Overview

Navigating tax debt can be overwhelming, and we understand that many Canadians may feel anxious about their financial situation. In 2025, there are eight essential tax debt relief options available to help you regain control. These include:

- Innovative AI-powered solutions

- Taxpayer relief provisions

- Consumer proposals

Each option is backed by evidence of effectiveness, showcasing real success stories. For instance, the Voluntary Disclosure Program has demonstrated impressive success rates, while the growing use of consumer proposals highlights a variety of pathways for Canadians seeking to alleviate their tax burdens.

You are not alone in this journey, and there are compassionate solutions available to help you move forward. We encourage you to explore these options and take the first step toward relief. Remember, reaching out for help is a sign of strength, and we're here to support you every step of the way.

Introduction

Tax debt can feel like a heavy burden for many Canadians, often leading to stress and financial instability. We understand that navigating this challenging situation can be overwhelming. Fortunately, with the evolving landscape of tax relief options in 2025, individuals now have access to innovative solutions, including AI-powered tools and established programs designed to alleviate their financial woes.

However, how can one effectively leverage these resources to achieve meaningful relief? This article explores eight essential tax debt relief options available for Canadians, shedding light on the benefits and processes involved.

Remember, you are not alone in this journey; we’re here to help you take control of your financial future.

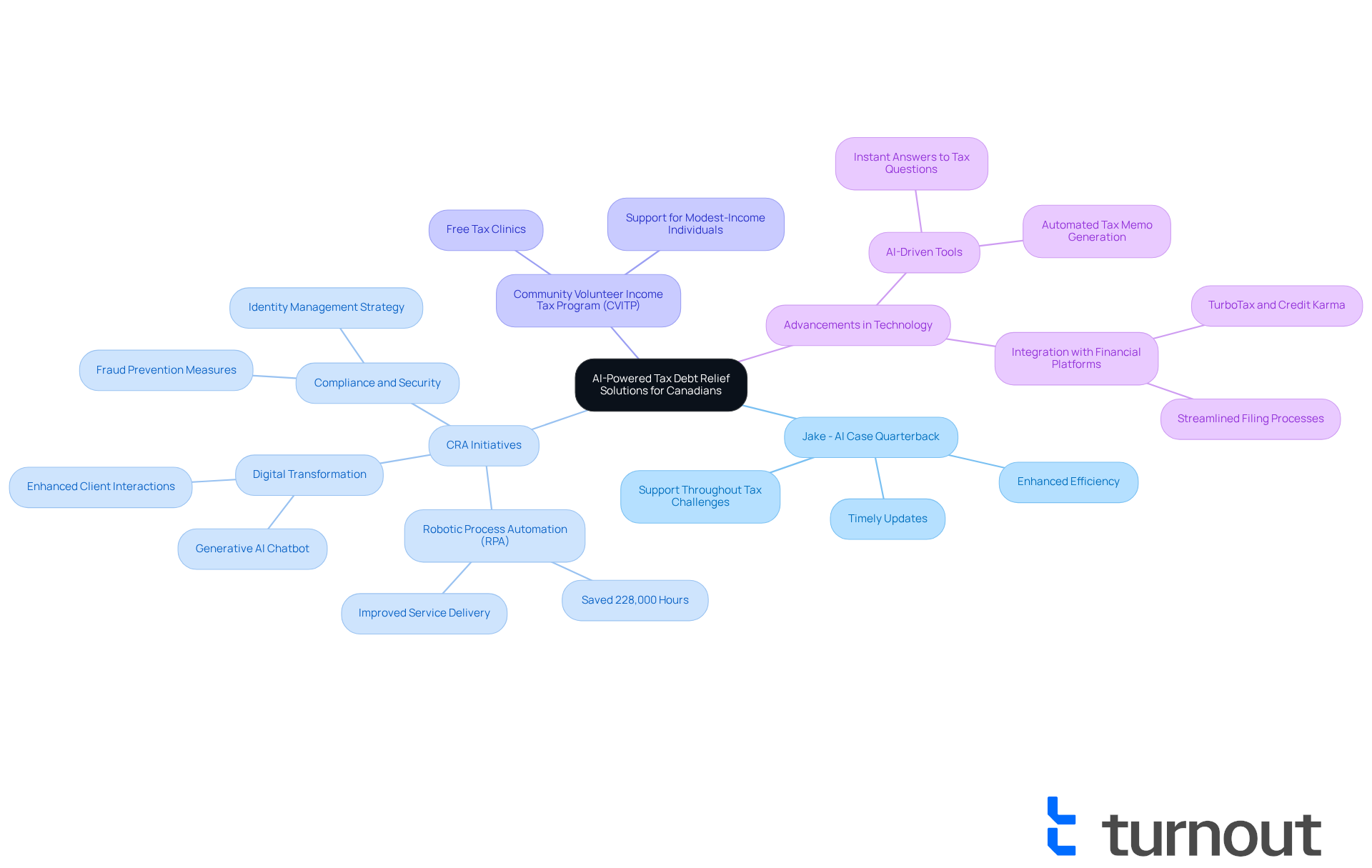

Turnout: AI-Powered Tax Debt Relief Solutions for Canadians

Turnout is transforming for Canadians by harnessing the power of to simplify and accelerate the process. At the heart of this innovation is Jake, the AI case quarterback, who ensures that you receive timely updates and support throughout your tax challenges. This approach not only enhances efficiency but also empowers you to navigate the complexities of the tax system with confidence, marking a significant step forward in .

We understand that tax season can be overwhelming. Successful case studies illustrate how AI can improve tax relief. For instance, the (CRA) has implemented robotic process automation (RPA), saving thousands of hours and enhancing service delivery. This demonstrates the potential of technology in addressing tax-related challenges. Additionally, initiatives like the (CVITP) provide vital support to modest-income individuals, ensuring you access the benefits you deserve.

Recent advancements in tax relief technology highlight our increasing reliance on AI solutions. The CRA's commitment to digital transformation aims to enhance client interactions and streamline processes. This reflects a broader trend toward automation in tax administration. Experts emphasize that can significantly reduce the time spent navigating complex tax regulations. This allows professionals to focus on high-value strategies rather than administrative tasks.

Overall, Turnout's AI-powered solutions signify a pivotal shift in how Canadians engage with tax debt relief. We’re fostering a more accessible and efficient system that prioritizes your needs. Remember, you are not alone in this journey, and we're here to help you every step of the way.

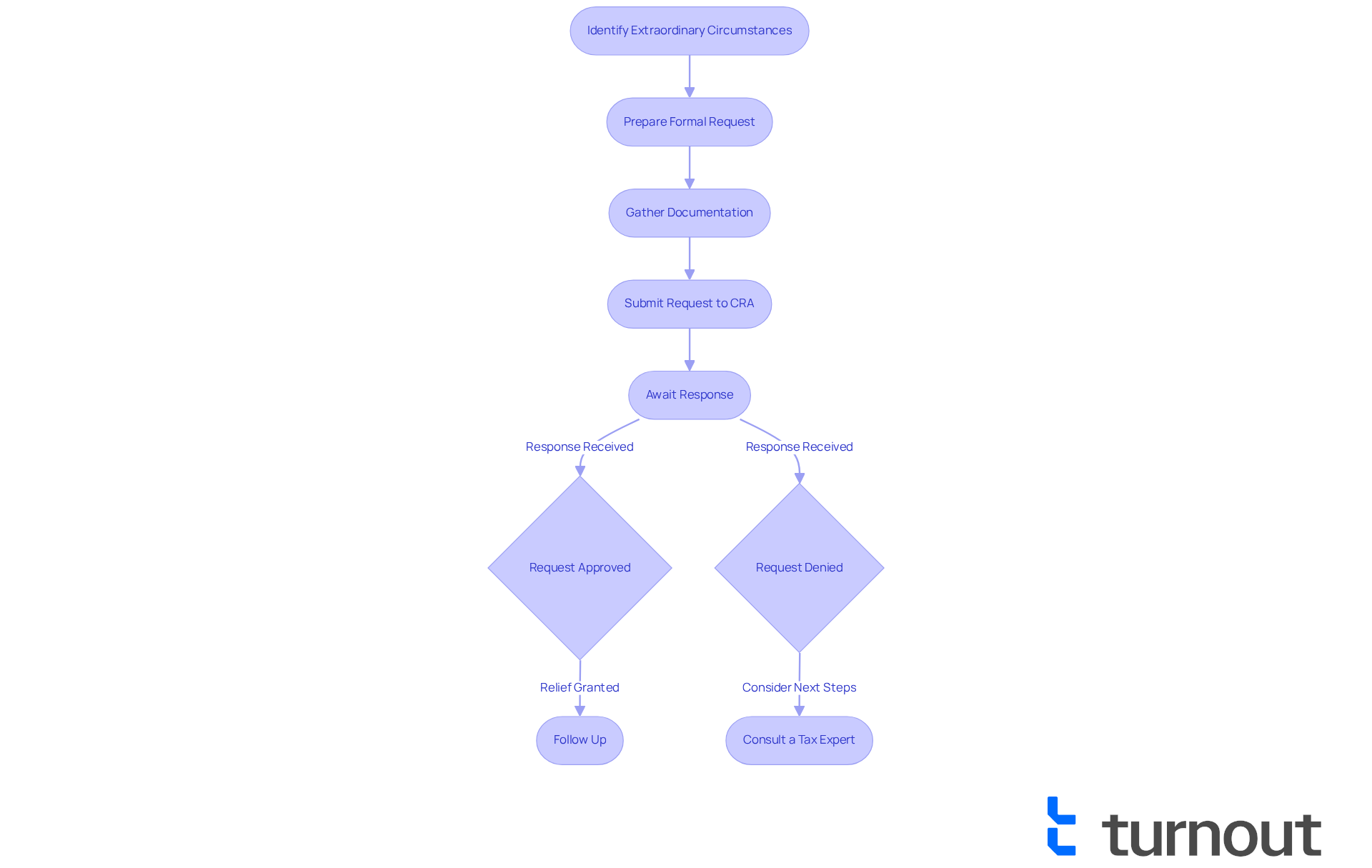

Taxpayer Relief Provisions: Requesting Waivers on Penalties and Interest

Canadians facing extraordinary circumstances may find relief through taxpayer provisions that allow for waivers on penalties and interest from the Canada Revenue Agency (CRA). We understand that navigating such challenges can be daunting, and it’s essential to know that you might be eligible for support. Approximately 30% of Canadians qualify for these provisions, highlighting the importance of being aware of your options.

To begin the process, individuals need to present a formal request. This , such as or unexpected events. Providing detailed documentation, including monetary statements and explanations of your situation, is crucial. While meeting the criteria does not guarantee approval, a well-prepared application can significantly enhance your chances of success. For instance, taxpayers demonstrating economic hardship through detailed income and expense statements may find their requests viewed more favorably.

in . We’re here to help by guiding you on the necessary documentation and preparing a compelling request tailored to your unique circumstances. Utilizing trained nonlawyer advocates, Turnout ensures that you receive the , enhancing your chances of obtaining relief.

Real-life examples show how effective these provisions can be:

- One taxpayer successfully obtained relief from penalties due to a serious illness that affected their ability to manage tax affairs.

- Another individual faced considerable economic distress after a natural disaster, resulting in a successful waiver of penalties.

These stories underscore the necessity of providing clear and thorough documentation when submitting your request.

Overall, understanding can empower Canadians to potentially achieve , lessen their tax burdens, and restore economic stability. To improve your chances of approval, consider gathering . Consulting a tax expert for advice can also be a beneficial step. Remember, you are not alone in this journey, and support is available to help you through.

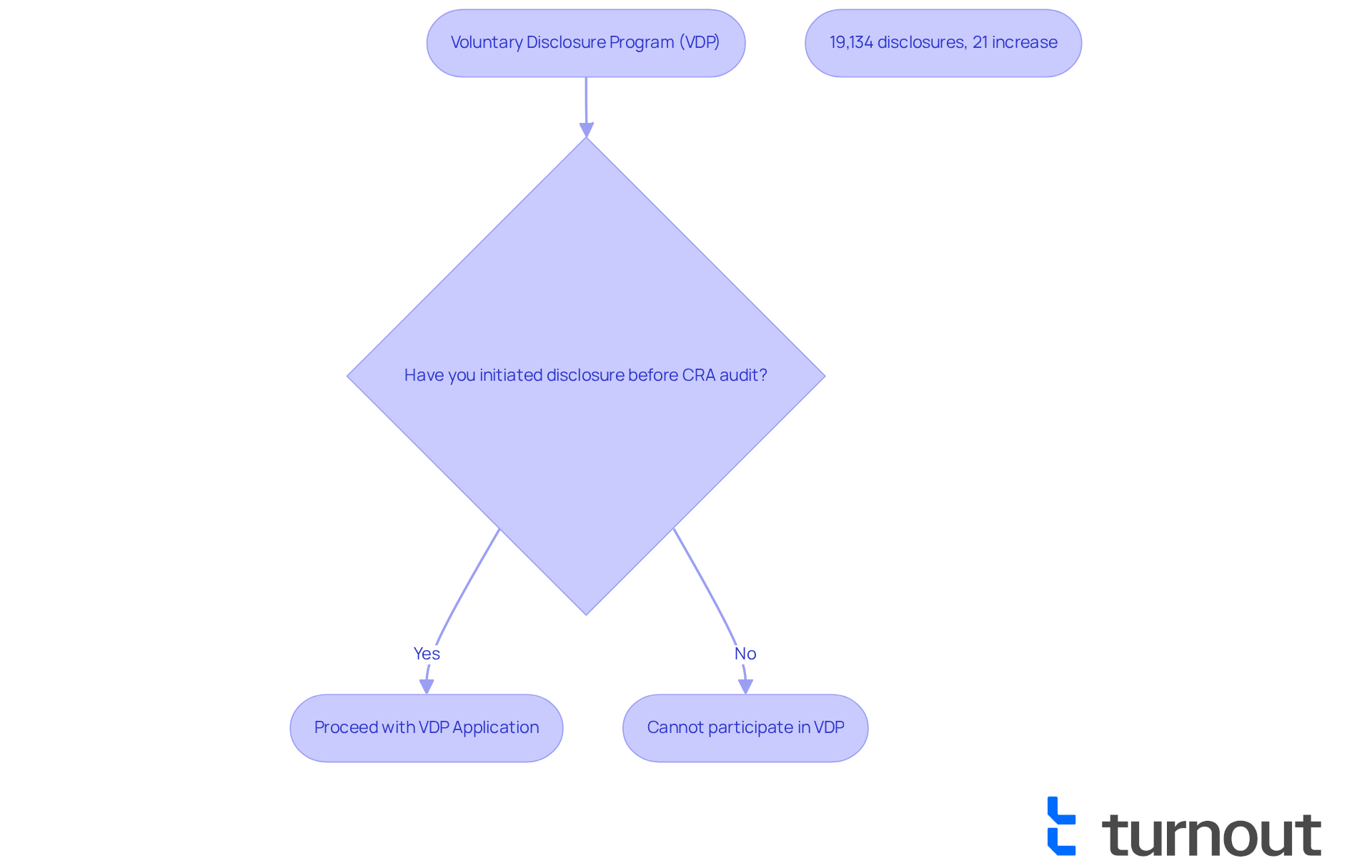

Voluntary Disclosure Program (VDP): Correcting Tax Errors Without Penalties

The (VDP) offers Canadians a vital opportunity to without the fear of penalties. We understand that navigating tax obligations can be overwhelming, and this program allows taxpayers to voluntarily disclose unreported income or , helping them avoid the severe consequences that often accompany tax non-compliance.

To qualify for the VDP, participants must meet specific criteria, including:

- Initiating the disclosure before the Canada Revenue Agency (CRA) begins an audit.

This proactive approach not only aids individuals in but also provides to alleviate financial burdens. Recent statistics show a , with 19,134 voluntary disclosures made in the last fiscal year, reflecting a 21% rise from the previous year. This surge highlights the program's effectiveness as a valuable resource for Canadians striving to achieve tax debt relief while managing their responsibilities with care.

Furthermore, the CRA has announced important changes to the VDP, effective October 1, 2025. These updates aim to simplify the application process and enhance accessibility for taxpayers. The adjustments include:

- Revised relief options for both unprompted and prompted applications, ensuring that the program remains equitable and does not inadvertently reward non-compliance.

Remember, you are not alone in this journey; we’re here to help you correct your tax records and find peace of mind.

Consumer Proposal: Negotiating Debt Relief with Creditors

A consumer proposal is a formal arrangement between a borrower and creditors to resolve obligations for less than the total sum due. This option enables individuals to negotiate feasible repayment terms, making it an appealing solution for those seeking . By collaborating with a , Canadians can formulate a proposal that aligns with their while ensuring creditors obtain a .

are the most popular form of debt relief in Canada, handling over 79% of consumer insolvencies as of December 2023. This statistic emphasizes their efficiency in offering assistance to people encountering economic challenges. Many individuals report positive outcomes from this process, as it alleviates urgent monetary strain while allowing them to preserve their assets and preventing creditors from initiating legal proceedings or seizing wages.

We understand that can be overwhelming. Expert opinions highlight the importance of empathy and understanding during negotiations. can assist individuals through the process, helping them articulate their financial circumstances effectively. Adam Cardwell, a licensed insolvency trustee, noted that creditors are becoming more receptive to negotiating consumer proposals. This shift reflects a growing recognition of the need for that prioritize the well-being of consumers.

Furthermore, it is crucial to complete two credit counseling sessions before concluding a consumer proposal. These sessions equip individuals for managing their finances after the proposal. In summary, consumer proposals provide a structured pathway for negotiating tax debt relief, empowering individuals to while ensuring fair treatment from creditors. Remember, you are not alone in this journey; we're here to help.

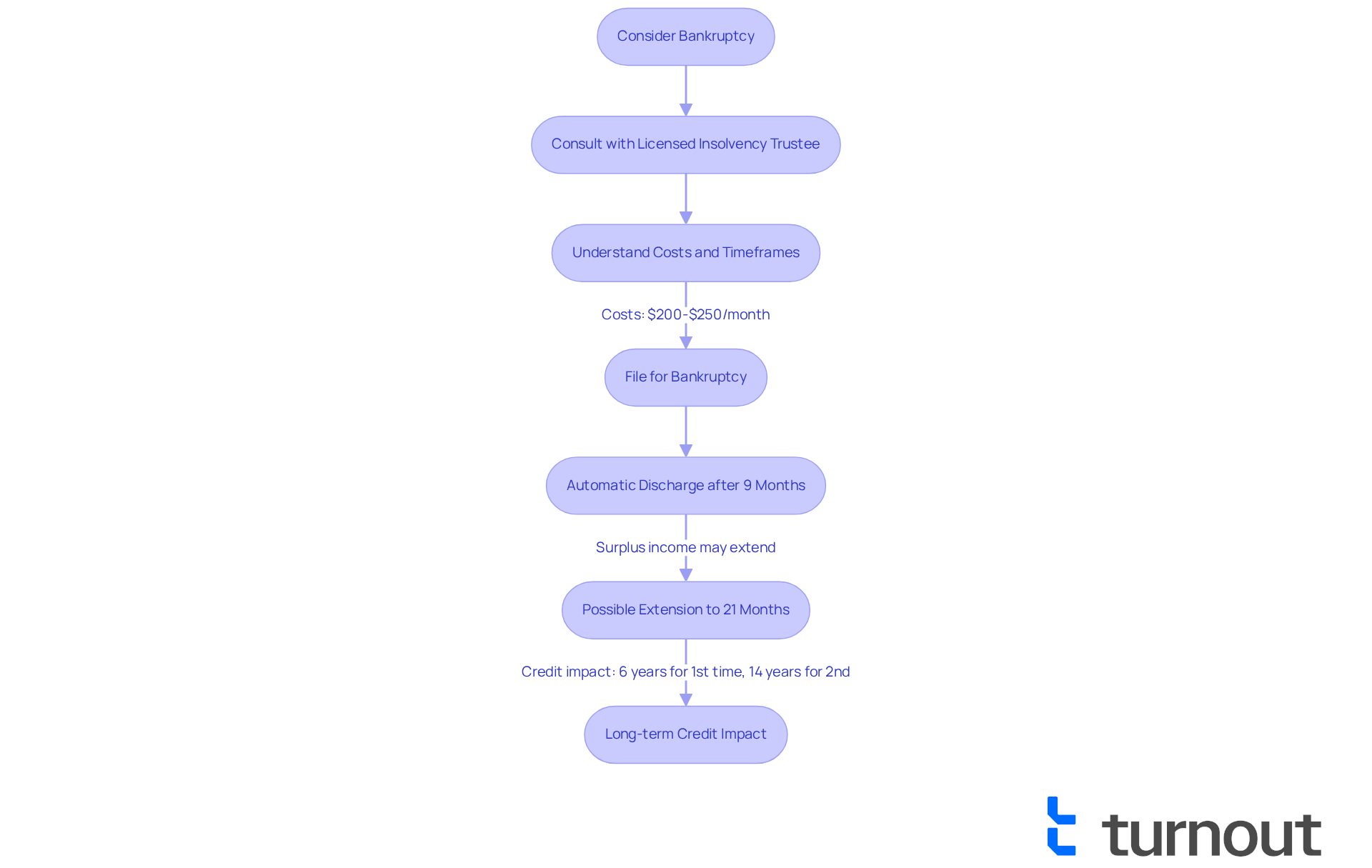

Bankruptcy: A Last Resort for Tax Debt Relief

Bankruptcy should be viewed as a last resort for Canadians seeking from overwhelming obligations. While it can relieve most unsecured debts, including tax liabilities, the can be significant. For instance, a will impact a person's credit report for up to six years after discharge. If someone files for bankruptcy a second time, this duration extends to 14 years. Such repercussions can severely limit future borrowing options and .

In Ontario, the costs associated with bankruptcy typically range from $200 to $250 per month, a crucial consideration for those contemplating this path. Additionally, first-time bankruptcy filers might qualify for automatic discharge after nine months, provided all duties are fulfilled; however, surplus income could prolong this period to 21 months.

Real-life stories underscore the seriousness of this issue. Many Canadians have faced bankruptcy due to , often exacerbated by a lack of or unexpected life events, which makes tax debt relief crucial. A survey revealed that a significant number of individuals experiencing insolvency cited the lack of tax debt relief as a primary reason for their financial struggles.

To effectively, it is essential to work with licensed professionals, such as a (LIT), who can offer vital guidance. Meeting with a LIT is crucial for discussing financial situations, understanding how bankruptcy affects future economic health, and addressing any outstanding obligations. As one expert noted, 'Bankruptcy is a financial relief option for those feeling trapped,' emphasizing the importance of careful consideration before proceeding.

Given recent trends, it is clear that the long-term effects of bankruptcy are increasingly relevant in conversations about in Canada. With rising insolvency rates, particularly in provinces burdened by high taxes, the significance of informed decision-making cannot be overstated. Remember, you are not alone in this journey; we’re here to help you navigate these challenging times.

CRA Payment Arrangement: Structuring Your Tax Debt Payments

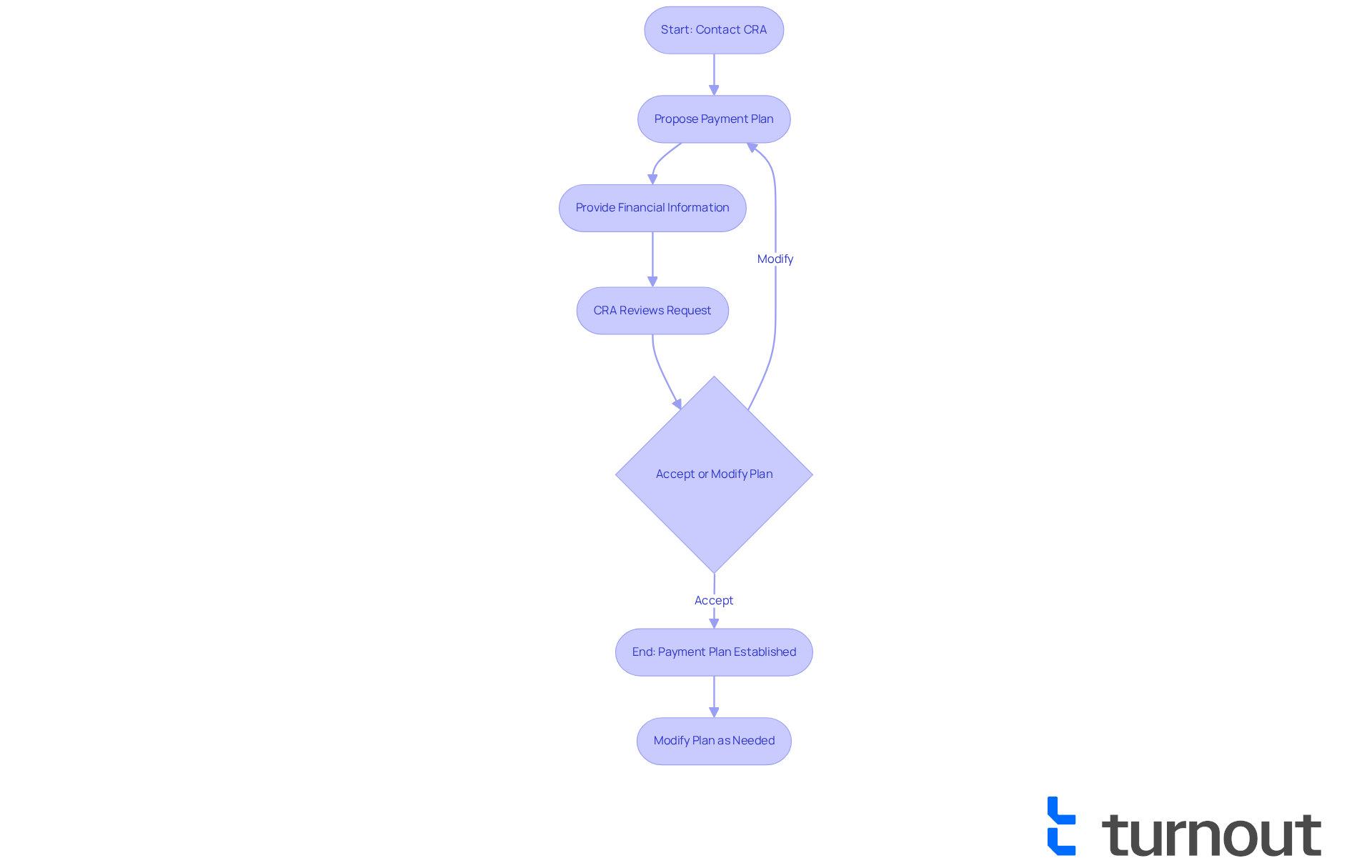

Establishing a payment arrangement with the (CRA) is a strategic way for Canadians to secure effectively. We understand that can feel overwhelming, and this arrangement offers tax debt relief by allowing individuals to pay their outstanding balances in manageable installments, easing the burden on their finances. To initiate this process, taxpayers should reach out to the CRA directly and propose a tailored to their financial circumstances.

In 2025, the CRA continues to offer , enabling taxpayers to negotiate terms that fit their budgets. As stated by the Canada Revenue Agency, "The CRA offers payment plans to taxpayers who cannot fully pay their income taxes by the deadline." Success rates for these arrangements have improved, with the CRA providing in outstanding tax debt during a specific period, showcasing the effectiveness of payment arrangements. Individuals can utilize and Income and Expense Worksheet to evaluate their economic situation and suggest a viable payment plan.

It's common to feel uncertain about negotiating with the CRA, but that showing economic hardship is essential. Taxpayers must provide detailed information about their income, expenses, assets, and liabilities to qualify for a payment plan. This transparency not only facilitates the approval process but also helps in structuring payments that are sustainable over time.

Many Canadians have successfully achieved tax debt relief by managing their tax obligations through structured payment plans. By being proactive and consistently assessing their financial situation, individuals can modify their arrangements as necessary. This ensures they stay compliant while reducing the stress of tax obligations. It's important to note that participating in a CRA financial relief program may influence credit scores, a significant consideration for taxpayers.

To set up a payment plan, taxpayers should call the CRA at 1-866-256-1147 or utilize their online services. The first step involves making an initial payment towards the obligation, which is essential for establishing the arrangement. The CRA's service hours are Monday to Friday from 7 am to 10 pm, providing ample opportunity for taxpayers to seek assistance. By taking these steps, you can navigate your tax obligations with greater confidence and ease. Remember, you're not alone in this journey; we're here to help.

Partial Payment to CRA: Easing Your Tax Debt Burden

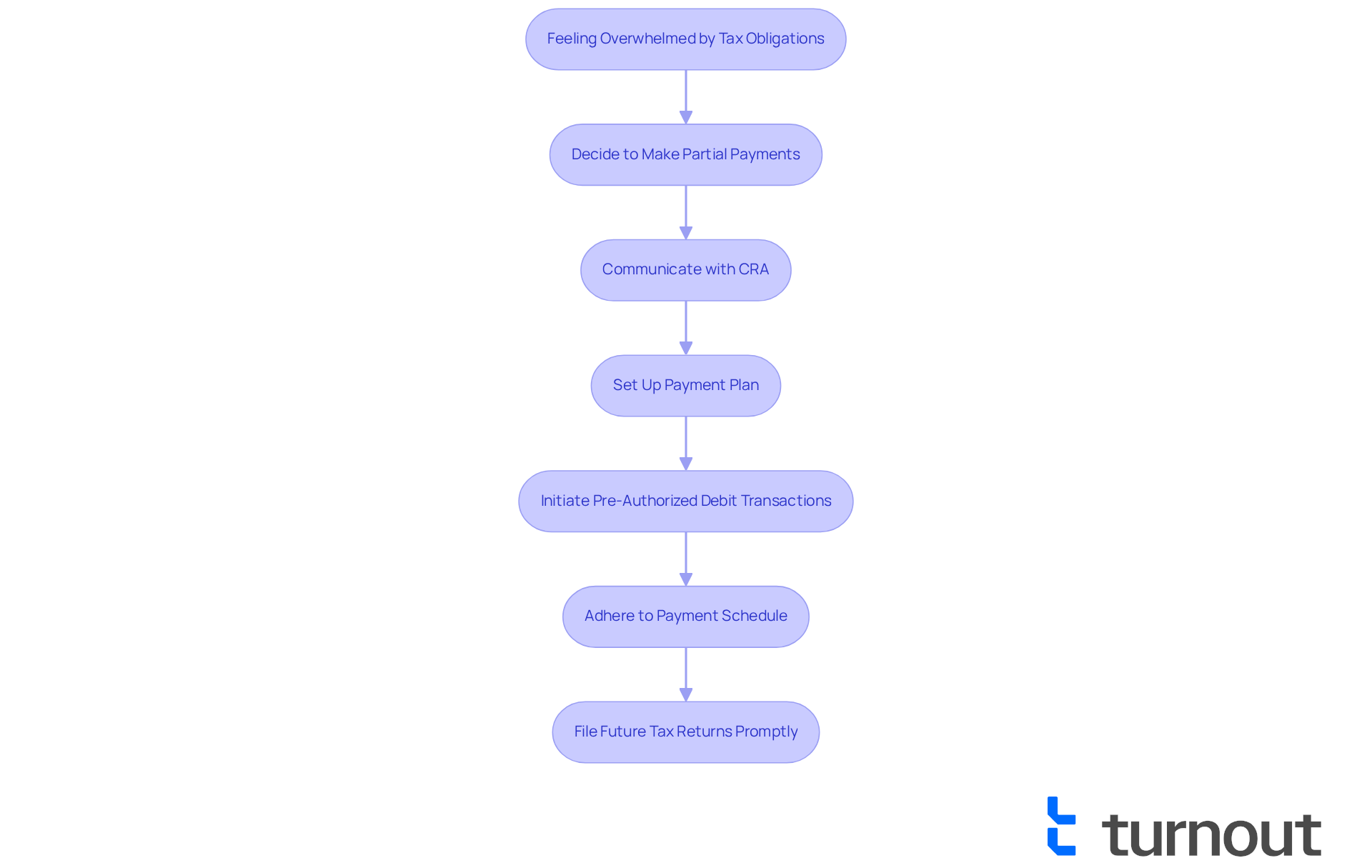

If you're feeling overwhelmed by , know that can be achieved by making to the CRA, which can significantly ease that pressure. This approach not only shows your commitment to resolving your debts but also helps with . By proactively communicating your intention to make partial payments, you can often and interest from piling up.

Many Canadians have successfully navigated their tax obligations through this method. For instance, individuals who initiate a with an initial payment can set up a series of pre-authorized debit (PAD) transactions. This enables them to without facing immediate legal actions, as long as they adhere to the agreed schedule.

Experts highlight that alleviating the through partial payments can lead to a more manageable economic situation. Relinquishing some can bring a sense of liberation and safety, which is vital for your overall well-being. Additionally, the CRA may apply specific federal payments and benefits you receive towards your outstanding tax obligations, even if a payment plan is in place, ensuring that your responsibilities are prioritized effectively.

It’s crucial to continue making payments on time and to file all future tax returns promptly to keep your payment arrangement intact. In summary, making partial payments is a viable option for Canadians seeking tax debt relief to ease their financial obligations. It allows you to take control of your financial situation while working towards a resolution. Remember, you are not alone in this journey, and we're here to help.

Tax Debt Forgiveness: Understanding Your Options

in Canada provides a variety of options for those who qualify, but we understand that navigating this landscape can feel overwhelming. The serve as a vital resource, allowing individuals to seek relief from penalties and interest under specific circumstances. For example, if unexpected occurrences like job loss or medical crises have negatively impacted your economic situation, you may be eligible for assistance.

In addition to these provisions, Canadians can explore . This option allows individuals to negotiate settlements with the Canada Revenue Agency (CRA) to repay a portion of their obligations over time. This approach can significantly reduce the overall amount owed and provide a structured path to .

At , we offer a range of tools and services designed to assist you in navigating these complex processes. Our support includes through IRS-licensed enrolled agents, who provide qualified assistance tailored to your specific needs. However, it's important to note that Turnout does not provide legal representation.

Many Canadians have successfully attained through these avenues. Those who have utilized the Taxpayer Relief Provisions often report significant reductions in their tax liabilities, showcasing the effectiveness of these programs. Recent statistics reveal that approximately 30% of applicants for the Taxpayer Relief Provisions have successfully received some form of relief, highlighting the potential for positive outcomes.

Understanding the nuances of taxpayer relief provisions is crucial if you're looking to alleviate your . Expert opinions suggest that being proactive and informed about available options can lead to better results. While Turnout provides valuable assistance, we want to be clear that we do not guarantee relief or legal representation. The success rates of tax forgiveness programs in Canada indicate that with the right approach, you can find relief and regain control over your economic situation. If you're seeking help, we recommend consulting with a money management expert or a tax specialist to explore the best options available and understand the . Remember, you are not alone in this journey; we're here to help.

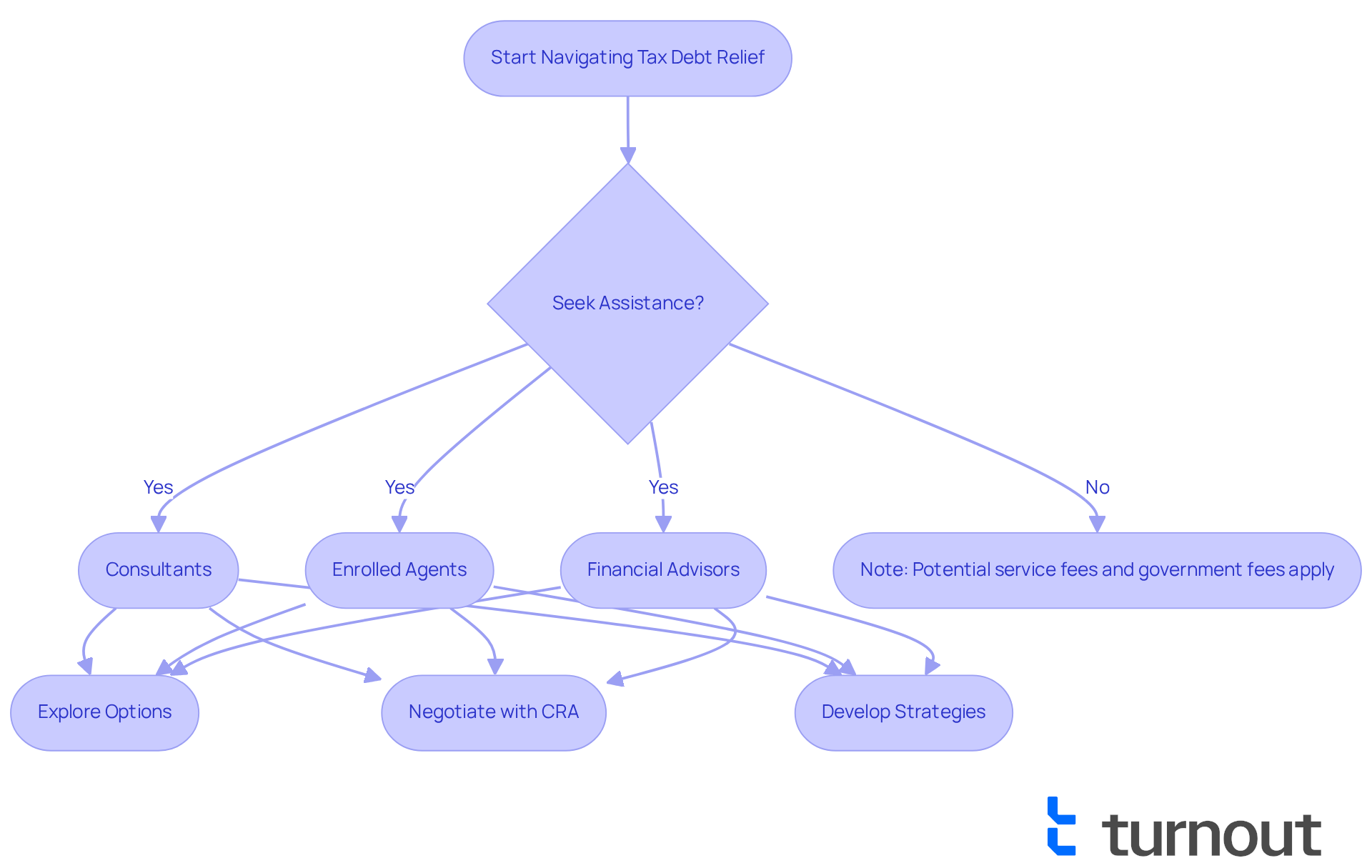

Professional Help: Navigating Tax Debt Relief with Expert Guidance

Navigating can feel overwhelming, and we understand that is a crucial step. Licensed experts, such as consultants, enrolled agents, and financial advisors, are often the most effective allies in this journey. These specialists provide . They help you and with the CRA.

It's important to note that while some of are free, others may come with service fees, and any government fees must be paid separately before we can submit paperwork on your behalf. Their expertise can lead to positive outcomes, as they develop that address your financial obligations and facilitate more effective resolutions.

Consider reaching out to a certified expert to discuss your specific tax circumstances. Working with these specialists not only alleviates the stress of managing tax responsibilities but also empowers you to take control of your . Remember, you are not alone in this journey, and we're here to help you every step of the way.

Long-Term Effects of Tax Debt: What Canadians Need to Know

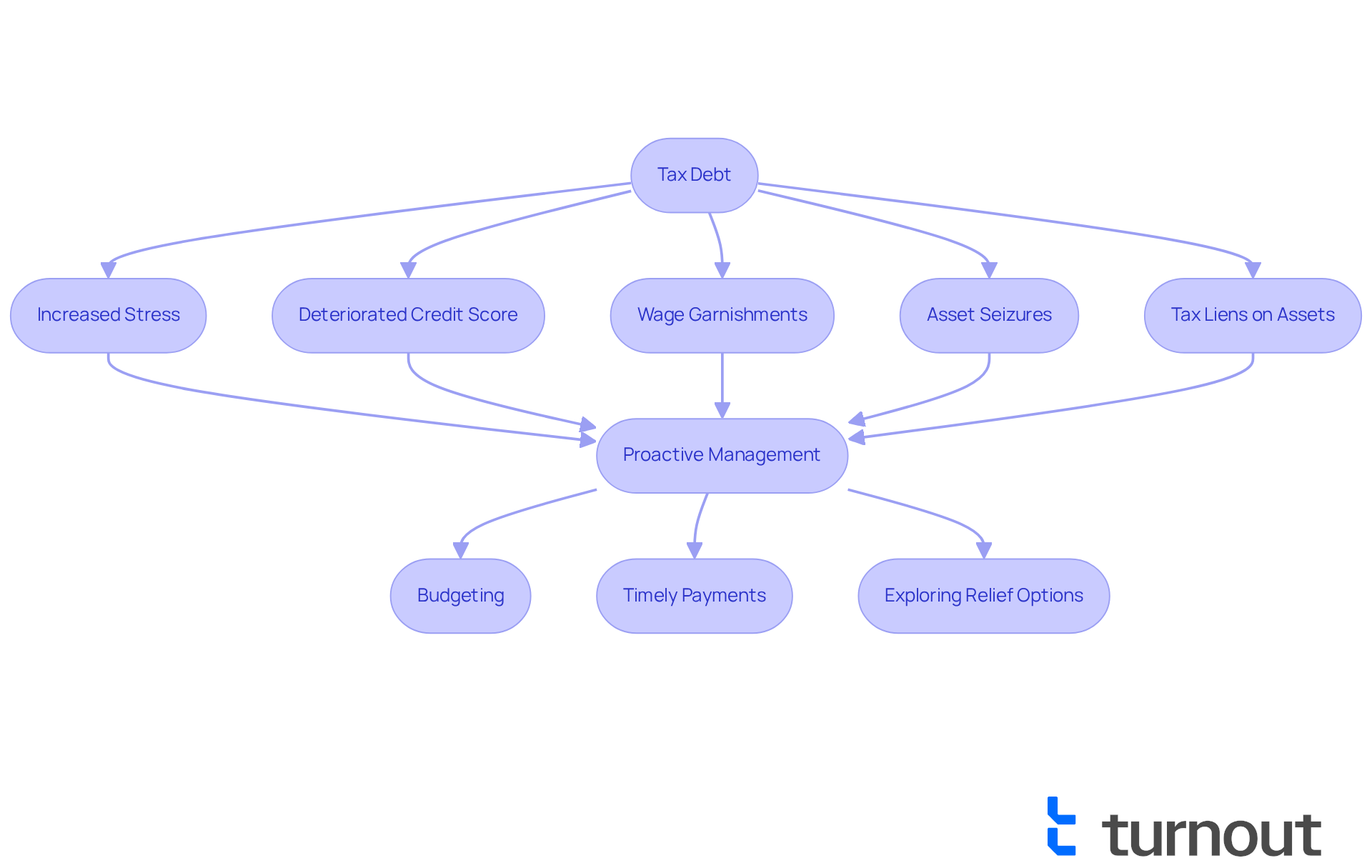

Having can profoundly impact the of Canadians. We understand that this often leads to heightened stress levels, deterioration of credit scores, and restricted access to future credit opportunities. can result in , such as wage garnishments and asset seizures by the Canada Revenue Agency (CRA). It's common to feel overwhelmed by the thought that the CRA has the power to ask employers to retain a portion of salaries to recover unpaid taxes, creating considerable economic strain.

Furthermore, may be placed on valuable assets, such as homes or vehicles, until the outstanding balance is settled. Considering these possible consequences, it is essential for individuals to manage tax obligations swiftly and explore options for . Monetary specialists suggest proactive management of tax responsibilities, including budgeting and timely payments, to protect credit scores and ensure overall .

By understanding the implications of tax debt relief and taking action, Canadians can work towards regaining control of their financial futures. Remember, you're not alone in this journey; we're here to help you and find a path to financial peace.

Conclusion

Navigating tax debt relief in Canada is a vital step for those striving to regain financial stability. We understand that the journey can feel overwhelming, but there are a variety of options available to help you, including:

- Innovative AI-powered solutions

- Taxpayer relief provisions

- Structured payment arrangements

By exploring these resources, you can find pathways to alleviate your financial burdens and take proactive steps toward managing your tax obligations effectively.

Key insights from this article illuminate various relief options tailored to your needs, such as:

- The Voluntary Disclosure Program

- Consumer proposals

- The possibility of negotiating payment plans with the CRA

Each of these avenues offers unique benefits, allowing you to address your specific situation while minimizing penalties and interest. Real-life examples demonstrate the importance of thorough documentation and informed decision-making, leading to successful outcomes.

Ultimately, seeking professional help is essential. Licensed experts provide invaluable guidance, helping you navigate the complexities of tax debt relief and ensuring you are aware of all available options. Remember, by taking action and utilizing the resources outlined, you can work toward a more secure financial future, alleviating the stress associated with tax obligations. Support is available, and you are not alone on this journey toward financial peace.

Frequently Asked Questions

What is Turnout and how does it help Canadians with tax debt relief?

Turnout is an organization that utilizes AI technology to simplify and accelerate tax relief for Canadians. Their AI case quarterback, Jake, provides timely updates and support, helping individuals navigate the complexities of the tax system.

How does AI technology improve tax relief processes?

AI technology enhances efficiency in tax relief by reducing the time spent on administrative tasks, allowing professionals to focus on high-value strategies. Successful case studies, such as the CRA's use of robotic process automation, demonstrate significant time savings and improved service delivery.

What support does the Community Volunteer Income Tax Program (CVITP) offer?

The CVITP provides vital assistance to modest-income individuals, ensuring they can access the tax benefits they deserve, particularly during tax season.

What are taxpayer relief provisions and who can benefit from them?

Taxpayer relief provisions allow Canadians facing extraordinary circumstances to request waivers on penalties and interest from the CRA. Approximately 30% of Canadians may qualify for these provisions, which can alleviate financial burdens.

How can individuals request a waiver on penalties and interest?

To request a waiver, individuals must submit a formal request outlining their reasons, such as economic hardships, along with detailed documentation to support their case. A well-prepared application can enhance the chances of approval.

What role does Turnout play in the waiver request process?

Turnout assists individuals by guiding them on necessary documentation and helping prepare a compelling request tailored to their unique situations, utilizing trained nonlawyer advocates for support.

What is the Voluntary Disclosure Program (VDP)?

The VDP allows Canadians to voluntarily disclose unreported income or correct tax errors without facing penalties, provided they initiate the disclosure before the CRA begins an audit.

What are the criteria for qualifying for the VDP?

To qualify for the VDP, individuals must voluntarily disclose their tax issues before the CRA initiates an audit.

What changes to the VDP were announced by the CRA?

Effective October 1, 2025, the CRA will implement changes to simplify the application process and enhance accessibility, including revised relief options for both unprompted and prompted applications.

How can individuals find support in correcting their tax records?

Individuals can seek assistance from organizations like Turnout, which provide guidance in correcting tax records and navigating the tax system to achieve peace of mind.