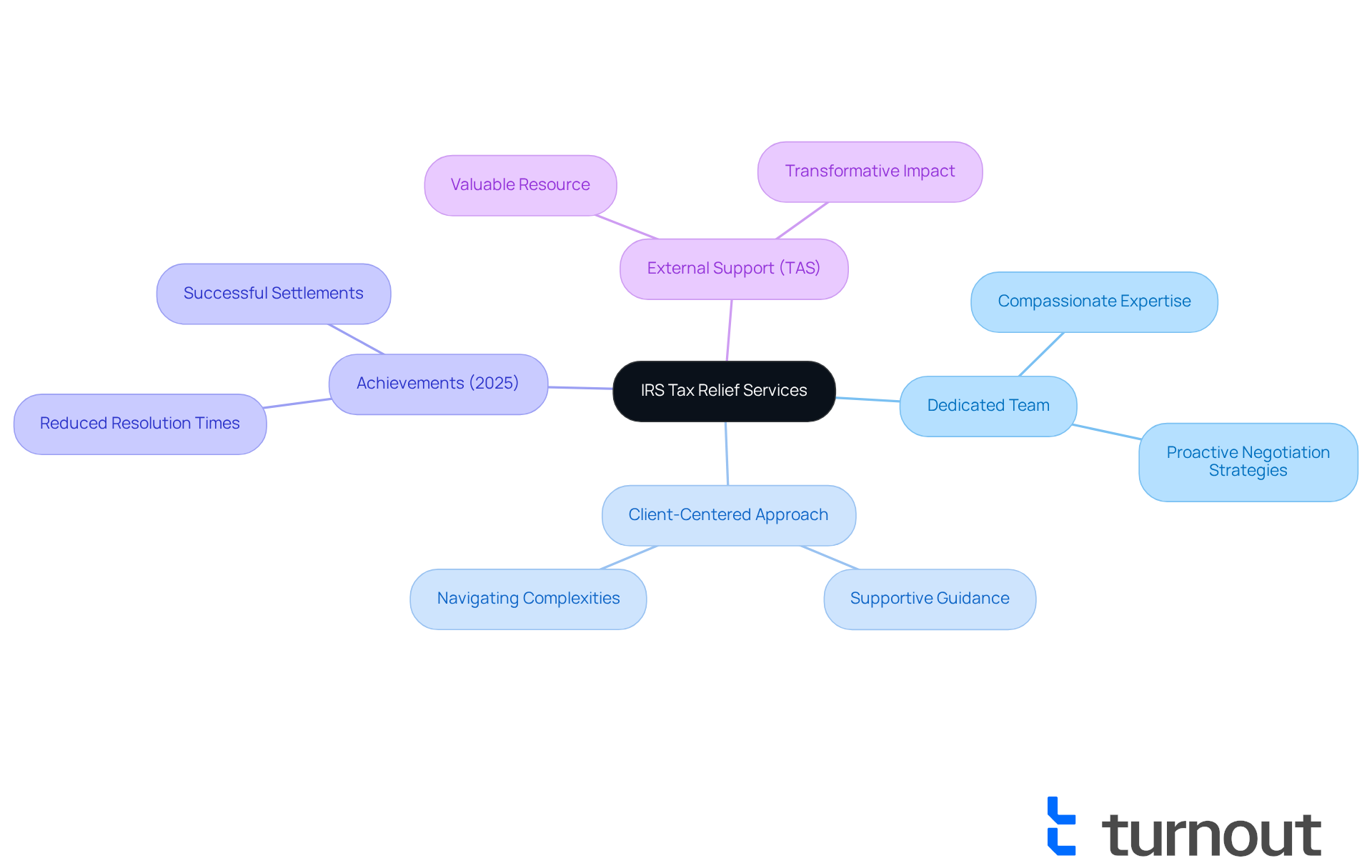

MW Attorneys: Dedicated IRS Tax Relief Services

At MW Professionals, we understand that dealing with tax debts can be overwhelming, and that's why it's important to seek help from Sacramento tax attorneys. Our dedicated team specializes in IRS tax relief services, focusing on helping individuals resolve their tax disputes with compassion and expertise. We know the complexities of IRS regulations can be daunting, but we work tirelessly to negotiate favorable settlements for you.

With a client-centered approach, MW Attorneys ensures that you receive the support you need to navigate these challenges. In 2025, we've seen a significant reduction in the average time taken to resolve IRS tax disputes, thanks to our proactive negotiation strategies that lead to quicker resolutions. This improvement is especially important given the operational difficulties faced by the IRS, which can complicate normal procedures.

If you find yourself struggling when traditional methods fail, remember that the Taxpayer Advocate Service (TAS) is a valuable resource. Many individuals have successfully overcome their tax debts with the help of experienced Sacramento tax attorneys, demonstrating the transformative impact of expert guidance in navigating complex tax issues. You are not alone in this journey, and we’re here to help you find relief.

SCL Tax Law: Premier IRS Tax Law Services with Free Consultations

Navigating the complexities of government benefits and financial aid can be overwhelming, especially when it comes to Social Security Disability (SSD) claims and tax debt relief. We understand that this journey can be challenging, and that's where participation becomes vital. Turnout is here to provide crucial assistance tailored to your needs.

It's important to note that we are not a legal firm and do not offer legal representation. Instead, we employ trained nonlawyer advocates who specialize in SSD claims and collaborate with IRS-licensed enrolled agents for tax debt relief. This ensures you receive informed support designed specifically for you, without the formalities of legal representation.

Imagine having personalized guidance on efficiently finalizing your SSD applications or negotiating tax agreements. By offering these services, Turnout empowers you to manage your financial challenges effectively and access the benefits you deserve. Remember, you are not alone in this journey; we are here to help you every step of the way.

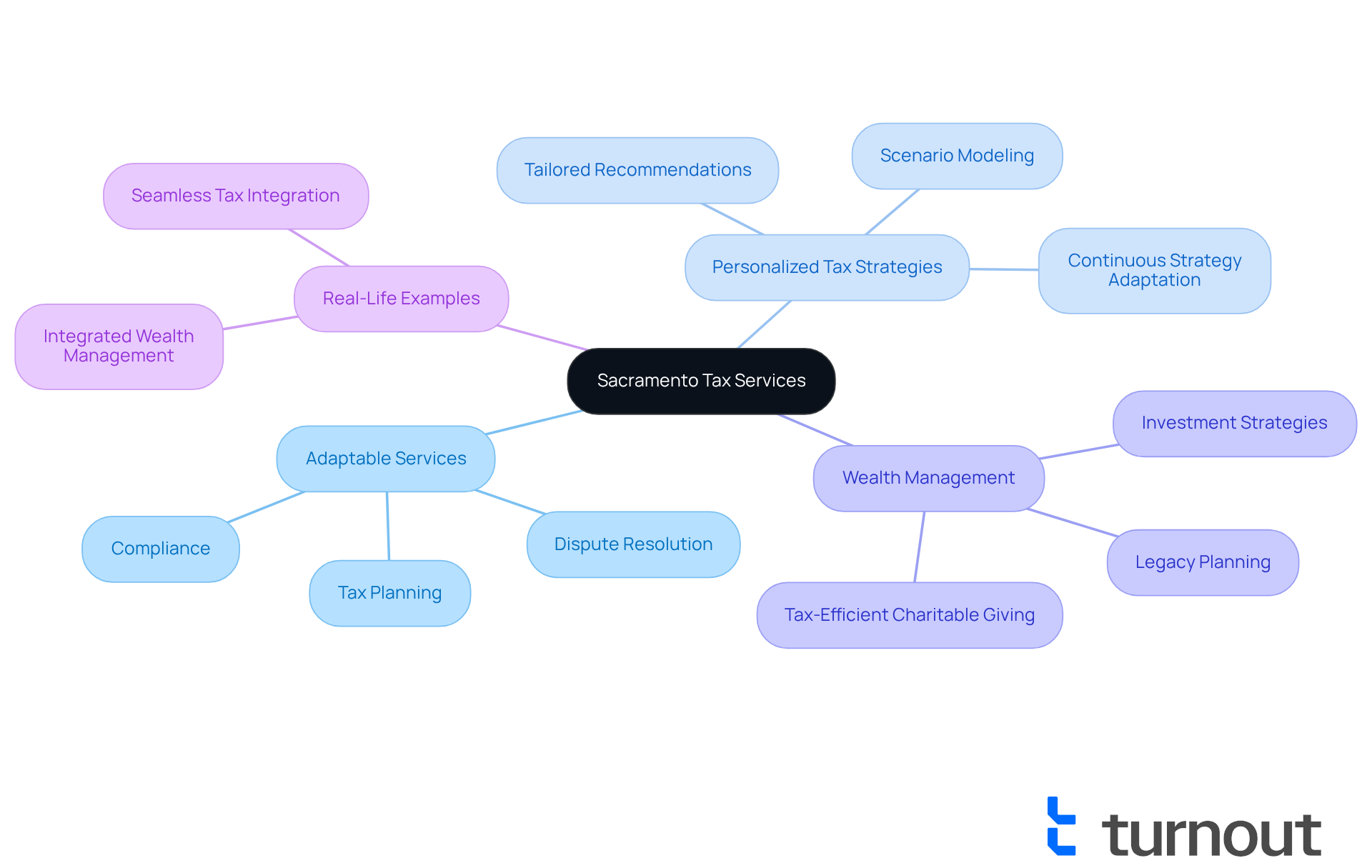

Sacramento Tax Lawyers: Versatile Tax Services for Legal Support

Sacramento tax attorneys offer adaptable tax services designed to meet a wide range of needs. We understand that navigating tax planning, compliance, and dispute resolution can be overwhelming, especially for those working with Sacramento tax attorneys. That’s why our dedicated team of Sacramento tax attorneys is here to assist you in tackling various tax-related challenges with compassion and expertise. Our commitment to providing customized solutions with the help of Sacramento tax attorneys ensures that you receive the assistance necessary to manage the complexities of tax regulations effectively.

In 2025, updates in tax planning and compliance highlight the importance of adjusting strategies to fit your unique situation. AAF Wealth Management embodies this principle with its integrated approach to tax planning, allowing for real-time adjustments based on life changes and financial goals. This ongoing collaboration with AAFCPAs means you can benefit from tailored, tax-sensitive recommendations that are both compliant and effective.

As Dan Seaman, CPA and Tax Partner at AAF Wealth Management, beautifully puts it, "We recognize that wealth is about more than numbers; it represents a lifetime of achievement, aspirations for your family, and a legacy for future generations." This perspective underscores the deep connection between wealth management and tax planning, especially during significant life events. A personal touch is essential; it ensures that your financial decisions are both intentional and tax-efficient.

Real-life examples illustrate the power of tailored solutions in tax planning. For instance, experts often use scenario modeling to explore different paths, allowing you to see the potential effects of each choice before making decisions. This strategic focus on tax efficiency not only alleviates tax burdens but also fosters long-term financial stability.

You are not alone in this journey. We’re here to help you navigate these complexities with care and understanding.

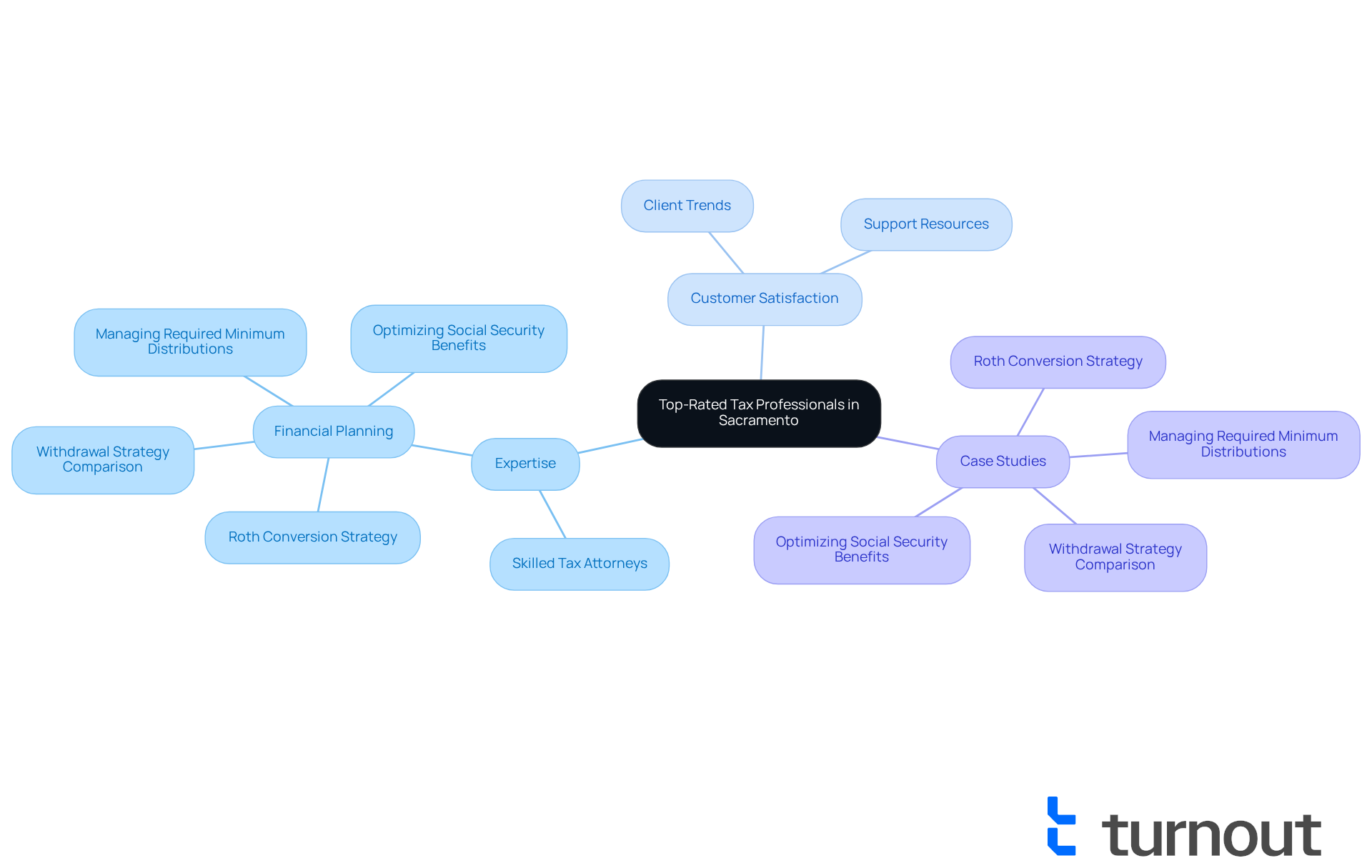

Super Lawyers: Top-Rated Tax Professionals in Sacramento

Super Lawyers offers a directory of highly-rated Sacramento tax attorneys who are recognized for their expertise and commitment to customer satisfaction. We understand that navigating tax matters can be overwhelming, and this resource helps you find trusted Sacramento tax attorneys who excel in the field. By showcasing these respected specialists, Super Lawyers supports you in finding the right assistance from Sacramento tax attorneys for your tax needs.

As the industry evolves, acknowledging skilled Sacramento tax attorneys becomes increasingly important. This ensures that you receive the highest standard of service and satisfaction when managing complex tax issues. For instance, Mariaca Wealth Management emphasizes the importance of carefully reviewing financial plans to maximize benefits, which is vital for anyone seeking help with tax-related concerns.

Moreover, case studies like 'Optimizing Social Security Benefits' demonstrate how collaborating with recognized professionals can lead to improved financial outcomes. We recognize that trends in client satisfaction are shifting, and engaging with these experts can provide the guidance you need to effectively navigate the complexities of tax systems. Remember, you are not alone in this journey; we’re here to help you every step of the way.

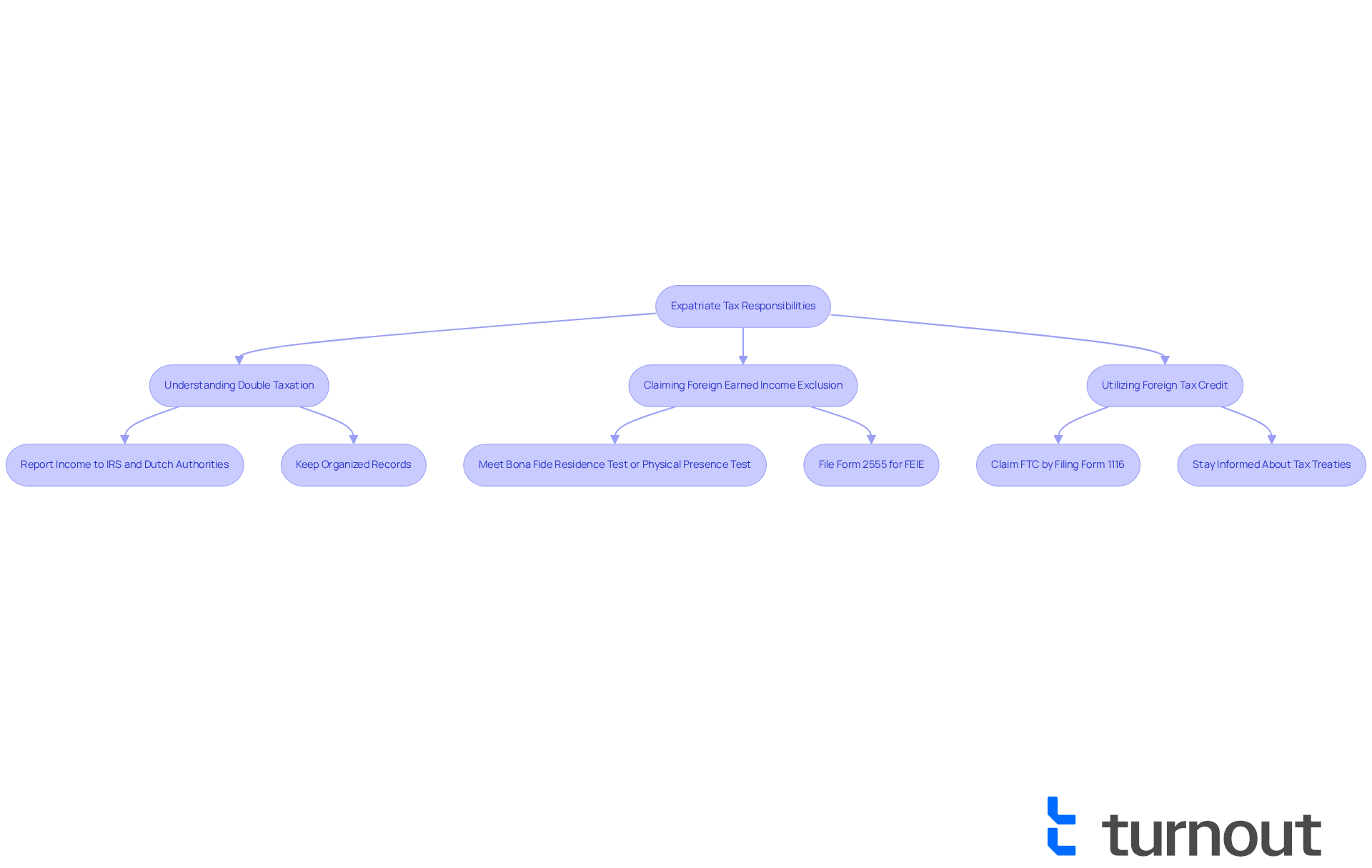

Sacramento Expat Tax Attorney: Expert Assistance for Expatriates

Navigating the intricate landscape of U.S. tax obligations while living abroad can be overwhelming. Sacramento Expat Tax Services understands the unique challenges expatriates face, such as the risk of double taxation and the complexities of compliance with reporting requirements. For example, U.S. citizens like Mark, who works in the Netherlands, must report his $70,000 income to both the Dutch government and the IRS, which can lead to the stress of potential double taxation. Fortunately, there are tax treaties or exclusions that may help alleviate these challenges. To support you through this process, these services offer tailored solutions that ensure compliance while maximizing available benefits.

We know how important it is for expatriates to feel empowered in managing their tax responsibilities. Sacramento tax attorneys are here to guide you through essential processes, such as claiming the Foreign Earned Income Exclusion (FEIE). This allows eligible expats to exclude up to $120,000 of foreign-earned income from U.S. taxation for 2023. Additionally, they provide assistance in understanding the Foreign Tax Credit (FTC), which applies to both earned and unearned income and can offset U.S. tax liabilities based on foreign taxes paid. This support can significantly reduce the burden of double taxation.

Proper record-keeping is another crucial aspect for expatriates, as it is essential for tax compliance. Maintaining organized records can save you time and stress during tax filing. By leveraging expert knowledge and personalized strategies, Sacramento tax attorneys enable you to navigate your tax obligations confidently. Remember, you are not alone in this journey; we are here to help ensure you remain compliant while optimizing your financial position.

Conclusion

Navigating the complexities of tax law and relief can feel overwhelming. However, the expertise of Sacramento tax attorneys shines as a beacon of hope. This article underscores the vital role these professionals play in assisting individuals and businesses in managing their tax obligations with confidence and clarity.

We understand that tax challenges can be daunting. Throughout this article, we’ve shared key insights about the transformative potential of AI in tax advocacy, the importance of proactive documentation in audit defense, and the specialized services available for expatriates facing unique tax issues. Each featured attorney and firm is dedicated to empowering clients, whether through business tax planning, IRS audit defense, or tailored expat services. Remember, you are not alone in facing your tax concerns.

In conclusion, seeking assistance from qualified tax professionals in Sacramento not only simplifies the tax process but also enhances your chances of achieving favorable outcomes. As tax laws continue to evolve, staying informed and supported is crucial. Engaging with the right attorney can make a significant difference in navigating these complexities, ensuring you can optimize your benefits while remaining compliant. The journey toward tax relief becomes much more manageable with expert guidance. Take the first step today and explore the resources available to you—help is here.

Frequently Asked Questions

What is the purpose of Turnout's AI-powered platform for tax relief?

Turnout's AI-powered platform is designed to simplify the complexities of the tax system, enabling consumers to easily access the benefits they deserve and fostering confidence in tackling tax challenges.

How does Turnout enhance the tax relief process?

Turnout enhances the tax relief process by using advanced technology and employing trained nonlegal advocates for Social Security Disability claims, as well as partnering with IRS-licensed enrolled agents for tax debt relief, making assistance more accessible.

What impact is AI having on the tax preparation industry?

Over 65% of tax preparation firms plan to adopt AI technologies within the next two years, leading to faster processing, higher accuracy, and a significant reduction in errors by an average of 40%, improving compliance and operational efficiency.

How does AI contribute to identifying tax fraud and potential tax credits?

AI algorithms can identify tax fraud with an accuracy rate of 85% and assist in detecting potential tax credits that might be overlooked, also boasting a detection rate of 85%.

Why is trust in AI solutions important for consumers?

Trust in AI solutions is crucial because companies with untrustworthy AI will struggle in the market, and users are less likely to adopt technology they cannot trust.

Who is John M. Goralka and what expertise does he offer?

John M. Goralka is an expert in business tax and estate planning with over 30 years of experience, dedicated to providing personalized tax solutions for individuals and businesses.

What challenges and opportunities are present in the tax law landscape as we approach 2025?

Increased IRS funding has led to more audits and compliance enforcement, but there are also potential benefits, such as enhanced federal tax credits for businesses investing in clean energy initiatives due to the Inflation Reduction Act.

What is the Work Opportunity Tax Credit?

The Work Opportunity Tax Credit allows employers to claim credits of up to $9,600 per qualified employee, highlighting the importance of proper documentation to avoid complications.

What services does Klasing Associates offer?

Klasing Associates provides comprehensive solutions through a team of dual-licensed professionals, offering personalized strategies for tax planning, compliance, and dispute resolution.

How does Klasing Associates support clients in their financial journey?

Klasing Associates is committed to addressing clients' specific concerns and guiding them toward the best outcomes, ensuring they feel supported throughout the process.