Overview

Navigating the world of amended tax returns can feel overwhelming, and we understand that you may have questions. This article serves as your comprehensive guide to checking the status of your amended tax returns. We’re here to help you every step of the way.

To get started, the IRS offers a helpful tool called 'Where's My Amended Return?' This tool is designed to assist you in easily accessing the information you need. You will find detailed instructions on how to use it effectively, ensuring you can track your amended filings with confidence.

Throughout the article, we will walk you through the processing timeline, the information you need for status checks, and common issues that may arise. Remember, you are not alone in this journey; many taxpayers face similar challenges. By understanding these aspects, you can monitor your amended filings more effectively.

We encourage you to take action by exploring the resources available to you. With the right tools and support, you can navigate this process with ease and peace of mind.

Introduction

Navigating the complexities of tax filings can feel overwhelming, especially when it comes to amended returns. Each year, millions of taxpayers submit revised documents to correct errors or claim missed deductions. It's common to feel anxious and uncertain during this process. This guide is here to provide a clear roadmap for checking the status of amended tax returns, helping you understand the steps to take and the resources available to you.

We understand that the wait can feel endless. What happens when you find yourself in this situation? How can you effectively troubleshoot common issues that may arise? We’re here to help you through this journey.

Understand Amended Tax Returns

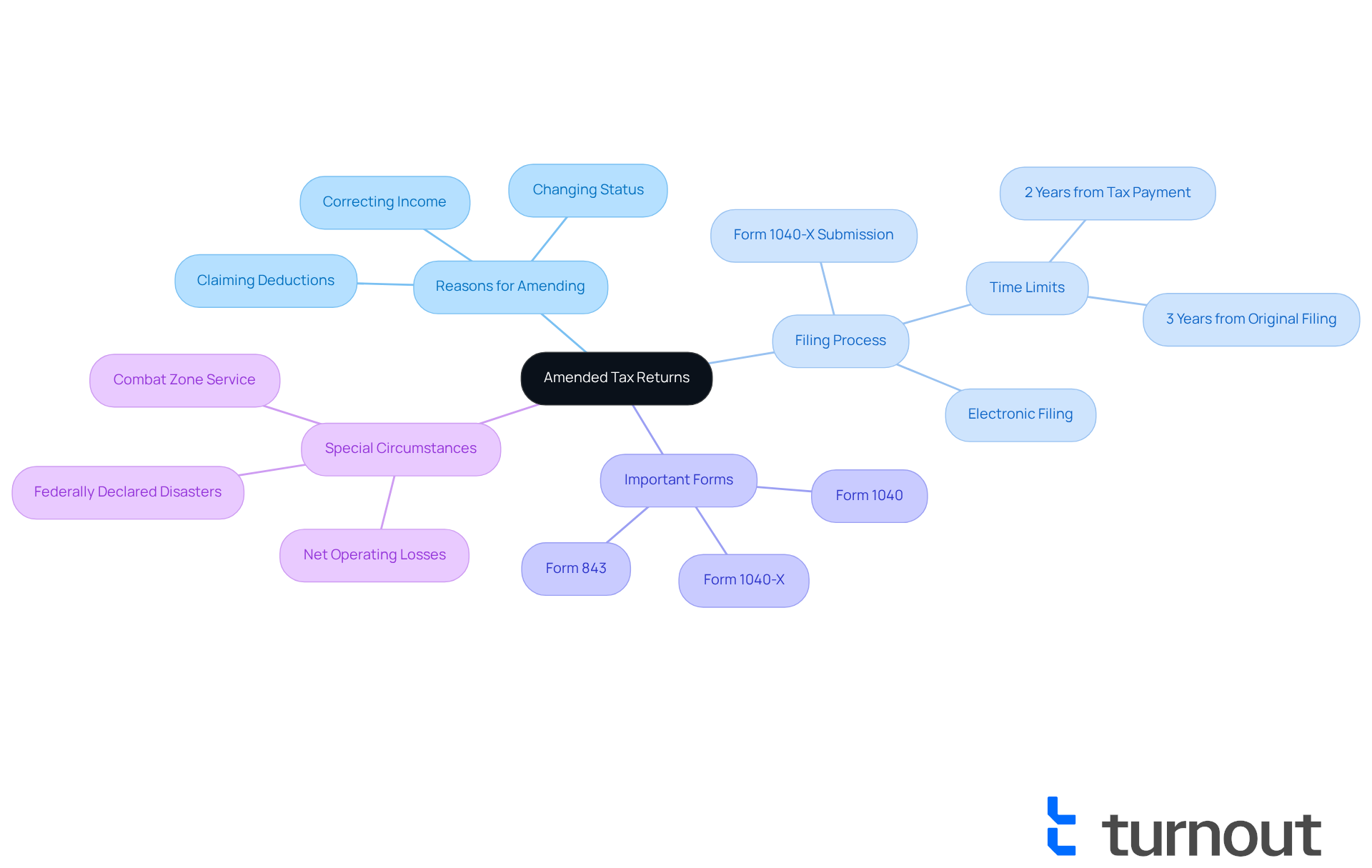

A is an important document submitted to the IRS to correct mistakes or make changes to a previously filed tax statement. The primary form used for this purpose is . We understand that include:

- Correcting reported income

- Changing filing status

- Claiming overlooked deductions or credits

It's essential to remember that you can only revise a submission within three years of the original filing date or within two years of remitting the tax, whichever is later. In fact, around 2.5 million taxpayers submit revised filings each year, highlighting the significance of this process.

If you are affected by a federally declared disaster or have served in a combat zone, you may have additional time to . Special rules also apply for refunds related to net operating losses, foreign tax credits, and other issues, which can provide additional context for your situation. It's important to note that you do not need to amend your submission if the IRS has already corrected errors or accepted your filing without certain forms.

[Form 1040-X](https://irs.gov/forms-pubs/about-form-1040x) has been updated for 2025, allowing electronic filing, which significantly streamlines the process. Tax professionals often emphasize the importance of accuracy, noting that common mistakes include failing to include all necessary forms or not adhering to the specific time limits for filing. Remember, taxpayers can submit up to three revised documents for the same year. It is essential to attach all required forms and schedules from the original submission when sending Form 1040-X.

Understanding the is crucial for ensuring that your tax documents are accurate and for knowing to receive any reimbursements you may deserve. If you need to , you can use resources such as the IRS's 'Where's My Amended Taxes?' which can provide updates on your filing details three weeks after submission. You're not alone in this journey, and we're here to help you navigate through it.

Check Your Amended Tax Return Status

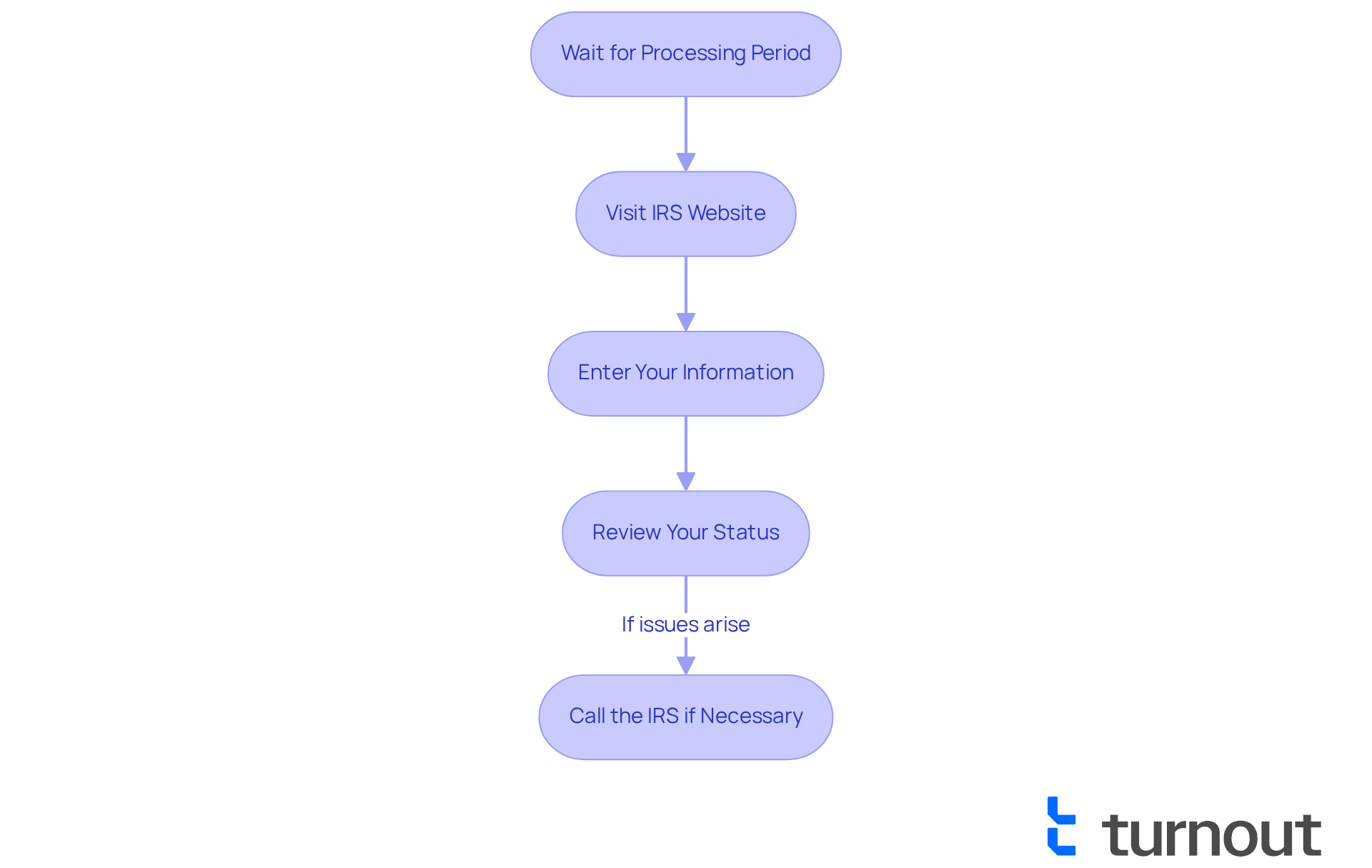

We understand that checking can be a source of anxiety. To help you navigate this process, follow these steps:

- Wait for the Processing Period: It’s common to feel uncertain, but you can verify your progress roughly three weeks after submitting your revised document. The IRS typically takes 8 to 12 weeks to process Form 1040-X, though it may extend to 16 weeks during peak tax season from February to April due to increased volume.

- : Take a moment to go to the IRS '' tool at www.irs.gov/filing/wheres-my-amended-return. This resource is designed to assist you in finding out where's my amended taxes.

- : You’ll need to provide your taxpayer identification number (Social Security Number or ITIN), date of birth, and ZIP code. This step is crucial for accessing your status.

- : After entering your information, you will see the status of your amended submission, which can be 'Pending', 'Processing', or 'Completed'. If your submission is completed, you may also see information about any refund due. Please note that the question is about 'where's my amended taxes?' tool does not provide updates on business outcomes or shipments with foreign addresses.

- : If you encounter issues or have questions, don’t hesitate to call the IRS at 866-464-2050 for assistance. Remember, the '[Where's My Amended Return?](https://myturnout.com/faqs)' tool is accessible 24 hours a day, except for specific maintenance on Mondays from 12 - 3 a.m. Eastern time and occasional Sundays from 1 - 7 a.m. Eastern time. We're here to help you track your progress.

Troubleshoot Common Issues with Amended Returns

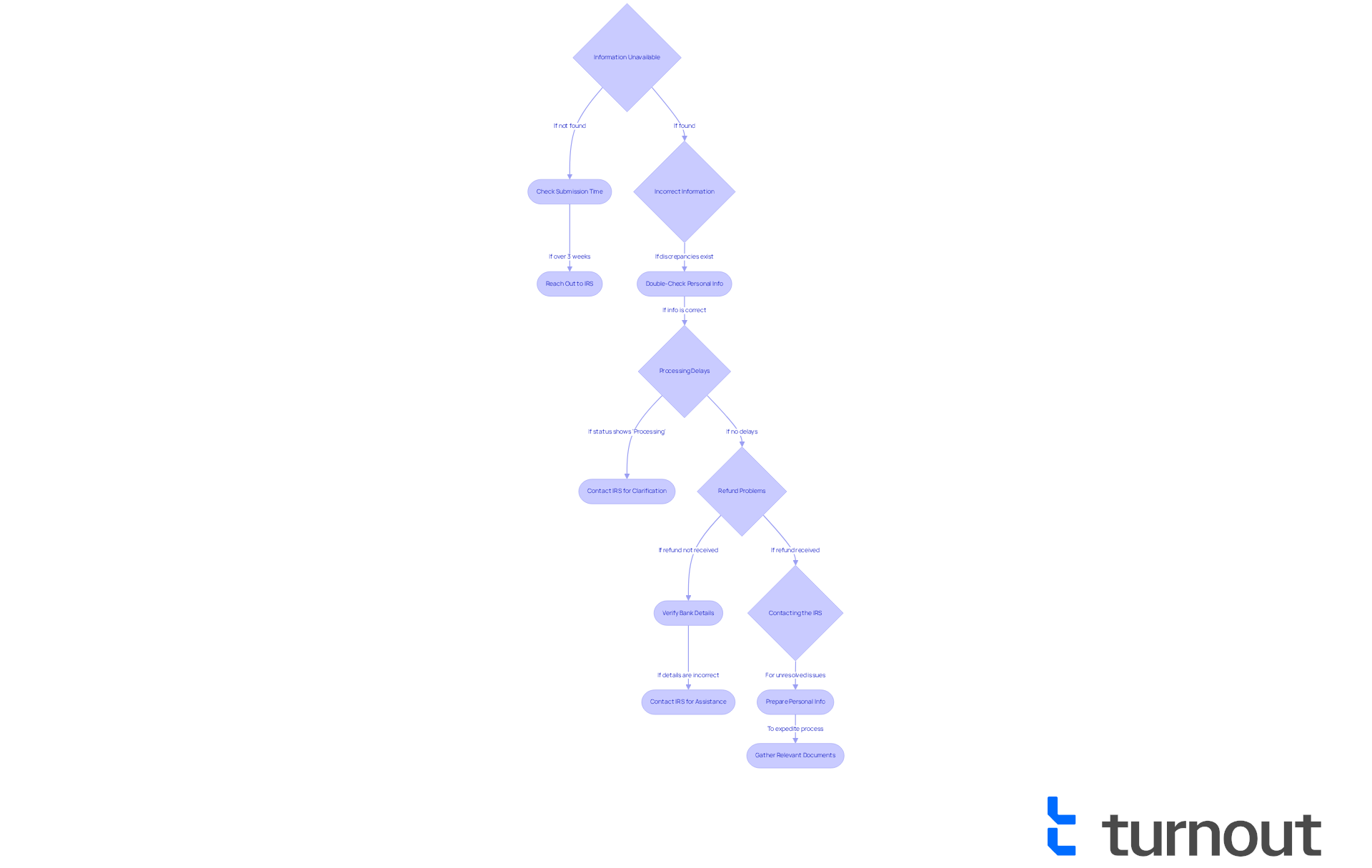

When reviewing the condition of your , it’s common to encounter some challenges. We understand how stressful this process can be, and we're here to help you .

- : If you cannot locate your update, please ensure that you have allowed at least three weeks after submitting your revised filing. If it has been longer, consider reaching out to the IRS for assistance. Remember, you are not alone in this journey.

- Incorrect Information: Double-check that the information you entered, such as your SSN, date of birth, and ZIP code, matches what the IRS has on file. Any discrepancies can hinder your ability to view your standing, and we want to ensure everything is accurate for you.

- : Approximately 20% of revised submissions encounter [processing delays](https://irs.gov/newsroom/irs-to-phase-out-paper-tax-refund-checks-starting-with-individual-taxpayers) due to mistakes or incomplete information. If your status shows 'Processing' for an extended period, it may be due to such issues. In this case, please don’t hesitate to for clarification.

- : If your revised submission is approved but you do not receive your refund, check that your bank details are accurate if you chose direct deposit. Refunds issued electronically are typically processed in less than 21 days. According to the IRS, 'Electronic refunds provide taxpayers quicker access to refunds, with payments issued in under 21 days if filing electronically, opting for direct deposit, and if there are no complications with the submission.' If you filed by mail, allow additional time for processing, as non-electronic payments may take six weeks or longer.

- : For any unresolved issues, please call the IRS at 866-464-2050. Be prepared with your personal information and details about your amended return to expedite the process. Tax consultants recommend having all relevant documents on hand to facilitate a smoother conversation with IRS representatives. Remember, you are not alone in this process, and there are people ready to assist you.

Conclusion

Navigating the complexities of amended tax returns can indeed feel overwhelming. However, understanding this process is essential for securing any refunds you may be entitled to. In this article, we’ve outlined the significance of filing a revised tax return using Form 1040-X, the steps to check the status of your amended return, and how to troubleshoot common issues that may arise along the way.

We recognize that there are many reasons for filing an amended return, such as:

- Correcting income

- Claiming missed deductions

It's important to utilize the IRS's 'Where's My Amended Taxes?' tool for tracking your submission. Remember, patience is key; the IRS typically takes 8 to 12 weeks to process these returns, and delays can occur during peak periods. By following the outlined steps and being aware of common pitfalls, you can alleviate stress and ensure that your amended filings are handled smoothly.

Ultimately, checking the status of your amended tax returns is more than just tracking a submission; it’s about reclaiming what is rightfully yours. By staying informed and utilizing the available resources, you can confidently navigate the complexities of the IRS system. Taking proactive steps leads to a successful resolution and peace of mind. We encourage you to act promptly and seek assistance when needed, because you are not alone in this journey.

Frequently Asked Questions

What is an amended tax return?

An amended tax return is a revised tax filing submitted to the IRS to correct mistakes or make changes to a previously filed tax statement, primarily using Form 1040-X.

Why would someone submit an amended tax return?

Common reasons for submitting an amended tax return include correcting reported income, changing filing status, and claiming overlooked deductions or credits.

What is the time limit for submitting an amended tax return?

You can only revise a submission within three years of the original filing date or within two years of remitting the tax, whichever is later.

Are there exceptions to the time limit for submitting an amended tax return?

Yes, if you are affected by a federally declared disaster or have served in a combat zone, you may have additional time to submit your revised filing.

Do I need to amend my tax return if the IRS has already corrected errors?

No, you do not need to amend your submission if the IRS has already corrected errors or accepted your filing without certain forms.

What is Form 1040-X and how has it changed for 2025?

Form 1040-X is the primary form used for submitting amended tax returns. It has been updated for 2025 to allow electronic filing, which streamlines the process.

How many amended returns can I submit for the same year?

Taxpayers can submit up to three amended returns for the same year.

What should I include when submitting Form 1040-X?

You must attach all required forms and schedules from the original submission when sending Form 1040-X.

How can I check the status of my amended tax return?

You can use the IRS's 'Where's My Amended Taxes?' resource to check the status of your amended submission, which provides updates three weeks after submission.