Overview

Navigating tax refund offsets can be challenging, and we understand that you may feel overwhelmed by the potential deductions from your tax refunds due to outstanding obligations. This article serves as a comprehensive guide to help you through this process, empowering you to take control of your financial responsibilities.

- First, it's important to identify the cause of the offset. By understanding what led to this situation, you can begin to address it effectively.

- Next, reach out to the relevant agencies. They are there to assist you, and establishing contact can be a crucial step in resolving any issues.

- Setting up payment plans is another vital action you can take. Many individuals find that creating a manageable plan alleviates some of the stress associated with outstanding obligations.

- Remember, you're not alone in this journey—there are resources available to help you navigate these challenges.

Utilizing these resources can provide you with the support you need. Whether it's seeking advice from professionals or connecting with community services, taking proactive measures will empower you to manage your situation more effectively. We’re here to help you every step of the way.

Introduction

Navigating the complexities of tax refund offsets can feel overwhelming. Many taxpayers are discovering that their expected refunds are reduced due to outstanding obligations. In 2025, nearly one in five federal tax returns faced deductions, often stemming from unpaid taxes, child support, or federal loans.

Understanding these offsets is crucial for anyone relying on their tax return for essential expenses. Yet, it’s common to feel unaware of the potential pitfalls. How can you take proactive steps to ensure you receive the refunds you anticipate while managing your financial responsibilities?

We’re here to help you through this journey. By recognizing the challenges and exploring solutions together, you can navigate these complexities with confidence.

Understand Tax Refund Offsets

A tax adjustment can be a source of concern for many. An offset on tax refund occurs when the federal government subtracts some or all of your federal tax return to repay an obligation to a federal or state organization. Common reasons for these reductions include:

- Unpaid federal taxes

- Child support obligations

- Other debts owed to government entities

In 2025, around 20% of federal tax returns were impacted by deductions, highlighting the growing prevalence of this issue.

Understanding this process is vital, especially if you were counting on that reimbursement for essential expenses. It's important to familiarize yourself with the types of financial obligations that can lead to offsets, such as loans and fees owed to the Small Business Administration (SBA). The SBA can request the IRS to offset a borrower's tax return to recover overdue amounts. This means that if you are expecting a reimbursement, it may be subject to an offset on tax refund due to the amount of your outstanding SBA obligations.

Moreover, if you file a combined tax return and one partner has an obligation, the reimbursement may go toward that obligation. However, the non-responsible partner can submit Form IT-280 to reclaim their share. Financial consultants emphasize the importance of understanding how adjustments can create an offset on tax refund. Alan Goldenberg, a taxation expert, noted that 'understanding these compensation programs can help taxpayers manage outstanding obligations while ensuring expected tax returns are received.'

By learning about the types of debts that may lead to deductions, you empower yourself to take proactive steps to address any issues, ensuring you won’t be caught off guard come tax season. With the resumption of compensation programs, individuals and businesses expecting returns should be particularly mindful of their financial responsibilities. Remember, you're not alone in this journey, and we're here to help you navigate these challenges.

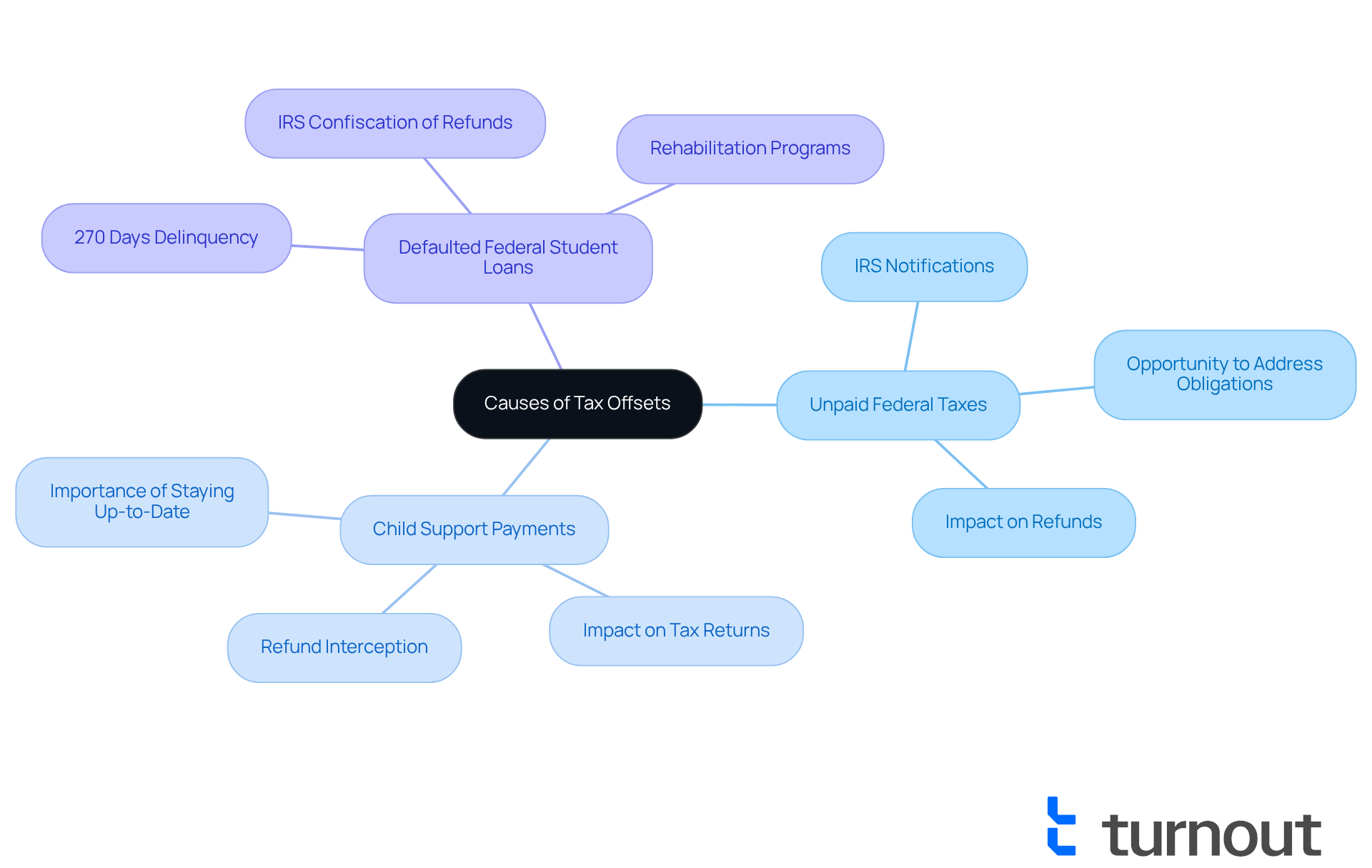

Identify Causes of Your Offset

To determine the reasons for your tax adjustment, we understand that it can be a confusing process. Begin by examining any notifications you received from the IRS or the Bureau of the Fiscal Service. These notifications usually describe the obligation that initiated the deduction, and it's important to know that a government organization must inform you in writing at least 60 days prior to transferring the obligation to the Treasury Offset Program. Common causes include:

- Unpaid Federal Taxes: If you owe back taxes, the IRS may apply your refund to cover these debts. The IRS often issues several notices before taking action, allowing you the opportunity to address your obligations. In 2024, almost 35 million tax returns were handled by the IRS, emphasizing the extent of possible adjustments.

- Child Support Payments: Refunds can be intercepted to satisfy overdue child support payments. In fact, many tax returns are impacted by this issue, highlighting the importance of staying up-to-date on support obligations. Numerous taxpayers encounter lesser-than-anticipated returns as a result of an offset on tax refund due to deductions associated with child support.

- Defaulted Federal Student Loans: Defaulted federal student loans can lead to an offset on tax refund. If a borrower fails to pay after 270 days of delinquency, the IRS may confiscate tax returns until the obligation is settled.

If you are unsure about the reason for your deduction, please don’t hesitate to reach out to the IRS at 800-829-1040 or the Bureau of the Fiscal Service at 800-304-3107 for clarification. Furthermore, if you submitted a joint return and your reimbursement was decreased because of your spouse's debt, you may recover your portion by filing IRS Form 8379. Consistently checking your IRS payment status can help avoid future surprises and ensure you are aware of any possible deductions. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

Take Action on Your Offset

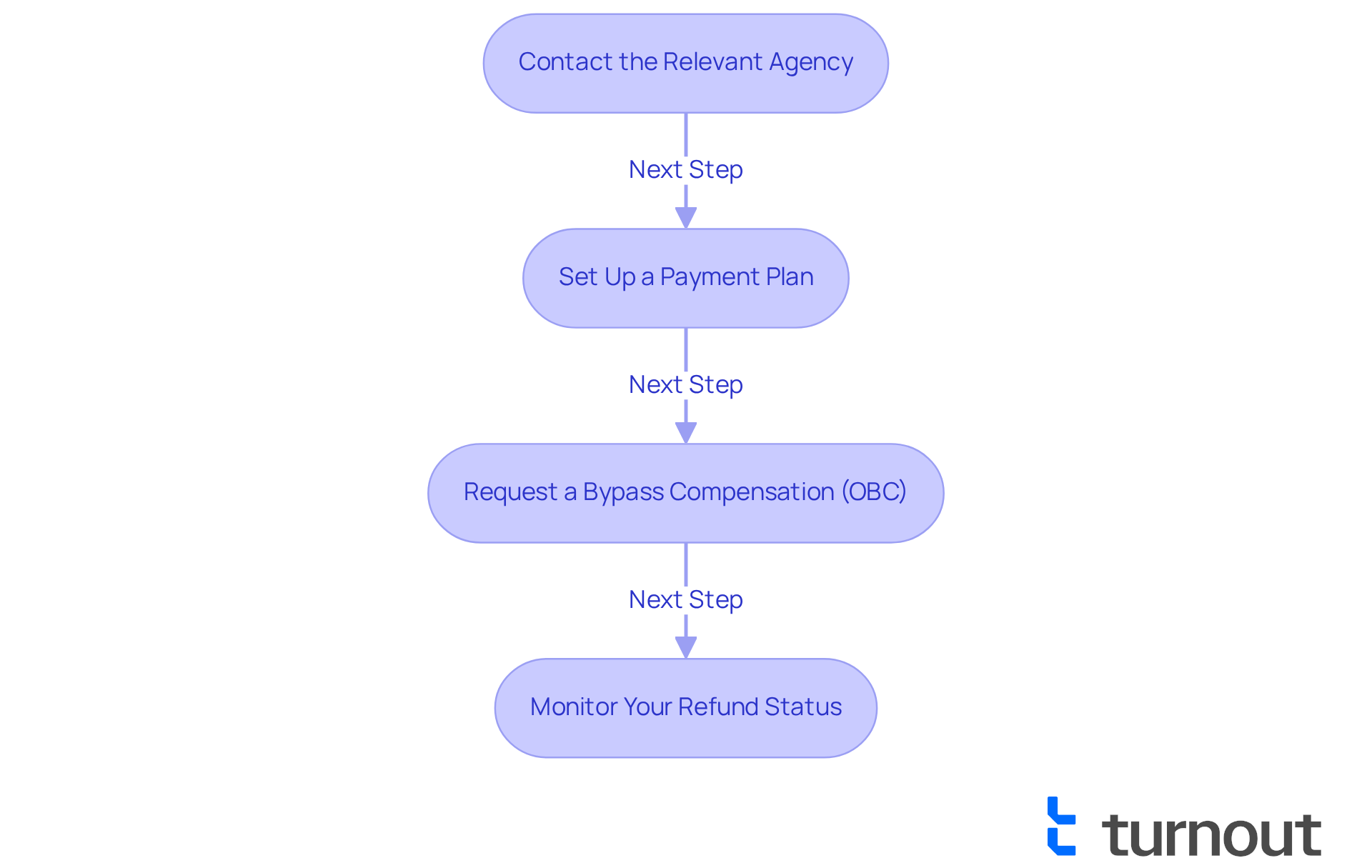

Once you have identified the cause of your offset on tax refund, it’s important to take action. We understand that this can be a stressful situation, but there are steps you can follow to find a resolution:

- Contact the Relevant Agency: Reach out to the agency managing your obligation, whether it’s the IRS for tax issues or a state agency for child support. Request information about your obligation and explore alternatives for repayment or resolution. Remember, you’re not alone in this process.

- Set Up a Payment Plan: If you have an obligation, consider asking about a payment plan. Many agencies offer flexible repayment options, helping you manage your financial obligations without incurring further penalties. For example, in fiscal year 2024, the IRS accepted over 7,199 offers in compromise out of 33,591 proposed, allowing taxpayers to settle their debts for less than the full amount owed.

- Request a Bypass Compensation (OBC): If you’re facing financial difficulties like eviction, foreclosure, or utility disconnection, you may be eligible for an OBC. This allows you to receive your compensation despite the deduction. To apply, file Form 911 with the Taxpayer Advocate Service and provide documentation of your financial situation. It’s essential to act quickly, as the OBC process is time-sensitive and usually only available before the IRS applies the payment to an outstanding federal tax obligation.

- Monitor Your Refund Status: Use the IRS 'Where's My Refund?' tool to keep track of your reimbursement and any deductions. This will help you stay informed about your financial situation. During the 2025 tax filing season, the IRS issued over 93.5 million tax reimbursements, with 93% delivered via direct deposit, ensuring quicker access to funds.

By following these guidelines, you can take proactive steps to address your tax reimbursement issue and work towards a solution that includes the offset on tax refund. Remember, we're here to help you through this journey.

Utilize Resources for Assistance

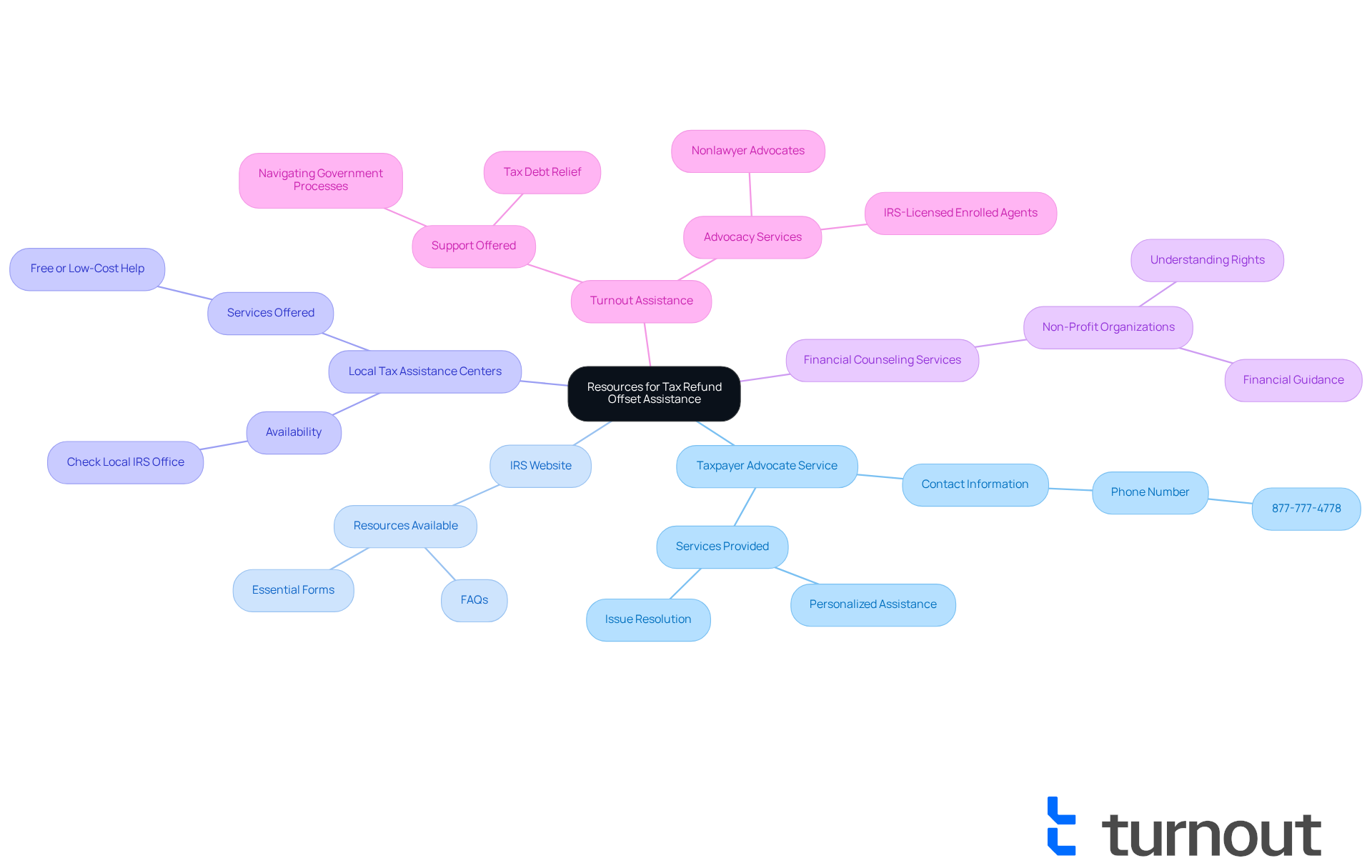

Navigating tax refund offsets can be challenging, but several valuable resources are here to help you through this process:

- Taxpayer Advocate Service (TAS): This independent organization within the IRS is dedicated to helping taxpayers resolve issues, including offsets. If you're feeling overwhelmed, you can reach out to them at 877-777-4778 for personalized assistance.

- IRS Website: The IRS website is a thorough resource that provides extensive details on tax adjustments, including FAQs and essential forms to assist you along the way.

- Local Tax Assistance Centers: Many communities host local tax assistance centers offering free or low-cost help with tax-related issues. We understand that finding support can be daunting, so it’s advisable to check with your local IRS office for availability and services offered.

- Financial Counseling Services: Non-profit organizations frequently offer financial guidance to help you manage obligations and comprehend your rights regarding deductions. You're not alone in this; they ensure you are well-informed and supported.

Utilizing these resources can provide you with the necessary support and guidance as you work to effectively resolve your offset on tax refund. Additionally, Turnout offers assistance in navigating government-related processes, including SSD claims and tax debt relief. While Turnout does not provide legal representation, our trained nonlawyer advocates and IRS-licensed enrolled agents are here to support you through these complex systems. Remember, we're here to help, and you are not alone in this journey.

Conclusion

Navigating tax refund offsets can feel overwhelming, but understanding the process is vital for managing your financial obligations with confidence. It's important to recognize the various reasons behind tax refund offsets, such as:

- Unpaid federal taxes

- Child support obligations

- Defaulted federal loans

By staying informed, you can take proactive steps to address these issues and lessen the impact on your expected tax refunds.

We understand that identifying the causes of offsets through IRS notifications can be daunting. Taking action by:

- Contacting relevant agencies

- Setting up payment plans

- Utilizing resources like the Taxpayer Advocate Service

are crucial steps in regaining control over your financial situation. You deserve to be in the know when tax season arrives. Moreover, monitoring your refund status is essential, as it allows for timely awareness of any potential deductions.

Ultimately, understanding and addressing tax refund offsets empowers you as a taxpayer. By taking informed steps and seeking assistance when needed, you can navigate these challenges with assurance. Remember, remaining proactive and utilizing available resources ensures that financial obligations do not overshadow the relief that tax refunds can provide. Take charge of your tax situation today, and know that support is always within reach.

Frequently Asked Questions

What is a tax refund offset?

A tax refund offset occurs when the federal government subtracts some or all of your federal tax return to repay an obligation to a federal or state organization.

What are common reasons for tax refund offsets?

Common reasons include unpaid federal taxes, child support obligations, and other debts owed to government entities.

How prevalent are tax refund offsets?

In 2025, around 20% of federal tax returns were impacted by deductions due to offsets.

What types of financial obligations can lead to tax refund offsets?

Financial obligations that can lead to offsets include loans and fees owed to the Small Business Administration (SBA) and other government debts.

Can tax refunds be affected if filing a combined tax return?

Yes, if one partner in a combined tax return has an obligation, the refund may go toward that obligation. However, the non-responsible partner can submit Form IT-280 to reclaim their share.

Why is it important to understand tax refund offsets?

Understanding tax refund offsets is vital to avoid being caught off guard during tax season, especially if you are counting on the reimbursement for essential expenses.

What should individuals and businesses do to prepare for potential offsets?

Individuals and businesses should familiarize themselves with their financial responsibilities and the types of debts that may lead to deductions, ensuring they take proactive steps to address any issues.