Overview

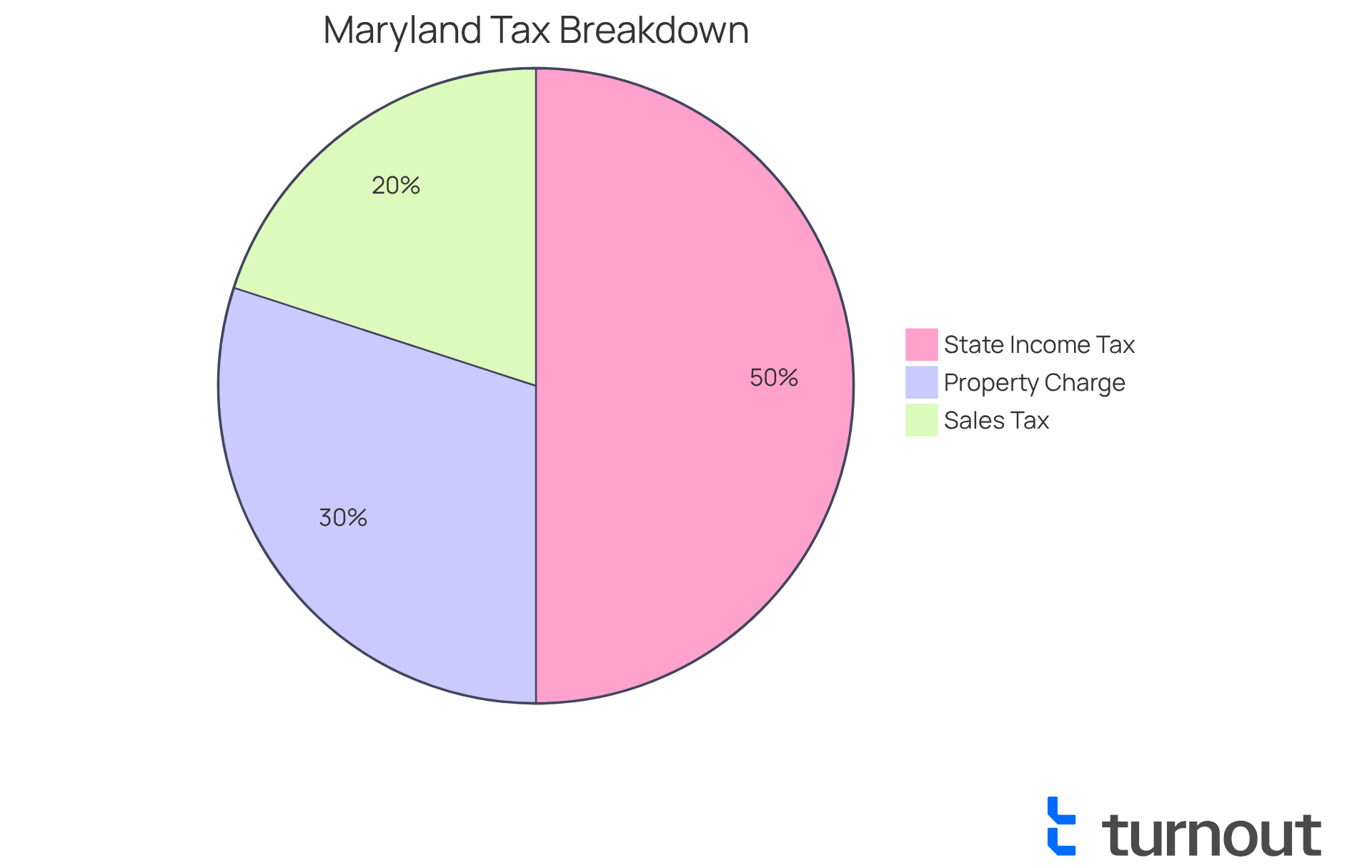

We understand that paying MD taxes can feel overwhelming. It's essential to first grasp your tax obligations, which include:

- State income tax

- Property charges

- Sales tax

Once you have a clear understanding, you can select a convenient payment method that suits you—whether it's online, by mail, or in person.

This article offers a detailed step-by-step guide designed to support you through this process. We emphasize the importance of gathering the necessary documents and choosing the right payment method. Remember, it's common to encounter issues along the way, but we provide troubleshooting tips to help ensure a smooth tax payment experience. You're not alone in this journey, and we're here to help you every step of the way.

Introduction

We understand that navigating the complexities of tax obligations can often feel daunting, especially for Maryland residents who face a variety of taxes, from state income to property charges. Acknowledging these responsibilities is crucial, yet knowing how to effectively manage and pay them can significantly alleviate stress.

It's common to feel confused during the payment process, but rest assured, you are not alone in this journey. This guide offers a clear, step-by-step approach to paying Maryland taxes, ensuring that you can tackle your obligations with confidence and clarity.

Together, we will address common pitfalls along the way, providing the support you need.

Understand Your Tax Obligations in Maryland

Before you can pay MD taxes, it’s important to understand what you owe. We understand that navigating taxes, especially when you need to pay MD taxes, can be overwhelming, but you’re not alone in this journey. Maryland residents face various taxes, including:

- State Income Tax: Depending on your income level, Maryland has a progressive income tax rate ranging from 2% to 5.75%.

- Property Charge: If you own property, you will need to pay MD taxes based on its assessed value.

- Sales Tax: The state imposes a 6% sales tax on most goods and services, and businesses are required to pay MD taxes on these.

To identify your specific responsibilities, we encourage you to visit the Comptroller's website of the state or consult with a financial advisor. This way, you can be informed of all relevant levies and any possible deductions or credits you may qualify for. Remember, we’re here to help you navigate this process with confidence.

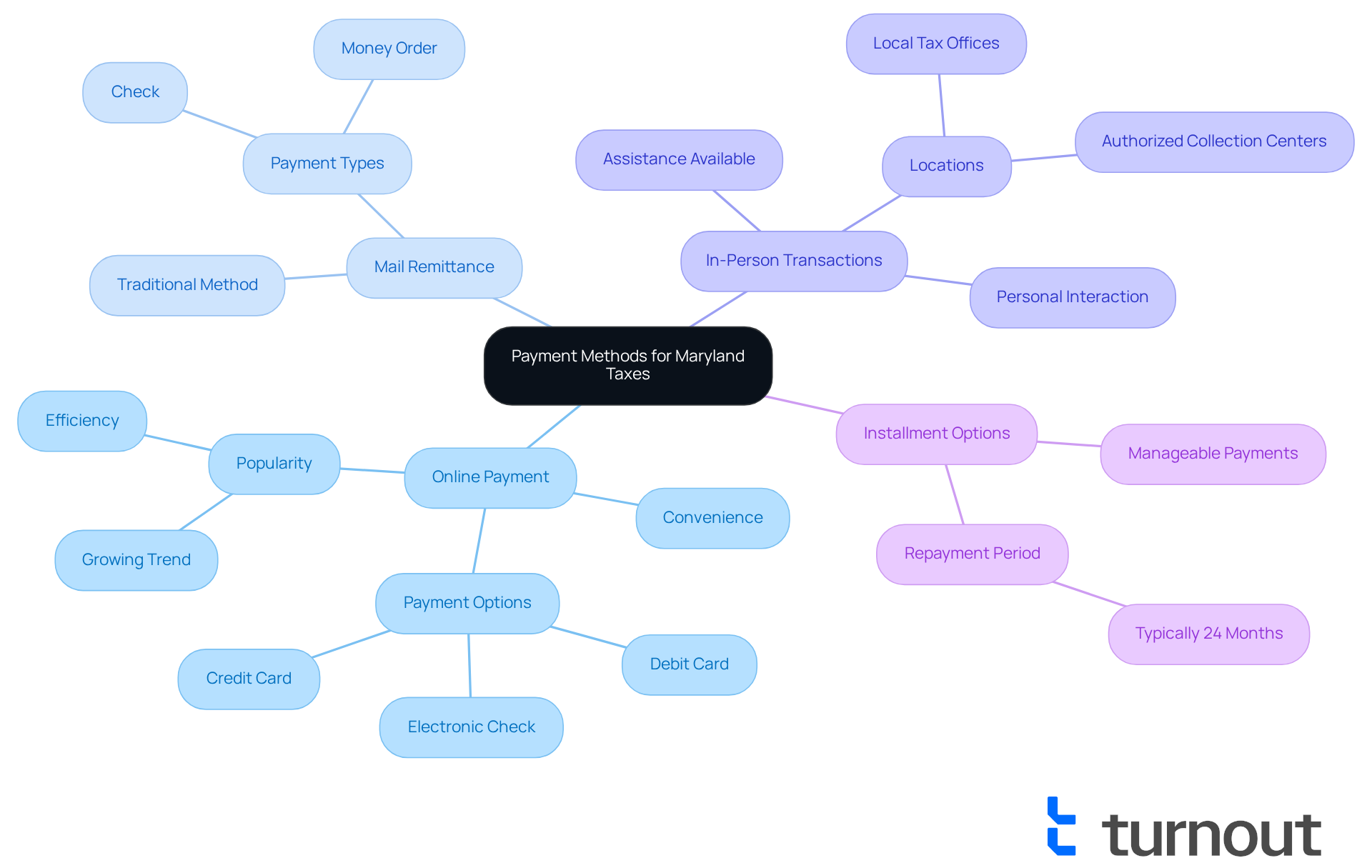

Explore Payment Methods for Maryland Taxes

Maryland understands that the process to pay md taxes can be a daunting task, and we want to make it as convenient as possible for you. Here are several methods available for paying your taxes, allowing you to choose the option that best fits your needs:

-

Online Payment: You can easily pay your taxes directly through the Maryland Comptroller's website using a credit card, debit card, or electronic check. This method has become increasingly popular, with many taxpayers appreciating the efficiency and ease it offers. In fact, in 2025, statistics show that a significant portion of tax liabilities is settled through online transactions, indicating a growing trend towards digital solutions.

-

Mail Remittance: If you feel more comfortable with traditional methods, you can send a check or money order to the address specified on your tax bill. This option remains a reliable choice for those who prefer not to engage with online transactions.

-

In-Person Transactions: For those who value personal interaction, transactions can also be conducted in person at designated locations, such as local tax offices or authorized collection centers. This choice is particularly beneficial for individuals who may need assistance with their transactions.

-

Installment Options: If paying your taxes in full is a challenge, Maryland offers installment options that allow you to manage your tax bill in smaller, more manageable portions. Typically, these plans require repayment within 24 months, providing a structured approach to addressing your tax obligations.

Many users have shared positive experiences with the online transaction system. They describe a simplified process, where accessing the Comptroller's Individual Online Service Center allows for new financial arrangements and even the ability to set up automatic transactions for ongoing agreements. Andrea Miller, a valued contributor, emphasizes, "Using online transaction options not only simplifies the process but also helps taxpayers stay organized and informed about their transaction history."

In summary, whether you choose to pay online, by mail, or in person, you have flexible options to pay MD taxes tailored to meet your payment needs. If you require assistance, please don’t hesitate to reach out to the Taxpayer Service Section at 410-260-7980 for central regions or 1-800-MDTAXES for other locations. Remember, understanding these methods can significantly ease the burden of your tax obligations, and we’re here to help you through this journey.

Follow Step-by-Step Instructions to Pay Your Taxes

To pay your Maryland taxes, follow these steps with confidence and care:

-

Gather Your Information: Begin by collecting essential tax documents, such as your Social Security number, tax identification number, and any relevant forms. We understand that organizing these documents can feel overwhelming, but tax professionals emphasize that having everything in order can significantly reduce stress during the payment process. As one tax expert wisely noted, "Being prepared with your documents can save you time and prevent unnecessary complications."

-

Choose Your Payment Method: Reflect on what payment method feels most convenient for you—whether online, by mail, or in person. It’s common to face issues like delays in mail processing or technical difficulties with online systems, so choose what works best for your situation.

-

For Online Payments:

- Visit the Maryland Comptroller's website.

- Select the 'Pay Taxes' option.

- Enter your details and follow the prompts to finalize your transaction. Online transactions are often the quickest route, allowing for prompt confirmation.

-

For Mail Payments:

- Write a check or money order payable to the 'Comptroller of Maryland'.

- Include your tax identification number on the transaction.

- Mail it to the address provided on your tax bill. Remember to be mindful of mailing times to ensure your remittance is received by the deadline. Many taxpayers have reported delays due to postal service slowdowns, so it’s wise to plan ahead.

-

For In-Person Payments:

- Locate your nearest tax office or authorized payment center.

- Bring your funds and any required documents. Face-to-face transactions can offer peace of mind, allowing you to verify receipt directly.

-

Confirm Your Transaction: After completing your transaction, ensure you receive a confirmation (especially for online payments) and keep it for your records. This step is vital for monitoring your transaction status and addressing any potential concerns. Recent statistics reveal that nearly 15% of taxpayers encounter issues with transaction confirmations, so maintaining a record is crucial.

By following these steps, you can navigate the tax settlement process with greater clarity and confidence to pay Maryland taxes. Remember, you are not alone in this journey. Real-world examples show that many individuals, including those with disabilities, benefit from assistance programs designed to help manage tax obligations effectively. We're here to help you every step of the way.

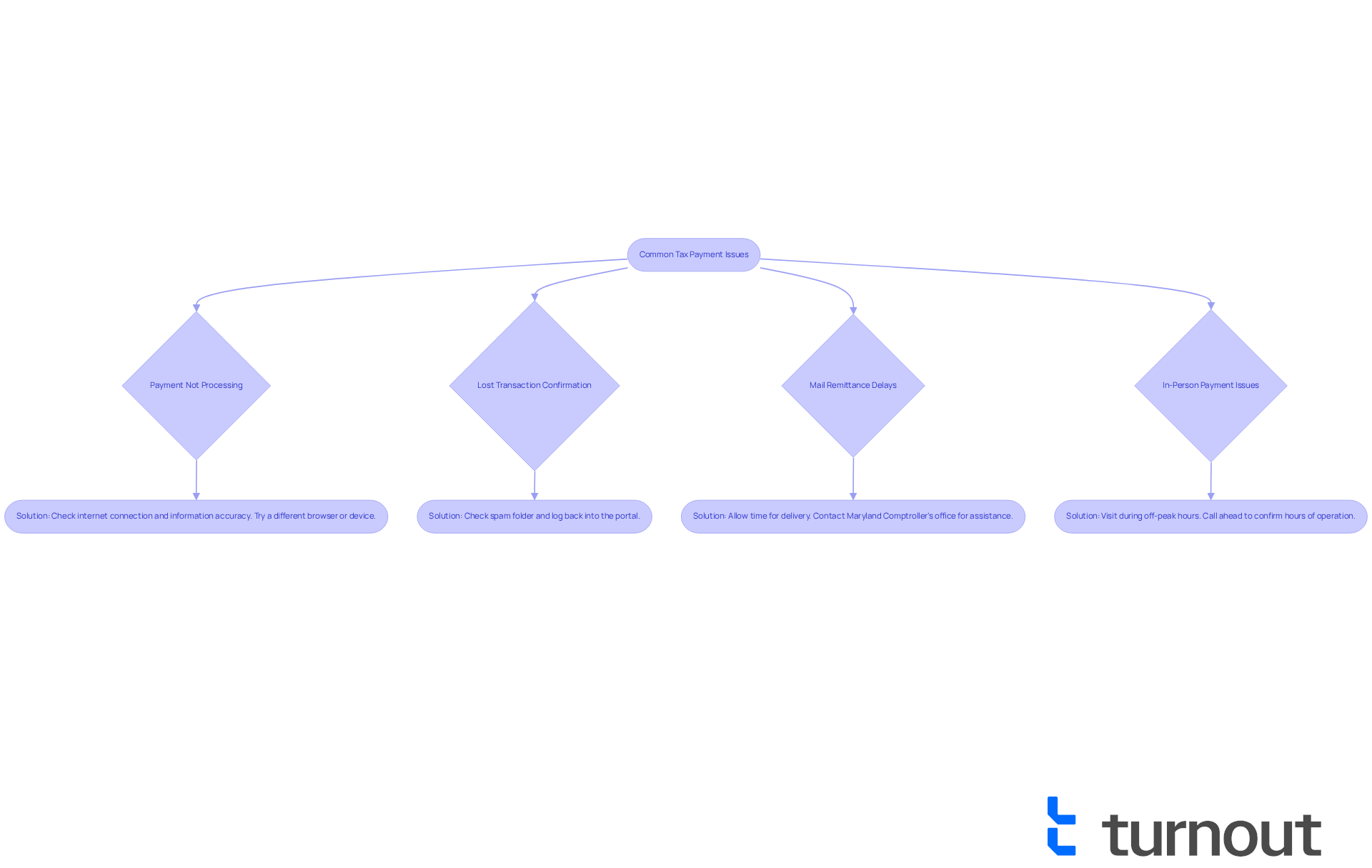

Troubleshoot Common Tax Payment Issues

If you encounter issues while you pay MD taxes, we understand how frustrating that can be. Here are some troubleshooting tips to help you navigate these challenges:

- Payment Not Processing: It's important to ensure that your internet connection is stable and that you've entered all required information correctly. If problems persist, consider trying a different browser or device—sometimes a simple change can make all the difference.

- Lost Transaction Confirmation: If you didn’t receive a confirmation after an online transaction, don’t worry! Check your email's spam folder, as it might be hiding there. You can also log back into the portal to confirm your transaction, giving you peace of mind.

- Mail Remittance Delays: If you’ve sent your remittance and it hasn’t been processed yet, please allow sufficient time for delivery. If you’re feeling concerned about how to pay MD taxes, it’s always a good idea to reach out to the Maryland Comptroller’s office for assistance—they’re here to help.

- In-Person Payment Issues: If you’re facing long wait times or other issues at a payment center, consider visiting during off-peak hours. You might also want to call ahead to confirm their hours of operation, ensuring a smoother experience.

Remember, you are not alone in this journey, and we’re here to support you every step of the way.

Conclusion

Understanding how to pay Maryland taxes is essential for residents to fulfill their obligations with confidence and clarity. This guide provides vital information about various tax types, payment methods, and step-by-step instructions to ensure a smooth process. By being informed and prepared, you can navigate the complexities of your financial responsibilities more effectively.

We understand that tax obligations can feel overwhelming. Key points discussed include the different types of taxes you may owe, such as:

- State income tax

- Property charges

- Sales tax

You’ll also find various payment methods available, including:

- Online transactions

- Mail remittance

- In-person payments

- Installment options

Additionally, we offer troubleshooting for common issues faced during the tax payment process, providing practical solutions to help you overcome potential hurdles.

Ultimately, being proactive and knowledgeable about Maryland's tax obligations empowers you to manage your finances with greater ease. Embracing the resources and assistance available can significantly alleviate the stress associated with tax payments. Remember, taking the time to understand these processes not only ensures compliance but also fosters a sense of control over your financial future. You are not alone in this journey, and we're here to help.

Frequently Asked Questions

What types of taxes do Maryland residents need to pay?

Maryland residents are responsible for several types of taxes, including State Income Tax, Property Charge, and Sales Tax.

What is the range of the State Income Tax rate in Maryland?

The State Income Tax rate in Maryland is progressive, ranging from 2% to 5.75% depending on your income level.

How is the Property Charge calculated in Maryland?

The Property Charge is based on the assessed value of the property you own.

What is the Sales Tax rate in Maryland?

The Sales Tax rate in Maryland is 6% on most goods and services.

Where can I find more information about my tax obligations in Maryland?

You can visit the Comptroller's website of the state or consult with a financial advisor to identify your specific tax responsibilities and any potential deductions or credits.