Overview

Navigating the world of disability payments can be challenging, and we understand that you may have many questions. Disability payments vary based on the type of assistance available. For instance, Social Security Disability Insurance (SSDI) averages around $1,537.13 per month for recipients, while Supplemental Security Income (SSI) offers nearly $650 per month.

These amounts are not just numbers; they reflect real lives and real needs. It's important to recognize that factors such as work history, income levels, family status, and cost-of-living adjustments play a significant role in determining your potential benefits. Understanding these elements can empower you to make informed decisions about your financial future.

We want you to know that you are not alone in this journey. By taking the time to understand how these payments work, you can better navigate your options and find the support you deserve. Remember, we're here to help you every step of the way.

Introduction

Understanding the intricacies of disability payments is crucial for millions navigating financial challenges due to medical conditions. We understand that this journey can be overwhelming.

With programs like Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), individuals can find essential support. However, the complexities of eligibility and payment calculations can feel daunting.

How can you ensure you are receiving the correct amount of assistance while effectively managing the various factors that influence these benefits? This guide offers a step-by-step approach to demystifying the calculation process, empowering you to confidently assess your potential monthly disability payments.

Remember, you are not alone in this journey—we're here to help.

Understand Disability Payment Basics

Disability payments are essential financial supports for individuals unable to work due to medical conditions. In the United States, the two main categories of disability assistance are Insurance (SSDI) and Supplemental Income (SSI).

- SSDI is intended for people who possess a work history and have contributed to Social Security, with payments determined by their average earnings throughout their working life.

- In contrast, SSI is a need-based program aimed at individuals with limited income and resources, regardless of their work history, with payment amounts determined by federal and state guidelines.

We understand that navigating these programs can be overwhelming. Both SSDI and SSI have that can be quite complex. For instance, in 2022, , highlighting the challenges many face in proving their eligibility. Understanding these differences is crucial, as they directly influence .

As of 2023, more than 8.7 million disabled recipients received , leading to questions about how much does disability pay per month, which averages around $1,537.13, while SSI recipients obtained nearly $650 per month.

It's common to feel uncertain about your options, but can link you to , which is a considerable advantage. It’s also important to note that individuals can receive both SSDI and SSI if their SSDI income is below the maximum SSI payment.

Turnout offers valuable support in navigating these intricate processes. Our trained non-legal advocates are here to assist you in understanding your choices and applying for assistance effectively. Please remember that Turnout is not a law firm and does not provide legal representation. In addition to SSD claims, we also offer support for , further assisting clients in overcoming financial challenges.

Getting acquainted with these fundamentals will empower you to handle the following stages in determining your entitlements efficiently. You are not alone in this journey; we’re here to help.

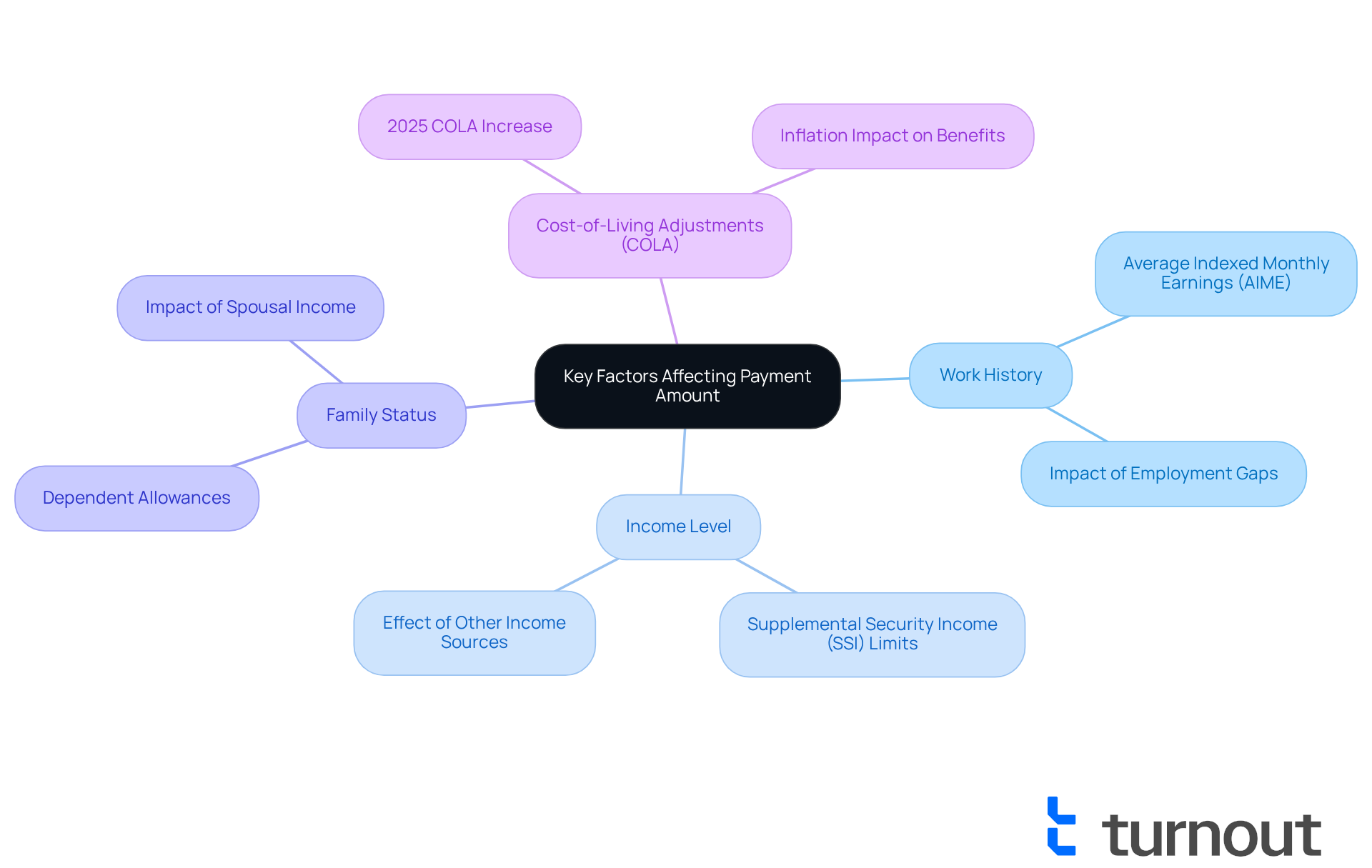

Identify Key Factors Affecting Payment Amount

Navigating the world of can be overwhelming, but understanding can significantly impact the support you receive.

- Work History: If you're seeking , it's important to know that your benefit amount is based on your . This reflects your highest-earning years. Generally, the more you have earned and contributed to Social Insurance, the greater your potential benefits. For example, individuals with a steady work history often receive higher SSDI payments compared to those with gaps in employment.

- Income Level: When it comes to , your total income and resources play a crucial role. If your income exceeds certain limits, your SSI assistance might be reduced or eliminated. In 2025, the federal SSI payment levels will be $967 monthly for individuals and $1,450 for couples, but remember, other sources of income can affect these amounts.

- Family Status: Your family situation can also impact your benefits. If you have dependents, you may qualify for additional allowances for your spouse and children, which could enhance your overall support.

- : It's comforting to know that benefits are periodically adjusted to keep pace with inflation. This means your monthly payments can increase over time. For instance, the Social Security Administration has announced a 2.5% COLA for 2025, which translates to an average increase of over $50 per month for recipients, helping you manage rising living costs.

Understanding these factors is essential for making informed decisions about how much does disability pay per month regarding your potential benefits. We’re here to help you navigate this journey, ensuring you are prepared for the financial implications of your disability. Remember, you are not alone in this process.

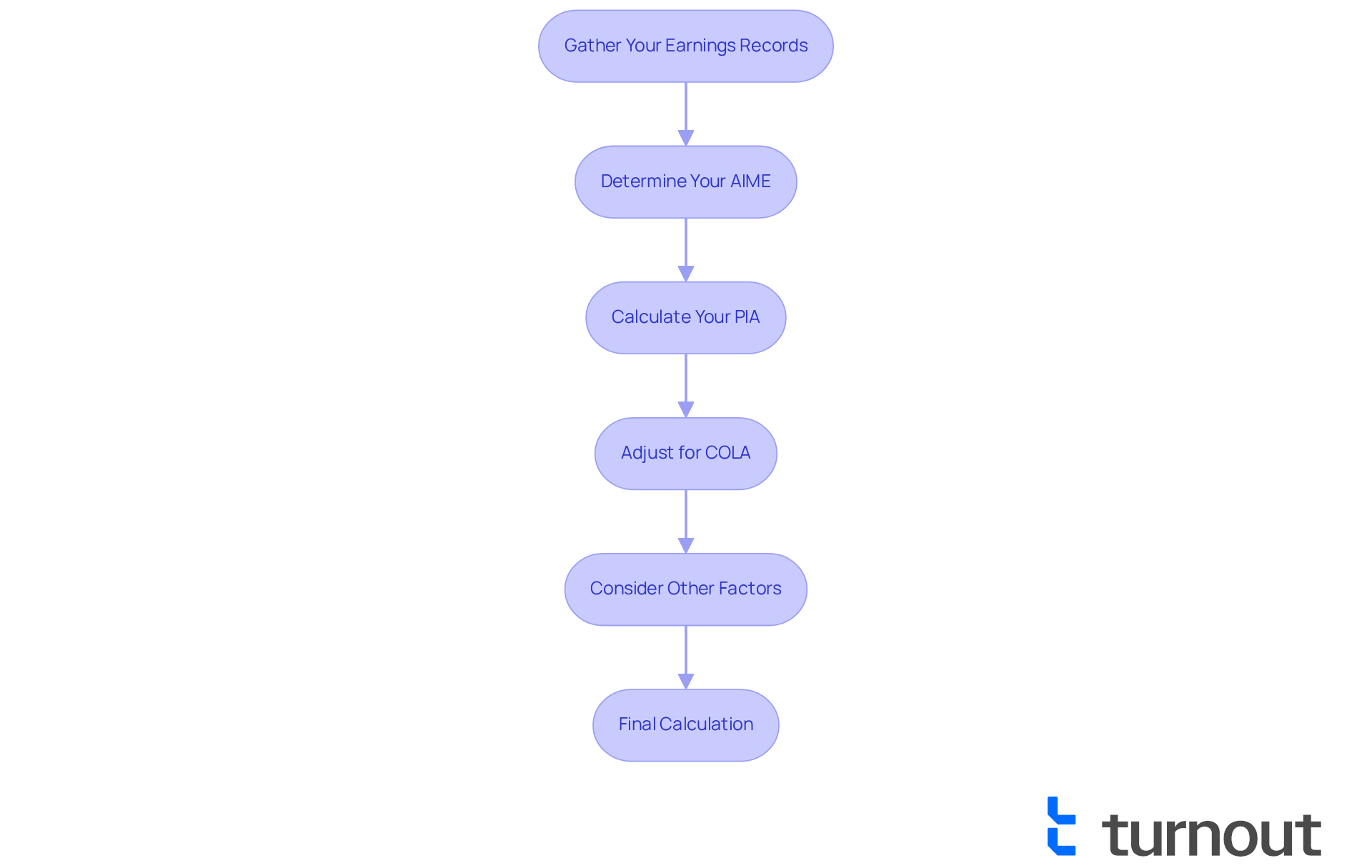

Calculate Your Monthly Disability Benefits Step-by-Step

Calculating can feel overwhelming, but we're here to help you through it. Follow these steps to gain a clearer understanding of your potential assistance:

- Gather Your Earnings Records: Start by collecting your income record, which shows your earnings history. You can easily access this through the .

- Determine Your AIME: Next, calculate your . This involves taking your highest-earning 35 years of work, adjusting for inflation, and dividing by the total number of months in those years.

- Calculate Your Primary Insurance Amount (PIA): Use this formula to find your PIA:

- For the first $1,115 of your AIME, multiply by 90%.

- For the next $5,557, multiply by 32%.

- For any total above $6,672, multiply by 15%.

- Combine these values to obtain your PIA.

- Adjust for COLA: If applicable, make sure to adjust your PIA for any . In 2025, the COLA raised SSDI payments by 2.5%, which is crucial for keeping pace with inflation.

- Consider Other Factors: If you're applying for , it's important to consider your earnings and assets to assess your eligibility and potential compensation level. Remember, receiving other government assistance may affect your monthly SSDI payment.

- Final Calculation: The total you calculate will be your . You can verify this through the Social Security Administration's online calculators or by contacting them directly. As of 2025, the average SSDI payment is approximately $1,580, with most recipients receiving between $1,200 and $1,800 monthly. Please note that there is a waiting period of five months from the date SSA determines when your disability began before assistance is provided.

By following these steps, you can achieve a clearer assessment of how much does disability pay per month for your assistance. Understanding how your earnings record impacts your benefits is essential for effective financial planning. You are not alone in this journey, and we are here to support you every step of the way.

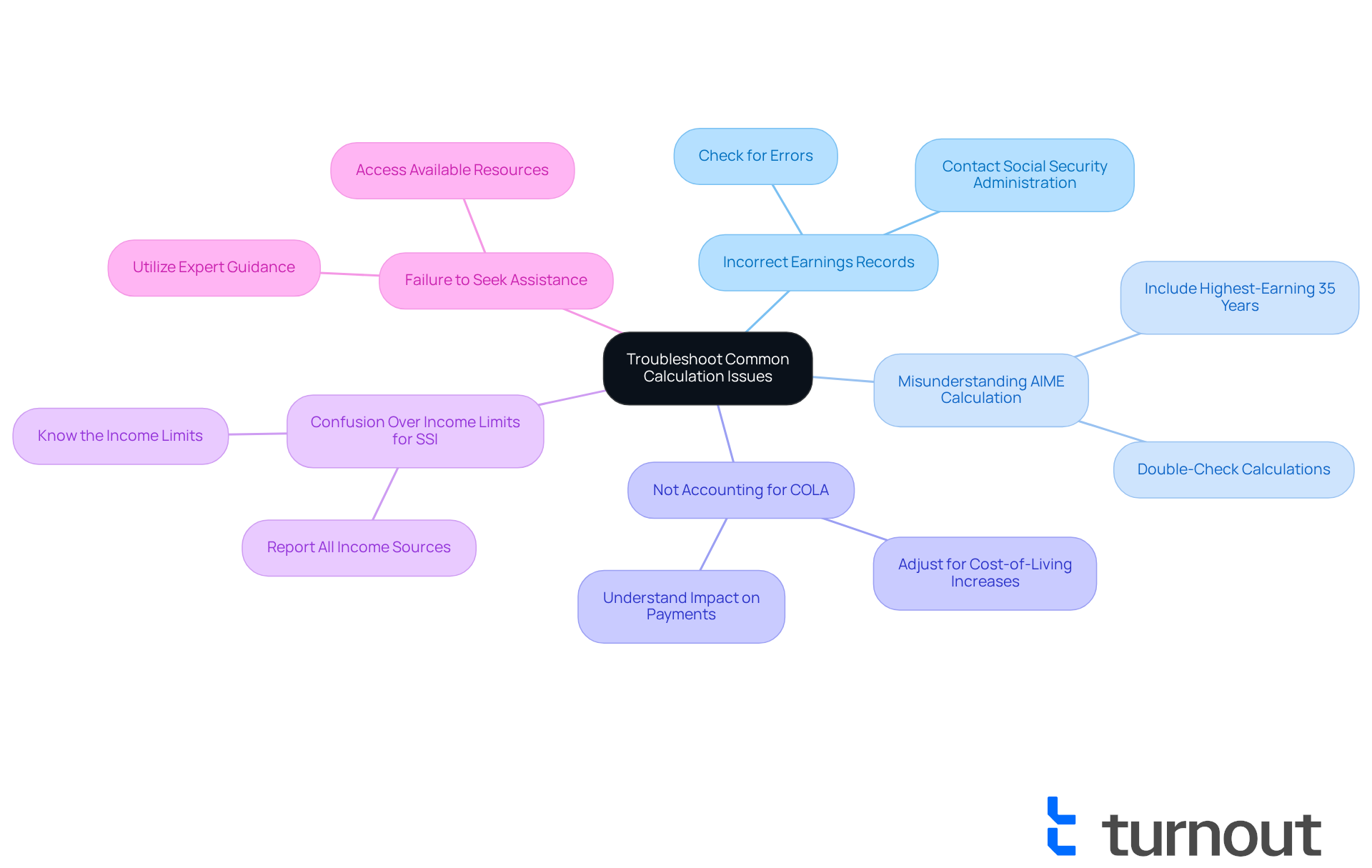

Troubleshoot Common Calculation Issues

When determining your , it’s common to encounter several challenges. We understand that navigating this process can be overwhelming, but here’s how to troubleshoot these issues with care:

- Incorrect Earnings Records: It’s essential to ensure that your earnings record is accurate. Discrepancies can lead to significant variations in your compensation value. If you notice any errors, please reach out to the Social Service Administration promptly to start the correction process.

- Misunderstanding AIME Calculation: Many individuals mistakenly miscalculate their by not including all eligible years. Double-check that you are using your highest-earning 35 years, as this is crucial for an accurate calculation.

- Not Accounting for COLA: Remember to adjust your calculations for any . For instance, in , which can significantly impact your final payment amount.

- Confusion Over Income Limits for SSI: If you are applying for , it’s important to be aware of the income limits that may affect your eligibility. For 2024, the income limit is $914 per month for individuals. Keep track of all your income sources and report them accurately to avoid complications.

- Failure to Seek Assistance: If you’re feeling uncertain about your calculations, please don’t hesitate to seek help. and support in navigating the complexities of , including tools and services designed to help you understand and optimize your entitlements.

By being aware of these common issues and knowing how to address them, you can feel more confident in ensuring an accurate calculation of in your benefits. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Understanding how much disability pays per month is crucial for those navigating the complexities of financial support due to medical conditions. We recognize that this journey can feel overwhelming, and it’s important to have the right information at your fingertips. This article has explored the foundational aspects of disability payments, specifically focusing on Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Each program serves different needs and has unique eligibility criteria, which significantly influence the amount of assistance you can receive.

Key factors affecting payment amounts include:

- Work history

- Income level

- Family status

- Cost-of-living adjustments

These factors have been detailed to provide a comprehensive understanding of how benefits are calculated. We understand that these details can be confusing, so we’ve included a step-by-step guide on calculating monthly disability benefits. This equips you with the tools necessary to assess your financial entitlements accurately. Additionally, troubleshooting common calculation issues ensures that you can effectively navigate potential pitfalls in the process.

In conclusion, the journey to securing disability benefits may seem daunting, but knowledge is empowering. By familiarizing yourself with the intricacies of SSDI and SSI programs, you can make informed decisions and optimize your benefits. Remember, you are not alone in this journey. It’s essential to seek assistance when needed, as support services like Turnout can provide valuable guidance throughout this process. Taking proactive steps today can lead to a more secure financial future for those relying on disability payments.

Frequently Asked Questions

What are the main types of disability payments available in the United States?

The two main types of disability payments in the United States are Social Security Disability Insurance (SSDI) and Supplemental Income (SSI).

Who is eligible for Social Security Disability Insurance (SSDI)?

SSDI is intended for individuals who have a work history and have contributed to Social Security, with payment amounts determined by their average earnings throughout their working life.

What is Supplemental Income (SSI) and who qualifies for it?

SSI is a need-based program for individuals with limited income and resources, regardless of their work history. Payment amounts are determined by federal and state guidelines.

What challenges do applicants face when applying for disability assistance?

Many applicants face challenges in proving their eligibility, with 62% of applicants being initially denied in 2022.

How much does disability pay per month for SSDI and SSI recipients?

As of 2023, SSDI recipients receive an average of around $1,537.13 per month, while SSI recipients receive nearly $650 per month.

Can individuals receive both SSDI and SSI?

Yes, individuals can receive both SSDI and SSI if their SSDI income is below the maximum SSI payment.

What additional benefits can qualifying for SSDI or SSI provide?

Qualifying for SSDI or SSI can provide access to health insurance coverage through Medicare or Medicaid.

How can Turnout assist individuals navigating disability payment processes?

Turnout offers support through trained non-legal advocates who help individuals understand their options and apply for assistance effectively, although they do not provide legal representation.