Overview

The Fresh Start Program is a compassionate tax relief initiative established by the IRS, designed to assist individuals and small businesses in managing their tax debts. Through options like Offer in Compromise and streamlined installment agreements, this program opens doors to financial relief.

We understand that navigating tax obligations can be overwhelming. By broadening eligibility criteria and simplifying the application process, the Fresh Start Program aims to provide significant support to those struggling with their tax responsibilities. This initiative is here to help you find your way toward economic stability.

You are not alone in this journey. Many have faced similar challenges, and this program is a testament to the IRS's commitment to easing your burden. Take the first step toward relief and explore the options available to you today.

Introduction

The burden of tax debt can weigh heavily on individuals and small businesses. It often leads to overwhelming stress and financial instability. We understand that navigating these challenges can feel isolating and daunting.

The Fresh Start Program, an initiative by the IRS, offers a beacon of hope for those grappling with these issues. This program provides a structured path to tax relief that has evolved significantly since its inception in 2011. As you consider this option, it’s natural to wonder: how can the Fresh Start Program truly transform your financial future and alleviate the strain of tax obligations?

By exploring this program, you may find the support you need to regain control of your financial situation. Remember, you are not alone in this journey. We’re here to help you understand the complexities of eligibility and application processes, guiding you toward a brighter financial outlook.

Defining the Fresh Start Program: Purpose and Importance

The Fresh Start Program, which is a vital tax relief initiative established by the IRS to assist individuals and small businesses in managing their tax debts, raises the question: what is the Fresh Start Program? Since its initiation in 2011, this program has been revised until 2025 to tackle the economic challenges that many individuals face. It provides a range of choices aimed at easing the strain of outstanding taxes. Its main objective is to offer a structured route for individuals to resolve their obligations, evade tax liens, and restore economic stability.

We understand that managing tax debts can be overwhelming. By streamlining the application process and broadening eligibility standards, including the necessity for individuals to submit all necessary tax returns from the past three years, the Fresh Start Program significantly assists individuals in managing their obligations more effectively.

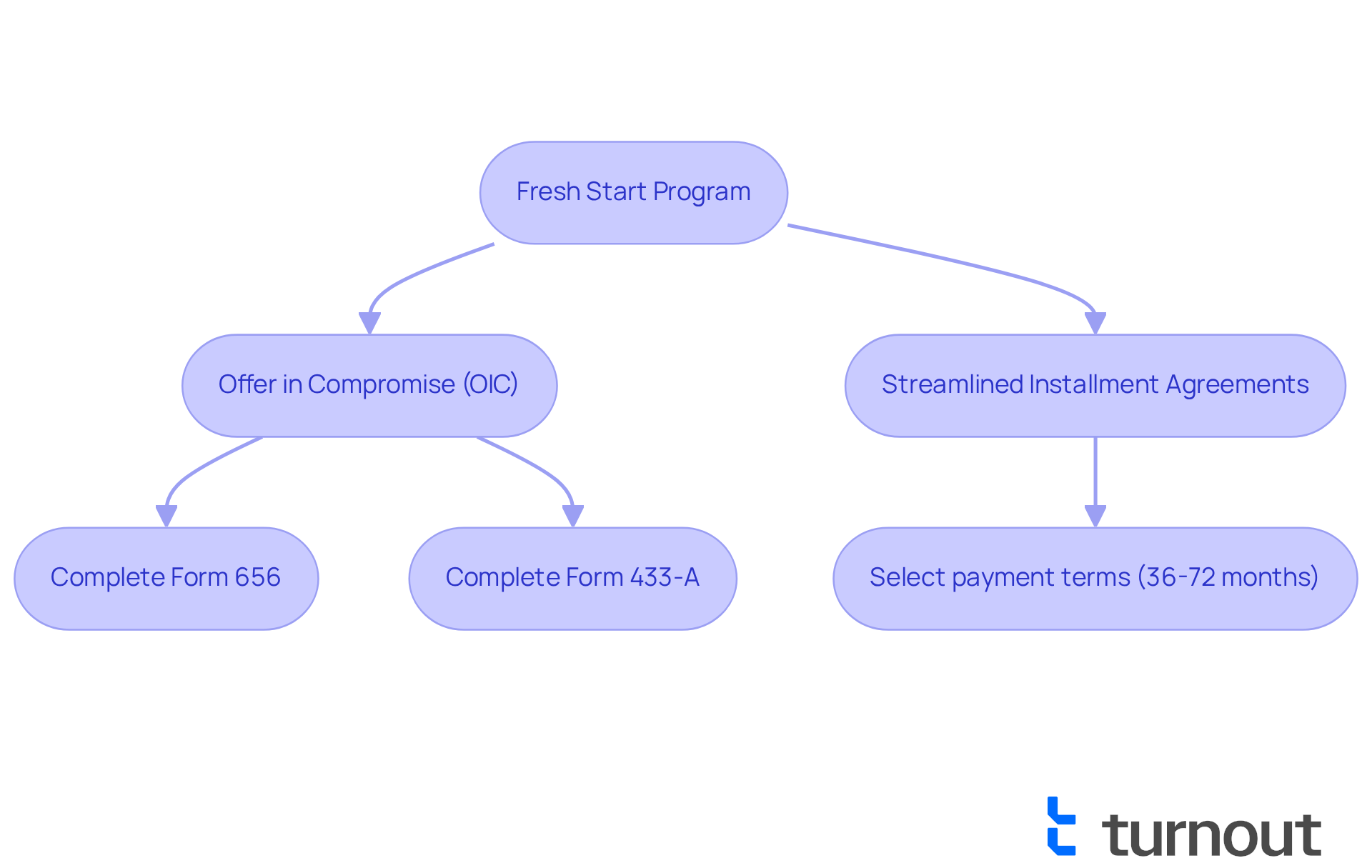

The program has successfully assisted thousands of clients in attaining economic stability through customized solutions to their tax challenges. For instance, the Offer in Compromise (OIC) permits eligible individuals to resolve their tax obligations for less than the full amount due. This requires the completion of Form 656 and Form 433-A for individuals as part of the application process. Additionally, streamlined installment agreements allow taxpayers to pay off their tax debts over time, with terms ranging from 36 to 72 months. This flexibility makes it easier for those with limited financial resources to manage their obligations.

Expert insights emphasize the significance of tax relief programs like the New Beginning initiative, which acts as a lifeline for individuals struggling with tax debt. The program's flexibility and favorable terms are crucial for those who find it difficult to meet their tax obligations, especially in light of economic challenges. As of 2025, the New Beginning Program continues to evolve, acknowledging the needs of self-employed individuals and offering expanded options for those experiencing significant income drops.

In summary, the New Beginning Program is not merely a temporary fix; it signifies a long-term dedication by the IRS to help individuals overcome monetary difficulties and attain a more secure economic future. Remember, you are not alone in this journey. For assistance with tax debt, we encourage you to reach out to Tax Law Advocates at 855-612-7777. We're here to help.

Eligibility Criteria: Who Can Access the Fresh Start Program?

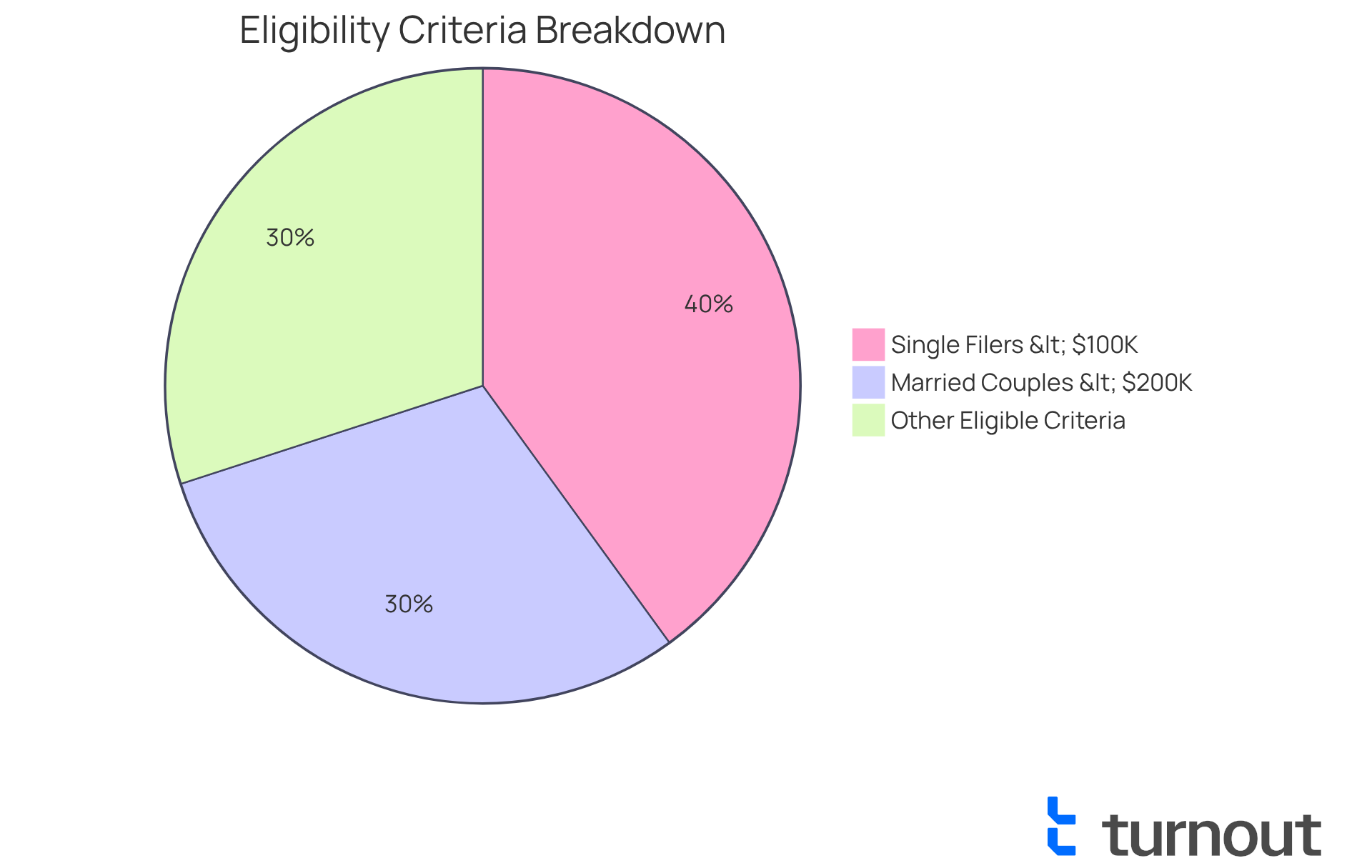

If you're feeling overwhelmed by tax obligations, you're not alone. The Fresh Start Program is designed to assist those genuinely struggling, and it may provide the relief you need. To qualify, individuals must owe $50,000 or less in combined tax, penalties, and interest. It's important to be current on all tax filings, so any unfiled returns should be submitted before applying.

Income limits are also in place to ensure the program reaches those who need it most. For instance:

- Single filers must have an adjusted gross income of less than $100,000.

- Married couples filing jointly should earn under $200,000.

These criteria help target assistance effectively, providing a viable path to relief. In fact, around 80% of applicants for the New Beginning Program demonstrate eligibility for the Fresh Start Program by meeting these requirements, highlighting its accessibility for many facing economic challenges.

Furthermore, in 2025, the IRS increased allowable living expenses for essentials like food, rent, and healthcare, broadening eligibility for the program. Consulting with tax experts can enhance your chances of approval. They can help showcase your economic situation and identify the best relief options for you.

Turnout offers access to trained nonlawyer advocates and IRS-licensed enrolled agents who can guide you through this process, ensuring you receive the support you deserve. As Angelica Leicht, Senior Editor for the Managing Your Money section, wisely notes, "If you're unsure about your eligibility or the best course of action, consider consulting with a tax professional." Remember, we're here to help you navigate this journey.

Exploring Relief Options: Installment Agreements and More

Are you feeling overwhelmed by your tax responsibilities? The New Beginning Program is here to offer you various assistance options designed to help you manage these obligations with ease. One of the most supportive options available is the simplified installment agreement, which allows you to settle your tax obligations in manageable monthly payments over a period of up to 72 months. Best of all, this option does not require extensive monetary documentation.

To understand what the Fresh Start Program is, you generally need to owe under $50,000 and be current with all required tax filings. If you meet these criteria, you may find relief through an offer in compromise. This option enables you to resolve your tax obligations for a lesser amount than what you owe, providing considerable economic relief. The application fee for an Offer in Compromise (OIC) is currently $205.

Many taxpayers have shared their success stories, highlighting how they negotiated settlements that drastically reduced their liabilities. In fact, the program boasts a significant success rate, helping individuals restore their economic stability. Financial advisors often recommend exploring these relief options within the Fresh Start Program, as they are intended to address a variety of financial circumstances.

By utilizing these tools, you can take proactive steps toward regaining control over your tax obligations. Remember, you are not alone in this journey. We're here to help you alleviate the stress associated with tax debt and move forward with confidence.

Navigating the Application Process: Steps to Enroll in the Fresh Start Program

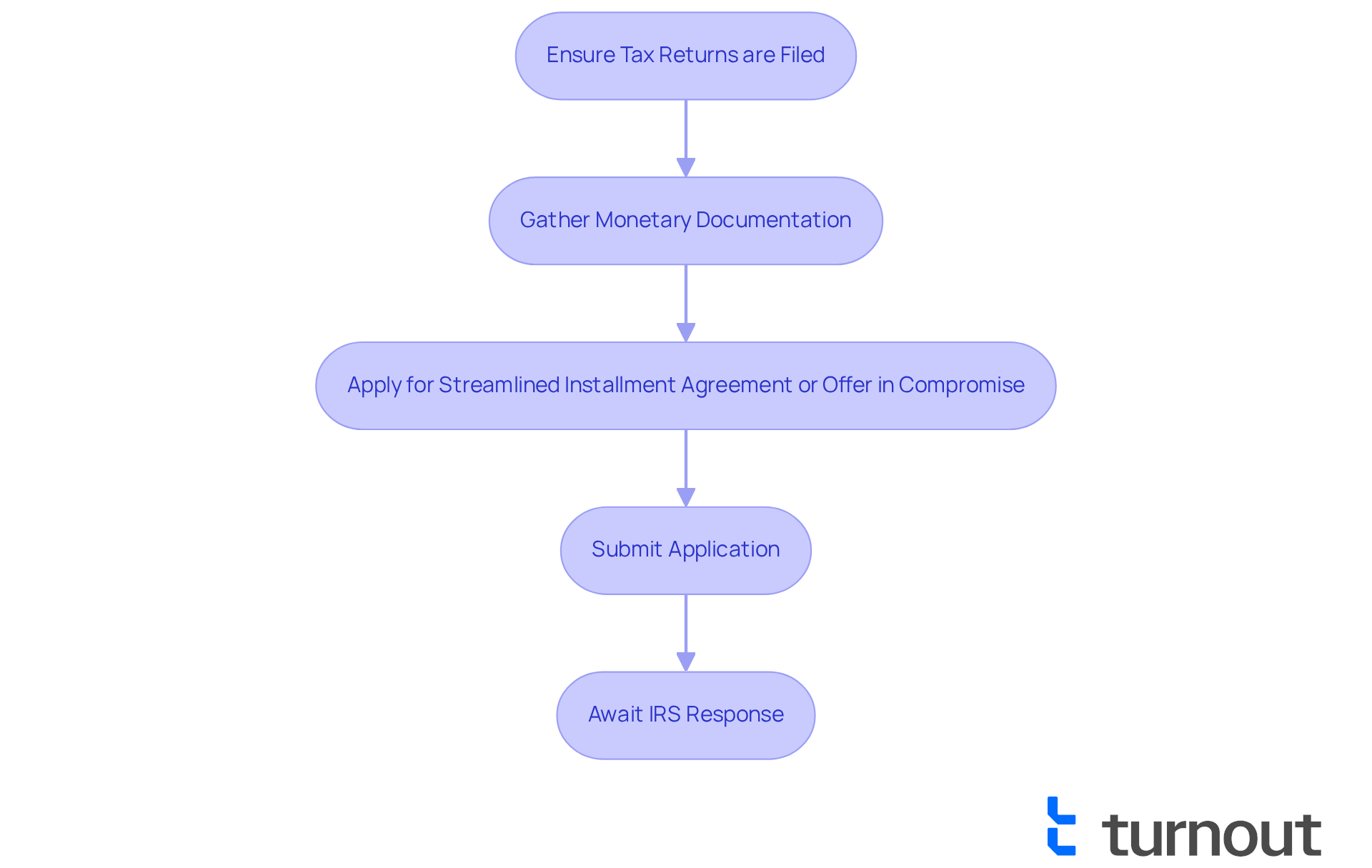

Enrolling in the program known as the Fresh Start Program can feel overwhelming, but we’re here to help you navigate this process. First, it’s essential to ensure that all tax returns are filed and up to date. Next, gather your important monetary documentation, such as income statements and relevant tax forms. If your balance is $100,000 or less and you opt for direct debit payments, you may qualify for a Streamlined Installment Agreement without needing to provide financial statements.

Once you’re prepared, you can apply for a streamlined installment agreement by completing IRS Form 9465 or submit an Offer in Compromise using Form 656. The IRS Fresh Start Program provides individuals with outstanding tax debts of $50,000 or less the chance to qualify for more favorable terms, which makes it easier to manage Fresh Start Program obligations. Providing detailed financial information is crucial to support your application.

After you submit your application, you can expect a response from the IRS regarding your application status. It’s common to feel anxious during this waiting period, so being prepared to follow up if necessary can help speed up the process. Remember, prompt follow-ups are often beneficial.

Launched in 2011, the IRS New Start Initiative aims to assist taxpayers facing financial difficulties. Understanding this context can help you appreciate the program's purpose. For example, Dana faced nearly $50,000 in tax debt but successfully reduced her total debt to $41,800 after understanding the Fresh Start Program. Similarly, Tyrell, who had a tax debt of $72,000, now pays $365 per month under a Partial Payment Installment Agreement, which highlights the Fresh Start Program's potential for manageable repayment plans.

Additionally, if you are self-employed, it’s important to note that you must demonstrate a 25% decline in income to qualify for certain program benefits. Remember, you are not alone in this journey, and there are options available to help you regain control of your financial situation.

Conclusion

The Fresh Start Program is a vital lifeline for individuals and small businesses struggling with tax debt. It offers a structured approach to ease financial burdens. By providing various options for tax relief, the IRS shows its commitment to helping taxpayers regain their economic footing. Understanding the program's intricacies can empower those affected to take proactive steps toward resolving their tax obligations.

Key insights throughout the article highlight the program's flexibility. Options like the Offer in Compromise and streamlined installment agreements enable taxpayers to manage their debts more effectively. The eligibility criteria are designed to ensure that those most in need can access these essential resources, with recent adjustments making them even more accessible. Success stories from individuals who have navigated the program underscore its effectiveness in restoring financial stability.

In a broader context, the Fresh Start Program not only addresses immediate tax concerns but also reflects a larger commitment to supporting economic recovery for individuals facing financial hardships. If you are considering this path, we encourage you to seek guidance from tax professionals to maximize your chances of successful enrollment. By leveraging the resources available through the Fresh Start Program, you can take significant steps toward achieving lasting financial relief and stability. Remember, you are not alone in this journey, and we are here to help.

Frequently Asked Questions

What is the Fresh Start Program?

The Fresh Start Program is a tax relief initiative established by the IRS to assist individuals and small businesses in managing their tax debts. It aims to provide a structured route for individuals to resolve their obligations, avoid tax liens, and restore economic stability.

When was the Fresh Start Program initiated and how long will it last?

The Fresh Start Program was initiated in 2011 and has been revised until 2025 to address the economic challenges faced by many individuals.

What are the main objectives of the Fresh Start Program?

The main objectives of the Fresh Start Program are to ease the strain of outstanding taxes, help individuals manage their tax obligations more effectively, and support them in achieving economic stability.

What are some options available under the Fresh Start Program?

Options available under the Fresh Start Program include the Offer in Compromise (OIC), which allows eligible individuals to settle their tax obligations for less than the full amount due, and streamlined installment agreements that enable taxpayers to pay off their tax debts over time.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is a program that permits eligible individuals to resolve their tax obligations for less than the total amount owed. Applicants must complete Form 656 and Form 433-A as part of the application process.

What are streamlined installment agreements?

Streamlined installment agreements are payment plans that allow taxpayers to pay off their tax debts over a period of 36 to 72 months, providing flexibility for those with limited financial resources.

How does the Fresh Start Program support self-employed individuals?

The Fresh Start Program acknowledges the needs of self-employed individuals and offers expanded options for those experiencing significant income drops, particularly as it evolves through 2025.

Why are tax relief programs like the Fresh Start Program important?

Tax relief programs like the Fresh Start Program are important because they provide crucial support for individuals struggling with tax debt, offering flexible and favorable terms that help them meet their tax obligations amid economic challenges.

How can individuals get assistance with tax debt?

Individuals seeking assistance with tax debt can reach out to Tax Law Advocates at 855-612-7777 for help.