Overview

Navigating payment plans for Maryland taxes can feel overwhelming, but you're not alone in this journey. This article offers a comprehensive overview of tax payment plans, outlining the various options available to you. It also details eligibility requirements and application steps, ensuring you have the information you need to move forward.

We understand that managing financial obligations while staying compliant with state regulations is crucial. That's why these structured plans are designed to support you in meeting your responsibilities. With effective management strategies in place, you can approach your tax obligations with confidence.

Remember, seeking assistance is a positive step. We're here to help you understand your options and guide you through the process. Together, we can navigate these challenges and find the best path for your financial well-being.

Introduction

Navigating tax obligations can often feel like an uphill battle, particularly for those burdened by unpaid debts. We understand that this journey can be overwhelming. In Maryland, however, you are not alone in this struggle; a variety of payment plans are designed to ease your burden and provide manageable solutions.

This article explores the different options available for Maryland tax payment plans, highlighting the benefits and eligibility requirements while addressing the common challenges you may face.

What steps can you take to not only qualify for these plans but also manage them successfully over time? We're here to help you find the support you need.

Understand Maryland Tax Payment Plans

In Maryland, we understand that managing tax obligations can be overwhelming. To support individuals who may struggle to settle their tax debts entirely, there is a available among various options. These plans are designed to help you manage your financial responsibilities more effectively, including a payment plan for Maryland taxes that allows you to pay off your debts over time. Here are some key options:

- : This flexible option permits taxpayers to pay their tax debt in monthly installments. The specific conditions may vary based on the amount owed and your financial situation. For instance, the Guaranteed Installment Agreement (GIA) allows a maximum term of 36 months for individuals with total tax liabilities of $10,000 or less. Meanwhile, the Streamlined Installment Agreement (SLIA) accommodates assessed tax balances of up to $50,000 over a maximum of 72 months. It's important to note that monetary disclosure is required for certain agreements, ensuring transparency.

- : If you can settle your tax debt within a short period—generally up to 120 days—you may qualify for this option, which typically incurs no additional fees. This can provide immediate relief without added financial strain.

- : For those facing larger debts, extended repayment schedules can span several months or even years, offering the flexibility you need during challenging times.

Recent changes to Maryland's have made applying easier than ever. You can now apply online through the Comptroller’s service center, which facilitates quicker approvals. Long-term installment agreements usually take about 7 to 10 business days for processing, allowing you to move forward with peace of mind.

It's worth noting that a significant number of taxpayers in Maryland utilize a payment plan for Maryland taxes, with over 70% opting for one of these installment arrangements. This statistic highlights the importance of these options in managing tax obligations effectively. To set up any installment agreement, taxpayers must file all required tax returns for at least the past six years, ensuring compliance with state regulations. Remember, failing to make a scheduled contribution can lead to serious consequences, including defaulting on the agreement and potential enforcement measures.

Understanding these options is crucial for effectively managing your liabilities under a payment plan for Maryland taxes. We encourage you to review the specific terms and conditions associated with each option to determine which one best suits your financial situation. Remember, you are not alone in this journey; we're here to help you with compassion and understanding.

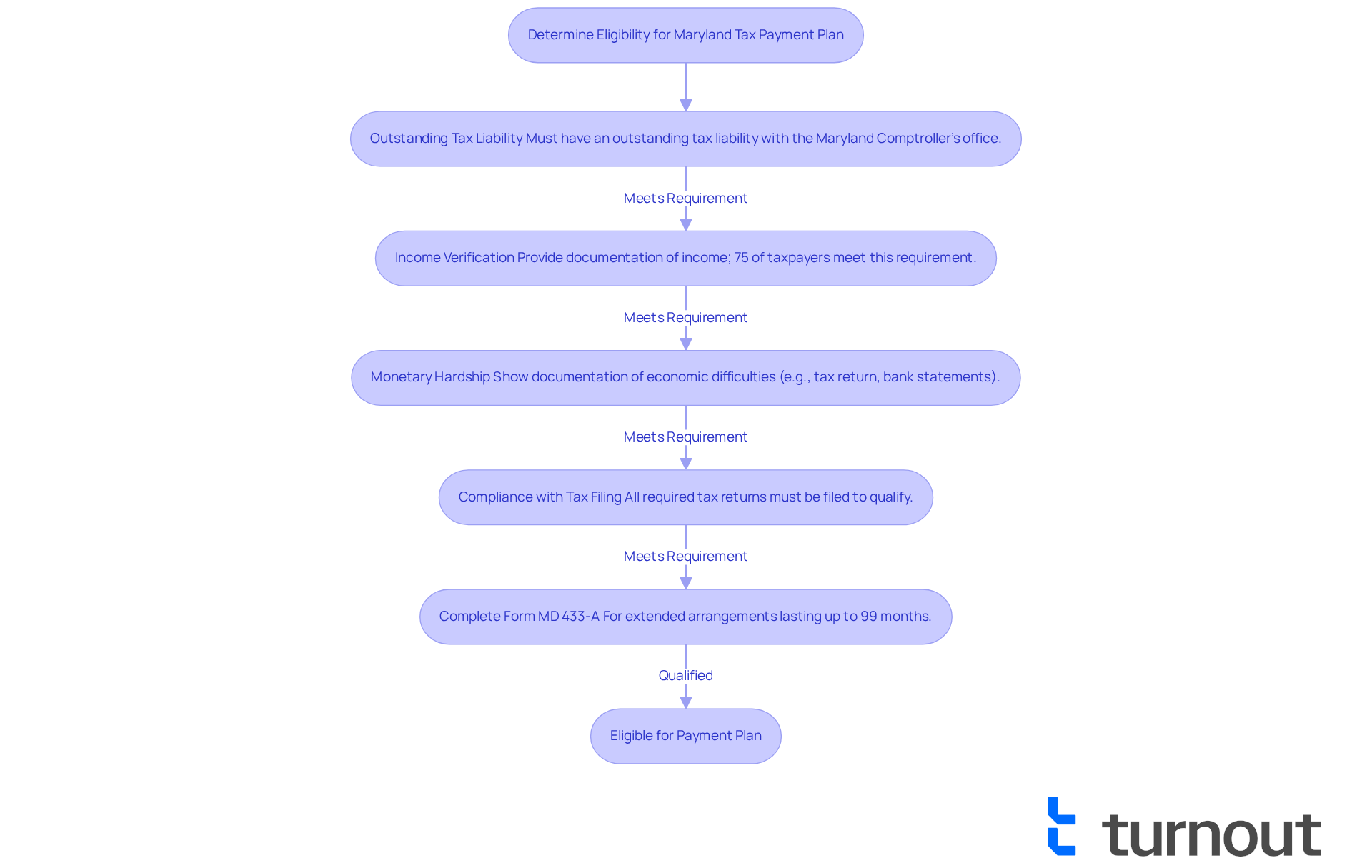

Determine Eligibility and Requirements

Navigating tax obligations can be challenging, and we understand that you may be facing difficulties. To qualify for a payment plan for , there are specific eligibility requirements to consider. Here are the key points to keep in mind:

- : It's essential to have an outstanding tax liability with the Maryland Comptroller’s office.

- : You will need to provide documentation of your income, as this information is crucial in assessing your ability to pay. Interestingly, around 75% of taxpayers successfully meet the income verification requirements when applying for payment plans.

- : If you're experiencing economic difficulties, it’s important to show this through documentation, such as your most recent tax return, bank statements, or pay stubs. Real-life examples of this documentation can include evidence of reduced income or unexpected expenses, like medical bills or job loss.

- Compliance with Tax Filing: Remember, all required . Failing to comply may prevent you from entering a financial arrangement.

If you can demonstrate financial difficulty, there’s hope: you might qualify for extended arrangements lasting as long as 99 months. To start the process, simply complete Form MD 433-A for these extended arrangements.

By examining these requirements thoroughly, you can better assess your qualification for a and gather the necessary paperwork to support your application. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

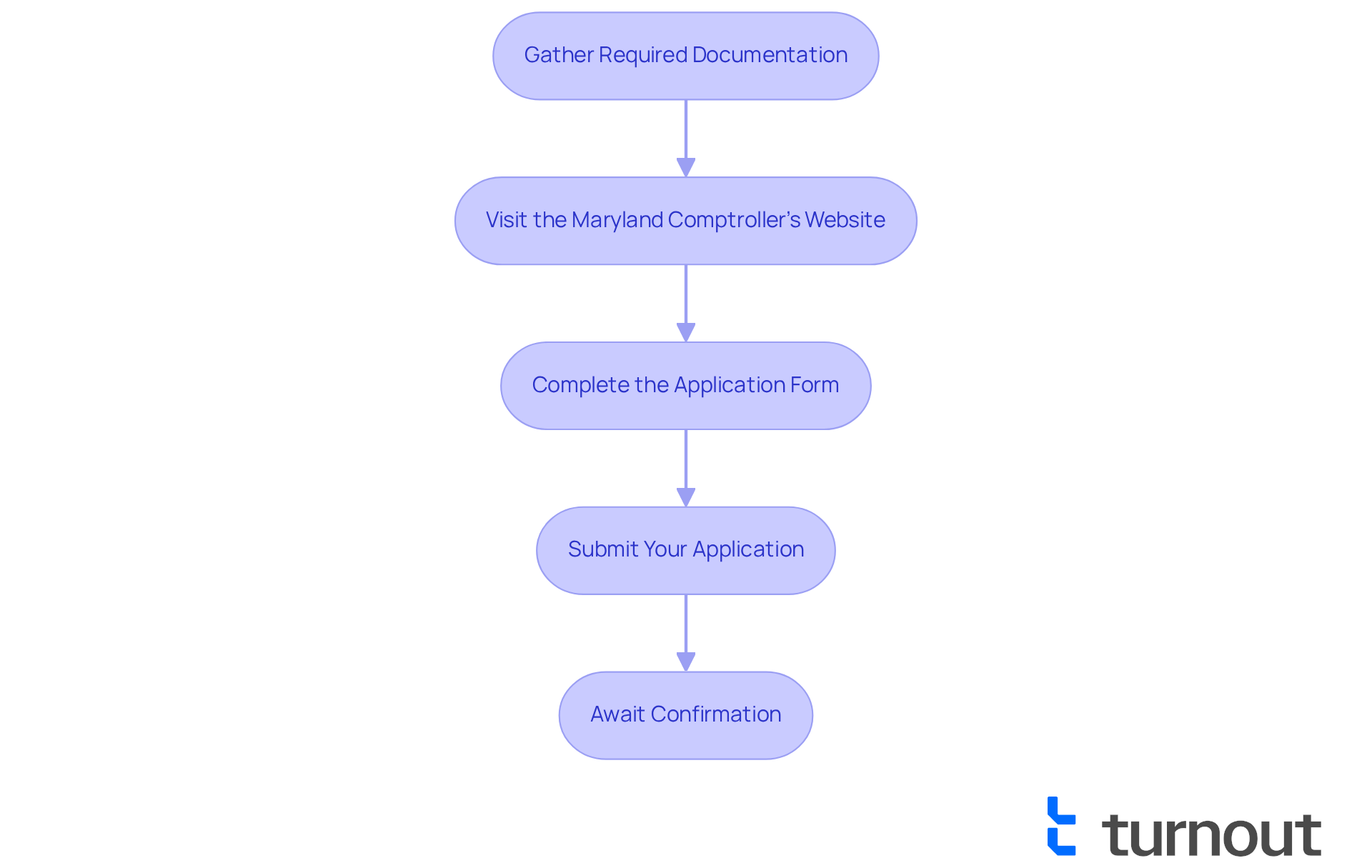

Apply for a Maryland Tax Payment Plan

Applying for a payment plan for can feel overwhelming, but we're here to help you navigate through it with ease. Here are some to guide you:

- Gather Required Documentation: Start by collecting all necessary documents, such as proof of income, your most recent tax return, and any financial statements that illustrate your current financial situation. This documentation is crucial for demonstrating your need for a .

- Visit the : Take a moment to navigate to the official Maryland Comptroller’s site. Here, you can access the application form for the financial arrangement. This online resource offers an efficient way to begin your .

- Complete the Application Form: When filling out the application form, ensure you provide accurate information. Include details about your income, expenses, and the total amount of tax owed. Completing this form carefully increases your chances of approval.

- Submit Your Application: After completing the form, submit your application online or via mail, following the instructions on the website. Online submissions are generally processed more quickly, often receiving confirmation within just a few days.

- Await Confirmation: Once your application is submitted, you will receive confirmation from the Comptroller’s office regarding its status. Be ready to respond promptly to any requests for additional information, as this can impact the processing time.

By following these steps, you can navigate the application process more efficiently, increasing your chances of obtaining a . Remember, most taxpayers are required to settle the entire amount within 24 months, but extended arrangements lasting up to 99 months may be available depending on your financial situation. If you need assistance, please don’t hesitate to contact the Comptroller's office at 410-974-2432 or reach out via email. You are not alone in this journey, and help is available for your tax questions.

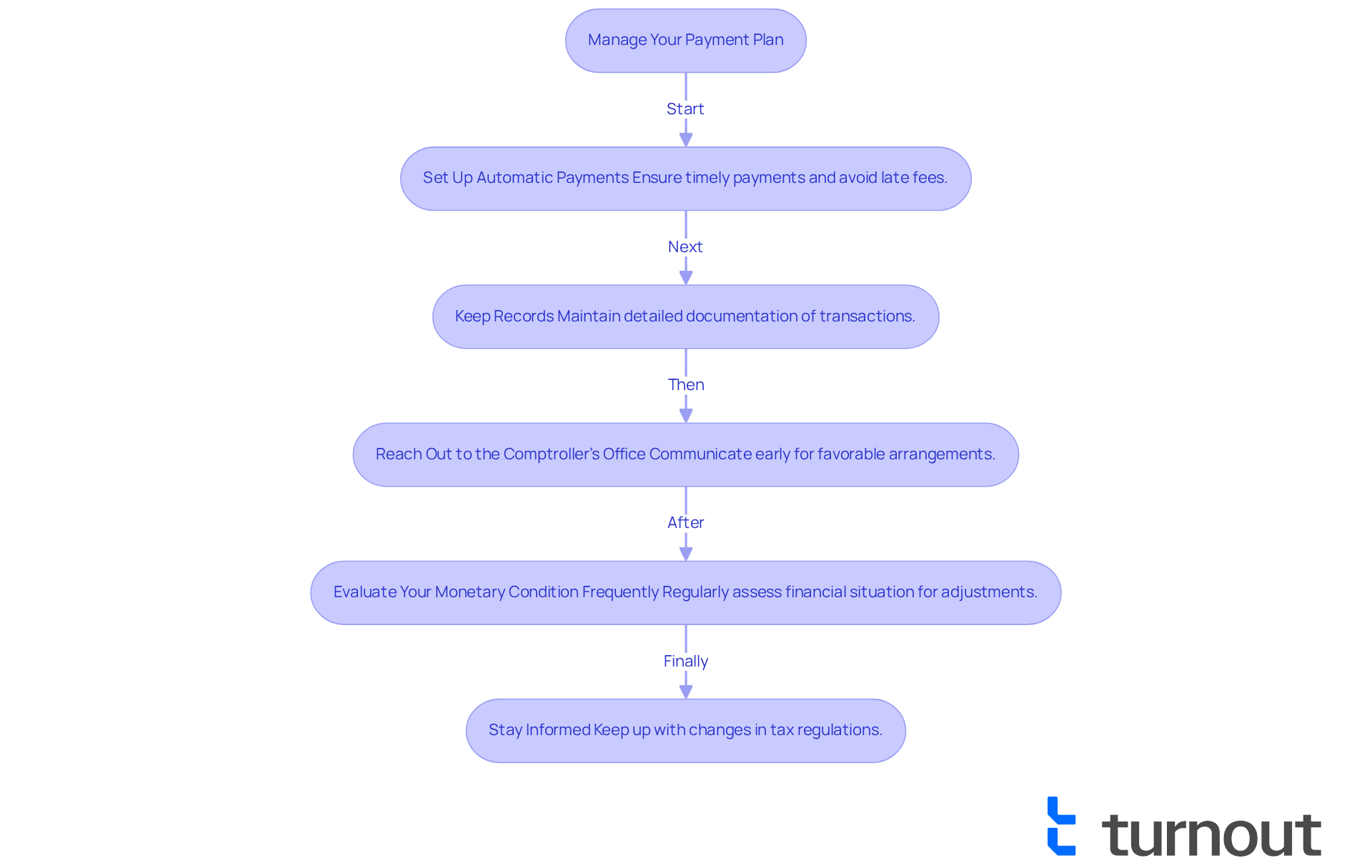

Manage Your Payment Plan Effectively

Once you enroll in a , effective management becomes essential for meeting your obligations. We understand that this can be a challenging time, but there are strategies that can help you navigate this journey with confidence.

- Set Up : Consider arranging for automatic deductions from your bank account. This proactive approach ensures timely payments and helps you avoid late fees. By taking this step, you can significantly reduce the risk of overdue amounts, which is a common concern among taxpayers.

- Keep Records: It's important to maintain detailed documentation of all transactions, including dates and amounts. This practice not only assists you in monitoring your progress but also provides confirmation of transactions if needed. Research shows that about 70% of taxpayers in Maryland keep detailed records of their tax contributions, which can be incredibly helpful in managing finances. As Benjamin Franklin wisely noted, "Beware of little expenses; a small leak will sink a great ship."

- Reach out to the Comptroller’s Office: If you encounter that could impact your ability to meet your obligations, please don’t hesitate to contact the Comptroller’s office. Early communication can lead to more favorable arrangements and prevent complications down the line. Remember, as Dave Ramsey emphasizes, "You must gain , or the lack of it will forever control you."

- Evaluate Your Monetary Condition Frequently: Regularly assessing your financial situation can help you determine if you can increase your contributions or if adjustments are needed. These regular reviews will keep you on track and allow you to make necessary changes based on your current financial health.

- Stay Informed: Keeping up to date with any changes in tax regulations or s that may affect your obligations is crucial. , and being informed can empower you to navigate your responsibilities more effectively.

By applying these management strategies, you can take control of your financial arrangement and work towards settling your tax obligations. Consider the story of a Maryland taxpayer who successfully managed their payment plan for Maryland taxes by setting up automatic payments and regularly reviewing their financial situation. This proactive approach not only alleviated stress but also empowered them to regain control over their finances. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Conclusion

Navigating the complexities of tax obligations can be overwhelming. We understand that many individuals face financial challenges, and knowing the various payment plans available in Maryland can offer much-needed relief. This guide highlights essential options, including:

- Installment agreements

- Short-term payment plans

- Extended repayment options

These options empower you to manage your debts effectively over time.

Key insights include the eligibility requirements for these plans, such as:

- Having an outstanding tax liability

- Demonstrating financial hardship

It's reassuring to know that the application process has been simplified, allowing you to apply online and receive timely confirmations. Effective management strategies, like:

- Setting up automatic payments

- Keeping detailed records

are crucial for ensuring compliance and avoiding penalties.

Ultimately, Maryland's tax payment plans serve as a vital resource for taxpayers facing financial difficulties. By taking proactive steps and utilizing the available support, you can regain control over your tax responsibilities and work towards a more stable financial future. Embracing these options not only alleviates stress but also empowers you to navigate your obligations with confidence. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What options are available for tax payment plans in Maryland?

Maryland offers several options for tax payment plans, including Installment Agreements, Short-Term Payment Plans, and Extended Repayment Options.

What is an Installment Agreement?

An Installment Agreement allows taxpayers to pay their tax debt in monthly installments. The terms may vary based on the amount owed and individual financial situations.

What is the Guaranteed Installment Agreement (GIA)?

The Guaranteed Installment Agreement (GIA) is for individuals with total tax liabilities of $10,000 or less, allowing a maximum repayment term of 36 months.

What is the Streamlined Installment Agreement (SLIA)?

The Streamlined Installment Agreement (SLIA) accommodates assessed tax balances of up to $50,000 over a maximum term of 72 months.

What are Short-Term Payment Plans?

Short-Term Payment Plans are available for those who can settle their tax debt within 120 days, typically without incurring additional fees.

What are Extended Repayment Options?

Extended Repayment Options provide flexibility for those facing larger debts, allowing repayment schedules to span several months or years.

How can I apply for a tax payment plan in Maryland?

You can apply online through the Comptroller’s service center, which facilitates quicker approvals for installment agreements.

How long does it take to process long-term installment agreements?

Long-term installment agreements typically take about 7 to 10 business days for processing.

What is the requirement for setting up an installment agreement?

Taxpayers must file all required tax returns for at least the past six years to set up any installment agreement.

What happens if I fail to make a scheduled payment?

Failing to make a scheduled payment can lead to serious consequences, including defaulting on the agreement and potential enforcement measures.

How common are payment plans among Maryland taxpayers?

Over 70% of taxpayers in Maryland utilize a payment plan for their taxes, highlighting its importance in managing tax obligations.