Overview

This article highlights essential tax breaks available for elderly Americans in 2025, including a new $6,000 deduction for individuals aged 65 and older. This significant reduction in taxable income can provide much-needed relief. We understand that financial burdens can weigh heavily on seniors, especially those relying on fixed incomes. This new allowance, alongside other deductions and credits discussed, aims to alleviate these pressures.

It's common to feel overwhelmed by financial concerns, but these tax benefits are designed to support you. By emphasizing the economic relief they provide, we hope to reassure older adults that help is available. Remember, you are not alone in this journey, and there are resources to assist you in navigating these changes.

Take a moment to reflect on how these benefits could impact your financial situation. We’re here to help you understand and take advantage of these opportunities for a more secure future.

Introduction

Navigating the tax landscape can feel particularly daunting for elderly Americans. We understand that with evolving regulations and opportunities for financial relief, it may seem overwhelming. In 2025, a series of essential tax breaks are set to provide significant benefits, including new deductions and credits specifically designed to ease the financial burden on seniors.

However, as these changes unfold, you might wonder: how can you ensure you are taking full advantage of these opportunities while avoiding common pitfalls? This article delves into the vital tax breaks available for elderly individuals, offering insights and strategies to maximize savings and enhance your financial security in the coming years.

You are not alone in this journey, and we’re here to help.

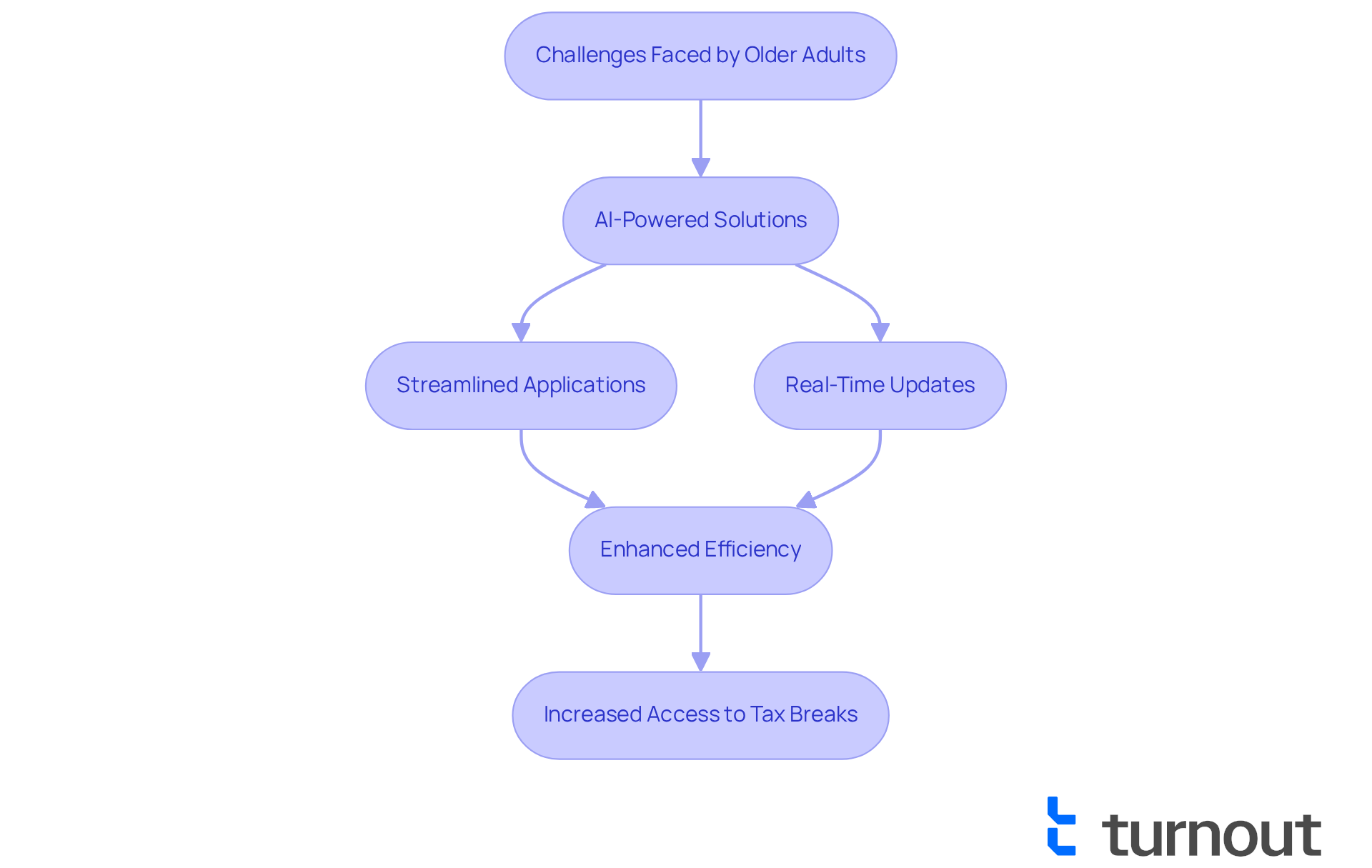

Turnout: AI-Powered Advocacy for Tax Breaks

Turnout understands the challenges older adults face when seeking . Utilizing , it provides customized support to help navigate this often complex process. By streamlining applications and offering real-time updates, Turnout allows elderly Americans to access the assistance they deserve with ease.

This innovative approach enhances efficiency and empowers older adults to confidently navigate the daunting tax landscape. In 2025, the integration of AI in consumer advocacy is set to transform how older adults engage with tax relief options. This ensures they receive the support necessary to alleviate .

Statistics show that AI can free up to 12 hours per week for professionals in the field. This allows them to focus on strategic assistance rather than administrative tasks. Successful implementations of technology in consumer advocacy have already demonstrated significant improvements in response times and client satisfaction. These results showcase the potential for AI to revolutionize tax advocacy for elderly Americans.

For instance, the StayNJ program in New Jersey aims to lower property tax bills for elderly residents, offering tax credits up to $6,500 for qualifying homeowners. Assembly Speaker Craig Coughlin emphasized, 'We owe it to our elderly citizens and their families to do what we can to alleviate those burdens.'

Additionally, Turnout's services include a clear fee structure. Some services are free, while others incur service fees, and government fees must be paid separately before any paperwork can be submitted on behalf of clients. With Turnout's commitment to leveraging AI, older adults can anticipate a more streamlined and supportive experience as they seek tax breaks for elderly individuals that they are entitled to. Remember, you are not alone in this journey—we're here to help.

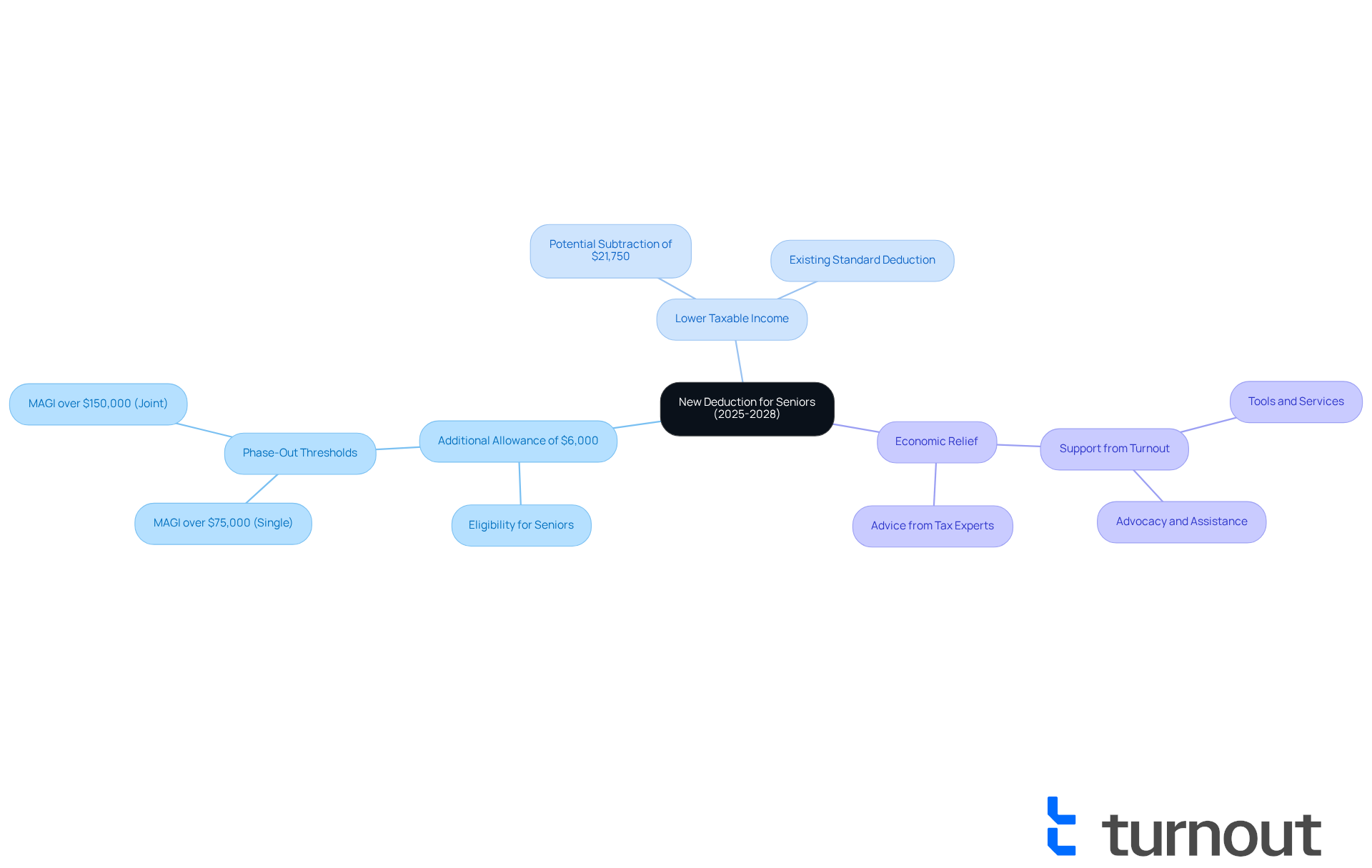

New Deduction for Seniors (2025-2028): Key Benefits

Starting in 2025, individuals aged 65 and above will benefit from , including an , valid until 2028. This new deduction complements the existing standard deduction, significantly lowering taxable income and offering tax breaks for elderly taxpayers. For instance, an individual aged 65 or older could potentially subtract as much as $21,750 from their taxable income. This provides substantial , especially with the implementation of tax breaks for elderly.

We understand that many older Americans face economic strain, and this alteration is part of a larger effort to provide . The extra subtraction not only reduces the amount of income subject to tax but also provides tax breaks for elderly individuals, ensuring that older adults can retain more of their hard-earned money. This improvement is vital for enhancing their , particularly through tax breaks for elderly.

Experts note that these adjustments, such as tax breaks for elderly, are crucial for older adults who often rely on fixed incomes and may struggle with rising living costs. It’s common to feel overwhelmed by these changes, but older adults can turn to Turnout for support. Turnout offers tools and services to help them understand and , including the new tax breaks for elderly.

By employing skilled nonlegal advocates and IRS-licensed enrolled agents, Turnout streamlines access to government benefits and financial assistance. This ensures that older adults can optimize their economic relief. Overall, the introduction of this allowance, which includes tax breaks for elderly, represents a meaningful step toward providing essential financial support for seniors.

We encourage elderly individuals to seek advice from or utilize available resources to ensure they effectively claim the tax breaks for elderly. Remember, you are not alone in this journey; we are here to help.

Medical Expense Deductions: Maximizing Your Savings

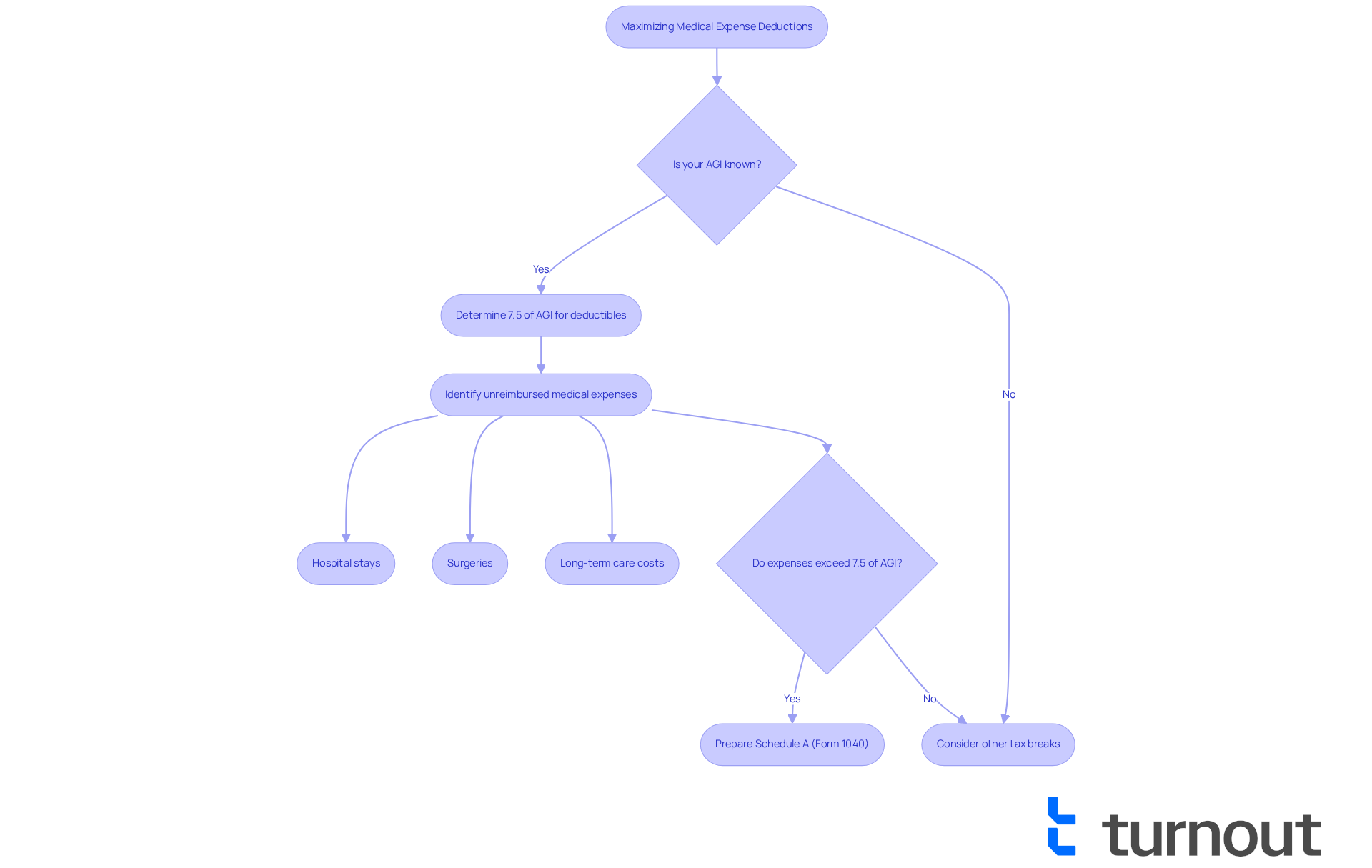

Seniors, we understand that managing finances can be overwhelming, especially when it comes to taxes and the available . You can significantly reduce your tax burden by that exceed 7.5% of your adjusted gross income (AGI). This reduction includes a wide array of expenses, such as:

- Hospital stays

- Surgeries

- Specific long-term care costs

For instance, if your AGI is $50,000, only medical expenses exceeding $3,750 would be deductible. is essential for optimizing these .

Tax experts emphasize the importance of detailing expenses through Schedule A (Form 1040) to ensure all qualifying medical costs are accounted for. Rocky Mengle, a tax specialist, points out that starting in 2025, there will be a that can be combined with current allowances. This includes an additional standard allowance of:

- $2,000 for individuals

- $1,600 for eligible partners

This potentially allows an eligible couple to subtract as much as $46,700 from their taxable earnings.

It's common to feel uncertain about these allowances, but statistics reveal that many seniors overlook tax breaks for elderly. In fact, one in five Americans has never considered healthcare expenses in retirement planning, a number that rises to one in four among Gen X. By understanding which —such as premiums for Medicare, long-term care insurance, and costs associated with necessary home modifications—you can navigate and take advantage of tax breaks for elderly.

Furthermore, the IRS allows deductions for costs related to chronic conditions, as long as a doctor verifies the necessity for support with daily living tasks. This means that expenses for personal care services in assisted living facilities might also be eligible for write-offs, easing your economic pressure. Plus, it's reassuring to know that more than 9 out of 10 IRS refunds are issued in less than 21 days, ensuring a timely return on your tax filings.

In summary, by utilizing available tax benefits, keeping organized records, and seeking advice from a or using tax preparation software, you can maximize your tax savings and improve your financial health. Remember, you're not alone in this journey; we're here to help you every step of the way.

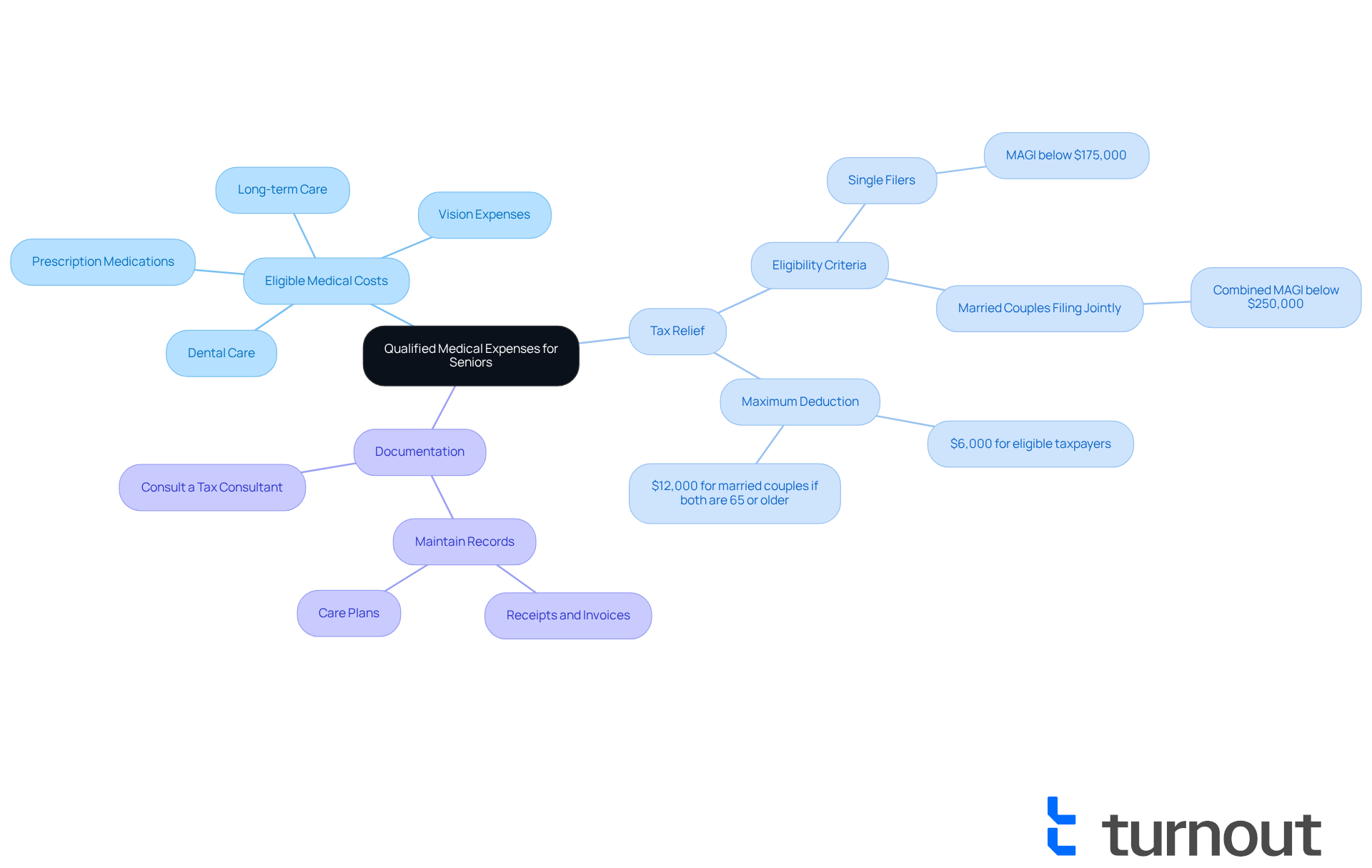

Qualified Medical Expenses: What Seniors Should Know

As older adults, you may face various eligible medical costs, including prescription medications, dental care, and vision expenses. Importantly, costs related to long-term care, such as nursing home charges, also qualify for reductions. By understanding these categories, you can strategically plan your reductions and enhance your .

In 2025, there will be aged 65 and older, providing a relief of $6,000. This relief can significantly lower your tax bills, particularly with the available tax breaks for elderly through the 2028 tax year. To be :

- Single filers must have a modified adjusted gross income (MAGI) below $175,000.

- Married couples filing jointly must have a total MAGI below $250,000.

Comprehending these thresholds is essential for you to fully utilize this benefit.

It's crucial to maintain , including any non-medical services that might be eligible for tax benefits if included in a recorded care plan. This documentation will support your claims during tax season. can also provide important guidance on optimizing reductions connected to . We're here to help you ensure that you fully benefit from available .

Record Keeping: Essential Tips for Seniors

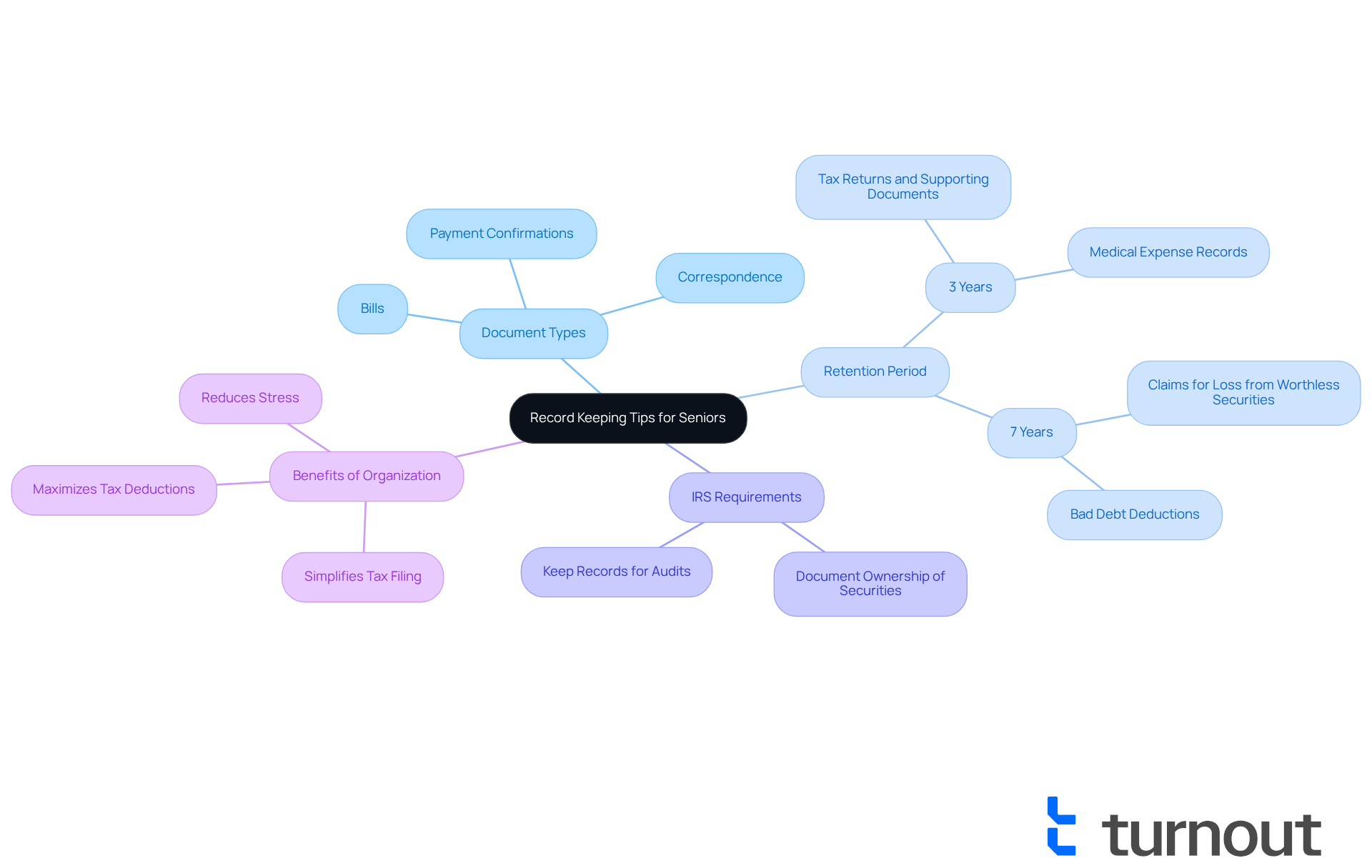

Seniors, we understand that managing can be overwhelming. It's important to keep all receipts and documentation for at least three years. This includes bills, payment confirmations, and any correspondence with healthcare providers. By establishing a well-structured system for these documents, you can simplify the and ensure that all qualifying claims are made.

Statistics reveal that in 2019, 4.4 million American tax returns reported reductions for medical expenses, highlighting the importance of meticulous record-keeping. According to the IRS, "You should if you file a claim for a loss from worthless securities or bad-debt deduction." This underscores the necessity of maintaining detailed documentation.

By keeping comprehensive records, older adults not only meet IRS requirements but also optimize their chances for . This can make much easier. For instance, many older adults who use digital folders to organize their medical expense receipts have reported a smoother tax preparation process. This allows them to focus more on their health and well-being. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Tax Credits for Seniors: Unlocking Financial Relief

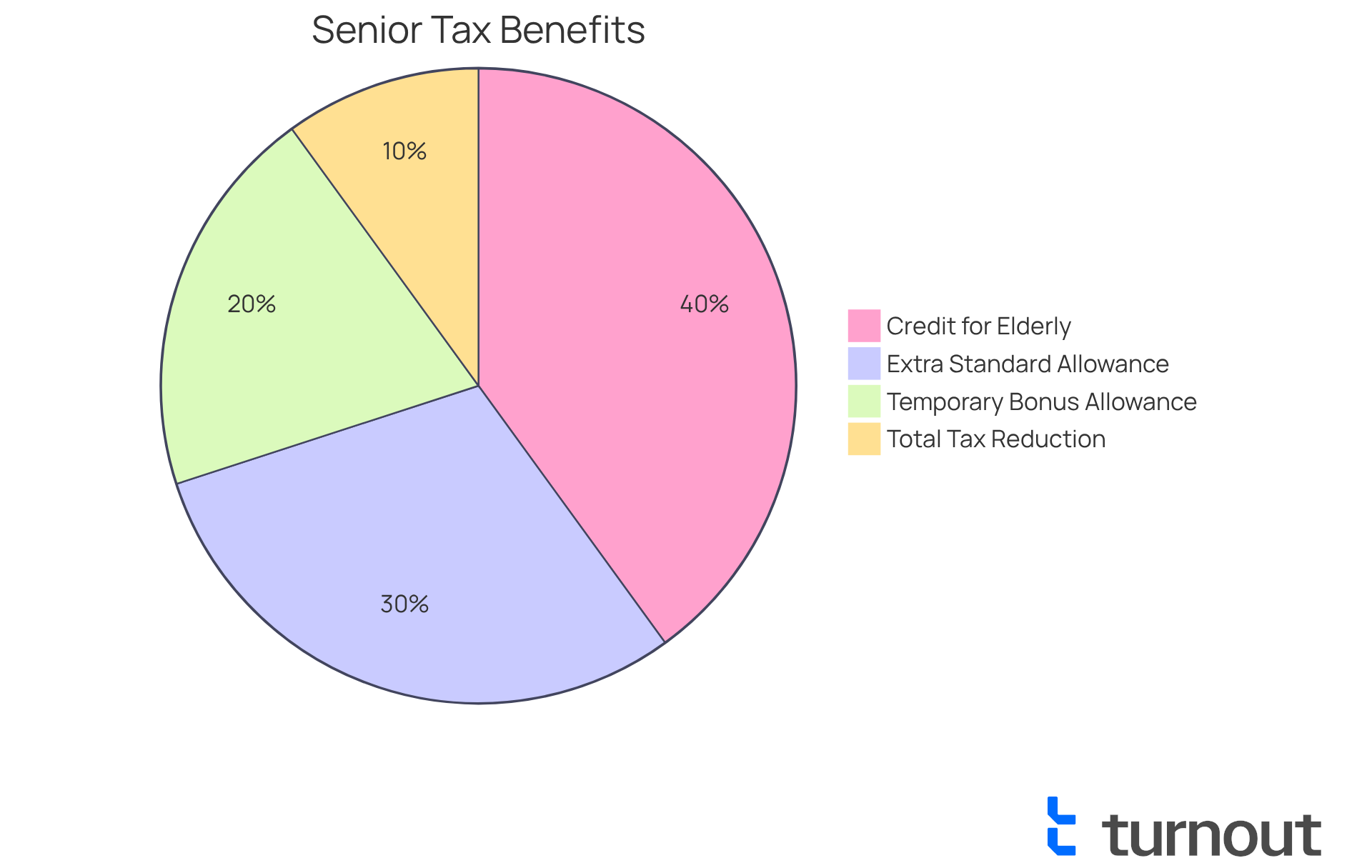

Seniors can benefit from that offer valuable financial relief. One notable benefit is the , which can significantly reduce tax liability. To qualify for this credit, individuals must be aged 65 or older and meet specific income thresholds. For instance, the is $17,500, while married couples filing jointly can qualify with a combined income of up to $25,000. The credit amount ranges from $3,750 to $7,500, depending on income and nontaxable benefits.

In 2025, the IRS is introducing updates that . We understand that is crucial, and the aged 65 and above will rise to $2,000. This change is part of a broader initiative to support elderly taxpayers, including tax breaks for elderly individuals, such as a for those aged 65 and older, available from 2025 through 2028.

Real-world examples illustrate the positive impact of these credits. A retired couple in Florida, for example, will benefit from the increased standard allowance and other . This could lead to a $1,650 tax reduction, helping them cover essential expenses such as groceries and medication. Likewise, a married elderly citizen in New Jersey who receives tips as a taxi driver will find an extra $1,989 in his pocket due to the new tax measures, including no tax on tips and the increased standard deduction.

Understanding these tax breaks for elderly is essential for seniors, as they can lead to . We encourage you to explore all available options to maximize your benefits. Remember, you are not alone in this journey, and we’re here to help ensure you receive the financial support you deserve.

Tax Management Tips: Simplifying Deductions and Credits

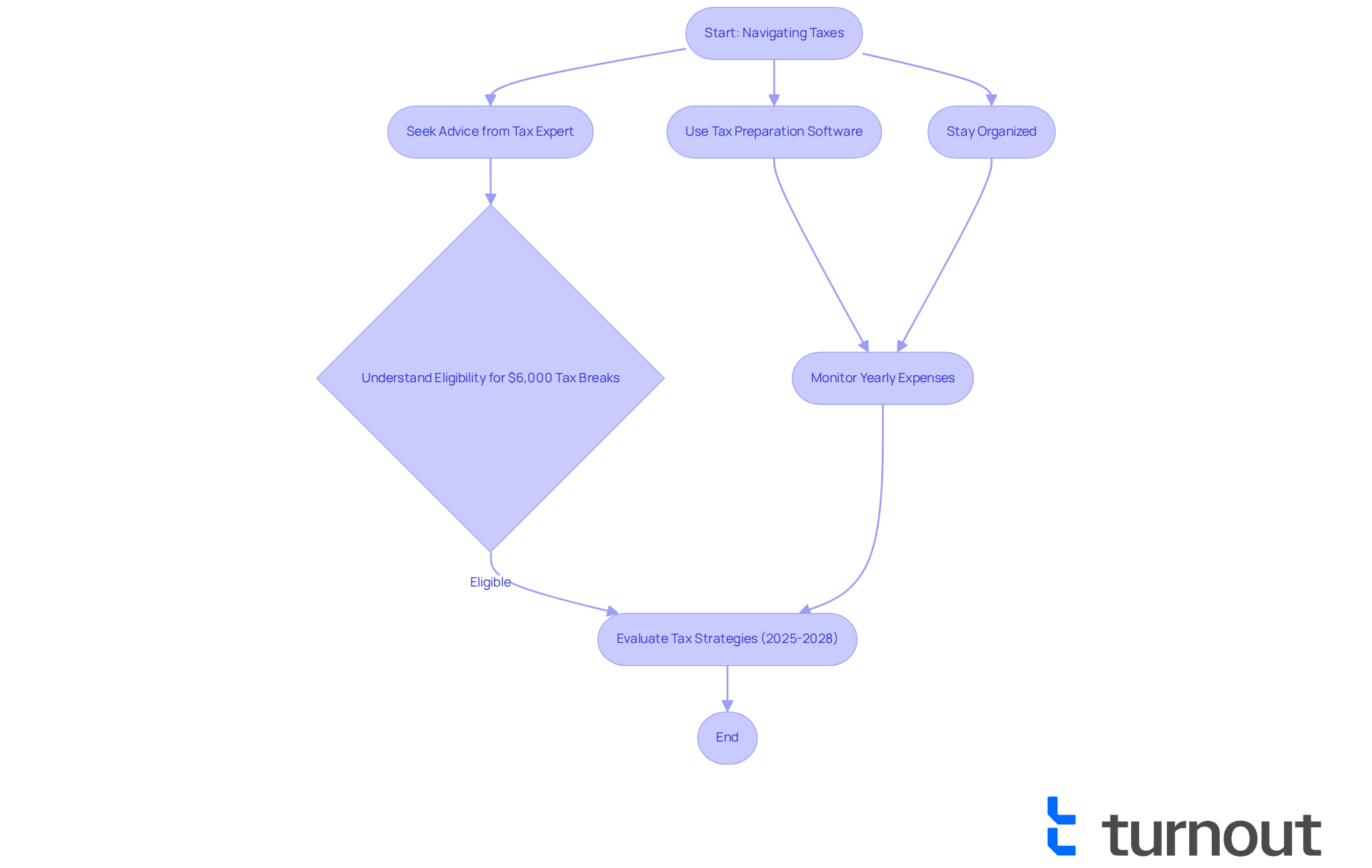

Seniors, we understand that can feel overwhelming. Seeking advice from a tax expert is a wise step to optimize your benefits and credits efficiently. With the introduction of the new $6,000 individuals aged 65 and older, applicable from 2025 through 2028, understanding eligibility and strategic planning is crucial. Tax experts can offer , helping you navigate the complexities of tax regulations and ensuring you fully utilize the benefits available to you.

Using can greatly simplify this process for older adults. These tools enable you to effortlessly recognize qualifying credits and allowances. They often include features that guide you through the tax filing process, making it more accessible. For instance, you may benefit from the expanded standard deduction, which could lead to , especially when combined with the new tax relief for seniors.

Staying organized throughout the year is another key strategy. By , you can reduce stress during tax season. Many older individuals have successfully used tax preparation software to streamline their filings and maximize their refunds. As one expert noted, "For those near the income phase-out thresholds, timing and planning could make a big difference." This highlights the importance of , particularly in relation to the tax breaks for elderly that will be available from 2025 to 2028.

It's also essential to recognize that the new reduction phases out for modified adjusted gross incomes exceeding $75,000 for individuals and $150,000 for couples. Understanding this is vital for grasping your eligibility. Furthermore, the new higher age tax breaks for elderly may influence the , as they can help reduce your adjusted gross income, potentially lowering the taxable portion of those benefits. Remember, you are not alone in this journey—we're here to help you make the most of these opportunities.

Government Resources: Accessing Support for Tax Breaks

Seniors, we understand that navigating tax obligations can feel overwhelming, particularly when it comes to . Fortunately, a wealth of government resources is available to support you. The , offering detailed information on tax breaks for elderly individuals and other deductions and credits. Additionally, the IRS provides various tools designed to help you of tax obligations. For instance, the Taxpayer Advocate Service (TAS) is an independent organization within the IRS dedicated to ensuring that every taxpayer is treated fairly and understands their rights under the Taxpayer Bill of Rights.

Programs like the offer complimentary tax assistance to older adults, helping them understand the tax breaks for elderly individuals and ensuring they receive the support they need. In 2023, over 11 million individuals aged 50 and older benefited from food assistance through the Supplemental Nutrition Assistance Program (SNAP), highlighting the importance of .

, including assistance with and . By utilizing trained nonlegal advocates and IRS-licensed enrolled agents, Turnout helps older adults navigate the complexities of tax relief and government benefits, ensuring you receive the support you deserve without the burden of legal representation.

Real-world examples illustrate the effectiveness of these resources. Many older adults have successfully utilized IRS tools to claim deductions for medical expenses, which can significantly reduce their taxable income. For instance, you can deduct medical and dental expenses that surpass 7.5% of your adjusted gross income (AGI), including costs for hospital services and prescribed medications.

Statistics reveal that around 5.5 million adults aged 55 to 64 acquire individual health insurance through ACA marketplaces, suggesting many older individuals actively seek assistance. The IRS also offers accessibility services for taxpayers with disabilities and limited-English proficiency, ensuring that all elderly individuals can access the help they need.

By utilizing these resources, including the assistance provided by Turnout, you can navigate your tax obligations more effectively and maximize your potential tax savings, particularly through tax breaks for elderly. We encourage you to regularly check the IRS website and consult with available programs to ensure you are taking full advantage of the benefits and deductions for which you qualify. Remember, you are not alone in this journey—we're here to help.

Non-Profit Organizations: Helping Seniors with Tax Issues

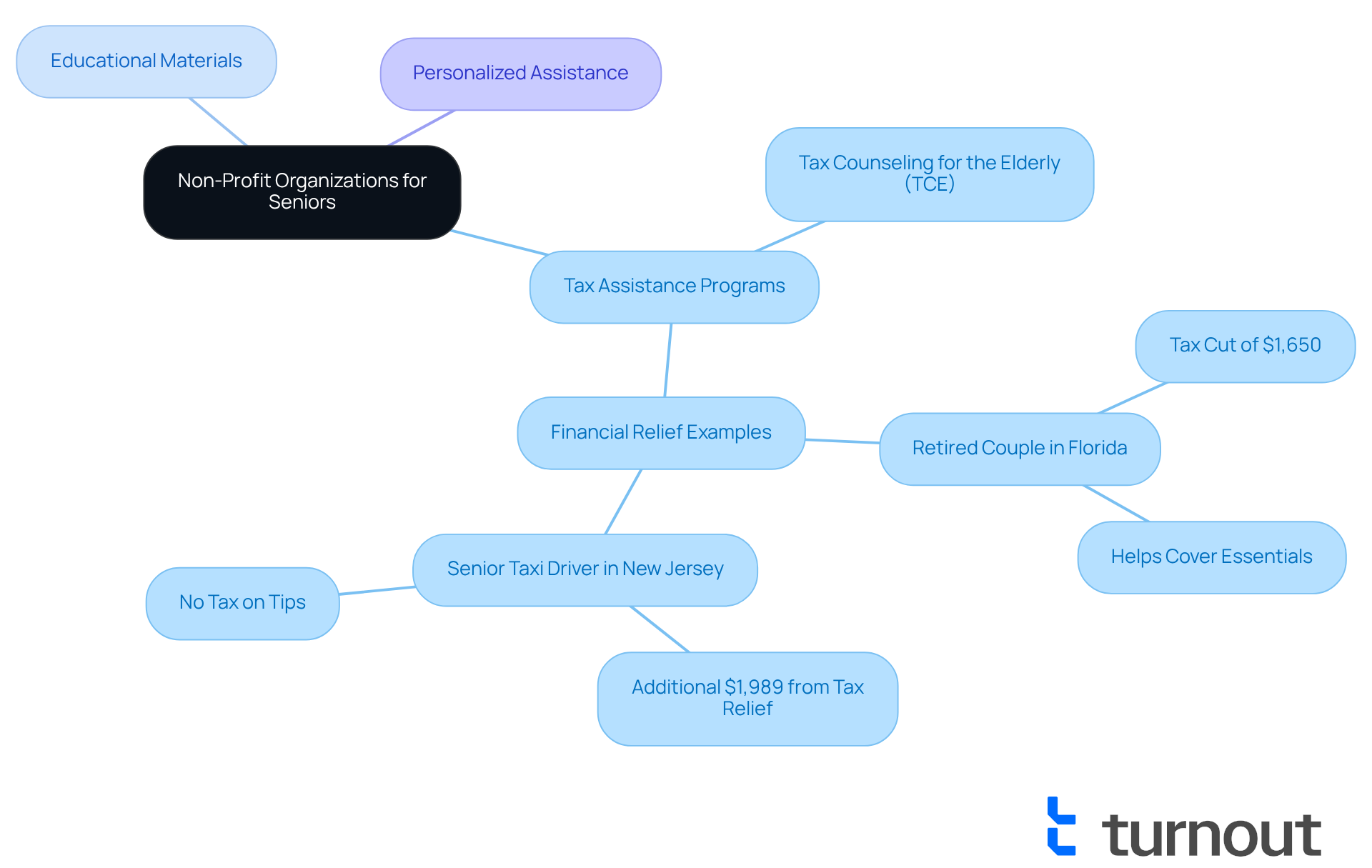

Many non-profit organizations are dedicated to providing specifically for older adults. These compassionate organizations offer complimentary tax preparation services, educational materials, and . This support enables older adults to with ease and enhances their benefits.

We understand that . Programs like focus on pensions and retirement-related matters, ensuring that older adults receive the help they need. Engaging with these organizations can significantly simplify the , alleviating stress and confusion.

Statistics reveal that many older adults benefit from these services. For instance, a retired couple in Florida received a $1,650 tax reduction due to expanded deductions. Such can be crucial for covering essential expenses like groceries and medication.

Successful examples of these programs highlight their positive impact. Consider the experienced taxi driver in New Jersey who . By utilizing the resources provided by non-profits, older adults can improve their economic stability and enjoy a more secure retirement.

Remember, you are not alone in this journey. We're here to help you navigate these challenges and .

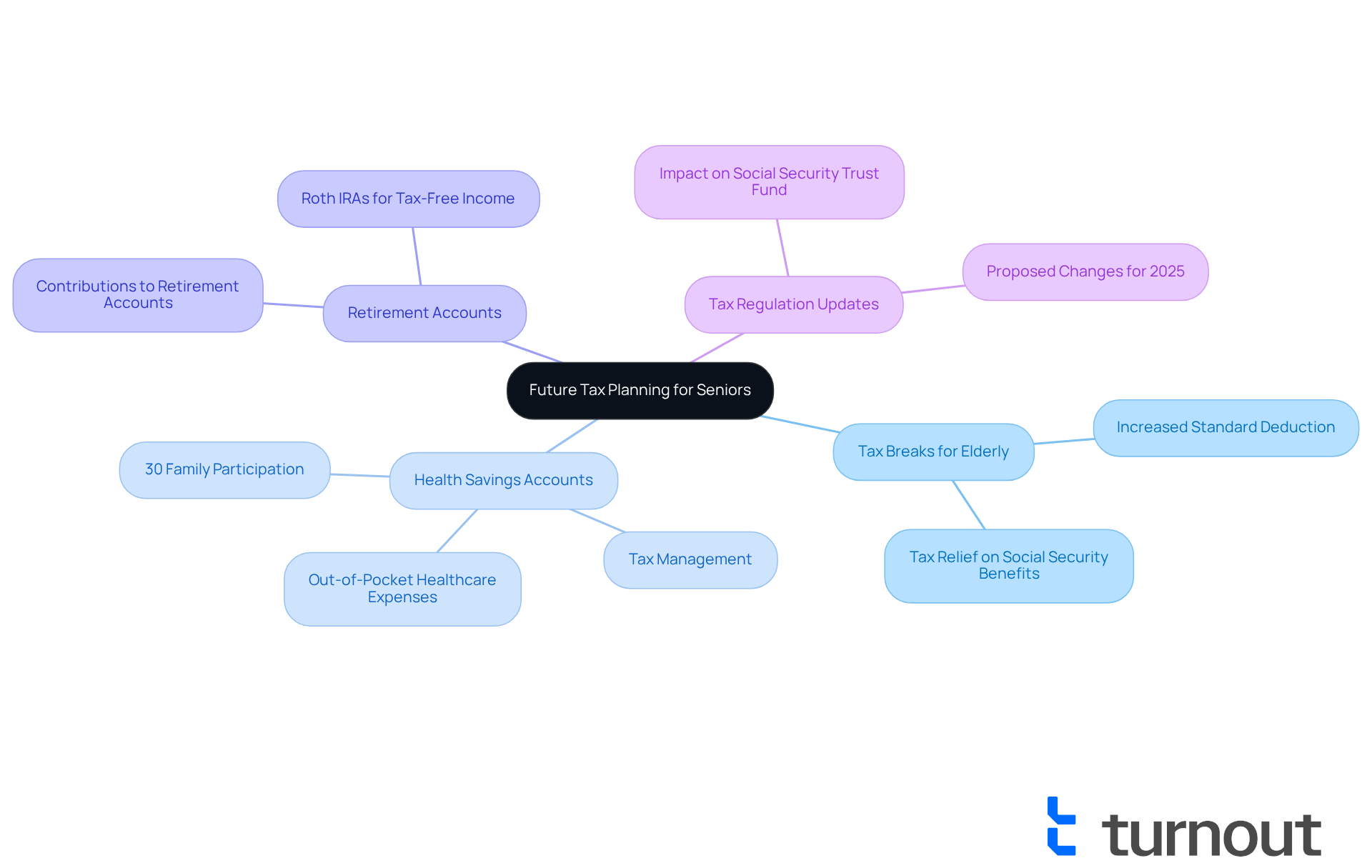

Future Tax Planning: Strategies for Seniors

Seniors, we understand that navigating financial matters can feel overwhelming. Prioritizing that include is essential for improving your economic security. Contributing to retirement accounts and utilizing are effective methods for . HSAs, in particular, have gained traction among older adults. Approximately 30% of families with employer-sponsored health insurance benefit from these accounts, especially those with elderly members. This trend reflects a growing recognition of HSAs as a valuable tool for , allowing individuals to set aside pretax income for qualified medical expenses.

It's common to feel uncertain about tax regulations, but staying updated on possible modifications, such as tax breaks for elderly, is crucial. For instance, recent proposals suggest to $5,000 for single filers and $10,000 for married couples filing jointly, thereby providing tax breaks for elderly. These changes could significantly reduce your taxable income, potentially alleviating the tax burden on , which are subject to taxation if provisional income exceeds $25,000 for single filers and $32,000 for couples filing jointly, and may also provide tax breaks for elderly individuals. Interacting with money consultants can offer , ensuring that you can enhance your tax results and manage the intricacies of the tax environment efficiently.

Real-world examples illustrate the benefits of HSAs for tax management. Families utilizing HSAs have reported spending 44% more on out-of-pocket healthcare expenses compared to those without such accounts. This highlights the importance of strategic planning in managing healthcare costs. By leveraging HSAs and other tax-efficient strategies, you can better position yourself for . Remember, you are not alone in this journey; we're here to help you navigate these important decisions.

Conclusion

Navigating the tax landscape can be particularly challenging for elderly Americans. We understand that the complexities of taxes can feel overwhelming. However, understanding the essential tax breaks available in 2025 can significantly alleviate financial burdens. The introduction of new deductions, credits, and the integration of AI-driven advocacy tools are set to empower seniors, ensuring they receive the financial support they deserve. These advancements not only simplify the process of claiming benefits but also enhance the overall experience for older adults as they manage their tax obligations.

Key points discussed in this article highlight several critical tax breaks for seniors. This includes:

- The new $6,000 deduction for individuals aged 65 and older

- Medical expense deductions

- Various tax credits specifically designed to provide financial relief

Additionally, resources such as Turnout and government programs like VITA and TAS play crucial roles in assisting seniors with their tax needs. These resources make it easier for you to access available benefits and optimize your financial health.

Ultimately, the information presented underscores the importance of being proactive in tax planning and seeking assistance when needed. By leveraging available resources, maintaining organized records, and understanding eligibility for various tax breaks, elderly individuals can enhance their economic stability and enjoy a more secure retirement. Embracing these strategies will not only simplify tax management but also empower seniors to take control of their financial futures. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it assist older adults with tax breaks?

Turnout is an AI-powered advocacy service that helps older adults navigate the complex process of applying for tax breaks. It streamlines applications and provides real-time updates, making it easier for elderly Americans to access the assistance they need.

What new tax deduction will be available for seniors starting in 2025?

Starting in 2025, individuals aged 65 and above will benefit from an additional tax deduction of $6,000, valid until 2028. This deduction complements the existing standard deduction and can significantly lower taxable income for elderly taxpayers.

How much can seniors potentially subtract from their taxable income with the new deduction?

An individual aged 65 or older could potentially subtract as much as $21,750 from their taxable income, providing substantial economic relief.

What types of medical expenses can seniors deduct to reduce their tax burden?

Seniors can deduct unreimbursed medical expenses that exceed 7.5% of their adjusted gross income (AGI). This includes expenses such as hospital stays, surgeries, and certain long-term care costs.

What is the significance of the new $6,000 allowance starting in 2025?

The new $6,000 allowance for older adults can be combined with current allowances, allowing eligible couples to potentially subtract as much as $46,700 from their taxable earnings, enhancing their economic stability.

How can seniors ensure they are maximizing their tax deductions for medical expenses?

Seniors should keep detailed records and receipts of their medical expenses and use Schedule A (Form 1040) to account for all qualifying costs. Consulting with tax experts or utilizing available resources can also help them effectively claim their benefits.

What should seniors do if they feel overwhelmed by the changes in tax laws?

Seniors are encouraged to seek advice from tax experts or utilize resources like Turnout to help them understand and claim the tax breaks they are entitled to, ensuring they are not alone in navigating these changes.

Are there any service fees associated with Turnout's services?

Yes, Turnout has a clear fee structure where some services are free, while others incur service fees. Government fees must also be paid separately before any paperwork can be submitted on behalf of clients.