Overview

Mastering tax preparation for your business can feel overwhelming, but you're not alone in this journey. Understanding the essential roles of tax preparers is crucial, as they can provide the guidance you need. Obtaining relevant qualifications and utilizing effective tools can make a significant difference in your experience.

Skilled tax professionals are here to help you enhance compliance and improve your financial health. They offer strategic guidance and utilize updated software, ensuring you stay informed on the latest tax law changes. It's common to feel uncertain about navigating the complexities of tax regulations, but with the right support, you can find clarity.

We want to reassure you that investing in ongoing education and leveraging the expertise of tax professionals can lead to a smoother tax preparation process. Remember, reaching out for assistance is a proactive step towards securing your business's financial future.

Introduction

Navigating the intricate landscape of business tax preparation can often feel daunting. We understand that as tax laws continue to evolve, the challenges may seem overwhelming. Recognizing the pivotal role tax preparers play in ensuring compliance and optimizing financial outcomes is essential for any business. This article explores best practices for mastering tax preparation.

We’ll highlight:

- The qualifications needed for tax professionals

- The tools that can streamline the process

- Strategies to stay informed about the latest tax law changes

How can businesses leverage these insights to not only survive but thrive in the complex world of taxation? You're not alone in this journey; we're here to help.

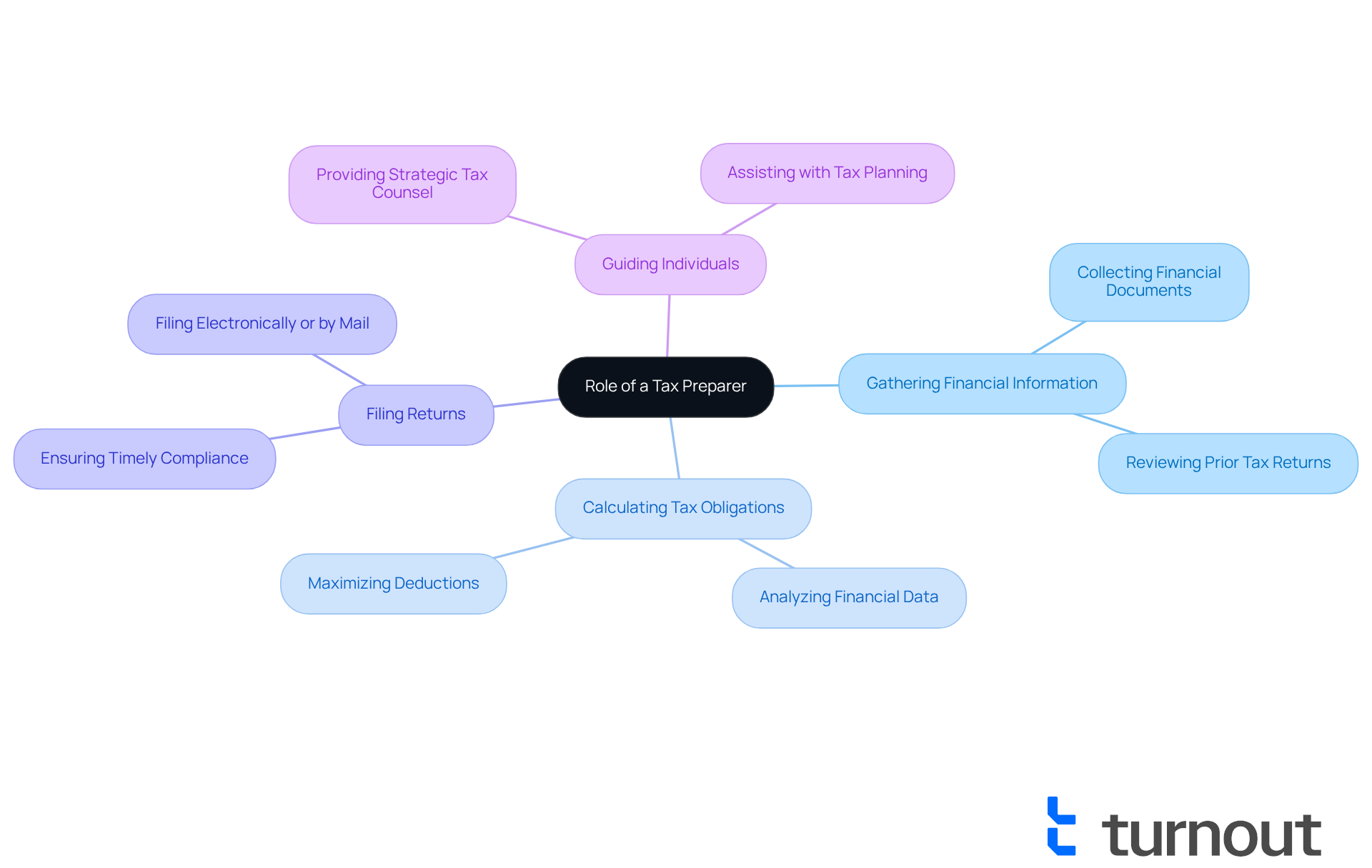

Understand the Role of a Tax Preparer

play a vital role in and in preparing and filing tax returns for individuals. They require a deep understanding of tax laws and regulations to . We understand that navigating taxes can be daunting, and that's where these experts come in to support you. Their key responsibilities include:

- : Tax preparers collect essential financial documents from clients, such as income statements, expense reports, and prior tax returns. This process ensures a comprehensive overview of your financial situation, which can alleviate stress.

- : They meticulously analyze financial data to ascertain accurate tax liabilities. This means ensuring that all income is reported and deductions are maximized, which is crucial for maintaining your financial health.

- : Once the tax documents are ready, tax professionals file returns electronically or by mail. They follow strict deadlines to prevent penalties and ensure timely compliance, giving you peace of mind.

- Guiding Individuals: Beyond basic preparation, on tax planning and compliance. They assist you in managing your tax responsibilities and discovering possible savings, making the process smoother.

The significance of tax professionals is highlighted by the fact that approximately 60% of individuals use tax experts for filing their taxes in 2025. This reliance emphasizes the value that qualified tax professionals bring to businesses, particularly those assisting disabled clients. They ensure accurate filings and . As one tax expert pointed out, "While most tax professionals are reliable, it’s essential to ensure quality service for taxpayers." Understanding these roles allows businesses to appreciate the significant impact a skilled tax preparer can have on their financial health and compliance efforts, particularly in tax preparation for business. Remember, you are not alone in this journey; .

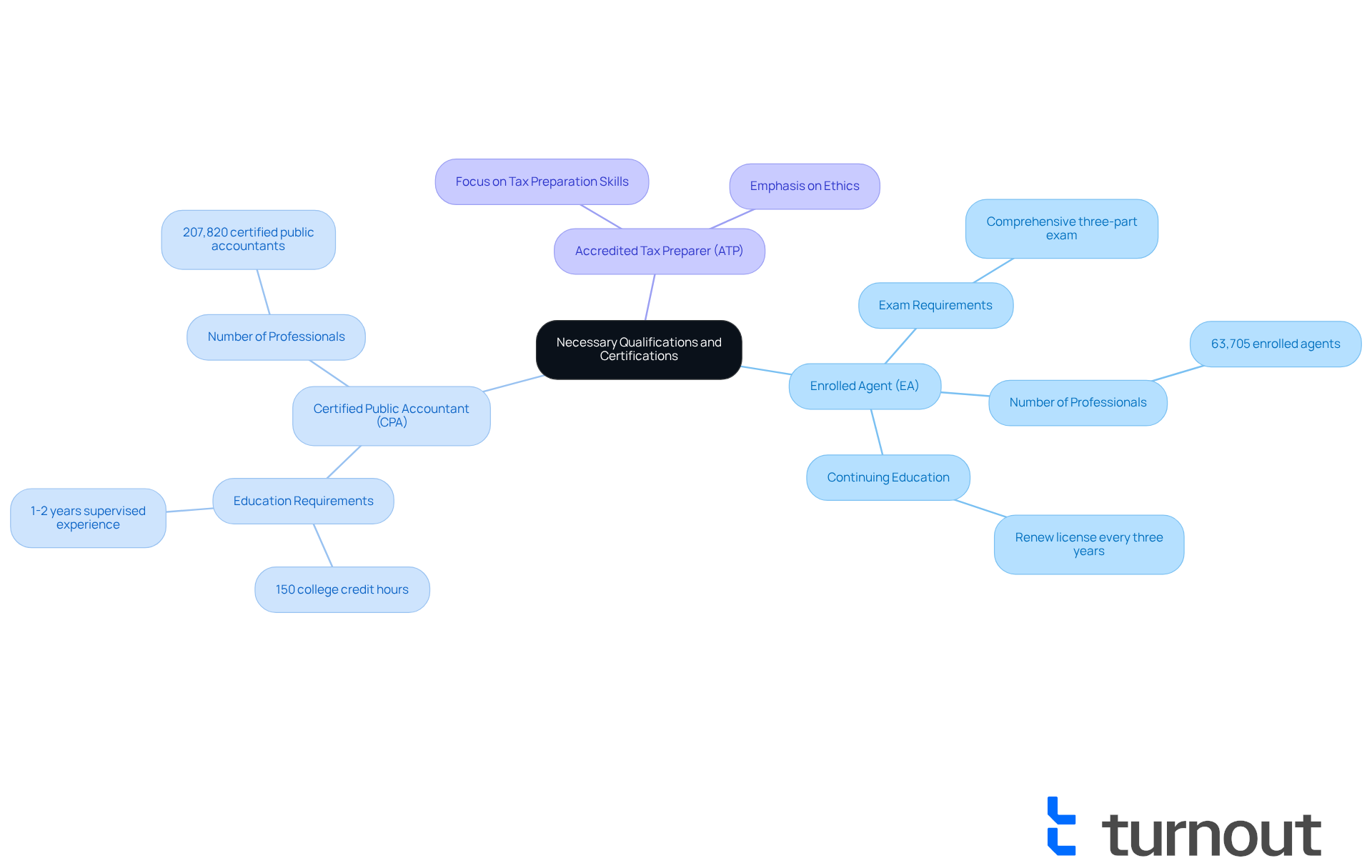

Obtain Necessary Qualifications and Certifications

To ensure effective , it's essential for to obtain relevant qualifications and certifications. We understand that navigating can be overwhelming, and having the right guidance is crucial. Here are key certifications to consider:

- : This certification empowers tax preparers to represent clients before the IRS. EAs must pass a comprehensive exam covering all aspects of the tax code and are required to complete continuing education and renew their licenses every three years. With 63,705 enrolled agents currently working in the tax field, their prevalence underscores their importance in navigating these complexities.

- : CPAs have completed rigorous education, including one to two years of supervised experience, and passed a standardized exam. They can provide a wide range of financial services, including tax preparation and planning. The total number of certified public accountants is 207,820, reflecting the scale of the profession and the competition within it.

- Accredited Tax Preparer (ATP): This certification emphasizes tax preparation skills and ethics, ensuring individuals are well-versed in current tax laws.

It's common to feel uncertain when selecting a tax professional, but businesses should verify the credentials of their tax advisors to ensure they possess the necessary expertise. The increasing need for highlights the significance of these certifications, especially for those assisting disabled persons with . As tax expert Tom O’Saben emphasizes, having qualified tax specialists can significantly influence individuals' ability to manage the intricacies of tax preparation. Remember, you are not alone in this journey; we're here to help you navigate these important decisions.

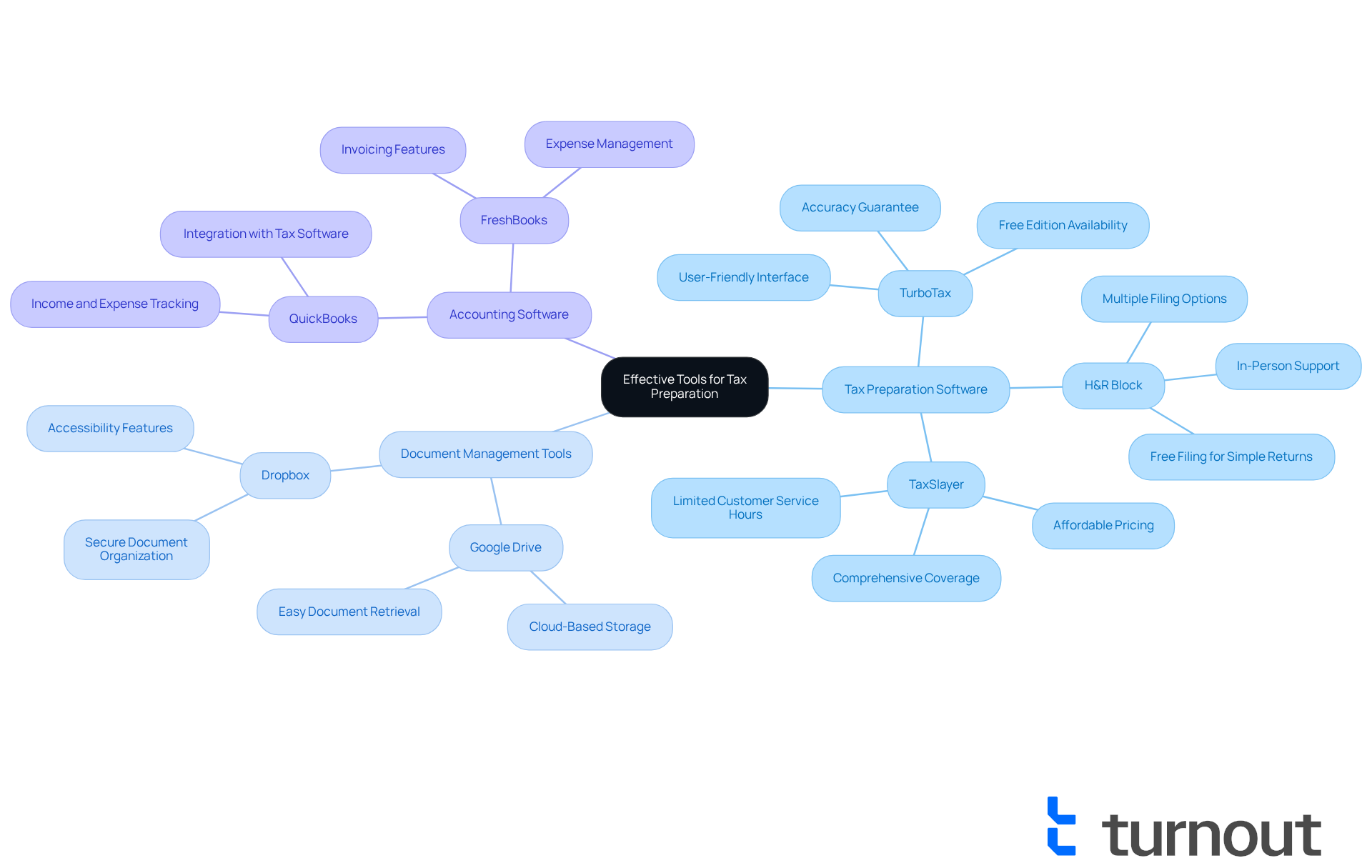

Utilize Effective Tools and Software for Tax Preparation

Effective tax preparation for business can feel overwhelming, but utilizing reliable tools and software can make a significant difference. Here are some solutions that can help you :

- : Programs like TurboTax, H&R Block, and Drake Software offer comprehensive features for preparing and filing taxes. These platforms often include built-in checks for accuracy and compliance, allowing you to tackle the complexities of tax regulations with confidence. TurboTax, for example, is well-loved for its user-friendly interface and extensive support options, making it a top choice among small businesses—over half of them opted for it in 2023.

- : Cloud-based storage solutions such as Google Drive or Dropbox can help you organize your documents securely and access them easily. These tools are especially beneficial for individuals with disabilities, as they simplify the document retrieval process, reducing stress and enhancing efficiency. Many success stories highlight how these tools have transformed tax preparation experiences, allowing individuals to manage their documents without unnecessary complications.

- : Integrating accounting software like QuickBooks can streamline the tracking of income and expenses, making tax preparation more efficient. This integration not only saves time but also reduces mistakes, enabling tax professionals to focus on providing quality service to those they assist. As industry experts note, using accounting software simplifies the , making it more accessible for individuals and businesses alike.

By adopting these tools, you can , minimize errors, and provide superior service to your clients. Remember, you are not alone in this journey, and we're here to help you every step of the way.

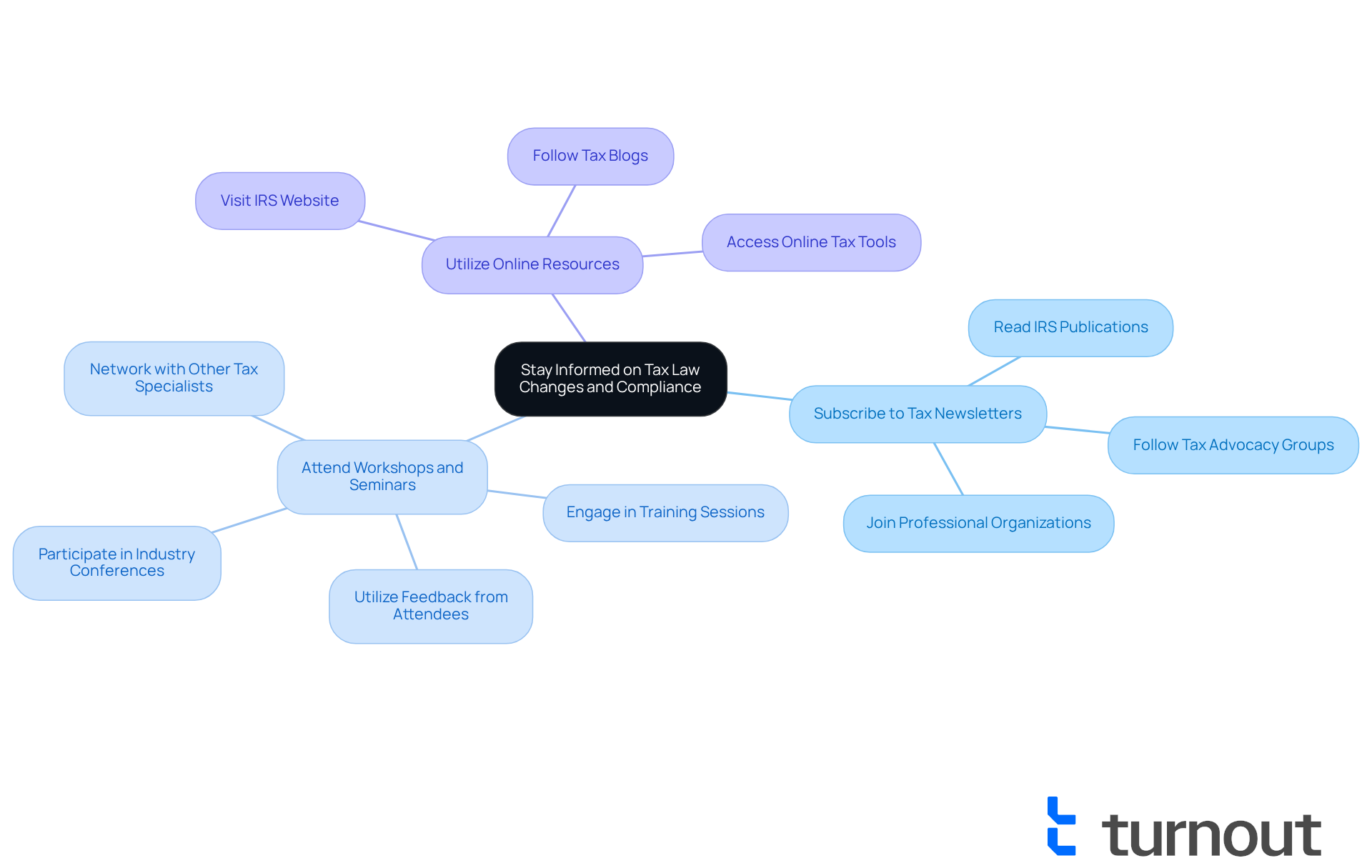

Stay Informed on Tax Law Changes and Compliance

Tax laws are constantly evolving, and we understand how challenging it can be for tax preparers to stay informed. Here are some effective strategies to help you navigate these changes:

- Subscribe to : Regularly reading publications from the IRS, tax advocacy groups, and professional organizations is crucial for receiving timely updates on . This practice is essential for grasping the subtleties that influence individuals, particularly those with disabilities.

- : Participating in industry conferences and training sessions can significantly enhance your knowledge. These events also provide valuable networking opportunities with other tax specialists. A recent survey indicated that over 66% of tax preparers who attended workshops reported enhanced service capabilities, especially in for disabled individuals. Furthermore, the State of the Tax Advisors Report emphasizes that 66% of tax advisors' clients prefer obtaining more detailed business guidance, underscoring the necessity for continuous education.

- : Websites like the IRS and tax-related blogs offer valuable insights into new regulations and compliance requirements. Many tax experts have discovered that utilizing these resources helps them stay ahead of the curve, ensuring they can provide precise and prompt advice.

Integrating perspectives from seasoned experts can further elevate the significance of . As one tax expert remarked, 'Keeping informed through workshops not only enhances our understanding but also fosters trust with those we serve, particularly individuals who depend on us to navigate their unique tax circumstances.'

By actively participating in ongoing education, you can ensure compliance and provide the highest quality service to those you assist. Success stories from workshops highlight how enhanced knowledge translates into better outcomes for clients, reinforcing the importance of ongoing professional development in the field. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Navigating the complexities of tax preparation for businesses can feel overwhelming, yet it is a crucial endeavor that significantly impacts financial health and compliance. We understand that the expertise of tax preparers is invaluable; they ensure accurate filings, optimize deductions, and provide strategic guidance tailored to your unique needs. Recognizing the multifaceted role of tax professionals—from gathering financial information to staying informed on tax law changes—is essential for any business striving to thrive in a challenging fiscal landscape.

In this article, we have highlighted key practices that can ease your journey:

- Obtaining relevant qualifications and certifications for tax preparers

- Utilizing effective tools and software

- Staying updated on evolving tax regulations

Each of these elements contributes to a robust tax strategy that enhances efficiency and reduces stress during tax season.

Ultimately, prioritizing effective tax preparation is not just about compliance; it’s about empowering you to make informed financial decisions. By leveraging the expertise of qualified tax professionals and embracing modern tools, you can navigate tax complexities with confidence and clarity. This proactive approach not only ensures compliance but also positions your business for long-term success in an ever-changing tax environment. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is the primary role of a tax preparer?

The primary role of a tax preparer is to assist individuals and businesses in preparing and filing tax returns, ensuring compliance with tax laws and optimizing deductions.

What are the key responsibilities of tax professionals?

Key responsibilities of tax professionals include gathering financial information, calculating tax obligations, filing returns, and providing guidance on tax planning and compliance.

How do tax preparers gather financial information?

Tax preparers collect essential financial documents from clients, such as income statements, expense reports, and prior tax returns, to gain a comprehensive overview of their financial situation.

Why is it important for tax preparers to calculate tax obligations accurately?

Accurate calculation of tax obligations is crucial to ensure that all income is reported, deductions are maximized, and to maintain the financial health of the client.

How do tax professionals file tax returns?

Tax professionals file tax returns either electronically or by mail, adhering to strict deadlines to prevent penalties and ensure timely compliance.

What additional support do tax specialists provide beyond basic preparation?

Tax specialists provide strategic counsel on tax planning and compliance, helping clients manage their tax responsibilities and discover potential savings.

What percentage of individuals used tax experts for filing their taxes in 2025?

Approximately 60% of individuals used tax experts for filing their taxes in 2025, highlighting the reliance on qualified tax professionals.

Why is it important to ensure quality service from tax professionals?

Ensuring quality service from tax professionals is important because it affects the accuracy of filings and the maximization of available benefits for taxpayers.