Overview

This article serves as a caring and comprehensive step-by-step guide on how to become an Internal Revenue Officer. We understand that navigating this journey can feel overwhelming, so we detail the role's responsibilities, required qualifications, and application process, along with the importance of professional development. It's common to have concerns about the path ahead, but rest assured, support is available to you throughout your journey.

To enhance your career prospects, candidates need a relevant educational background, training, and networking. These elements are crucial, and we’re here to help you every step of the way. Remember, you are not alone in this journey; many have successfully walked this path before you, and their experiences can inspire and guide you.

Take the first step by exploring the information provided, and know that with determination and the right support, you can achieve your goal of becoming an Internal Revenue Officer.

Introduction

Becoming an Internal Revenue Officer is not just a career choice; it’s a chance to make a meaningful difference in the lives of individuals and businesses navigating the intricate world of taxes. We understand that this journey can feel overwhelming, but this guide is here to provide you with a comprehensive roadmap. It outlines the essential qualifications, training, and application processes necessary to thrive in this vital role.

However, it’s common to wonder about the challenges you might face in securing a position. What hurdles could arise, and how can you effectively prepare to overcome them? Rest assured, you are not alone in this journey. We’re here to help you navigate each step with confidence and clarity.

Understand the Role of an Internal Revenue Officer

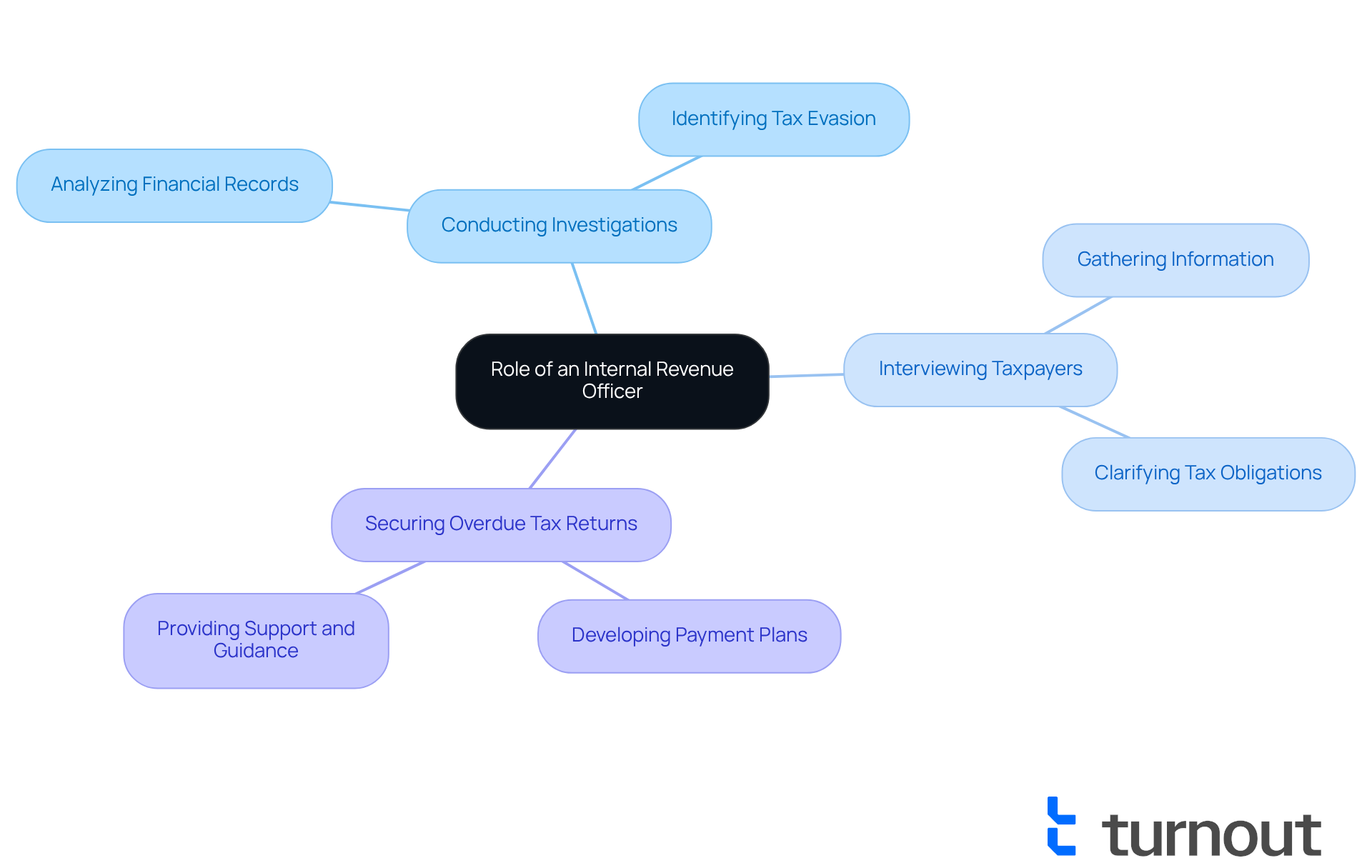

An internal revenue officer plays a crucial role in our community by implementing and assisting individuals and businesses in navigating their financial responsibilities. Their duties include:

- Conducting investigations

- Interviewing taxpayers

- Securing overdue tax returns

We understand that dealing with taxes can be stressful, and the internal revenue officer is here to support you through this process. They work closely with you to assess your financial situation and develop manageable .

Understanding these responsibilities is vital for anyone considering this career. It highlights the importance of strong communication skills, analytical thinking, and a solid grasp of tax regulations. Remember, you are not alone in this journey; seeking help can make a significant difference in managing your .

Identify Required Qualifications and Training

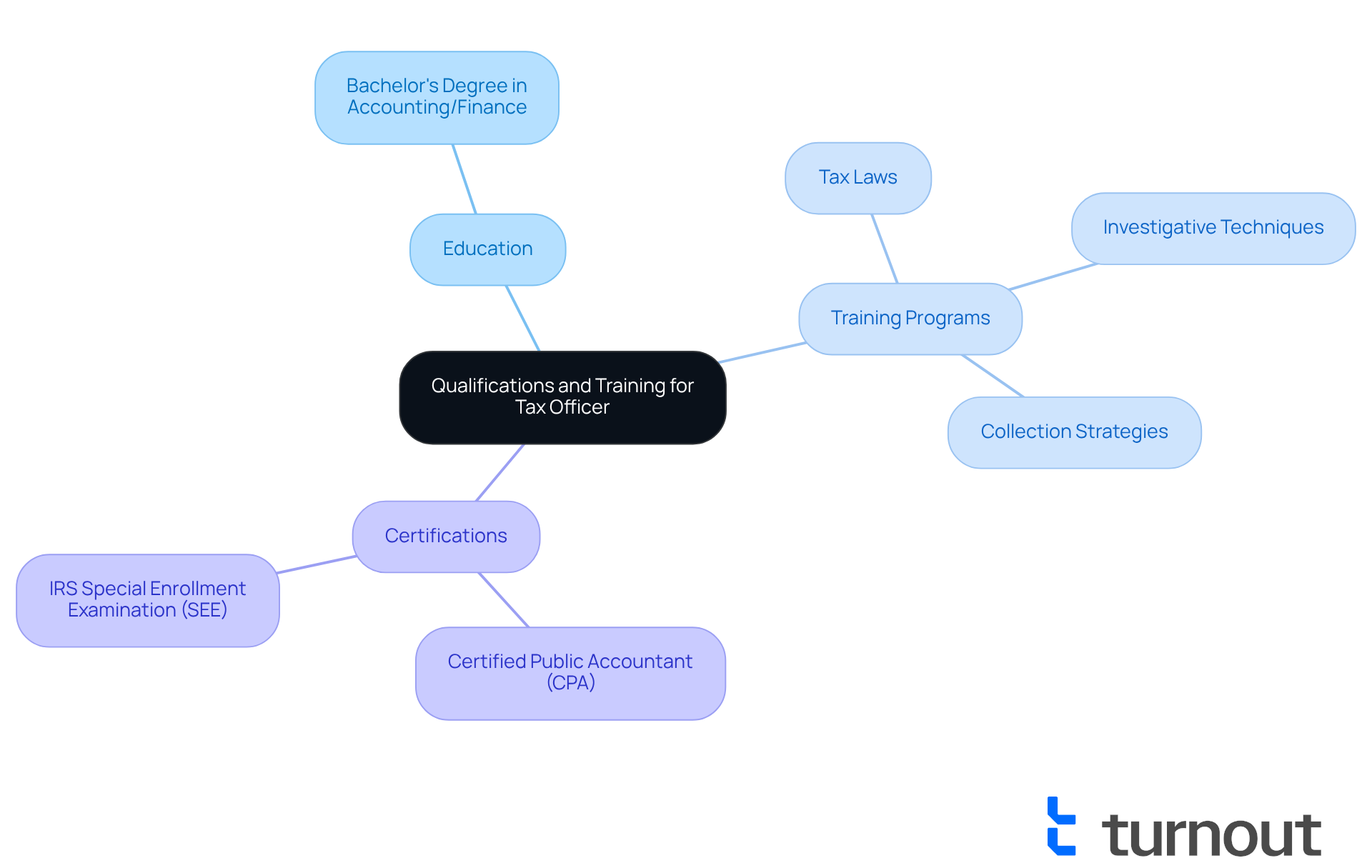

can be a fulfilling career choice, and we understand that the journey may seem daunting. Generally, candidates require a bachelor's degree in accounting, finance, or a related discipline. Alongside your education, relevant experience in tax collection or financial analysis can be incredibly beneficial.

The that cover essential topics such as:

- Tax laws

- Investigative techniques

- Collection strategies

These resources are designed to equip you with the knowledge you need to succeed. Additionally, you might consider obtaining certifications like:

- Certified Public Accountant (CPA)

- IRS Special Enrollment Examination (SEE)

These qualifications can significantly enhance your opportunities in this field.

Remember, you're not alone in this journey. We're here to help guide you every step of the way as you pursue this rewarding career.

Navigate the Application Process

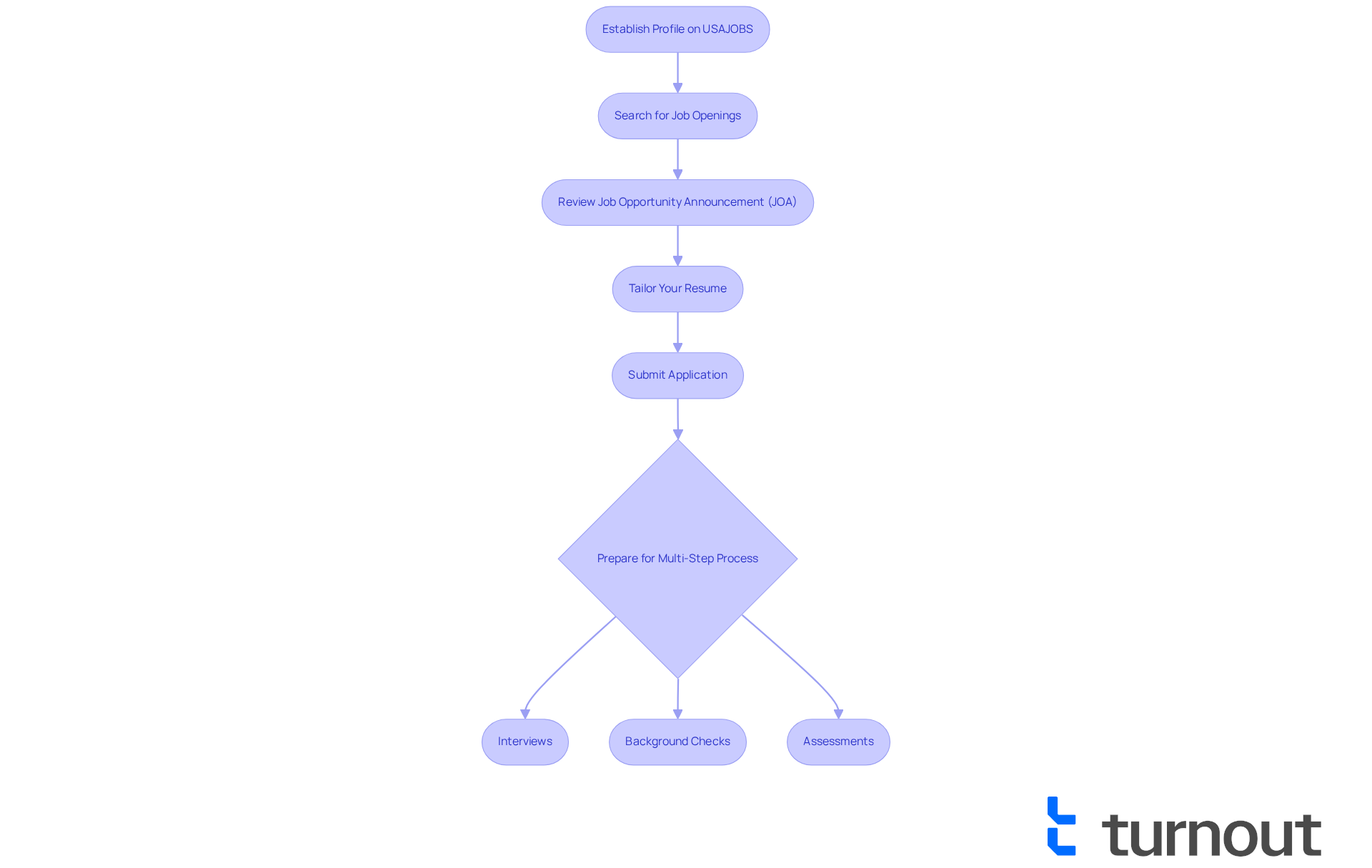

Applying for a can feel overwhelming, but we’re here to help you navigate the process. It all begins with establishing a profile on USAJOBS, the federal employment portal. Take your time to search for job openings and carefully review the (JOA) to understand the specific requirements.

It's essential to tailor your resume to showcase your . Remember, this is your chance to shine! After submitting your , be prepared for a that may include:

- Interviews

- Assessments of your qualifications

We understand that this can be a lot to manage, but staying organized and proactive during this phase can significantly enhance your chances of success.

Ultimately, you are not alone in this journey. With the right preparation and mindset, you can approach this opportunity with confidence.

Engage in Professional Development and Networking

To excel as an , we understand that is essential. This journey can feel overwhelming at times, but attending , workshops, and seminars led by an internal revenue officer focused on and enforcement strategies can truly make a difference.

Networking with other through associations and events is another vital step. It can provide valuable insights and opportunities for collaboration. Joining organizations such as the National Association of Tax Professionals (NATP) or participating in local tax forums can help you build a robust professional network. Remember, this network is crucial for your career growth and staying informed about industry changes.

You're not alone in this journey; we're here to help you with confidence.

Conclusion

Becoming an Internal Revenue Officer is not just a career; it’s a fulfilling journey that plays a crucial role in helping individuals and businesses meet their tax obligations. We understand that navigating this path can feel overwhelming, which is why this guide outlines the essential steps to embark on this meaningful profession. It’s important to grasp the responsibilities, qualifications, and application process involved.

Key duties of an Internal Revenue Officer include:

- Conducting investigations

- Assisting taxpayers in managing their financial responsibilities

We recognize that this role can significantly impact the lives of others, and it’s essential to have the right educational background and training. Certifications can enhance your career prospects and provide you with the tools needed for success.

Navigating the application process can also be daunting, but remember, engaging in professional development through networking and continuous education is vital. You are not alone in this journey; many have walked this path and found fulfillment.

Ultimately, pursuing a career as an Internal Revenue Officer offers not only personal satisfaction but also the opportunity to contribute to the greater good by ensuring compliance with tax regulations. By following these outlined steps and remaining proactive in your professional growth, you can confidently take on this important role. Together, we can make a significant impact in our communities, and we’re here to support you every step of the way.

Frequently Asked Questions

What is the role of an internal revenue officer?

An internal revenue officer plays a crucial role in implementing tax regulations and assisting individuals and businesses in managing their financial responsibilities.

What are the main duties of an internal revenue officer?

The main duties include conducting investigations, interviewing taxpayers, and securing overdue tax returns.

How does an internal revenue officer assist taxpayers?

They work closely with taxpayers to assess their financial situation and develop manageable payment plans.

Why is it important to understand the responsibilities of an internal revenue officer?

Understanding these responsibilities is vital for anyone considering a career in this field, as it emphasizes the need for strong communication skills, analytical thinking, and a solid grasp of tax regulations.

What should individuals know when dealing with tax obligations?

Individuals should know that they are not alone in managing their tax obligations and that seeking help from an internal revenue officer can make a significant difference.