Overview

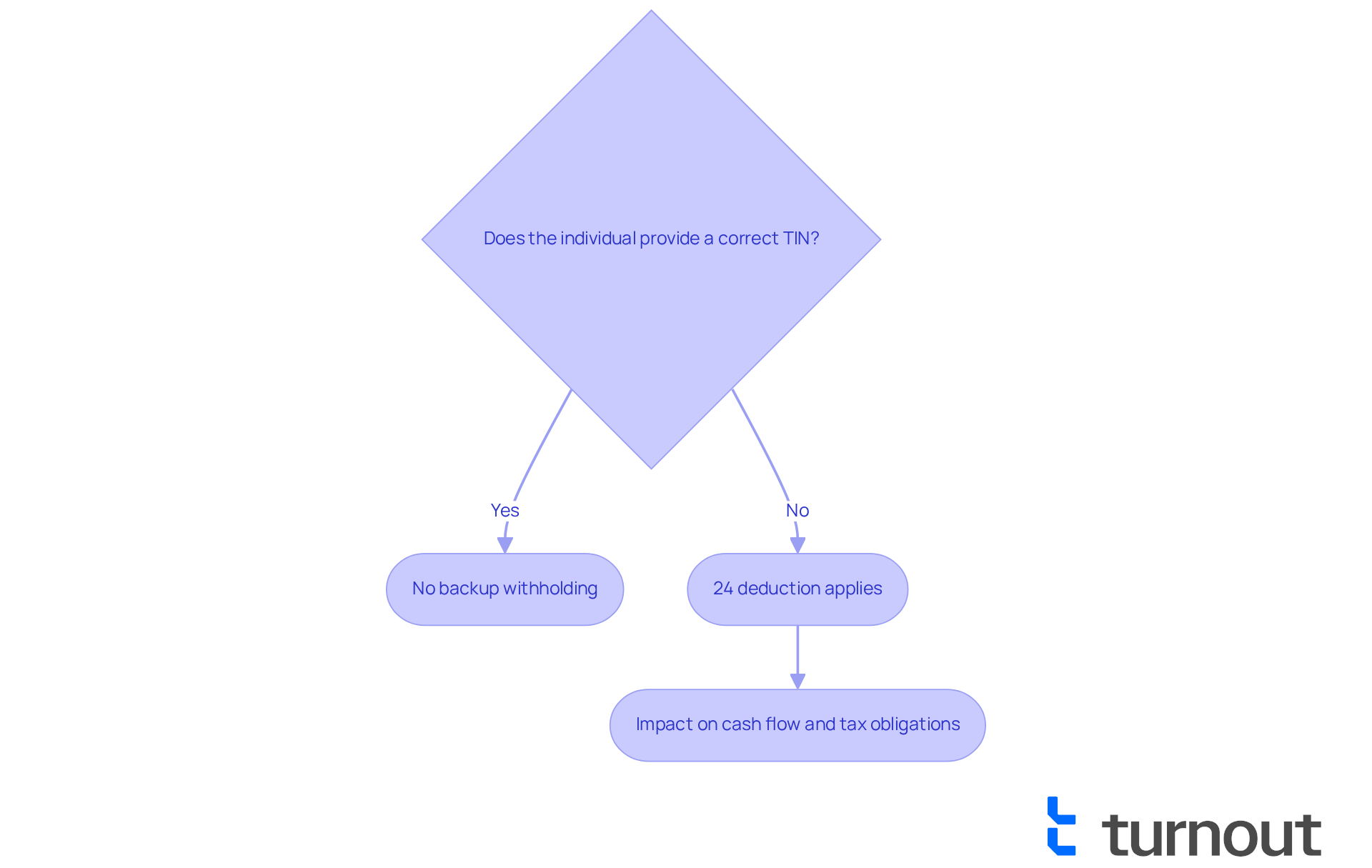

This article highlights the essential steps to master backup tax withholding, recognizing its importance for those receiving certain payments. We understand that navigating tax obligations can be overwhelming, and it's crucial to avoid a 24% deduction from your payments. To do this, providing a correct taxpayer identification number (TIN) is vital. Staying informed about your tax responsibilities can help prevent unexpected tax liabilities that may impact your cash flow. Remember, you are not alone in this journey; we’re here to help you manage your tax obligations with confidence.

Introduction

Navigating the complexities of income reporting and tax obligations can be overwhelming, and understanding backup tax withholding is essential. This IRS-imposed system mandates a flat 24% deduction from certain payments, which can significantly impact individuals and businesses alike. If accurate taxpayer identification numbers are not provided, the consequences can be even more stressful. We understand that as tax regulations evolve, it’s common to feel uncertain about how to manage and prevent the financial strain caused by backup withholding.

This article delves into the critical steps and insights necessary to master backup tax withholding. Our goal is to equip you with the knowledge to protect your financial interests and avoid unexpected deductions. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges with confidence.

Define Backup Withholding and Its Importance

The IRS has implemented backup tax withholding, a tax system that requires payers to deduct a flat rate of 24% from specific disbursements made to individuals or entities that do not provide a correct taxpayer identification number (TIN) or fail to report income accurately. We understand that this retention can feel overwhelming, but it serves as a protection for the IRS to ensure that taxes are collected on income that might otherwise go unreported. Grasping the concept of backup tax withholding is crucial for anyone receiving funds that could be subject to this tax, as it directly impacts cash flow and tax responsibilities. It's important to be aware that failure to adhere to backup tax withholding obligations can lead to unexpected tax liabilities and challenges in obtaining benefits or payments.

Looking ahead to 2025, the IRS will continue to enforce reserve tax deduction requirements, with no changes to the deduction tables or information returns for that tax year. This means individuals must remain vigilant about their TIN status and ensure accurate reporting regarding backup tax withholding to avoid unnecessary deductions. Additionally, starting January 1, 2025, reporting requirements for brokers concerning backup tax withholding will come into effect, which is vital for consumers to understand regarding their tax obligations.

Real-world examples can shed light on the importance of compliance. For instance, Rebecca Jordan, an American citizen, faced tax deduction issues after neglecting to declare taxable interest income. When she opened a new brokerage account, her status led to a 24% deduction on her earnings, which she later reported on her tax return. This could potentially result in a refund if her tax obligation was less than the amount deducted.

Expert insights reveal that retention of funds is not merely an administrative hurdle; it can significantly affect taxpayers' financial strategies and access to benefits. By understanding the implications of tax retention, including exceptions for certain transactions like real estate deals and distributions from retirement funds, you can better manage your tax responsibilities and protect your financial interests. Remember, you're not alone in this journey—we're here to help you navigate these complexities.

Identify Payments Subject to Backup Withholding

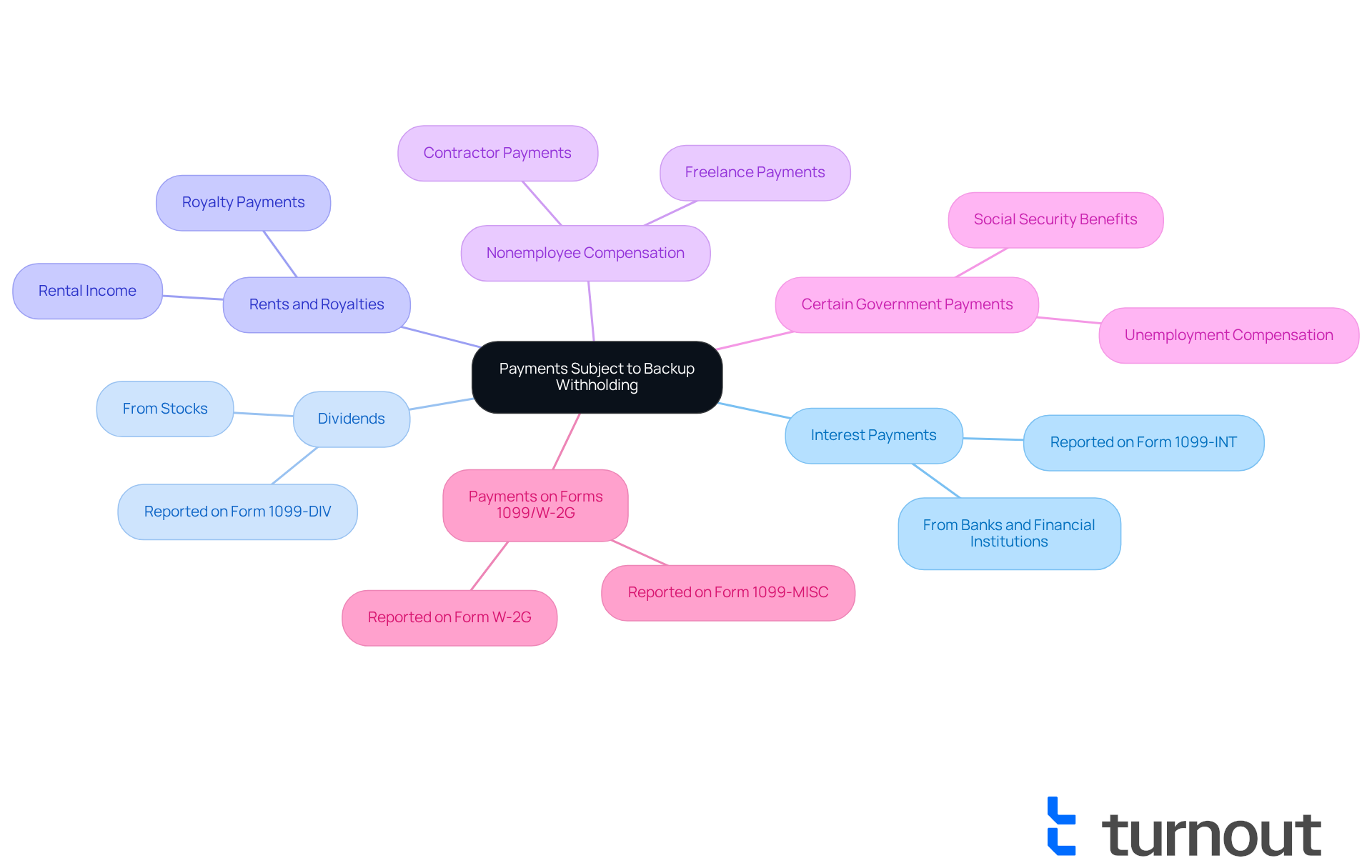

Payments that may be subject to backup tax withholding can feel overwhelming, but understanding them is crucial for your financial well-being. These payments typically include:

- Interest payments from banks or financial institutions

- Dividends from stocks

- Rents and royalties

- Nonemployee compensation, such as payments to freelancers or contractors

- Certain government payments

- Payments reported on Forms 1099 and W-2G.

Grasping these classifications is essential for anyone receiving such funds, as it helps you anticipate possible deductions and manage your finances effectively. The tax deduction involves a flat rate of 24% taken from these payments, which serves as a credit toward your taxes due. If you do not provide accurate taxpayer identification information, this deduction may apply to you.

It's important to note that supplemental tax deductions do not apply to salaries, unemployment benefits, and most retirement account withdrawals. The IRS usually sends several notifications before initiating tax collection, giving you a chance to correct any discrepancies. To avoid tax deductions, ensure you present your Taxpayer Identification Number (TIN) when opening accounts or receiving amounts reportable on Form 1099.

As financial author Barbara Cook wisely points out, "Retained income tax is federal tax deducted directly by payers from disbursements to recipients governed by IRS tax regulations." By understanding these transaction methods and the related obligations, you can take proactive steps to ensure compliance and mitigate the impact of backup tax withholding on your financial situation. Remember, we're here to help you navigate this process—you are not alone in this journey.

Explain How Backup Withholding Works

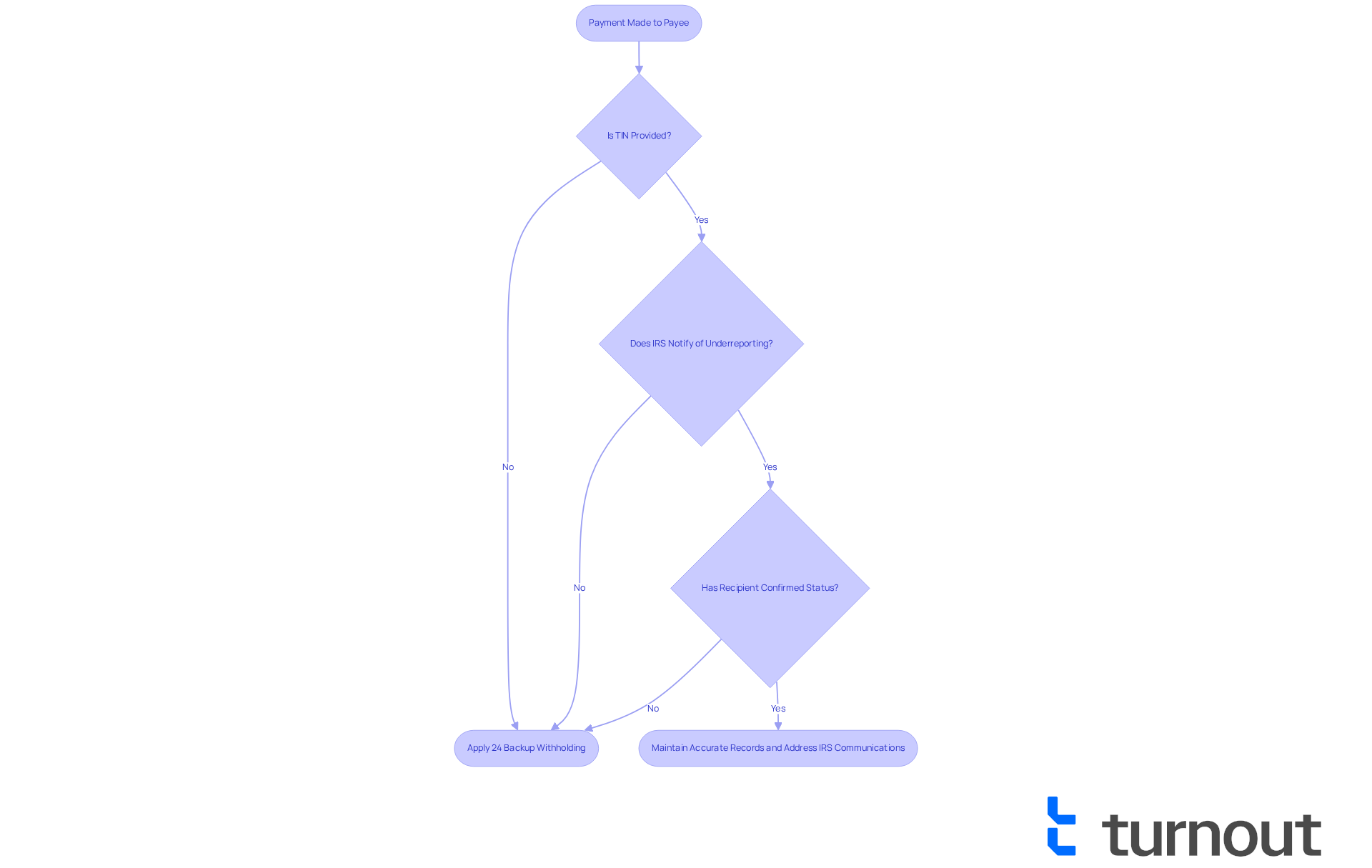

Backup tax withholding begins when a payer must deduct taxes from payments made to a payee who has not provided a valid Taxpayer Identification Number (TIN) or has underreported income. In such cases, the payer is required to apply backup tax withholding of 24% of the payment and remit it to the IRS. This situation typically arises when:

- The payee does not provide their TIN as required.

- The IRS notifies the payer that the payee is subject to backup tax withholding due to discrepancies in reported earnings.

- The recipient fails to confirm that they are not subject to backup tax withholding.

We understand that navigating these requirements can be overwhelming for both payers and payees. It's crucial to grasp this process to ensure compliance and avoid potential penalties. For instance, if a payee like Rebecca Jordan does not respond to IRS notifications regarding underreported income, they may find that 24% is deducted from their payments. This situation highlights the importance of maintaining accurate records and promptly addressing IRS communications to prevent unnecessary deductions. Remember, you are not alone in this journey, and taking proactive steps can make a significant difference.

Outline Exemptions from Backup Withholding

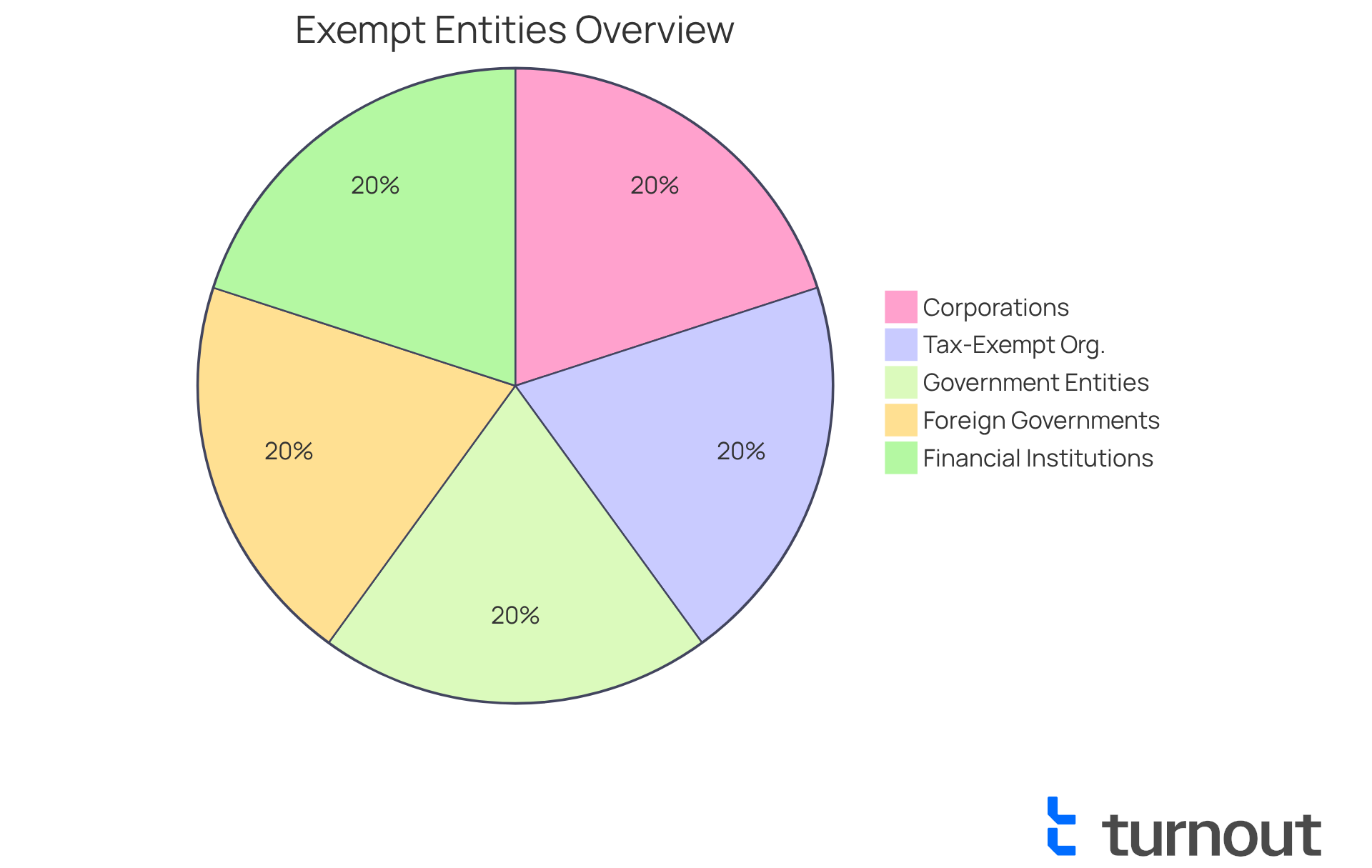

It's important to recognize that certain individuals and entities may be exempt from backup withholding. This includes:

- Corporations

- Tax-exempt organizations

- Government entities

- Foreign governments

- Certain financial institutions

Additionally, individuals who submit a valid TIN and confirm they are not subject to tax deductions are also exempt. Understanding these exemptions can help you avoid unnecessary deductions, which is crucial for both individuals and businesses regarding backup tax withholding.

We understand that navigating tax regulations can be overwhelming. Staying informed about these exemptions is vital for effective tax management, particularly regarding backup tax withholding and compliance. For example, the IRS has announced that starting January 1, 2025, brokers will need to report digital asset transactions on Form 1099-DA. This highlights the importance of being aware of the evolving landscape of tax reporting. Moreover, the IRS has provided transition relief for tax liability related to alternative payments for transactions in 2025, emphasizing the need for individuals and businesses to keep up with current regulations.

Instances of companies and tax-exempt entities successfully navigating secondary tax deductions illustrate the practical benefits of these exemptions. By understanding these concepts, you can maneuver through complex tax environments more efficiently. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Detail Steps to Prevent or Stop Backup Withholding

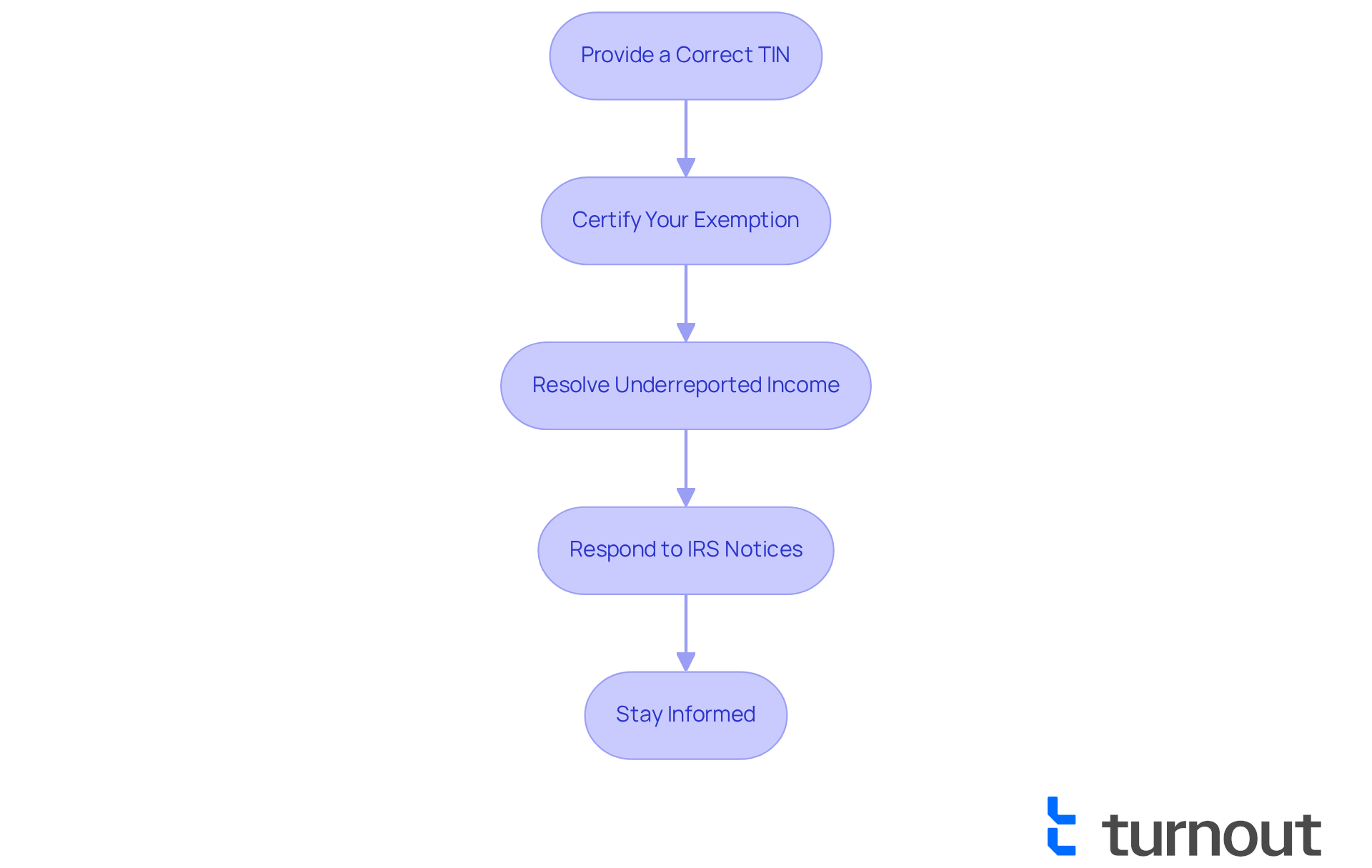

To prevent or stop backup withholding, we understand that taking the right steps can feel overwhelming. Here’s how you can navigate this process with confidence:

- Provide a Correct TIN: It's essential to provide your correct taxpayer identification number (TIN) to the payer. You can do this using Form W-9, which certifies your TIN's accuracy under penalties of perjury. Remember, your TIN can be your Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN).

- Certify Your Exemption: If you qualify for an exemption from backup tax withholding, make sure to complete the necessary certification to notify the payer. This step helps clarify your status and can prevent unnecessary retention of your funds.

- Resolve Underreported Income: If you’ve underreported income, it’s important to rectify this by filing the appropriate tax returns and paying any owed taxes. For instance, if you understated interest earnings, amending your tax returns promptly can help you evade future deductions.

- Respond to IRS Notices: Receiving a notification from the IRS about backup retention can be concerning. It’s crucial to reply swiftly to address any inconsistencies. Ignoring these notifications may lead to an automatic deduction at a flat rate of 24% on future payments. Typically, the IRS issues four notifications over a 120-day timeframe before starting deductions.

- Stay Informed: Regularly reviewing your tax situation is vital. Ensure that all information provided to payers is accurate and up-to-date. By monitoring your TIN and any changes in your financial circumstances, you can prevent issues related to retained amounts.

Payments that may be subject to additional tax deductions include interest payments, dividends, commissions, and certain government payments. By following these steps, you can effectively manage your exposure to backup tax withholding and maintain better control over your finances. Remember, timely action—like correcting TIN errors or responding to IRS notifications—can lead to successful resolutions and help you avoid significant financial strain. You are not alone in this journey; we're here to help.

Conclusion

Understanding backup tax withholding is crucial for managing your financial responsibilities and ensuring compliance with IRS regulations. We recognize that navigating tax obligations can be overwhelming. This tax mechanism mandates a flat 24% deduction from certain payments when a valid taxpayer identification number (TIN) is not provided, safeguarding tax collection on potentially unreported income. By acknowledging the significance of this withholding, you can avoid unexpected tax liabilities and maintain better control over your finances.

Key insights from this article highlight various payments subject to backup withholding, including:

- Interest

- Dividends

- Nonemployee compensation

It's vital to provide accurate taxpayer information and promptly address IRS notifications. These actions directly impact your financial well-being. Furthermore, understanding exemptions from backup withholding can empower you to navigate this complex landscape effectively and minimize unnecessary deductions.

Ultimately, proactive engagement with your tax obligations is essential. By following the outlined steps to prevent or stop backup withholding, you can safeguard your financial interests and ensure compliance with IRS guidelines. Remember, staying informed and taking timely action not only protects against potential financial strain but also fosters confidence in managing your tax responsibilities. You're not alone in this journey—we're here to help.

Frequently Asked Questions

What is backup withholding and why is it important?

Backup withholding is a tax system implemented by the IRS that requires payers to deduct a flat rate of 24% from certain payments made to individuals or entities that do not provide a correct taxpayer identification number (TIN) or fail to accurately report income. It serves to ensure that taxes are collected on income that might otherwise go unreported, impacting cash flow and tax responsibilities.

What are the consequences of not adhering to backup withholding obligations?

Failing to comply with backup withholding obligations can lead to unexpected tax liabilities and challenges in obtaining benefits or payments.

What payments are subject to backup withholding?

Payments that may be subject to backup withholding include interest payments from banks, dividends from stocks, rents and royalties, nonemployee compensation (like payments to freelancers), certain government payments, and payments reported on Forms 1099 and W-2G.

Are there any payments that are exempt from backup withholding?

Yes, supplemental tax deductions do not apply to salaries, unemployment benefits, and most retirement account withdrawals.

How can individuals avoid backup withholding?

To avoid backup withholding, individuals should ensure they provide accurate taxpayer identification information (TIN) when opening accounts or receiving payments that are reportable on Form 1099.

What changes are expected regarding backup withholding in 2025?

In 2025, the IRS will continue to enforce backup tax deduction requirements with no changes to the deduction tables or information returns. Additionally, new reporting requirements for brokers concerning backup tax withholding will come into effect.

Can you provide an example of how backup withholding affects individuals?

For instance, Rebecca Jordan faced a 24% deduction on her earnings after failing to declare taxable interest income when opening a new brokerage account. This deduction could potentially result in a refund if her actual tax obligation was less than the amount deducted.

What should individuals understand about the implications of tax retention?

Understanding the implications of tax retention is crucial as it can significantly affect financial strategies and access to benefits. Certain transactions, like real estate deals and distributions from retirement funds, may have exceptions regarding backup withholding.