Overview

This article aims to guide you in mastering the Social Security Disability benefits available to individuals like yourself. We understand that navigating through the distinctions between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) can be overwhelming. By detailing the eligibility criteria, benefit calculations, and common misconceptions, we hope to illuminate how understanding these factors can significantly influence the financial support you receive.

It's common to feel confused about which program applies to your situation. That’s why we’re here to help. Recognizing the differences between SSDI and SSI is crucial, as each program has its own eligibility requirements and benefits. By exploring these aspects, you can make informed decisions that may enhance your financial well-being.

We encourage you to reflect on your own experiences and consider how this information might apply to you. You are not alone in this journey; many individuals face similar challenges. Together, we can navigate these complexities and work towards securing the support you deserve.

Introduction

Navigating the intricacies of Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) can feel overwhelming. We understand that many individuals rely on these programs for financial stability, and grasping the differences and eligibility requirements is crucial. The impact of understanding these factors on the benefits you might receive cannot be overstated.

However, it’s common to face challenges in understanding how your work history, income, and living arrangements influence your benefit calculations. What are the key factors that determine the amount of support available? How can you maximize your benefits in this ever-evolving landscape?

We’re here to help you through this journey, providing clarity and support as you explore your options. Together, we can ensure that you have the information needed to navigate these complexities with confidence.

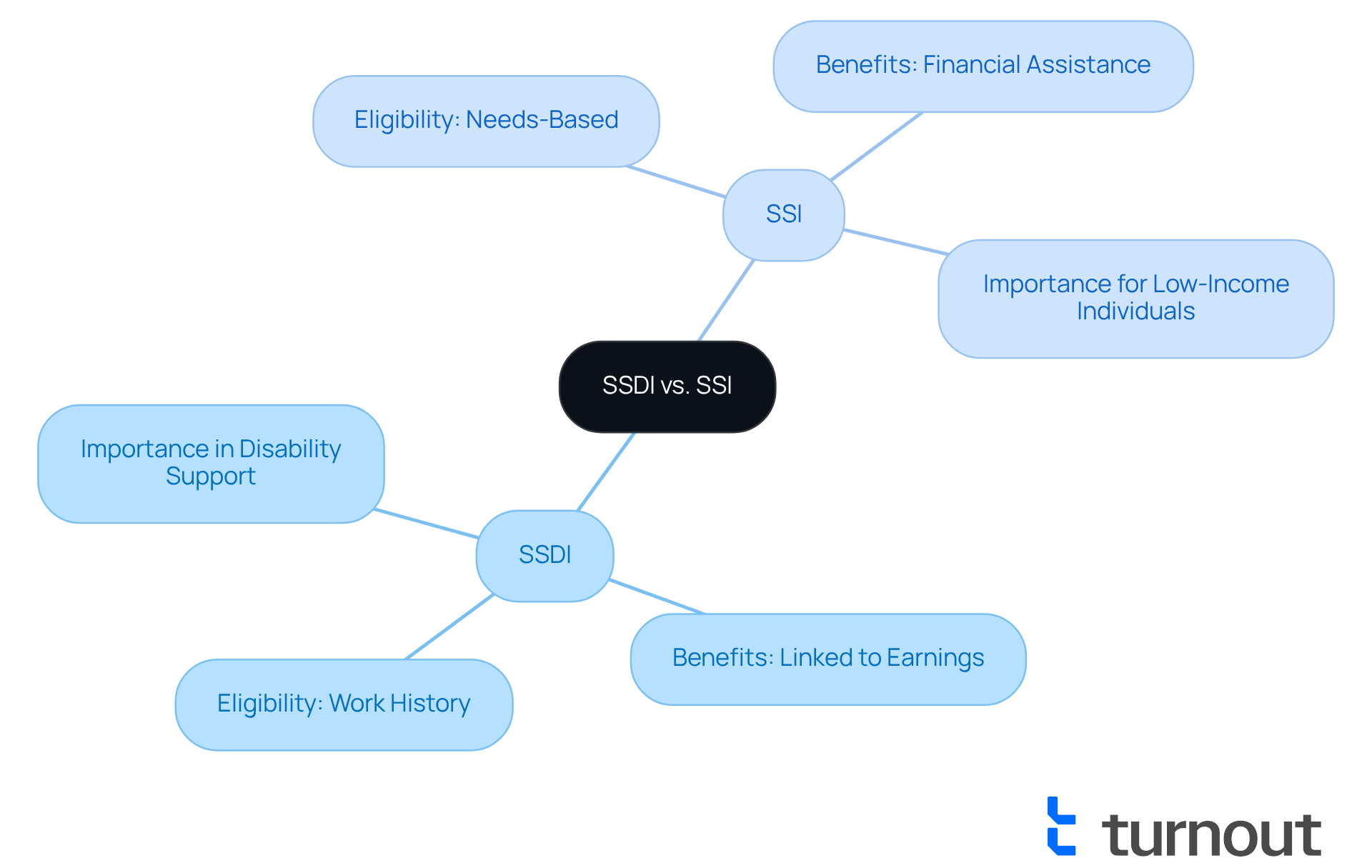

Explore SSDI and SSI: Key Concepts and Differences

and play distinct yet crucial roles in supporting individuals with disabilities. SSDI is designed for those who have a work history and have contributed to Social Security taxes, with benefits determined by their average lifetime earnings. In contrast, SSI is a needs-based program that offers financial assistance to individuals with limited income and resources, irrespective of their employment history. This essential distinction is vital for understanding eligibility and the type of support available.

- SSDI: This program is tailored for individuals who have contributed to Social Security through their employment. The benefits are closely linked to a person's earnings history, ensuring that those who have worked are rewarded according to their contributions.

- SSI: This program focuses on providing a basic level of financial support to individuals who may not have a substantial work history. It is essential for those who need help meeting their fundamental needs, regardless of their past employment.

Understanding which program aligns with your unique circumstances can significantly impact the available to you and the . As of 2025, the Social Security Administration reported that over 8.7 million disabled recipients received disability payments, totaling nearly $12.7 billion. This highlights the program's vital role in supporting individuals with disabilities. Moreover, the average monthly [social security disability amount of benefits](https://blog.turnout.co/what-is-tdiu-va-understanding-total-disability-benefits-for-veterans) for disabled workers was approximately $1,537.13, underscoring the importance of these programs in providing financial stability.

Real-world examples illustrate the profound impact of these programs. For instance, a single mother named Angela L. shared her struggles with financial burdens while relying on limited income, emphasizing the urgent need for increased support. Similarly, Patricia V. expressed her concern that the does not keep pace with inflation, which further strains her financial situation. These stories remind us of the importance of and supplemental income as we navigate the complexities of disability assistance.

We understand that seeking help can be overwhelming, but you are not alone in this journey. We're here to help you explore your options and find the support you need.

Understand Factors Affecting Benefit Calculations

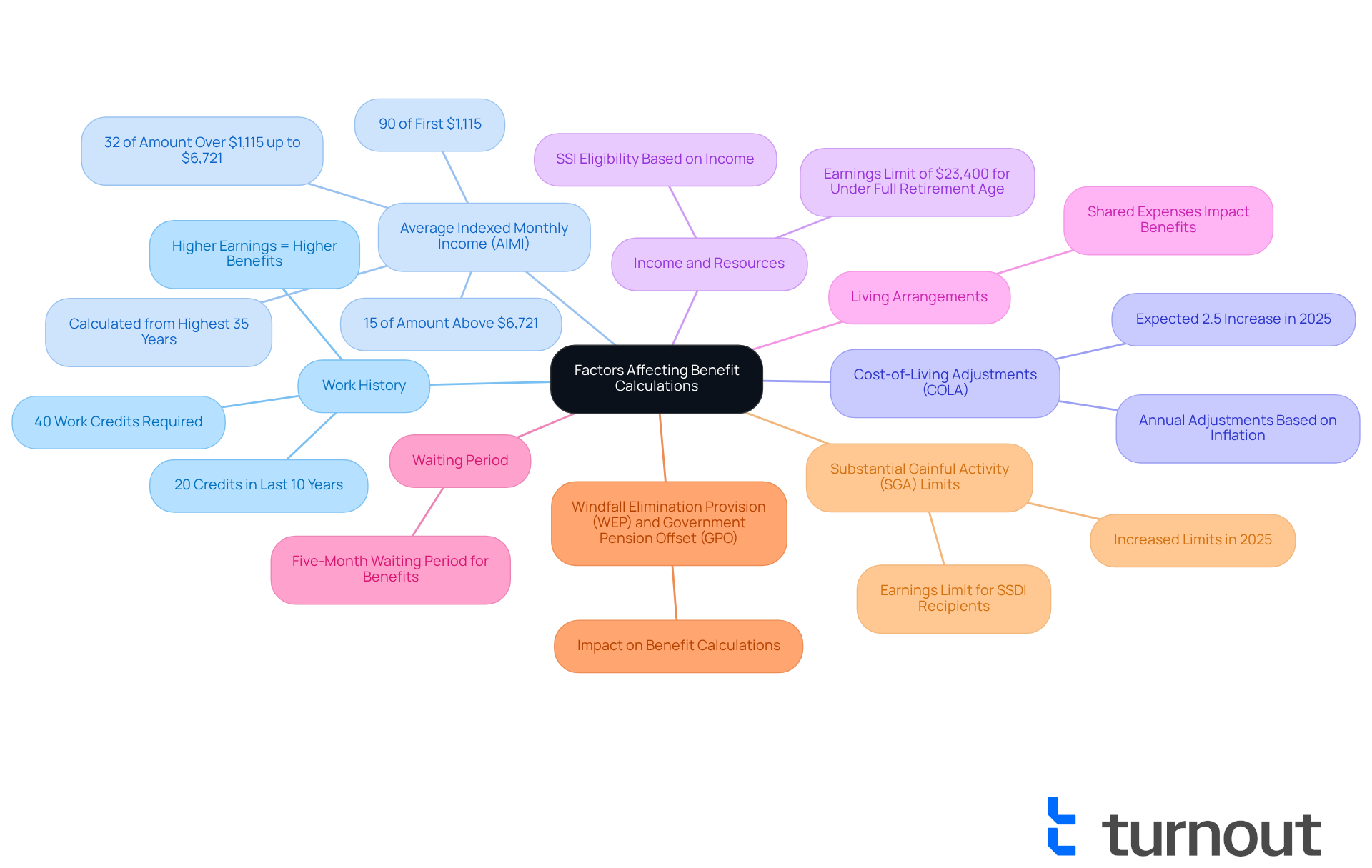

Several key factors influence the calculation of the for SSDI and SSI. Understanding these can empower you as you navigate the complexities of the system related to the social security disability amount of benefits with the support of Turnout.

- Work History: are crucial for SSDI. Generally, individuals need 40 work credits, with at least 20 earned in the last 10 years. The more you earn and contribute to Social Security, the greater your potential advantages. A strong work history may lead to significantly higher monthly payments compared to someone with fewer credits.

- : This figure is calculated from your highest 35 years of income, adjusted for inflation. It plays a vital role in determining your social security disability amount of benefits. In 2025, the formula will apply 90% of the first $1,115 of your AIME, 32% of the amount over $1,115 up to $6,721, and 15% of any amount above $6,721. This ensures that those with lower lifetime earnings receive a higher percentage of their AIME.

- : Benefits are adjusted annually based on inflation, which can increase the amount you receive over time. In 2025, a , providing financial relief for current SSDI beneficiaries who are receiving a social security disability amount of benefits.

- Income and Resources: For SSI, your income and resources are assessed to determine eligibility and payment amounts. Exceeding certain limits can diminish or remove advantages. For instance, in 2025, individuals under full retirement age will have an earnings limit of $23,400, with deductions applied for earnings above this threshold.

- Living Arrangements: Your living situation can also influence SSI assistance. Living with others may change the amount you receive based on shared expenses, impacting your overall financial support.

- Waiting Period: It's important to note that there is a five-month . This detail can be confusing, as even after your application is accepted, you might not receive assistance until five months have elapsed.

- and Government Pension Offset (GPO): These provisions can significantly impact calculations for many individuals, particularly those who have worked in positions not covered by Social Security.

- : In 2025, the raised SGA thresholds will enable individuals receiving disability support to work part-time without forfeiting assistance, offering greater flexibility as you navigate the system.

and navigating the SSD claims process effectively. Please note that Turnout is not a law firm and does not provide legal advice; our trained nonlawyer advocates are here to support you in your journey.

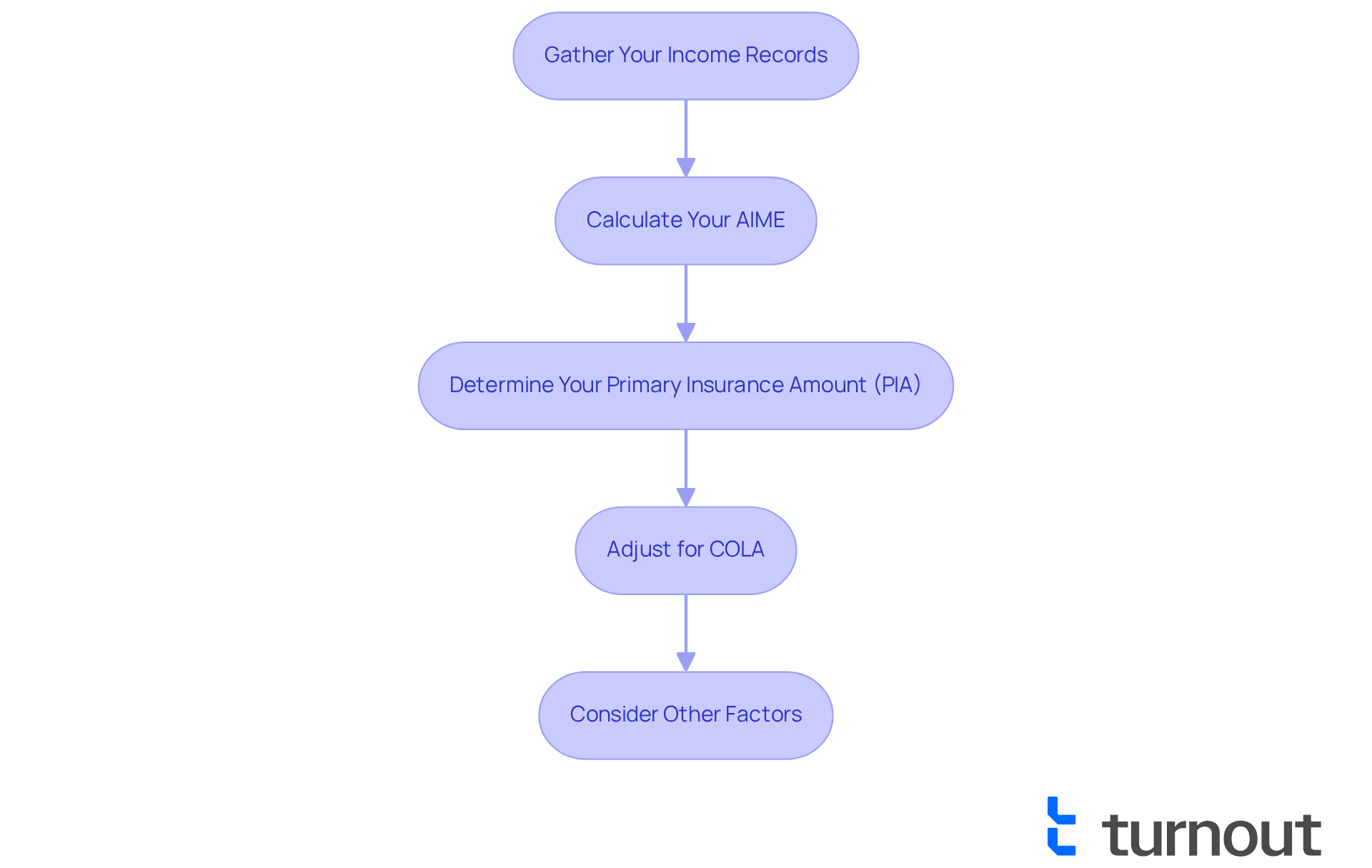

Calculate Your SSDI Benefits: A Step-by-Step Guide

Calculating the can feel overwhelming, but we're here to help you through the process. By following these steps, you can gain a clearer .

-

Gather Your Income Records: Start by obtaining your Social Security income record, which details your income throughout your working life. You can access this through the SSA's website. Gathering and submitting the necessary documentation is critical for the SSDI application process.

-

:

- Identify your highest 35 years of indexed earnings.

- Add these amounts together and divide by 420 (the number of months in 35 years) to find your Average Indexed Monthly Earnings (AIME).

-

Determine Your Primary Insurance Amount (PIA):

- The PIA is calculated using a formula that applies different percentages to portions of your AIME. For 2025, the formula is:

- 90% of the first $1,226 of AIME

- 32% of AIME over $1,226 and up to $7,391

- 15% of AIME over $7,391

- The PIA is calculated using a formula that applies different percentages to portions of your AIME. For 2025, the formula is:

-

Adjust for COLA: If applicable, remember to apply any to your calculated PIA. In 2025, disability support payments will receive a 2.5% cost-of-living adjustment to help keep up with inflation.

-

Consider Other Factors: It’s important to include any extra income or resources that may influence your eligibility or the amount you receive. For instance, obtaining additional public disability payments might lower your Social Security Disability Insurance payments if they exceed 80% of your earnings prior to the disability. Additionally, be aware that to process, and there is a five-month waiting period after becoming incapacitated before qualification for benefits begins in the sixth month.

By adhering to these steps, you can assess your disability support and gain a clearer understanding of your social security disability amount of benefits from the program. Many individuals who proactively examine their earnings records and comprehend the calculation process often achieve improved results in securing their benefits. If you find yourself needing assistance, through trained nonlawyer advocates who can help you navigate the SSD claims process effectively. Please note that Turnout does not provide legal representation or advice.

Clarify Common Misconceptions About SSDI Payments

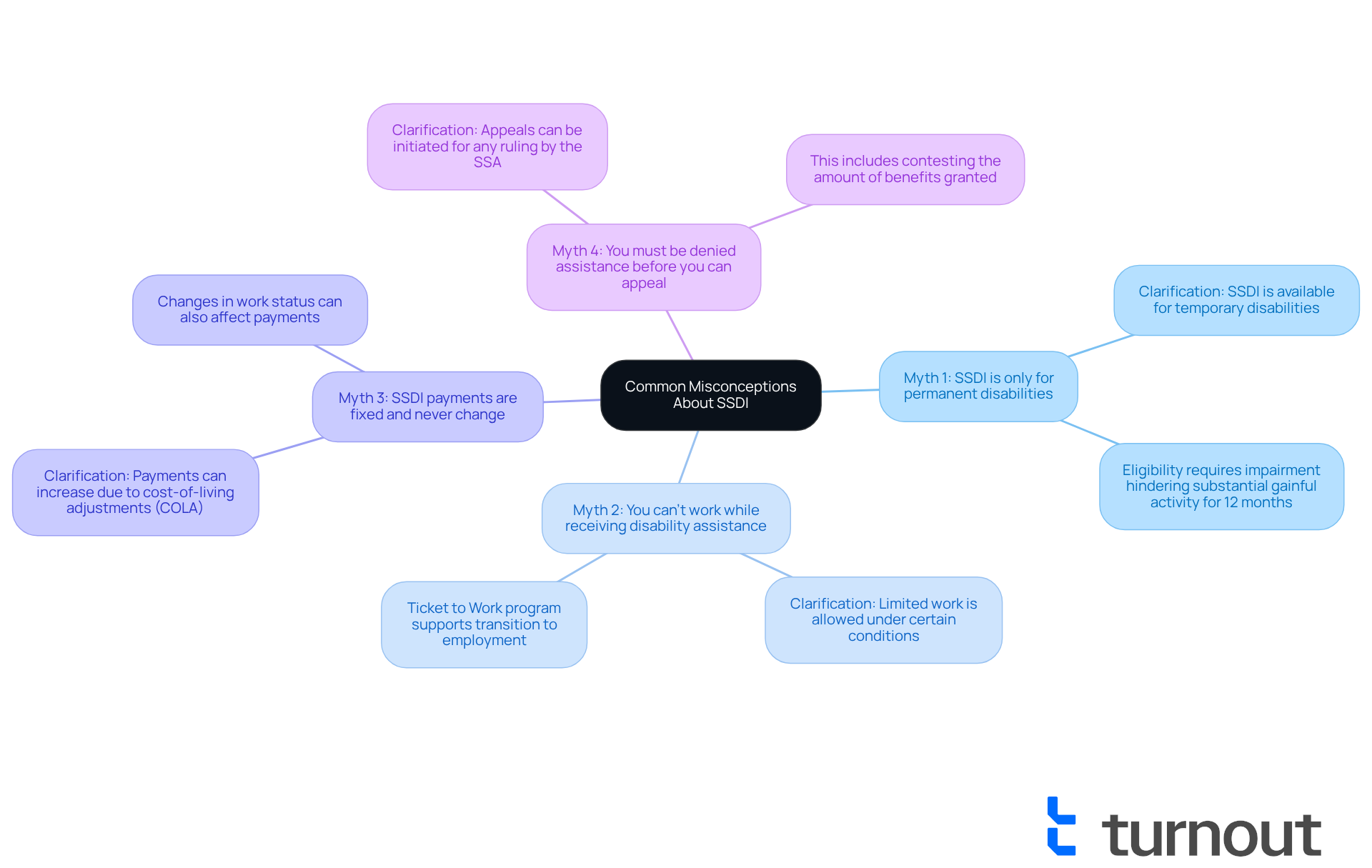

Navigating the world of (SSDI) can be overwhelming, especially with the many misconceptions that exist. We understand that these myths can create confusion for potential beneficiaries. Let's clarify some common misunderstandings:

- Myth: Social Security Disability Insurance is only for permanent disabilities. It's a common belief that only individuals with permanent disabilities qualify for SSDI. In reality, SSDI is available to anyone whose impairment hinders substantial gainful activity (SGA) for a minimum of 12 months, including those with temporary disabilities.

- Myth: . Many people think that any type of employment disqualifies them from receiving support. However, the disability insurance program allows for limited work under certain conditions without risking assistance. Thanks to initiatives like the Ticket to Work program, recipients can transition to employment while maintaining their benefits.

- Myth: . There is a misconception that once SSDI payments are established, they remain static. In fact, these payments can increase due to cost-of-living adjustments (COLA) and changes in work status, providing potential financial growth over time.

- Myth: You must be denied assistance before you can appeal. Some believe they need to be denied support to initiate an appeal. Nevertheless, individuals can contest any ruling issued by the Social Security Administration (SSA), including those concerning the granted.

By dispelling these myths, you can approach the SSDI process with a clearer understanding. Remember, you're not alone in this journey, and we're here to help you to secure the benefits you deserve.

Conclusion

Mastering the intricacies of Social Security Disability benefits, especially the differences between SSDI and SSI, is essential for anyone navigating this complex system. We understand that this journey can be overwhelming, but understanding these programs empowers you to make informed decisions regarding your eligibility and the financial support available to you. By recognizing the unique characteristics of SSDI and SSI, you can better assess your circumstances and maximize your benefits.

Key insights highlight the importance of various factors influencing benefit calculations, such as:

- Work history

- Average Indexed Monthly Income (AIME)

- Cost-of-living adjustments

It’s common to feel confused about SSDI payments, and this article clarifies those misconceptions, ensuring that you have a realistic understanding of your rights and options. These insights not only demystify the application process but also encourage you to engage proactively with the system.

Ultimately, navigating the Social Security Disability landscape requires both knowledge and support. As you seek to secure your benefits, remember that you are not alone in this journey. We encourage you to utilize available resources and assistance, such as Turnout, to ensure you understand your rights and maximize your financial stability. By taking these steps, you can pave the way for a more secure future, reinforcing the significance of understanding and mastering your Social Security Disability benefits.

Frequently Asked Questions

What are SSDI and SSI?

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are programs designed to support individuals with disabilities. SSDI is for those who have a work history and have contributed to Social Security taxes, while SSI provides financial assistance to individuals with limited income and resources, regardless of their employment history.

Who is eligible for SSDI?

SSDI is tailored for individuals who have contributed to Social Security through their employment. Eligibility is based on the individual's work history and the benefits are determined by their average lifetime earnings.

Who qualifies for SSI?

SSI is a needs-based program that focuses on providing financial support to individuals who may not have a substantial work history. Eligibility depends on having limited income and resources.

How are the benefits calculated for SSDI and SSI?

SSDI benefits are linked to a person's earnings history, rewarding those who have worked according to their contributions. In contrast, SSI provides a basic level of financial support without regard to past employment.

What is the average monthly benefit amount for SSDI recipients?

As of the information provided, the average monthly benefit amount for disabled workers receiving SSDI was approximately $1,537.13.

How many recipients are currently receiving disability payments?

As of 2025, over 8.7 million disabled recipients were reported to be receiving disability payments, totaling nearly $12.7 billion.

What concerns do recipients have regarding the benefits?

Some recipients express concerns about the adequacy of support. For example, Patricia V. noted that a 2.5% increase in SSA rates for 2025 does not keep pace with inflation, which adds to financial strain.

How can individuals find support when applying for these programs?

Seeking help can be overwhelming, but individuals are encouraged to explore their options and find the support they need, as there are resources available to assist them in navigating the complexities of disability assistance.