Overview

The article titled "10 Essential Insights on State Tax Liens for Investors" is designed to provide you with crucial information about state tax liens. We understand that navigating this area can be daunting, and it's important to grasp the implications, risks, benefits, and purchasing process involved. Investing in state tax liens can indeed offer high returns and secured investments, but it’s essential to recognize the complexities that come with tax obligations, market conditions, and the potential for competing claims. These factors are vital for making informed investment decisions.

We’re here to help you feel more confident in your investment journey. By understanding these insights, you can approach state tax liens with a clearer perspective, enabling you to make choices that align with your financial goals. Remember, you are not alone in this journey; many investors share similar concerns and questions. Embrace the opportunity to learn and grow in your investment strategy.

Introduction

State tax liens can feel overwhelming, representing a challenging blend of financial obligation and investment opportunity. We understand that many investors grapple with uncertainty in this area. It's essential to recognize the nuances of these liens, as they can significantly influence property values and your investment returns.

In this article, we delve into ten essential insights designed to equip you with the knowledge needed to navigate the intricate landscape of state tax liens.

What challenges do these liens present?

How can you leverage their potential for profit while minimizing risks?

You're not alone in this journey, and we're here to help you find clarity.

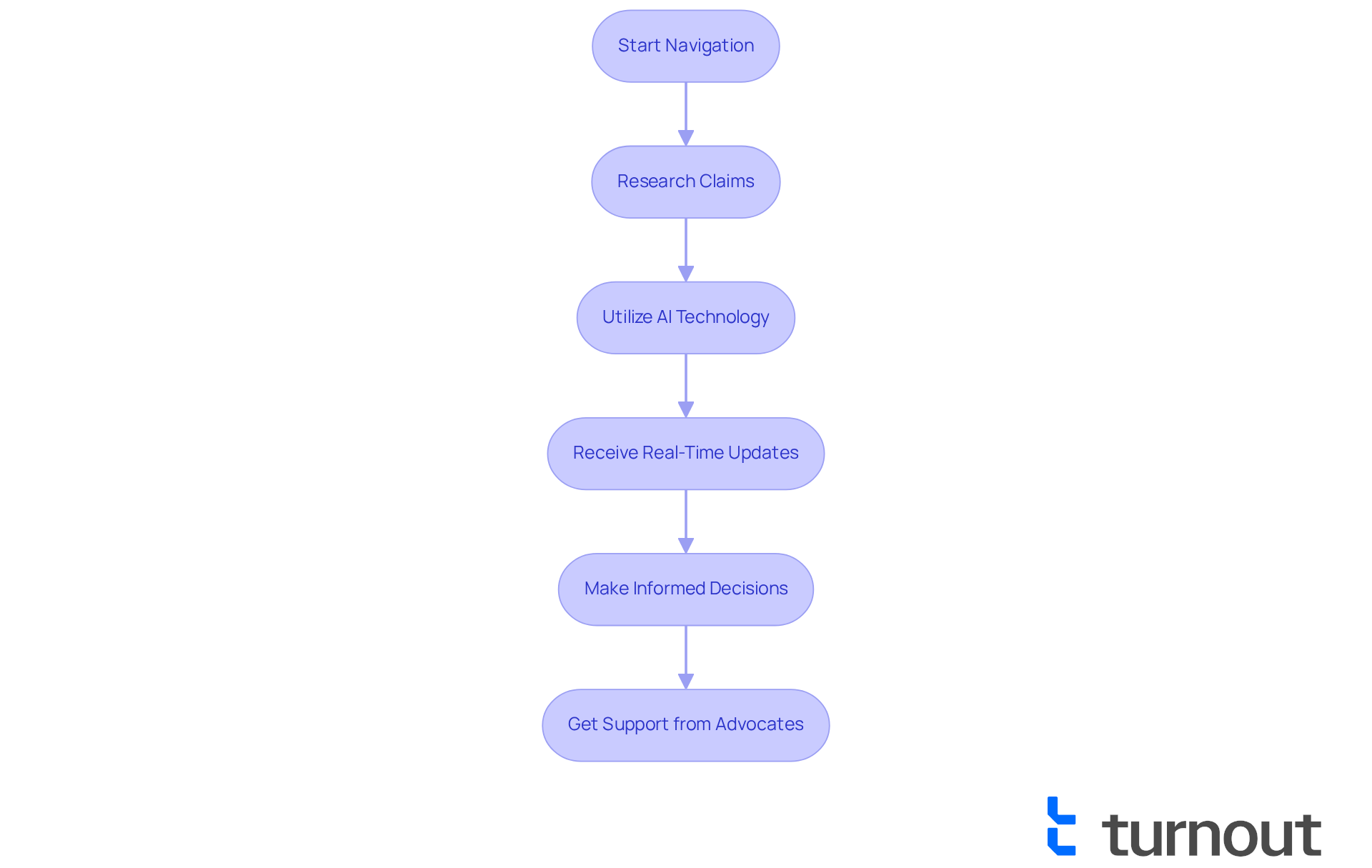

Turnout: AI-Powered Advocacy for Tax Liens

Navigating claims related to state tax lien and government benefits can be overwhelming. At Turnout, we understand the challenges you face. Our AI technology is designed to transform consumer advocacy, making it easier for you to manage complex processes like SSD claims and dealing with a state tax lien. By automating these tasks and providing real-time updates, we empower you to make informed decisions swiftly.

Imagine cutting your research time from weeks to just minutes. With our AI-driven approach, you can confidently maneuver through the intricate terrain of tax claims, including state tax liens, and financial support. While Turnout is not a law firm and does not provide legal advice, we are here to support you. Our team includes trained nonlawyer advocates and IRS-licensed enrolled agents dedicated to guiding you through these processes.

You are not alone in this journey. We ensure you receive the assistance you need without the complexities of legal representation. Together, we can navigate these challenges and find the best solutions for you.

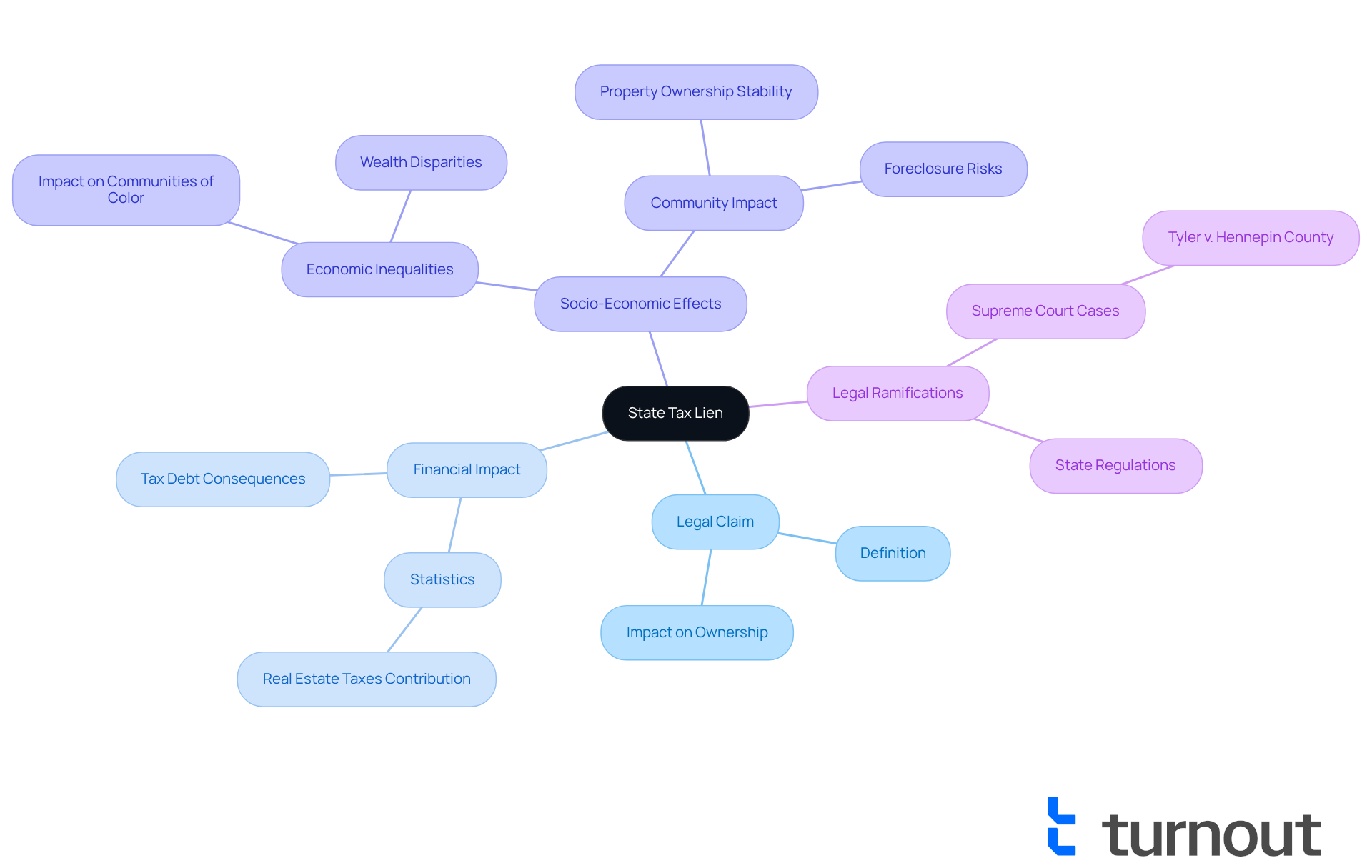

Definition of a State Tax Lien: Key Concepts

A state tax obligation can feel overwhelming. A state tax lien is a legal claim placed by a state government on an asset due to unpaid taxes, ensuring the state's interest in that asset until the tax debt is resolved. When such a claim is established, it can significantly impact your ability to sell or refinance the asset, as the claim must be addressed before any change in ownership can occur. We understand that navigating these complexities can be daunting, especially for investors seeking to understand the tax landscape.

In recent years, the number of tax claims submitted in the U.S. has been on the rise, highlighting the increasing challenges faced by landowners in dealing with state tax liens and meeting their tax obligations. For instance, real estate taxes accounted for 32.2% of total local tax revenue in the fiscal year 2020. This statistic underscores the financial pressure that can lead to tax claims and potential foreclosures.

However, the impact of governmental claims related to the state tax lien extends beyond immediate financial concerns. They can disrupt property ownership stability and contribute to broader economic inequalities, particularly in communities of color where biased tax evaluation methods have historically intensified wealth disparities. It's common to feel lost in these circumstances, but understanding your rights and the implications of tax claims is crucial.

The U.S. Supreme Court decision in Tyler v. Hennepin County serves as a reminder of the legal ramifications of tax claims, illustrating important changes in how tax debts are managed. Grasping state regulations and local auction guidelines is essential for navigating the intricacies of tax investment. Remember, you are not alone in this journey; we’re here to help you find clarity and support as you move forward.

Triggers of State Tax Liens: Common Causes

State claims often arise from unpaid real estate levies, income assessments, or a state tax lien and other state-mandated charges. We understand that failure to file tax returns, underreporting income, or neglecting timely tax payments can be overwhelming. Economic downturns significantly contribute to rising tax delinquencies. For instance, the delinquency rate reached 5.1% in 2025, up from 4.5% in 2024. This increase correlates with a staggering 27% rise in real estate taxes from 2019 to 2025, placing additional strain on homeowners' finances.

Investors should closely monitor economic indicators, such as unemployment rates and property tax trends. These factors can signal a surge in state tax lien opportunities. It's common to feel uncertain, especially in states like Mississippi, where delinquency rates have soared to 13.8%. The connection between economic instability and tax obligations becomes even clearer through case studies. Take Diana Nesbitt, for example, who faced significant tax debt after missing payments due to financial hardships.

The emotional and financial burdens faced by individuals, like Velma Lewis, who lost her home due to unpaid taxes, highlight the human impact of these systemic issues. Moreover, the 2023 Supreme Court decision in Tyler v. Hennepin County raises questions about current tax sale methods, emphasizing the need for changes in the management of state tax liens.

Grasping these dynamics is essential for investors aiming to navigate the complexities of tax obligations. Remember, you are not alone in this journey. We're here to help you understand and address these challenges.

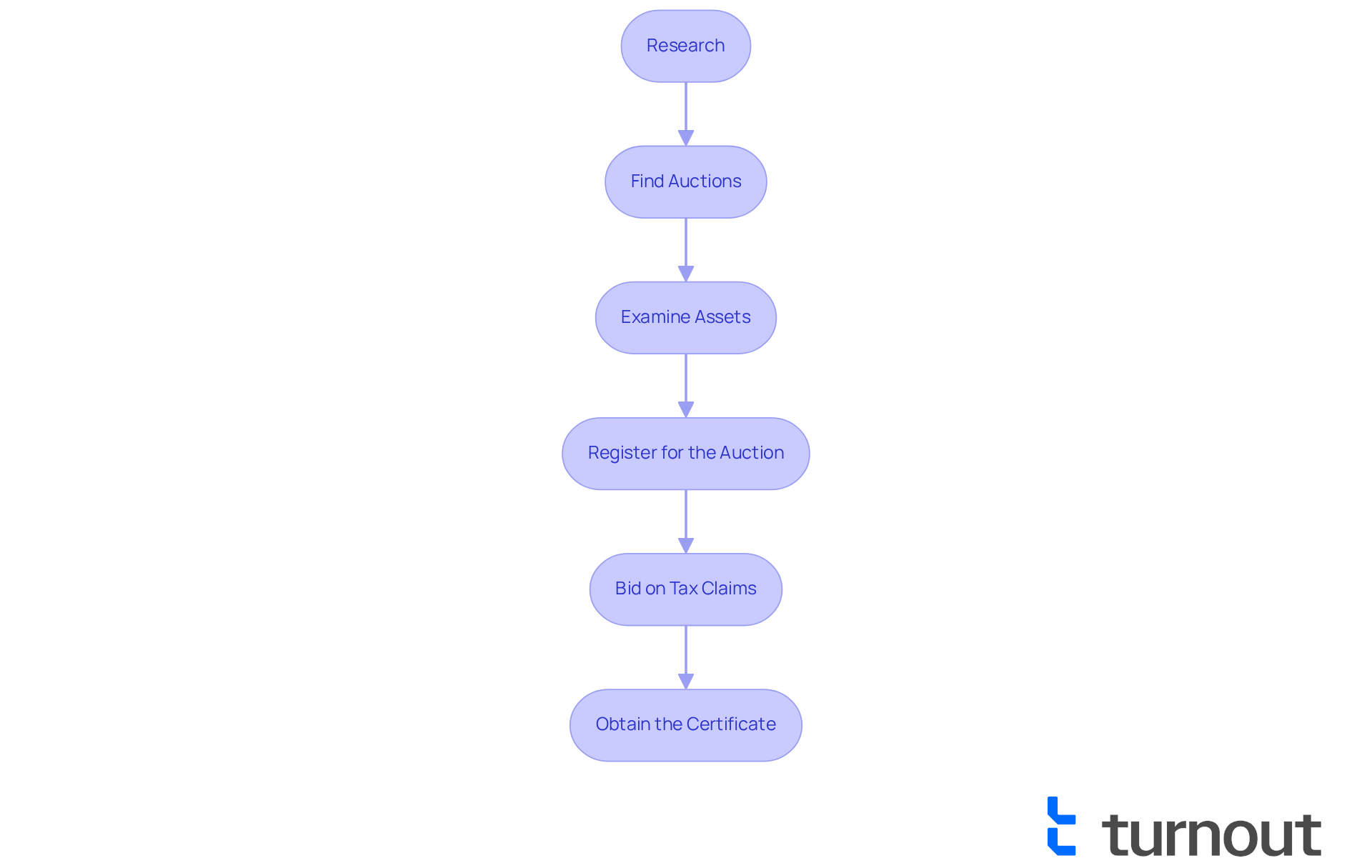

Purchasing State Tax Liens: Step-by-Step Guide

- Research: We understand that navigating tax claim investing can feel overwhelming. Start by identifying the states that allow this type of investment and familiarize yourself with their specific laws and regulations concerning state tax lien. It's important to know that average yearly returns for tax-related investments, such as those involving a state tax lien, can range from 8% to 30%, presenting an opportunity for significant profit.

- Find Auctions: Begin your search for upcoming tax certificate auctions in your desired area. These auctions are often advertised on local government websites, which also provide essential details on auction timelines and key dates. Remember, staying informed is key to your success.

- Examine the assets associated with the claims, including any state tax lien, before you place a bid. Assess their market value and condition to understand potential risks. It’s common to feel uncertain, but keep in mind that property owners typically have a redemption period—often about five years in California—to settle their outstanding dues and reclaim their property.

- Register for the Auction: Make sure to register for the auction ahead of time, as some require pre-registration. This step is crucial to secure your ability to bid and move forward confidently.

- Bid on Tax Claims: During the auction, place bids on the tax claims that interest you. Be prepared to settle the overdue payments upfront, as this is usually a requirement for successful bids related to a state tax lien. We know this can be a stressful moment, but trust in your preparation.

- Obtain the Certificate: If you win the bid, you will receive a certificate for the outstanding payments, granting you the authority to collect the owed amounts plus interest. It’s important to consider that the foreclosure process can be costly and emotionally taxing, so weigh the potential profits against these factors. Remember, you are not alone in this journey; we’re here to help you navigate the complexities.

Risks of Investing in State Tax Liens: What to Watch For

Investing in state tax liens can feel overwhelming, and it's important to be aware of several risks that may affect your journey:

- Property Condition: The physical state of the property plays a crucial role in its value. Properties in poor condition may not yield the returns you hope for, as they could require significant repairs or may even be uninhabitable. For instance, small plots of land with years of unpaid dues often prove to be valueless, leading to financial losses. Did you know that assets sold at tax auctions can sometimes be as small as one-tenth of an acre? This may not be a practical investment for many.

- Redemption Periods: Each region has its own redemption durations, which allow owners to reclaim their assets by settling owed taxes. If owners redeem their properties quickly, your returns might be lower than expected. Understanding these timelines is essential, as they can vary widely across states in relation to state tax liens. For example, in Georgia, there is a foreclosure period before you can take possession of a house purchased at a tax auction.

- Competing Claims: Properties may have multiple outstanding claims, which can complicate your investment. It's vital to conduct thorough due diligence to uncover any existing claims that might affect your investment. For example, if an asset has unpaid taxes owed to various agencies, it could lead to unforeseen financial challenges. The presence of extra claims, such as a state tax lien, can make the investment landscape more complex for buyers.

- Market Variations: The real estate market is ever-changing, and these fluctuations can impact the value of assets tied to tax obligations. Staying informed about market trends is crucial for making educated decisions. A market downturn could reduce the asset's value, affecting your potential returns. Notably, the total dollar value of tax claims sales increased from $3.8 billion in 2021 to $5.02 billion in 2024. This suggests a growing market, but it also indicates potential instability.

By recognizing these risks and conducting thorough research, including understanding auction regulations and tax redemption timelines, you can navigate the complexities of tax-related investing more effectively. Remember, you are not alone in this journey, and we’re here to help you make informed choices.

Benefits of State Tax Liens: Why Invest?

Investing in state tax liens provides numerous advantages that can attract both seasoned and novice investors. We understand that navigating investment opportunities can be overwhelming, but tax liens present a unique chance to grow your portfolio.

- High Returns: Tax liens typically offer high-interest rates, often ranging from 3% to 18%. This makes them an attractive investment opportunity. Many successful investors have reported significant profits, especially when they perform comprehensive research and understand the assets involved.

- Secured Investment: The claim is guaranteed by the asset itself, which greatly diminishes the risk of complete loss. This security provides peace of mind, knowing that your investment is backed by tangible assets.

- Chance for Real Estate Purchase: If the owner neglects to settle the claim, you might have the opportunity to obtain the asset at a small portion of its market worth. This potential for property acquisition can lead to lucrative opportunities, especially in desirable locations.

- Support for Local Authorities: By investing in state tax lien claims, you play a crucial role in helping local governments collect overdue taxes. This not only contributes to community funding and services but also supports the overall health of the community.

- Historical Returns: Traditionally, tax claims investments have generated returns similar to standard savings accounts, but with the possibility of significantly greater profits. As competition in the market rises, grasping the intricacies of tax investment becomes crucial for optimizing returns.

- Expiration Dates: It's important to recognize that tax claims have expiration dates following the redemption period. This means you must be conscious of the time-sensitive aspect of your investments.

- Competitive Landscape: The market for tax claims has become progressively competitive, with banks and hedge funds entering the space. This makes it more challenging for individual investors to find lucrative opportunities.

These advantages highlight why tax claims are an attractive choice for those seeking to broaden their portfolios. Remember, you are not alone in this journey. With the right information and support, you can participate in a market that offers both financial gains and community assistance.

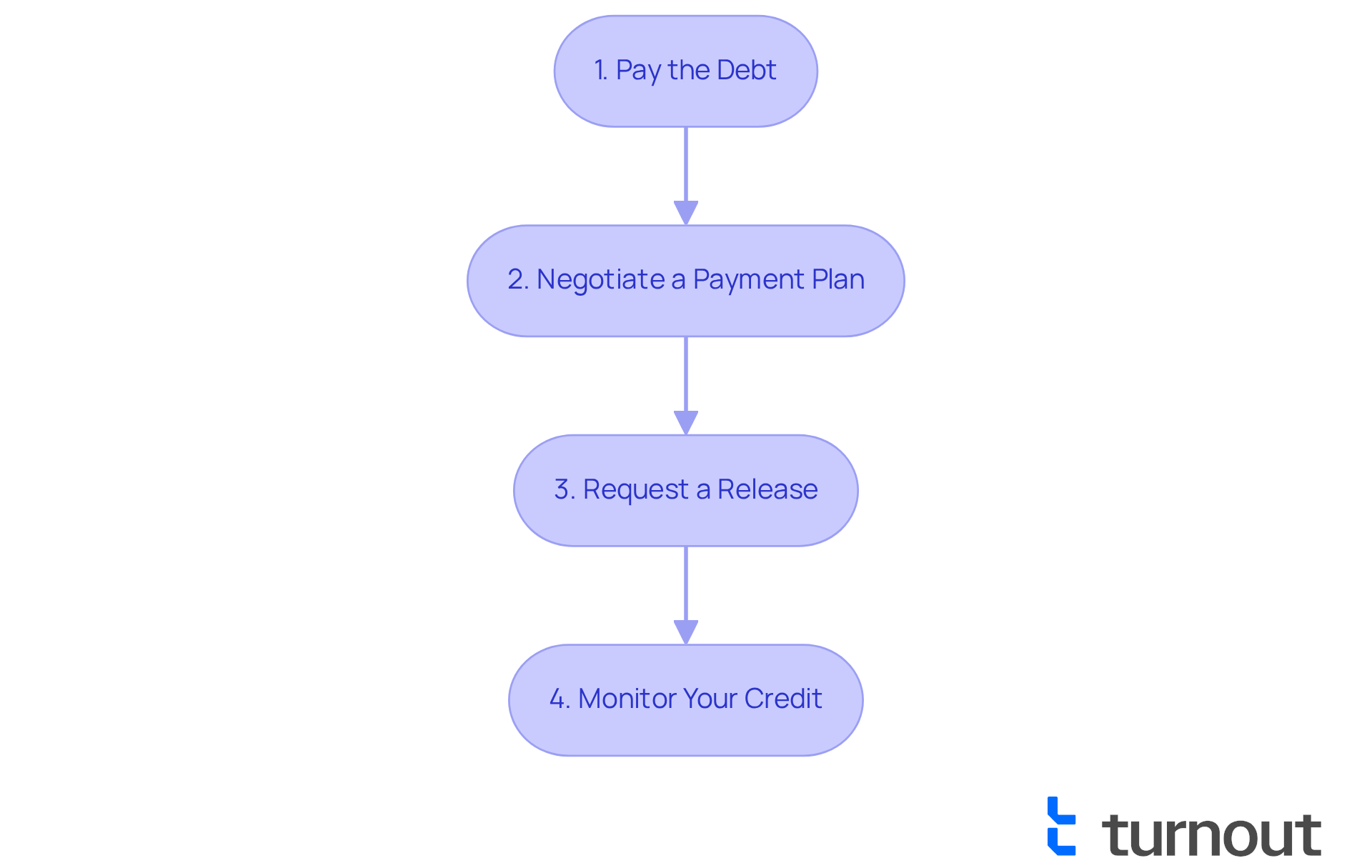

Resolving State Tax Liens: Essential Steps

To effectively resolve a state tax lien, it's important to take a few essential steps that can help ease your worries:

- Pay the Debt: The most straightforward method to resolve a lien is to pay the outstanding tax debt in full, including any penalties and interest. This action typically leads to the quickest resolution, allowing you to move forward without the burden of debt.

- Negotiate a Payment Plan: If paying the entire sum is not practical, we understand that financial constraints can be challenging. Consider reaching out to the tax authority to discuss a payment arrangement. Many states offer flexible options, allowing you to pay off your debts over time. For instance, some individuals have successfully negotiated plans that spread payments over several months, making it easier to manage their finances.

- Request a Release: After settling the debt, promptly ask for a discharge of the claim. This step is crucial to clear your property title and prevent future complications in property transactions. In California, for instance, the Franchise Tax Board may consent to remove a claim after you establish a payment agreement and demonstrate good faith.

- Monitor Your Credit: Finally, keep an eye on your credit report to ensure that the claim is removed. State tax liens can adversely affect your credit rating, so confirming their elimination is essential for preserving your financial well-being. It's important to recognize that regional tax claims may still show up on credit reports, which can influence loan and refinancing requests.

By following these steps, you can manage the intricacies of regional tax obligations more effectively, alleviating stress and enhancing your financial position. Remember, you're not alone in this journey—consulting with a tax professional can provide valuable assistance in navigating these issues. We're here to help you every step of the way.

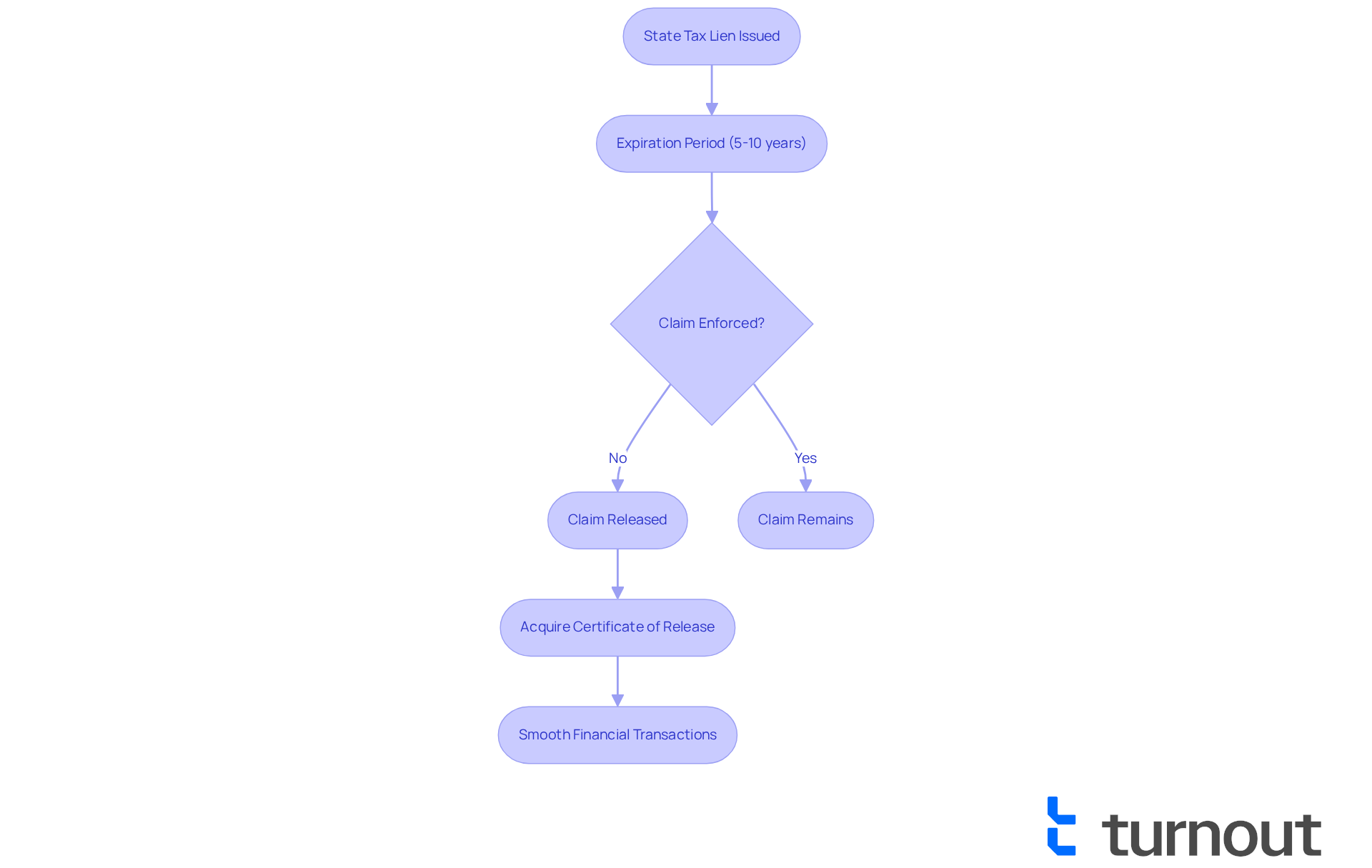

Expiration of State Tax Liens: What Investors Need to Know

We understand that navigating a state tax lien can be daunting. Generally, these claims expire after a designated period, usually between 5 to 10 years, depending on specific state regulations. If a claim goes unenforced within this timeframe, it may be automatically released. It's crucial for investors to be aware of these timelines to avoid holding onto claims like a state tax lien that might diminish in value.

As J. David Tax Regulations points out, "Tax claims can considerably affect financial well-being, and general tranquility." This highlights the importance of understanding these expiration processes. By grasping the nuances of claim expiration, you can better strategize your investments and steer clear of unnecessary complications.

It's common to feel overwhelmed by these regulations. However, as J. David Tax Law emphasizes, "Allowing a state tax lien to expire might appear to be a simple solution, but it’s frequently not the most effective method," since the underlying tax obligation remains enforceable. Therefore, acquiring a Certificate of Release after the claim expires is essential to ensure that the obligation is officially cleared from public records. This step facilitates smoother financial transactions in the future, and remember, you are not alone in this journey—we're here to help.

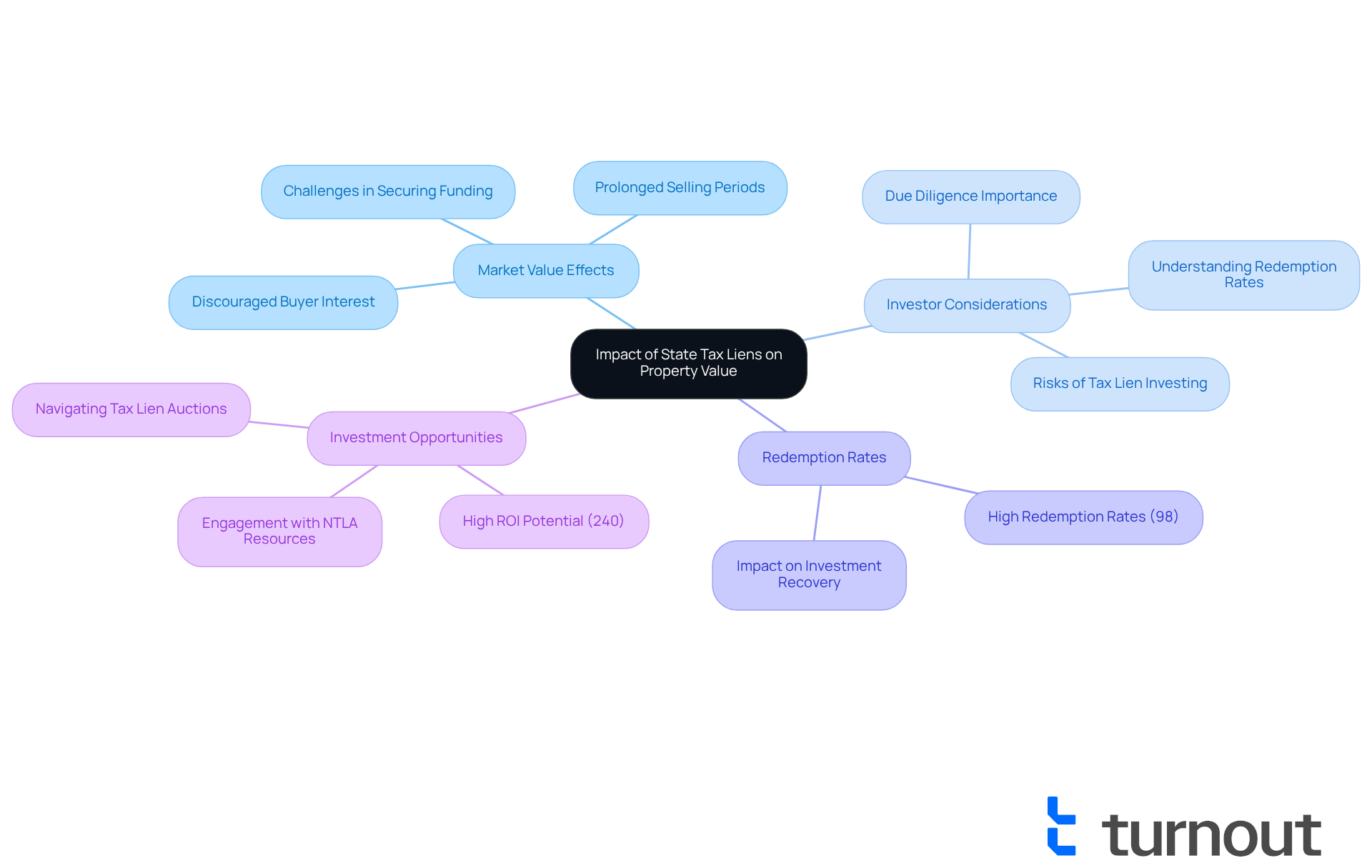

Impact of State Tax Liens on Property Value: An Overview

State tax liens can significantly impact real estate values and marketability. When a claim arises, it signals to potential buyers that there are unpaid obligations tied to the asset. This knowledge can understandably discourage interest and lower market value. Moreover, assets with encumbrances may face challenges in securing funding, as lenders often require clear titles. It's important for investors to consider these factors when evaluating properties linked to a state tax lien, as they can influence resale potential and overall investment returns.

We understand that tax claims come with an expiration date, emphasizing the need for timely action. Properties burdened with a state tax lien often linger on the market longer than those without, as the complexities of resolving such issues can deter buyers. For instance, in Maricopa County, properties with a state tax lien might undergo additional scrutiny, affecting their appeal to prospective purchasers.

Real estate examples illustrate the tangible effects of claims on market interest. Properties that have faced a state tax lien frequently receive lower offers or experience prolonged selling periods, as buyers weigh the risks of assuming such debts. It's crucial for investors to recognize that a state tax lien not only complicates the selling process but may also diminish the asset's overall attractiveness. Thus, conducting thorough due diligence is essential before proceeding with any investment.

Investors should also take comfort in knowing that approximately 98% of property owners redeem their properties before foreclosure, which can provide reassurance about the likelihood of recovering investments. Additionally, the potential for high returns on tax-related investments, with a fixed ROI of 240%, is a compelling opportunity not to be overlooked. Engaging with resources like the National Tax Lien Association (NTLA) can offer valuable insights and guidance in navigating the complexities of tax investment. Finally, conducting a full title search early in the process is vital to prevent complications and ensure a smooth transaction. Remember, you're not alone in this journey; we're here to help you every step of the way.

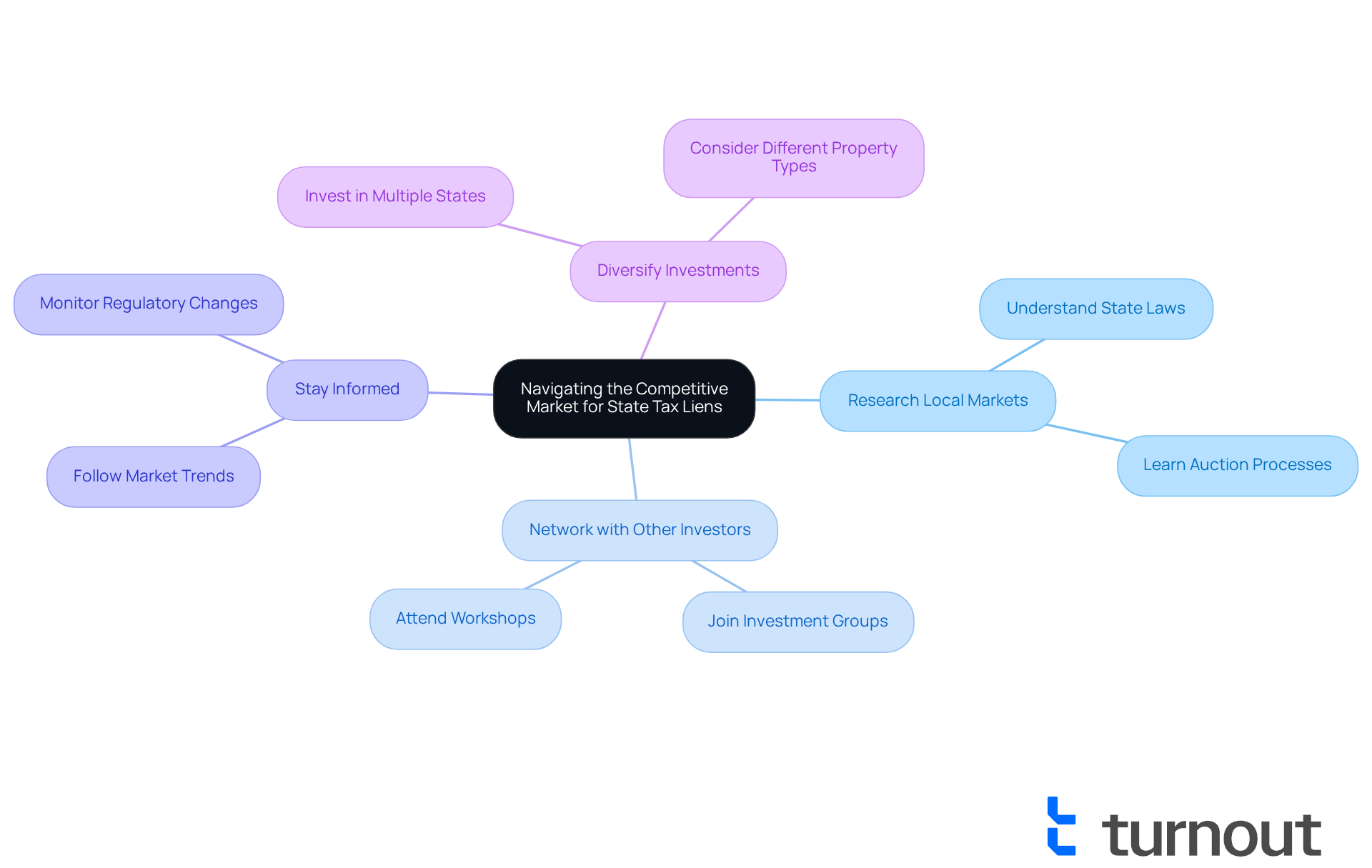

Competition in State Tax Lien Investing: Navigating the Market

Navigating the competitive market for state tax liens can feel overwhelming, but you are not alone in this journey. Many investors are vying for the same opportunities, and it's essential to equip yourself with the right strategies.

- Research Local Markets: Understanding the specific state tax lien laws and auction processes in your target areas can empower you to make informed decisions.

- Network with Other Investors: Building relationships with fellow investors not only provides valuable insights but also opens doors to new opportunities.

- Stay Informed: Keeping up with market trends and changes in state tax lien regulations is vital. This knowledge allows you to adapt your strategies effectively.

- Diversify Investments: By considering investments in multiple states or types of properties, you can spread risk and enhance your potential returns.

We understand that taking these steps may seem daunting, but remember, every small action can lead to significant progress. You're on the right path, and with persistence and support, you can achieve your investment goals.

Conclusion

Investing in state tax liens offers a unique opportunity for those looking to enhance their portfolios while navigating complex financial landscapes. We understand that this journey can seem daunting, but the article highlights critical aspects of state tax liens, from their definition and common triggers to the step-by-step process of purchasing them. Moreover, the discussion on the inherent risks and benefits provides a well-rounded perspective for potential investors, emphasizing the importance of thorough research and strategic planning.

Key insights include:

- Recognizing the expiration timelines of state tax liens

- Understanding their impact on property values

- Acknowledging the competitive nature of the investment market

By grasping these elements, you can make informed decisions that not only secure your investments but also contribute positively to local communities. The integration of AI technology in tax lien advocacy illustrates the evolving landscape, offering support and guidance to navigate these challenges.

Ultimately, engaging with state tax liens can be a rewarding venture for investors willing to invest the time and effort to understand the nuances involved. As the market continues to grow and evolve, staying informed and leveraging available resources will be essential. Embracing these insights empowers you to take action, capitalize on opportunities, and contribute to a more equitable tax landscape. Remember, you are not alone in this journey; we're here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it help with tax lien advocacy?

Turnout is an AI-powered platform designed to assist individuals in navigating claims related to state tax liens and government benefits. It automates complex processes, such as SSD claims, and provides real-time updates to help users make informed decisions quickly.

What is a state tax lien?

A state tax lien is a legal claim placed by a state government on an asset due to unpaid taxes. This claim ensures the state's interest in the asset until the tax debt is resolved and can significantly impact the ability to sell or refinance the asset.

What are the common causes of state tax liens?

Common causes of state tax liens include unpaid real estate levies, income assessments, failure to file tax returns, underreporting income, and neglecting timely tax payments. Economic downturns can also contribute to rising tax delinquencies.

How have tax claims in the U.S. changed recently?

The number of tax claims submitted in the U.S. has been increasing, with real estate taxes accounting for a significant portion of local tax revenue. The delinquency rate for taxes rose from 4.5% in 2024 to 5.1% in 2025, correlating with a 27% increase in real estate taxes from 2019 to 2025.

What is the significance of the Supreme Court decision in Tyler v. Hennepin County?

The Supreme Court decision in Tyler v. Hennepin County highlights important legal ramifications regarding tax claims and illustrates changes in how tax debts are managed, emphasizing the need for understanding state regulations and local auction guidelines.

Who can assist users with tax lien issues through Turnout?

Turnout provides support through trained nonlawyer advocates and IRS-licensed enrolled agents who guide users through the processes related to state tax liens and government benefits, ensuring they receive assistance without the complexities of legal representation.