Overview

The role of a revenue officer is vital in helping individuals navigate the challenges of tax compliance and debt resolution. We understand that determining tax liabilities, collecting overdue payments, and negotiating payment plans can feel overwhelming. Revenue officers are here to support you through this journey.

They not only educate taxpayers about their rights and available resources but also play a significant part in maintaining the fiscal health of our communities. By ensuring timely tax collection, they ultimately support essential public services that we all rely on.

Remember, you are not alone in this process. Revenue officers are dedicated to guiding you and providing the assistance you need. Together, we can work towards a brighter financial future.

Introduction

Understanding tax responsibilities can often feel like navigating a labyrinth. We understand that facing overdue payments and compliance issues can be overwhelming. In this complex journey, revenue officers emerge as crucial guides, dedicated to assisting individuals in managing their tax obligations effectively. As the landscape of tax collection evolves, how can you leverage the expertise of these professionals? Not only can they help resolve your debts, but they can also enhance your overall financial well-being. You're not alone in this journey, and there are solutions available to support you.

Defining a Revenue Officer: Role and Responsibilities

A revenue officer is a vital government worker dedicated to collecting overdue taxes and ensuring compliance with tax regulations. We understand that navigating tax responsibilities can be overwhelming, and a in assisting individuals with this process. As a revenue officer, their primary responsibilities include:

- Determining

- Collecting overdue payments

- Negotiating

With around 2,300 revenue agents employed throughout the United States, their presence is essential in promoting compliance and . These revenue officers frequently interact directly with individuals and companies to settle outstanding debts. They are accountable for informing citizens about their duties and rights, which is especially crucial since many individuals are unaware of the resources available to them through a revenue officer. For instance, a revenue officer can provide guidance on various payment options, such as , helping individuals manage their financial challenges more effectively.

To assess their ability to pay , taxpayers must provide Form 433-A or Form 433-B, a critical part of the process. We recognize that this can feel daunting, but it’s an important step toward resolution.

Furthermore, a recent policy change requires to arrange meetings through Letter 725-B instead of making —previously numbering in the tens of thousands annually. This demonstrates a commitment to enhancing interactions with taxpayers. This shift allows individuals to prepare the necessary documentation, leading to more efficient resolutions of their cases.

By understanding their rights, including the option to seek professional assistance, and recognizing the role of a revenue officer, taxpayers can approach these interactions with greater confidence. This ultimately improves their chances of achieving positive outcomes. Additionally, the mean salary of financial agents is $200,755, and the average age is 48.4 years, providing further context about this dedicated workforce. It’s also important to note that tax officials differ from tax agents, who primarily manage audits, highlighting the distinct functions within the IRS. Remember, you are not alone in this journey—.

The Importance of Revenue Officers in Financial Systems

Revenue officers play a vital role in our , ensuring that dues owed to government bodies are collected promptly. This is not just about numbers; it directly impacts public services that we all rely on, such as education, healthcare, and infrastructure. For instance, in the 2024 fiscal year alone, the IRS has collected over $1.1 billion from wealthy individuals, which significantly enriches the financial resources available for . Additionally, the IRS has recovered $482 million from 1,600 millionaires, showcasing how enforcement efforts are crucial for community funding.

By collecting overdue taxes, financial officers help maintain the of government entities, ultimately supporting our community's well-being. Their addresses current delinquencies while fostering a culture of compliance among taxpayers. This is essential, as it not only reduces the likelihood of future tax delinquencies but also enhances public trust in the financial system.

Furthermore, we cannot overstate the effect of tax income on community services. Local authorities primarily depend on property tax, the largest source of income, yet they often face challenges in adapting to modern economic conditions. The tax gap, estimated at $700 billion annually, highlights the urgent need for effective . Revenue officers play an instrumental role in , ensuring our communities receive the necessary funding to thrive. Their work exemplifies how can lead to improved financial health for both government entities and the communities they serve. As Ryan Polk mentions, targeted enforcement efforts have , while investments in services for individuals have facilitated access to assistance.

We understand that navigating these financial systems can feel overwhelming, but remember, you are not alone in this journey. Together, we can work towards a more stable and supportive community.

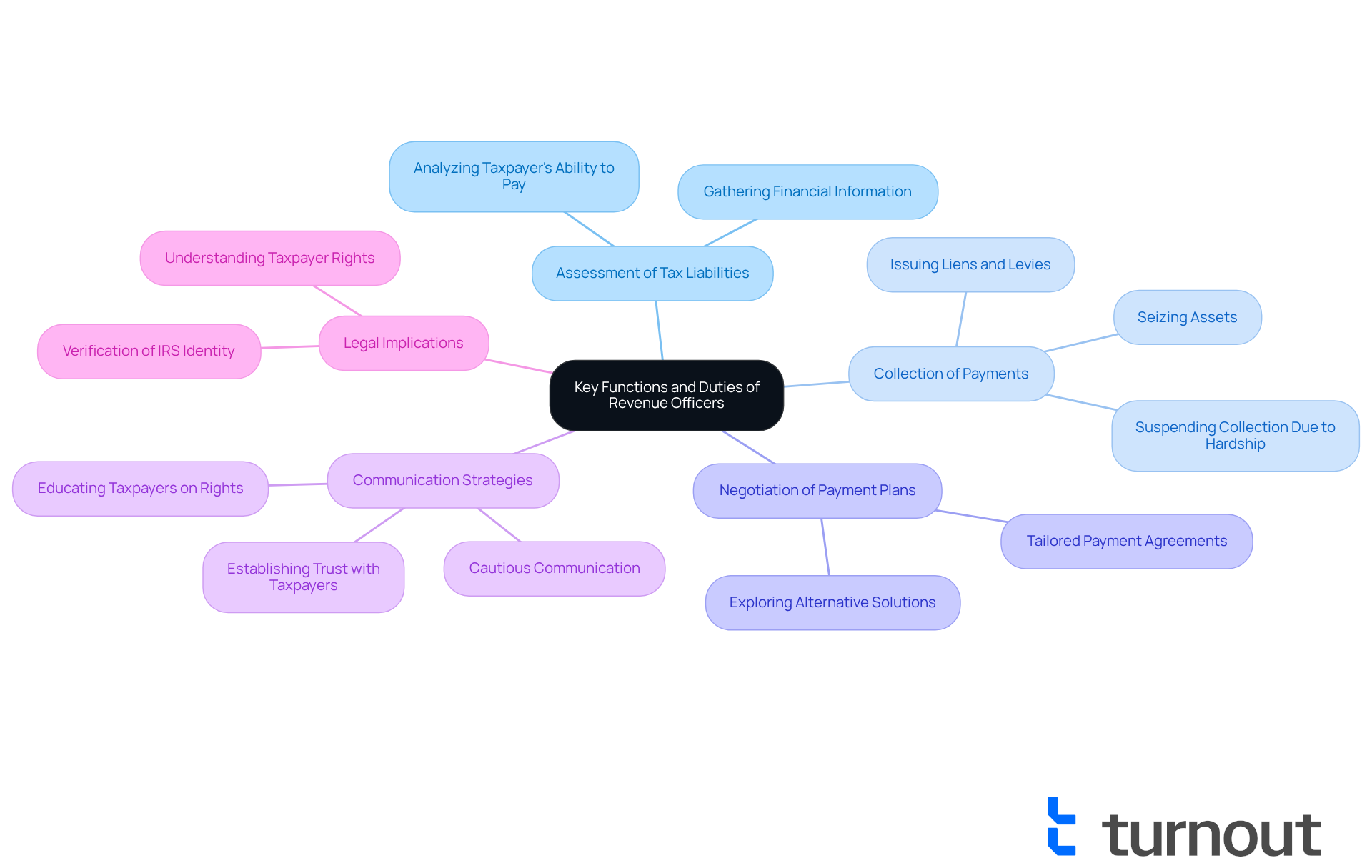

Key Functions and Duties of Revenue Officers

Revenue agents play a crucial role in the . They focus on assessing , collecting overdue payments, and negotiating . We understand that facing can be overwhelming, and these agents are here to help. They conduct scheduled interviews with taxpayers to gather detailed financial information, which is essential for determining the most effective strategies for debt resolution.

With around 2,300 functioning across the country, their duties encompass the power to seize bank accounts, withhold wages, and impose liens on properties to ensure payment. This direct involvement often indicates a serious that requires immediate attention, especially for cases involving back taxes exceeding $250,000. It's common to feel anxious when dealing with such matters, but knowing that help is available can bring relief.

In their discussions, financial agents employ a tailored method, enabling personal conversations that elucidate choices and promote problem resolution. They can establish to your financial situation, exploring alternative solutions when full payment is not feasible. For example, if you are facing financial difficulties, collection agents may pause their efforts or provide relief from penalties for overdue tax bills.

Expert opinions indicate that effective negotiation with a revenue representative involves and clearly outlining what can be paid. This strategic communication is vital, as making a single misstatement could jeopardize the chances of a favorable resolution. provide guidance on your rights and responsibilities, ensuring that you are informed about the implications of your financial decisions. Additionally, it is important for you to verify the identity of IRS representatives during interactions, as this step enhances safety and awareness of your rights.

Overall, their multifaceted role requires strong communication skills and a deep understanding of tax laws and regulations. They ultimately aim to assist you in navigating your obligations and achieving resolution. Remember, you are not alone in this journey. The average salary range for a revenue officer at the IRS falls between $46,500 and $98,500, reflecting the significance of their role in the tax system.

Revenue Officers vs. Related Financial Roles

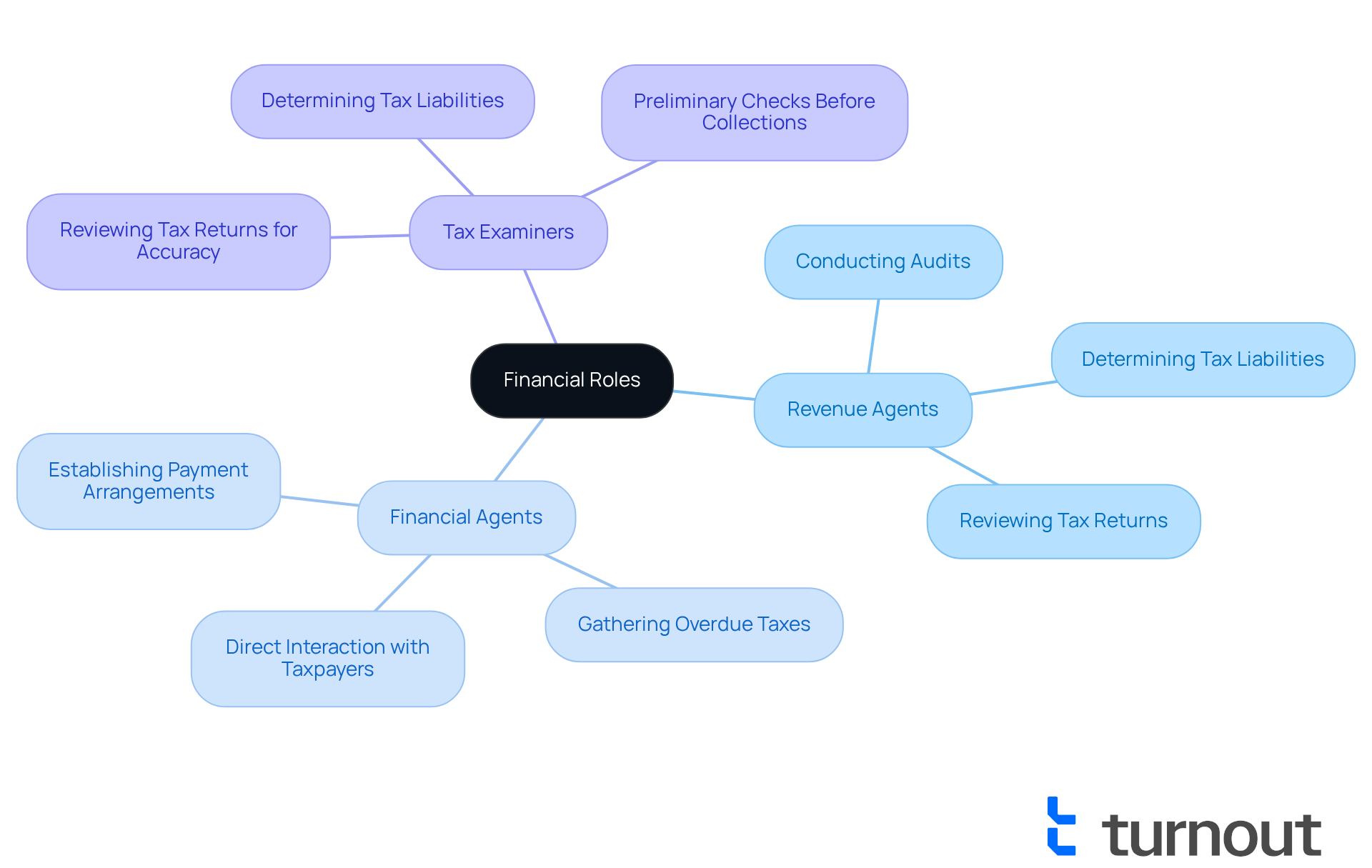

play a vital role that distinguishes them from other monetary specialists, such as and tax inspectors. Their specific duties are essential for individuals navigating the complexities of tax payments. Revenue agents focus on conducting audits to verify the accuracy of tax returns and ensure compliance with tax laws. In contrast, financial agents are tasked with gathering overdue taxes and addressing delinquent accounts. They often interact directly with individuals to establish payment arrangements, offering a personal touch in what can be a stressful situation. Tax examiners, meanwhile, review tax returns for accuracy and determine tax liabilities, serving as a preliminary check before any collection actions are taken.

is crucial for taxpayers, especially when seeking benefits. It's common to feel overwhelmed by the financial landscape. For instance, financial agents may conduct face-to-face visits to explore payment options, while tax assessors typically manage cases via written communication. Statistics indicate that financial agents earned an average yearly income of $56,780 in 2021, reflecting the specialized nature of their work. Furthermore, job prospects for , including financial agents, are expected to decrease by 2% from 2024 to 2034. This shift emphasizes the evolving environment of tax collection and compliance.

Expert insights reveal that where traditional collection methods have failed. Their unique responsibilities require them to , making their role essential in the . By recognizing the differences between these roles, individuals can better identify the appropriate resources and support available to them. Remember, you are not alone in this journey; understanding these nuances can empower you to resolve your tax issues and .

Conclusion

Revenue officers play a crucial role in guiding individuals through the complexities of tax obligations, ensuring compliance with financial regulations. They go beyond mere collection; they act as educators and negotiators, helping taxpayers understand their rights and options. By fostering a supportive environment, revenue officers empower individuals to navigate their financial challenges with confidence.

We understand that tax issues can be overwhelming. Key insights highlighted throughout the article show the vital functions of revenue officers in assessing tax liabilities, collecting overdue payments, and negotiating tailored payment plans. Recent policy changes, such as scheduled meetings instead of unannounced visits, further demonstrate a commitment to enhancing taxpayer interactions. The distinction between revenue officers and other financial roles underscores the unique support they provide in the benefits journey.

Recognizing the importance of revenue officers is essential for individuals seeking assistance with tax-related issues. Their proactive approach not only aids in resolving current delinquencies but also contributes to the overall stability of community funding. Embracing this understanding can lead to a more informed and empowered taxpayer base. Remember, you are not alone in this journey; seeking help can ensure that public services remain robust and accessible for everyone.

Frequently Asked Questions

What is the role of a revenue officer?

A revenue officer is a government worker responsible for collecting overdue taxes and ensuring compliance with tax regulations. They assist individuals in navigating their tax responsibilities.

What are the primary responsibilities of a revenue officer?

The primary responsibilities of a revenue officer include determining tax liabilities, collecting overdue payments, and negotiating payment plans with taxpayers.

How many revenue officers are employed in the United States?

There are approximately 2,300 revenue officers employed throughout the United States.

How do revenue officers assist individuals and companies?

Revenue officers interact directly with individuals and companies to settle outstanding debts and inform citizens about their duties and rights regarding tax obligations.

What forms must taxpayers provide to assess their ability to pay tax debt?

Taxpayers must provide Form 433-A or Form 433-B to assess their ability to pay tax debt.

What recent policy change has affected how revenue officers arrange meetings?

A recent policy change requires revenue officers to arrange meetings through Letter 725-B instead of making unannounced visits, allowing taxpayers to prepare necessary documentation.

How can understanding their rights benefit taxpayers when interacting with revenue officers?

By understanding their rights and the role of a revenue officer, taxpayers can approach these interactions with greater confidence, improving their chances of achieving positive outcomes.

What is the mean salary and average age of revenue officers?

The mean salary of revenue officers is $200,755, and the average age is 48.4 years.

How do tax officials differ from tax agents?

Tax officials, such as revenue officers, focus on collecting overdue taxes and ensuring compliance, while tax agents primarily manage audits.