Overview

The article highlights essential insights into short-term disability insurance for pregnancy, emphasizing its vital role in offering financial support and job security for expecting mothers. We understand that navigating this journey can be challenging, and having the right resources can make all the difference.

It outlines the eligibility requirements and coverage details, ensuring you know what to expect. Additionally, it discusses the interplay between short-term disability insurance and the Family and Medical Leave Act (FMLA). This information is crucial as it demonstrates how these resources can help mothers effectively manage their maternity leave.

You are not alone in this journey. With the right assistance, you can ensure that you receive the necessary support during this critical time. We’re here to help you navigate these options and make informed decisions for you and your family.

Introduction

Navigating the intricacies of short-term disability insurance during pregnancy can feel overwhelming for many expecting mothers. We understand that financial uncertainty and the need for adequate support during this critical time can weigh heavily on your mind. That's why it's essential to grasp the benefits and eligibility requirements available to you. As the landscape of maternity leave continues to evolve, it's common to wonder how best to secure the financial assistance needed for recovery and bonding with your newborn.

What insights can empower you to effectively advocate for your rights and make informed decisions regarding your maternity leave options? You're not alone in this journey, and we're here to help.

Turnout: Streamlined Advocacy for Short-Term Disability Insurance During Pregnancy

We understand that navigating short term disability insurance for pregnancy during temporary incapacity can be overwhelming. That’s why Turnout is changing the strategy by harnessing the power of AI technology. This innovative platform provides a streamlined advocacy experience, guiding expecting mothers through the often complex and bureaucratic claims process.

With the support of trained advocates, you will receive prompt assistance and clear guidance. This ensures you can access the advantages you deserve without unnecessary delays. Our approach not only simplifies the claims process but also empowers you, making it easier to navigate your rights and options during this critical time.

You are not alone in this journey. We’re here to help you every step of the way, ensuring that you feel supported and informed as you move forward.

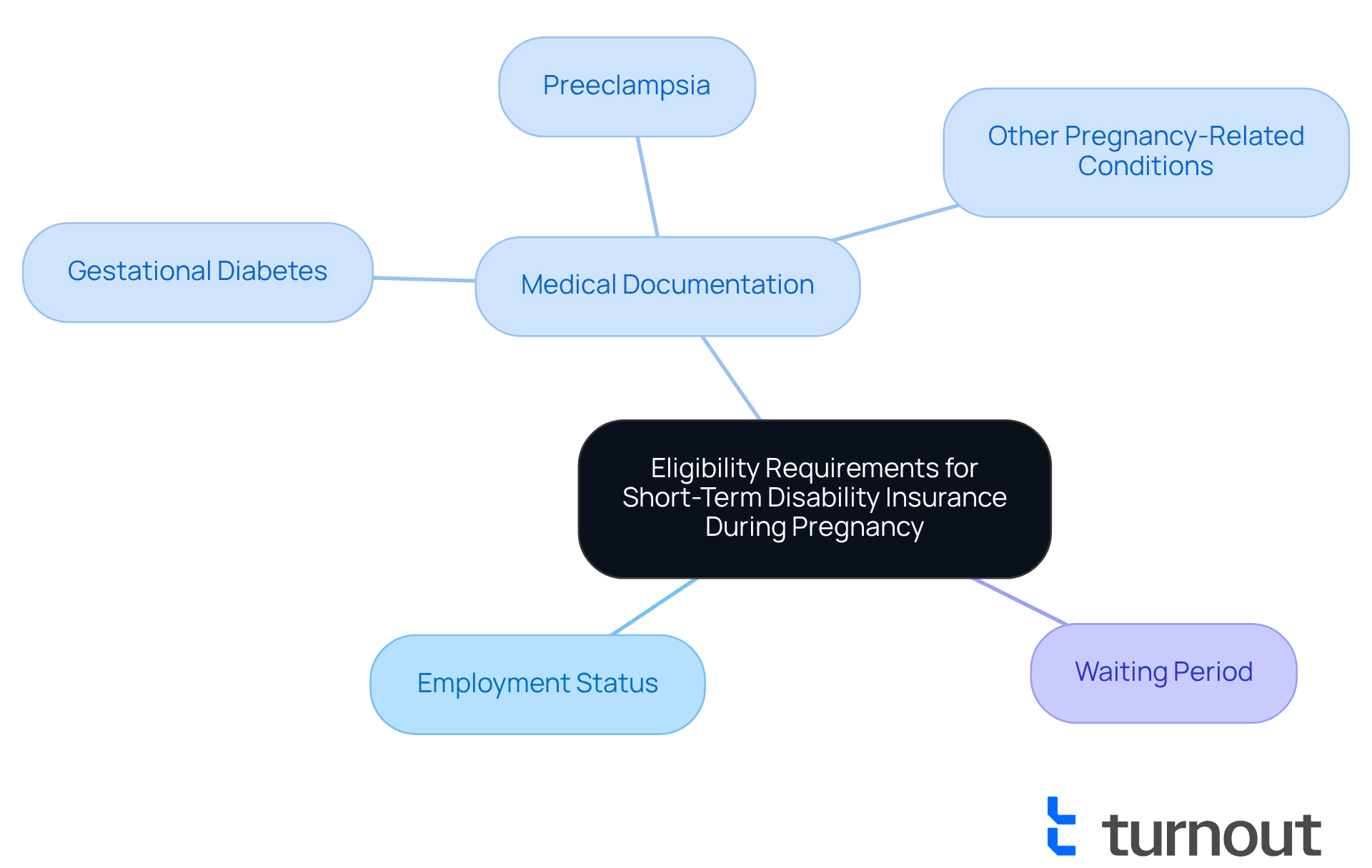

Eligibility Requirements for Short-Term Disability Insurance During Pregnancy

Navigating the world of short term disability insurance for pregnancy can feel overwhelming. We understand that you may have concerns about eligibility and the support available to you. To qualify for short term disability insurance for pregnancy, individuals generally need to meet specific criteria, which may include:

- Being employed and covered under a short-term disability policy

- Providing medical documentation that confirms the pregnancy and any related complications

- Complying with the waiting period outlined in the policy before accessing benefits

In 2025, updates to these eligibility criteria may reflect a broader understanding of pregnancy-related conditions, ensuring that more individuals can access the support they need. For instance, real-life experiences show that women facing issues like gestational diabetes or preeclampsia may be eligible for assistance, provided they possess the necessary medical documentation.

Understanding these requirements is crucial for ensuring a smooth application process for short term disability insurance for pregnancy. Insurance professionals emphasize that comprehensive medical records are essential for substantiating claims, especially for conditions that may not be immediately visible. It's common to feel anxious about potential rejections for reasons such as inadequate medical documentation or prior health issues, including concerns regarding short term disability insurance for pregnancy in certain situations. Furthermore, it's important to be aware that temporary income support may be subject to taxation based on the method of premium payment.

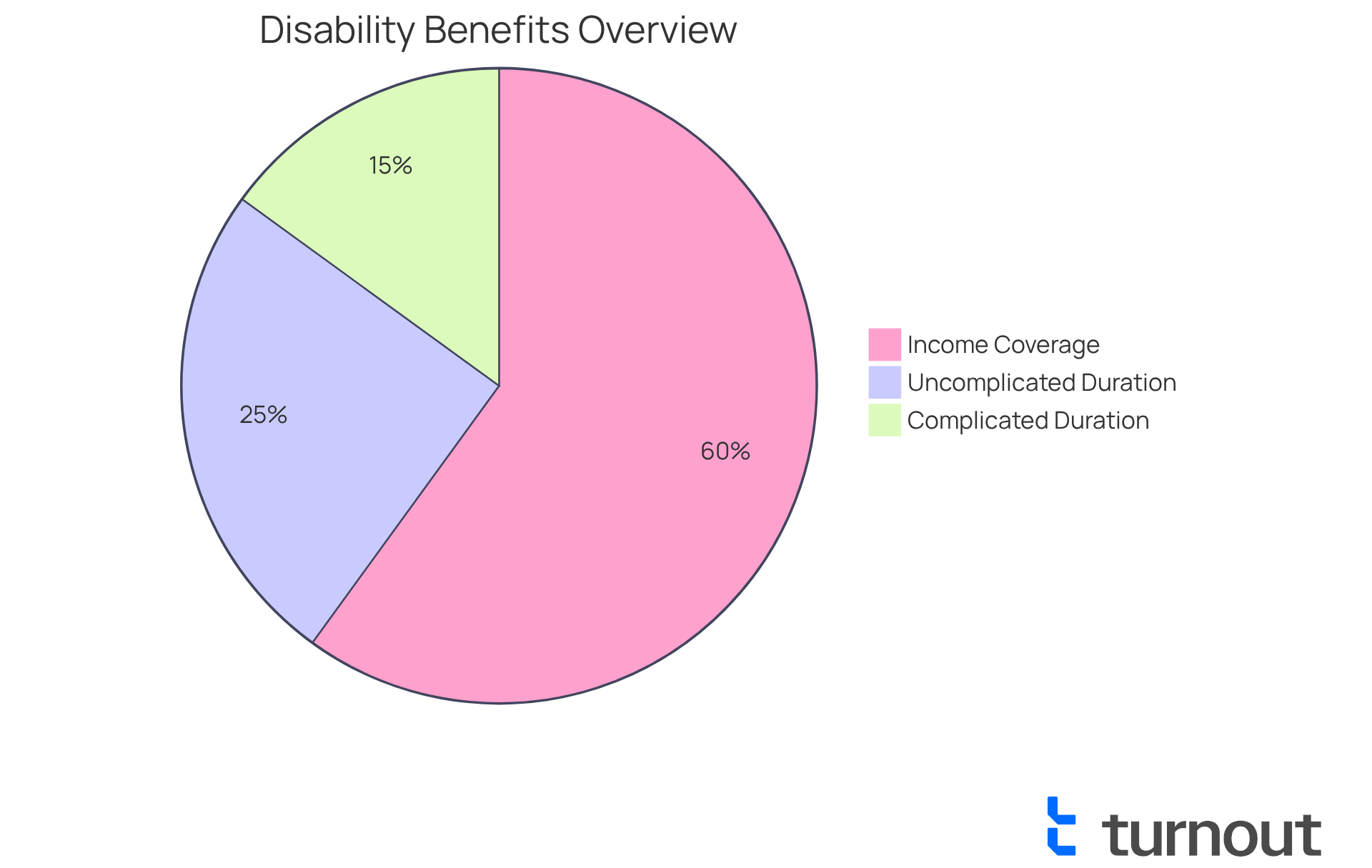

With around 60% of workers in the U.S. protected by some form of temporary income insurance, knowing how to manage these criteria can significantly influence your financial security during maternity leave. Remember, short-term payments for incapacity can take up to two weeks to commence, and reimbursement may be necessary if you receive Social Security benefits or exceed income limits while working part-time. You're not alone in this journey; we're here to help you navigate these complexities.

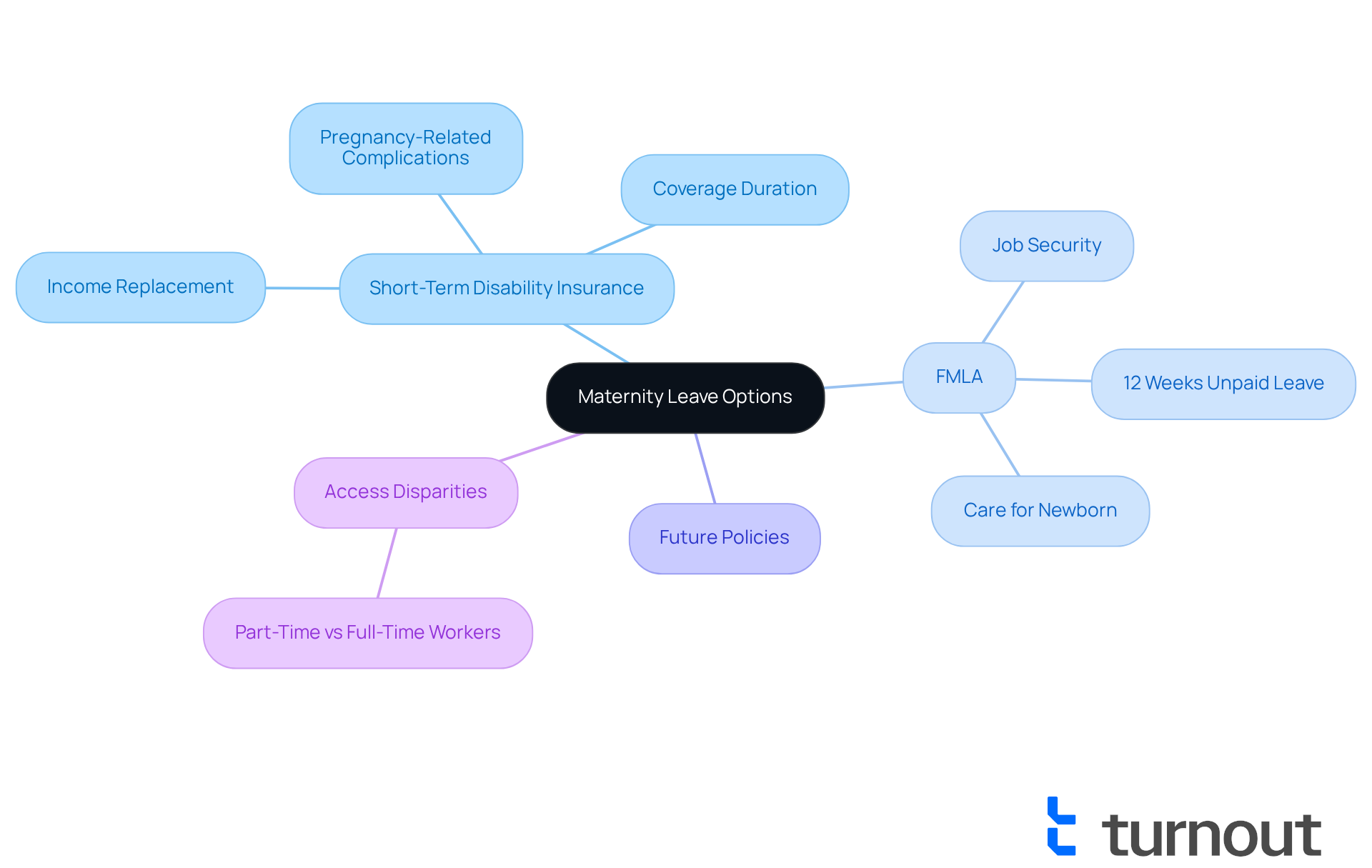

Short-Term Disability vs. FMLA: Key Differences for Expecting Mothers

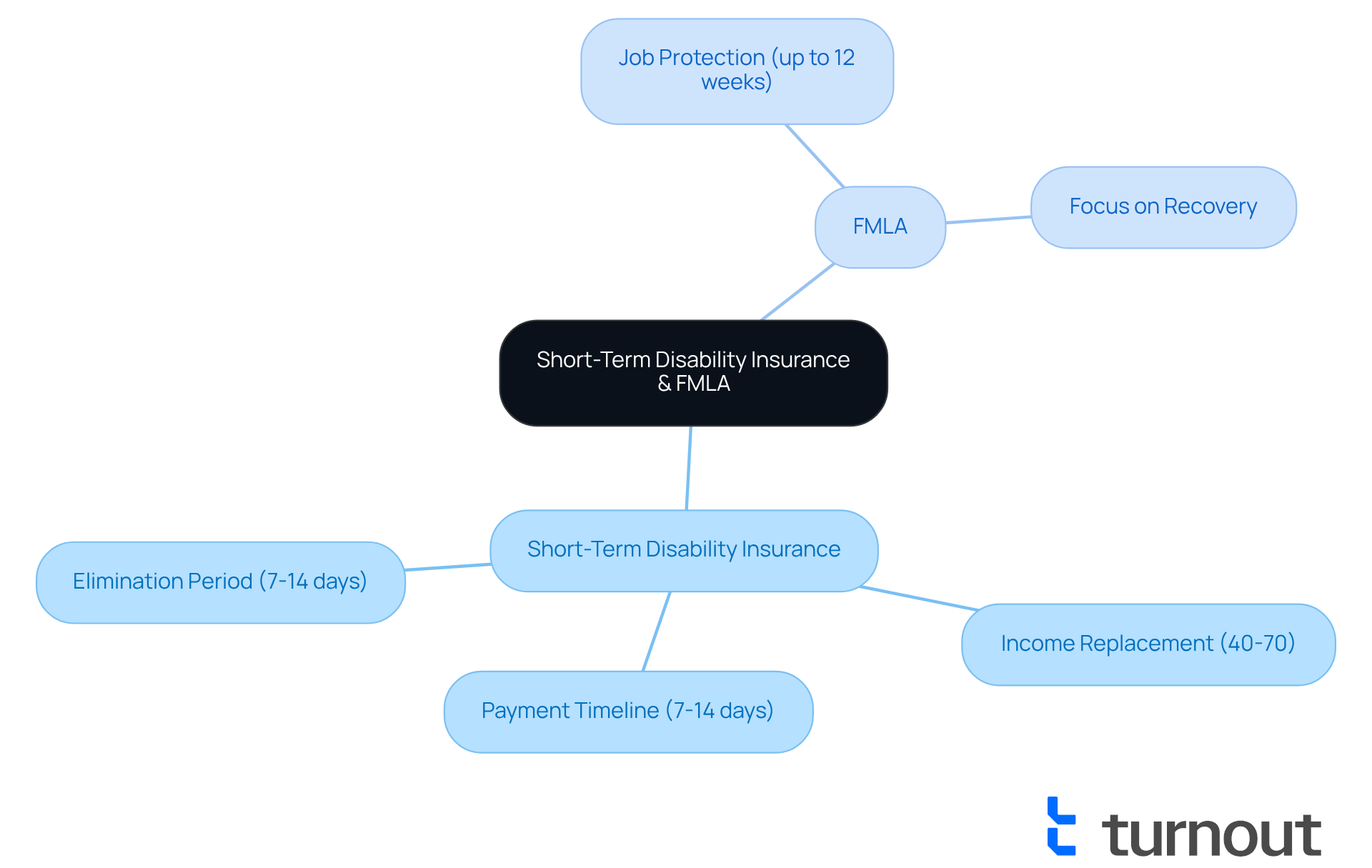

Short-term disability insurance for pregnancy and the Family and Medical Leave Act (FMLA) play distinct yet complementary roles for expecting mothers.

This short term disability insurance for pregnancy provides crucial income replacement for a limited duration due to medical conditions, including pregnancy-related complications. It typically covers a portion of the employee's salary, allowing them to manage financial responsibilities during recovery.

FMLA: This federal statute offers job security for up to 12 weeks of unpaid time off for qualified employees. It allows new parents to take time off for childbirth or to care for a newborn without the fear of losing their job.

Understanding these differences is vital for expecting mothers as they navigate their options. We recognize that the landscape is changing. In 2025, conversations about maternity absence policies continue to evolve, with states like New York enacting the nation's first compensated prenatal absence regulation on January 1, 2025. This law offers 20 hours of paid time off annually for prenatal medical appointments, reflecting a growing acknowledgment of the need for comprehensive support for new parents.

Studies indicate that many expecting mothers utilize short term disability insurance for pregnancy, often in conjunction with FMLA. This dual strategy empowers them to secure income while ensuring job protection during their absence. For instance, many women find that short term disability insurance for pregnancy can cover the initial recovery period after birth, while FMLA provides essential time to bond with their newborn.

As more states implement paid family provisions, the environment for maternity leave is evolving, creating new opportunities for expecting mothers to balance their health and family needs effectively. However, it’s important to understand that access to paid family leave is unevenly distributed. Only 14 percent of part-time workers have access compared to 31 percent of full-time workers. This gap may influence the choices of expectant mothers regarding their options for temporary leave and FMLA. Remember, you are not alone in this journey, and we’re here to help you navigate these important decisions.

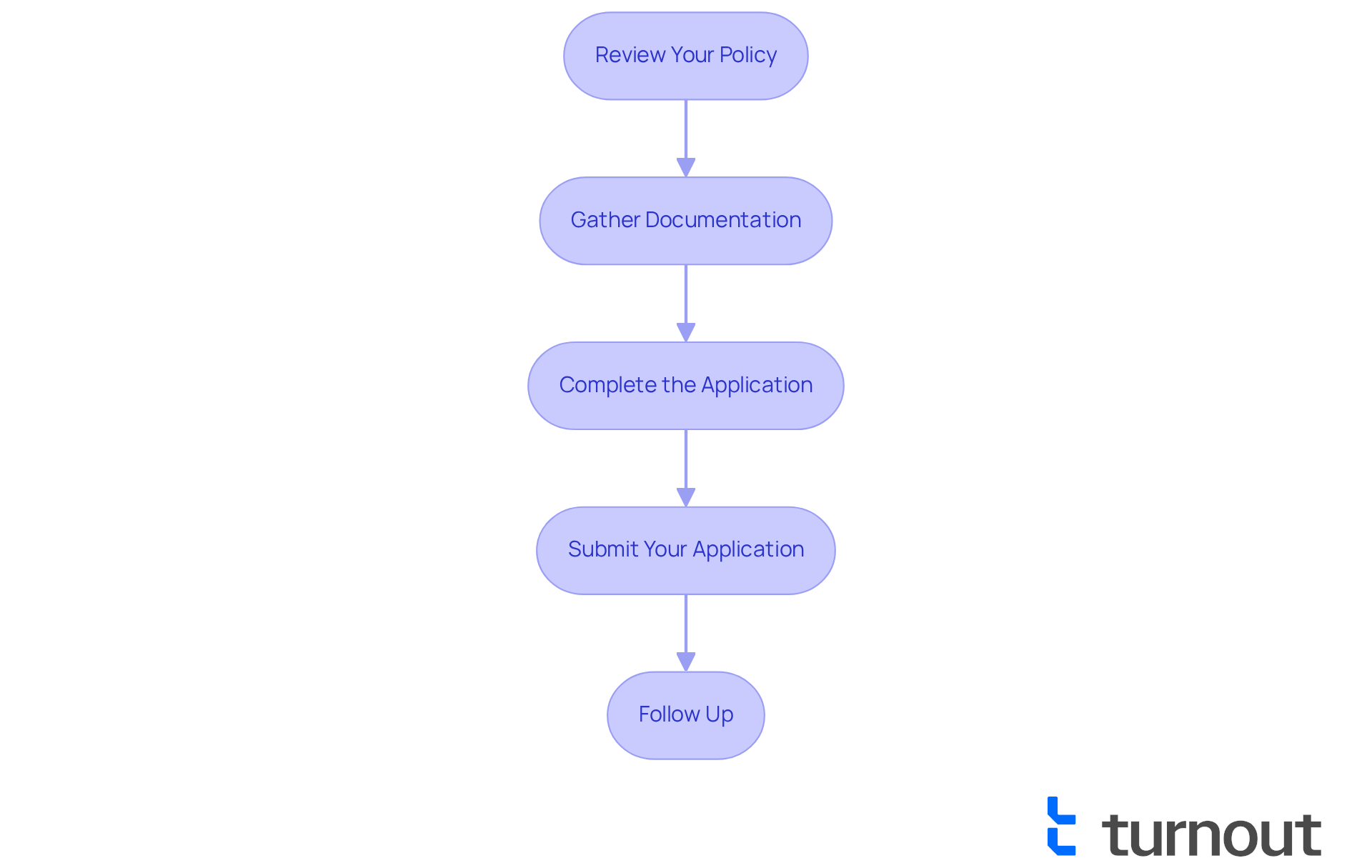

How to Apply for Short-Term Disability Insurance for Pregnancy

Applying for short-term disability insurance for pregnancy can feel overwhelming, but we’re here to guide you through the essential steps to ensure a smooth process:

- Review Your Policy: It's important to familiarize yourself with the specific terms and conditions of your short term disability insurance for pregnancy. Understanding your coverage can provide peace of mind during this time.

- Gather Documentation: Collecting essential medical records that confirm your pregnancy and any related complications is crucial. Remember, thorough documentation is key; approximately 68% of disability claims are denied due to incomplete information. You’re not alone in feeling the pressure of this task.

- Complete the Application: Take your time to accurately fill out the application form provided by your insurance company. Ensuring all details are correct will help avoid potential processing issues, allowing you to focus on your health.

- Submit Your Application: Once your application is complete, send it along with the supporting documents to your insurance provider promptly. Staying proactive can alleviate some stress.

- Follow Up: It's common to feel anxious about the status of your claim. Maintain communication with your provider to check on your application and respond to any additional requests for information. Starting in 2025, California employees earning under about $62,000 annually will receive 90% of their earnings as State Disability Insurance payments. This highlights the importance of staying informed throughout the process. Additionally, employers must uphold group health coverage for up to 4 months as if you were actively engaged, providing crucial support during your absence.

Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Coverage of Maternity Leave Under Short-Term Disability Insurance

Short-term disability insurance for pregnancy often provides maternity leave coverage for a defined duration, which can vary significantly by policy. We understand that navigating these details can be overwhelming, so let’s break down the key aspects of this coverage:

- Time off for recovery from childbirth, including any complications that may arise, is essential for your well-being.

- Benefits may begin prior to your due date if deemed medically necessary by a healthcare professional, although there is frequently a waiting period of one to two weeks before they commence.

- Typically, assistance lasts from six to eight weeks for standard deliveries, with possible extensions for cesarean sections or complications.

- Some policies may also extend coverage for a period after birth, allowing new parents additional time to bond with their newborn.

Understanding the specifics of your short term disability insurance for pregnancy policy is crucial, as the coverage details can differ widely. For instance, in California, recent legislation has increased paid family leave provisions. This change allows eligible workers earning less than $63,000 annually to receive up to 90% of their regular wages while on leave, effective for new claims filed on or after January 1, 2025. To qualify in 2024, workers must have earned at least $283 weekly or a total of $14,200 in the previous four quarters. This reflects a growing recognition of the importance of supporting families during significant life events. As Senator Maria Elena Durazo stated, "SB 951 will ensure every California worker can afford to care for their family and themselves during life’s most important moments."

Furthermore, it is vital to comprehend workplace accommodation policies and your legal rights under regulations such as the Family and Medical Leave Act (FMLA). We’re here to help you navigate these advantages effectively. Remember, you are not alone in this journey.

Duration of Short-Term Disability Benefits for Pregnant Individuals

The length of temporary assistance for expectant individuals can greatly vary based on the specific short term disability insurance for pregnancy policy in place. Typically, benefits may last from:

- 6 to 12 weeks for uncomplicated pregnancies.

- Up to 26 weeks for those facing complications or requiring extended recovery.

It's important to note that short term disability insurance for pregnancy usually covers 50-70% of a worker's income during maternity leave, which is crucial for financial planning during this time. We encourage you to review your policy details for precise durations and any potential extensions related to short term disability insurance for pregnancy based on medical recommendations. For instance, complications such as severe anemia or infections exacerbated by pregnancy can justify an extended disability duration. Additionally, policies may broaden support for cesarean sections or other issues, highlighting the necessity for short term disability insurance for pregnancy to ensure adequate recovery time.

Furthermore, understanding your rights under the Family and Medical Leave Act (FMLA) is essential, as it provides job security during maternity absence. We understand that navigating this process can be daunting, so it’s advisable for pregnant individuals to inform their employer about their pregnancy and expected time away as early as possible. If you find yourself needing to explore additional financial assistance, Turnout offers resources to help navigate SSD claims, ensuring you receive the support necessary during this critical period. Remember, you are not alone in this journey; we’re here to help.

Conditions Covered by Short-Term Disability Insurance During Pregnancy

Short term disability insurance for pregnancy typically covers a range of conditions that are vital for expecting mothers to understand. We recognize that this journey can be overwhelming, and knowing what is covered can ease some of that burden.

Consider the various situations that may arise:

- Pregnancy complications such as gestational diabetes or preeclampsia can significantly impact a mother’s health and ability to work. It’s essential to know that you’re not alone in facing these challenges.

- Recovery from childbirth is another critical area. For instance, cesarean sections often require extended healing time. Coverage usually provides 50% to 70% of income for up to eight weeks post-delivery, ensuring financial support during this crucial period.

- Mental health conditions related to pregnancy, like postpartum depression, are also acknowledged. We understand the emotional challenges that can arise during this time, and it’s important to address them.

Understanding these covered conditions is essential for expecting mothers to know when they can file a claim for short term disability insurance for pregnancy. Recent statistics show that many claims for pregnancy-related conditions emphasize the importance of short term disability insurance for pregnancy. An insurance expert at Higginbotham reminds us, "No two financial situations are alike, and understanding your coverage is essential for navigating the complexities of maternity leave."

Many women experience complications that necessitate time off work, making it vital to be informed about the specifics of their insurance policies. It’s common to feel uncertain about what lies ahead. Furthermore, possible obstacles may occur when seeking temporary income protection on your own, such as health-related inquiries or medical tests, which can complicate the claims procedure. By being aware of these provisions and challenges, mothers can better navigate their financial and health needs during pregnancy. Remember, you are not alone in this journey, and we’re here to help.

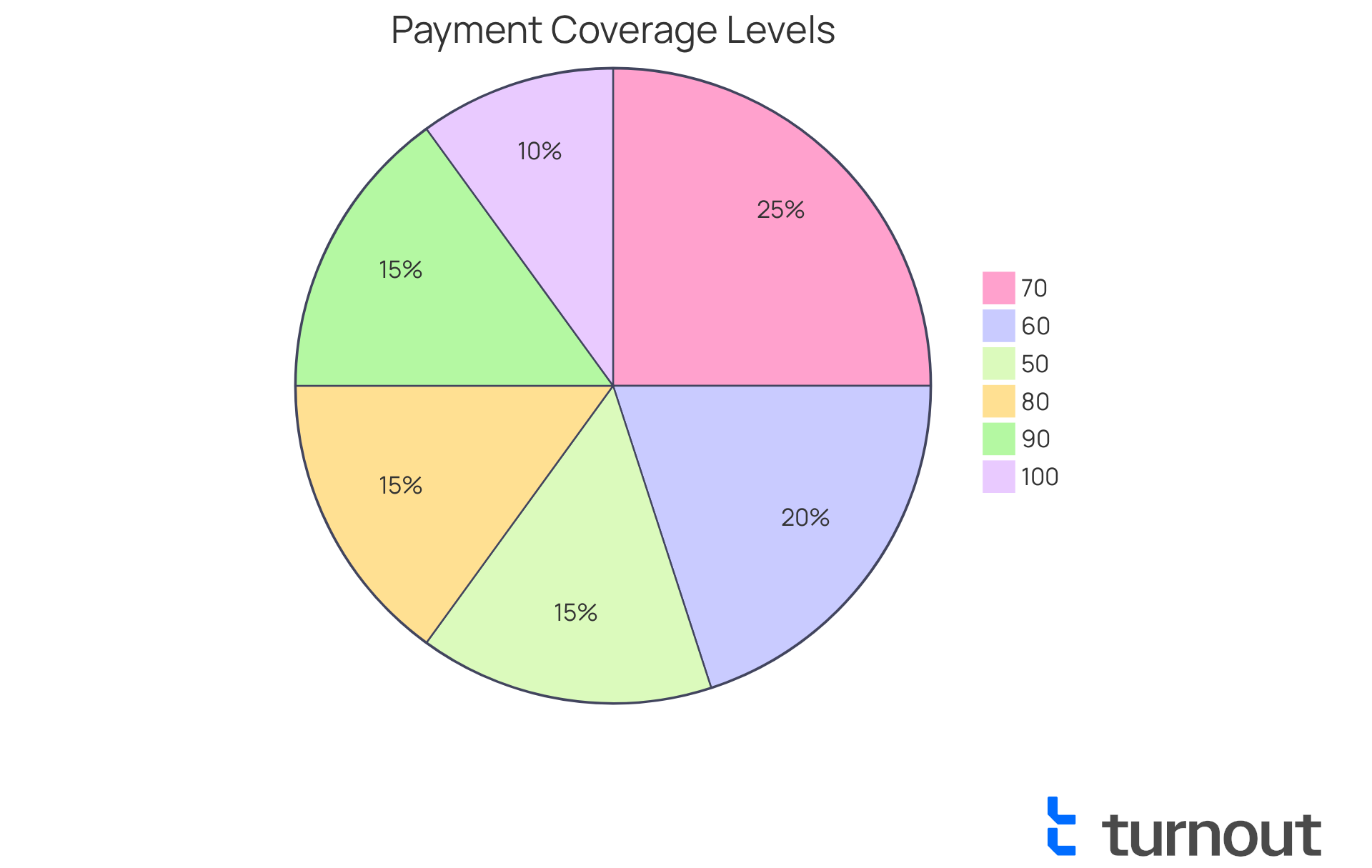

Payment Amounts for Short-Term Disability Insurance During Pregnancy

Navigating the complexities of short term disability insurance for pregnancy can feel overwhelming. Payment amounts typically range from 50% to 100% of your salary, depending on the specific policy. We understand that this variability can add to your stress, especially when you need support the most. Short term disability insurance for pregnancy typically covers 50% to 70% of your regular wages, offering essential financial relief during your recovery.

It's important to note that some plans for short term disability insurance for pregnancy may offer a fixed rate instead of a percentage of your salary, which can significantly impact the total financial assistance you receive during maternity leave. Payments often begin after a waiting period, typically between 1 to 14 days. In South Carolina, this waiting period usually falls between 7 to 14 days. We encourage you to take the time to thoroughly review your policy to understand the payment structure and any potential exclusions.

Looking ahead to 2025, there may be updates to payment structures, including improved salary replacement rates. Some states, like Washington, could offer benefits reaching up to 90% of average weekly pay. This ensures that new parents can focus on recovery and bonding without the added worry of lost income.

As you navigate maternity leave, it is crucial to understand your rights under the Pregnancy Discrimination Act (PDA) and the Family and Medical Leave Act (FMLA), as well as the options for short term disability insurance for pregnancy. If you feel uncertain about your options regarding insurance payments related to disabilities, remember that Turnout is here to help. They offer tools and services designed to guide you through these intricate financial systems, ensuring you comprehend your choices without needing legal assistance.

We recommend reviewing specific state regulations or consulting with a financial advisor to maximize your benefits. You are not alone in this journey; support is available to help you through this challenging time.

Using Short-Term Disability Insurance Concurrently with FMLA

Expecting mothers often face numerous challenges, but they can significantly enhance their advantages by utilizing short-term income protection insurance alongside the Family and Medical Leave Act (FMLA). Here’s how this combination works:

- Short-term disability insurance provides essential income replacement during the recovery period after childbirth. Typically, it covers 40% to 70% of lost wages, with the exact percentage varying by state. Payments generally begin 7 to 14 days after the claim is filed. However, it’s important to remember that there is often an elimination period before payments start, usually lasting 7 to 14 days.

- FMLA offers job protection for up to 12 weeks, allowing mothers to take the necessary time off without the fear of losing their job. This ensures they can focus on recovery and bonding with their newborn.

By thoughtfully merging these advantages, mothers can secure both financial support and employment stability during this crucial time. Many expecting mothers have successfully managed their maternity absence by applying for temporary benefits immediately after childbirth, while also seeking FMLA to cover their extended time off. This approach not only maximizes their income during recovery but also guarantees their position within the workplace.

In 2025, changes to regulations regarding the simultaneous use of temporary leave and FMLA will continue to highlight the importance of these benefits for working mothers. Human resources professionals advocate for this strategy, noting that it facilitates a smoother transition back to work while allowing mothers to prioritize their health and family needs. With only 13% of private sector employees having access to paid family support, the combination of these two benefits is vital for fostering a nurturing environment for new parents. Remember, you are not alone in this journey, and we’re here to help you navigate these options.

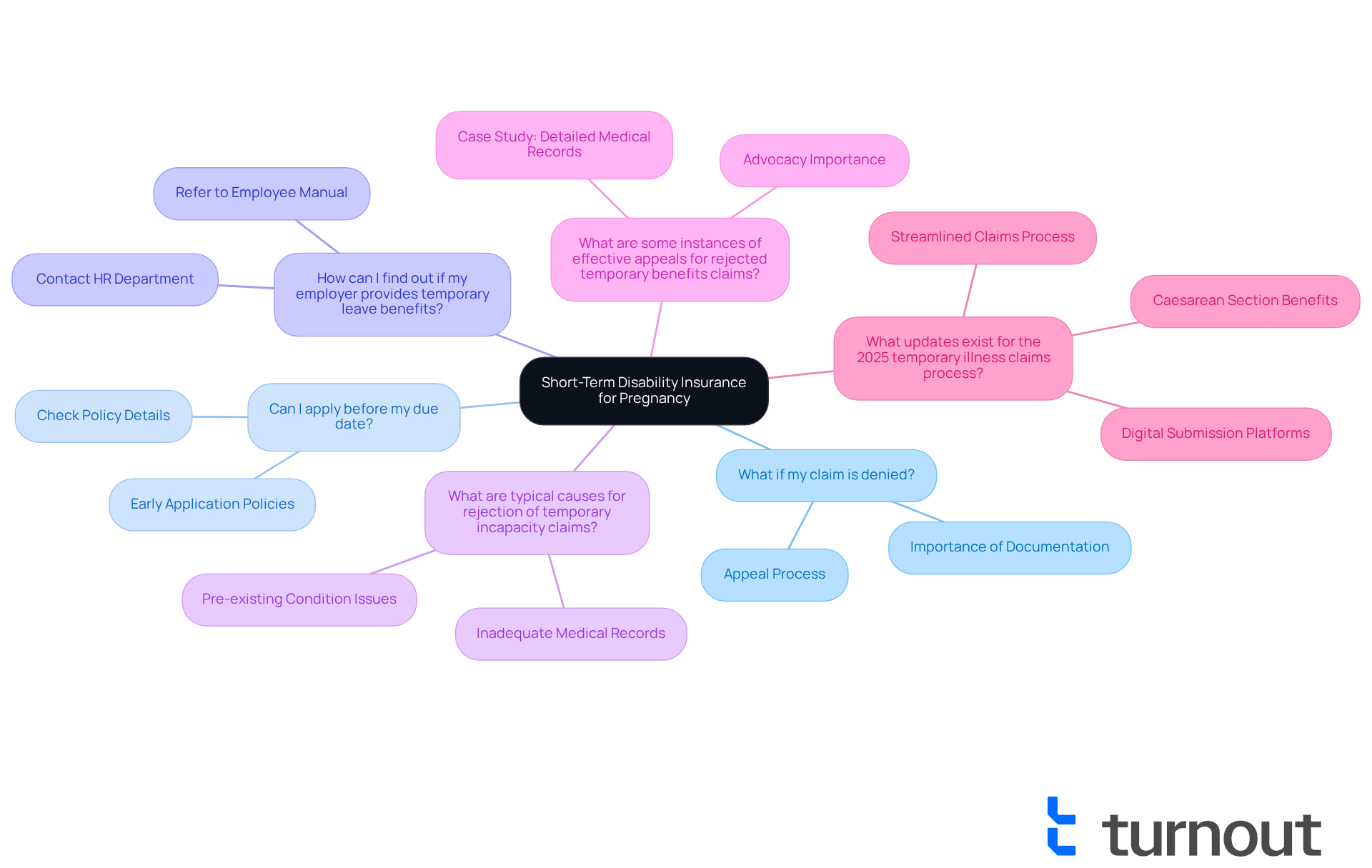

Frequently Asked Questions About Short-Term Disability Insurance for Pregnancy

Here are some frequently asked questions about short-term disability insurance for pregnancy:

- What if my claim is denied? If your claim is denied, we understand how frustrating that can be. You can appeal the decision by submitting additional documentation or clarification to support your case. Many successful appeals involve providing further evidence of your condition or the necessity of your leave. Remember, it’s important to advocate for yourself.

- Can I apply before my due date? Yes, many policies allow for early applications if medically necessary. It’s advisable to check your specific policy details to understand the timeline for applications. We want to ensure you have the support you need during this time.

- How can I find out if my employer provides temporary leave benefits? To determine if your employer offers temporary illness coverage, refer to your employee manual or talk directly with your HR department. They can provide detailed information about the benefits available to you, so don’t hesitate to reach out.

What are typical causes for rejection of temporary incapacity claims? Claims may be rejected for various reasons, such as inadequate medical records, not fulfilling the policy's criteria for impairment, or applying during a pre-existing condition period. Understanding these factors can help you prepare a stronger application, and we’re here to help you navigate this process.

What are some instances of effective appeals for rejected temporary benefits claims? One case involved an individual who initially had their claim denied due to a lack of detailed medical records. Following the submission of thorough documentation from their healthcare provider, the appeal was successful, and they received the entitlements they were eligible for. This highlights the importance of thorough documentation in the claims process. Remember, you are not alone in this journey.

- What updates exist for the 2025 temporary illness claims process? As of 2025, the claims process has become more streamlined, with many employers adopting digital platforms for easier submission and tracking of claims. This change seeks to shorten processing durations and enhance communication among staff and administration. Additionally, it’s important to note that Caesarean sections may qualify for longer benefit periods under short term disability insurance for pregnancy, which can be a crucial consideration for expecting parents. We’re here to support you every step of the way.

Conclusion

Navigating the complexities of short-term disability insurance for pregnancy is essential for expecting mothers seeking financial support during this critical time. This insurance not only offers income replacement but also provides peace of mind as mothers prepare for the arrival of their newborns. By understanding the eligibility requirements, application processes, and the interplay between short-term disability and FMLA, mothers can better advocate for their rights and ensure they receive the benefits they deserve.

Key insights discussed in this article highlight the importance of:

- Thorough documentation

- The differences between short-term disability and FMLA

- The evolving landscape of maternity leave policies

As states implement new regulations and benefits, such as increased payment rates and expanded coverage for complications, it becomes crucial for expectant mothers to stay informed and proactive. Utilizing resources like Turnout can streamline the claims process, making it easier to navigate the complexities of insurance and ensuring that mothers are well-supported during their maternity leave.

Ultimately, the significance of short-term disability insurance during pregnancy cannot be overstated. Expecting mothers are encouraged to:

- Familiarize themselves with their options

- Advocate for their needs

- Utilize available resources to secure the financial and emotional support necessary during this transformative period

By taking these steps, mothers can focus on their health and their growing families, confident that they have the backing they need to thrive.

Frequently Asked Questions

What is Turnout and how does it assist expecting mothers with short-term disability insurance during pregnancy?

Turnout is an innovative platform that uses AI technology to provide a streamlined advocacy experience for expecting mothers navigating short-term disability insurance during pregnancy. It offers guidance and support through the claims process, ensuring that mothers can access their benefits without unnecessary delays.

What are the eligibility requirements for short-term disability insurance during pregnancy?

To qualify for short-term disability insurance for pregnancy, individuals generally need to be employed and covered under a short-term disability policy, provide medical documentation confirming the pregnancy and any related complications, and comply with the waiting period outlined in the policy.

How might eligibility criteria for short-term disability insurance change in the future?

In 2025, updates to eligibility criteria may reflect a broader understanding of pregnancy-related conditions, potentially allowing more individuals to access support. Conditions like gestational diabetes or preeclampsia may qualify for assistance if proper medical documentation is provided.

What is the difference between short-term disability insurance and the Family and Medical Leave Act (FMLA) for expecting mothers?

Short-term disability insurance provides income replacement for a limited duration due to medical conditions, including pregnancy-related complications, while FMLA offers job security for up to 12 weeks of unpaid leave for qualified employees. Many expecting mothers use both to secure income and job protection during their absence.

What should expecting mothers know about the timing of short-term disability payments?

Short-term disability payments for incapacity can take up to two weeks to commence. Additionally, reimbursement may be necessary if recipients receive Social Security benefits or exceed income limits while working part-time.

How does the landscape for maternity leave and support for expecting mothers evolve?

The landscape is changing with new laws, like New York's compensated prenatal absence regulation starting in 2025, which offers paid time off for prenatal medical appointments. However, access to paid family leave remains uneven, with part-time workers having less access compared to full-time workers.

What resources are available for expecting mothers navigating short-term disability insurance and FMLA?

Turnout provides support and guidance for expecting mothers as they navigate the complexities of short-term disability insurance and FMLA, ensuring they feel informed and supported throughout the process.