Overview

Navigating tax obligations can be overwhelming, especially when it comes to understanding payment plans. The article outlines a four-step process for mastering the state of Maryland payment plan for taxes, designed to help you manage your tax obligations through structured payment arrangements. We understand that financial stress can be daunting, and this guide aims to alleviate that burden.

Within the article, you will find detailed information on:

- Eligibility requirements

- Necessary documentation

- The application process

It's common to feel uncertain about where to start, but knowing these steps is crucial. By understanding the process, you can avoid penalties and feel more in control of your financial situation.

Remember, you are not alone in this journey. We’re here to help you every step of the way. Take a moment to reflect on your situation, and know that there are solutions available to ease your concerns.

Introduction

Navigating tax obligations can often feel daunting, especially for those experiencing financial difficulties. We understand that this can be overwhelming. In Maryland, there is a structured payment plan designed to ease the burden of tax debts, allowing individuals to manage their payments over time. This article will guide you through the essential steps for mastering the Maryland tax payment plan, highlighting how you can alleviate stress and regain control of your financial situation.

But what if the complexity of tax regulations and eligibility criteria leaves you feeling uncertain about your options? You're not alone in this journey, and we're here to help.

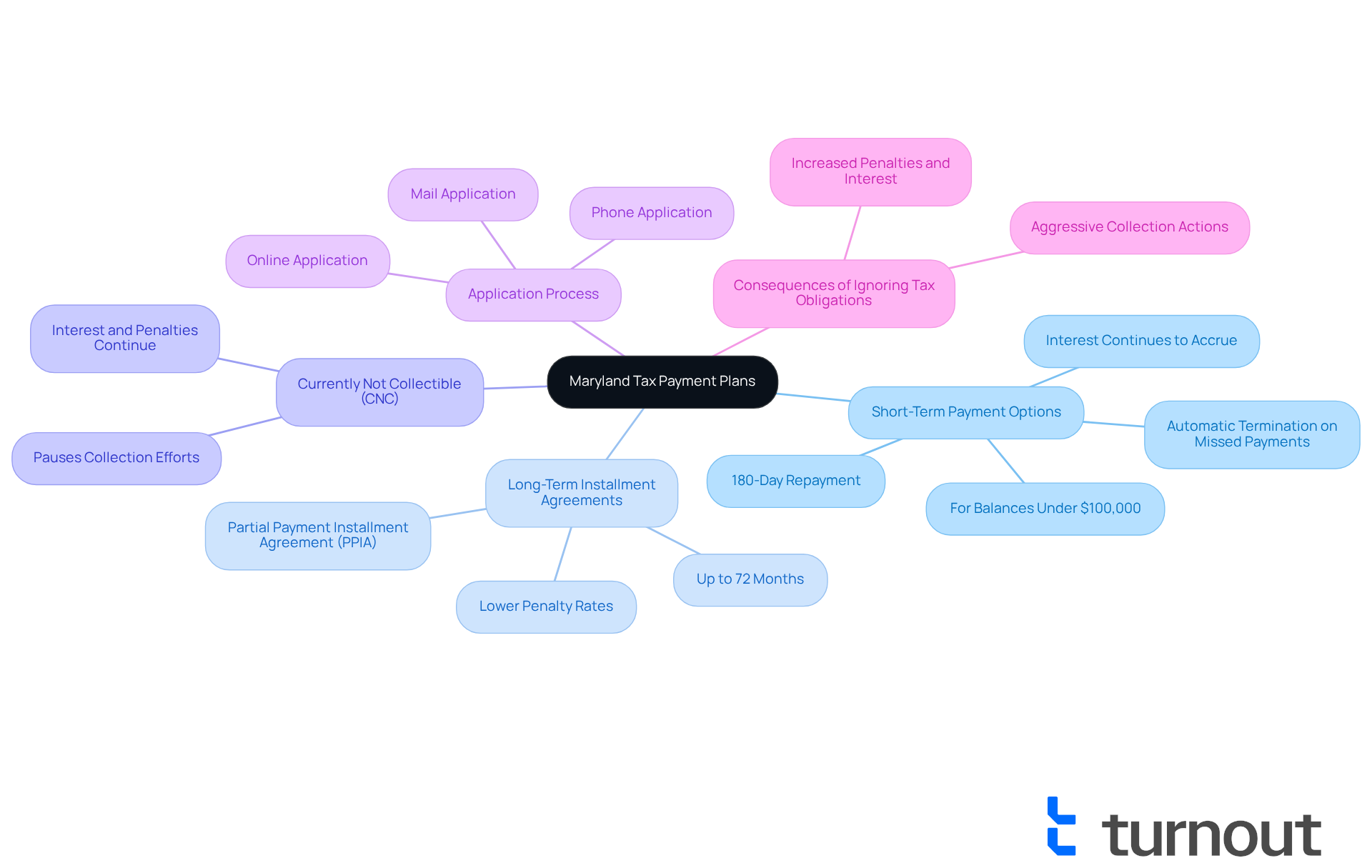

Understand Maryland Tax Payment Plans

Maryland provides a [state of Maryland payment plan for taxes](https://solvable.com/tax-help/can-i-arrange-a-maryland-tax-payment-plan) that offers several tax settlement options designed to assist individuals who are struggling to meet their tax obligations. These arrangements allow taxpayers to utilize a state of Maryland payment plan for taxes, enabling them to make manageable monthly payments over a specific period and alleviating the stress of immediate payment. Understanding the different types of strategies available is crucial for effective debt management.

- Short-Term Payment Options: For those with tax balances under $100,000, these options allow repayment within 180 days without a setup fee. However, it’s important to note that interest and penalties continue to accrue during this time. Missing any scheduled payment in a repayment arrangement can lead to automatic termination, resulting in significant interest and penalties on the remaining balance.

- Long-Term Installment Agreements: If you need more time, long-term arrangements can extend up to 72 months for debts of $50,000 or less. These agreements typically include a lower penalty rate for those who may struggle to pay while enrolled. Additionally, taxpayers who cannot pay their full balance might consider the Partial Payment Installment Agreement (PPIA), which allows contributions based on disposable income and assets.

You can apply for the state of Maryland payment plan for taxes through the Comptroller's website, where you will find detailed information about eligibility and requirements. Starting in 2025, thousands of Maryland taxpayers will be using these financial arrangements to manage their tax obligations effectively.

"With this type of financial arrangement, you allow the state to withdraw your monthly payment directly from your checking account," shares a representative from the Comptroller’s Office. This feature simplifies the transaction process and helps ensure timely payments, which are vital for maintaining the agreement.

For those experiencing financial hardship, the Currently Not Collectible (CNC) status can pause active collection efforts, although interest and penalties will still accrue. Furthermore, Low-Income Taxpayer Clinics (LITC) provide free or low-cost representation for low-income taxpayers who meet income guidelines.

Becoming familiar with these options is the first step toward effectively managing your tax debt. This knowledge empowers you to navigate the complexities of the state's tax system with greater confidence. Remember, you are not alone in this journey, and we’re here to help you find the best path forward.

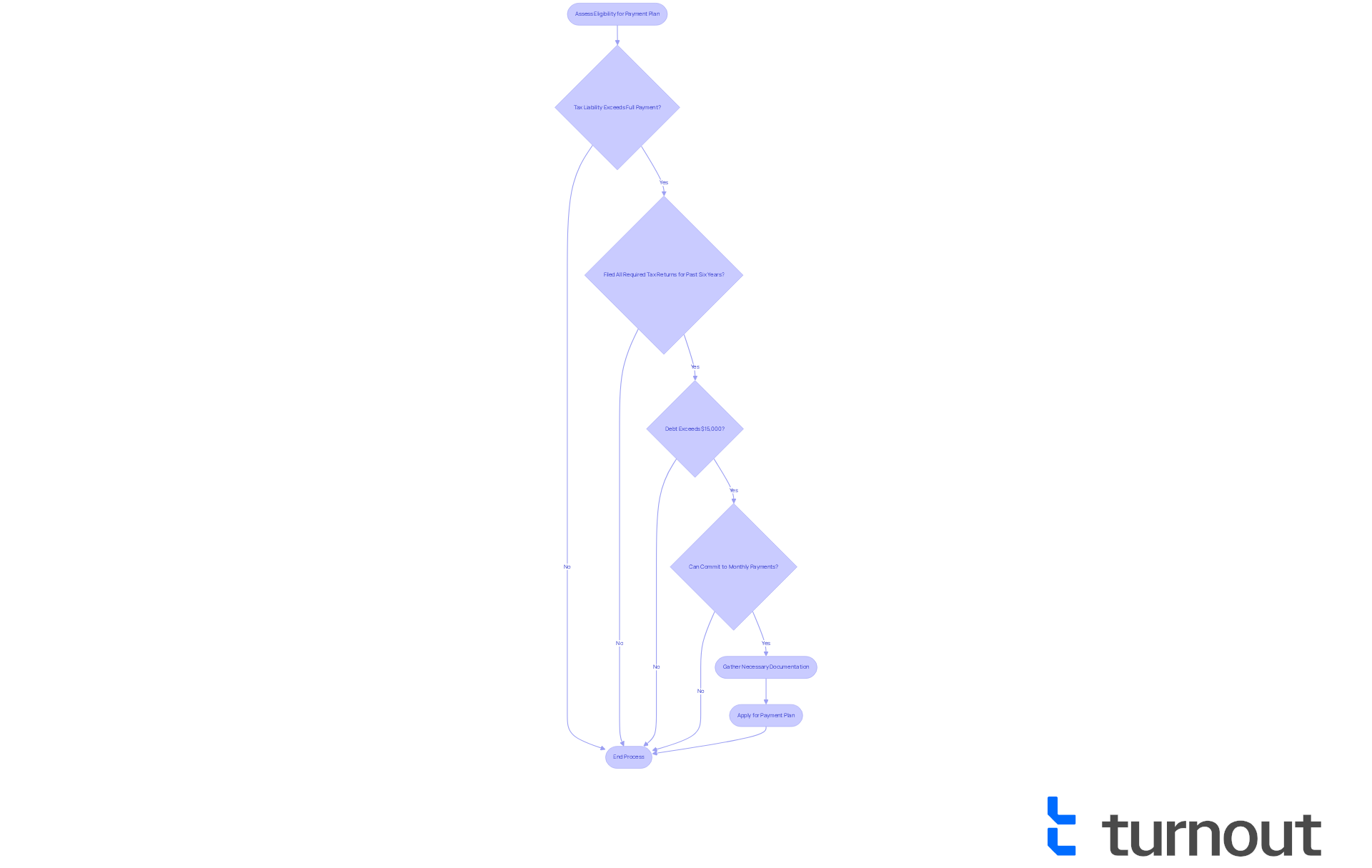

Determine Your Eligibility for a Payment Plan

Navigating tax obligations can feel overwhelming, especially when you find yourself unable to pay your full tax liability. To qualify for the state of Maryland payment plan for taxes, it's essential to meet specific criteria. Generally, this means your tax liability exceeds what you can pay in full. Additionally, you need to have filed all required tax returns for the past six years. If your debt exceeds $15,000, you may be asked to provide a deposit of about 25% of your total balance. It's vital to assess your financial situation and ensure that you can commit to the monthly payments outlined in the arrangement.

While enrolled in a financing plan, remember to file your income tax returns by the due date to avoid defaulting on your agreement. If you meet these criteria, you can move forward with gathering the necessary documentation for your application. We understand that this process can be daunting, but many taxpayers in Maryland have successfully navigated the state of Maryland payment plan for taxes.

For instance, a self-employed individual managed to resolve $39,378 in IRS back taxes by utilizing available settlement options. Statistics reveal that a significant number of taxpayers qualify for installment plans, highlighting the accessibility of these solutions. Tax professionals often stress the importance of demonstrating an inability to pay the full tax debt to qualify for programs like the Offer in Compromise, which can provide additional relief. Remember, overdue amounts can lead to serious consequences, so understanding these requirements is crucial for effectively managing your tax responsibilities. You're not alone in this journey, and support is available to help you through it.

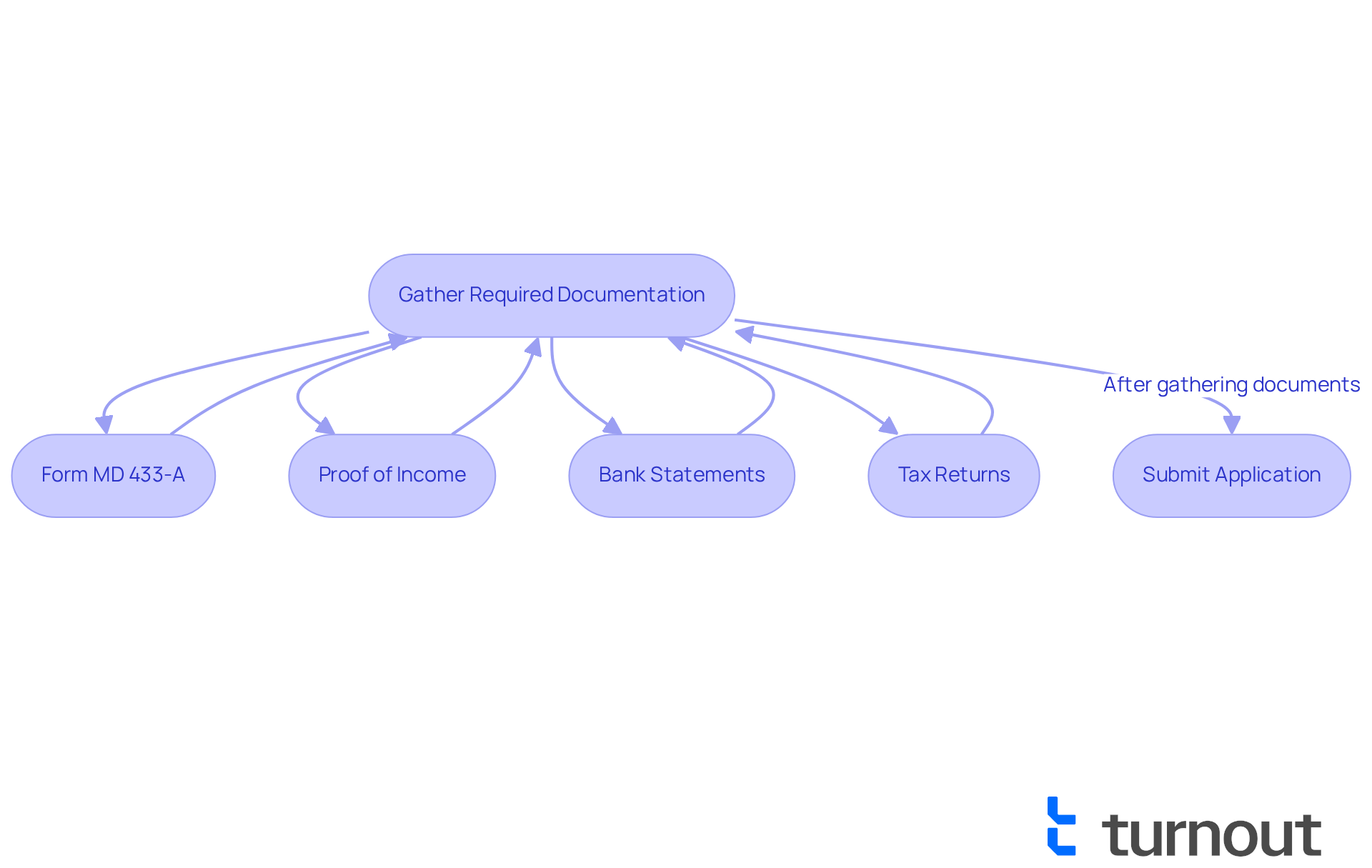

Gather Required Documentation for Application

When you're considering a [state of Maryland payment plan for taxes](https://taxcure.com/state-taxes/maryland/payment-plan), we understand that the process can feel overwhelming. To help ease your journey, it's essential to gather several important documents. These typically include:

- Form MD 433-A: This Collection Information Statement outlines your financial situation, detailing your income, expenses, and assets. It’s crucial for assessing extended repayment arrangements.

- Proof of Income: Recent pay stubs, profit and loss statements, or other documentation that reflects your current income can provide clarity.

- Bank Statements: Statements from all your accounts for the past few months illustrate your financial standing.

- Tax Returns: Copies of your filed tax returns for the past six years are also necessary.

Most taxpayers are requested to settle the entire amount due within 24 months. However, if you're facing financial difficulties, you can utilize the state of Maryland payment plan for taxes, which offers extended arrangements that can stretch up to 99 months. It’s important to recognize that failing to make a scheduled installment can lead to automatic termination of the repayment arrangement, resulting in significant interest and charges. By preparing these documents in advance, you can streamline your application process and significantly enhance your chances of approval. Remember, you are not alone in this journey; we’re here to help you every step of the way.

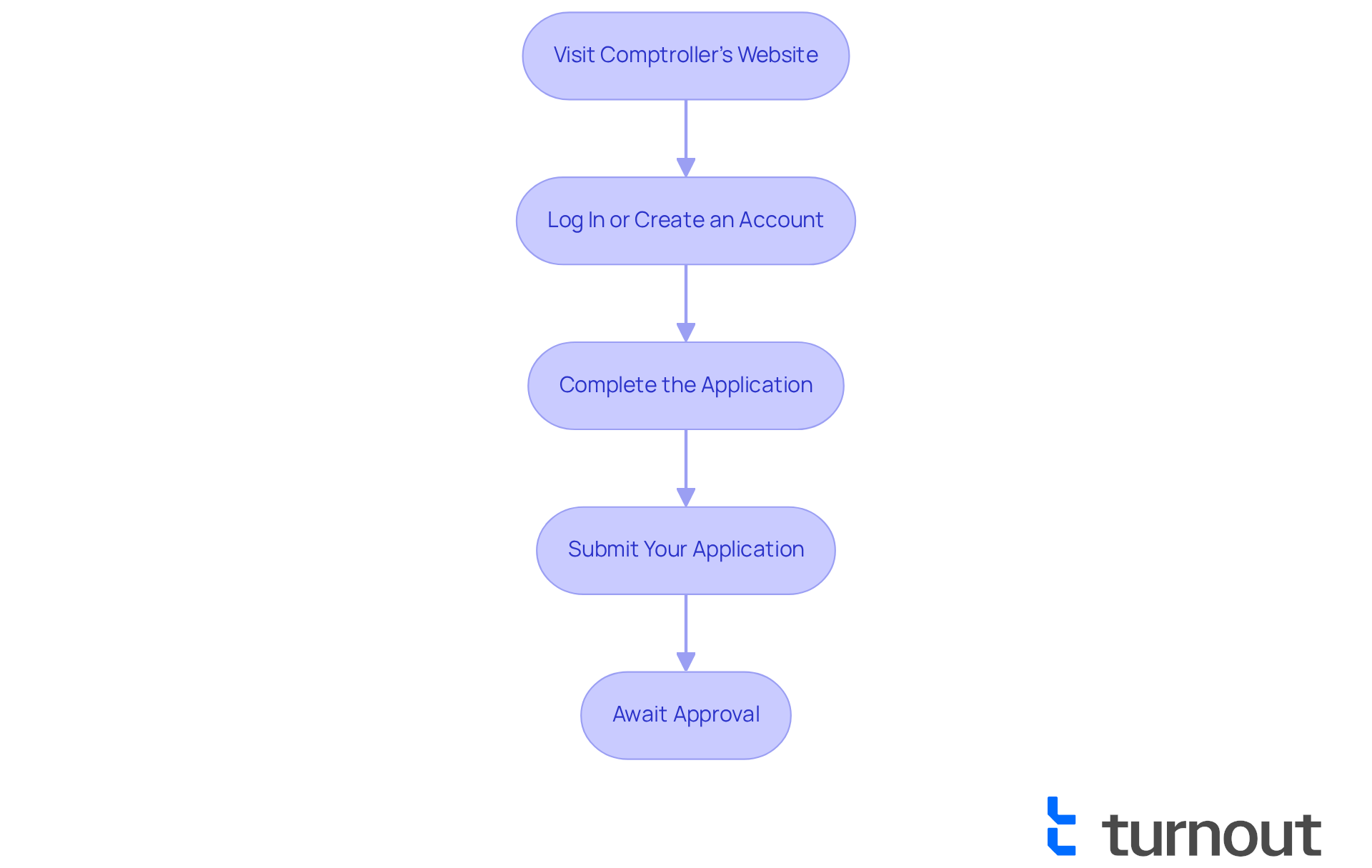

Apply for Your Maryland Tax Payment Plan

If you're considering applying for the state of Maryland payment plan for taxes, we understand that this can be a challenging time. To help you navigate this process smoothly, here are the steps you can follow:

- Visit the Comptroller's Website: Start by navigating to the Individual Payment Agreement page on the Comptroller of Maryland's website.

- Log In or Create an Account: If you're new, you'll need to create an account. Returning users can simply log in with their existing credentials.

- Complete the Application: Take your time to fill out the online application form. Make sure to provide all required information and upload any necessary documentation, such as a Collection Information Statement if you're seeking a long-term arrangement.

- Submit Your Application: Before you submit, review your application for accuracy. Once processed, you will receive a confirmation.

- Await Approval: The Comptroller's office will review your application and notify you of their decision. If approved, you'll receive details regarding your financial arrangement, including the monthly payment amount and duration.

By following these steps, you can successfully request a state of Maryland payment plan for taxes, which will allow you to manage your tax responsibilities with greater ease. Many successful applications lead to manageable financial arrangements, helping taxpayers avoid aggressive collection efforts and penalties that can reach 25% of the owed amount. Remember, if there is an existing lien, payment arrangements can extend up to 60 months; otherwise, they can last up to 36 months. The approval time for these plans can vary, so it’s important to stay informed and proactive throughout this journey. You are not alone in this process, and we're here to help you every step of the way.

Conclusion

Navigating tax obligations can feel overwhelming, and we understand that. The state of Maryland offers a structured payment plan designed to ease the financial burden on taxpayers. By exploring the various payment options available, you can take control of your tax responsibilities and alleviate the stress of immediate payment demands.

This guide has outlined essential steps for utilizing the Maryland payment plan for taxes. It includes:

- Understanding eligibility requirements

- Gathering necessary documentation

- Following the application process

From short-term payment options to long-term installment agreements, you have multiple pathways to manage your debts effectively. Additionally, resources such as Low-Income Taxpayer Clinics can provide vital support for those in need.

Taking action to explore these payment plans is crucial for anyone struggling with tax liabilities. By leveraging the available resources and understanding the requirements, you can find a manageable solution to your financial challenges. Embracing these options not only alleviates immediate stress but also fosters a more stable financial future. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is the Maryland Tax Payment Plan?

The Maryland Tax Payment Plan offers several tax settlement options to assist individuals who are struggling to meet their tax obligations, allowing them to make manageable monthly payments over a specific period.

What are the short-term payment options available in Maryland?

Short-term payment options are available for tax balances under $100,000, allowing repayment within 180 days without a setup fee. However, interest and penalties continue to accrue during this period.

What happens if I miss a scheduled payment in a short-term repayment arrangement?

Missing any scheduled payment can lead to automatic termination of the repayment arrangement, resulting in significant interest and penalties on the remaining balance.

What are long-term installment agreements in Maryland?

Long-term installment agreements can extend up to 72 months for debts of $50,000 or less. These agreements typically include a lower penalty rate for those struggling to pay while enrolled.

What is the Partial Payment Installment Agreement (PPIA)?

The Partial Payment Installment Agreement (PPIA) allows taxpayers who cannot pay their full balance to make contributions based on their disposable income and assets.

How can I apply for the Maryland Tax Payment Plan?

You can apply for the Maryland Tax Payment Plan through the Comptroller's website, where detailed information about eligibility and requirements is provided.

What is the Currently Not Collectible (CNC) status?

The Currently Not Collectible (CNC) status can pause active collection efforts for individuals experiencing financial hardship, although interest and penalties will still accrue.

What support is available for low-income taxpayers in Maryland?

Low-Income Taxpayer Clinics (LITC) provide free or low-cost representation for low-income taxpayers who meet income guidelines.

How does the automatic withdrawal feature work in the Maryland Tax Payment Plan?

The automatic withdrawal feature allows the state to withdraw monthly payments directly from your checking account, simplifying the transaction process and ensuring timely payments.