Overview

Navigating the tax relief agency process can feel overwhelming, especially when dealing with tax burdens. It's important to understand that you are not alone in this journey. Many individuals face similar challenges, and seeking assistance is a courageous step toward relief.

This article highlights the significance of grasping various forms of tax relief available to you. Tax relief agencies play a vital role in guiding individuals through these complex matters, ensuring that you have the support you need. By engaging with these agencies, you can find structured approaches to resolving your tax debts, which is crucial for achieving favorable outcomes.

We understand that the process may seem daunting, but with the right information and support, you can navigate it successfully. Remember, reaching out for help is a proactive choice, and there are resources available to assist you every step of the way.

Introduction

Navigating the complexities of tax relief can be daunting for many individuals and businesses. We understand that the various programs designed to alleviate financial burdens may leave you feeling overwhelmed. It's crucial to grasp the intricacies of these options for achieving economic stability. However, the journey is often fraught with challenges, from deciphering complex tax laws to avoiding scams that target vulnerable taxpayers.

How can you effectively master the tax relief agency process? Securing the assistance you need is possible, and we’re here to help you avoid common pitfalls. You are not alone in this journey, and with the right information and support, you can find your way through the complexities of tax relief.

Define Tax Relief and Its Importance

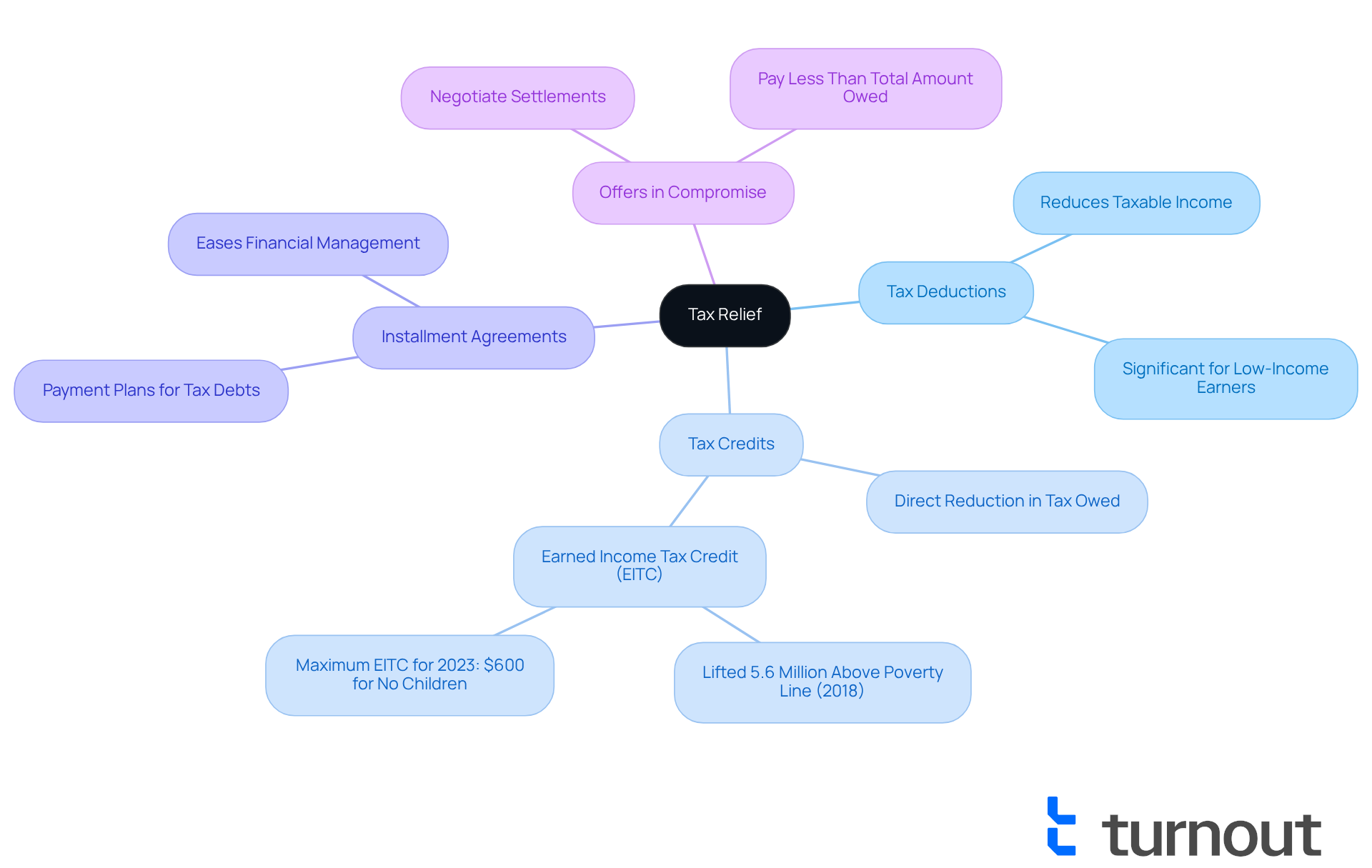

The encompasses a variety of government programs and policies aimed at alleviating the tax burdens faced by individuals and businesses. We understand that navigating tax debt can be overwhelming, making it essential to comprehend these options. They can provide significant economic support and help restore your financial stability. Here are some key forms of tax relief:

- Tax Deductions: These reduce your taxable income, effectively lowering your overall tax bill. For many, especially low-income earners, deductions can significantly impact the amount owed.

- Tax Credits: Unlike deductions, tax credits offer direct reductions in the tax owed, potentially leading to refunds. For example, the (EITC) lifted about 5.6 million individuals above the poverty line in 2018, showcasing its effectiveness in providing economic assistance.

- : These payment plans allow you to settle your debts over time, making it easier to manage your financial obligations without feeling overwhelmed.

- Offers in Compromise: This option enables you to negotiate settlements that allow you to pay less than the total amount owed, offering a more affordable way to resolve tax debts.

It's common to feel unsure about accessing options from a tax relief agency, especially for disabled individuals seeking benefits. Please note that Turnout is not a law firm and is not affiliated with or endorsed by any law firm or government agency. The information provided here does not constitute legal advice, and using Turnout's services does not establish an attorney-client relationship. Turnout, a tax relief agency, employs trained nonlawyer advocates and IRS-licensed enrolled agents to help you navigate the complexities of without the need for legal representation. Recent have further expanded these options, particularly for low-income families. For 2023, the maximum EITC amount for households without children is $600, while families with children may qualify for significantly higher credits, depending on their income levels. These measures aim to lessen the economic burden on American taxpayers, especially those in vulnerable positions, and to promote economic stability. Remember, you are not alone in this journey, and there are resources available to support you.

Explore the Role of Tax Relief Agencies

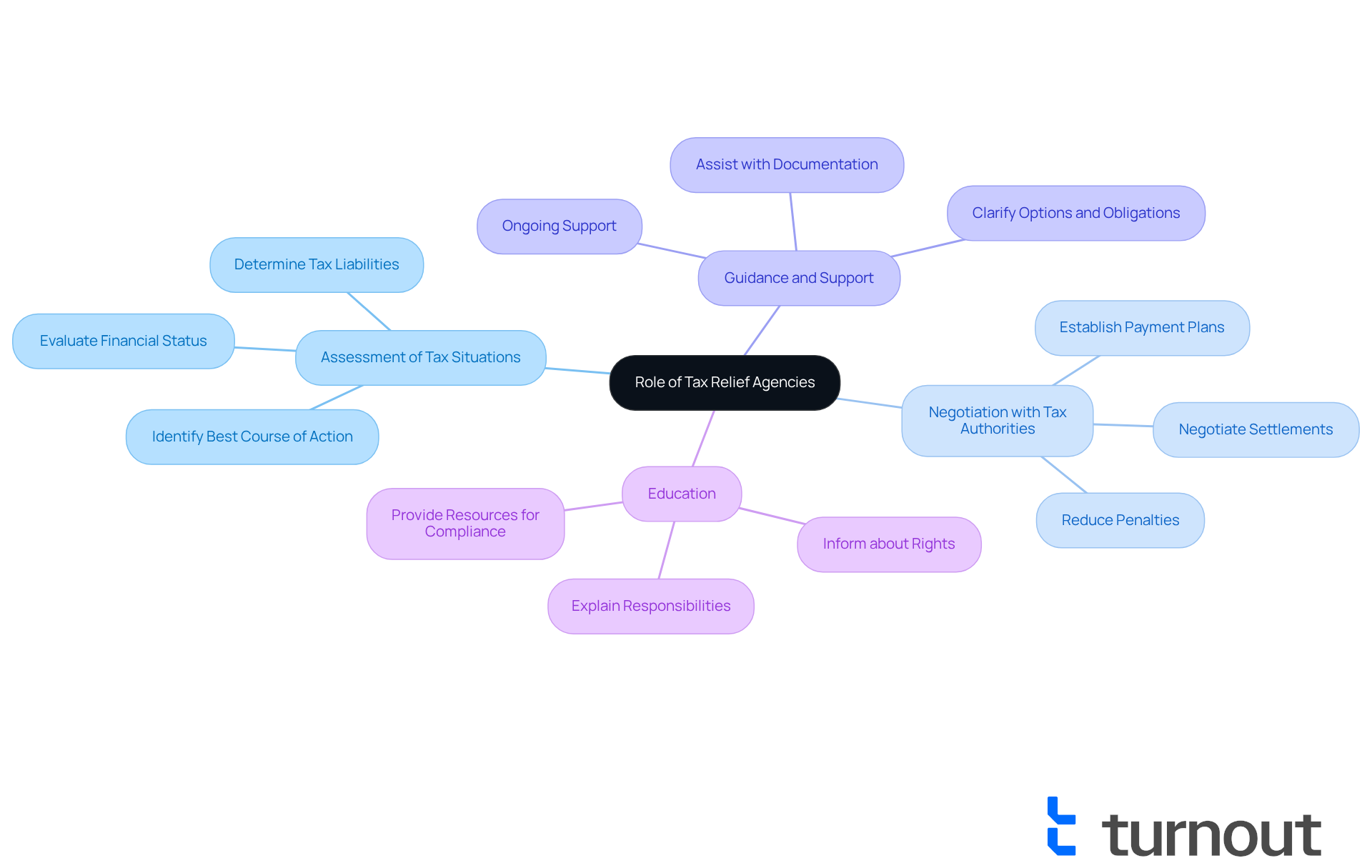

serve as compassionate intermediaries between taxpayers and tax authorities, guiding individuals through the complexities of tax matters. We understand that can be overwhelming, and these organizations are here to help. Their roles include:

- Assessment of Tax Situations: Evaluating a client's financial status and tax liabilities to determine the best course of action.

- Negotiation with Tax Authorities: Acting on behalf of clients to negotiate settlements, payment plans, or reductions in penalties.

- Guidance and Support: Providing ongoing support throughout the tax resolution process, ensuring clients understand their options and obligations.

- Education: Helping clients learn about their rights and responsibilities regarding tax obligations.

These organizations can greatly simplify the process of , making it less intimidating for individuals facing financial difficulties. As U.S. income tax revenue is projected to rise by approximately 39% from 2023 to 2027, the role of [tax assistance organizations](https://cbsnews.com/news/best-tax-debt-relief-companies-2025-top-advice-to-know-now) becomes ever more crucial in helping taxpayers manage these changes effectively.

It's essential for taxpayers to conduct thorough research when choosing a , as this can lead to better outcomes. Remember, you are not alone in this journey. Be cautious of companies that promise low payments or guaranteed program acceptance without first assessing your financial situation. is vital; some services may incur Service Fees, while Government Fees are separate and must be settled before any paperwork can be submitted on your behalf.

Additionally, clients consent to receive all communications electronically, which includes important notices and agreements related to their . We are here to support you every step of the way.

Navigate the Process of Engaging a Tax Relief Agency

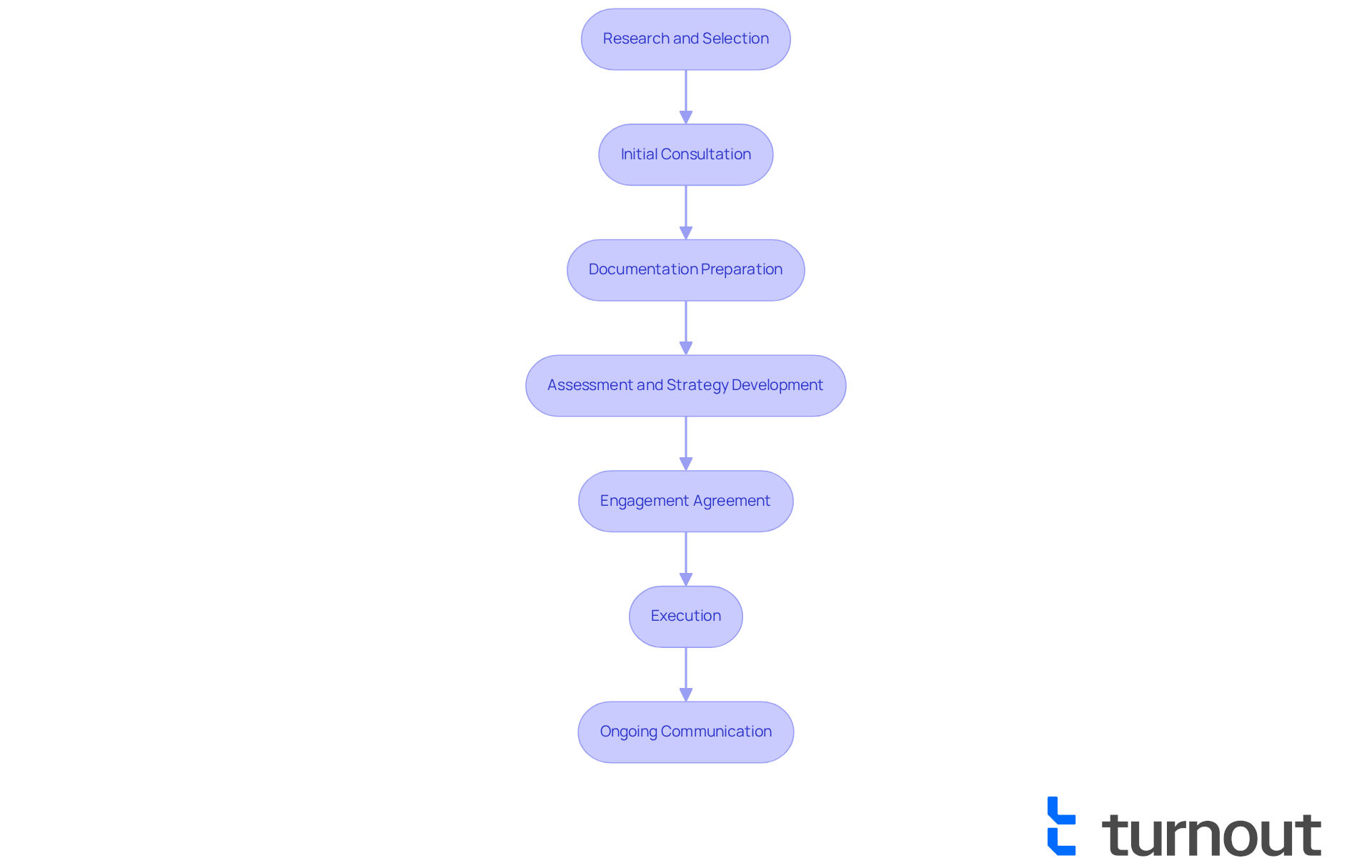

may seem overwhelming, but we are here to guide you through each step with care and understanding.

- Research and Selection: Begin by seeking and demonstrate clear practices. It's important to verify their credentials and experience, ensuring they are accredited by reputable organizations, such as a . Many reputable firms often set minimum debt thresholds, typically requiring debts over $10,000 for their services to be practical.

- Initial Consultation: Schedule a consultation to discuss your unique tax situation. This meeting is frequently complimentary, allowing you to evaluate the organization's strategy and expertise in handling cases like yours. As Angelica Leicht, senior editor for CBSNews.com, wisely notes, "Start by attempting direct resolution with the IRS, then research potential companies thoroughly, focusing on credentials, customer reviews, and transparent fee structures."

- Documentation Preparation: Gather essential documents such as tax returns, notices from the IRS, and financial statements. This preparation is crucial for providing a comprehensive overview of your situation, enabling a more accurate assessment.

- Assessment and Strategy Development: The organization will carefully assess your case and suggest a . This may include options like Offer in Compromise, which allows you to settle debts for less than the full amount owed.

- Engagement Agreement: Review and sign an engagement agreement that outlines the services provided, fees, and expected outcomes. Understanding the fee structure is vital, as typical charges imposed by a tax relief agency in 2025 can vary significantly depending on the complexity of the case.

- Execution: Collaborate closely with the organization to execute the agreed-upon strategy, including discussions with tax authorities. Effective communication during this phase is essential for achieving success.

- Ongoing Communication: Maintain regular communication with the agency to stay informed about your case's progress and any necessary actions on your part. It's also advisable to start by communicating directly with the IRS before seeking professional help, as this can lead to more efficient resolutions.

By adhering to these steps, you can secure a smoother experience when seeking help from a tax relief agency, ultimately leading to more favorable outcomes. Remember, you are not alone in this journey; we are here to help you every step of the way.

Address Challenges in Seeking Tax Relief

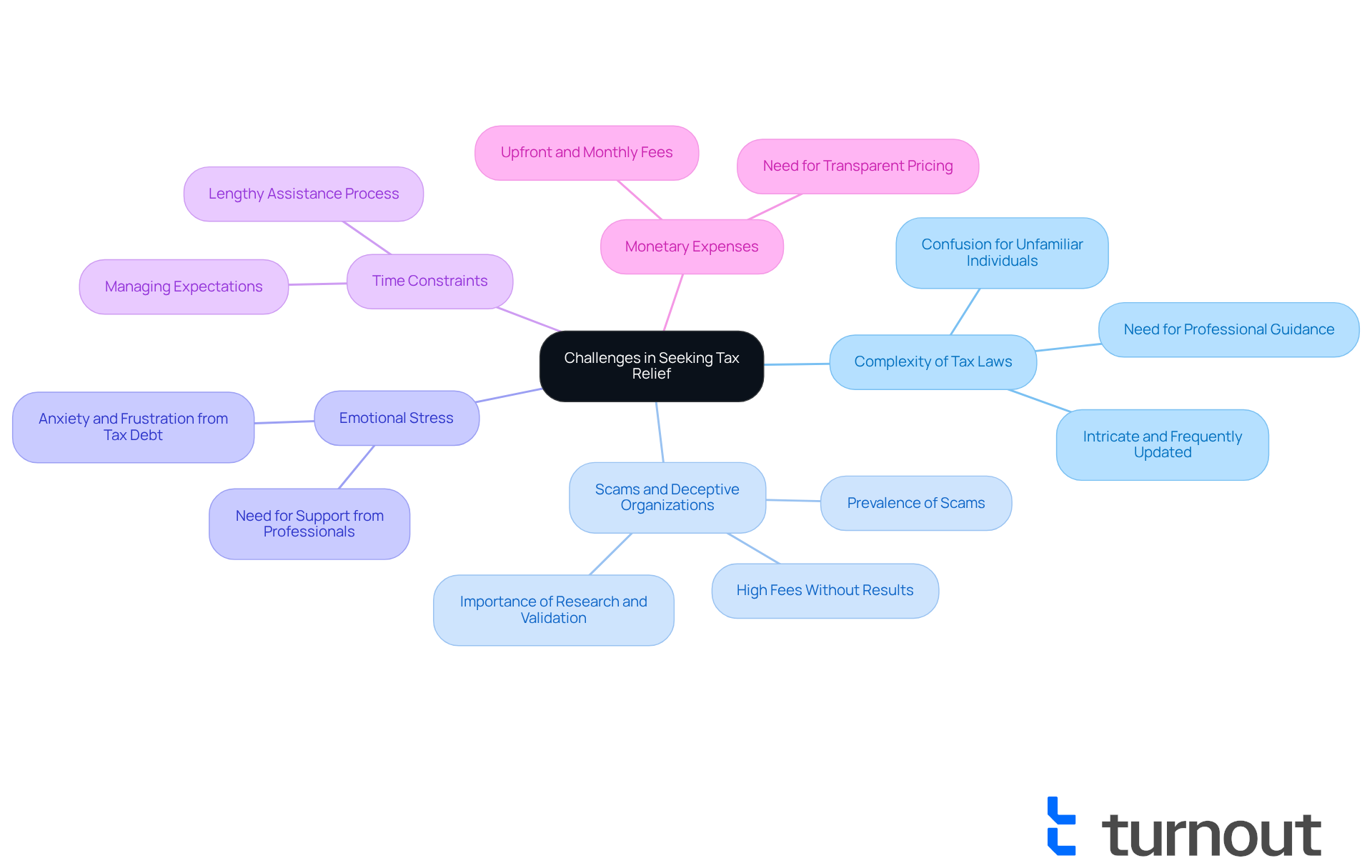

Navigating the tax relief landscape can present several significant challenges, and we understand how overwhelming this can feel:

- : Tax laws are intricate and frequently updated, making it challenging for individuals to understand their rights and options without professional guidance. Tax professionals emphasize that the nuances of these laws can lead to confusion, particularly for those unfamiliar with the system. by offering access to trained nonlegal advocates from a tax relief agency who can assist you through the intricacies of tax assistance.

- Scams and Deceptive Organizations: The , with numerous firms making appealing promises that frequently result in financial loss. In recent years, the prevalence of such scams continues to be a significant issue, highlighting the necessity of thorough research and validation of any organization's legitimacy before utilizing their services. It's common to feel cautious; consumers are advised to be informed, as some companies may exploit vulnerable individuals by charging high fees without delivering effective assistance. , providing a trustworthy alternative.

- Emotional Stress: The burden of tax debt can lead to significant . As noted by Keith Ellison, "There are no easy ways or quick fixes for getting out of debt." Seeking support from trusted professionals, like those at Turnout, can help alleviate some of this pressure, allowing you to focus on resolving your tax issues rather than becoming overwhelmed by them.

- Time Constraints: The tax assistance process can be lengthy and requires patience. Understanding that resolution may take time is crucial for managing expectations and maintaining a positive outlook throughout the process. Turnout's advocates are equipped to help you .

- Monetary Expenses: Hiring a tax assistance agency frequently entails charges, which can be a worry for individuals already experiencing economic hardships. It is essential to discuss costs upfront and ensure transparency regarding any potential charges to avoid unexpected financial strain. Turnout is committed to providing clear information about costs and services, helping you make informed decisions.

By recognizing these challenges and leveraging the support of Turnout's experts, you can better prepare yourself and seek the necessary assistance from a tax relief agency to navigate the complexities of tax relief effectively. Remember, you are not alone in this journey, and it’s important to note that Turnout is not a law firm and does not provide legal representation.

Conclusion

Navigating the tax relief agency process can feel overwhelming for individuals and businesses looking to ease their tax burdens. We understand that understanding the various forms of tax relief—such as deductions, credits, and installment agreements—can significantly impact your financial stability. By engaging with a reputable tax relief agency, you can access the support and guidance you need to manage your tax liabilities effectively.

Tax relief agencies play a critical role in this journey. They assess individual tax situations, negotiate with tax authorities, and provide ongoing education. It’s essential to choose trustworthy organizations and remain vigilant against scams in the tax assistance sector. To help you feel prepared, we outline a step-by-step approach to engaging a tax relief agency, ensuring you are informed throughout the process.

Ultimately, seeking assistance from a tax relief agency can be a vital step toward your financial recovery. Recognizing the challenges involved and leveraging the support of trained professionals can empower you to navigate the complexities of tax relief with confidence. Remember, taking action is crucial. Conduct thorough research and choose the right agency to ensure the best possible outcome in managing your tax obligations. You are not alone in this journey; support is available, and together, we can face these challenges.

Frequently Asked Questions

What is tax relief?

Tax relief refers to various government programs and policies designed to alleviate the tax burdens faced by individuals and businesses, providing significant economic support and helping restore financial stability.

What are the key forms of tax relief?

Key forms of tax relief include tax deductions, tax credits, installment agreements, and offers in compromise.

How do tax deductions work?

Tax deductions reduce your taxable income, which effectively lowers your overall tax bill. They can significantly impact the amount owed, especially for low-income earners.

What are tax credits and how do they differ from deductions?

Tax credits offer direct reductions in the tax owed, potentially leading to refunds. Unlike deductions, which lower taxable income, tax credits directly decrease the amount of tax payable.

Can you provide an example of a tax credit and its impact?

The Earned Income Tax Credit (EITC) is an example that lifted about 5.6 million individuals above the poverty line in 2018, demonstrating its effectiveness in providing economic assistance.

What are installment agreements?

Installment agreements are payment plans that allow individuals to settle their tax debts over time, making it easier to manage financial obligations.

What is an offer in compromise?

An offer in compromise enables individuals to negotiate settlements that allow them to pay less than the total amount owed, providing a more affordable way to resolve tax debts.

Who can assist with tax relief options?

Turnout, a tax relief agency, employs trained nonlawyer advocates and IRS-licensed enrolled agents to help navigate tax debt assistance without the need for legal representation.

Are there recent changes to tax relief policies?

Yes, recent tax reduction policies have expanded options, particularly for low-income families, with higher maximum EITC amounts for 2023 based on household composition.

Is the information provided by Turnout considered legal advice?

No, the information provided by Turnout does not constitute legal advice, and using their services does not establish an attorney-client relationship.