Overview

We understand that navigating the world of royalty taxation can feel overwhelming. This article offers a comprehensive tutorial designed to help you master the taxation of royalties. You will discover the various types of royalties and their tax implications, which can help alleviate some of your concerns.

Royalty income is typically taxed like regular earnings, and it’s essential to report this income accurately on your tax forms. Knowing how to approach this can make a significant difference in your financial journey. We emphasize the importance of understanding the deductions and credits available to you, as these can help minimize your tax liability.

Remember, you are not alone in this journey. We're here to help you navigate these complexities with confidence. By gaining a deeper understanding of your tax obligations, you can take proactive steps to manage your finances effectively.

Introduction

Navigating the complexities of royalty taxation can feel daunting for anyone involved in intellectual property or asset management. We understand that with various types of royalties—from copyright and patent payments to mineral rights—each category brings its own unique implications for income and tax obligations. It’s common to feel overwhelmed by the intricacies of reporting and maximizing deductions. How can you find your way through this landscape to ensure compliance while also optimizing your financial outcomes?

You are not alone in this journey. Many individuals grapple with these challenges, and it’s important to know that there are solutions available. Together, we can explore the options that will help you manage your tax obligations effectively and with confidence. Let’s take the first step toward understanding these complexities and finding the support you need.

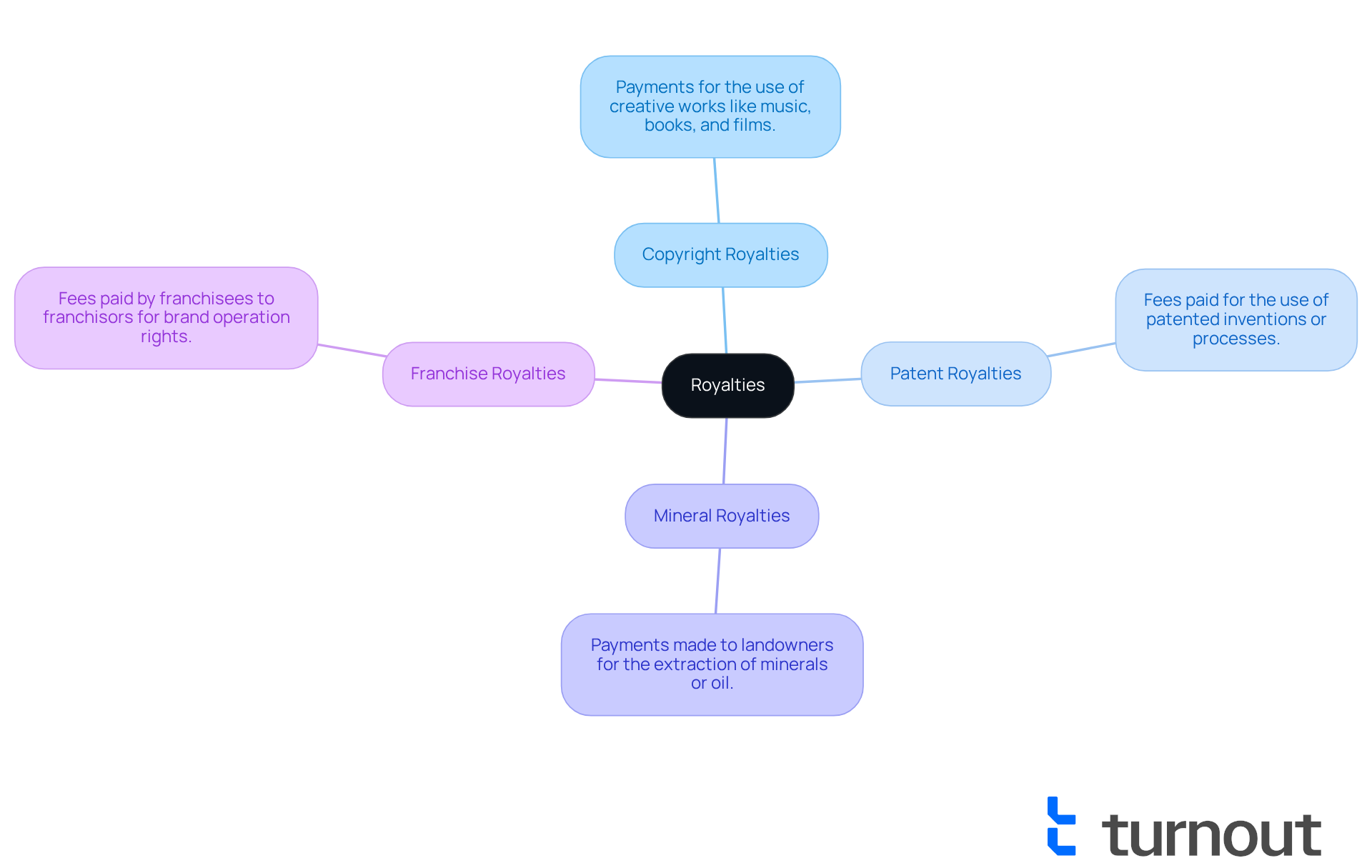

Define Royalties: Types and Importance

Royalties are for the use of their assets. These assets can include intellectual property like copyrights, patents, and trademarks, as well as physical assets such as mineral rights. Understanding the is essential, as they can significantly impact your and the .

- Copyright Royalties: These are payments for the use of creative works, such as music, books, and films.

- Patent Royalties: These fees are paid for the use of patented inventions or processes.

- Mineral Royalties: Payments made to landowners for the extraction of minerals or oil from their property.

- Franchise Royalties: Fees paid by franchisees to franchisors for the right to operate under a brand.

We understand that navigating these categories can feel overwhelming. It's common to wonder how each type of royalty impacts your income and the taxation of royalties. Remember, you're not alone in this journey. We're here to help you grasp these concepts, guiding you toward informed decisions that can enhance your financial well-being.

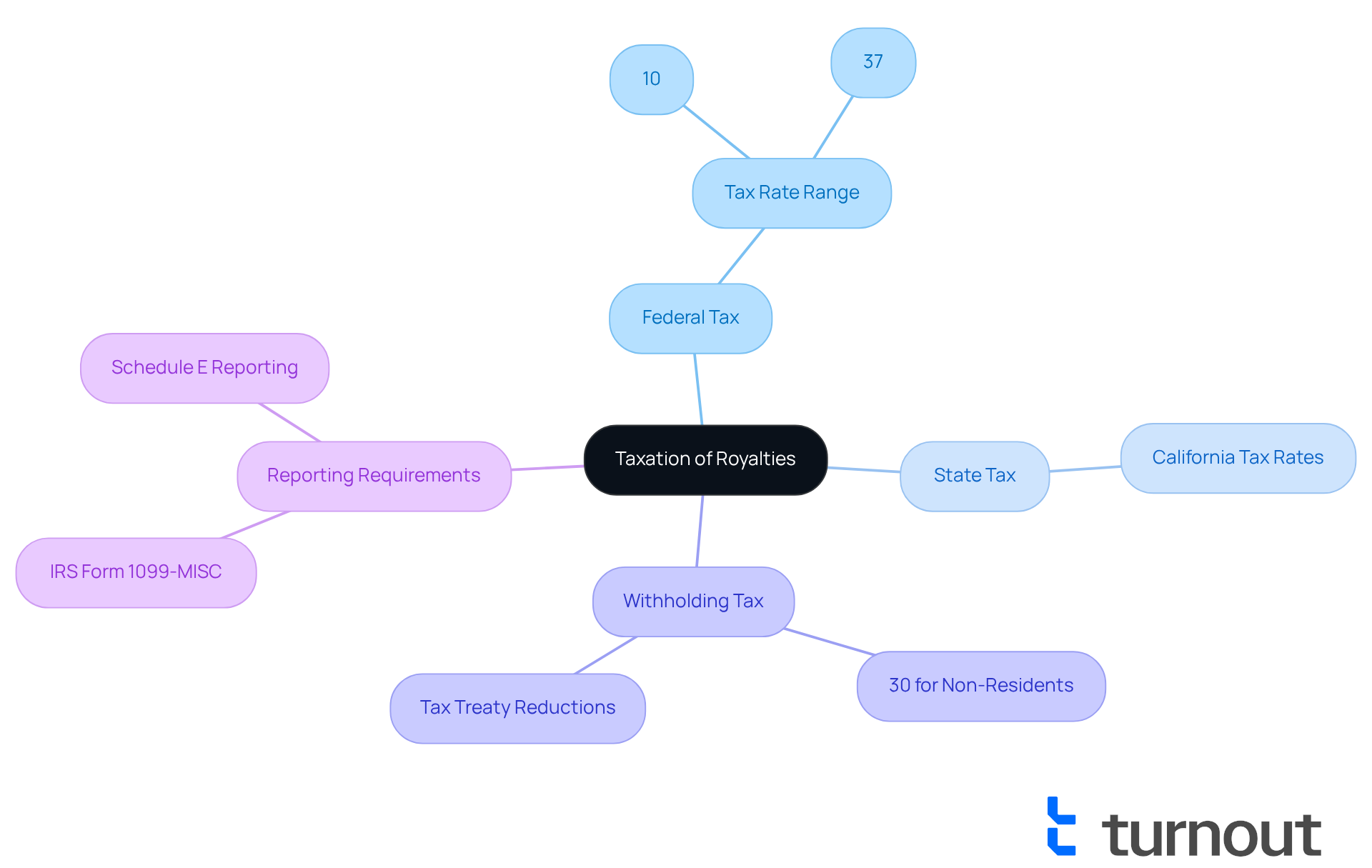

Explore Taxation Framework for Royalties

Understanding the can seem overwhelming, but we are here to assist you. The taxation of royalties is typically treated like regular earnings, meaning they are subject to the same . Here are some important points to keep in mind:

- Federal Tax: Your royalty income will be reported on your and taxed at your applicable income tax rate, which can range from 10% to 37% in 2025.

- Taxation of Royalties: Depending on where you live, additional state taxes may apply. For example, California has specific rates for the taxation of royalties earned.

- Withholding Tax: The taxation of royalties may impose a 30% made to non-resident aliens unless a tax treaty reduces this amount.

- Reporting Requirements: Generally, the taxation of royalties mandates that royalty payments should be declared on , and recipients must of their tax return.

We understand that navigating these requirements can be challenging, but having a clear grasp of these aspects is essential for compliance and effective taxation of royalties. You're not alone in this journey; with the right information, you can take confident steps forward.

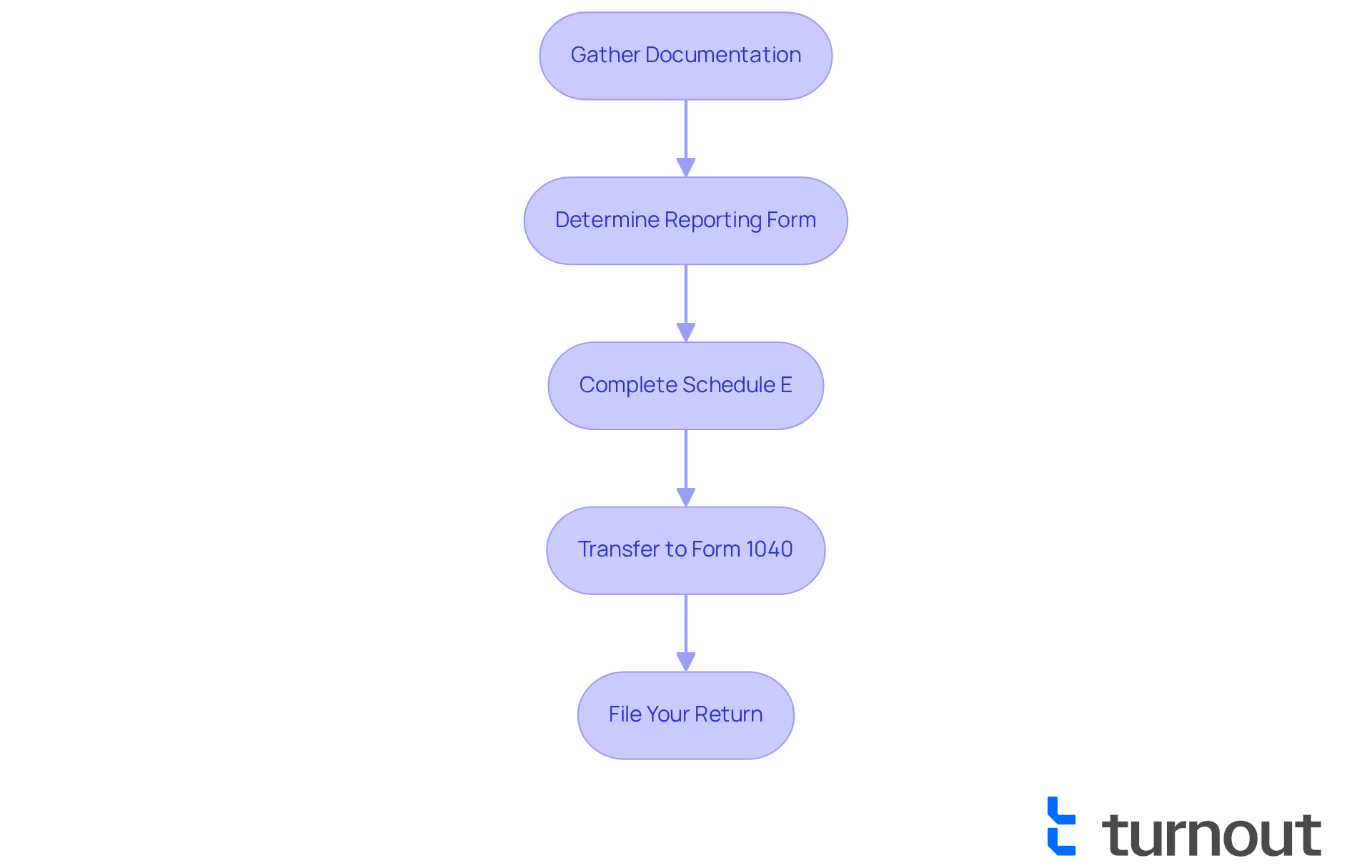

Report Royalty Income: Step-by-Step Guide

can feel overwhelming due to the , but we're here to help you with ease. Follow these steps to ensure you're on the right track:

- Gather Documentation: Start by collecting all relevant documents, including from payers, which outlines the total payment amounts you’ve received. This is your foundation.

- Determine Reporting Form: Most individuals report earnings from royalties on (Form 1040). If your payments are part of a business, you’ll want to use Schedule C instead.

- Complete Schedule E: On Schedule E, list the total royalty earnings you received. Be sure to include all relevant costs in the appropriate sections to accurately determine your net earnings.

- Transfer to Form 1040: Once you’ve completed Schedule E, transfer the net profit amount to your Form 1040. This step is crucial for clarity.

- File Your Return: Finally, ensure that all forms are submitted by the , typically April 15, to avoid any penalties. Remember, timely filing is key.

By following these steps, you can feel confident that your earnings are reported correctly and in accordance with IRS regulations, particularly concerning the taxation of royalties. You're not alone in this journey; many find tax season daunting, but with careful attention, you can manage it successfully.

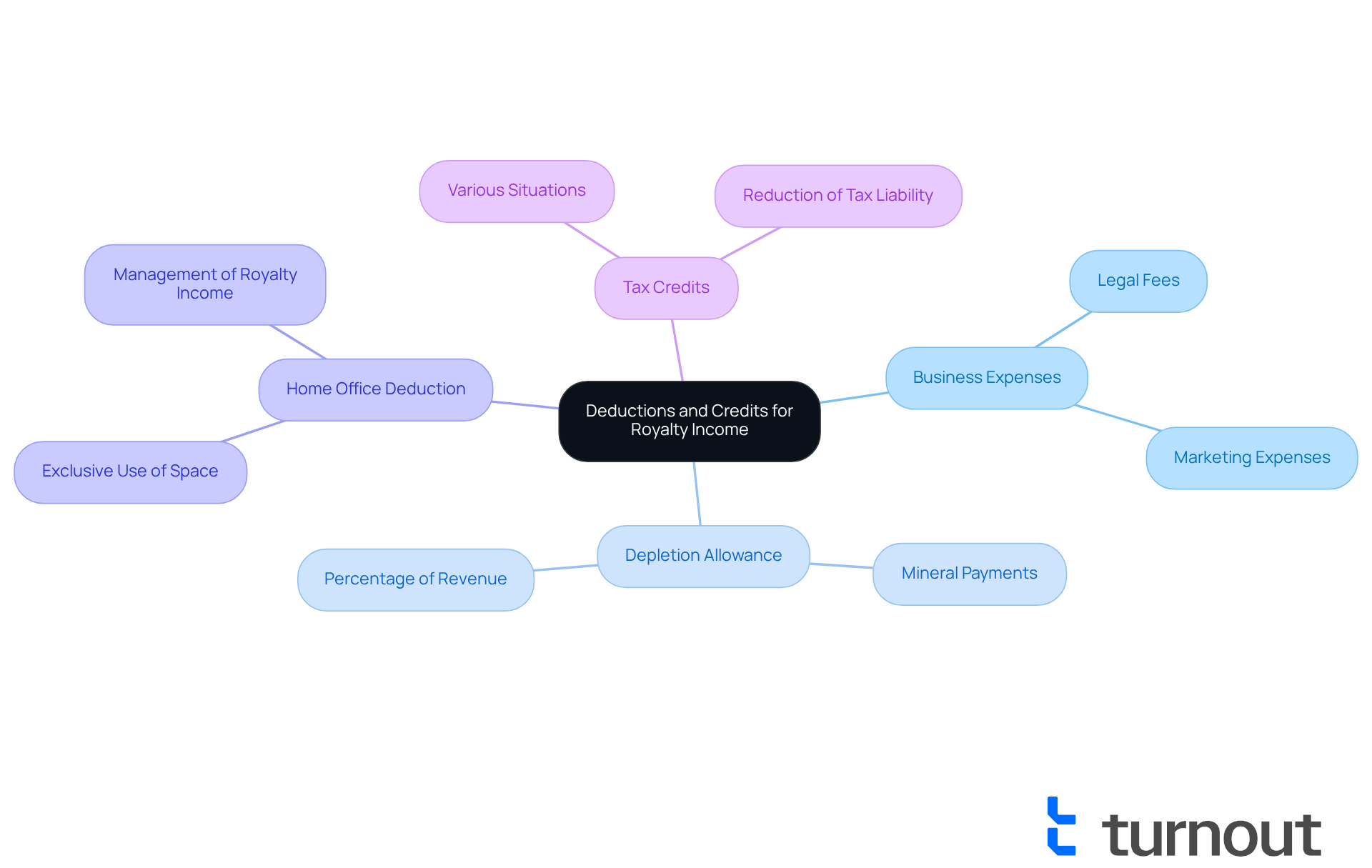

Identify Deductions and Credits for Royalty Income

When it comes to , we understand that can feel overwhelming. Fortunately, several deductions and credits may be available to help reduce your taxable income:

- : If you incur costs related to generating earnings from royalties, such as legal fees or marketing expenses, these can be deducted.

- Depletion Allowance: For mineral payments, you may qualify for a depletion deduction, allowing you to subtract a percentage of the revenue generated from the extraction of resources.

- : If you use part of your home exclusively for managing your royalty income, you may qualify for a home office deduction.

- : Depending on your situation, various tax credits may further reduce your .

We encourage you to consult with a tax professional who can help identify all eligible deductions and credits. Remember, you are not alone in this journey, and we’re here to help you maximize your tax savings.

Conclusion

Mastering the taxation of royalties is essential for anyone generating income from intellectual or physical assets. We understand that navigating the complexities of royalty taxation can feel overwhelming. By familiarizing yourself with various types of royalties—such as copyright, patent, mineral, and franchise royalties—you lay a solid foundation for effective financial management and compliance with tax regulations. This knowledge empowers you to make informed decisions that enhance your financial well-being.

In this article, we shared key insights on the taxation framework for royalties, including federal and state tax implications, reporting requirements, and potential deductions. We recognize the importance of accurate documentation and timely filing to avoid penalties, which is why our step-by-step guide to reporting royalty income is so valuable. Exploring available deductions and credits can significantly reduce your taxable income, making it vital to consult with tax professionals to maximize your savings.

Ultimately, understanding the taxation of royalties not only fosters compliance but also empowers you to optimize your financial strategies. Embracing this knowledge can lead to better financial outcomes and a more robust approach to managing royalty income. Remember, you are not alone in this journey. Engage with these insights, seek out professional guidance, and take proactive steps to master the taxation of royalties. Together, we can ensure that your financial journey is both informed and rewarding.

Frequently Asked Questions

What are royalties?

Royalties are payments made to property owners for the use of their assets, which can include intellectual property like copyrights, patents, and trademarks, as well as physical assets such as mineral rights.

What are the different types of royalties?

The different types of royalties include: Copyright Royalties: Payments for the use of creative works such as music, books, and films. Patent Royalties: Fees paid for the use of patented inventions or processes. Mineral Royalties: Payments made to landowners for the extraction of minerals or oil from their property. Franchise Royalties: Fees paid by franchisees to franchisors for the right to operate under a brand.

Why is it important to understand the different types of royalties?

Understanding the different types of royalties is essential because they can significantly impact your financial strategies and the taxation of royalties.

How can royalties affect financial well-being?

Royalties can impact your income and financial decisions, making it important to grasp these concepts for informed decision-making that can enhance your financial well-being.