Overview

We understand that failing to file taxes can feel overwhelming, and it can lead to serious consequences. These include:

- Accumulating financial penalties

- Potential legal actions

- Challenges in securing loans or mortgages

It's important to know that the IRS imposes a Failure to File charge of 5% per month on unpaid taxes. In severe cases of non-compliance, this can escalate to criminal charges. This highlights the importance of timely tax submission to avoid these repercussions. Remember, you're not alone in this journey—there are resources available to help you navigate these challenges.

Introduction

Neglecting to file taxes can lead to a series of financial and legal challenges that many taxpayers may not fully grasp. We understand that the stakes can feel overwhelming, with potential penalties piling up quickly and serious repercussions looming for those who overlook their responsibilities.

As you navigate the complexities of tax compliance, you might wonder: what truly happens when taxes go unfiled? How can you find your way through the difficult landscape of non-compliance? Understanding these critical consequences is vital for anyone seeking to protect their financial future and maintain peace of mind.

Remember, you're not alone in this journey, and we're here to help you find clarity and support.

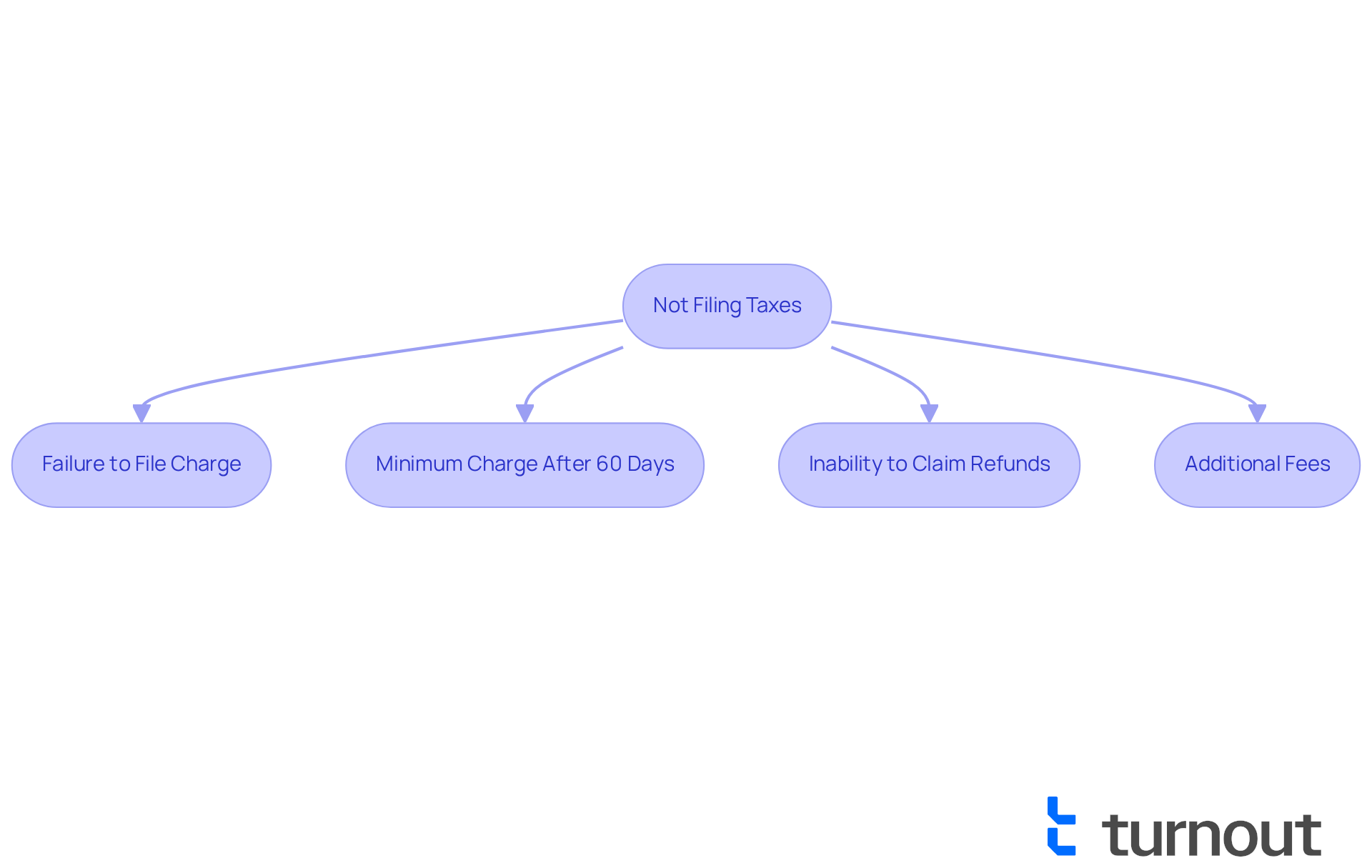

Define the Consequences of Not Filing Taxes

We understand that can be a source of anxiety, potentially leading to serious outcomes such as financial charges and legal consequences. The IRS imposes a , typically 5% of the unpaid tax for each month the return is delayed, capped at a maximum of 25%. If a taxpayer neglects to submit their return for over 60 days after the due date, they could face a minimum charge of either $435 or the full amount of tax owed, whichever is lower.

It's common to feel overwhelmed by these . , as the IRS has a three-year period for claiming them. Did you know that there is over $1 billion in unclaimed refunds for 2021? This statistic underscores the importance of . For instance, if you owe the IRS $1,000 and submit your return just 10 days past the due date, you may face a charge of $5 plus interest. Moreover, missing the April 15 deadline can lead to .

As Jim Buttonow, CPA, wisely advises, "If you have an outstanding amount, don’t submit late because you will worsen your issues." It’s crucial to or request a delay to avoid what happens if you don't file taxes. Remember, you are not alone in this journey; . Taking action now can greatly .

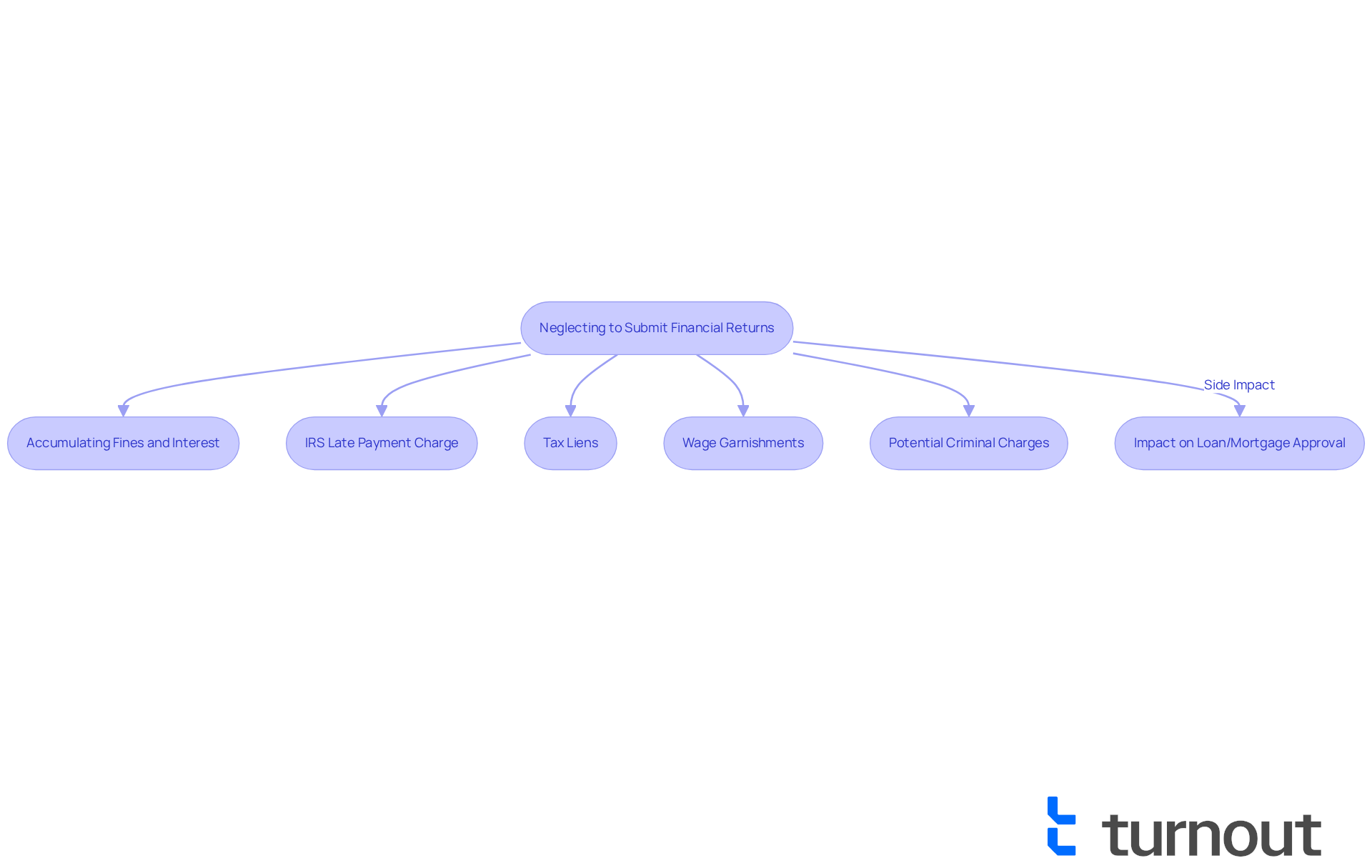

Examine Immediate and Long-Term Repercussions

Neglecting to submit financial returns can lead to . You might face accumulating fines and interest on outstanding sums. The imposes a late payment charge of 0.5% of the unpaid tax for each month the balance remains unpaid, with a maximum limit of 25%. Over time, these consequences can escalate significantly, potentially resulting in , wage garnishments, and even criminal charges in severe cases of tax evasion. It's common to feel anxious about , such as the [IRS](https://myturnout.com/resources) placing liens on your property or levying your bank accounts.

Moreover, or mortgages, as lenders typically require proof of tax compliance. This lack of compliance can severely impact your and creditworthiness. We understand that navigating these challenges can be stressful. The IRS suggests that individuals submit their overdue returns as soon as possible to prevent the , emphasizing the importance of adherence to tax obligations. It's also important to note that the IRS can begin aggressive collection actions after a formal assessment, further highlighting the need to promptly.

Case studies show that individuals who quickly submit their past-due returns can halt the failure-to-submit consequence and demonstrate their commitment to compliance to the IRS, even if they cannot pay the entire amount owed. Moreover, individuals with a history of proper tax adherence might qualify for administrative sanction relief, offering a more balanced perspective on the repercussions and options available. Understanding these long-term consequences is crucial for anyone considering their tax obligations, as the cumulative effects can lead to increased financial burdens and stress. Remember, you're not alone in this journey—there are steps you can take to regain control.

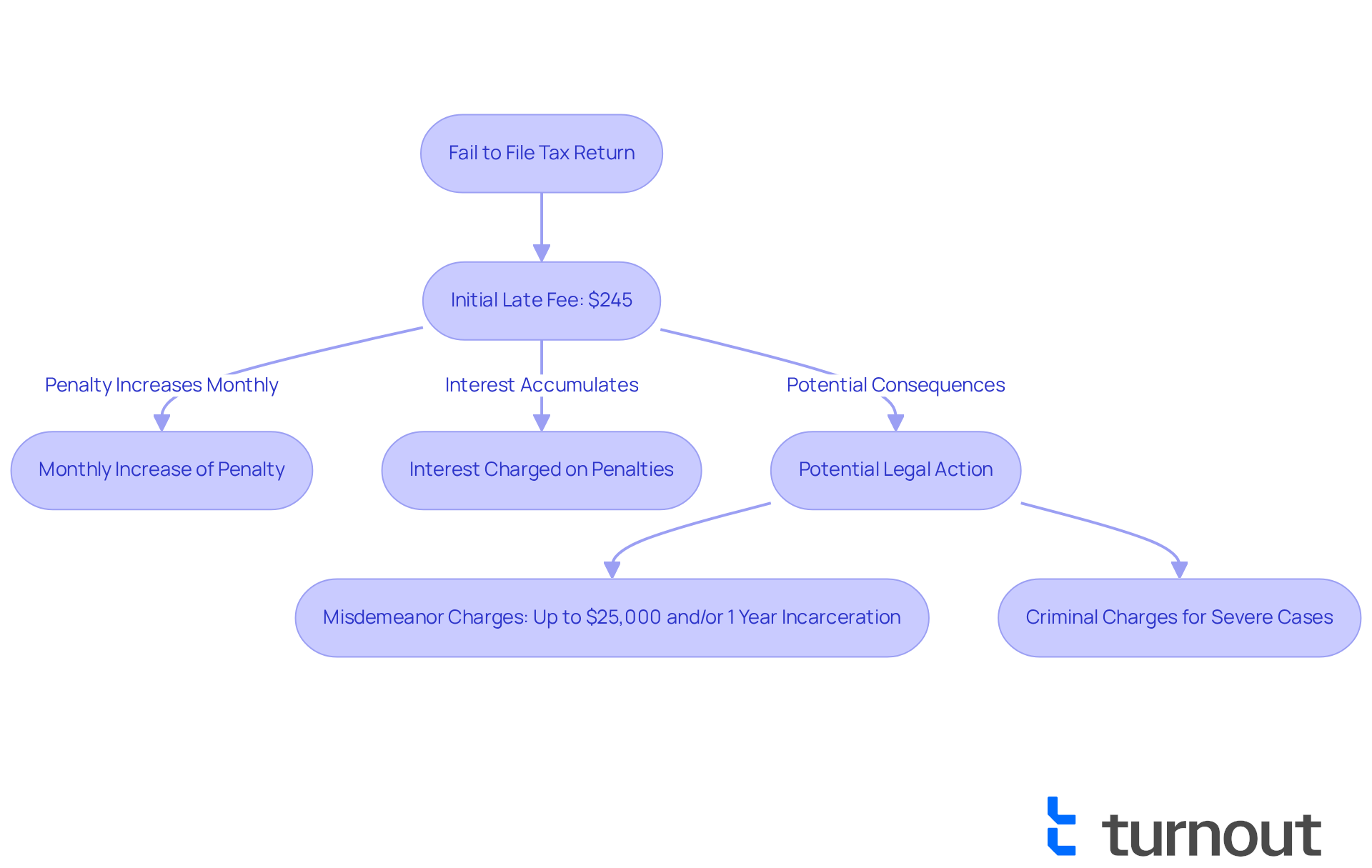

Understand Legal Obligations and Penalties

Every U.S. citizen and resident has a legal responsibility to file a tax return if their income surpasses a certain threshold. We understand that navigating taxes can be overwhelming, and it's important to know , as it can lead to . The that can add up quickly. For returns due after December 31, 2024, the initial late fee starts at $245, and this amount can increase each month for up to 12 months. Alongside these , interest is charged on penalties, further increasing the total owed until it is fully paid.

It's common to feel anxious about , but it's important to know that the IRS may also take . For instance, failing to submit a tax return can result in misdemeanor charges, with penalties reaching up to $25,000 or even a year of incarceration. In the most severe cases of non-compliance, individuals might face criminal charges. This highlights the importance of understanding your legal obligations to avoid the pitfalls of non-filing, particularly what happens if you don't file taxes, and to ensure compliance with tax laws.

If you're feeling uncertain about your tax responsibilities, remember that you're not alone in this journey. Taxpayers are encouraged to seek assistance from a , where help is available to navigate these obligations. We’re here to support you every step of the way.

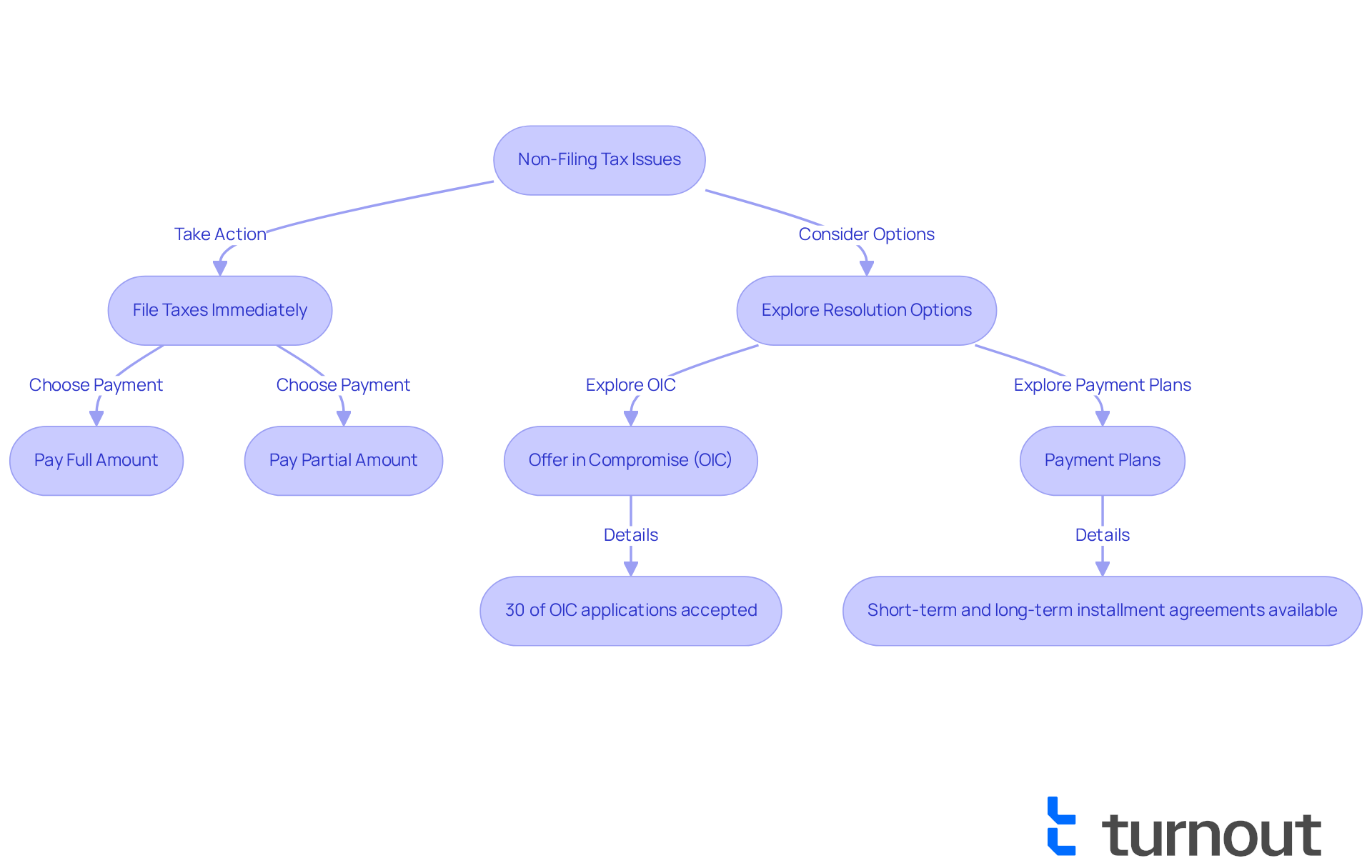

Explore Options for Resolving Non-Filing Issues

If you haven't filed your taxes yet, it's important to take action quickly to understand and explore your options for resolution. We understand that navigating tax issues can be overwhelming, but the IRS strongly encourages you to , even if you're unable to pay the full amount owed. Filing promptly can significantly reduce fines and interest, which can accumulate quickly. For instance, the failure-to-file charge is 5% monthly on any outstanding dues, while the failure-to-pay charge is 0.5% monthly, capped at 25%. Importantly, there are no penalties for filing late if the IRS owes you a refund, which can ease your worries about moving forward.

One effective option for those facing tax debt is the Offer in Compromise (OIC). This program allows eligible taxpayers to settle their . In 2025, the IRS reported that about 30% of OIC applications were accepted, highlighting its potential as a viable solution for many individuals. Additionally, the IRS offers various , including both short-term and long-term installment agreements.

To understand what happens if you don't file taxes, it's essential to submit your tax return as quickly as possible and pay as much as you can to mitigate the consequences. Even making partial payments can help lighten your overall financial burden. If you , filing immediately is crucial to avoid , as well as to limit further penalties and interest. Furthermore, you may qualify for valuable tax credits like the Earned Income Tax Credit (EITC) or the Child Tax Credit, which can provide additional financial relief. Remember, seeking assistance from consumer advocacy organizations can also be a great way to navigate the complexities of tax compliance and resolution. You're not alone in this journey, and there are resources available to help you manage your tax obligations effectively.

Conclusion

Neglecting to file taxes can lead to a myriad of serious consequences that extend beyond mere financial penalties. We understand that the implications of not fulfilling tax obligations can feel overwhelming. Understanding these implications is crucial for maintaining your financial stability and ensuring legal compliance. The risks associated with non-filing include escalating fines, potential legal action, and long-term damage to your creditworthiness. This underscores the necessity of timely tax submission.

Throughout this article, we have discussed key points that matter to you. These include:

- The immediate and long-term repercussions of failing to file taxes

- The legal obligations every taxpayer faces

- The various options available for resolving non-filing issues

It's important to note that the IRS imposes significant penalties for late submissions, and failing to file can hinder your ability to secure loans or mortgages. However, taking proactive steps, such as filing overdue returns and exploring programs like the Offer in Compromise, can help mitigate the financial burden and restore compliance.

The significance of understanding your tax responsibilities cannot be overstated. It is essential for you to take action, seek assistance when needed, and file your returns promptly to avoid compounding penalties and interest. By prioritizing tax compliance, you not only protect your financial well-being but also pave the way for a more secure future. Embracing this responsibility is a vital step toward achieving peace of mind and ensuring that your financial landscape remains stable and secure. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What are the consequences of not filing taxes?

Not filing taxes can lead to financial charges and legal consequences, including a Failure to File charge of 5% of the unpaid tax for each month the return is delayed, up to a maximum of 25%.

What happens if I don't file my return for over 60 days after the due date?

If you neglect to submit your return for over 60 days after the due date, you could face a minimum charge of either $435 or the full amount of tax owed, whichever is lower.

How does not filing affect my ability to secure refunds?

Unfiled returns can hinder your ability to claim refunds, as the IRS has a three-year period for claiming them. If you miss this window, you may lose out on potential refunds.

What is the financial impact of filing late?

If you owe the IRS $1,000 and submit your return just 10 days past the due date, you may face a charge of $5 plus interest. Additionally, missing the April 15 deadline can result in extra fees that worsen your financial situation.

What advice do experts give regarding late tax submissions?

Experts, like CPA Jim Buttonow, advise against submitting late if you have an outstanding amount, as doing so can exacerbate your financial issues. It is better to submit your taxes on time or request a delay.