Overview

Understanding your Social Security Disability Insurance (SSDI) payments is crucial, especially during challenging times. The amount you receive is determined by your Average Indexed Monthly Earnings (AIME), and it can range from about $1,580 to a maximum of $4,018 per month. This variance depends on your work history and contributions, which can feel overwhelming.

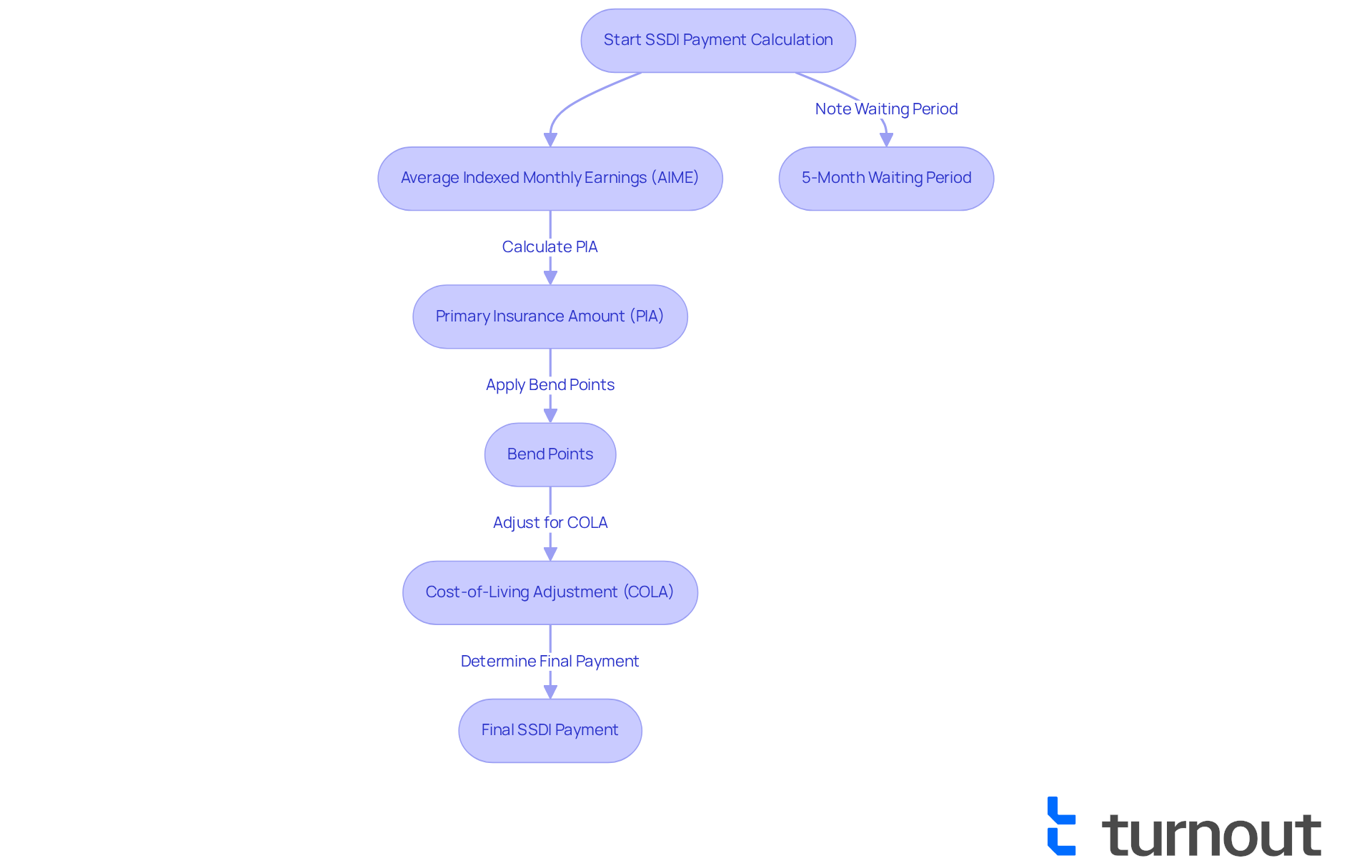

It's important to know that the calculation includes progressive 'bend points.' These are designed to ensure fair benefits for those who may have lower lifetime earnings. Additionally, factors such as a five-month waiting period and annual cost-of-living adjustments play a significant role in shaping your potential SSDI payments.

We understand that navigating this process can be daunting, but you are not alone in this journey. Gaining clarity on these elements can empower you to make informed decisions about your financial future. Remember, we're here to help you through this.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming for many individuals seeking financial support during tough times. We understand that knowing what to expect from SSDI is essential, as payments are determined by a formula that takes into account your past earnings and contributions.

With the maximum benefit projected to reach $4,018 per month in 2025, it’s common to have questions about eligibility requirements and payment calculations.

- How do these factors influence your financial security while relying on SSDI?

- What can you do to ensure you receive the support you need?

We're here to help you through this journey.

Understanding SSDI Payment Calculations

Navigating disability payments can feel overwhelming, but understanding how much do you get on SSDI is the first step toward securing your financial future. These payments are calculated using a formula based on your Average Indexed Monthly Earnings (AIME) throughout your working life. The Social Security Administration (SSA) focuses on your highest-earning years to establish your Primary Insurance Amount (PIA), which is then adjusted for inflation.

In 2025, while the maximum SSDI payment is expected to reach $4,018 per month, many may wonder how much do you get on SSDI, with the average disbursement being around $1,580. The calculation includes several 'bend points' that apply different percentages to portions of your AIME, ensuring that those with lower lifetime earnings receive a relatively higher benefit. This progressive structure aims to provide a safety net for individuals who have contributed to the system through their work history.

It's important to remember that there is a mandatory five-month waiting period after qualifying for disability benefits, during which no payments are made. For instance, a service technician at a chemical company received $64,396 in back pay after being granted disability benefits, while a Post Office Clerk's daughter received $60,270, illustrating the variability in financial support available to beneficiaries.

Additionally, the cost-of-living adjustment (COLA) for 2025 is set at 2.5%, which affects how disability payments are modified each year. Understanding these calculations and factors is essential for strategizing your financial future while considering how much do you get on SSDI in managing the intricacies of Social Security Disability Insurance.

We’re here to help you through this process. Turnout provides access to trained nonlawyer advocates who can assist you in navigating your SSD claims effectively. You are not alone in this journey; support is available every step of the way.

Comparing SSDI Payments with Other Disability Benefits

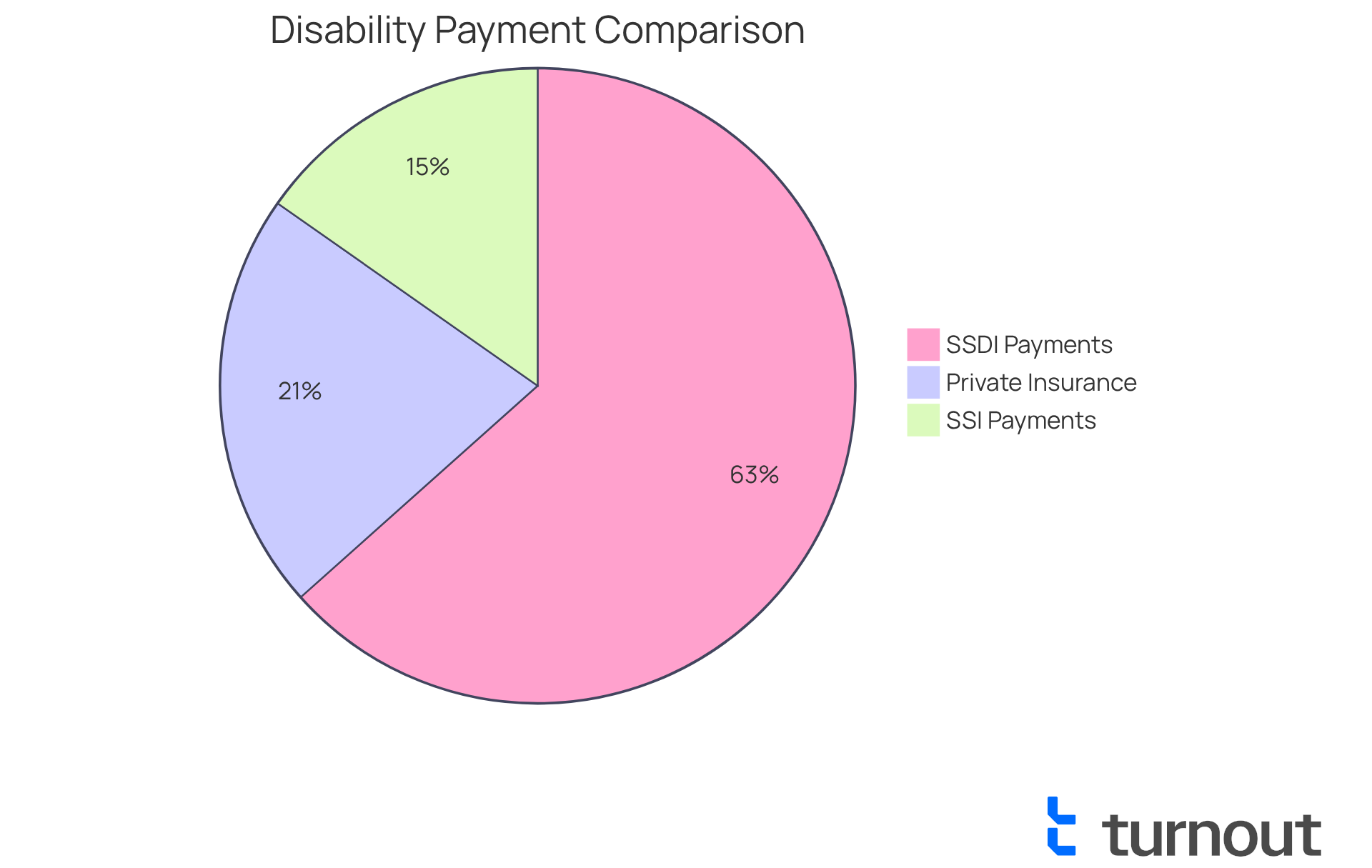

When comparing Social Security Disability Insurance to other forms of disability assistance, such as Supplemental Security Income (SSI), it's important to understand your unique situation. We recognize that navigating these options can be overwhelming. Social Security Disability Insurance relies on your work history and contributions to Social Security, while SSI is a needs-based program designed to support individuals with limited income and resources.

As of 2025, the maximum SSI payment is $967 monthly for individuals and $1,450 for couples. In contrast, how much do you get on SSDI can vary and may reach up to $4,018 per month, depending on your earnings history. It’s common to feel uncertain about which option is right for you.

Additionally, private disability insurance often provides higher monthly payments than Social Security Disability Insurance. However, it typically requires premium contributions and may have stricter eligibility criteria. For instance, those with private disability coverage may receive an average payment that exceeds Social Security Disability Insurance, but they must navigate the complexities of policy terms and conditions.

Understanding how much do you get on SSDI is essential for anyone exploring financial support during challenging times. Remember, you are not alone in this journey, and we’re here to help you find the best path forward.

Eligibility and Income Considerations for SSDI Benefits

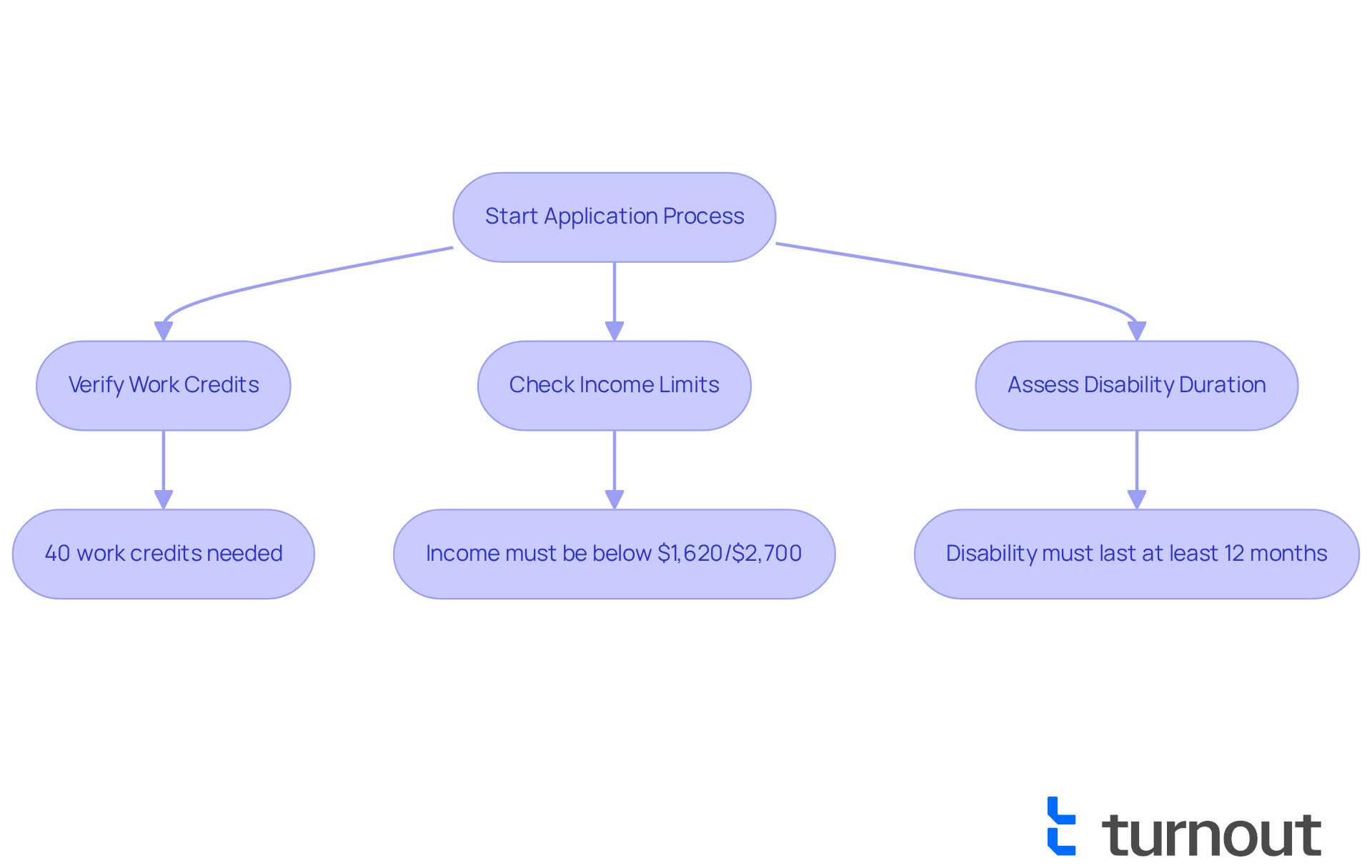

We understand that applying for disability benefits can be a daunting process. To be eligible, it's important to show an adequate work history, which typically means accumulating 40 work credits—at least 20 of those should be earned in the last 10 years before the disability began. In 2025, the Social Security Administration (SSA) defines substantial gainful activity (SGA) as earning over $1,620 monthly for non-blind individuals and $2,700 for those who are blind. If your income exceeds these thresholds, it may affect your status as disabled under the relevant criteria.

It's crucial to demonstrate that your disability is expected to last at least 12 months or could result in death. Understanding these eligibility criteria is key for anyone seeking disability assistance, as they significantly influence both your chances of acceptance and how much do you get on SSDI in total support. Gathering comprehensive medical evidence to back up your claims and verify your work credits is also essential.

We encourage you to consult with knowledgeable professionals, like Turnout's trained nonlawyer advocates. They can provide valuable guidance throughout the application process, helping to enhance your chances of a successful outcome. Furthermore, the anticipated 2025 cost-of-living adjustment is expected to increase support, which is an important factor for applicants managing their financial needs. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

Impact of Cost-of-Living Adjustments on SSDI Benefits

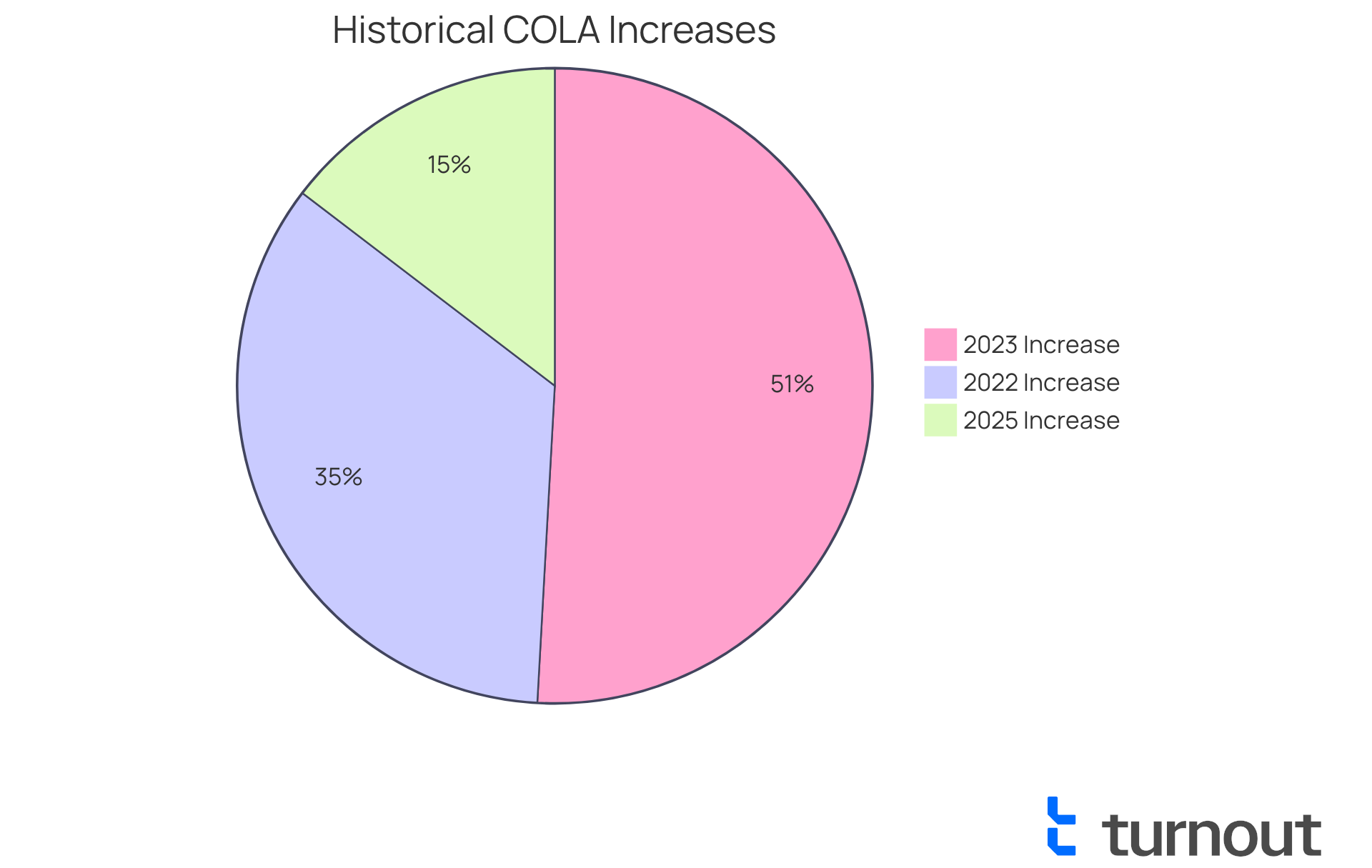

Cost-of-living increases are implemented to assist in preserving the purchasing power of recipients amid inflation. For 2025, the cost-of-living adjustment increase is set at 2.5%, translating to an average monthly benefit rise of approximately $48. This adjustment is crucial for individuals who want to know how much do you get on ssdi, as it helps offset rising living costs. However, we understand that while cost-of-living adjustments can offer some relief, they may not completely offset inflation, especially in sectors like healthcare and housing.

Historically, cost-of-living adjustments have varied significantly, with a record high of 8.7% in 2023 and previous increases of 5.9% in 2022. Understanding these trends provides context for the current adjustment's significance. The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of goods and services over time.

Additionally, it's important for recipients to recognize possible tax consequences. For example, individual filers making over $34,000 might have as much as 85% of their payments taxed. Furthermore, the updated income thresholds for disability assistance recipients in 2025 permit earnings up to $1,550 monthly without forfeiting support. This change offers greater flexibility for individuals contemplating part-time employment.

Real-life examples demonstrate the challenges encountered by recipients. An individual who previously managed with their social security payments may find that rising costs for medications or housing can diminish the purchasing power of their assistance, despite the cost-of-living adjustment. As inflation continues to affect the cost-of-living adjustment calculation, it is essential for recipients to understand how much do you get on ssdi payments.

We’re here to help you navigate these complexities, ensuring you are informed about your benefits and the financial assistance available to you. The COLA is designed to help recipients maintain their financial stability, but it is essential for you to remain vigilant about your budgeting and financial strategies in light of ongoing economic fluctuations. Remember, you are not alone in this journey.

Conclusion

Understanding the intricacies of Social Security Disability Insurance (SSDI) is crucial for anyone seeking financial support during challenging times. We recognize that navigating this system can feel overwhelming. This article highlights how SSDI payments are calculated based on work history and earnings, emphasizing the importance of the Average Indexed Monthly Earnings (AIME) and the Primary Insurance Amount (PIA). With the maximum SSDI payment projected to rise significantly in 2025, it is vital for individuals to grasp how these benefits can provide a safety net based on their lifetime contributions.

Key insights from the article reveal the differences between SSDI and other disability benefits, such as Supplemental Security Income (SSI) and private disability insurance. While SSDI relies on past work contributions, SSI is needs-based, and private insurance often offers higher payments but with stricter eligibility criteria. It’s common to feel confused about these options. Additionally, the impact of cost-of-living adjustments (COLA) on SSDI benefits is highlighted, showcasing how these increments aim to preserve purchasing power amid inflation, albeit with limitations.

In navigating the complexities of SSDI, we encourage you to consult knowledgeable professionals who can assist in understanding eligibility criteria and maximizing benefits. The journey may seem daunting, but with the right support and information, you can secure your financial future. Awareness of the various factors affecting SSDI payments, including income limits and eligibility requirements, will empower you to make informed decisions and advocate for your rights in accessing the assistance you deserve. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

How are SSDI payments calculated?

SSDI payments are calculated using a formula based on your Average Indexed Monthly Earnings (AIME) throughout your working life, focusing on your highest-earning years to establish your Primary Insurance Amount (PIA), which is then adjusted for inflation.

What is the expected maximum SSDI payment in 2025?

The maximum SSDI payment is expected to reach $4,018 per month in 2025.

What is the average SSDI payment?

The average SSDI payment is around $1,580.

What are 'bend points' in the SSDI payment calculation?

'Bend points' are thresholds in the calculation that apply different percentages to portions of your AIME, ensuring that individuals with lower lifetime earnings receive a relatively higher benefit.

Is there a waiting period for SSDI payments after qualifying?

Yes, there is a mandatory five-month waiting period after qualifying for disability benefits, during which no payments are made.

Can you provide examples of back pay received by SSDI beneficiaries?

A service technician at a chemical company received $64,396 in back pay after being granted disability benefits, while a Post Office Clerk's daughter received $60,270.

What is the cost-of-living adjustment (COLA) for SSDI in 2025?

The cost-of-living adjustment (COLA) for 2025 is set at 2.5%, which affects how disability payments are modified each year.

How can I get assistance with my SSDI claims?

Turnout provides access to trained nonlawyer advocates who can assist you in navigating your SSD claims effectively. Support is available throughout the process.