Overview

Navigating the Georgia tax payment plan can feel overwhelming, but we're here to help you through it. This article outlines a systematic approach, emphasizing five key steps that can guide you:

- Understanding the options available

- Checking your eligibility

- Gathering necessary documentation

- Applying for the plan

- Troubleshooting common issues

Each step is supported by practical advice and examples, such as the ability to make manageable payments over time.

We understand that maintaining communication with the Department of Revenue is crucial. It helps address any financial difficulties you may encounter during the payment process. Remember, you are not alone in this journey; many have faced similar challenges and found their way through.

By following these steps, you can take control of your situation and find a solution that works for you. Let's take this journey together, step by step.

Introduction

Navigating tax obligations can often feel like an uphill battle, especially for those grappling with debt in the state of Georgia. We understand that managing these responsibilities can be overwhelming. Fortunately, the Georgia tax payment plan offers a lifeline, allowing individuals to handle their tax debts through manageable installment payments rather than daunting lump sums.

As you explore this option, you may wonder: what are the specific steps to successfully establish and maintain a payment plan, and how can you overcome potential challenges along the way? This guide will illuminate your pathway to financial relief.

We’ll detail essential steps from eligibility checks to troubleshooting common issues, ensuring that you can regain control over your financial future. Remember, you are not alone in this journey; we're here to help.

Understand Georgia Tax Payment Plans

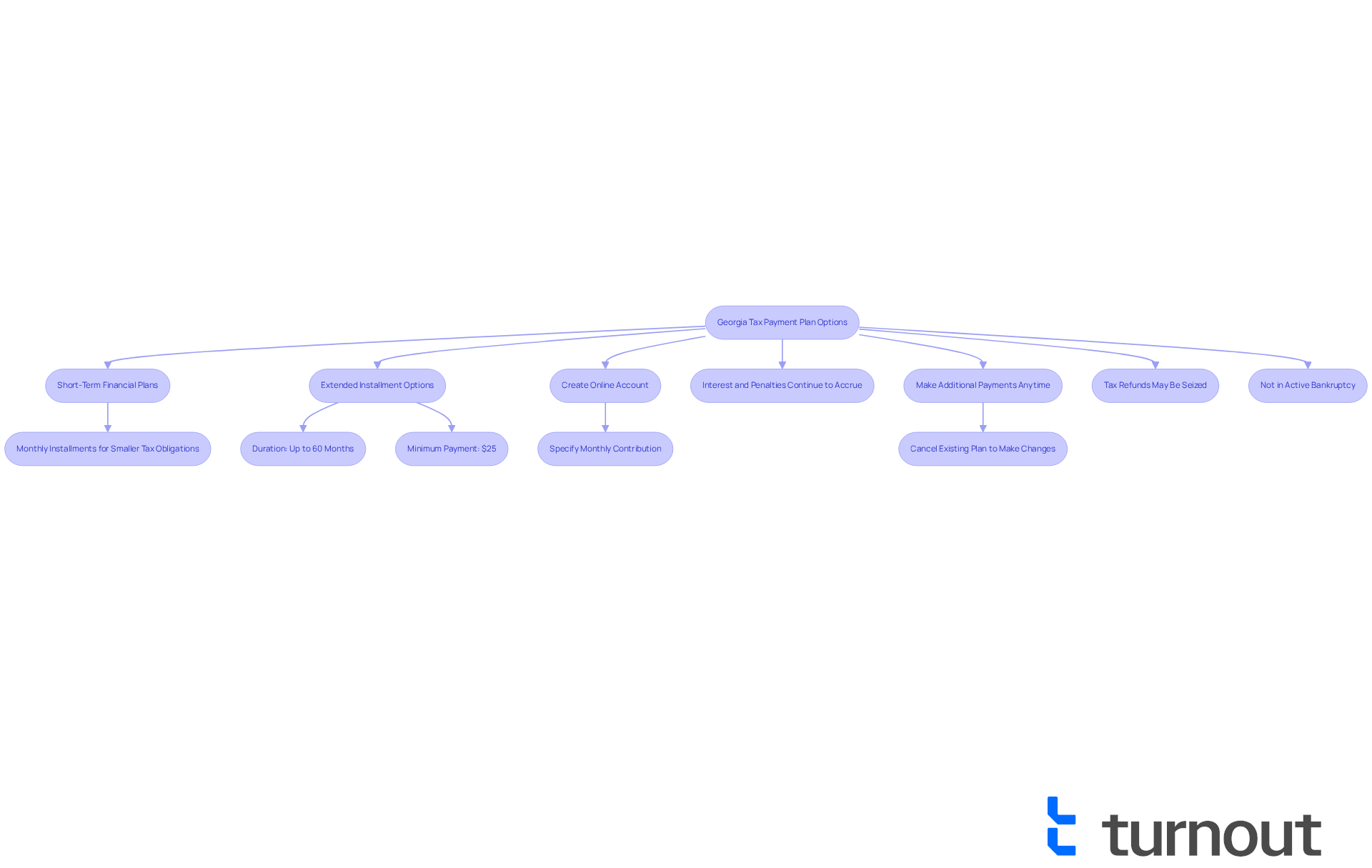

Georgia provides a variety of options under the state of Georgia tax payment plan to help you manage your tax debts more effectively. We understand that handling tax obligations can be overwhelming, which is why the state of Georgia tax payment plan allows you to settle your owed taxes in installments rather than a single payment. This approach makes it easier to fulfill your financial responsibilities. It's essential to understand the different strategies available for managing the state of Georgia tax payment plan so you can choose the best option for your situation.

- Short-Term Financial Plans: These arrangements typically allow for installments over a few months, providing a quick solution for smaller tax obligations.

- Extended Installment Options: For larger sums due, extended arrangements can last up to 60 months, allowing for affordable monthly payments starting at just $25.

You can create an online account at the Georgia Online Tax Center to request a state of Georgia tax payment plan. When you apply, you'll need to specify your proposed monthly contribution and select a due date. It’s important to note that while you are under an installment agreement, interest and penalties will continue to accrue until your total tax obligation is paid off. However, establishing a state of Georgia tax payment plan can stop most involuntary collections, such as wage garnishments and asset seizures, providing you with immediate relief.

Real-life examples highlight the effectiveness of these financial arrangements. For instance, individuals earning $22,050 or less can create a state of Georgia tax payment plan for just $25, making it more accessible for low-income taxpayers. Additionally, if you choose direct debit from your bank account, you can lower the setup fee from $100 to $50, further easing your financial burden.

Once your financial arrangement is in place, including the state of Georgia tax payment plan, you have the option to contribute extra amounts at any time to speed up the settlement process. However, please be aware that changes cannot be made directly to your current arrangement; you would need to terminate the existing agreement and request a new one. This flexibility, along with the tiered fee structure, encourages compliance with tax obligations and helps you regain control over your financial situation. It's also crucial to understand that tax refunds may be withheld and applied to your tax obligation while you are on an arrangement, and applicants should not be involved in an ongoing bankruptcy case or awaiting a review for an offer in compromise. Remember, you are not alone in this journey, and we are here to help you navigate these challenges.

Check Your Eligibility for a Payment Plan

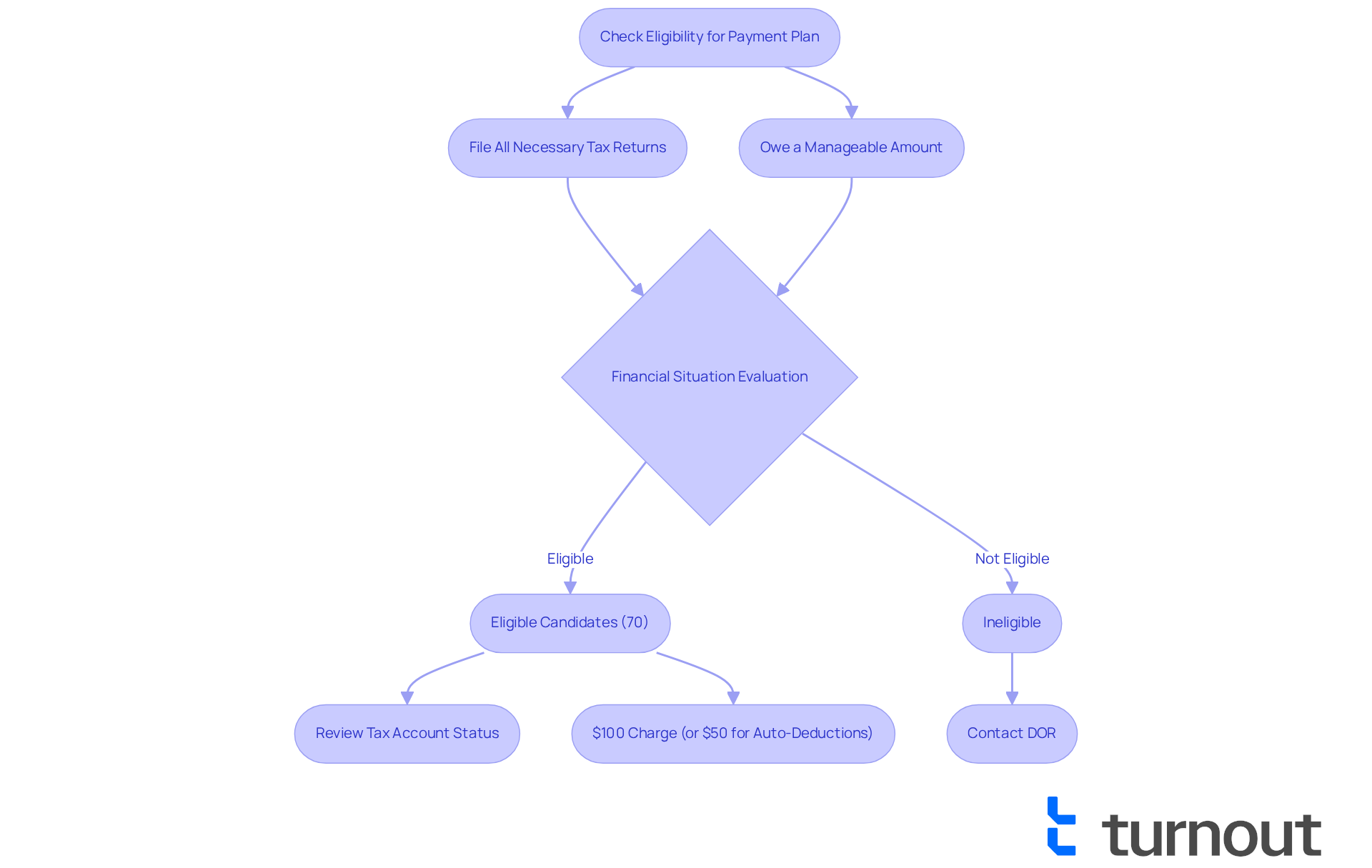

We understand that navigating tax responsibilities can be overwhelming. To qualify for the state of Georgia tax payment plan, it’s essential to meet specific requirements set by the Georgia Department of Revenue (DOR). First and foremost, you should have filed all necessary tax returns and owe an amount that is manageable, yet cannot be paid in full. The DOR will evaluate your financial situation to determine your ability to make regular contributions. It's encouraging to note that around 70% of candidates are accepted for these financing options, suggesting a positive perspective for those who meet the criteria.

To check your eligibility, we recommend reviewing your tax account status through the Georgia Tax Center online portal or contacting the DOR directly. This proactive step can clarify your standing and help you understand any outstanding obligations. Additionally, it’s important to be aware that establishing a state of Georgia tax payment plan involves a charge of $100, which decreases to $50 if contributions are directly deducted from a bank account.

Tax advisors emphasize the importance of being transparent about your financial situation when applying, as this can significantly influence the approval process. Remember, you must also adhere to the state of Georgia tax payment plan by paying all state taxes punctually and in full to uphold your agreement and avoid penalties.

Case studies show that individuals who submit detailed financial statements and demonstrate a genuine inability to settle their tax obligations are more likely to be eligible for an installment arrangement. Moreover, understanding the criteria for financial arrangements, including the necessity to maintain punctual contributions to prevent fines, is essential for effectively managing your tax responsibilities. You are not alone in this journey; we’re here to help you navigate these challenges.

Gather Required Documentation

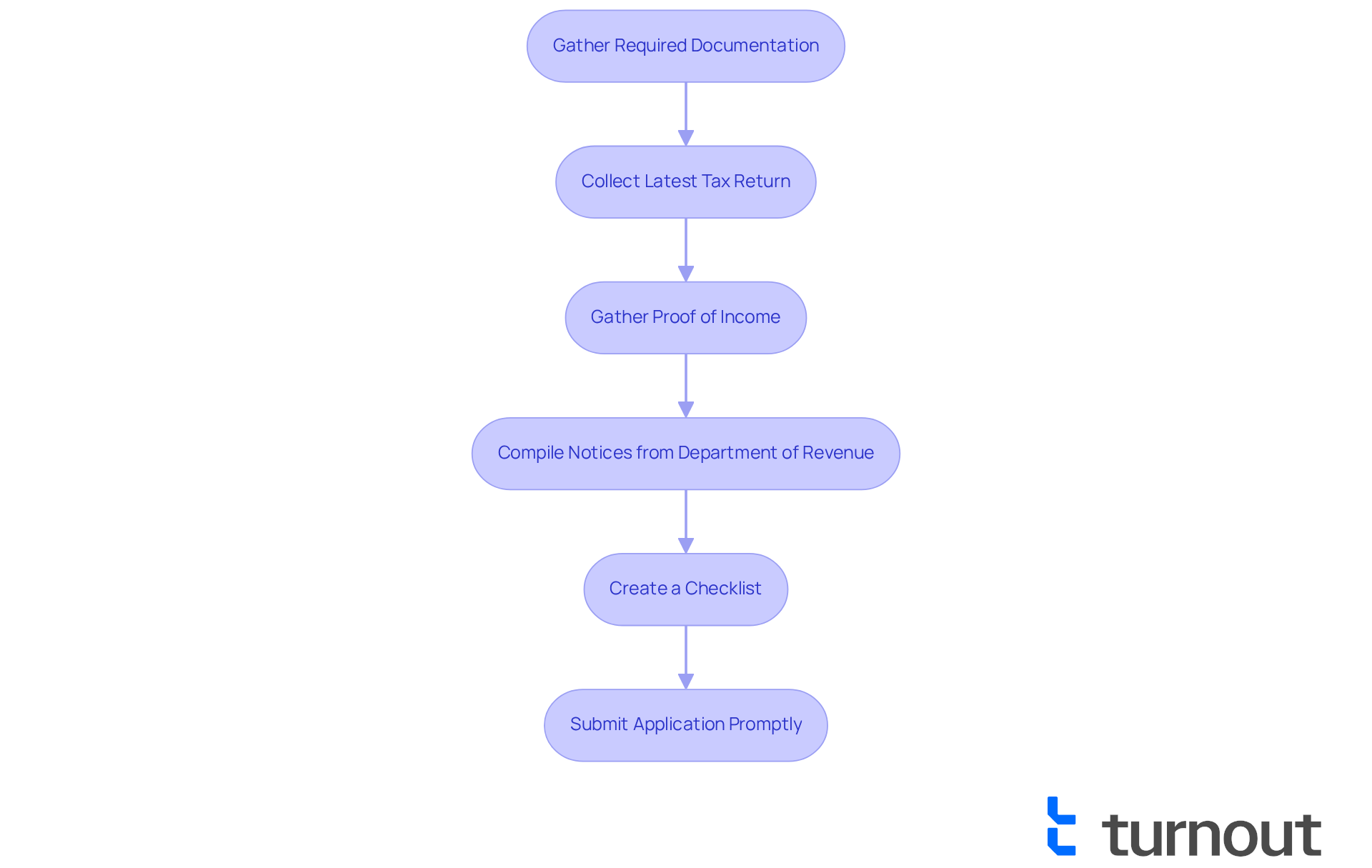

Before you request a state of Georgia tax payment plan, it's important to gather all the necessary documentation to support your application. This typically includes your latest tax return, proof of income—like pay stubs or bank statements—and any correspondence from the Department of Revenue regarding your tax debt. Organizing these documents not only simplifies the application process but also provides a clear picture of your financial situation.

We understand that compiling these documents can feel overwhelming. Tax professionals suggest taking the time to do this thoroughly. Common examples of required documentation often include:

- W-2 forms

- 1099s

- Any notices from the Department of Revenue

On average, taxpayers may need about one to two weeks to gather everything, depending on their personal circumstances and record-keeping habits. If you earn $22,050 or less, you can set up a financing arrangement for just $25, which may encourage low-income taxpayers to take that important step.

To make this process easier, consider creating a checklist of the required documents. Set aside dedicated time to collect and review them. You can also use the Georgia Tax Center's online portal to check the status of your transactions and applications. This proactive approach can significantly increase your chances of a successful application for the state of Georgia tax payment plan. Remember, submitting your application promptly is crucial to avoid potential penalties for missed deadlines.

Apply for Your Tax Payment Plan

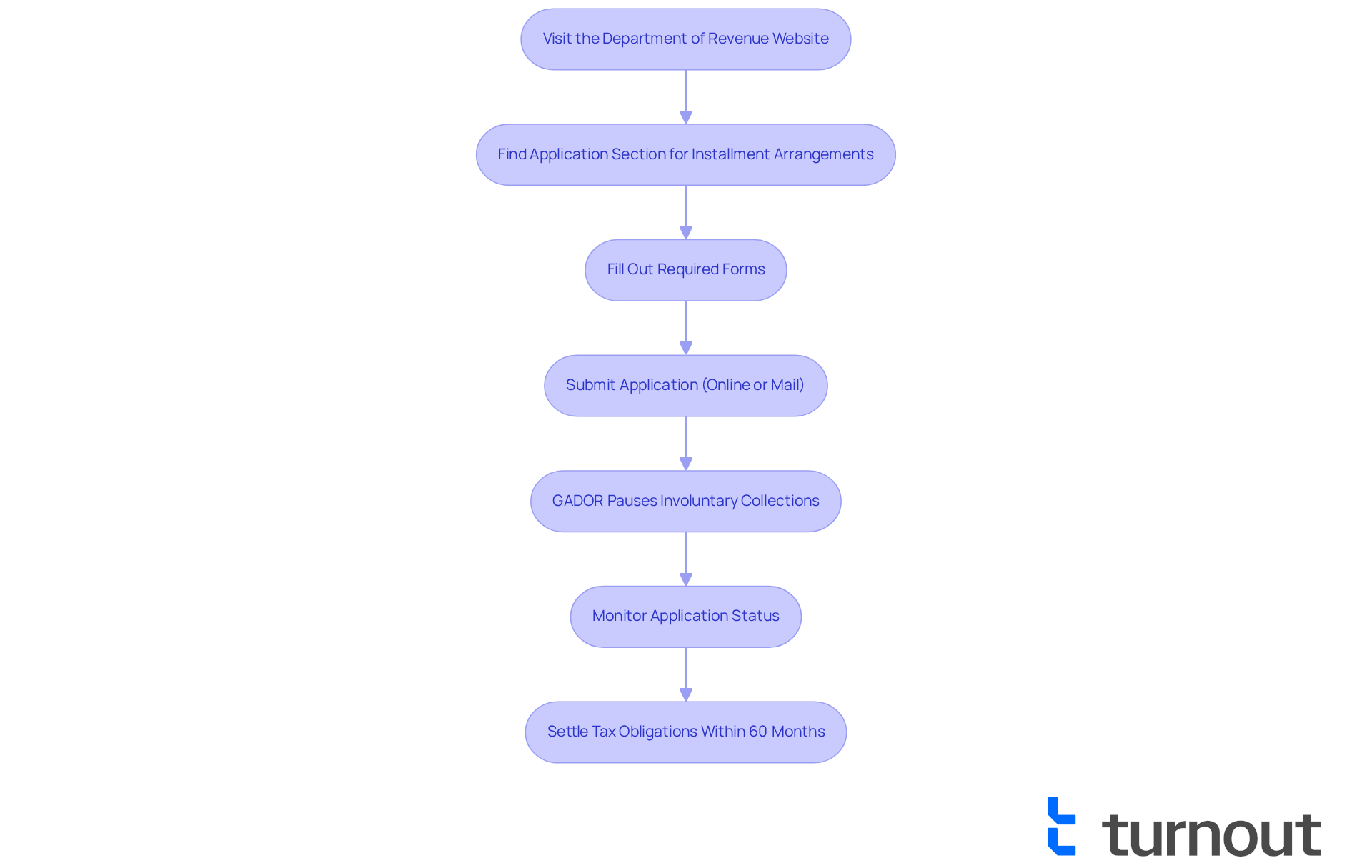

If you're feeling overwhelmed by tax obligations, know that you're not alone. To request a state of Georgia tax payment plan, begin by visiting the Department of Revenue's website. There, you can find the application section specifically for installment arrangements. As you fill out the required forms, take your time to ensure that all information aligns with your documentation.

It's important to remember that to be eligible for the state of Georgia tax payment plan, you must submit all state tax returns for the last five years. Once you've submitted your application, the Georgia Department of Revenue (GADOR) will pause most involuntary collections against you, including wage garnishments and asset seizures. You have the option to submit your application either online or via mail, depending on what feels most comfortable for you.

After submission, keep a close eye on your application status. Be prepared to provide any additional information the department may request. It's understandable to feel anxious during this process, but rest assured that tax obligations must be settled within 60 months (five years). You can make contributions through various methods, including:

- online payments

- checks

- money orders

- credit cards for both personal and business taxes

Please be aware that there might be an initial charge for the financing option, which can vary based on your earnings and method of transaction. If you ever encounter a situation where a check or draft does not go through due to insufficient funds, the DOR will send you a 'Cure/In Grace letter.' This letter will notify you of the due date and any extra charges to help you avoid default. Remember, we're here to help you navigate this journey, and you have support every step of the way.

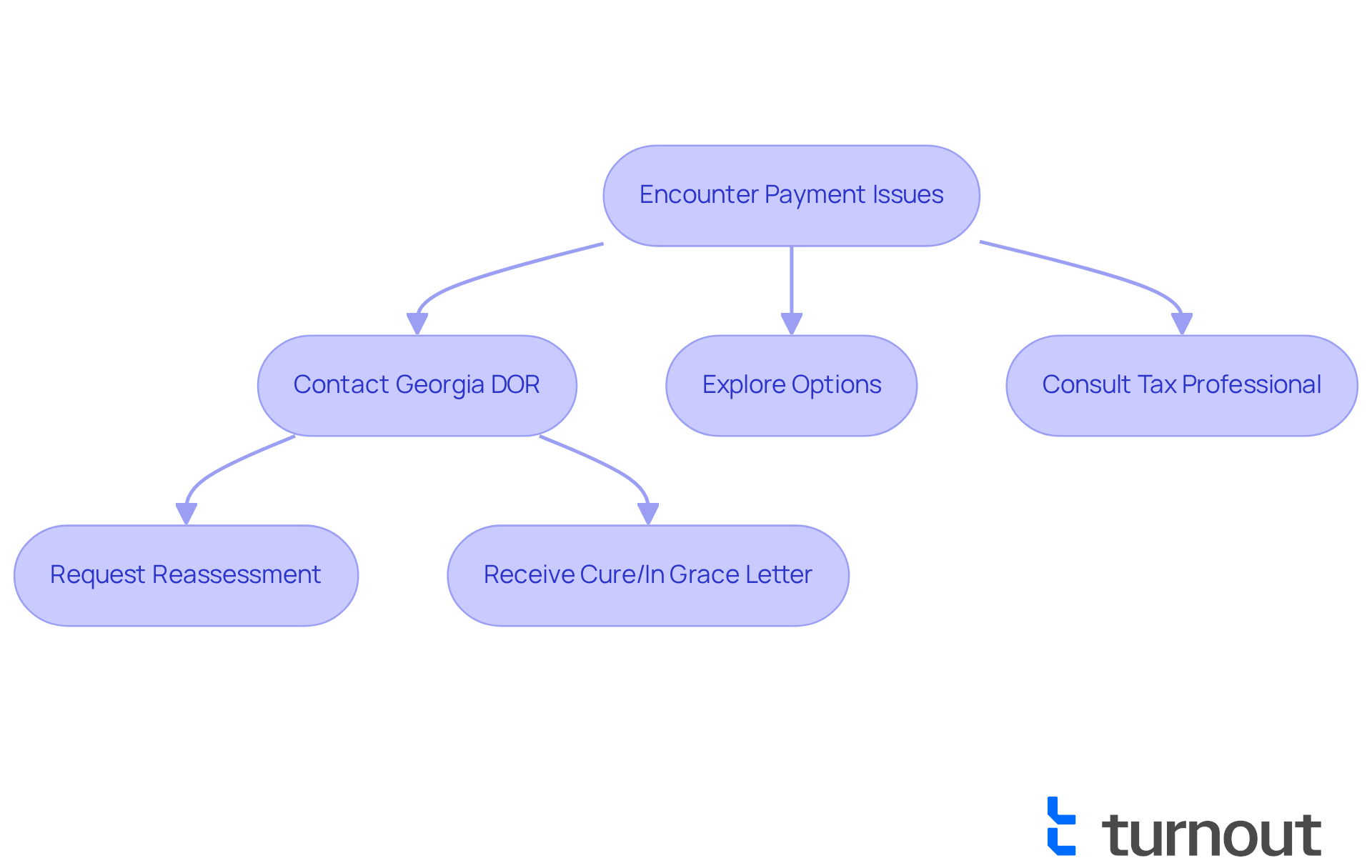

Troubleshoot Common Issues with Your Payment Plan

Once your financial arrangement is set up, it’s common to encounter difficulties like missed installments or changes in your economic situation. If you find yourself unable to complete a payment, we understand how stressful this can be. It’s crucial to reach out to the Georgia Department of Revenue (DOR) promptly to explore your options for a state of Georgia tax payment plan. The DOR may allow you to restore your arrangement or modify the terms based on your current circumstances. For instance, taxpayers facing significant financial difficulty can request a reassessment of their arrangement, which might lead to reduced monthly installments.

Statistics reveal that many taxpayers experience challenges with missed payments; indeed, a substantial number of financial agreements encounter issues due to insufficient funds. If a check or draft bounces because of inadequate funds, you will receive a 'Cure/In Grace letter' from the DOR. This letter will inform you of the due date and an additional $25 return fee to help you avoid defaulting on your agreement.

Tax advisors recommend maintaining proactive communication with the DOR as a key strategy for effectively managing the state of Georgia tax payment plan. They emphasize that understanding the terms of your agreement and addressing any issues promptly can significantly enhance your chances of successfully navigating the complexities of the state of Georgia tax payment plan. Additionally, we encourage you to consult a licensed tax professional for specific tax advice. By staying informed and engaged, you can better manage your obligations and avoid further complications. Remember, you are not alone in this journey; we're here to help.

Conclusion

Navigating the complexities of tax obligations can feel overwhelming. We understand that the state of Georgia offers a structured tax payment plan, providing a manageable path to fulfilling these responsibilities. By exploring the various options available—from short-term financial plans to extended installment arrangements—you can find a solution tailored to your unique financial situation. This plan not only facilitates easier payments but also helps alleviate the stress associated with tax debts.

It's important to recognize the key insights that emphasize eligibility, documentation, and proactive communication with the Georgia Department of Revenue. You must ensure that you meet the necessary requirements, gather all relevant documents, and maintain open lines of communication to effectively manage your payment plans. Real-life examples show that even low-income individuals can access these plans, making them a viable option for many.

Ultimately, the Georgia tax payment plan serves as a crucial lifeline for those struggling with tax debts. Taking the first step by assessing your eligibility and preparing the required documentation is essential. By doing so, you can regain control over your financial situation and work towards a resolution. Embracing this opportunity not only alleviates immediate financial pressures but also sets the stage for a more stable financial future. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What is the Georgia tax payment plan?

The Georgia tax payment plan allows taxpayers to settle their owed taxes in installments rather than a single payment, making it easier to manage tax debts.

What are the types of payment plans available in Georgia?

There are two main types of payment plans: Short-Term Financial Plans, which allow installments over a few months for smaller tax obligations, and Extended Installment Options, which can last up to 60 months for larger sums, starting at monthly payments of $25.

How can I apply for a Georgia tax payment plan?

You can create an online account at the Georgia Online Tax Center to request a payment plan. You will need to specify your proposed monthly contribution and select a due date.

Will interest and penalties accrue while I am on a payment plan?

Yes, while you are under an installment agreement, interest and penalties will continue to accrue until your total tax obligation is paid off.

What relief does a Georgia tax payment plan provide?

Establishing a Georgia tax payment plan can stop most involuntary collections, such as wage garnishments and asset seizures, providing immediate relief.

Are there any fees associated with the Georgia tax payment plan?

There is a charge of $100 to establish a payment plan, which decreases to $50 if you choose direct debit from your bank account.

Can I make extra payments on my tax payment plan?

Yes, you can contribute extra amounts at any time to speed up the settlement process, but you cannot change your current arrangement directly; you must terminate the existing agreement and request a new one.

What are the eligibility requirements for a Georgia tax payment plan?

To qualify, you must have filed all necessary tax returns and owe an amount that is manageable but cannot be paid in full. The Georgia Department of Revenue will evaluate your financial situation to determine your ability to make regular contributions.

How can I check my eligibility for a payment plan?

You can check your eligibility by reviewing your tax account status through the Georgia Tax Center online portal or by contacting the Georgia Department of Revenue directly.

What should I keep in mind while applying for a Georgia tax payment plan?

It is important to be transparent about your financial situation when applying, as this can influence the approval process. You must also pay all state taxes punctually and in full to maintain your agreement and avoid penalties.