Overview

Managing tax liabilities can feel overwhelming, but IRS payment plans, specifically installment agreements, are here to help. These plans allow individuals to make gradual payments rather than facing a daunting lump sum. We're glad to share that nearly 95% of individual filers can access these options. This means you have structured choices for both short-term and long-term payments.

It's common to feel anxious about severe collection actions, but these payment plans can significantly reduce that risk. They promote financial stability, allowing you to breathe a little easier. Remember, you're not alone in this journey, and support is available to guide you through.

If you're feeling uncertain about your tax situation, consider exploring these options. We're here to help you find a solution that works for you.

Introduction

Navigating the complexities of tax obligations can often feel like an uphill battle. We understand that facing the looming threat of unpaid debts can be overwhelming. IRS payment plans are designed to alleviate the financial strain of tax liabilities, offering a structured approach for individuals to manage their payments over time.

With various options available and recent enhancements to these plans, it’s common to feel uncertain about the best path forward. This guide provides a comprehensive, step-by-step overview of IRS monthly payment plans, equipping you with the knowledge to confidently tackle your tax responsibilities while avoiding potential pitfalls.

Remember, you are not alone in this journey; we’re here to help.

Define IRS Payment Plans and Their Purpose

IRS , often referred to as arrangements, are designed to help individuals settle their tax liabilities gradually, rather than in a single payment. We understand that meeting can be overwhelming, especially when full payment is not feasible by the deadline. By participating in an , you can avoid more severe collection actions, such as wage deductions or bank seizures, while managing your in a structured way. The primary aim of these plans is to make it easier for you to fulfill your obligations without excessive financial strain.

In 2025, the IRS made significant enhancements to these installment agreements, making them more accessible and user-friendly. Did you know that roughly 95% of individual filers qualify for the ? This option allows for terms of up to 120 months for individuals with assessed balances of $50,000 or less. This flexibility is designed to ease the burden on taxpayers, allowing you to make manageable while avoiding penalties and interest.

Real-life examples highlight how effective these agreements can be. For instance, consider someone facing an initial amount of $48,000, including penalties and interest. They can enter into an arrangement that allows them to fulfill their obligations through manageable monthly payments to the IRS. This structured approach not only helps maintain compliance but also safeguards future refunds and credit ratings. However, it’s crucial to make timely payments to avoid defaulting on your financial agreements, which could lead to serious consequences like liens and levies.

You can easily manage your financial arrangements through the , allowing you to view and adjust your financial details as needed. Remember, IRS installment agreements are a vital resource for individuals seeking relief from . They offer a pathway to financial stability while ensuring that your obligations are met on time. You're not alone in this journey; we're here to help you navigate through it.

Explore Types of IRS Payment Plans: Short-Term vs. Long-Term

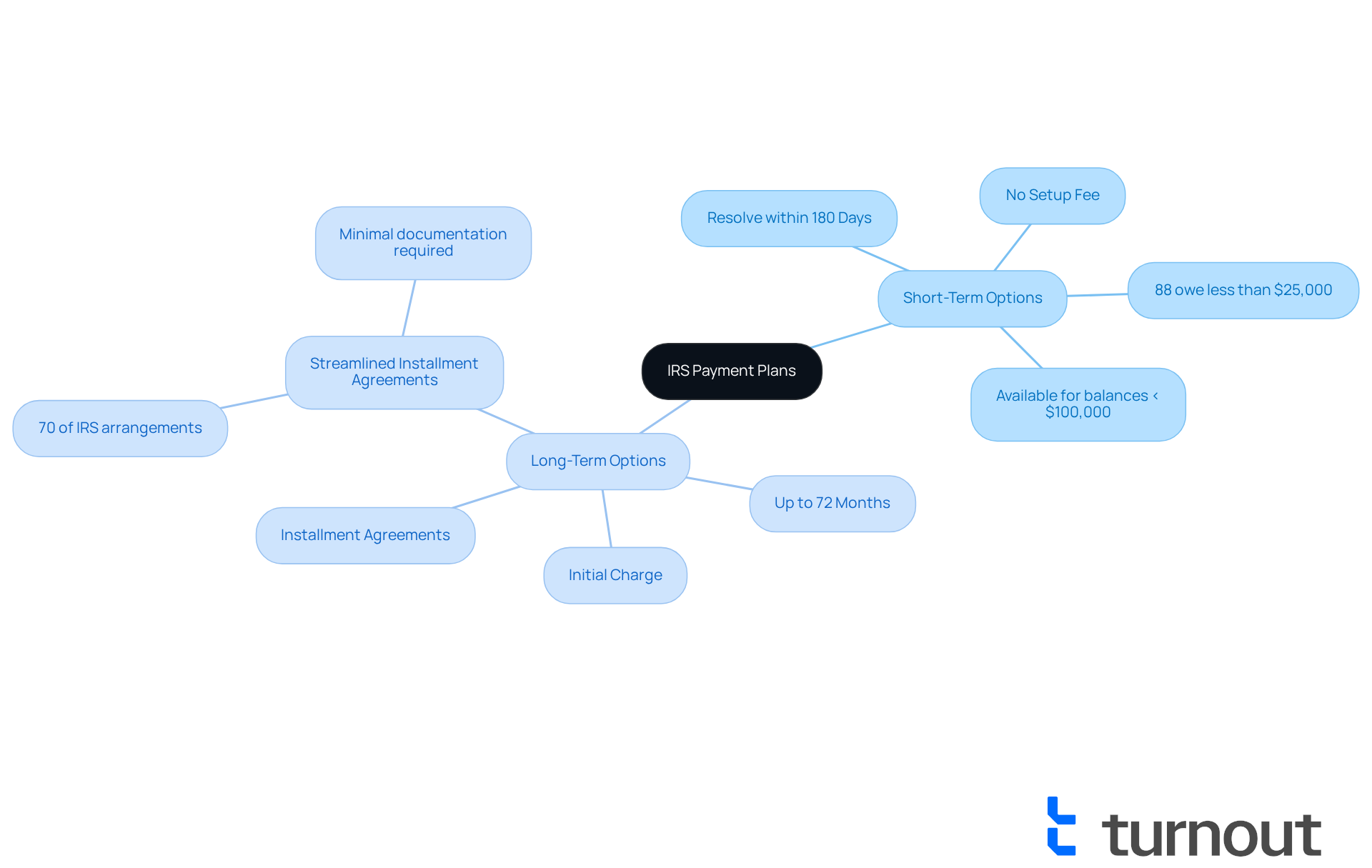

Navigating tax obligations can be overwhelming, but understanding your options can ease that burden. There are two main categories of : short-term and long-term, each designed to accommodate different financial circumstances.

- : If you expect to have the necessary funds soon, short-term arrangements allow you to resolve your tax obligations within 180 days. What’s more, there’s no setup fee for these options, making them even more appealing for those who can settle their balance quickly. Did you know that 88% of personal filers owe less than $25,000 to the IRS? This makes a feasible choice for many who find themselves in a similar situation.

- : For those who need more time to settle their debts, , can extend up to 72 months. While there may be an initial charge, these arrangements provide a structured way to manage your payments, with monthly installments calculated based on the total amount owed divided by the number of months in the agreement. This option is especially beneficial for individuals seeking a more manageable financial plan that includes a over an extended period. If your balance exceeds $50,000, you’ll need to provide financial disclosures, but if it’s under this amount, you may qualify for a streamlined installment agreement with minimal documentation. In fact, streamlined installment agreements (SLIAs) make up nearly 70% of IRS arrangements, highlighting their popularity among taxpayers.

As we look ahead to 2025, it’s important to know that the typical timeframe for IRS arrangements remains flexible, with short-term options lasting up to six months and long-term options extending up to six years. We understand that selecting the right option is crucial, and it’s essential to evaluate your financial situation carefully. The appropriate strategy can significantly alleviate the stress of tax responsibilities. As tax expert Jim Buttonow emphasizes, choosing the right arrangement is vital for effective tax management. Remember, you are not alone in this journey; we’re here to help you find the best solution.

Guide to Setting Up Your IRS Payment Plan: Steps and Requirements

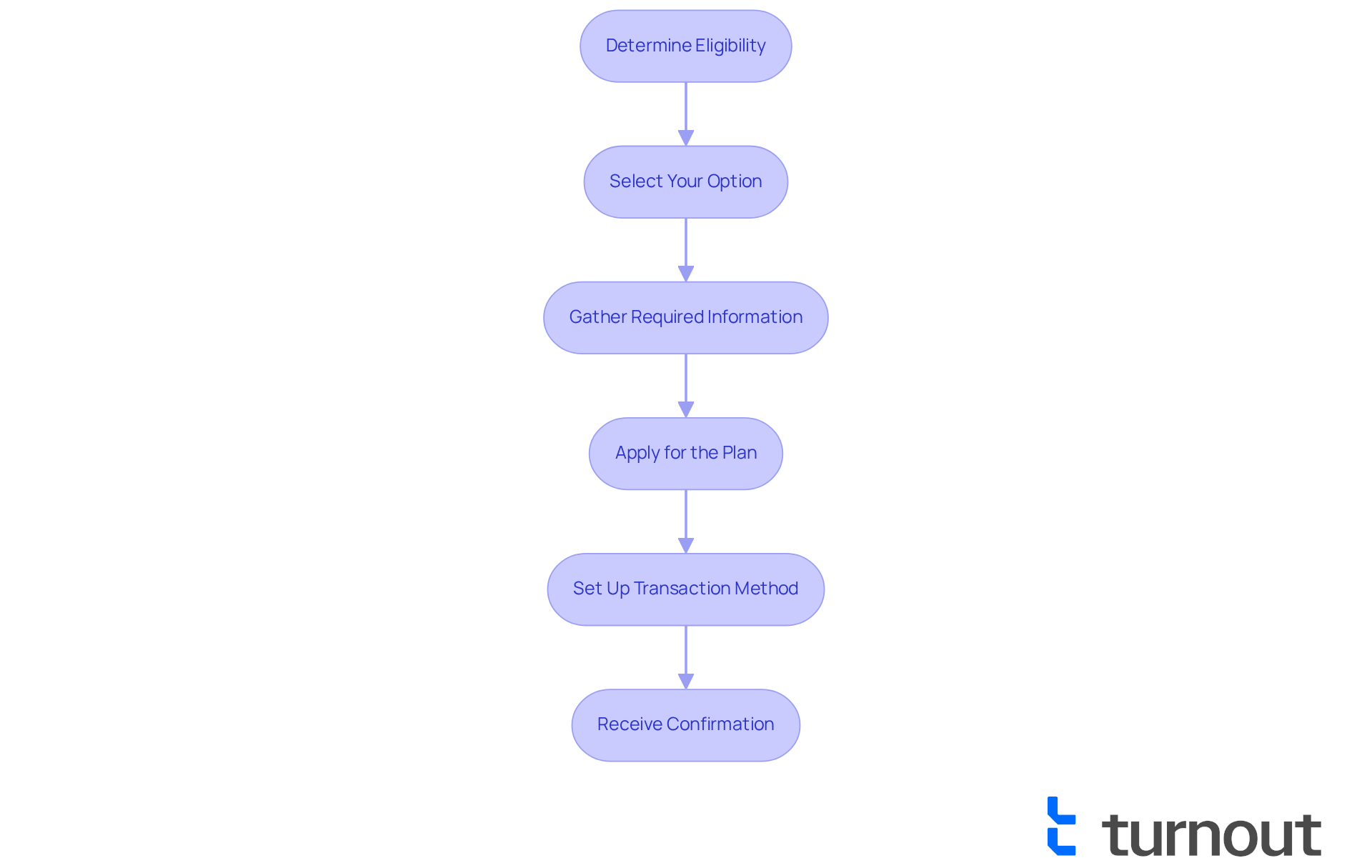

Setting up a plan can feel overwhelming, but our team is here to help you through it. Let’s walk through the key steps together:

- Determine Eligibility: First, confirm that you meet the eligibility criteria. Generally, this means being current on your tax filings and owing less than $50,000 in total tax, penalties, and interest. It’s worth noting that 88% of individual contributors owe less than $25,000, making short-term arrangements particularly accessible. Most taxpayers find they are eligible for an , which includes options for a [[monthly payment IRS](https://irs.gov/payments/payment-plans-installment-agreements)](https://myturnout.com/resources), reinforcing the availability of these choices.

- Select Your Option: Next, think about what option suits your financial situation best. You can choose between a short-term financing arrangement, which allows up to 180 days to settle your balance, or a long-term option that can extend up to 72 months.

- Gather Required Information: Now, gather the necessary documents. This includes your , tax return information, and details about your income and expenses. This preparation is crucial for a smooth application process.

- Apply for the Plan: When you’re ready, you can through the , by phone, or by mailing Form 9465. If you choose to apply online, you’ll need to create an IRS Online Account, which will help you manage your financial plan effectively.

- Set Up : It’s important to select your transaction method. You might consider direct debit, which is required for balances between $25,000 and $50,000, or mailing checks. Direct debit streamlines the procedure and lowers the chance of overlooking due payments. If you have limited income, you may even have the user fee exempted if you agree to make electronic debit transactions via a Direct Debit Installment Agreement.

- Receive Confirmation: Once your application is processed, you will receive confirmation of your financial arrangement, including the conditions and monthly installment amount. This confirmation ensures you are informed about your obligations regarding the monthly payment IRS moving forward.

Remember, penalties and interest will continue to accrue until your balance is paid in full. It's also crucial to be aware that the IRS will never contact you through phone, text, or social media to request prompt payment, so always verify any communications you receive.

For additional assistance, the IRS offers extensive resources on . You are not alone in this journey, and there is support available to help you manage this process effectively.

Understand Costs and Fees of IRS Payment Plans

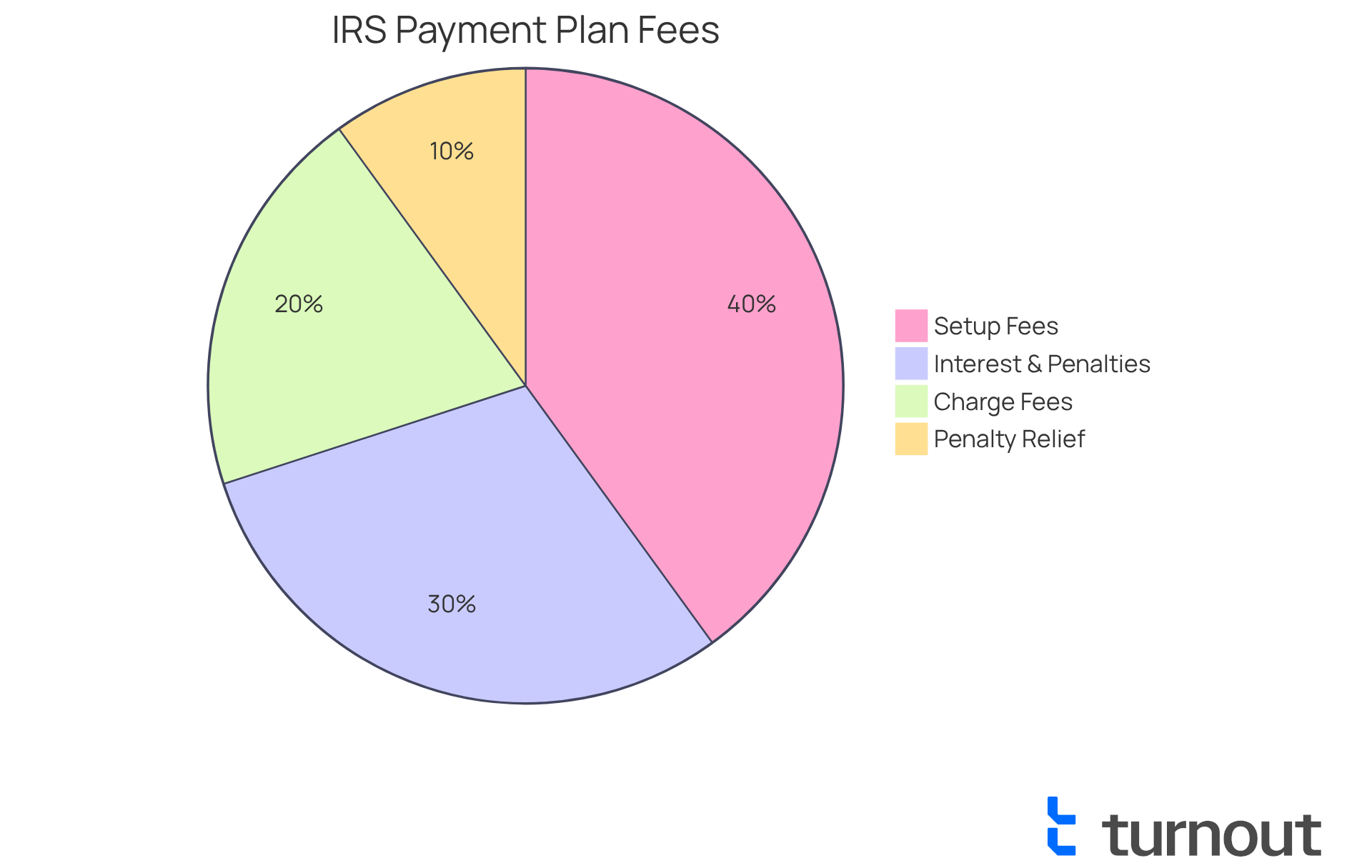

When considering an , involved with the is essential, as this knowledge can ease your worries and aid in your budgeting process.

- Setup Fees: The fees for establishing a payment plan can differ depending on how you apply. If you choose to apply online, the fee is typically $69. However, if you prefer to apply by phone, mail, or in person, you might face a fee of $178. If you're a low-income taxpayer, you may qualify for a reduced fee of just $43.

- Interest and Penalties: It's important to be aware that interest will accumulate on any outstanding tax balances, and penalties may apply for missed payments. The IRS imposes a failure-to-pay penalty of 0.5% per month on the unpaid balance, which can add up over time. Fortunately, during an , this penalty is reduced to 0.25%, offering you potential savings.

- Method of Charge Fees: If you opt for direct debit for your payments, you might encounter additional charges, but it often helps manage your expenses more efficiently. For debit card transactions, there is a processing charge of around $2, while credit card transactions may incur a fee of about 2% of the total amount.

- Eligibility Criteria: To qualify for a , it's necessary to owe $50,000 or less in total tax, penalties, and interest, and all tax returns must be submitted.

- Online Application Efficiency: The IRS offers a that allows you to set up your financial arrangements quickly. You'll receive prompt notification of approval, making the process more accessible and less stressful.

- : If you've made efforts to comply with tax laws but have faced challenges beyond your control, you may qualify for penalty relief. This can provide you with additional options for managing your tax obligations.

is vital for effective budgeting and avoiding surprises related to your [monthly payment IRS](https://blog.myturnout.com/10-handicap-scholarships-for-students-with-disabilities) as you navigate your repayment period. For more detailed information on fees, please refer to the IRS resources on payment plan costs. Remember, you're not alone in this journey; we're here to help.

Conclusion

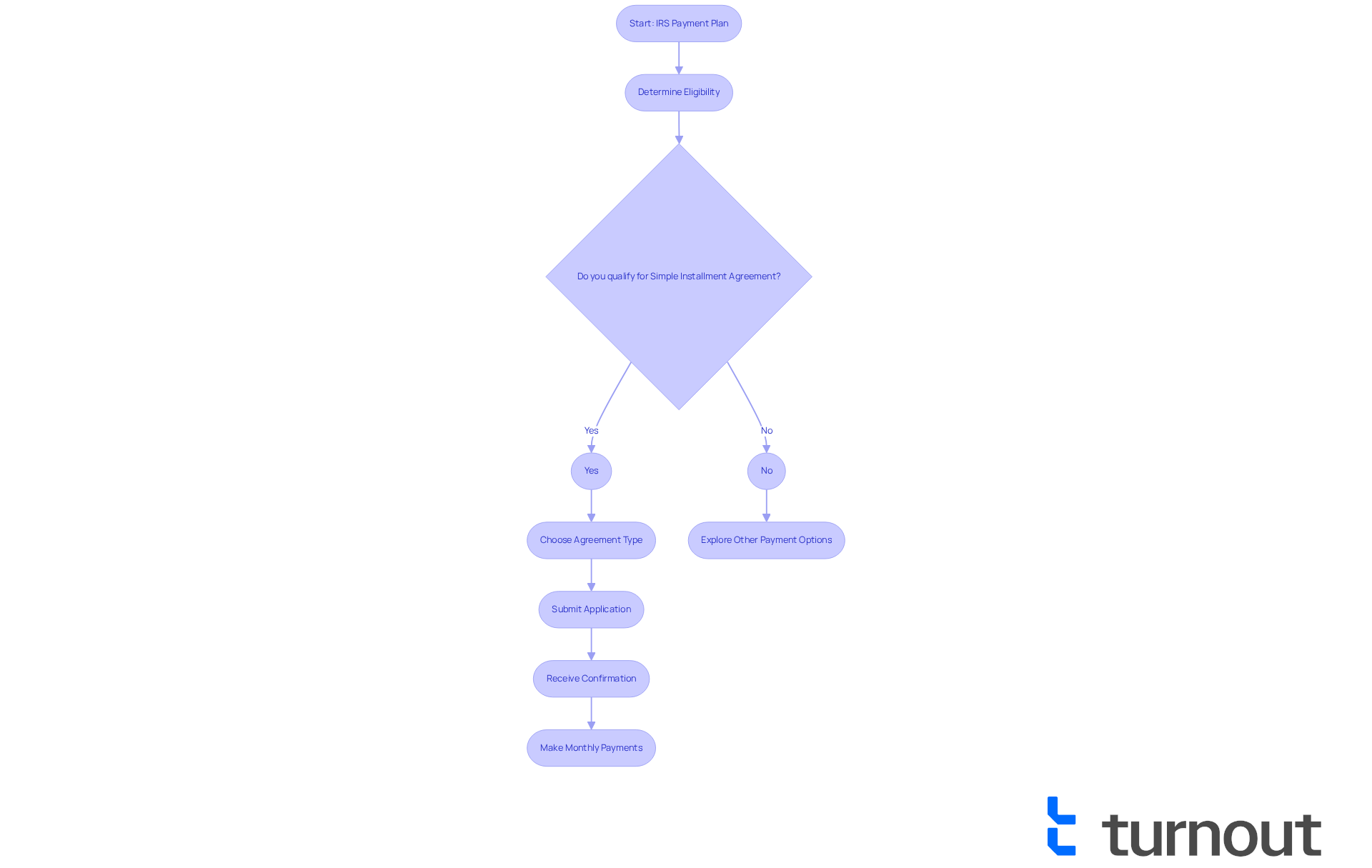

Navigating the complexities of IRS payment plans can significantly ease the burden of tax obligations. We understand that dealing with taxes can be overwhelming, and these arrangements are designed to provide a manageable way for individuals to settle their tax liabilities over time, rather than facing the stress of a lump-sum payment. By understanding the various options available, including short-term and long-term plans, you can choose the path that best suits your financial situation and avoid severe consequences like wage garnishments or bank levies.

The essential steps for setting up an IRS payment plan are crucial. It’s important to:

- Determine your eligibility

- Select the appropriate option

- Understand the associated costs and fees

With roughly 95% of individual filers qualifying for a Simple Installment Agreement, many can benefit from a structured repayment plan that allows for manageable monthly payments. Additionally, the insights shared regarding the costs, such as setup fees and interest rates, equip you with the knowledge needed to budget effectively and avoid unexpected financial burdens.

Ultimately, the significance of IRS payment plans cannot be overstated. They offer a lifeline for those struggling with tax debt, providing a clear path toward financial stability. For anyone facing tax challenges, taking the first step to explore these options can lead to a more secure financial future. Embrace the resources available, and remember that you are not alone in this journey. Seeking assistance can truly make a world of difference in managing tax obligations effectively.

Frequently Asked Questions

What are IRS payment plans and their purpose?

IRS payment plans, also known as installment agreements, are designed to help individuals settle their tax liabilities gradually rather than in a single payment. They aim to ease the burden of meeting tax obligations, allowing taxpayers to avoid severe collection actions while managing their financial responsibilities in a structured manner.

What recent enhancements have been made to IRS installment agreements?

In 2025, the IRS made significant enhancements to installment agreements, making them more accessible and user-friendly. Approximately 95% of individual filers qualify for the Simple Installment Agreement, which allows for terms of up to 120 months for individuals with assessed balances of $50,000 or less.

How do installment agreements benefit taxpayers?

Installment agreements allow taxpayers to make manageable monthly payments to the IRS, helping them avoid penalties and interest. They provide a structured approach to fulfilling tax obligations, maintaining compliance, and safeguarding future refunds and credit ratings.

What happens if a taxpayer defaults on their installment agreement?

If a taxpayer fails to make timely payments on their installment agreement, they risk defaulting, which could lead to serious consequences such as liens and levies.

How can taxpayers manage their IRS installment agreements?

Taxpayers can manage their financial arrangements through the IRS Online Account, which allows them to view and adjust their financial details as needed.

What is the importance of IRS installment agreements for individuals with tax debt?

IRS installment agreements are a vital resource for individuals seeking relief from tax debt, offering a pathway to financial stability while ensuring that their obligations are met on time.