Overview

This article aims to help you find the Missouri tax refund phone number with ease, offering essential steps and resources along the way. We understand that navigating tax issues can be stressful, and gathering the right information is crucial. Before reaching out to the Missouri Department of Revenue, it's important to have your Social Security Number and filing status ready.

Utilizing the official website and exploring alternative contact methods can lead to more efficient assistance.

Remember, we're here to help you through this process.

Introduction

Navigating the complexities of tax refunds can often feel like an uphill battle. We understand that finding the right contact information for assistance is crucial for Missouri taxpayers. The quest for the Missouri tax refund phone number is an essential step in resolving inquiries and ensuring timely refunds. This guide highlights the resources available and equips you with practical steps to streamline communication with the Missouri Department of Revenue.

However, it’s common to feel frustrated when information is elusive or the process becomes overwhelming. Understanding how to effectively tackle these challenges can make all the difference in achieving a successful outcome. Remember, you are not alone in this journey; we're here to help.

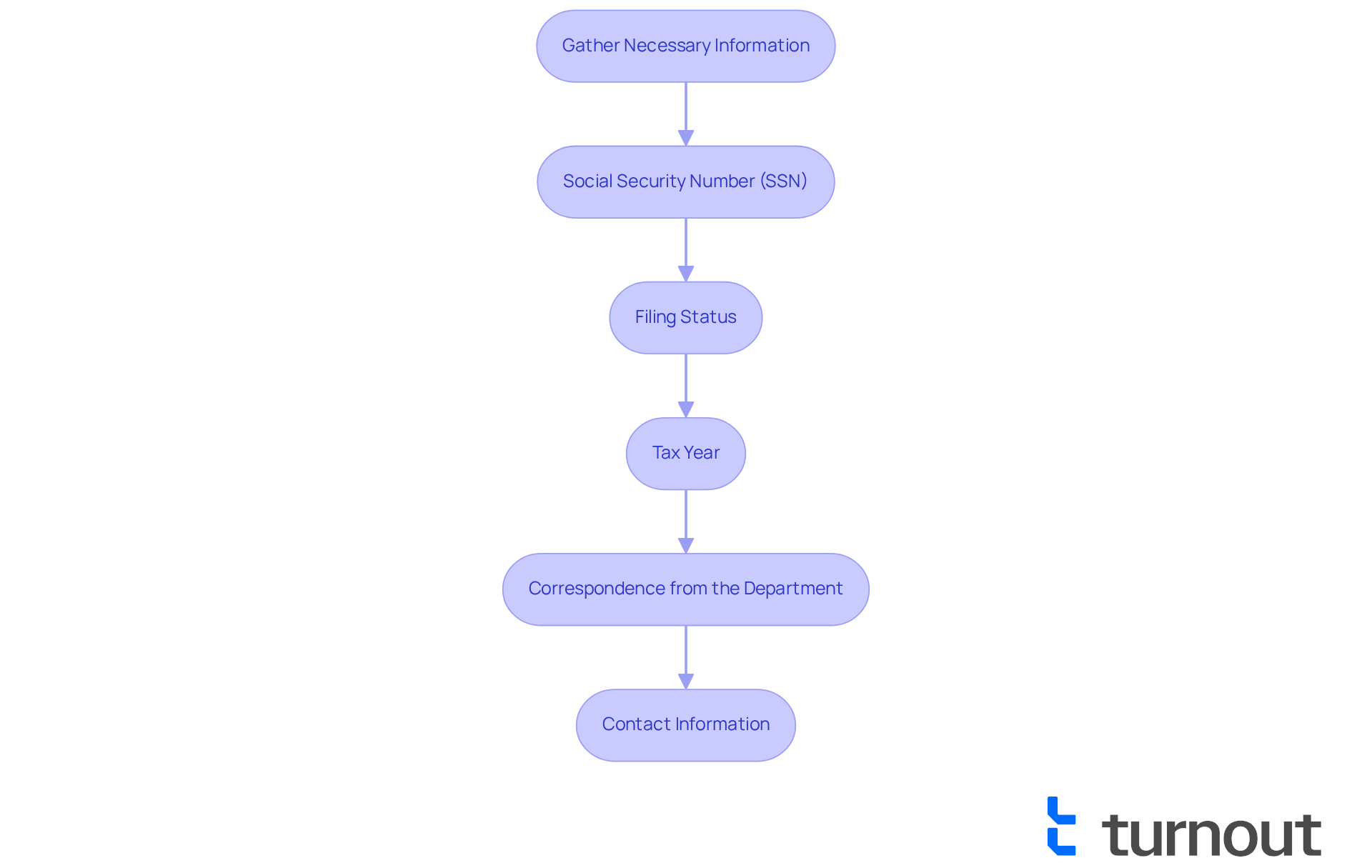

Gather Necessary Information Before You Start

Before you start looking for the Missouri tax refund phone number, we recognize that collecting the required information can seem overwhelming. To make this process smoother for you, please prepare the following details:

- Your Social Security Number (SSN): This is vital for identifying your tax records and ensuring precise handling of your request.

- Filing Status: Be ready to indicate whether you filed as single, married, head of household, etc. This detail is essential for the tax authorities.

- Tax Year: Clearly indicate the year for which you are inquiring about the refund. This helps streamline the process.

- Any Correspondence from the Department of Revenue: If you have received any letters or notices, keep them accessible. They may include pertinent details that can aid in your investigation.

- Your Contact Information: Ensure you have your current address and phone number ready, as this may be required during the inquiry process.

Having this information prepared will make the next steps smoother and more efficient. It’s important to note that many taxpayers experience delays due to insufficient information when contacting tax authorities. Tax professionals emphasize that being well-prepared, including having the Missouri tax refund phone number, can help mitigate these delays and facilitate a smoother resolution to your refund inquiries. Remember, you are not alone in this journey. The IRS encourages you to utilize online tools available at IRS.gov for immediate answers to tax-related questions. We're here to help you every step of the way.

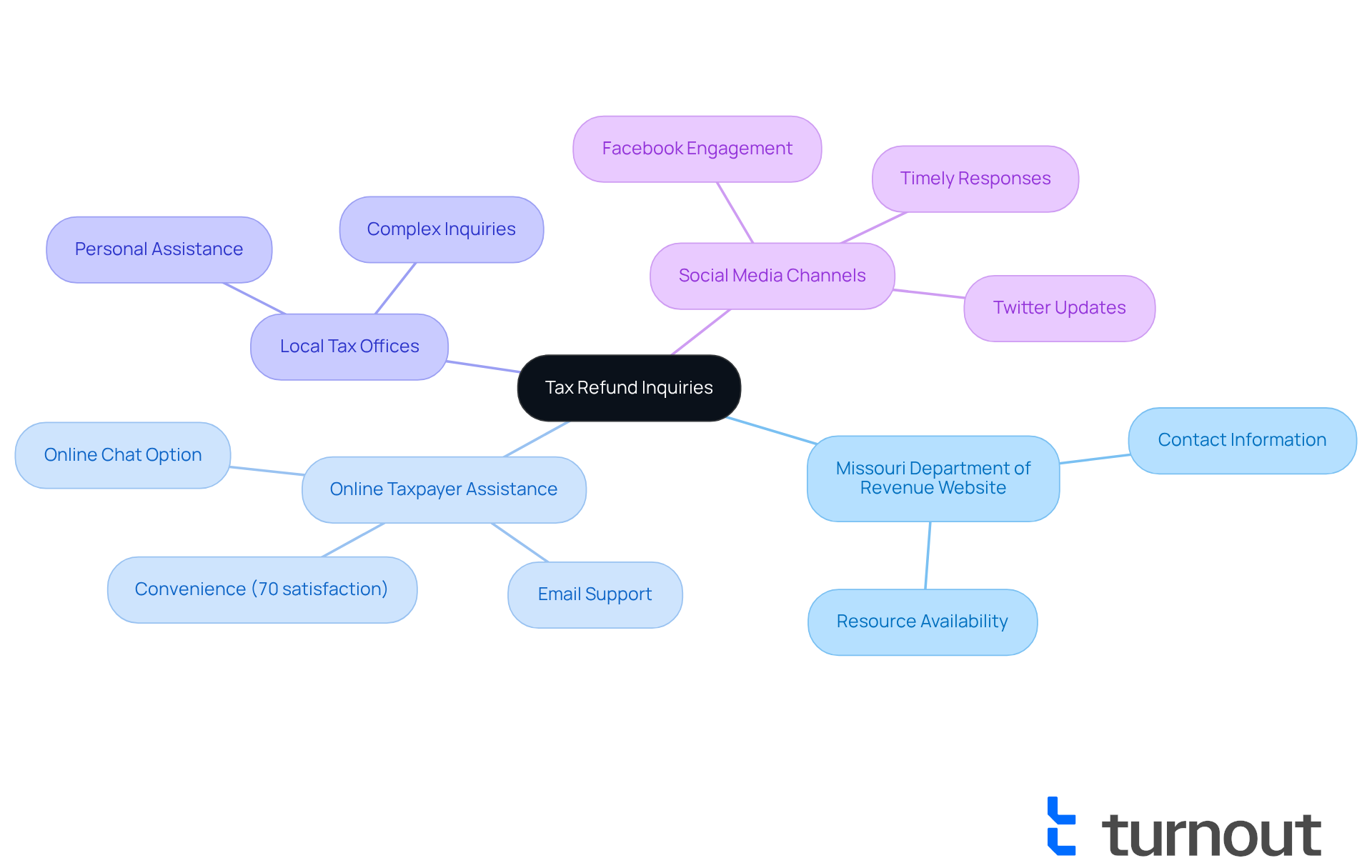

Identify Key Resources for Tax Refund Inquiries

Finding the Missouri tax refund phone number may seem overwhelming, but we are here to assist you. You can start by visiting the Missouri Department of Revenue Website at dor.mo.gov. This official site is a treasure trove of information about tax refunds and provides essential contact details.

If you have immediate questions, consider using the Online Taxpayer Assistance features available on the website. The online chat option or email support can offer prompt responses. Many taxpayers, about 70%, find these online services convenient and efficient.

For those who prefer a personal touch, Local Tax Offices are a great option. You can locate your nearest Missouri Department of Revenue office through their website. This can be especially beneficial for more complex inquiries.

Additionally, following the Social Media Channels of the Missouri Department of Revenue on platforms like Twitter or Facebook can keep you updated and provide quick access to contact information. Engaging with these channels often results in timely responses and extra support.

These resources will help you find the Missouri tax refund phone number and provide further assistance as you navigate this process. Remember, using online taxpayer support can simplify your experience, making it easier to address your tax questions. Just be cautious when sharing personal information via email, as security is important. You're not alone in this journey, and we're here to support you every step of the way.

Contact the Missouri Department of Revenue Directly

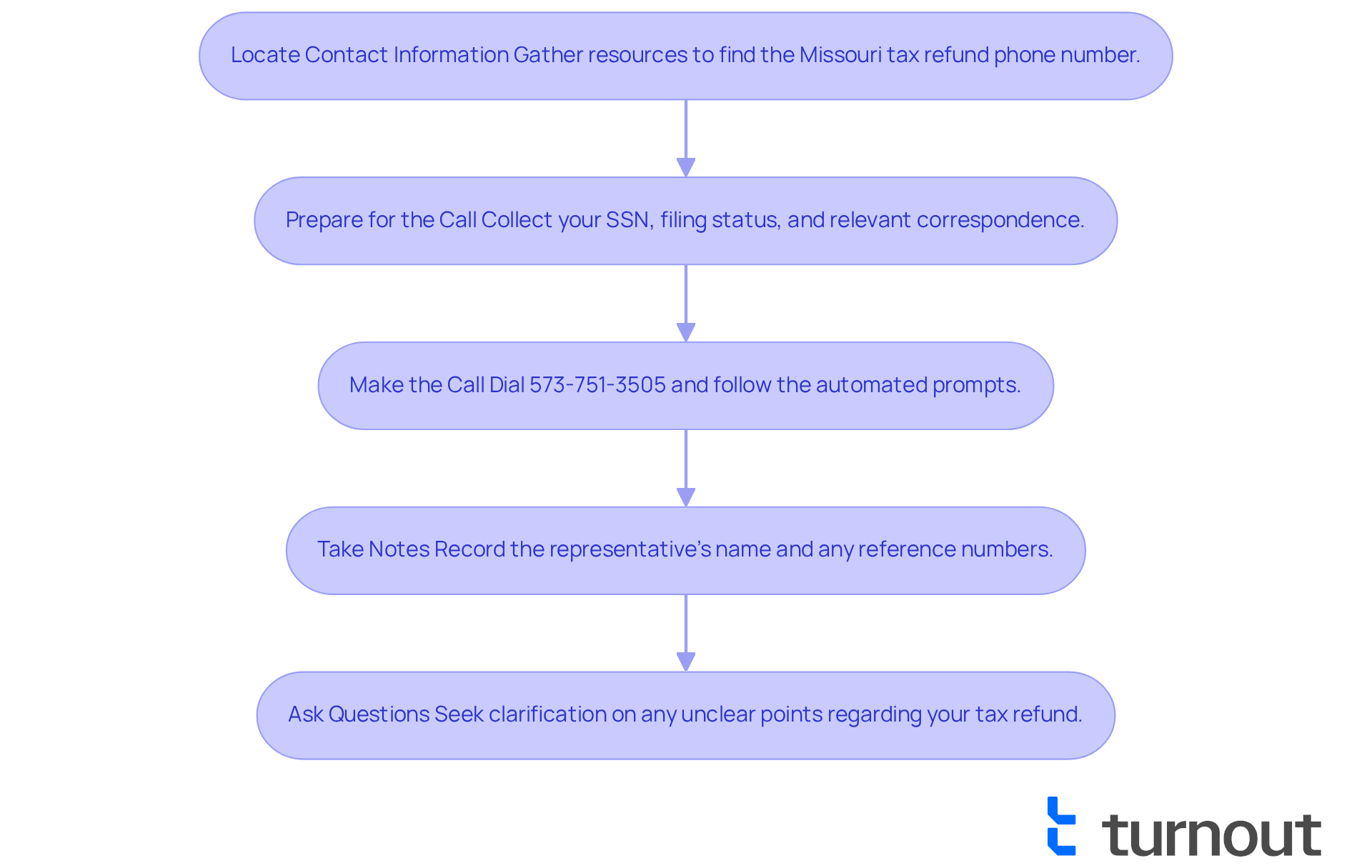

If you're feeling uncertain about how to contact the Missouri Department of Revenue regarding your tax refund, you can look up the Missouri tax refund phone number for assistance. Here are some essential steps to help you navigate this process with confidence:

- Locate the contact information by gathering the necessary resources to find the correct Missouri tax refund phone number for your inquiries. You can reach the Individual Income Tax office at PO Box 2200, Jefferson City, MO 65105-2200, or call the Missouri tax refund phone number, which is 573-751-3505.

- Prepare for the Call: Before you make the call, take a moment to gather all the important information you'll need. This includes your Social Security Number (SSN), your filing status, and any relevant correspondence. Being prepared can ease your mind.

- Make the Call: When you're ready, dial the number and follow the automated prompts. It’s common to experience some wait times, so be patient with the process.

- Take Notes: During your conversation, jot down important details like the representative's name and any reference numbers they provide. This information can be invaluable for any future inquiries.

- Ask Questions: Remember, it’s perfectly okay to seek clarification on any points that seem unclear. Understanding the next steps regarding your tax refund is crucial.

Statistics show that taxpayers who prepare thoroughly for their calls often achieve a higher success rate in obtaining the information they need during their first attempt. For example, a study revealed that 70% of well-prepared callers received the information they sought on their initial call. By following these steps, you can approach the process with clarity and assurance.

Additionally, consider utilizing the fax contact for individual income tax inquiries at 573-522-1762 or the automated inquiry line for property tax credit claims at 573-526-8299 for further assistance. If you need to send documents quickly, express or overnight packages should be directed to the Taxation Division at 301 West High St., Room 102, Jefferson City, MO 65101.

As Arthur C. Clarke wisely noted, "The best measure of a man’s honesty isn’t his income tax return. It’s the zero adjust on his bathroom scale." This serves as a gentle reminder of the importance of being prepared and honest in your dealings with tax authorities. Remember, we're here to help you through this journey.

Troubleshoot Common Issues When Searching for Your Refund Number

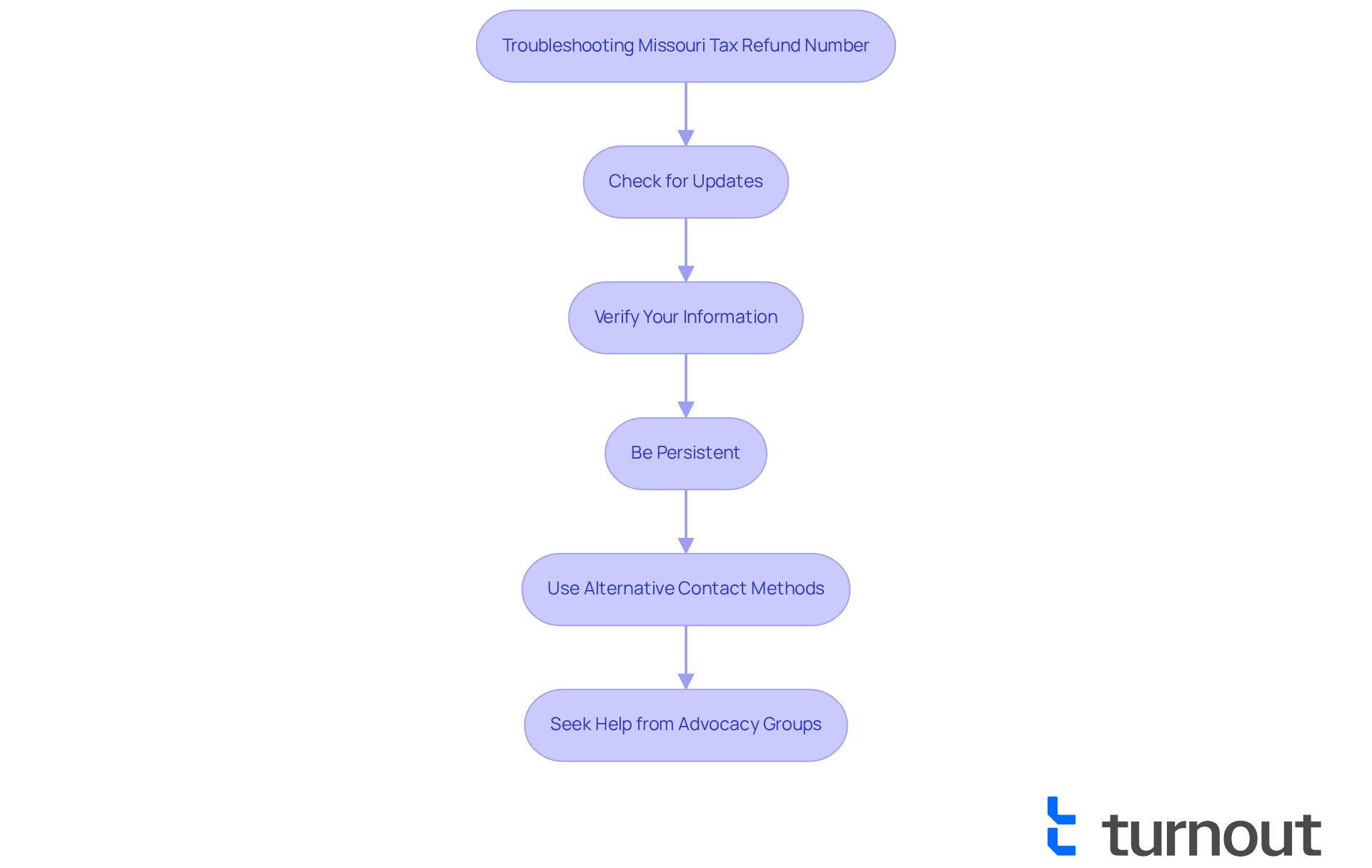

If you are encountering difficulties while looking for the Missouri tax refund phone number, we recognize how frustrating that situation can be. Here are some supportive tips to help you navigate this process:

- Check for Updates: Make sure you have the most current contact details from the Missouri Department of Revenue website. Staying informed can make a difference.

- Verify Your Information: It’s important to double-check that the information you’ve gathered is accurate, including your SSN and tax year. This can save you time and effort.

- Be Persistent: If you cannot reach a representative right away, don’t lose hope. Try calling at different times of the day to avoid peak hours; patience can pay off.

- Use Alternative Contact Methods: If phone calls aren’t yielding results, consider reaching out through email or online chat options. These methods may provide the assistance you need.

- Seek Help from Advocacy Groups: If you continue to face challenges, remember that you are not alone. Consumer advocacy organizations are available to offer additional support and guidance.

By following these troubleshooting steps, you can overcome common obstacles and successfully locate the Missouri tax refund phone number. Remember, we’re here to help you through this journey.

Conclusion

Navigating the Missouri tax refund inquiry process can feel overwhelming, but with the right preparation and resources, it can be much simpler. By gathering essential information such as your Social Security Number, filing status, and any relevant correspondence, you can significantly enhance your chances of a smooth experience when reaching out to the Missouri Department of Revenue.

We understand that this process can be challenging. That's why we've highlighted key strategies throughout this guide, including:

- Utilizing the Missouri Department of Revenue website

- Engaging with online taxpayer assistance

- Being persistent in your communication efforts

These steps not only help you locate the necessary contact information but also empower you to address your refund inquiries with confidence. If you encounter any common challenges along the way, remember that troubleshooting tips can help you overcome them.

Ultimately, staying informed and prepared is crucial for successfully navigating your tax refund inquiries. We encourage you to take proactive steps in gathering the required information and utilizing the available resources. By doing so, you can ensure a more seamless experience and potentially resolve any issues more quickly. Remember, the journey toward retrieving your tax refund doesn't have to be daunting; with the right tools and knowledge, it can be a manageable task. You're not alone in this journey, and we're here to help you every step of the way.

Frequently Asked Questions

What information do I need to gather before looking for the Missouri tax refund phone number?

You need to prepare your Social Security Number (SSN), filing status, tax year, any correspondence from the Department of Revenue, and your current contact information.

Why is my Social Security Number important when inquiring about my tax refund?

Your SSN is vital for identifying your tax records and ensuring precise handling of your request.

What filing statuses should I be ready to indicate?

You should be prepared to indicate whether you filed as single, married, head of household, etc.

How does specifying the tax year help in the inquiry process?

Clearly indicating the tax year for which you are inquiring about the refund helps streamline the process.

Why should I keep any correspondence from the Department of Revenue accessible?

Correspondence may include pertinent details that can aid in your investigation regarding your tax refund.

What contact information should I have ready during the inquiry process?

Ensure you have your current address and phone number ready, as this may be required during the inquiry.

How can being well-prepared help mitigate delays when contacting tax authorities?

Many taxpayers experience delays due to insufficient information, so being well-prepared can facilitate a smoother resolution to refund inquiries.

Where can I find immediate answers to tax-related questions?

The IRS encourages you to utilize online tools available at IRS.gov for immediate answers to tax-related questions.