Overview

A levy is a legal seizure of property or assets, often carried out by government agencies to collect unpaid debts. We understand that this can significantly impact your financial stability and access to essential resources. It’s common to feel overwhelmed by such situations. This article explains how levies can lead to the loss of wages, bank funds, or Social Security benefits.

Understanding your rights and options is crucial in navigating these challenging circumstances effectively. Remember, you are not alone in this journey, and we’re here to help you find the best path forward.

Introduction

Understanding the complexities of levies is crucial in today's financial landscape. We recognize that government agencies can seize assets to recover unpaid debts, which can feel overwhelming. This article explores the various types of levies—tax, bank, and wage garnishments—highlighting their potential impact on both individuals and businesses.

As financial burdens grow, it's common to wonder how to effectively navigate these challenging situations. How can you protect your vital resources? Exploring proactive measures and available support can illuminate the path toward financial stability and peace of mind. Remember, you're not alone in this journey; we're here to help you find the right solutions.

Define Levy: Understanding Its Meaning and Purpose

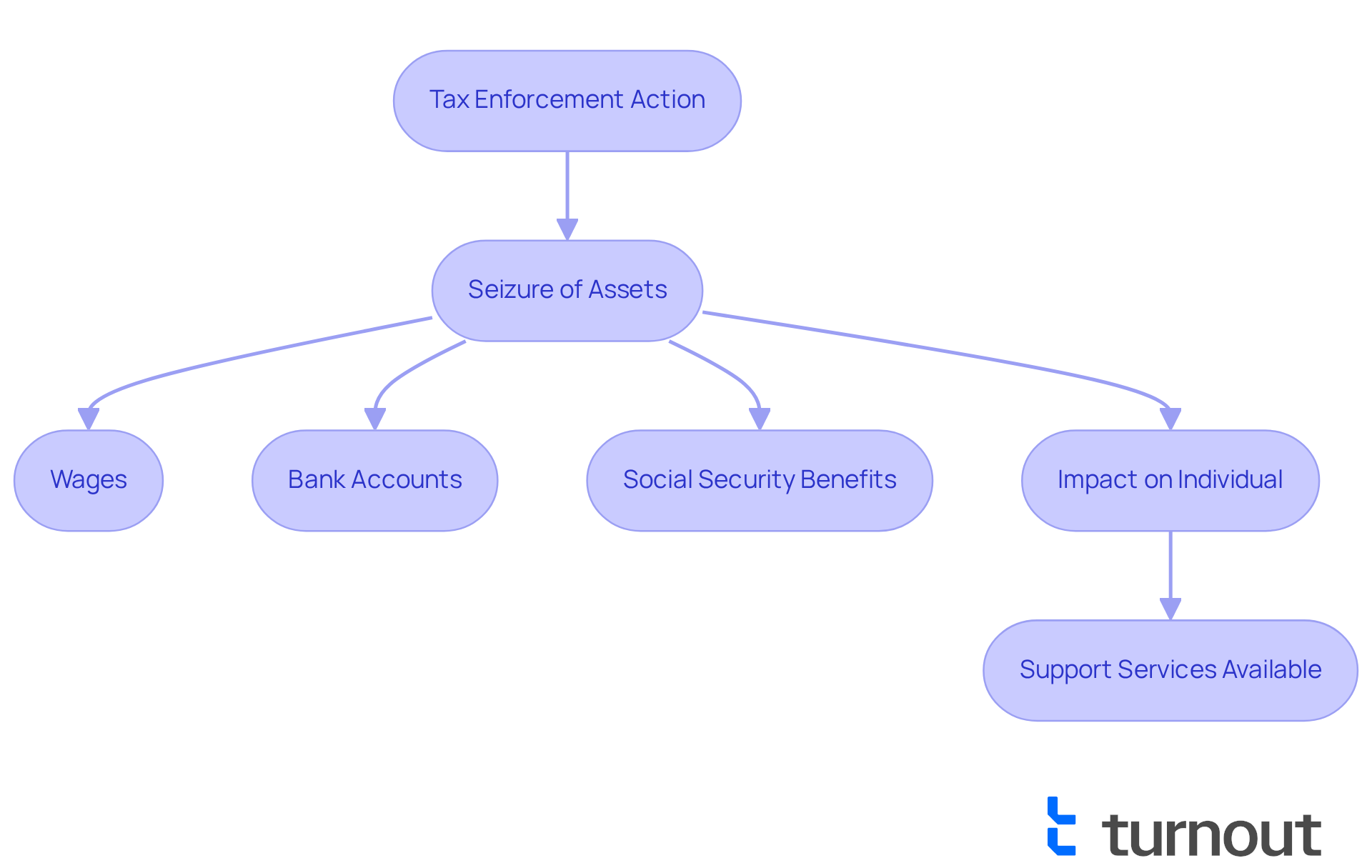

A tax is a legal seizure of property or assets to satisfy an outstanding debt. This process is often employed by government agencies, such as the IRS, to collect unpaid taxes. When a tax enforcement action is enacted, it enables the agency to seize a taxpayer's assets, which may encompass wages, bank accounts, and even Social Security benefits.

We understand that encountering such situations can be overwhelming, especially during economic hardships. Understanding what’s a levy is vital, as it can greatly influence your economic stability and access to essential resources.

At Turnout, we're here to help. We provide tools and services designed to assist you in navigating these complex situations, particularly those related to Social Security Disability (SSD) claims and tax debt relief. Our trained nonlawyer advocates and IRS-licensed enrolled agents are dedicated to supporting you in understanding your rights and options. You are not alone in this journey; we ensure you have access to the financial assistance you need.

Explore Types of Levies: Tax, Bank, and More

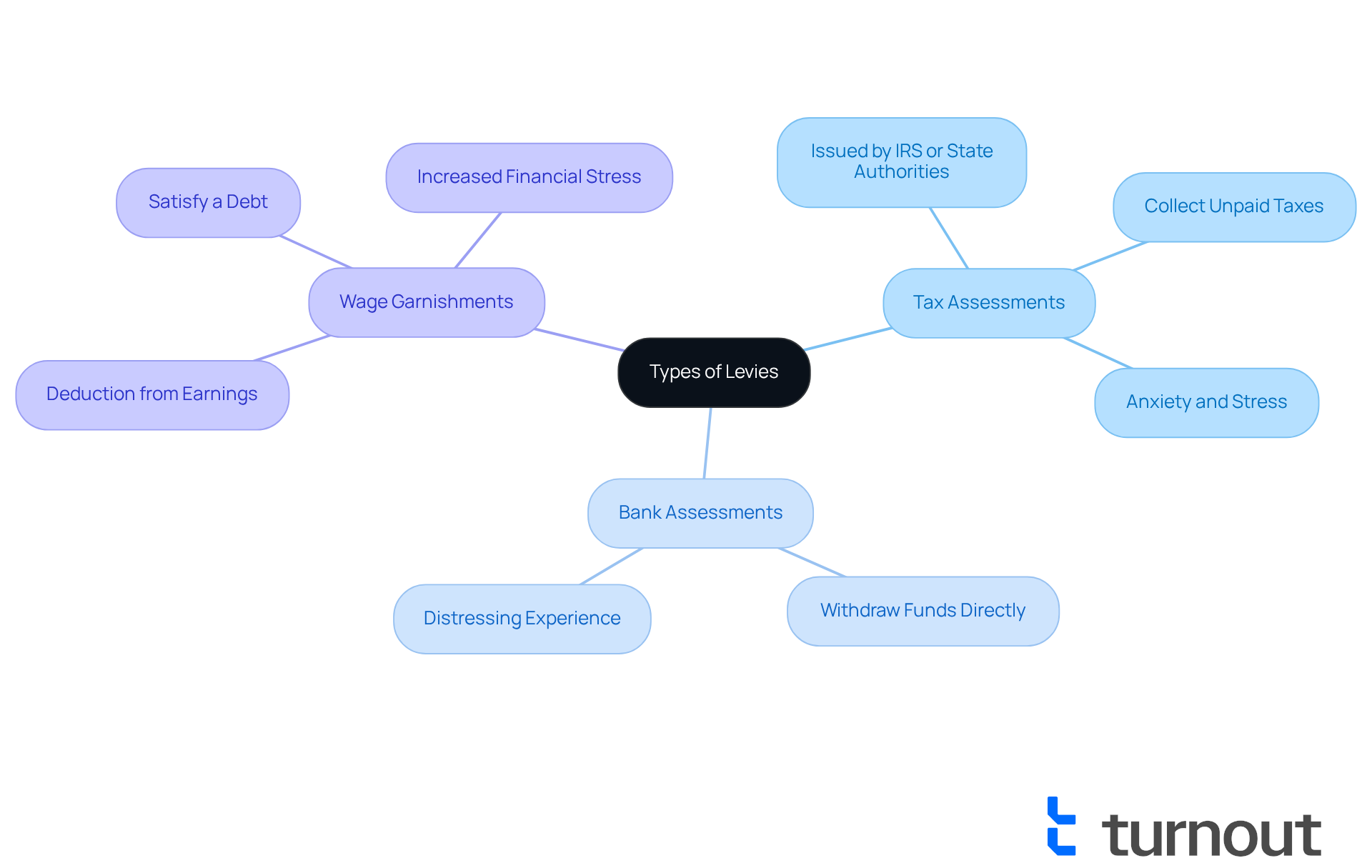

We understand that navigating financial assessments can be overwhelming. There are various forms of assessments that you might encounter, including:

- Tax assessments

- Bank assessments

- Wage garnishments

A tax assessment is typically issued by the IRS or state tax authorities to collect unpaid taxes. It's common to feel anxious when faced with such notices. A bank seizure allows these agencies to withdraw funds directly from your bank account, which can be a distressing experience. Wage garnishments involve the direct deduction of a portion of your earnings to satisfy a debt, adding more stress to your financial situation. Each category of charge has its own procedures and implications. Therefore, it is essential for you to understand how they operate and the potential consequences you may encounter. Remember, you're not alone in this journey, and we're here to help you navigate these challenges.

Examine Implications of Levies: Effects on Individuals and Businesses

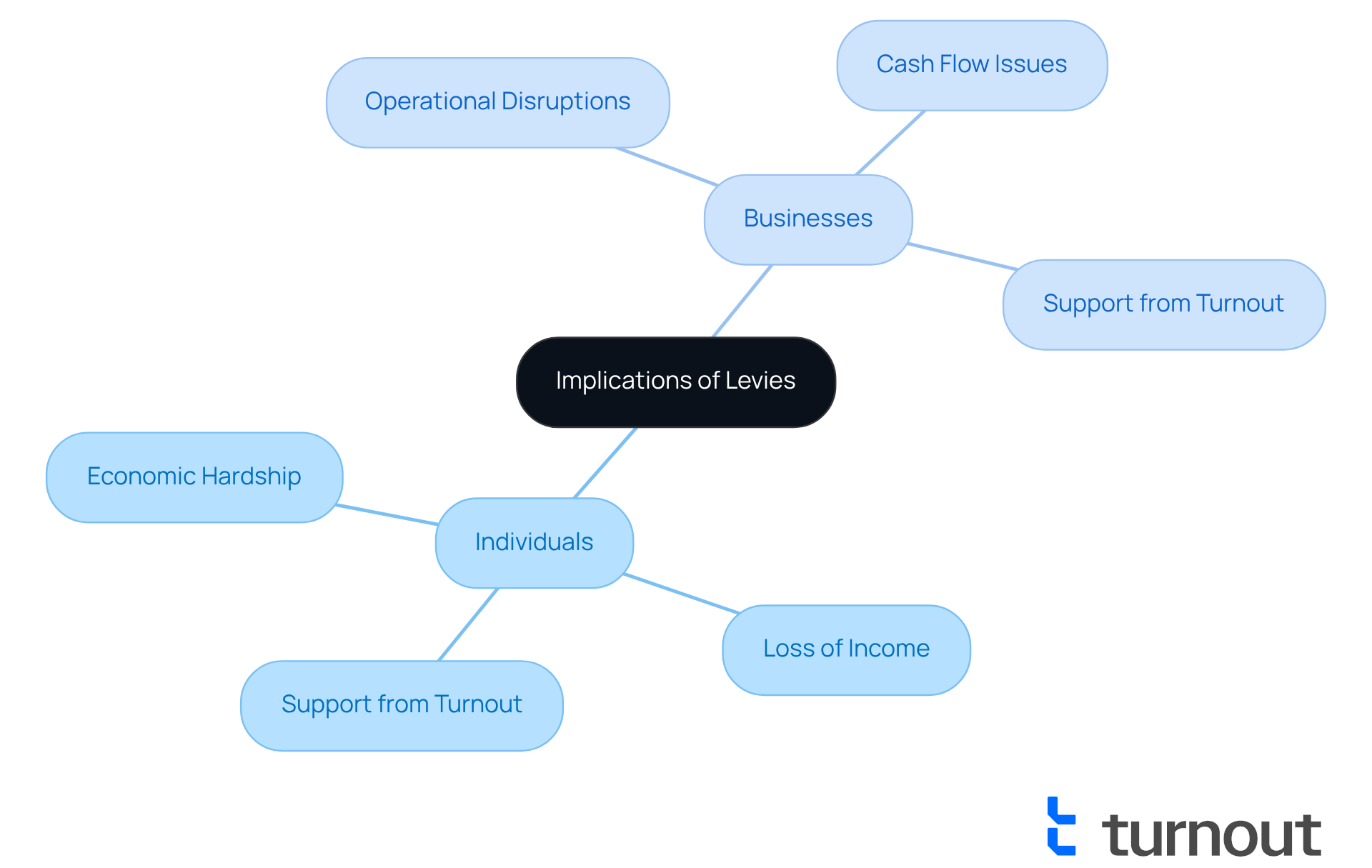

Understanding what’s a levy is important, as it can have severe consequences for both individuals and businesses. We understand that a tax can lead to immediate economic hardship, potentially resulting in the loss of vital income or savings. For instance, if Social Security benefits are levied, it can jeopardize a person's ability to meet basic living expenses. Tax assessments can complicate financial circumstances further, making it difficult for individuals to manage their tax responsibilities.

It's common to feel overwhelmed when facing these challenges, but Turnout provides tools and services to help consumers navigate them. Particularly for those dealing with SSD claims and tax debt relief, our trained nonlawyer advocates are here to support you. They can help you understand your rights and options without the need for legal representation.

For businesses, the implications can be just as daunting. If bank accounts are levied, which raises the question of what's a levy, operational disruptions can occur, leading to cash flow issues and potential insolvency. Understanding these implications is crucial for navigating your financial situation effectively. Remember, you are not alone in this journey. Turnout is here to assist you every step of the way.

Identify Strategies to Avoid Levies: Proactive Measures for Consumers

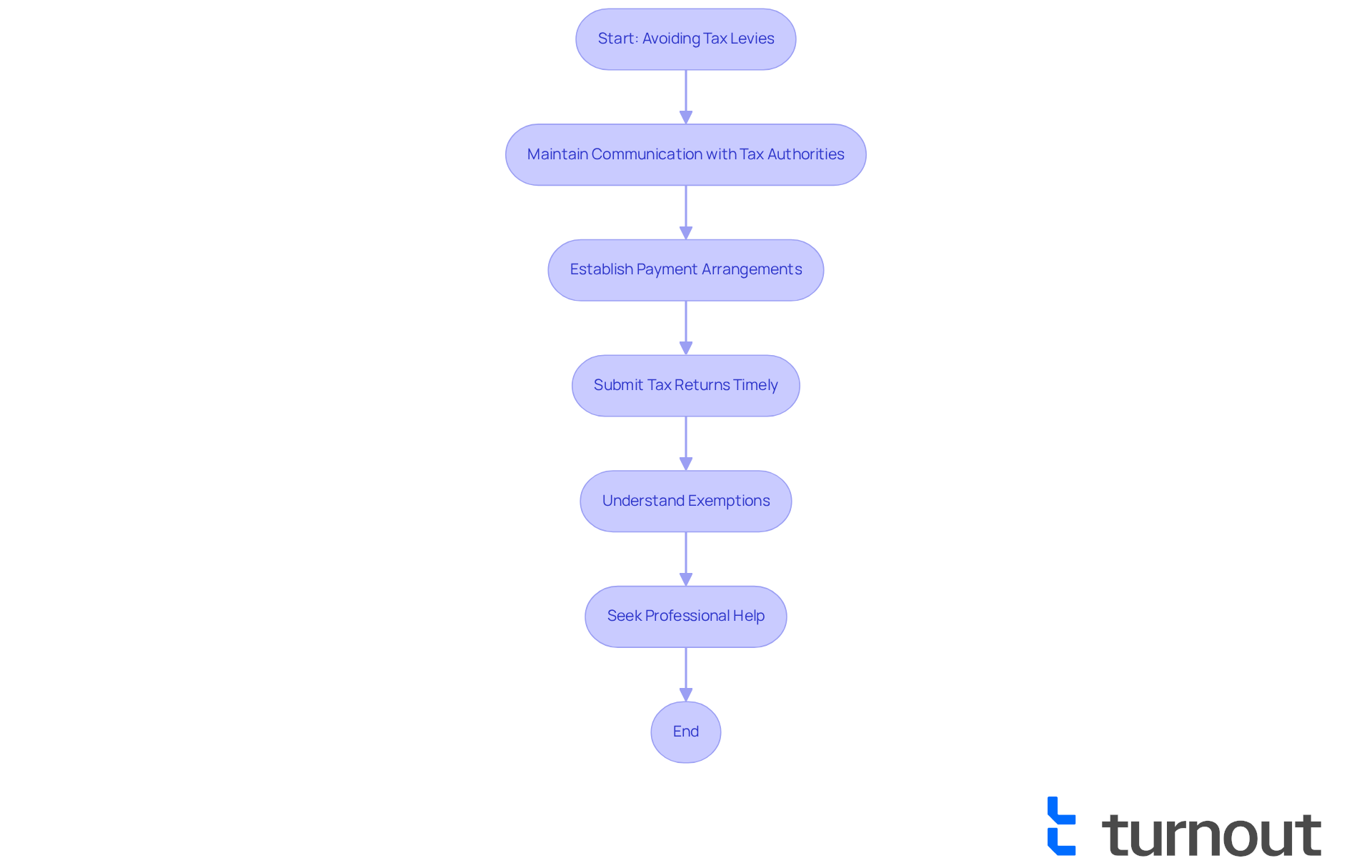

We understand that facing tax challenges can be overwhelming. To prevent charges, it's essential for consumers to take proactive steps. Maintaining open communication with tax authorities is crucial. Establishing payment arrangements for any outstanding debts and ensuring timely submission of tax returns can significantly help.

Additionally, you can protect certain assets by understanding the exemptions that may apply to your situation. For instance, benefits like Social Security might have safeguards against seizures under specific conditions.

Turnout is here to provide valuable assistance in navigating these complexities. Our trained nonlawyer advocates and IRS-licensed enrolled agents are dedicated to helping clients understand their rights and options regarding SSD claims and tax relief.

By being informed and proactive, you can significantly reduce the risk of facing what's a levy. Remember, you are not alone in this journey; we're here to help.

Conclusion

Understanding levies is crucial for anyone navigating the complexities of tax obligations and financial stability. A levy represents a significant legal action that can lead to the seizure of assets, impacting both individuals and businesses. It’s important to be informed about the different types of levies—such as tax, bank, and wage garnishments—because these actions can profoundly affect your financial well-being and access to essential resources.

We recognize that levies can impose severe consequences, particularly on vulnerable populations relying on benefits like Social Security. It’s common to feel overwhelmed, but proactive measures can help you avoid such situations. Maintaining open communication with tax authorities and understanding applicable exemptions are vital steps. Additionally, support services provided by organizations like Turnout are invaluable resources for those facing these challenges, ensuring you are aware of your rights and options.

Ultimately, being proactive and informed is paramount in mitigating the risks associated with levies. By taking necessary steps to understand and navigate these financial challenges, you can better protect your assets and maintain your economic stability. Remember, you are not alone in this journey. Seeking assistance and utilizing available resources empowers you to face potential financial hardships with confidence.

Frequently Asked Questions

What is a levy in the context of taxes?

A levy is a legal seizure of property or assets by government agencies, such as the IRS, to collect unpaid taxes or satisfy an outstanding debt.

What types of assets can be seized through a levy?

A levy can result in the seizure of various assets, including wages, bank accounts, and Social Security benefits.

Why is it important to understand what a levy is?

Understanding what a levy is vital because it can significantly influence your economic stability and access to essential resources, especially during challenging financial times.

How can Turnout assist individuals dealing with levies?

Turnout provides tools and services to help individuals navigate complex situations related to levies, particularly concerning Social Security Disability (SSD) claims and tax debt relief.

Who are the advocates at Turnout?

The advocates at Turnout include trained nonlawyer advocates and IRS-licensed enrolled agents dedicated to helping individuals understand their rights and options regarding tax issues and levies.