Overview

We understand that navigating financial assistance can be challenging. In 2025, the monthly payment for Social Security Disability Insurance (SSDI) is expected to average around $1,580. For those with a strong work history and earnings, the maximum benefit could reach approximately $4,018. This information is crucial as it highlights how payments are calculated based on Average Indexed Monthly Earnings (AIME).

It's common to feel uncertain about how these benefits can support you. The significance of Cost-of-Living Adjustments (COLA) plays a vital role in helping beneficiaries keep pace with inflation. We’re here to help you understand these details, ensuring you feel informed and empowered in your journey.

Introduction

Understanding the financial landscape of Social Security Disability Insurance (SSDI) is crucial for the millions of Americans navigating the challenges of disability.

With approximately 10 million individuals relying on these benefits, the monthly payment amounts can significantly impact their quality of life.

As we approach 2025, it's common to feel uncertain about how these payments are calculated and what factors influence their variability.

What does this mean for you and others seeking financial stability in an uncertain world?

You're not alone in this journey, and we're here to help you find clarity.

Defining Social Security Disability Insurance Payments

For those unable to work due to qualifying disabilities, it is important to understand what is the monthly payment for social security disability, as Social Security Disability Insurance disbursements provide crucial monthly benefits. These payments aim to replace a portion of the income lost when individuals cannot engage in substantial gainful activity. Financed by payroll taxes under the Federal Insurance Contributions Act (FICA), eligibility for these benefits depends on work history and the extent of the impairment. In 2025, what is the monthly payment for social security disability is expected to be approximately $1,483.10, reflecting a Cost-of-Living Adjustment (COLA) of 2.5% to help keep up with inflation.

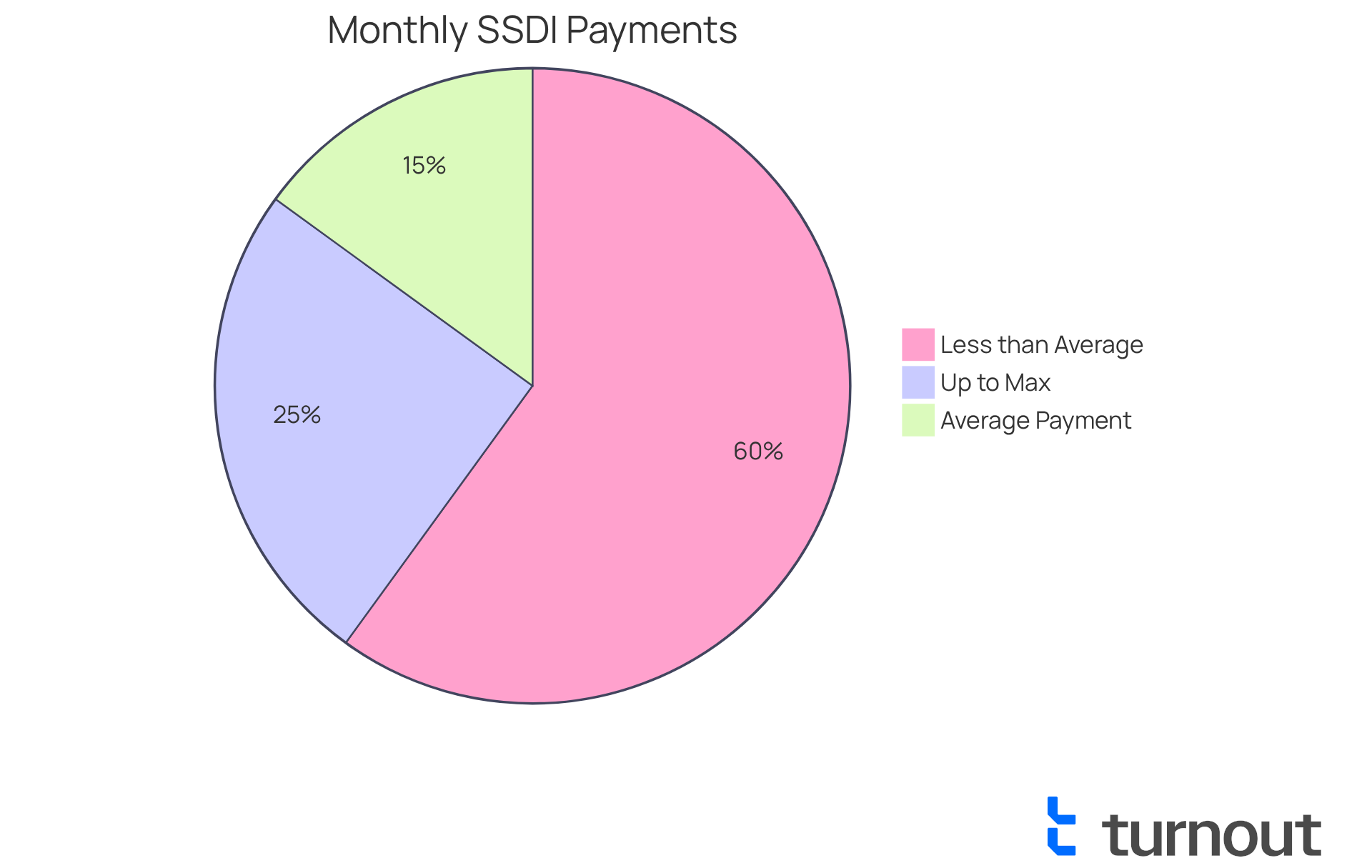

As we look to 2025, around 10 million Americans rely on disability support. This underscores the program's vital role in providing financial assistance to individuals with disabilities. The amount received can vary greatly based on a person's earnings history before becoming disabled. For instance, while the highest potential benefit can reach $3,822, many recipients receive significantly less. This highlights the importance of understanding what is the monthly payment for social security disability within the payment framework.

Real-life experiences illustrate the impact of Social Security Disability Insurance on people's lives. For example, a survey found that many beneficiaries struggle with the complexities of the application process. This indicates a pressing need for improved resources and education. Furthermore, changes to the disability assistance program in 2025 may affect eligibility standards and compensation calculations. It’s essential for recipients to stay informed about possible changes that could influence their financial security. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

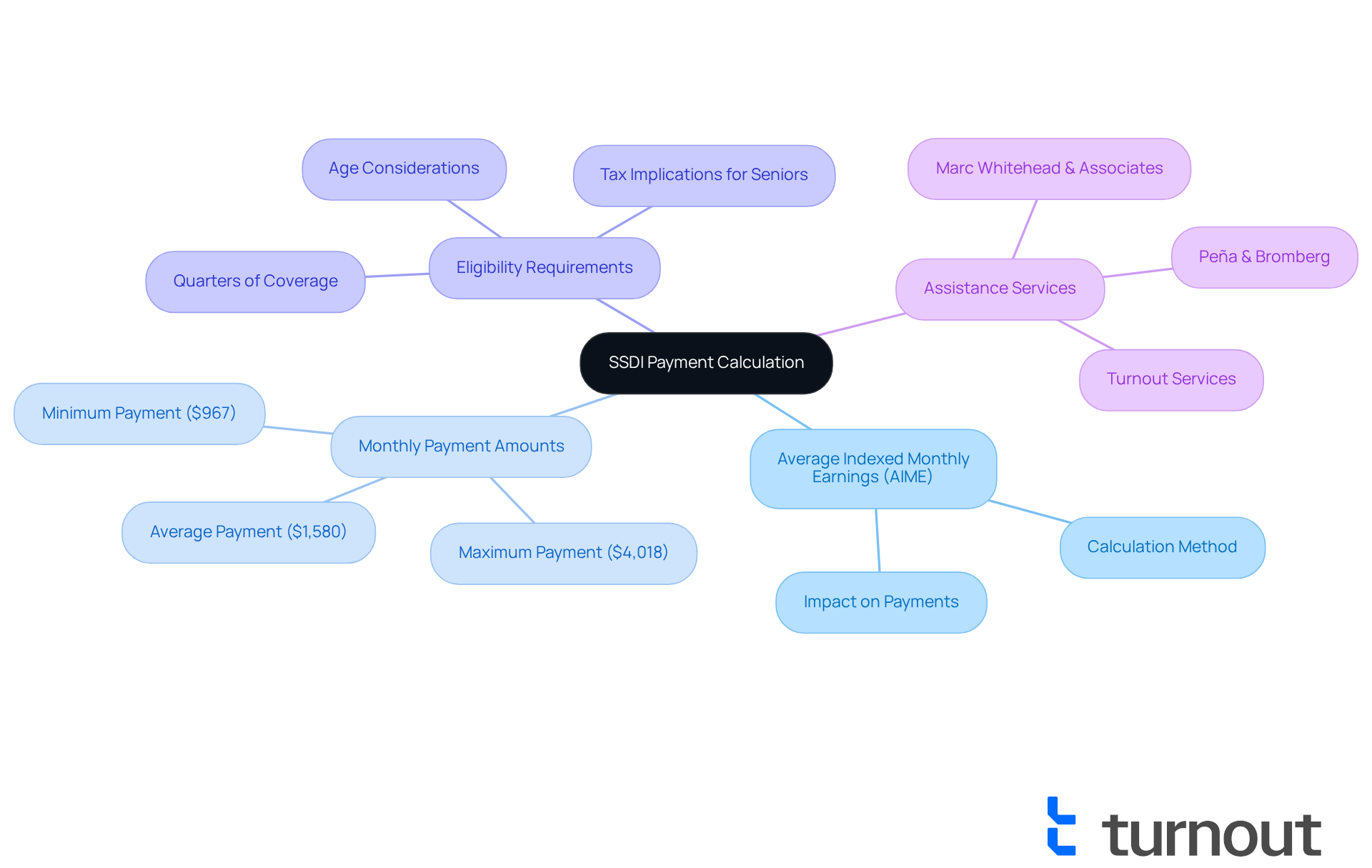

Calculating Your Monthly SSDI Payment Amount

Understanding Social Security Disability Insurance can feel overwhelming, but we're here to help. To understand what is the monthly payment for social security disability, it is determined by your Average Indexed Monthly Earnings (AIME), which considers your highest-earning years—typically up to 35 years of your career. To determine what is the monthly payment for social security disability, the Social Security Administration (SSA) uses a formula with 'bend points' to calculate your Primary Insurance Amount (PIA).

In 2025, what is the monthly payment for social security disability, where the maximum payment is $4,018 and the average amount is approximately $1,580? With the Cost of Living Adjustment (COLA) set at 2.5% for 2025, these figures will help address rising living expenses. You can easily assess your benefits using SSA's online calculators by entering your earnings history.

It's essential to remember that eligibility for Social Security Disability Insurance requires a specific number of quarters of coverage, reflecting your employment history. Additionally, if you're 65 or older, your disability payments may be subject to taxation based on your total income. Grasping how AIME impacts your assistance is crucial, as it directly affects the amount you receive.

At Turnout, we offer tools and services to guide you through the SSD claims process. Our trained non-legal advocates are here to help you understand your benefits and ensure you get the financial support you deserve. Please note that Turnout is not a law firm and does not provide legal advice. We also offer tax debt relief services to support your financial needs. Remember, you are not alone in this journey; we're here to assist you every step of the way.

Factors Affecting SSDI Payment Amounts

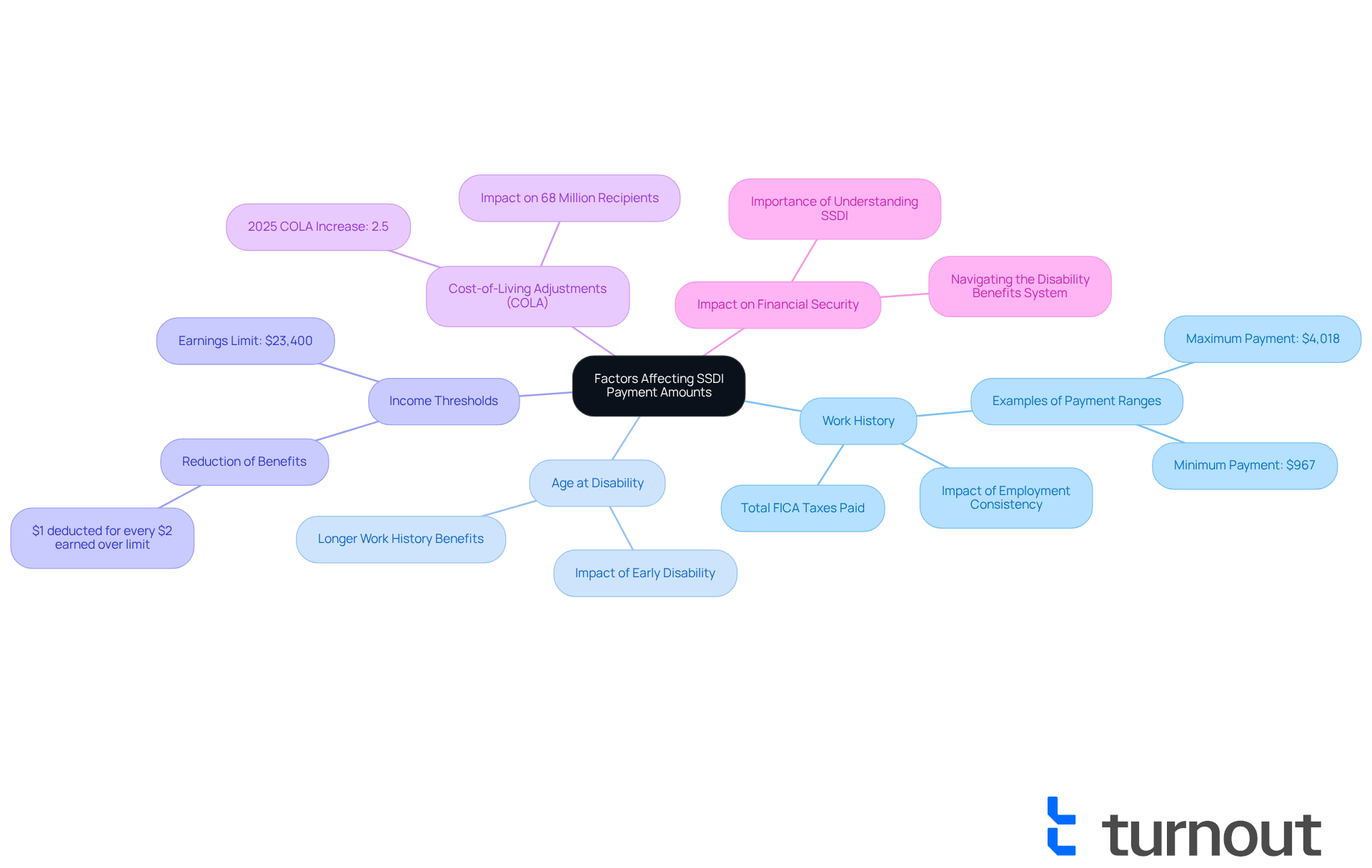

Several important factors influence what is the monthly payment for social security disability insurance that a person receives. We understand that navigating this system can be challenging, and it's essential to grasp these elements. Primarily, a person's work history plays a crucial role; the total amount of FICA taxes paid during their working years directly impacts compensation calculations. For example, in 2025, what is the monthly payment for social security disability will be $967 at its lowest, while the highest may reach up to $4,018, depending on the individual's earnings history.

Additionally, the age when an individual becomes disabled can affect their assistance. Those who become disabled earlier in their careers may receive reduced compensation compared to individuals with a longer work history. It's common to feel concerned about how any income earned while receiving Social Security Disability Insurance can lead to a reduction in benefits. In 2025, beneficiaries will notice $1 subtracted from their disbursements for every $2 earned above $23,400, highlighting the significance of understanding the earnings thresholds.

Cost-of-living adjustments (COLA) are significant in determining what is the monthly payment for social security disability (SSDI) amounts. In 2025, recipients will benefit from a 2.5% COLA increase, which is essential for keeping pace with inflation and rising living costs. This adjustment signifies that around 68 million Social Security recipients will experience an increase in their monthly payments, which raises the question of what is the monthly payment for social security disability, offering vital financial assistance as costs continue to rise.

Real-world examples demonstrate the influence of work history on disability assistance. Individuals with a strong work background may be eligible for higher payments, while those with inconsistent employment may find their benefits considerably reduced. Understanding these dynamics is crucial for anyone navigating the disability benefits system, as it can directly impact financial security and overall well-being.

Moreover, it's important to note that Turnout is not a law firm and does not provide legal advice. SSDI claims are assessed through a sequential evaluation process defined by U.S. federal law, determining eligibility based on specific criteria. Turnout is here to support you in managing these complexities, employing trained non-legal advocates to assist you in understanding your choices and optimizing your advantages. Furthermore, the expected rise in the Substantial Gainful Activity (SGA) limit for 2025 will enable disabled persons to earn more while still meeting the criteria for benefits. Seeking expert assistance from Turnout can be essential for managing the intricacies of disability claims, ensuring that you receive the support you require.

Understanding SSDI Payment Schedules

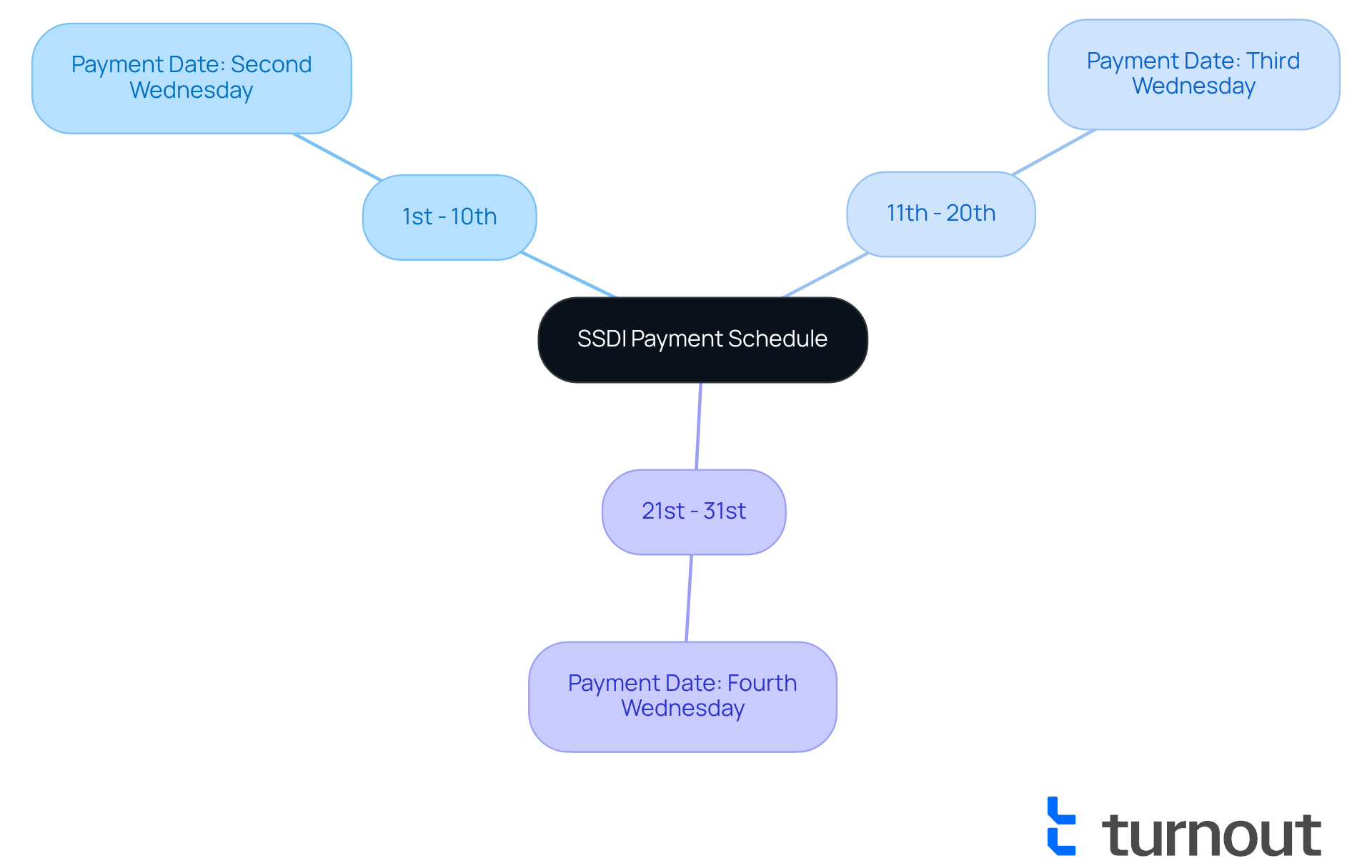

SSDI disbursements follow a structured timetable based on your birth date, and we understand how important this predictability is for your financial planning. If you were born from the 1st to the 10th, you can expect your payments on the second Wednesday of each month. Those with birthdays from the 11th to the 20th will receive theirs on the third Wednesday, while recipients born between the 21st and 31st can anticipate their funds on the fourth Wednesday. This schedule is crucial as it allows you to effectively manage your monthly expenses, including what is the monthly payment for social security disability, and cash flow.

Consider this: a financial advisor might suggest creating a budget that aligns with what is the monthly payment for social security disability and these payment dates. By doing so, you can ensure that essential bills are paid on time and that you have resources available for necessary expenses. Understanding when your benefits will arrive can help you avoid late charges and reduce financial strain, giving you peace of mind.

In 2025, millions of SSDI recipients will rely on this payment schedule, making it essential to stay informed. By leveraging this knowledge, you can build a more stable financial foundation. This stability allows you to focus on your health and well-being without the added burden of financial uncertainty. Remember, you are not alone in this journey. Turnout is here to assist you in navigating the complexities of SSD claims. Our trained nonlawyer advocates provide tools and services designed to help you understand your benefits and ensure you receive the support you need without the need for legal representation.

Conclusion

Understanding the monthly payment for Social Security Disability Insurance (SSDI) is essential for those who are unable to work due to disabilities. These payments provide crucial financial support and reflect your work history and contributions. As we look ahead to 2025, the expected monthly payment is approximately $1,483.10, with the possibility of higher benefits based on prior earnings. This highlights the importance of being informed about eligibility and the factors that influence payment amounts.

We understand that SSDI payments can be complex. They are calculated based on Average Indexed Monthly Earnings (AIME) and are also influenced by Cost-of-Living Adjustments (COLA). Factors such as your work history, the age when your disability began, and any additional income earned while receiving benefits play significant roles in determining your final payment. Moreover, understanding the structured payment schedule based on birth dates can help you in planning your finances, ensuring you manage your resources effectively.

In light of these details, it is crucial for you to seek assistance and remain informed about your rights and benefits as you navigate the SSDI system. The evolving landscape of Social Security Disability payments requires ongoing education and support to ensure your financial security. By utilizing available resources and tools, you can better understand your benefits and advocate for yourself. Remember, you are not alone in this journey, and we are here to help you reinforce the importance of this vital program in your life.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance (SSDI) provides monthly benefits to individuals unable to work due to qualifying disabilities, aiming to replace a portion of the income lost when they cannot engage in substantial gainful activity.

How are SSDI payments financed?

SSDI payments are financed by payroll taxes under the Federal Insurance Contributions Act (FICA).

What factors determine eligibility for SSDI benefits?

Eligibility for SSDI benefits depends on an individual's work history and the extent of their impairment.

What is the expected monthly payment for SSDI in 2025?

The expected monthly payment for SSDI in 2025 is approximately $1,483.10, reflecting a Cost-of-Living Adjustment (COLA) of 2.5% to help keep up with inflation.

How many Americans rely on SSDI support?

In 2025, around 10 million Americans are expected to rely on disability support from SSDI.

Does the amount received from SSDI vary among recipients?

Yes, the amount received can vary greatly based on a person's earnings history before becoming disabled, with the highest potential benefit reaching $3,822, while many recipients receive significantly less.

What challenges do beneficiaries face regarding SSDI?

Many beneficiaries struggle with the complexities of the application process, highlighting the need for improved resources and education.

Are there expected changes to the SSDI program in 2025?

Yes, changes to the disability assistance program in 2025 may affect eligibility standards and compensation calculations, so it is essential for recipients to stay informed about possible changes that could influence their financial security.