Overview

We understand that navigating insurance can be overwhelming, especially when it comes to the elimination period. This is the waiting time between the onset of a disability or illness and when benefit payments begin. Typically, this period can range from 30 days to two years, depending on your policy.

Recognizing the significance of this timeframe is essential for your financial planning. A shorter elimination period may provide quicker support, but it often comes with higher premiums. On the other hand, opting for a longer period can lead to cost savings, although it might delay the financial assistance you need during recovery.

It's common to feel uncertain about these choices, but we're here to help you make informed decisions that suit your needs. Remember, you are not alone in this journey, and understanding your options is a vital step toward securing your peace of mind.

Introduction

Navigating the intricacies of insurance can often feel like finding your way through a complex maze. We understand that the elimination period—a crucial yet frequently overlooked aspect of coverage—can be particularly daunting. This waiting period, which determines when benefits begin following a disability or illness, significantly influences financial strategies during challenging times.

As you consider the implications of various waiting times, it’s common to wonder: how do you balance the need for immediate support with the cost of premiums?

Exploring this essential concept not only clarifies your options but also empowers you to make informed decisions that align with your unique circumstances. Remember, you're not alone in this journey; we're here to help you every step of the way.

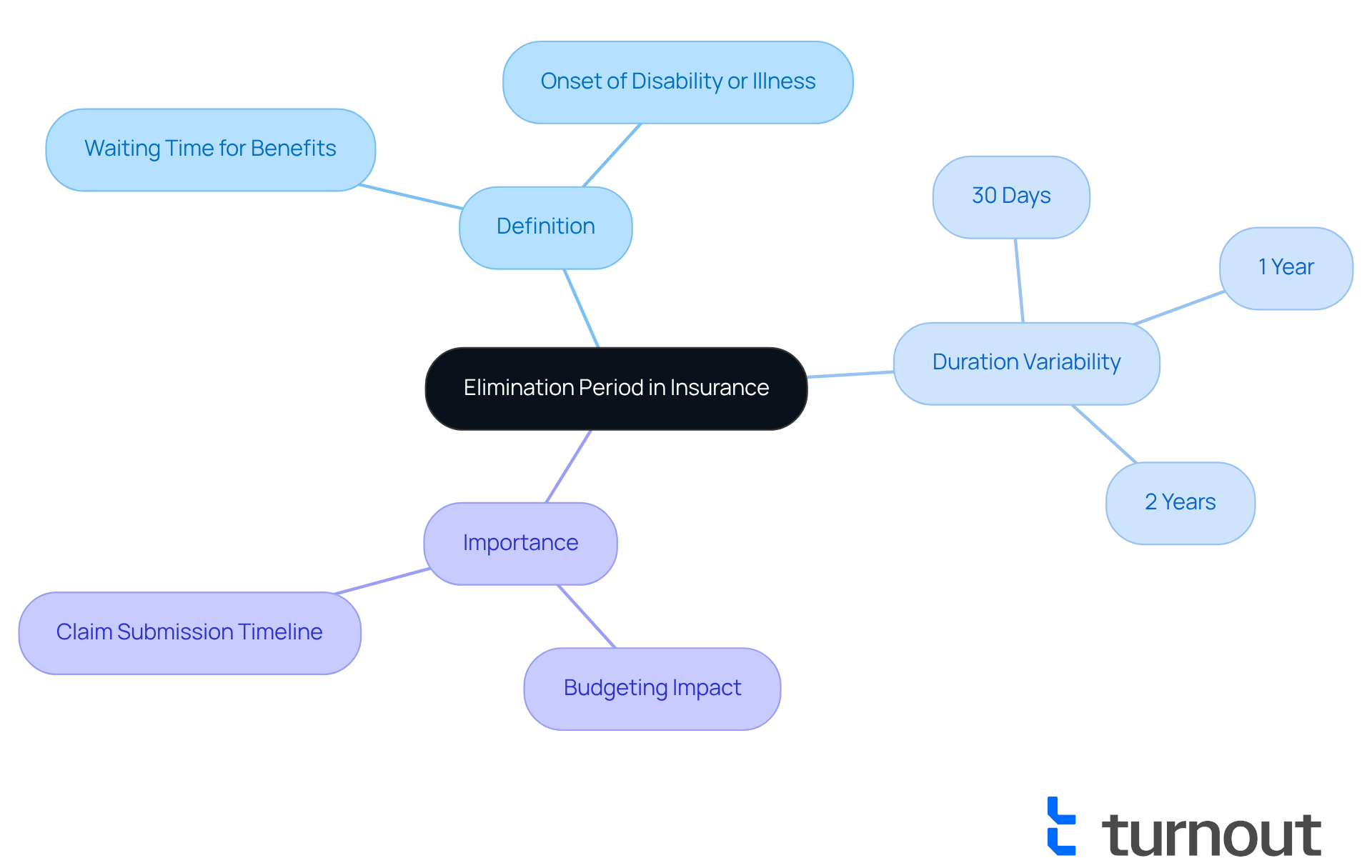

Define the Elimination Period in Insurance

In insurance, an elimination period refers to the waiting time between the onset of a disability or illness and when benefit payments from an insurer begin. We understand that this waiting time is crucial, as it determines when you can start receiving assistance after submitting a claim. Generally, the elimination period can vary, ranging from 30 days to two years, depending on the specific policy and the insurer's conditions.

It's common to feel overwhelmed when navigating these details, especially when seeking support or long-term care coverage. Grasping this concept is essential, as it directly impacts your budgeting during times of need. Remember, you are not alone in this journey; we’re here to help you understand your options and make informed decisions.

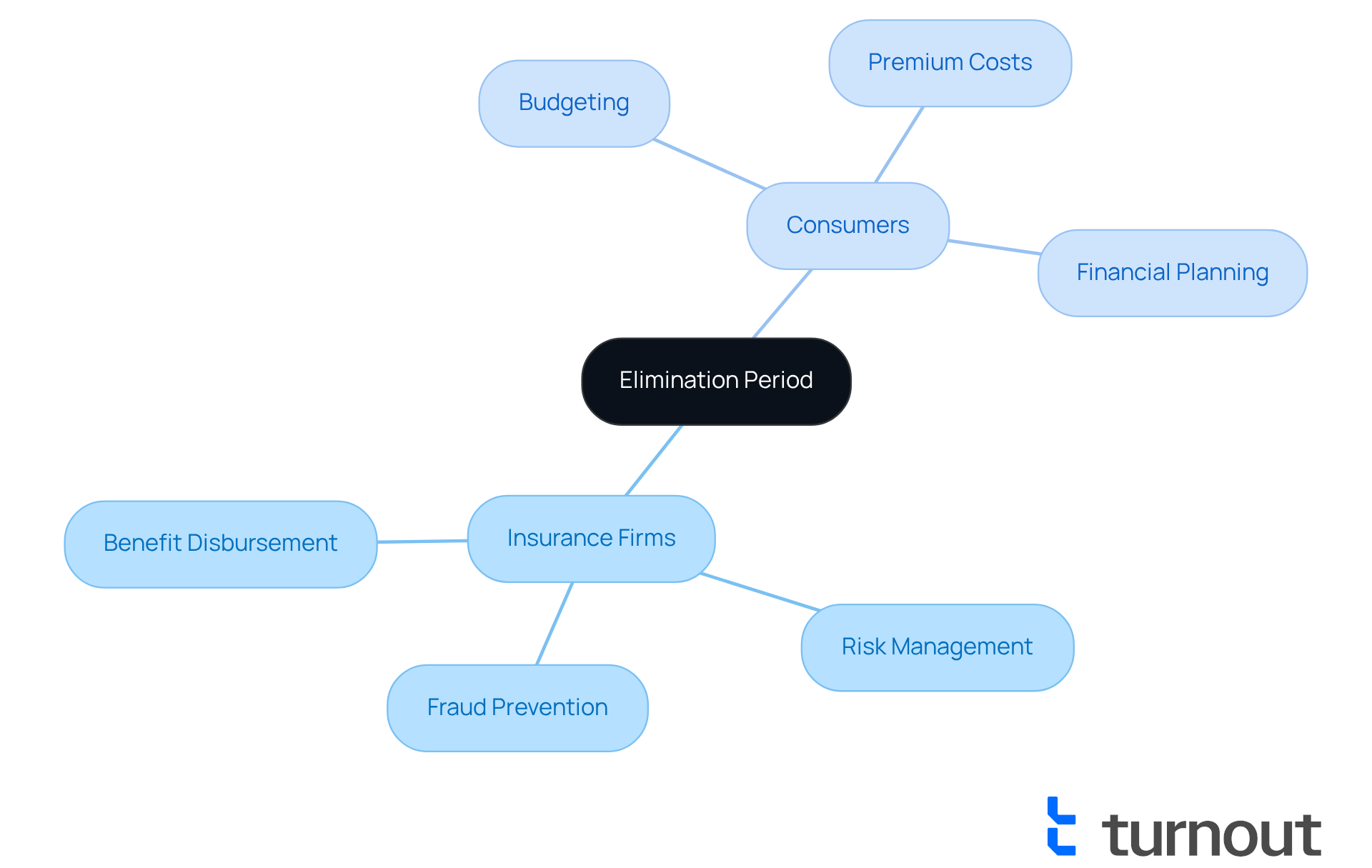

Context and Importance of the Elimination Period

The waiting phase serves as a protective measure for insurance firms, helping them manage risks effectively. By asking policyholders to wait before benefits are disbursed, insurers can minimize the chances of fraudulent claims. This ensures that support reaches those who genuinely need it, particularly individuals with long-term disabilities.

For consumers, understanding what is an elimination period is essential for effective budgeting. It influences not only when benefits are received but also the overall cost of premiums. Generally, shorter waiting times lead to higher premiums, while longer durations can result in cost savings. This trade-off is a crucial consideration for individuals as they select coverage plans that align with their financial situations and health needs.

We understand that navigating these choices can be overwhelming. You're not alone in this journey, and we're here to help you make informed decisions that best suit your circumstances. Consider how the waiting phase, or what is an elimination period, impacts your financial planning, and know that taking the time to understand these factors can lead to better outcomes for your health and finances.

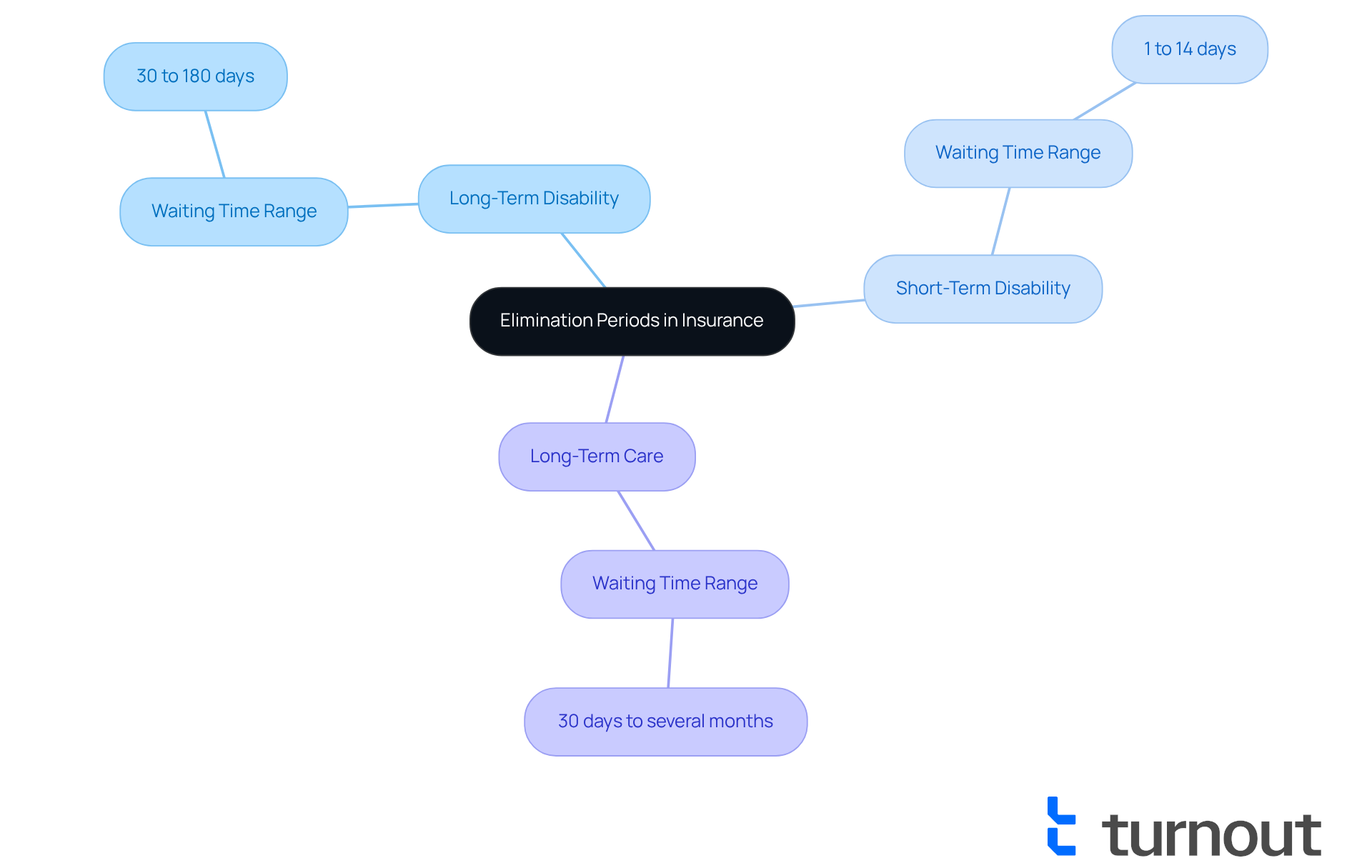

Variations in Elimination Periods Across Insurance Types

We understand that navigating the world of insurance can feel overwhelming, particularly when you are trying to figure out what is an elimination period for coverage plans. For instance, in long-term disability coverage, what is an elimination period may refer to waiting times that range from 30 to 180 days. In contrast, short-term disability plans can offer waiting times as brief as 1 to 14 days, prompting the inquiry of what is an elimination period. In long-term care insurance, what is an elimination period refers to the waiting periods that may extend from 30 days to several months, depending on the specific policy.

These differences are not just numbers; they reflect the nature of the coverage you need and how insurers assess risk. Recognizing these distinctions is crucial for you as a consumer. It empowers you to select policies that align with your unique situation and financial capabilities. Remember, you are not alone in this journey. We're here to help you make informed choices that support your well-being.

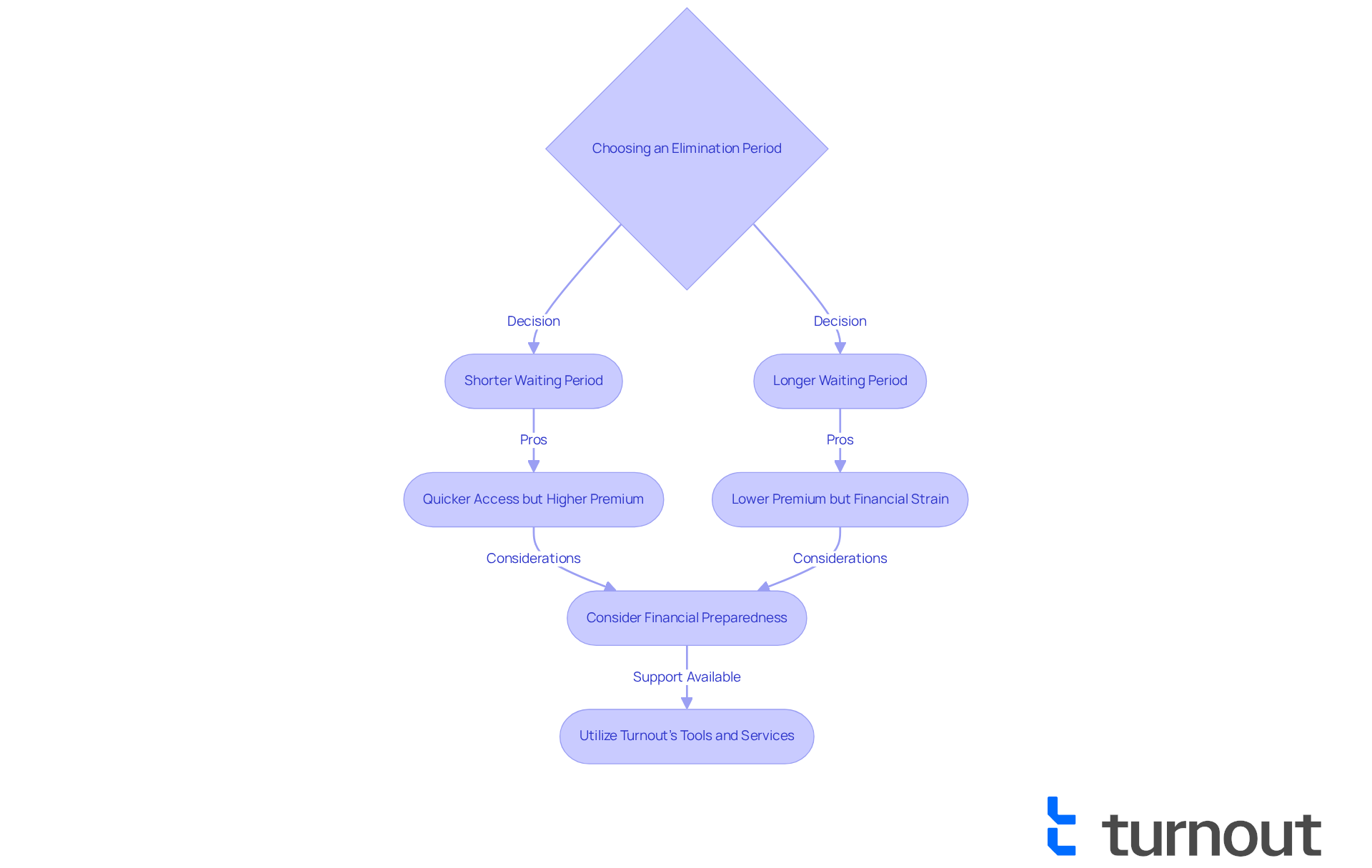

Implications of Choosing an Elimination Period

Choosing a waiting duration is a significant decision that can have lasting effects on your financial well-being. We understand that a shorter waiting time may provide quicker access to assistance, which can be crucial for those facing urgent financial pressures due to a disability. However, this convenience often comes with a higher premium cost. On the flip side, opting for a longer waiting duration can help reduce monthly expenses, making insurance more affordable, but it may leave you without financial support for an extended period during recovery.

For example, if you have a 90-day waiting period, you might find yourself relying on savings or other income sources during that time. This situation can lead to financial strain if you're not adequately prepared. It’s important to comprehend what is an elimination period when selecting a waiting duration, as this knowledge can help you prepare for potential financial challenges.

Additionally, we want you to know that Turnout offers a variety of tools and services designed to assist you in navigating the complexities of government benefits, like Social Security Disability (SSD) claims. By working with trained nonlawyer advocates, Turnout ensures you have the support you need to effectively manage your financial situation during what is an elimination period. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding the elimination period in insurance is crucial for anyone seeking coverage. It directly influences when benefits are received and how financial planning is approached. This waiting period, which can vary from a few days to several months, is not merely a technical detail; it is a vital component that shapes the overall insurance experience and impacts the financial security of policyholders in times of need.

We understand that the elimination period serves as both a protective measure for insurers and a significant consideration for consumers. Shorter waiting times may provide quicker access to benefits, but they often come with higher premiums. On the other hand, longer periods can reduce costs, potentially leading to financial strain during recovery. Moreover, the variations in elimination periods across different types of insurance highlight the importance of tailoring coverage to fit individual circumstances and financial capabilities.

Ultimately, making an informed decision about the elimination period can lead to better financial outcomes and peace of mind. Engaging with knowledgeable advocates and utilizing available resources can empower you to navigate this complex landscape. By recognizing the implications of your choices, you can ensure that you select insurance policies that not only meet your immediate needs but also align with your long-term financial goals. Remember, you're not alone in this journey; we're here to help you every step of the way.

Frequently Asked Questions

What is an elimination period in insurance?

An elimination period in insurance is the waiting time between the onset of a disability or illness and when benefit payments from an insurer begin.

Why is the elimination period important?

The elimination period is important because it determines when you can start receiving assistance after submitting a claim, which can significantly impact your budgeting during times of need.

How long can the elimination period be?

The elimination period can vary, typically ranging from 30 days to two years, depending on the specific policy and the insurer's conditions.

What should I consider when navigating the elimination period?

It's essential to understand the elimination period as it directly affects your financial planning during times of need.

Where can I find support while dealing with insurance coverage?

You are not alone in this journey; there are resources available to help you understand your options and make informed decisions regarding your insurance coverage.