Overview

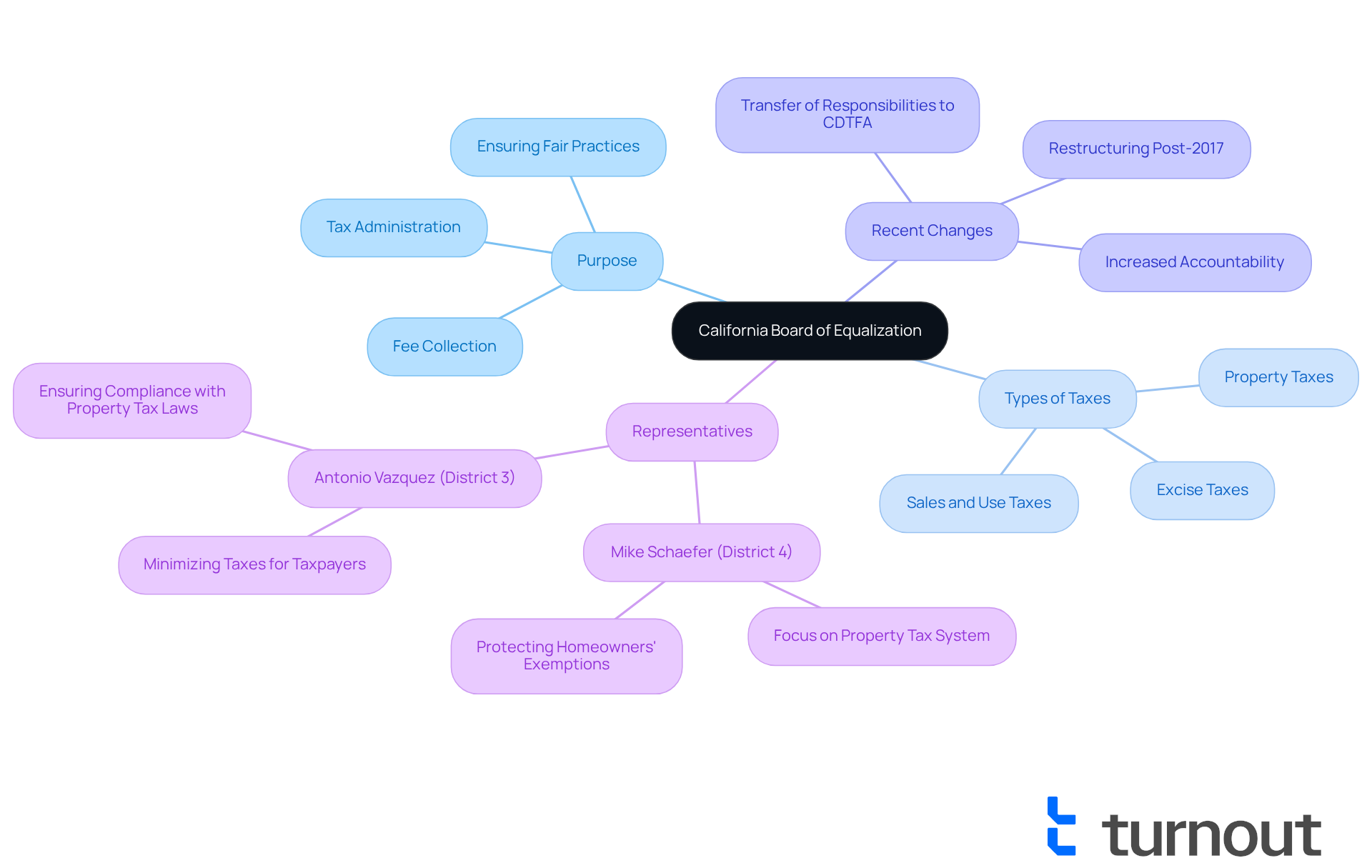

The California Board of Equalization (BOE) plays a vital role in our community, overseeing tax administration and ensuring fair practices across our state. This includes property, sales, and excise taxes. We understand that navigating tax matters can be challenging, and the BOE is here to support you in maintaining equitable tax assessments. Their efforts generate significant revenue for public services that benefit us all.

Recently, the BOE has undertaken restructuring initiatives aimed at improving accountability and efficiency in tax collection. These changes are designed with your needs in mind, ensuring that the tax system works better for everyone. Together, we can foster a fairer tax environment that supports our communities.

If you have questions or concerns, remember that you are not alone in this journey. The BOE is committed to helping you understand your rights and responsibilities. We encourage you to reach out for assistance, as they are dedicated to making the tax process as smooth as possible for all Californians.

Introduction

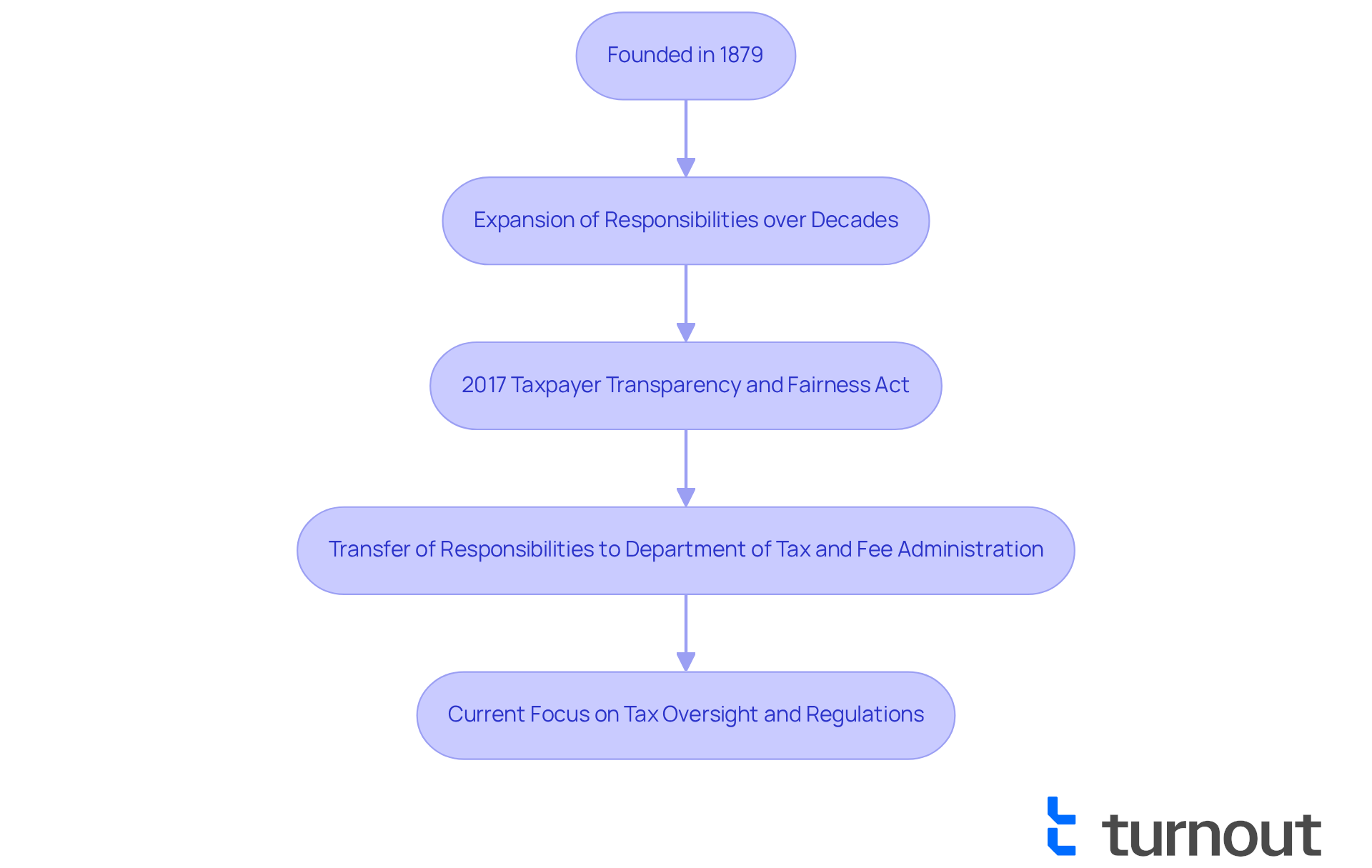

The California Board of Equalization (BOE) has been a vital part of our state's tax administration since 1879, ensuring fair and effective tax practices for all residents. We understand that navigating recent restructuring and controversies can be challenging, making it essential to grasp the BOE's purpose and functions.

How does the BOE adapt to these challenges while continuing to uphold taxpayer interests and maintain public trust? This article explores the BOE's history, responsibilities, and the ongoing reforms that are shaping its future, reassuring you that you are not alone in this journey.

Define the California Board of Equalization and Its Purpose

The CA has been a vital public agency since its establishment in 1879, dedicated to overseeing tax administration and fee collection across our state. Its primary mission is to serve you, the residents, by ensuring fair, effective, and efficient . The CA Board of Equalization administers various taxes, including property taxes, sales and use taxes, and excise taxes on specific goods. By maintaining consistent and fair evaluations across the 58 counties, the CA Board of Equalization protects your interests as taxpayers and ensures that local governments receive the essential funding needed for public services.

We understand that changes can be challenging. In recent years, the CA Board of Equalization has undergone significant restructuring, especially after 2017, when many of its responsibilities were transferred to the Department of Tax and Fee Administration (CDTFA). This shift arose from concerns about the BOE's effectiveness in and administration, as highlighted by a report from the California Department of Finance that pointed out misallocations of tax revenue. The restructuring aimed to . Despite these challenges, the CA Board of Equalization continues to play a crucial role in evaluating real estate values, which are essential for local tax levies. For the fiscal year 2025-26, the BOE adopted , generating approximately $2.8 billion in tax revenue for schools and local communities. This revenue is vital for funding public services and supporting educational initiatives.

The functions of the CA Board of Equalization are not only crucial for tax collection but also for ensuring adherence to tax regulations and promoting tax justice. Representatives from various districts, like Mike Schaefer from District 4 and Antonio Vazquez from District 3, focus on leveraging the BOE's oversight to protect homeowners' exemptions and support funding for education. This commitment to equitable tax administration is essential for maintaining public trust and ensuring that you, as taxpayers, receive the services you deserve. Governor Jerry Brown's call for legislative action following the BOE's missteps highlights the importance of accountability in tax administration. Remember, you are not alone in this journey; .

Trace the History and Evolution of the California Board of Equalization

Founded by a constitutional amendment in 1879, the CA Board of Equalization was originally tasked with ensuring uniform across the state. We understand that can be complex and overwhelming. Over the decades, the BOE's role has expanded to manage various taxes and fees, reflecting the growing intricacies of .

A pivotal moment in the BOE's journey occurred in 2017 with the enactment of the . This legislation reorganized the agency, transferring many of its to the newly formed Department of Tax and Fee Administration. This shift aimed to within the state's tax administration framework, showcasing ongoing efforts to adapt to California's dynamic economic landscape.

Today, the BOE focuses primarily on , ensuring compliance among County Assessors while upholding its constitutional responsibilities. Additionally, the BOE administers over 30 tax and fee programs and oversees property tax regulations. However, it is common to feel concerned about the agency's challenges, such as the ongoing inquiry by the state's Department of Justice regarding the misallocation of $350 million in sales revenue.

The BOE also considers various appeals, including State Assessed Property Appeals and Alcoholic Beverage Tax Appeals. This illustrates the in the state's tax administration. Remember, ; the BOE is committed to supporting you through these processes.

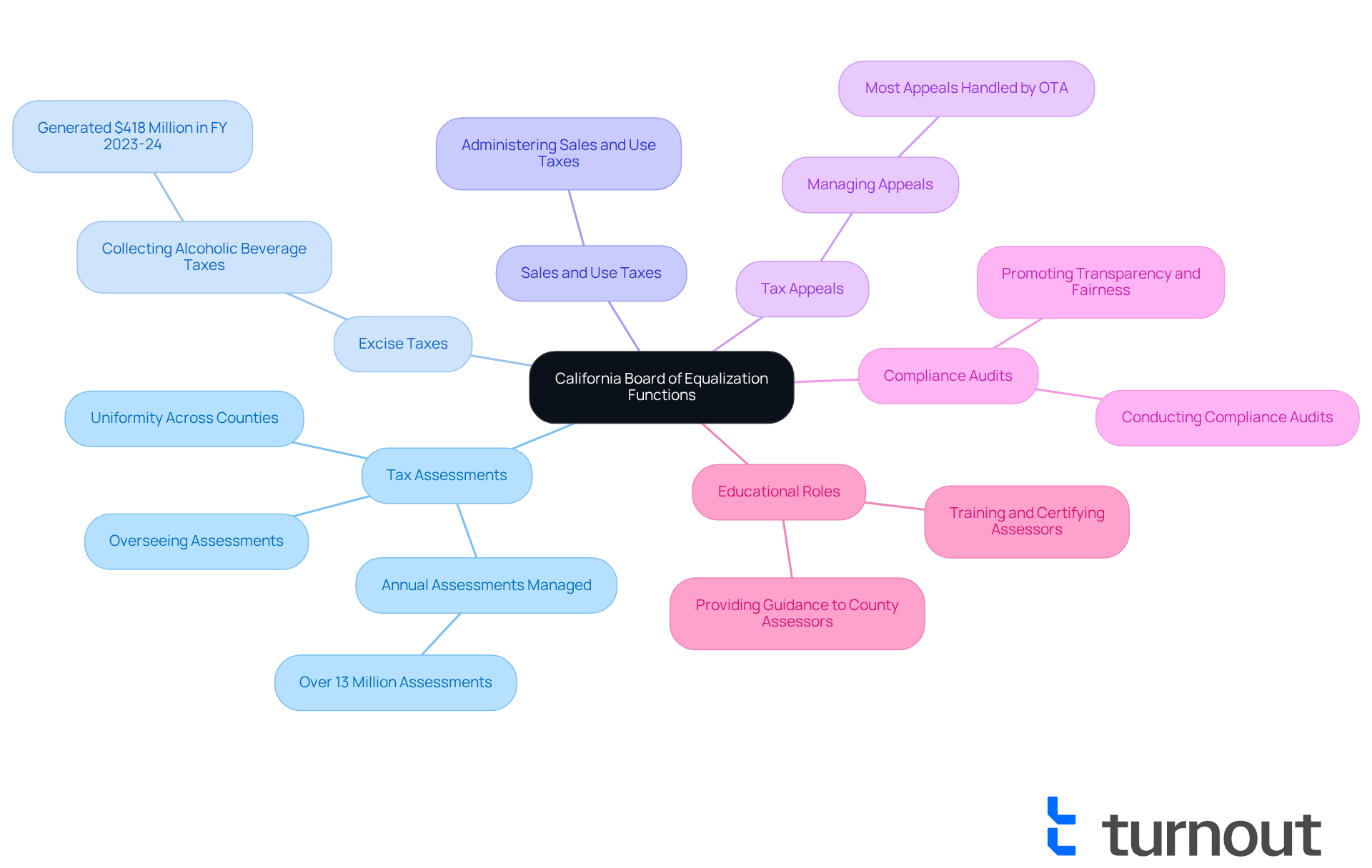

Outline the Key Functions and Responsibilities of the BOE

The plays a vital role in overseeing real estate and collecting . It also administers the state's sales and use taxes. We understand that tax evaluations can be daunting, but the CA Board of Equalization is dedicated to ensuring that these assessments are accurate and fair across all 58 counties. Together, these counties manage over 13 million assessments each year.

In Fiscal Year 2023-24, the net statewide assessed value reached an impressive $8.6 trillion. This substantial figure contributes significantly to funding for schools and local governments, with $51.1 billion allocated to educational institutions and $44.2 billion to local entities. It’s reassuring to know that these funds support essential services in our communities.

The CA Board of Equalization also oversees , although most of these appeals are now managed by the Office of Tax Appeals (OTA), a separate agency created in 2017. This function is crucial for maintaining public trust in the tax system. Furthermore, the CA Board of Equalization establishes the tax forms used by all County Assessors throughout the state, ensuring uniformity in tax procedures. They conduct to promote transparency and fairness in California's tax administration.

Founded in 1879, the CA Board of Equalization is dedicated to ensuring that counties comply with tax regulations, promoting fair treatment for taxpayers throughout the state. They also educate and certify individuals in appraisal or assessment analyst roles, enhancing the efficiency of tax evaluations. This dedication to accuracy and fairness is essential for the financial health of local communities and the state as a whole.

The efforts of the CA Board of Equalization in managing property tax assessments and excise taxes ultimately support the infrastructure and services that we all rely on. Remember, you are not alone in this journey; the CA Board of Equalization is here to help guide you through the complexities of tax assessments.

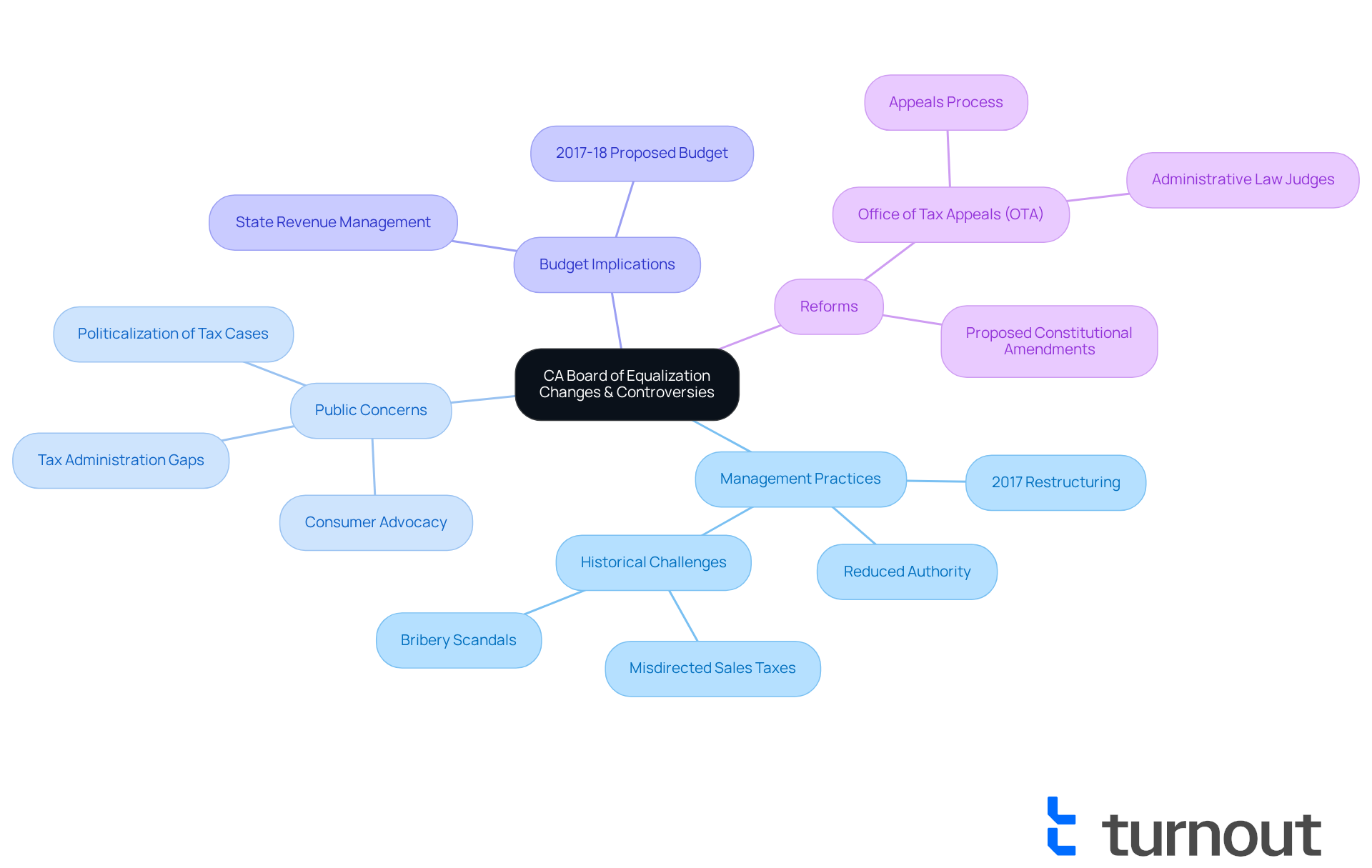

Examine Recent Changes and Controversies Involving the BOE

The has recently come under increased scrutiny regarding its effectiveness and management practices. We understand that many individuals are concerned about the agency's role and efficiency, especially following the 2017 restructuring aimed at enhancing accountability and streamlining operations. Critics express that the CA Board of Equalization's reduced authority has led to gaps in , causing confusion and politicization of tax cases. In contrast, supporters believe that these changes have fostered greater accountability and transparency.

As we navigate these changes, it’s important to acknowledge that the CA Board of Equalization is currently undergoing . Proposals for constitutional amendments are being discussed, which could either further restructure the agency or abolish it altogether. This contentious atmosphere highlights the critical need for , as many rely on the CA Board of Equalization for fair treatment in tax assessments and appeals. The agency's budget for 2017-18 included proposed expenditures of $670.7 million, reflecting its substantial role in managing over $60 billion in state revenues, which constitutes more than 30 percent of the total revenue of the state.

Moreover, the establishment of the Office of Tax Appeals (OTA) under the Taxpayer Transparency and Fairness Act has shifted the landscape of tax dispute resolutions. The OTA is set to hear appeals and issue decisions within 100 days, a pivotal move to enhance the integrity of [tax administration](https://calmatters.org/commentary/2017/06/board-equalization-embarrassment-decades-finally-getting-overhaul). We recognize the historical challenges faced by the CA Board of Equalization, including the misdirection of $350 million in sales taxes, which is currently under investigation by California's Department of Justice. As the BOE continues to navigate these reforms, we remain focused on the impact on tax administration data and consumer experiences. Your concerns are valid, and we are here to help you through this journey.

Conclusion

The California Board of Equalization (BOE) is more than just a tax agency; it is a vital ally in ensuring fair tax administration and effective fee collection throughout our state. Since its establishment in 1879, the BOE has remained dedicated to protecting taxpayer interests and securing essential funding for public services. While recent restructuring efforts have aimed to improve accountability, the BOE continues to be a cornerstone in overseeing property tax assessments and managing various tax programs, reinforcing its significance in California's fiscal landscape.

Throughout its history, the BOE has adapted to the evolving complexities of tax administration, especially following the significant changes brought about by the Taxpayer Transparency and Fairness Act in 2017. Though this restructuring has sparked debate, its goal is to enhance the agency's efficiency and transparency. The BOE's oversight of real estate evaluations and tax compliance audits demonstrates its unwavering commitment to equitable tax practices, which are crucial for maintaining public trust and ensuring essential services are adequately funded.

As the CA Board of Equalization navigates ongoing reforms and addresses past controversies, it is essential for you, the taxpayer, to stay informed about its functions and responsibilities. Engaging with the BOE and advocating for fair treatment in tax assessments is vital for fostering a transparent and accountable tax system. Remember, understanding the significance of the BOE not only empowers you but also highlights the agency's critical role in supporting community needs and enhancing the overall fiscal health of California. We’re here to help you navigate this journey together.

Frequently Asked Questions

What is the California Board of Equalization (BOE)?

The California Board of Equalization is a public agency established in 1879 that oversees tax administration and fee collection in California, ensuring fair and efficient tax practices for residents.

What are the main responsibilities of the CA Board of Equalization?

The CA Board of Equalization administers various taxes, including property taxes, sales and use taxes, and excise taxes on specific goods, while maintaining consistent evaluations across the state's 58 counties.

What changes have occurred in the CA Board of Equalization's structure in recent years?

In recent years, especially after 2017, many of the BOE's responsibilities were transferred to the Department of Tax and Fee Administration (CDTFA) due to concerns about the BOE's effectiveness in tax collection and administration.

Why was the restructuring of the CA Board of Equalization necessary?

The restructuring was necessary to enhance accountability and improve tax administration processes, following a report from the California Department of Finance that identified misallocations of tax revenue.

How does the CA Board of Equalization contribute to local funding?

For the fiscal year 2025-26, the BOE adopted state-assessed asset values totaling $167.2 billion, generating approximately $2.8 billion in tax revenue, which is essential for funding public services and educational initiatives in local communities.

What role do BOE representatives play in tax administration?

BOE representatives focus on protecting homeowners' exemptions and supporting funding for education, promoting equitable tax administration and maintaining public trust.

What has been highlighted by Governor Jerry Brown regarding the CA Board of Equalization?

Governor Jerry Brown emphasized the importance of accountability in tax administration following the BOE's missteps, calling for legislative action to address these issues.