Overview

Navigating the world of disability claims can be overwhelming, and we understand that financial uncertainties often add to the stress. That's why it's essential to effectively use the SSDI Retroactive Payments Calculator. This tool can help you estimate your potential back pay from the Social Security Administration, providing some clarity in these challenging times.

To get started, focus on three essential steps:

- Gather the necessary information. This will ensure that you have everything you need at your fingertips.

- Input accurate dates—this is crucial for obtaining the most precise estimate.

- Take the time to understand the results; they can offer valuable insights into your financial future.

By following this structured approach, you can alleviate some of the worries associated with your disability claim. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming, especially when it comes to understanding potential retroactive payments. We understand that this journey can be challenging, and that’s why the SSDI Retroactive Payments Calculator is here to help. This essential tool allows individuals to estimate their back pay, empowering you to make informed financial decisions during this difficult time.

You may be wondering: how can you effectively utilize this calculator to ensure accurate results and avoid common pitfalls? It’s common to feel uncertain, but this article will guide you through a step-by-step process. We will highlight the calculator's features while addressing typical issues users may encounter, helping you to maximize your benefits with confidence. Remember, you are not alone in this journey, and we are here to support you every step of the way.

Understand the SSDI Retroactive Payments Calculator

The ssdi retroactive payments calculator is a vital tool for anyone seeking to understand their potential back pay from the Social Security Administration (SSA). We recognize that navigating this process can be overwhelming, and this calculator is here to help you assess your situation.

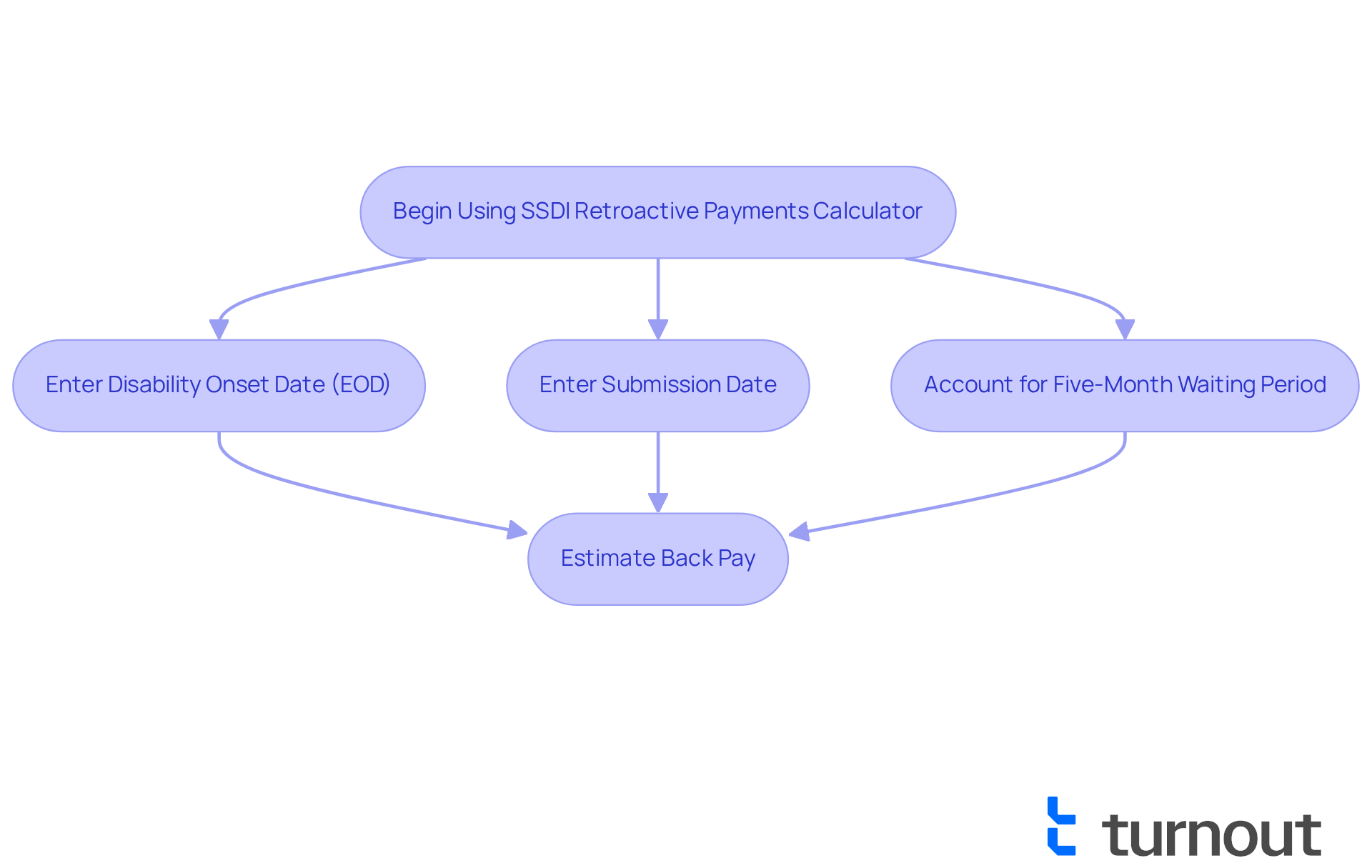

Key factors to consider include:

- Disability Onset Date (EOD): This is when your disability began, as recognized by the SSA.

- Submission Date: The date you submitted your application for disability benefits.

- Five-Month Waiting Period: SSDI benefits usually start five months after the EOD.

By entering these dates into the calculator, you can estimate your back pay, which may be a crucial financial resource during tough times. For example, beneficiaries in 2025 can expect an average retroactive payment of around $6,710. This highlights how important accurate calculations can be.

Disability advocates stress the significance of using this calculator effectively. Understanding the difference between the EOD and your application date can greatly assist in your financial planning. As one advocate wisely said, "Good information is essential for navigating complex systems like Social Security."

Using the ssdi retroactive payments calculator empowers you to make informed decisions about your claims. It also helps clarify the often-confusing world of Social Security benefits. Remember, you are not alone in this journey; we are here to support you as you prepare for the financial implications of your disability claims.

Follow the Step-by-Step Process to Use the Calculator

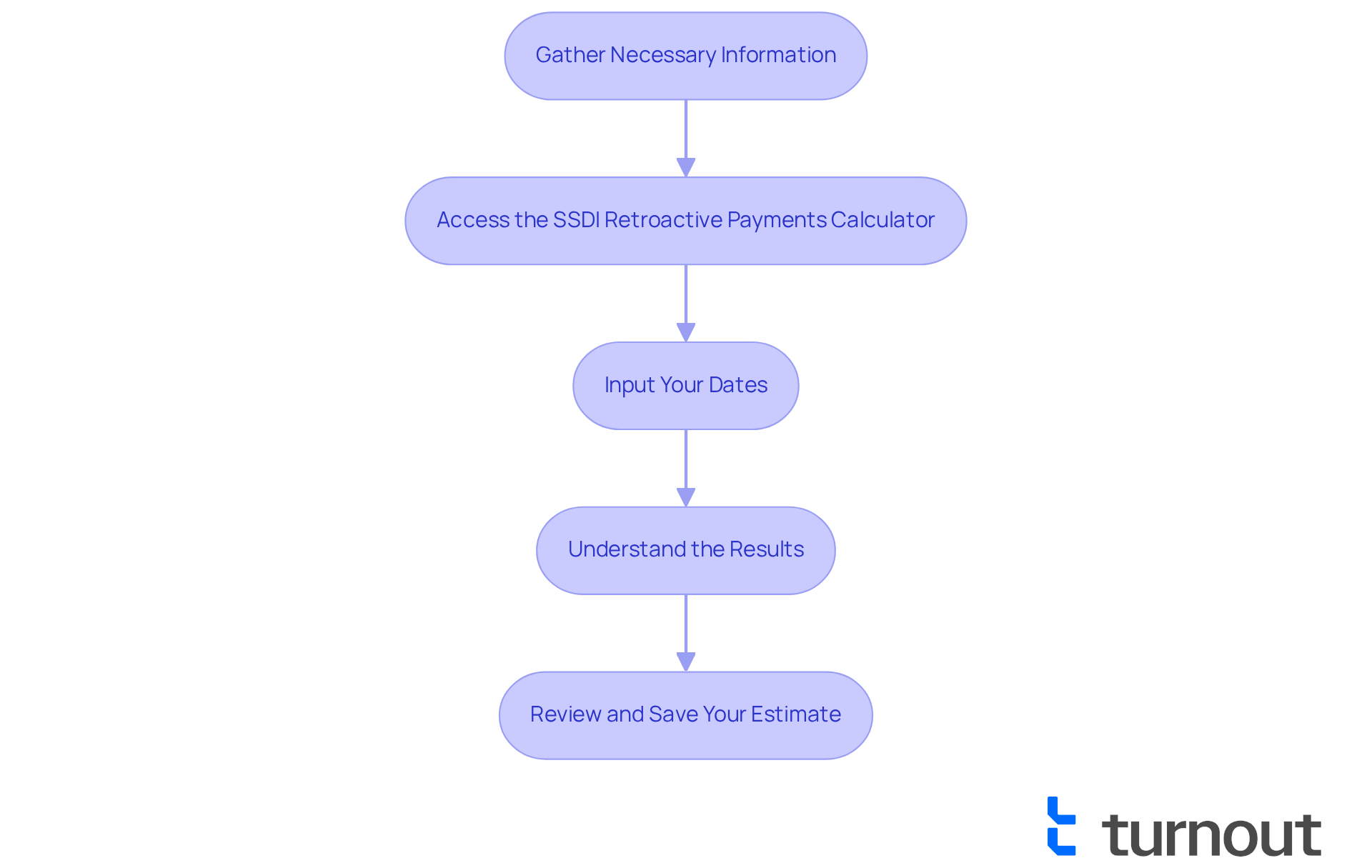

To effectively use the SSDI Retroactive Payments Calculator, let's take this step-by-step together:

- Gather Necessary Information: Before you begin, it’s important to collect some key information. Please have your Disability Onset Date (EOD) and the date you submitted your SSDI application ready. This will help ensure a smoother process.

- Access the SSDI retroactive payments calculator: You can visit a reliable SSDI estimation website, such as those provided by the Social Security Administration (SSA) or trusted disability advocacy organizations. These platforms often provide state-specific guides and tools designed to make this process easier for you.

- Input Your Dates: Now, enter your EOD and application date into the specified fields on the SSDI retroactive payments calculator. Precision is key here; even small mistakes can lead to significant differences in your projected benefits.

- Understand the Results: After you’ve entered your information, the SSDI retroactive payments calculator will give you an estimate of your back pay. This amount reflects the overall assistance you might receive from the SSA, taking into account the five-month waiting period that typically applies to disability claims. Understanding how your benefits are calculated can be reassuring as you prepare for what lies ahead.

- Review and Save Your Estimate: Make sure to note the estimated amount. This information can be incredibly useful for budgeting and planning your finances while you await your disability approval. Many applicants encounter challenges, such as lengthy wait times and the need for thorough documentation, so having a clear estimate can help ease some of the stress during this time.

By following these steps, you can navigate the disability benefits calculator with confidence. Remember, you are not alone in this journey, and we’re here to help you understand your potential benefits and plan accordingly.

Troubleshoot Common Issues with the Calculator

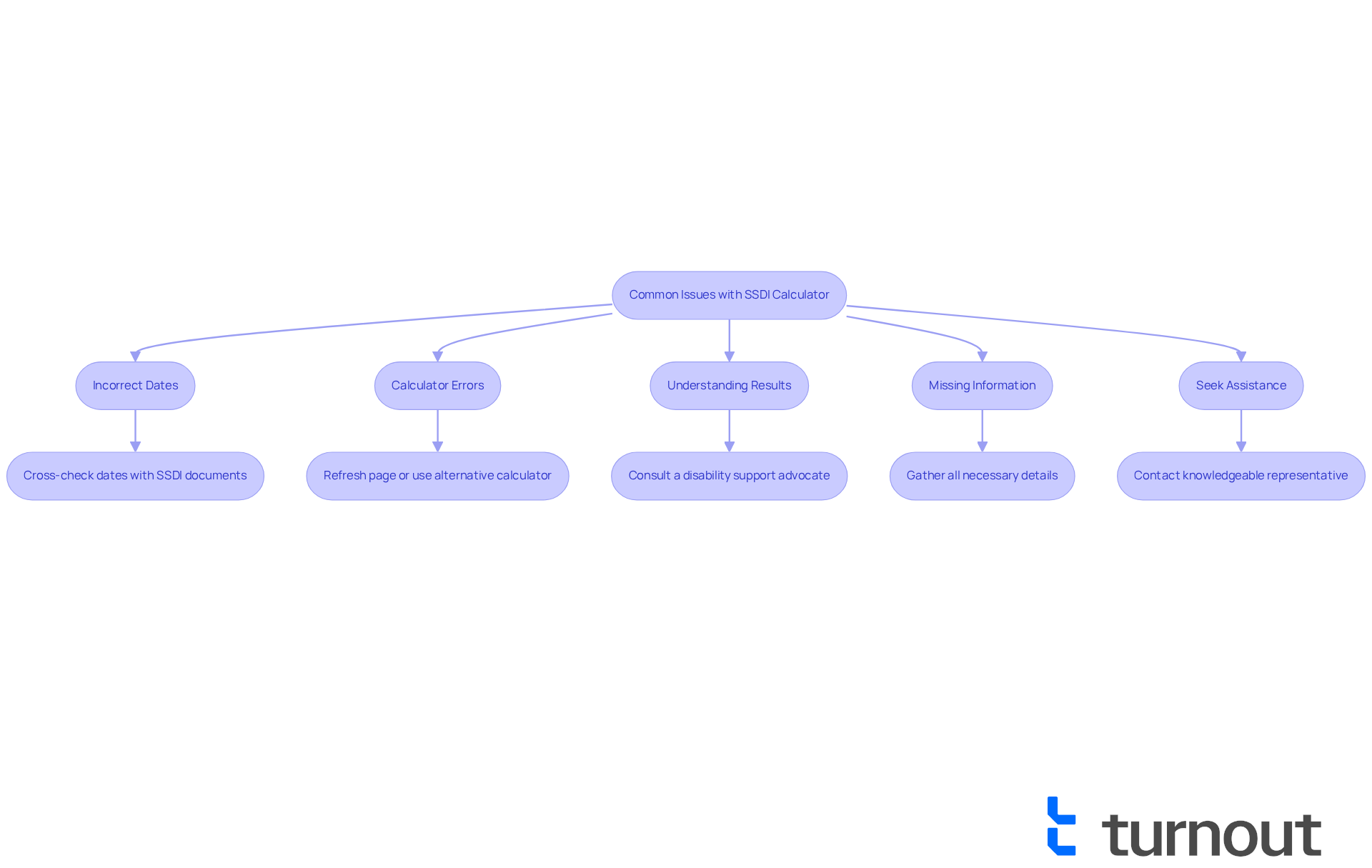

When utilizing the ssdi retroactive payments calculator, it's common to encounter several typical issues. We understand that navigating this process can be challenging, so here’s how to effectively troubleshoot them:

- Incorrect Dates: Are you sure you’re inputting the accurate Disability Onset Date (EOD) and application timestamp? It’s essential to cross-check these dates with your SSDI application documents to ensure accuracy.

- Calculator Errors: If the calculator fails to provide results, try refreshing the page or using an alternative calculator. Technical glitches can occasionally disrupt functionality, and it’s frustrating when this happens.

- Understanding Results: If the estimated back pay seems incorrect or unclear, consider seeking assistance from a disability support advocate. Turnout utilizes trained nonlawyer advocates who can help clarify the results and offer valuable insights into your situation. As highlighted by proponents, "Precise data entry is essential; even slight errors can result in considerable variations in advantages."

- Missing Information: Ensure you have all necessary details, including your EOD, as the tool may not operate correctly without complete information. Gathering all required data before attempting to use it again can make a significant difference.

- Seek Assistance: If problems continue, don’t hesitate to contact a knowledgeable representative or support group specializing in SSDI resources. Turnout's trained nonlawyer advocates are here to provide guidance and help resolve any complications you may face.

By following these steps and leveraging the support of advocates, you can navigate the ssdi retroactive payments calculator more effectively to ensure you receive the benefits you deserve. Remember, you are not alone in this journey, and Turnout is here to help. Please note that Turnout is not a law firm and does not provide legal advice.

Conclusion

Utilizing the SSDI retroactive payments calculator is essential for individuals navigating the complexities of Social Security Disability Insurance (SSDI). We understand that this process can feel overwhelming, and this tool not only provides clarity regarding potential back pay but also empowers you to make informed financial decisions based on your unique circumstances. By grasping the significance of accurate input, such as the Disability Onset Date and application submission date, you can gain valuable insights into your expected benefits.

The article outlines a clear, step-by-step process for effectively using the calculator, from gathering necessary information to troubleshooting common issues. Remember, precision in data entry is crucial. Additionally, support resources, such as disability advocates, are available to assist you in overcoming obstacles. These insights highlight the calculator's role as a vital resource in financial planning during the often-stressful waiting period for SSDI approval.

In conclusion, the SSDI retroactive payments calculator serves as a beacon of hope for those seeking clarity and support in their financial journey. By leveraging this tool and the assistance of knowledgeable advocates, you can confidently navigate the SSDI process, ensuring you receive the benefits you deserve. Taking the time to understand and utilize this calculator can significantly impact your financial stability during challenging times. Remember, you are not alone in this journey, and this tool is here to help you along the way.

Frequently Asked Questions

What is the SSDI retroactive payments calculator?

The SSDI retroactive payments calculator is a tool designed to help individuals understand their potential back pay from the Social Security Administration (SSA) related to disability benefits.

What key factors do I need to consider when using the calculator?

The key factors to consider include the Disability Onset Date (EOD), the Submission Date of your application for disability benefits, and the Five-Month Waiting Period, which indicates that SSDI benefits typically start five months after the EOD.

How can I estimate my back pay using the calculator?

By entering your Disability Onset Date and Submission Date into the calculator, you can estimate your back pay, which is crucial for financial planning during challenging times.

What is the average retroactive payment expected for beneficiaries in 2025?

Beneficiaries in 2025 can expect an average retroactive payment of around $6,710.

Why is it important to understand the difference between the EOD and the application date?

Understanding the difference between the EOD and your application date is significant for financial planning and can help you navigate the complexities of the SSDI process more effectively.

How does the calculator assist in navigating Social Security benefits?

The calculator empowers users to make informed decisions about their claims and clarifies the often-confusing aspects of Social Security benefits.

Is support available for individuals navigating the SSDI claims process?

Yes, there is support available for individuals as they prepare for the financial implications of their disability claims, ensuring they are not alone in their journey.