Overview

We understand that navigating tax obligations can be overwhelming, especially for seniors. It's important to know that you may not need to file taxes when your total earnings fall below certain thresholds. These thresholds can vary based on your age, filing status, and sources of income, such as Social Security benefits.

The article highlights key criteria, including income levels and available deductions, which are essential for determining whether you need to file. By understanding these factors, you can make informed decisions about your tax obligations.

Remember, you are not alone in this journey. We're here to help you navigate these complexities and ensure that you have the support you need.

Introduction

Navigating the complexities of tax filing can feel overwhelming for seniors, especially as the financial landscape changes and new regulations emerge. We understand that this can be a challenging time, and that’s why this guide is here to help illuminate the key criteria for when seniors can stop filing taxes. It will also highlight the benefits of various deductions and credits available to you.

Amidst the shifting thresholds and intricate calculations, it’s common to wonder: how can you effectively navigate these changes and ensure you are not paying more than necessary? Remember, you are not alone in this journey, and we’re here to support you every step of the way.

Identify Key Criteria for Tax Filing Requirements

Understanding whether you need to file taxes can feel overwhelming, especially as you age. We’re here to help you navigate this process with care. Consider these important criteria that can guide your decision:

- Age: If you are 65 or older by the end of the tax year, different filing thresholds apply, which can ease your filing burden.

- Filing Status: Your filing status—whether single, married filing jointly, or another category—affects your earnings thresholds. It’s essential to know how this impacts you.

- Total Earnings: For 2025, if you are a single senior, you must file if your total earnings reach $16,550 or more. For married couples both over 65, the combined threshold is $32,300. Additionally, if your overall earnings exceed $25,000, a portion of your Social Security benefits may be taxable.

- Earnings Sources: It’s important to consider all sources of income, including Social Security, pensions, and any other earnings, as they contribute to your gross earnings. If Social Security is your only source of income, you likely do not need to file a federal tax return.

- Filing Options: For those aged 65 and older, using Form 1040-SR can simplify the tax filing process, making it more manageable.

- IRMAA Considerations: Be mindful that IRMAA surcharges may apply if your earnings surpass certain thresholds, which can affect your Medicare premiums.

By understanding these criteria, you can better assess your tax filing obligations and identify when you can stop filing taxes to potentially avoid unnecessary submissions. Furthermore, a new $6,000 deduction for older adults, effective from 2025, allows eligible individuals to lower their taxable earnings; however, this deduction phases out for modified adjusted gross earnings over $150,000. Remember, consulting with a tax professional can provide valuable guidance as you navigate these complexities. You are not alone in this journey—support is available to help you through.

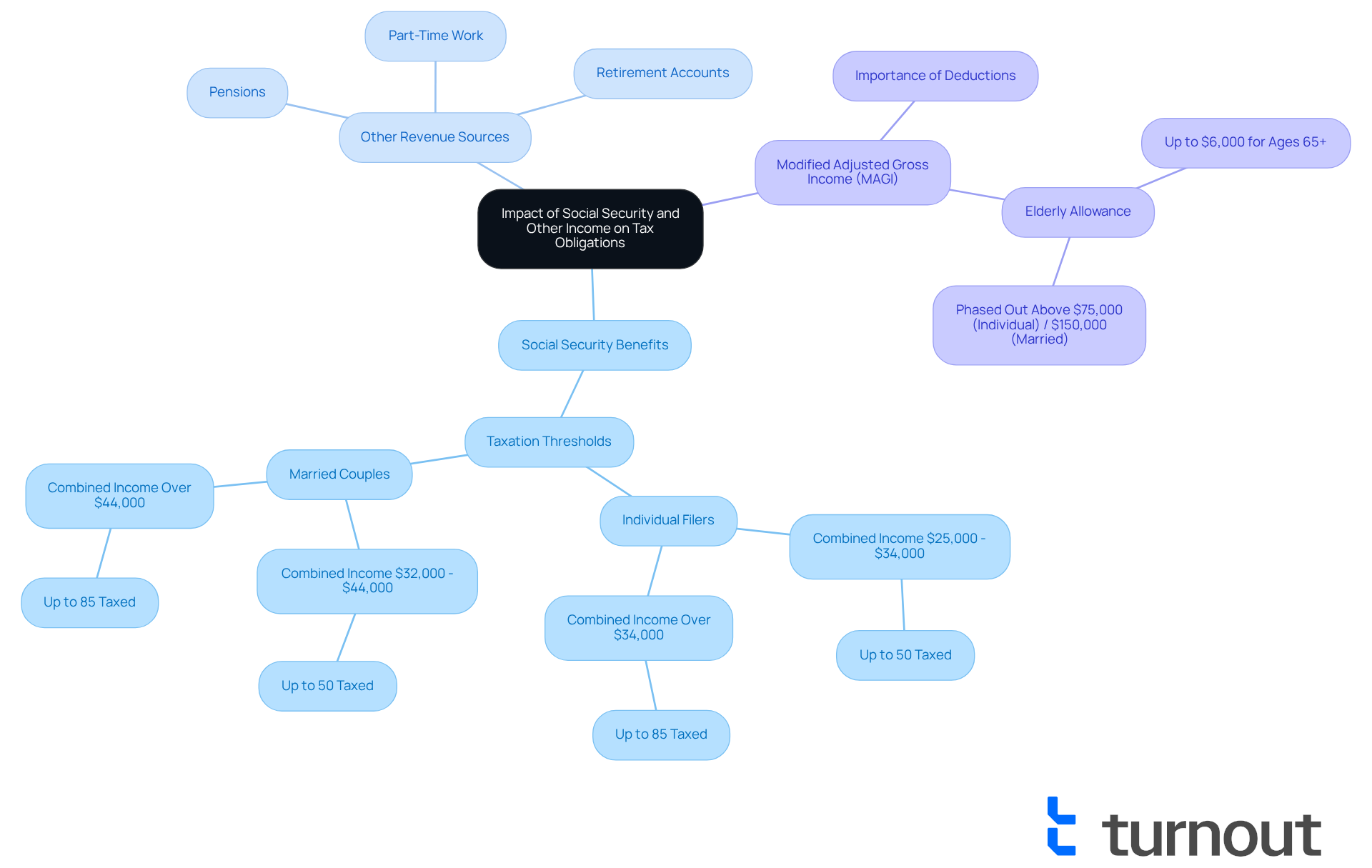

Evaluate the Impact of Social Security and Other Income on Tax Obligations

When evaluating your tax obligations, it's important to consider a few key factors that may affect you:

- Social Security Benefits: Many elderly individuals find that their Social Security benefits are partially taxable. If your total earnings exceed $25,000 for individual filers or $32,000 for married couples filing jointly, you may be responsible for a portion of your benefits. It’s comforting to know that nearly 90% of Social Security recipients will no longer pay federal taxes on their benefits due to the One Big Beautiful Bill, which significantly alters the tax landscape for seniors.

- Other Revenue Sources: Income from pensions, retirement accounts, and part-time work can increase your overall earnings, potentially pushing you over the filing threshold. For example, individuals with combined earnings between $25,000 and $34,000 may see up to 50% of their Social Security benefits taxed, while those earning above $34,000 could face taxation on up to 85% of their benefits.

- Modified Adjusted Gross Income (MAGI): Understanding your MAGI is crucial for determining your tax liability. This figure includes your modified gross earnings along with specific deductions. For older adults, grasping MAGI can clarify tax responsibilities, especially with the new elderly allowance of up to $6,000 available for individuals aged 65 and over, effective for tax years 2025 through 2028. However, this benefit gradually decreases for earnings exceeding $75,000 for individuals and $150,000 for married couples filing jointly.

By considering these factors, you can gain a clearer understanding of when can you stop filing taxes. Remember, you are not alone in this journey, and by staying informed, you can make decisions that help you retain as much of your earned income as possible.

Explore Tax Credits and Deductions Available to Seniors

As we age, navigating financial responsibilities can often feel overwhelming. Fortunately, seniors have access to various tax credits and deductions that can significantly ease this burden. Here’s how you can take advantage of these opportunities:

- Standard Allowance: Starting in the 2025 tax year, individuals aged 65 and older can claim an additional allowance of $6,000. This increases the total standard allowance to $23,750 for single filers and $47,500 for married couples filing jointly. This new deduction complements the existing additional standard deduction for older adults, which is $2,000 for individuals and $1,600 for eligible spouses.

- Credit for the Elderly or Disabled: This credit provides extra tax relief for seniors who meet specific financial and age criteria, helping to lower your overall tax burden.

- Medical Expenses: If you have unreimbursed medical costs that exceed 7.5% of your adjusted gross income, you can deduct these expenses. This can be particularly beneficial for those facing high medical costs, allowing for significant savings on your taxable income.

- State-Specific Benefits: Many states offer additional allowances or credits for older adults. It’s essential to explore local tax regulations to maximize your potential benefits.

- Effective Date: The new $6,000 allowance will apply for tax years beginning January 1, 2025. You can first claim it when filing your 2025 federal tax return in early 2026.

- Phase-Out: Be aware that this new tax benefit will gradually decrease to $0 if your Modified Adjusted Gross Income (MAGI) exceeds $75,000 for individuals or $150,000 for joint filers.

- Social Security Context: The average annual Social Security benefit for a retired worker is about $24,000, with up to 85% potentially taxable under current law. Understanding these figures can help you see how these deductions may impact your tax situation.

- Automatic Inclusion: You don’t need to apply separately for the Enhanced Standard Deduction; it’s automatically included in your tax return if you qualify.

By familiarizing yourself with these options, you can effectively reduce your taxable income and potentially lower your tax bills. Remember, you are not alone in this journey; we’re here to help you navigate these financial opportunities.

Assess Your Personal Situation to Decide on Tax Filing

Making an informed decision about when you can stop filing taxes can feel overwhelming, especially for seniors. It's important to evaluate a few key factors to guide you through this process.

- Earnings Level: First, take a moment to assess your overall earnings from all sources, including Social Security benefits, pensions, and investments. Compare this total to the IRS filing thresholds to see if you are required to file. Remember, up to 85% of Social Security benefits may be subject to taxation based on your total earnings, which includes half of your Social Security benefits along with other taxable income.

- Expenses: Next, consider your deductible expenses, such as medical costs or charitable contributions. These can significantly affect your tax liability and may make filing beneficial. If you're over 65, you can claim a higher standard deduction, which can further reduce your taxable income.

- Future Financial Goals: Think about how your decision to file or not may impact your long-term financial situation. Filing could lead to potential refunds or credits that may be advantageous. As specialists often say, 'Tax season doesn't have to be overwhelming during your later years — especially if you begin preparing now.'

- Consultation: If you're feeling uncertain about your tax obligations, know that you're not alone. Consulting a tax professional or utilizing resources like the IRS website can provide clarity and guidance. Additionally, programs like the Tax Counseling for the Elderly (TCE) offer free in-person tax preparation assistance for older adults, ensuring you have support in navigating your tax responsibilities.

By thoughtfully assessing these factors, you can make well-informed decisions about when you can stop filing taxes. Remember, we're here to help you navigate the complexities of the tax system effectively.

Conclusion

Understanding the nuances of tax filing can significantly ease the financial burden for seniors. We recognize that navigating this complex landscape can be overwhelming. It's essential to understand the key criteria that dictate when seniors can stop filing taxes. By evaluating age, filing status, total earnings, and various income sources, seniors can make informed decisions regarding their tax obligations and potentially reduce unnecessary filings.

Throughout this guide, we've highlighted critical aspects such as the impact of Social Security benefits, available tax credits, and deductions specifically designed for seniors. The introduction of a new $6,000 deduction for those aged 65 and older starting in 2025 is a positive change. Understanding Modified Adjusted Gross Income (MAGI) empowers seniors to optimize their tax situations. We also emphasize the importance of consulting tax professionals and utilizing available resources, as these steps can provide clarity and support.

Ultimately, being proactive and informed about tax responsibilities can lead to substantial savings and peace of mind for seniors. As financial landscapes evolve, staying updated on tax regulations and seeking assistance when needed is crucial. Remember, you are not alone in this journey. By taking these steps, seniors can navigate their tax obligations confidently, ensuring that they retain as much of their hard-earned income as possible.

Frequently Asked Questions

What are the key criteria for determining if I need to file taxes as a senior?

The key criteria include your age, filing status, total earnings, sources of earnings, and available filing options.

How does age affect tax filing requirements?

If you are 65 or older by the end of the tax year, different filing thresholds apply, which can ease your filing burden.

What is the total earnings threshold for a single senior in 2025?

For 2025, a single senior must file if their total earnings reach $16,550 or more.

What is the combined earnings threshold for married couples both over 65?

The combined threshold for married couples both over 65 is $32,300.

How do Social Security benefits impact tax filing?

If your overall earnings exceed $25,000, a portion of your Social Security benefits may be taxable. However, if Social Security is your only source of income, you likely do not need to file a federal tax return.

What is Form 1040-SR and how does it help seniors?

Form 1040-SR is designed for seniors and can simplify the tax filing process, making it more manageable.

What are IRMAA surcharges and how do they affect seniors?

IRMAA surcharges may apply if your earnings surpass certain thresholds, which can affect your Medicare premiums.

Is there a new deduction for older adults starting in 2025?

Yes, there is a new $6,000 deduction for older adults effective from 2025, which allows eligible individuals to lower their taxable earnings, but it phases out for modified adjusted gross earnings over $150,000.

Should I consult a professional for tax filing assistance?

Yes, consulting with a tax professional can provide valuable guidance as you navigate tax filing complexities.