Overview

We understand that failing to file taxes for even one year can be a daunting experience, leading to severe consequences. This can include significant penalties, interest charges, and even potential legal actions like wage garnishment or asset seizure. It's important to recognize that the IRS imposes a 5% monthly penalty on unpaid taxes, which can accumulate to a maximum of 25%.

However, we want to emphasize the importance of filing your taxes, even if you cannot make a payment right away. Taking this step can help mitigate further repercussions and open up options for payment plans. Remember, you are not alone in this journey, and there are ways to navigate these challenges. We're here to help you find the best path forward.

Introduction

Neglecting to file taxes can lead to serious consequences that affect both your personal finances and legal standing. We understand that the implications of failing to submit tax returns, even for just one year, can feel overwhelming. This may result in hefty penalties, lost refunds, and potential legal issues.

As you grapple with the complexities of tax obligations, you might wonder: what happens when one chooses to ignore these responsibilities? It's common to feel anxious about this, but understanding the full scope of repercussions is crucial for anyone navigating the challenging landscape of tax compliance.

Remember, you're not alone in this journey; we're here to help you avoid the pitfalls of non-filing.

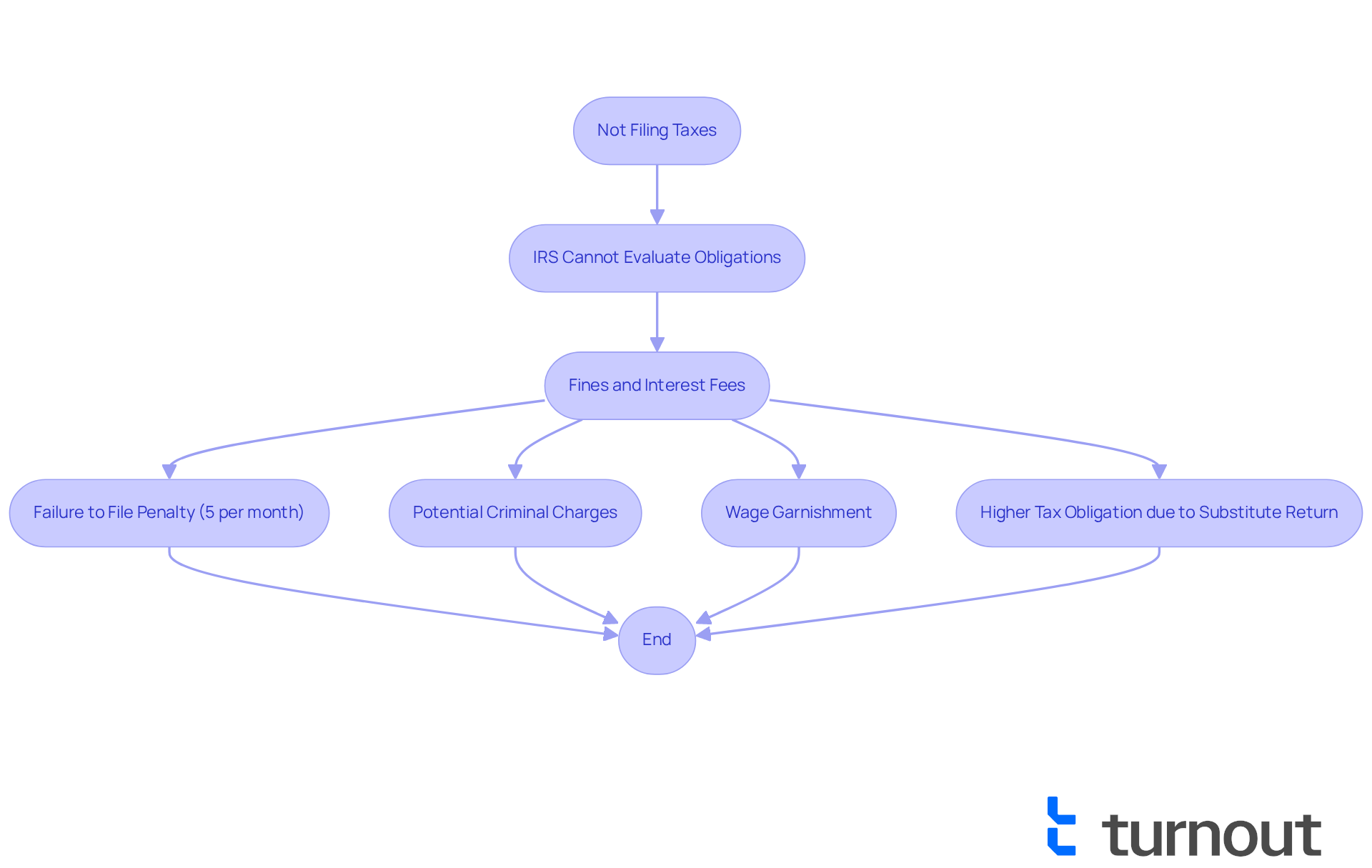

Define the Consequences of Not Filing Taxes

Neglecting to submit required documentation can lead to significant repercussions, similar to [what happens if you don't file taxes for 1 year](https://irs.gov/payments/failure-to-file-penalty), both in the short term and long-lasting. We understand that if you don't file taxes for 1 year, the Internal Revenue Service (IRS) cannot evaluate your financial obligation. This situation may lead to a range of fines and interest fees, highlighting what happens if you don't file taxes for 1 year. The IRS enforces a 'failure to file' charge of 5% of the owed amounts for each month the return is delayed, leading to significant penalties which highlight what happens if you don't file taxes for 1 year, capped at 25%. This penalty is notably harsher than the 'failure to pay' penalty, which is only 0.5% per month, also capped at 25%.

It's common to feel overwhelmed by these consequences. In extreme cases, non-filing may be viewed as a willful act, potentially leading to criminal charges. For instance, individuals who owe $25,000 or more may face severe consequences, including wage garnishment, asset seizure, or even arrest for evasion of payment. Moreover, if the IRS submits a substitute return for you due to non-filing, it often results in a greater tax obligation, as it does not consider any deductions or credits you might qualify for. Misty Erickson, a tax content manager, highlights that such a return will not include all the deductions or credits a taxpayer is entitled to, typically resulting in higher taxes owed than if the taxpayer filed their own return.

The financial implications of what happens if you don't file taxes for 1 year can be profound. Taxpayers risk losing their entitlement to refunds, which raises the question of what happens if you don't file taxes for 1 year. If you do not submit by the deadline, you may experience consequences similar to what happens if you don't file taxes for 1 year, such as forfeiting valuable credits and benefits. For example, taxpayers must submit their 2021 federal tax return by April 15, 2025, to qualify for specific credits, including the energy-efficient home improvement credit.

We want to emphasize the importance of prompt action. Practical examples show that individuals who have faced consequences for not submitting often experience financial pressure, leading them to question what happens if you don't file taxes for 1 year. If you discover that you cannot meet the filing deadline, it is essential to request an extension or establish a payment arrangement. Taking these steps can help reduce possible fines and safeguard your financial well-being. Remember, you are not alone in this journey; we're here to help.

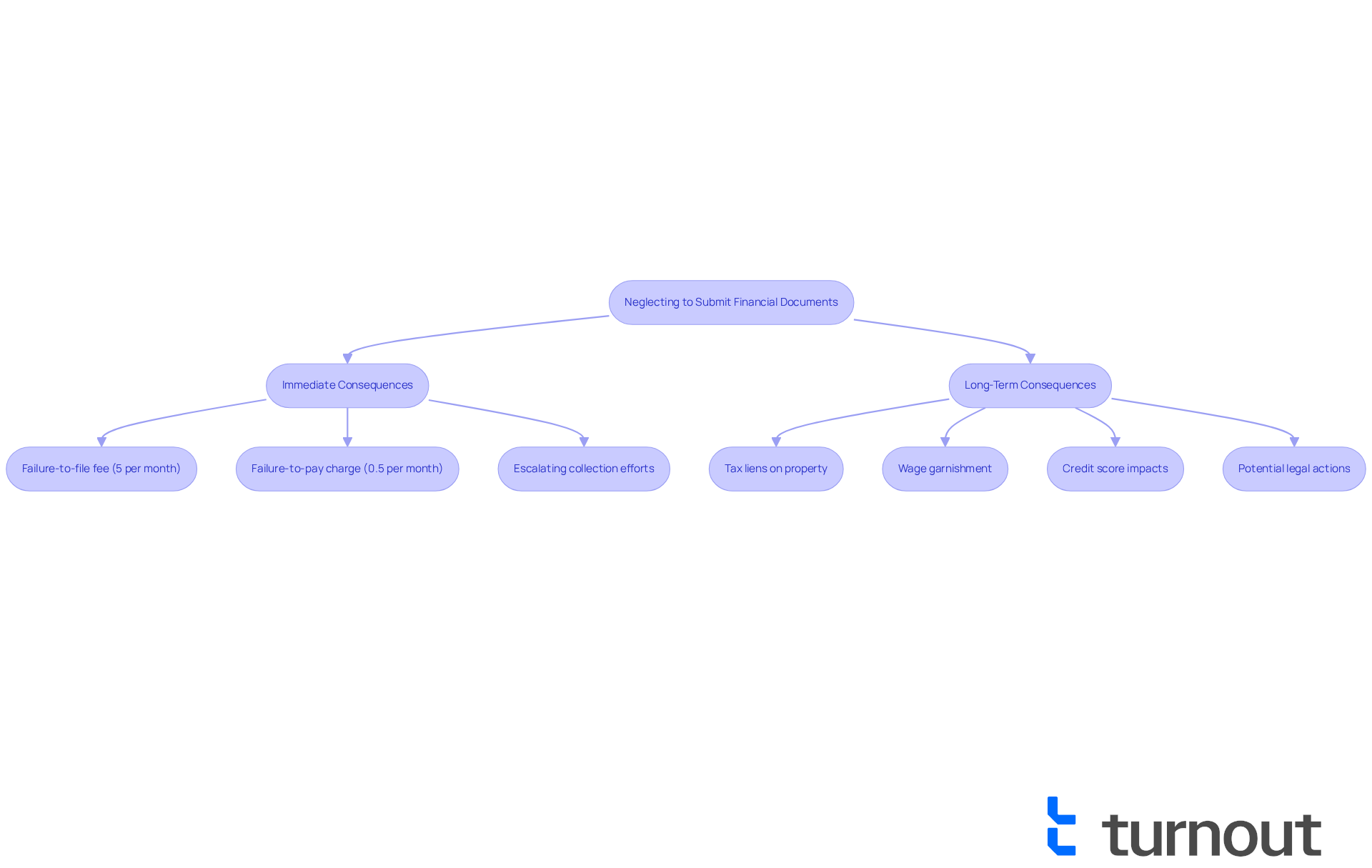

Examine Immediate and Long-Term Repercussions

Neglecting to submit required financial documents can lead to swift consequences, highlighting what happens if you don't file taxes for 1 year, including the accumulation of charges and interest on any outstanding sums. We understand that dealing with taxes can be overwhelming. The IRS imposes a failure-to-file fee of 5% of the unpaid tax for each month the return is delayed, with a maximum limit of 25%. Additionally, if taxes are owed, a failure-to-pay charge of 0.5% per month applies to the unpaid balance. Jay A. Soled highlights that these charges can reach five percent monthly for delinquency, stressing the urgency of addressing tax responsibilities.

The long-term consequences can be even more severe when considering what happens if you don't file taxes for 1 year. If you don't file taxes for 1 year, tax liens may be placed on your property and your wages can be garnished, significantly impacting your financial stability. It's common to feel anxious about these possibilities. Moreover, unresolved tax issues can adversely affect credit scores, complicating future financial endeavors such as securing loans or mortgages. If you have failed to meet filing deadlines, we encourage you to submit outstanding returns at your earliest convenience, even if you cannot pay the total amount. This can help reduce repercussions and demonstrate your commitment to adhering to IRS requirements.

Case studies illustrate that individuals who ignore tax obligations often face escalating collection efforts from the IRS, which raises concerns about what happens if you don't file taxes for 1 year, including aggressive notices and potential legal actions. For instance, those who delay filing may experience what happens if you don't file taxes for 1 year, including being subject to liens or asset seizures, which creates a cycle of financial strain. Addressing tax issues promptly is crucial. Submitting overdue returns, even if full payment cannot be made right away, can stop the buildup of fines and show the IRS your readiness to comply. This proactive strategy not only lessens immediate repercussions but also opens up opportunities for payment plans and assistance, ultimately decreasing the likelihood of encountering more severe outcomes in the future.

Additionally, you may qualify for an offer in compromise with the IRS, allowing you to settle your tax debt for less than the full amount owed. The IRS is generally willing to work with taxpayers to establish payment plans or installment agreements, providing further avenues for relief. Remember, you are not alone in this journey—we're here to help.

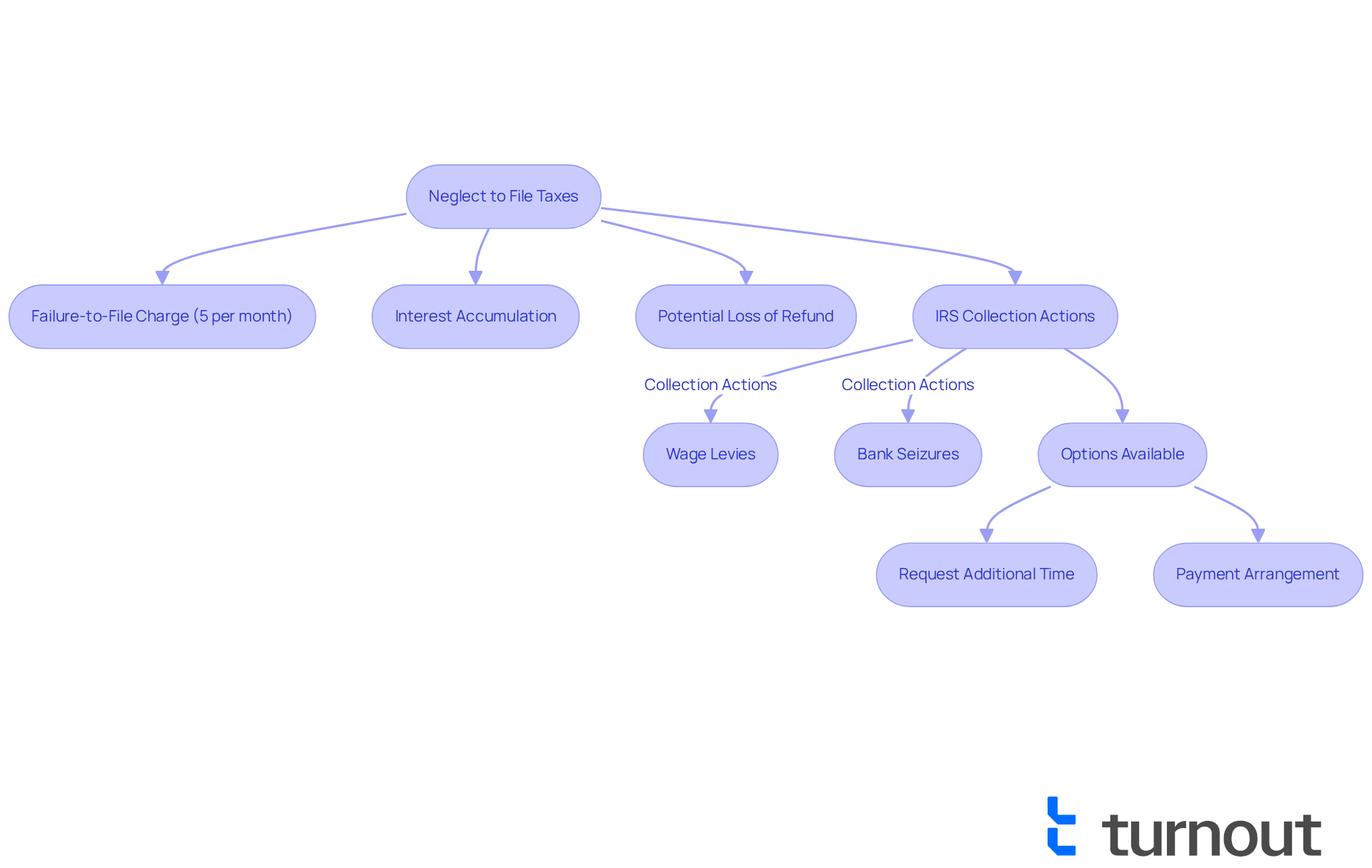

Detail Penalties and Financial Implications

The financial repercussions of what happens if you don't file taxes for 1 year can be overwhelming. We understand that navigating tax responsibilities can be stressful. The IRS enforces a failure-to-file charge of 5% of the unpaid tax for every month the return is delayed, with a maximum limit of 25%. If a return is filed more than 60 days past the deadline, the minimum penalty escalates to either 100% of the tax due or $135, whichever is lower. Additionally, interest on unpaid taxes compounds, further exacerbating the financial burden. For those expecting a refund, neglecting to file can result in forfeiting that refund entirely, as the IRS allows only a three-year window for claiming refunds. Importantly, there are usually no consequences for late submission if the taxpayer is due a refund, emphasizing the importance of fulfilling tax responsibilities promptly.

Consider the situation of a taxpayer who neglected their filing duties, leading to the consequences of what happens if you don't file taxes for 1 year and faced increasing fines. After several months, the total failure-to-file charges reached a significant amount, leading to aggressive collection actions by the IRS, including wage levies and bank account seizures. It's common to feel overwhelmed by such actions, which the IRS begins after the filing deadline passes. This illustrates how quickly financial strain can escalate when considering what happens if you don't file taxes for 1 year.

Moreover, the IRS has the power to submit a Substitute for Return (SFR) for those who do not file. This often leads to a greater tax obligation due to the absence of deductions and credits. The result can be even more severe financial consequences, as the taxpayer may end up owing more than if they had filed their own return. Thus, it is essential for individuals to submit their taxes on time to avoid the consequences of what happens if you don't file taxes for 1 year, even if they cannot pay the entire sum due. This approach helps reduce fines and allows for exploring available assistance options. As the IRS emphasizes, "You can avoid a penalty by filing and paying your tax by the due date. If you are unable to do so, you may request additional time to submit or a payment arrangement." Remember, you are not alone in this journey, and we're here to help you navigate these challenges.

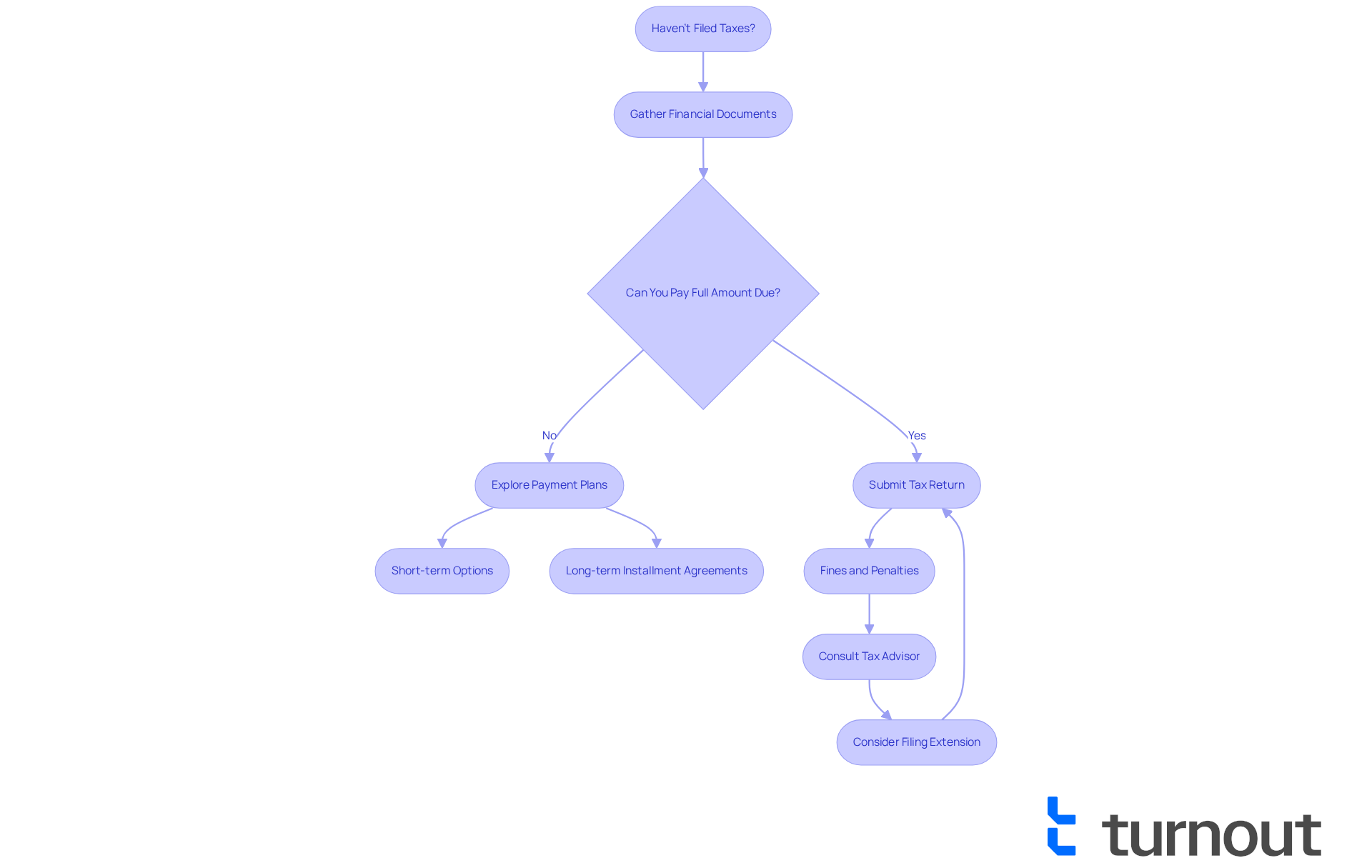

Outline Steps to Take If You Haven't Filed Taxes

If you haven't filed your taxes yet, we understand that what happens if you don't file taxes for 1 year can be overwhelming. Start by gathering all necessary financial documents, such as W-2s, 1099s, and other relevant income statements. It's essential to submit your tax return as soon as possible to understand what happens if you don't file taxes for 1 year, even if you cannot pay the entire amount due. Remember, the IRS offers various payment plans for those needing assistance, including:

- Short-term options for payments within 180 days

- Long-term installment agreements that can extend up to six years

Additionally, nearly 1 million taxpayers who failed to file prior year tax returns may be due refunds, which highlights the importance of filing even if you believe you do not need to.

Consulting with a qualified tax advisor or a consumer advocacy organization can provide valuable insights into your options and rights. If you are facing fines, you may be eligible for relief under certain conditions, such as financial difficulty or natural calamities. For instance, the IRS might authorize a one-time reduction of late-filing charges if you have not faced fines in the past three years.

Submitting on time can greatly reduce the buildup of interest and charges on owed dues. The failure-to-file fee is 5% of the taxes owed for each month the filing is delayed, capped at 25%. However, if you submit promptly, you can minimize these charges and possibly prevent the IRS from generating a substitute return that might overlook qualifying credits and deductions. Remember, you can also file for an automatic six-month extension, allowing you to submit your tax forms without penalties until October 15. Taking these steps can help mitigate the consequences of what happens if you don't file taxes for 1 year and assist you in getting back on track with your tax obligations.

Conclusion

Neglecting to file taxes for even one year can lead to a cascade of serious consequences that affect both immediate and long-term financial stability. We understand that the repercussions can be daunting—hefty penalties, interest fees, and potential legal actions may severely impact your financial health. It's crucial to recognize the importance of timely tax filing, as it not only helps avoid these pitfalls but also ensures you can take advantage of available credits and benefits.

Throughout this article, we've highlighted key points, including the significant penalties imposed by the IRS, such as the failure-to-file charge of 5% per month. Additionally, we discussed long-term repercussions like wage garnishment and tax liens. It's common to feel overwhelmed, but proactive measures—like filing for extensions or seeking payment plans—can help mitigate the financial strain associated with unpaid taxes. Real-life examples illustrate how quickly the situation can escalate, underscoring the urgency of addressing tax obligations promptly.

Ultimately, the message is clear: taking action is essential to prevent the severe consequences of not filing taxes. You should not hesitate to gather your documents, seek professional advice, and file your returns, even if you cannot pay the full amount owed. By doing so, you can protect yourself from escalating fines and legal complications, paving the way for a healthier financial future. Ignoring tax responsibilities only compounds the issues; instead, embrace the opportunity to rectify the situation and secure peace of mind. Remember, you are not alone in this journey, and we're here to help.

Frequently Asked Questions

What are the consequences of not filing taxes for one year?

Not filing taxes for one year can lead to significant repercussions, including fines and interest fees. The IRS imposes a 'failure to file' penalty of 5% of the owed amounts for each month the return is delayed, capped at 25%. This penalty is harsher than the 'failure to pay' penalty, which is only 0.5% per month, also capped at 25%.

What happens if the IRS files a substitute return for me?

If the IRS files a substitute return due to non-filing, it often results in a greater tax obligation because it does not take into account any deductions or credits you may qualify for, typically leading to higher taxes owed than if you had filed your own return.

Can neglecting to file taxes lead to criminal charges?

Yes, in extreme cases, not filing taxes may be viewed as a willful act, potentially leading to criminal charges. Individuals who owe $25,000 or more may face severe consequences, including wage garnishment, asset seizure, or even arrest for evasion of payment.

What financial implications arise from not filing taxes?

Taxpayers risk losing their entitlement to refunds and valuable credits and benefits. For example, to qualify for specific credits, such as the energy-efficient home improvement credit, taxpayers must submit their federal tax return by the relevant deadline.

What should I do if I can't meet the tax filing deadline?

If you discover that you cannot meet the filing deadline, it is essential to request an extension or establish a payment arrangement. Taking these steps can help reduce possible fines and safeguard your financial well-being.